Luxury Products in eCommerce

Why eCommerce and Luxury Sales Are Tough to Unite

The brand experience is at the forefront of consumer spending on luxury products.

Article by Nadine Koutsou-Wehling | January 27, 2025

Right now, Fashion Week starts in Paris, Copenhagen, and Berlin. This provides an opportunity to look at luxury eCommerce and how it differs from the overall market. During the pandemic, luxury products seemed to find a channel in eCommerce that offset some of the losses this exceptional situation caused. But in the years since, it has become obvious that offline channels remain the preferred way for luxury customers to buy their products.

Luxury eCommerce Follows General Development

In general, luxury online shares follow the development of the overall market: There was a peak in online sales at the height of the pandemic, followed by a decline in online shares in the years after. This is because luxury customers, like everyone else, returned to physical stores in 2022. But for luxury product categories, eCommerce often isn’t the primary focus.

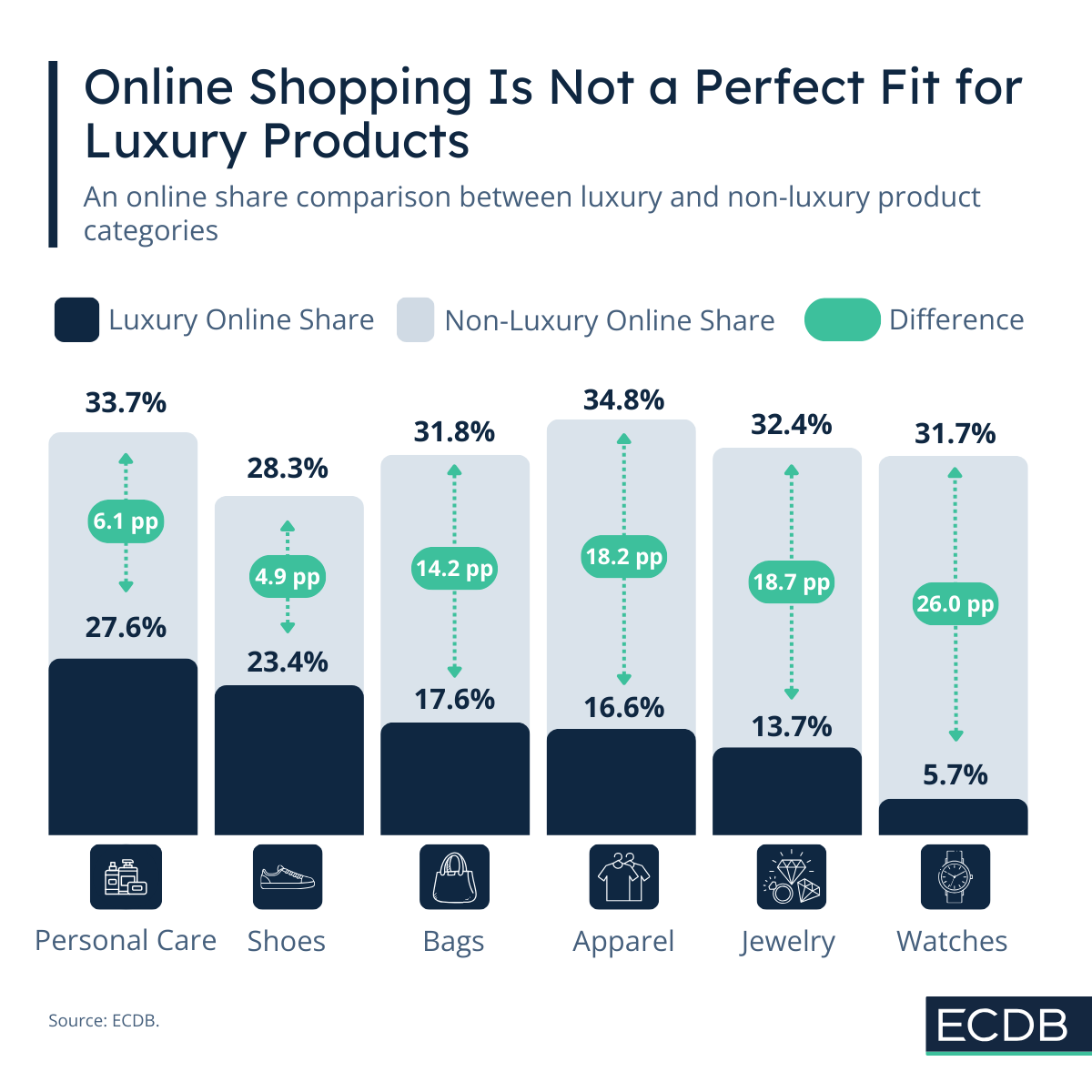

Looking at the online shares of the total market, luxury product categories have consistently had lower online shares. When comparing the online shares of product categories in 2024, divided into luxury and non-luxury, the difference starts at around 5 percentage points (Shoes) and reaches up to 26 percentage points (Watches).

Luxury Brands Prioritize the Customer Experience

The exclusive nature of luxury products, combined with the special relationship between brands and their customers, often makes offline channels more favorable than online sales.

In most cases, it isn’t just about the product itself – the experience of buying it is equally as important. Customers who spend thousands of dollars on a purchase want to receive the face-to-face acknowledgement of a store representative, which is more impactfully given in a physical location than on a website.

The extent of this tendency varies across product categories and becomes more pronounced with higher-value items. For example, in the Watches category, luxury Watches had an online market share of just 5.7% in 2024, compared to 31.7% for Watches in the overall market — the largest gap observed across all categories. Given that luxury Watches serve more as status symbols than mere timekeeping devices, the significance of in-person interactions during the purchase becomes even more apparent.

There is also the element of trust to consider. As prices rise, the risk of encountering fakes or counterfeits increases significantly. This risk is exacerbated in online channels, where it is more difficult to verify product authenticity.

Conversely, the luxury product category with the highest online share is Personal Care with 27.6%. This includes products like fragrances, creams, and makeup. Considering that these are the luxury products which tend to be most accessible to the general public, buying them online does not mean foregoing the special treatment in-store. In addition, the shorter lifespan of Personal Care products leads to more frequent use, making them an ideal category for online reorders.

What Does All of the Above Mean for Luxury eCommerce Sales?

Quite simply, it is highly unlikely that some luxury product categories will ever reach the same level of online share as their non-luxury counterparts. As in the case of fashion weeks, despite the availability of online alternatives, some experiences are bound to happen physically. With a growing integration of the online market, hybrid experiences are likely to become more relevant, but the benefits of offline channels remain.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The United States Takes the International Lead in eCommerce Revenue per Capita

The United States Takes the International Lead in eCommerce Revenue per Capita

Deep Dive

Valentine’s Day Drives eCommerce Revenues for Flowers & Gifts

Valentine’s Day Drives eCommerce Revenues for Flowers & Gifts

Deep Dive

Shopify Is the Most Used Shop Software Globally, But Magento Dominates in Europe

Shopify Is the Most Used Shop Software Globally, But Magento Dominates in Europe

Deep Dive

Why the Online Pharmacy Trend Has Continued Beyond the Pandemic

Why the Online Pharmacy Trend Has Continued Beyond the Pandemic

Deep Dive

What Countries Are Driving Revenues in the Global Online Smartphones Market?

What Countries Are Driving Revenues in the Global Online Smartphones Market?

Back to main topics