eCommerce: Market Trends

Online Fashion Market in Spain & Portugal: Fast Fashion on Top

Spain's and Portugal's eCommerce fashion markets are primarily shaped by the presence of the conglomerate Inditex, of which Zara stands out as the flagship brand. But what does this mean for the ranking of top fashion stores in the region? Discover the market with the help of ECDB data.

Article by Patrick Nowak | March 28, 2024Download

Coming soon

Share

Fashion in Spain and Portugal: Key Insights

Spanish Fast Fashion Goes Global: Inditex is considered to have started the fast fashion trend. It is defined as fast-produced, trend-driven clothing that beats traditional retail in terms of affordability and speed.

Key Players in Online Fashion: In 2023, Shein is the leading fashion online retailer in both Spain and Portugal. In Portugal, four of the top five online fashion stores are fast fashion companies. In Spain, the influence of Amazon, El Corte Inglés and Zalando is more pronounced.

Explaining the Fashion Paradox: The success of fast fashion in Spain and Portugal is partly due to their economic circumstances and proximity to production facilities. On a universal level, the success of fast fashion is explained by a phenomenon called the "fashion paradox".

Spain and Portugal are home to some of the world's best-known fashion brands. Particularly the conglomerate Inditex (short for Industria de Diseño Textil) comes to mind, which manages the brands Zara, Pull&Bear, Massimo Dutti, Bershka, and Stradivarius, among others.

As these brands are commonly referred to as operating under the fast fashion business model, the following examines the connection between fast fashion and the online fashion markets in Spain and Portugal.

Fast Fashion: Definition and Origin

Although fast fashion is widely discussed these days, the concept itself is not new. It was introduced in the 1960s by Spanish entrepreneur Amancio Ortega Gaona, whose first business venture evolved into today's Inditex.

The introduction of fast fashion into global business has changed the market in a lasting way, and there are factors in Spain and Portugal that contribute to the success of fast fashion. But before we get too far ahead of ourselves, here are the key aspects that distinguish the fast fashion business model:

Vertical Integration: Supply is synchronized with customer demand, leading to a more accurate picture of which items are worth stocking and which are dead stock. This results in more efficient use of manufacturing and logistics capacity.

Rapid Design Cycles: Inditex has pioneered a significant reduction in the time it takes to bring new designs to customers. While shoppers used to have to wait around half a year for designers to launch their new styles, fast fashion companies like Inditex use the vertical integration and local production facilities to reduce this period to around five weeks. The rapid production cycle is what ultimately gave the business model its name and disrupted the industry.

Competitive Pricing: Instead of determining prices based on production costs, fast fashion brands first estimate how much consumers are willing to pay for their competitors’ products. The final price is then set at a lower margin, followed by a search for manufacturers capable of providing these products at a cost that leaves ample room for profit.

Why the Business Model Is Under Scrutiny

With Inditex's introduction of this model based on speed, affordability, and trend-driven production, many fashion retailers have jumped on the bandwagon. There are undoubtedly advantages to fast fashion, including being affordable to consumers of all income levels. However, recent reports highlight the negative effects of this business model.

Because low-cost and quick-to-buy products reflect a lower value of purchases to consumers, they are more likely to discard items after a few uses or not wear them at all.

Another point of contention is the industry's common disregard for workers' rights and fair compensation in manufacturing countries. Since collections need to be produced as cheaply as possible, the easiest way for brands to cut costs is to avoid paying workers a living wage.

Read below to see how this applies to Spain and Portugal.

