Fast Fashion eCommerce

Fast Fashion Brands Shein, H&M & Zara Are Changing European eCommerce

European fast fashion brands are facing competition from Asian brands that undercut them in price and turnaround time. But not every online market in Europe has the same preferences. Here is where H&M, Zara and Shein perform best.

Article by Nadine Koutsou-Wehling | July 19, 2024European eCommerce varies across markets: Consumers with distinct preferences meet different economic circumstances, and the tendencies of regional industries have an additional impact on each market.

Our data at ECDB highlights country-specific eCommerce trends and patterns within Europe. The dominant question is: What drives fast fashion online sales in European countries?

Which Countries Are Fast Fashion Leaders?

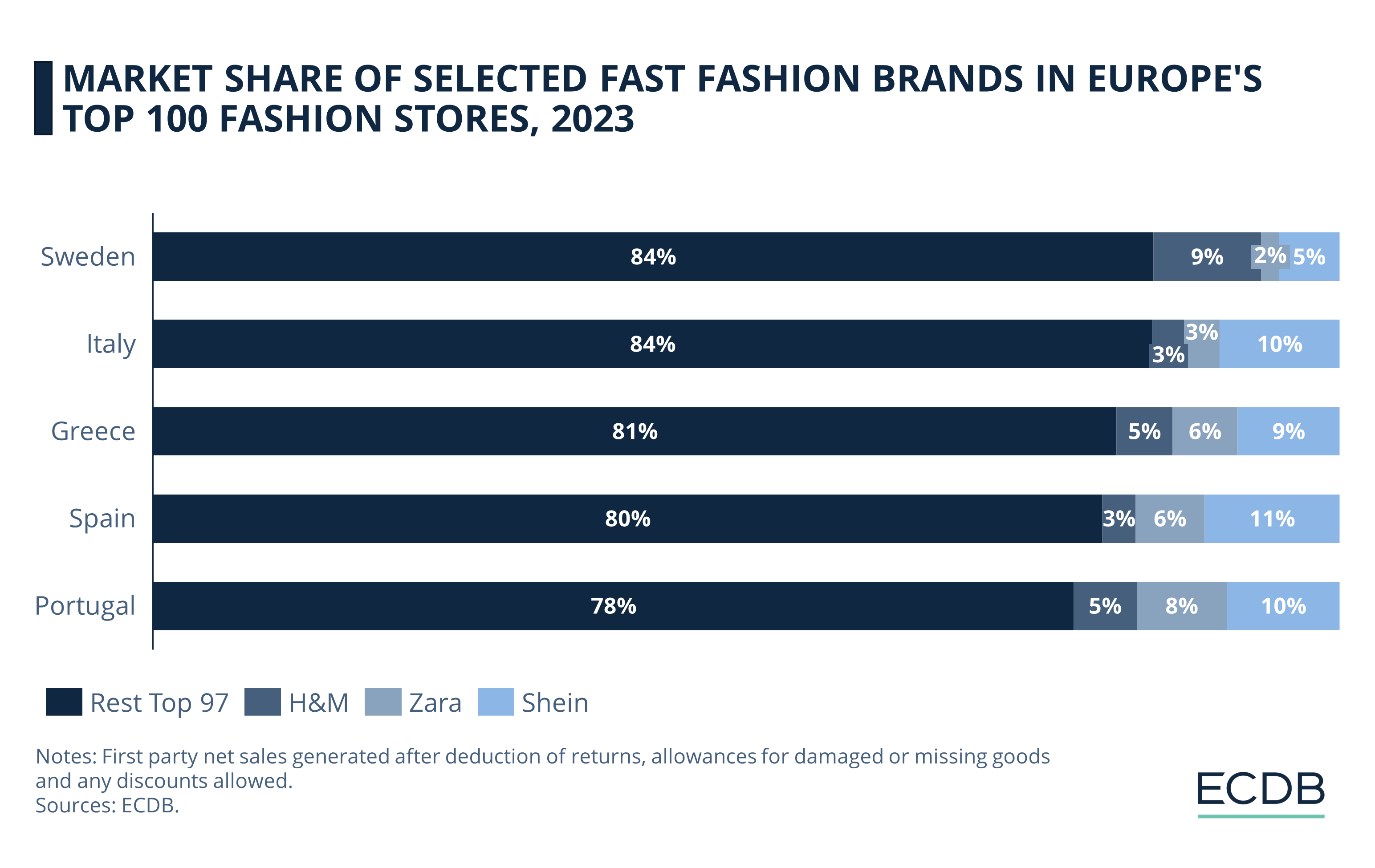

ECDB data reveals the markets where the three selected fast fashion stores - H&M, Zara, and Shein - account for the largest share of a country's top 100 online fashion store net sales.