Spain & Portugal: Top Online Fashion Stores

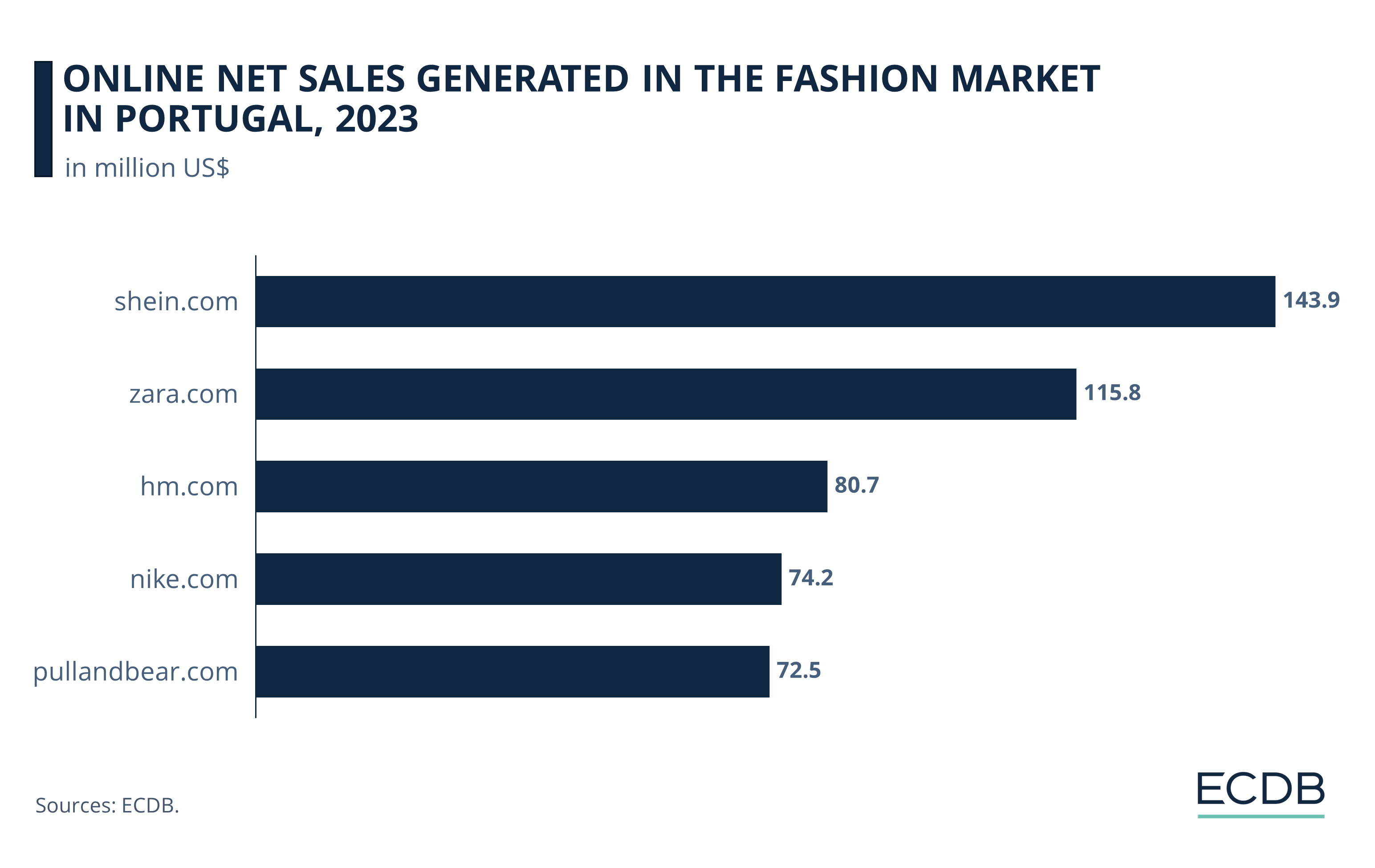

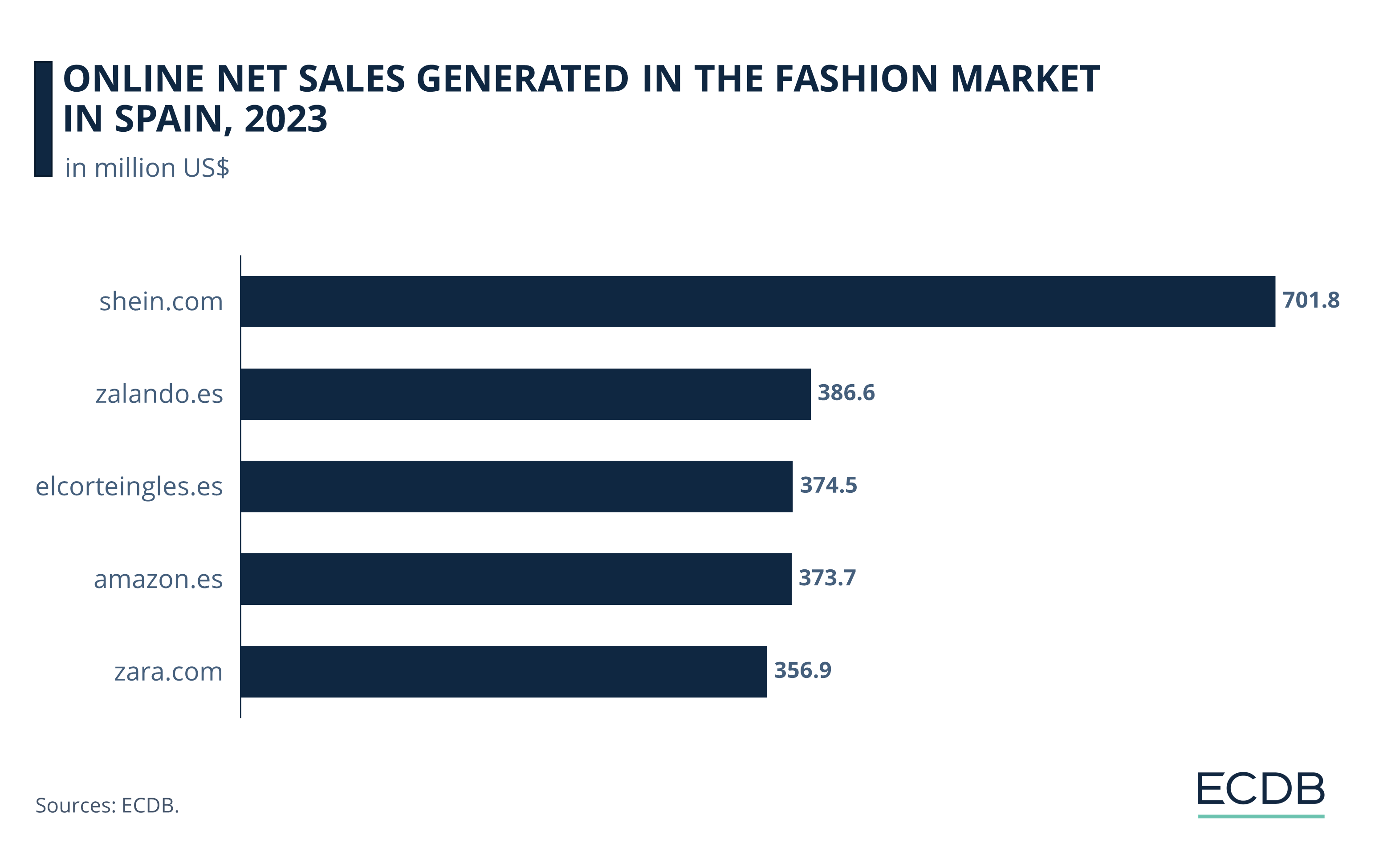

In both markets, fast fashion stores take the lead. The online platform of Spanish homegrown brand Zara ranks second in Portugal and fifth in Spain, with 2023 online net sales of US$116 million and US$357 million, respectively.

Overall, the prevalence of fast fashion brands is quite evident in the Portuguese online fashion market, with four out of the top five players operating under this business model.

In Spain, on the other hand, there are more fashion players that offer a wider variety of fashion brands. These include Amazon with online net sales of US$374 million, Zalando with US$387 million and El Corte Inglés with US$375 million.