Here are five markets where fast fashion generates the largest share of a country's online net sales:

1. Portugal

In Portugal, Shein represents 10% of the top 100 fashion online retailers' net sales. This makes it the best-selling online store for fashion products in the country, despite Portugal's close to proximity to Inditex and the presence of production hubs for Zara and the likes.

Zara eCommerce net sales make up 8% of the top 100 fashion stores' net sales, while H&M is not as prevalent with a 5% share.

2. Spain

In Spain, Shein was also the leading fast-fashion retailer in 2023, with US$702 million in net sales and an 11% share of the country's top 100 fashion store revenues. Zara follows with US$357 million and a 6% share.

Similar to Portugal, H&M does not perform as strongly in Spain, accounting for 3% of the top 100 fashion stores' eCommerce net sales.

3. Greece

19% of eCommerce revenues of the top 100 fashion online stores in Greece are generated by Shein, H&M and Zara.

Again, Shein is eCommerce fashion frontrunner in Greece (9%), followed by Zara (6%) and H&M (5%).

4. Italy

The same pattern holds true for Italy, where Shein accounts for 10% of the top 100 fashion eCommerce stores' net sales. With H&M and Zara accounting for 3% each, these three retailer make up 16% of the top 100's online net sales.

5. Sweden

Sweden's pattern diverges: Here, local brand H&M is the most relevant fast fashion retailer, accounting for 9% of the top 100 fashion stores' sales, or US$276 million. Shein follows with 5% and net sales of US$157 million.

It’s clear from the data that Shein is increasingly outgrowing its competition. While Zara's and H&M's online revenues have declined slightly since 2022, Shein continues its upward climb.

The online company's pre-eminent position is even more evident when viewed from a pan-European perspective.

Shein in Europe: Sold US$8.8 Billion in 2023

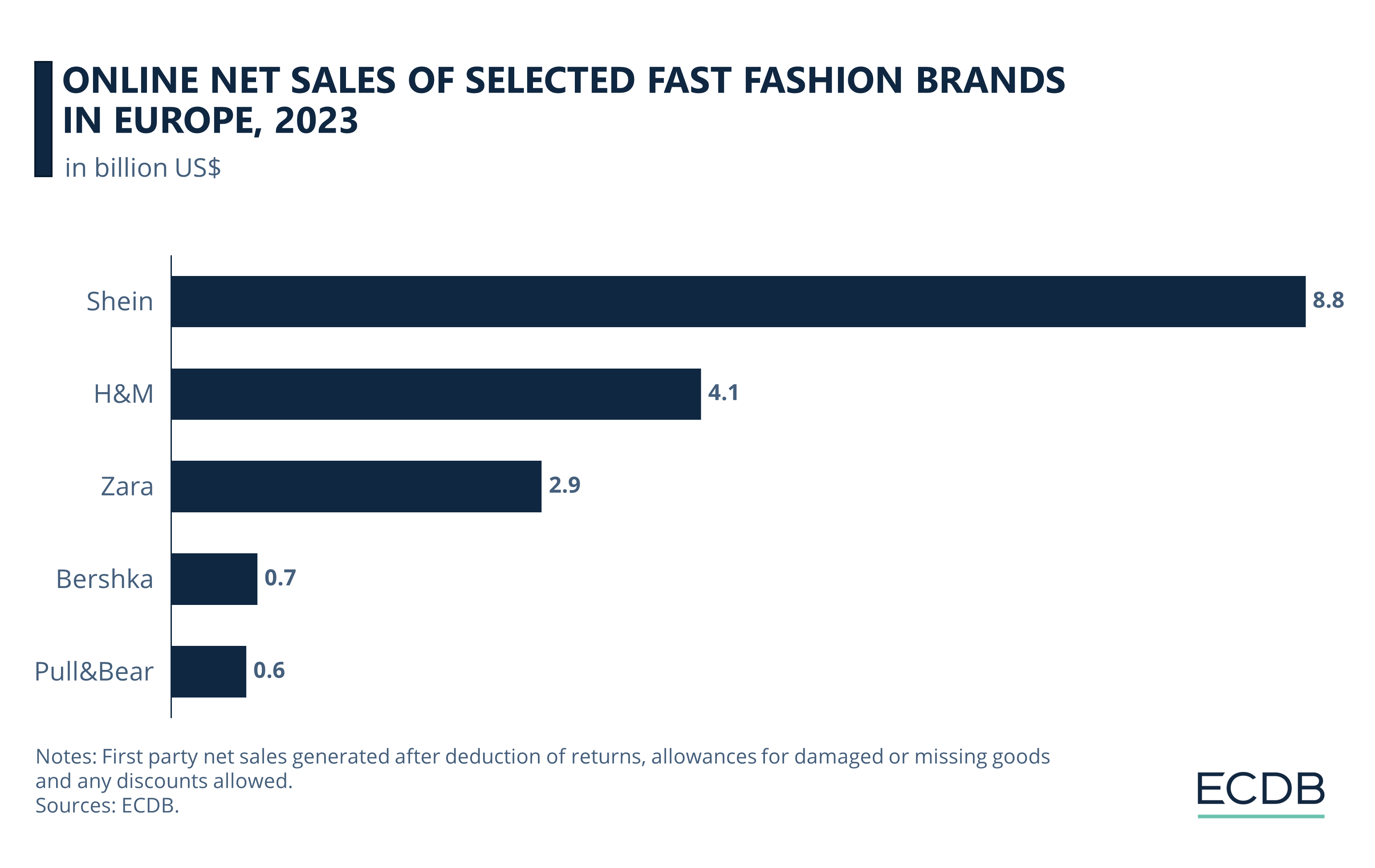

Online fashion retailer Shein has undercut industry leaders on price and turnaround time, and boosted sales with marketing strategies that capture the attention of its predominantly young customer base. Consequently, Shein ranks fifth among all eCommerce stores worldwide.

The company’s low-cost products primarily attract young users with a low disposable income, who are exposed to the products through the company’s extensive social media marketing. In essence, this means that Shein is giving free samples to micro-influencers on platforms like TikTok for so-called clothing hauls.

The effectiveness of this strategy is reflected in Shein’s position in European eCommerce. Among the five fast fashion stores we included in the analysis, Shein ranks first with European online net sales of US$8.8 billion in 2023.

Among the other players, H&M follows further behind, having generated US$4.1 billion in Europe. Inditex’s Zara comes in third with US$2.9 billion, while the other two Inditex brands, Bershka and Pull&Bear, did not quite reach the billion mark with 2023 online revenues of US$666 million and US$580 million, respectively.

For your information: We regularly update our rankings with the latest data from our models, providing valuable insights to help improve your company. Which stores and companies are leading eCommerce? Which categories are driving bestsellers and high sales? Find out for yourself on our rankings for companies, stores, and marketplaces. Stay a step ahead of the market with ECDB.

So, what are the factors that contribute to the success of the leading fast fashion brands in Europe?

H&M and Zara Step Up Their Hybrid Approach

H&M and Zara have a long-standing presence in European fashion. With their hybrid model of online and offline sales, both stores reach consumers through a multichannel strategy.

But with the emergence of Shein, the situation has changed. Shein’s success is based on increasing the speed of production while undercutting prices and reaching customers through targeted marketing initiatives. This method is forcing traditional fashion stores to either adapt their strategies or face the consequences, i.e. suffer the losses.

In the face of a collective outcry against the harmful impact of cheap clothing on the environment and on workers’ rights in the factories, both H&M and Zara have responded. H&M has announced a shift to a marketplace model, including third-party products on its site, while Zara has focused more on exclusive and limited-time collaborations with third-party brands, as well as higher product prices for its own-brand items.

Sustainable Practices or Greenwashing?

In our insight on H&M’s role in the Scandinavian market, we talked about the Swedish brand’s move towards sustainable business practices. But accusations of greenwashing, or using terms that suggest sustainability while doing little to change truly harmful behaviors, continue to surface.

The problem is that the success of these stores is based on hyper-fast production cycles and the use of low-cost materials and labor, so that consumers can afford the items and visit the stores multiple times a year to buy the latest styles.

Food for Thought: Recent EU initiatives to create a standardized supply chain law, which aims at reducing human rights violations and environmental malpractices in manufacturing locations, demonstrate how difficult it is to find practical solutions to implement these standards.

But if this legislation were to pass, would it fundamentally change the way online fashion brands like H&M and Shein source their products? Or would factories and brands find loopholes to avoid the requirements?

Despite these regulatory efforts, competitors like Shein are raising the bar on the proliferation of low-cost items and rapid production cycles.