A competitor that stands out in both rankings is Shein, the online fashion retailer commonly referred to as an ultra-fast fashion platform. With online net sales of US$702 million in Spain and US$144 million in Portugal in 2023, Shein ranks first in both countries.

With a strategy that leverages the same aspects mentioned above - vertical integration, rapid design cycles, and competitive pricing - Shein undercuts established fast fashion brands on price and overshadows them on volume.

Shein's meteoric rise took off in 2020, where it has significantly increased its global net sales. The concept of traditional fast fashion retail has become increasingly outdated in consequence, rendering it less competitive in the evolving market.

Why Is Fast Fashion So Successful?

A key success factor for fast fashion is its affordability. By offering customers trendy styles that they can buy at low prices, making clothing accessible to younger users or those struggling financially is a key factor in generating sales.

Local production also accounts for its popularity in Spain and Portugal. As Inditex's country of origin, many of its manufacturing facilities are located in Spain. Due to low production costs and proximity, Portugal is also an important hub for manufacturers. Proximity to both markets facilitates distribution and improves marketing.

But beyond these two fundamental factors, there are other, more universal principles that account for fast fashion's success.

Economic Conditions Affect Consumer Spend

Spain and Portugal are countries with precarious economic conditions, reflected in high levels of income inequality and a high percentage of the population at risk of poverty, even among the working population. Although some progress had been made in the years before the pandemic, the Covid-19 crisis exacerbated structural dependencies and left many Spaniards unemployed, especially those working in the tourism sector. Youth unemployment in Spain was at 28.5% in 2023, according to EUROSTAT (via Trading Economics).

Inflation is another aspect that affects consumer ability to spend, especially in populations that were already struggling economically before prices soared. All of these factors likely contribute to the popularity of fast fashion brands in the Iberian Peninsula, but their prevalence is not limited to countries at the lower end of the economic spectrum.