Shein Changes the Face of Fast Fashion

The nature of fast fashion has changed the way consumers relate to the products they buy. And the company’s business model continues to prove successful, not only because the concept is being emulated by new competitors, but also because of Shein's growth and expansion. This includes the acquisition of the bankrupt fast fashion player Forever 21.

As a result, Shein now features Forever 21 items on its store website, providing customers with more variety and recognizable products. At the same time, Shein is offering its pieces in Forever 21’s physical stores. This is a new development for the company, which has only been involved in physical retailing through temporary pop-ups in urban centers.

Shein’s ubiquity in the European market leads to our main question about fast fashion companies: Are there observable trends that indicate where fast fashion works best?

Distribution of Fast Fashion in Europe

Using ECDB data on the five fashion stores H&M, Zara, Bershka, Pull&Bear, and Shein, we mapped the percentage of online net sales generated by these companies as a share of the countries' top 100 online fashion stores.

The core strategy of fast fashion is to offer affordable products at short intervals between new collections. In this way, brands appeal to a wide range of consumers, particularly those in lower income brackets and younger demographics. For this reason, we assumed that countries with more pronounced economic challenges would have a higher fast fashion share.

The map confirms the assumption in part, but there are also other factors at play:

Consistent with the first section, Portugal emerges as the country with the highest fast fashion share of the top 100 online fashion stores. With a whopping 30.5%, the fast fashion model generates a significant proportion of sales. Similarly, Spain (25.6%), Greece (22.3%), Italy (17.5%), Sweden (16.1%) and Denmark (16%) indicate high shares.

Fast Fashion's Impact Is Decreasing

It should be noted that Europe seems to be swearing off fast fashion: Compared to last year's data, all of the countries tracked have moved down the scale of fast fashion influence and brightened their map colors.

Is the European supply chain law proposal working? Or is there a deeper cultural shift taking place, of which the supply chain discussion is only one part?

While EU lawmakers haggle over the details of the law, a recent Guardian report cited an estimate by environmental groups that the law in its current form would exclude 70% of EU companies. The Supply Chain Act is applied according to company size, and lobby groups are wielding their influence to impose stricter conditions, seeing the law as an unnecessary increase in cost and bureaucracy.

So, what are the most common factors that lead to high adoption of fast fashion online sales in a country?

Economic Conditions Play a Role, But...

In our look at the online fashion landscape in Spain and Portugal, we showed that economic hardship plays a role in the adoption of fast fashion, but other factors contribute to the pattern.

One of these is the distribution of garment production hubs across the continent. With the presence of the Spanish fashion conglomerate Inditex in the Iberian Peninsula, many of the conglomerate’s top brands are successful in Portuguese and Spanish eCommerce. The same is true in Sweden. As a Swedish company, H&M generates 6.6% of its net sales in Sweden, while Germany, Denmark, the Netherlands, and Norway belong to the top 10 countries where H&M sells its products.

So while there are garment production hubs throughout Europe, the countries with the closest operational proximity to the leading brands in our focus have a higher share of net sales from these stores.

This more detailed picture of the importance of fast fashion in Europe shows us that while economics have an impact, it is not the whole story. Proximity to production and successful marketing also determine where consumers tend to shop, while the size of the national fashion market predestines the number of alternatives consumers have to decide where to spend their income.

Fast Fashion in Europe:

Closing Remarks

Despite growing criticism, fast fashion continues to grow in Europe. While there are general characteristics in the fast fashion business model that apply universally, such as low prices and rapidly changing product assortments, some countries may be more susceptible to the influence of fast fashion companies. The reasons for this include proximity to manufacturing hubs and the competitive landscape of the respective country's online fashion market.

A viable solution to the fast fashion conundrum can only work on a large scale, such as the currently disputed supply chain law in the EU, which poses its own complexities and hurdles nonetheless.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Who Are the Number One Shop Software Providers in Each European Country?

Who Are the Number One Shop Software Providers in Each European Country?

Deep Dive

The United States Takes the International Lead in eCommerce Revenue per Capita

The United States Takes the International Lead in eCommerce Revenue per Capita

Deep Dive

Valentine’s Day Drives eCommerce Revenues for Flowers & Gifts

Valentine’s Day Drives eCommerce Revenues for Flowers & Gifts

Deep Dive

Shopify Is the Most Used Shop Software Globally, But Magento Dominates in Europe

Shopify Is the Most Used Shop Software Globally, But Magento Dominates in Europe

Deep Dive

Why the Online Pharmacy Trend Has Continued Beyond the Pandemic

Why the Online Pharmacy Trend Has Continued Beyond the Pandemic

Back to main topics