The Fashion Paradox: A Universal Case

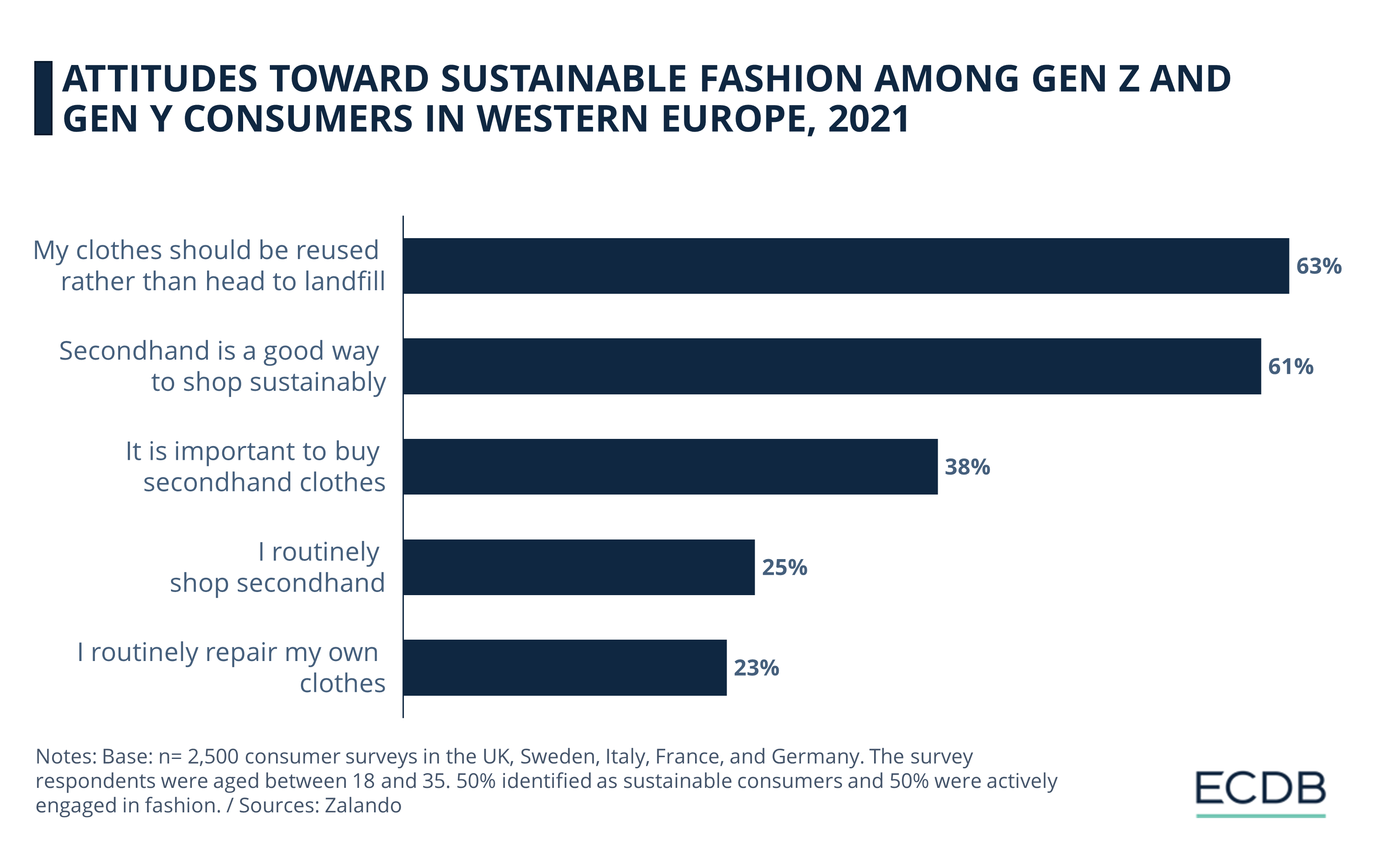

The recent rise of Shein and the ultra-fast fashion model has reignited the discussion about the unsustainability of products and unethical treatment of workers in fast fashion. Although most consumers are aware of the negative consequences and care about the ethical side of their consumption, few do actually act on their stated attitudes, also known as the “attitude-behavior gap”. When it comes to fashion, researchers coined this the “fashion paradox.”

The chart below illustrates the paradox.

While more than 60% of European respondents to the Zalando survey said they were in favor of reusing and buying used clothes, only 23% to 25% also said they routinely bought secondhand or repaired their own clothes.

Distrust of Corporate Intentions

In addition, many consumers are skeptical about the true sustainability of brands. Greenwashing, the practice of companies claiming to be sustainable without actually being so, has made a significant portion of the population wary of these claims. Other barriers to sustainable purchasing include high prices and the perception that sustainable fashion products are less trendy. All these aspects tie into and reinforce the fashion paradox as defined above.

Building Trust and Offering Affordable Quality

The cases of Spain and Portugal in particular show us that despite widespread education and news reports about the negative aspects of fast fashion, consumers will still buy these products because they can afford them.

Brands can compete in these markets by offering credible sustainable products at competitive prices, as there is a fairly large portion of consumers in Spain who are interested in sustainable products, as long as they can afford the price and the styles are on-trend.

Fashion in Spain and Portugal: Wrap-Up

Fast fashion has had a profound impact on the eCommerce markets of Spain and Portugal, building on affordability, fast production cycles and local production facilities.

However, its negative ethical and environmental impacts have raised concerns and initiated a critical discourse on the sustainability of this model. Shein's meteoric rise and leadership in Spain's and Portugal's eCommerce markets illustrates how fast fashion has undermined its own model by introducing new stores with even faster production at significantly lower prices.

Shein's success may herald a change in the way Inditex does business: Recent developments at Zara suggest that the company is moving toward a more qualitative approach, avoiding association with the low-cost model with which it has thrived.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Deep Dive

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Deep Dive

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Deep Dive

South Korean Online Fashion 2024: Revenue, Stores & Trends

South Korean Online Fashion 2024: Revenue, Stores & Trends

Back to main topics