eCommerce: Inflation

Inflation's Impact on eCommerce

Inflation is reshaping online shopping. From price drops in groceries to rising luxury cosmetics sales, see how consumers and retailers are adapting.

Article by Cihan Uzunoglu | October 21, 2024Download

Coming soon

Share

Inflation’s Impact on eCommerce: Key Insights

Inflation's Impact: Inflation has pushed shoppers towards cheaper alternatives like private-label brands, while high-end cosmetics continue to grow as consumers indulge in small luxuries.

Grocery Price Fluctuations: Online grocery prices saw a 3.7% drop in 2024, but inflation-driven price hikes since 2019 mean pre-pandemic levels are unlikely to return.

Trust Issues in eCommerce: Trust remains a challenge for eCommerce, with younger generations skeptical of online-only brands due to counterfeit goods and fake reviews.

Retailer Challenges in Germany: Inflation and competition are top concerns for German retailers, with 75% of them citing buyer reluctance as a major hurdle in 2024.

Inflation has changed the way people shop online. While grocery prices have dropped, and cosmetics are still seeing growth, not all sectors have adjusted as smoothly. Consumers are choosing private-label products over name brands, and retailers are feeling the pinch of rising costs.

But what happens when inflation starts to slow down? Will spending habits shift back, or have permanent changes set in? Global inflation has fluctuated dramatically over the last decade, and understanding how it has impacted eCommerce – and what’s next – is critical.

Global Inflation Trends in the Last 10 Years

The burning question here is: How has inflation shaped online shopping trends, and what are retailers doing to keep up?

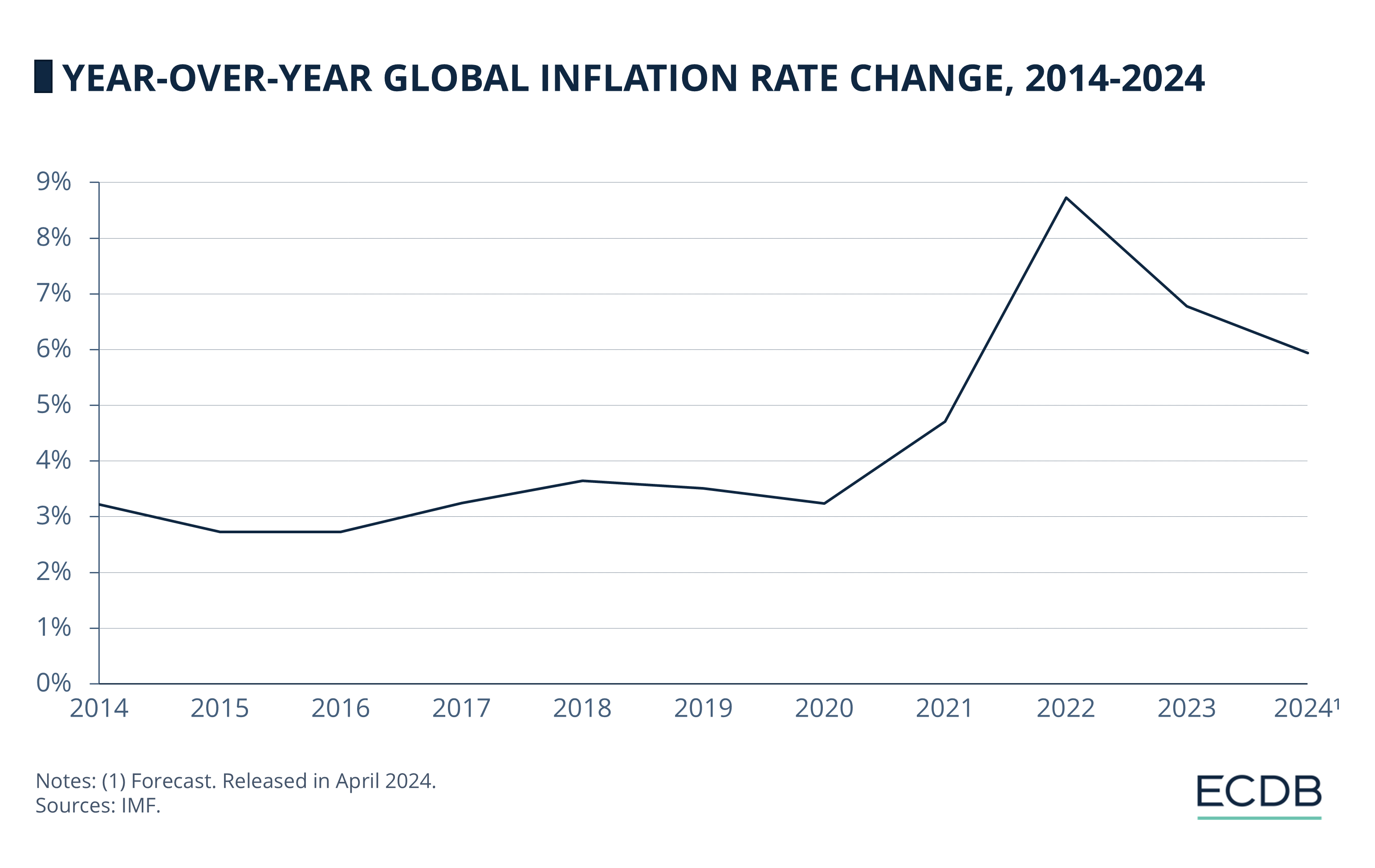

Global inflation has fluctuated over the last decade, with notable spikes in recent years. These changes have impacted consumer spending habits and the broader economy. Here’s a breakdown of key trends by IMF:

Sharp increase since 2021: The year-over-year global inflation rate change spiked from 4.71% in 2021 to a peak of 8.73% in 2022, reflecting severe disruptions from supply chain issues and geopolitical tensions.

Stable changes from 2014-2020: Before 2021, the year-over-year global inflation rate changes were relatively stable, fluctuating between 2.73% and 3.65%, pointing to a more predictable economic environment during this period.

Moderation forecast for 2024: The inflation rate change is expected to moderate to 5.94% in 2024, though it remains higher than pre-2021 levels, signaling ongoing economic uncertainty.

We need to zoom in and see how individual countries have dealt with inflation to fully understand the impact of this economic phenomenon on the online shopping market.

Country-Specific Inflation Rates

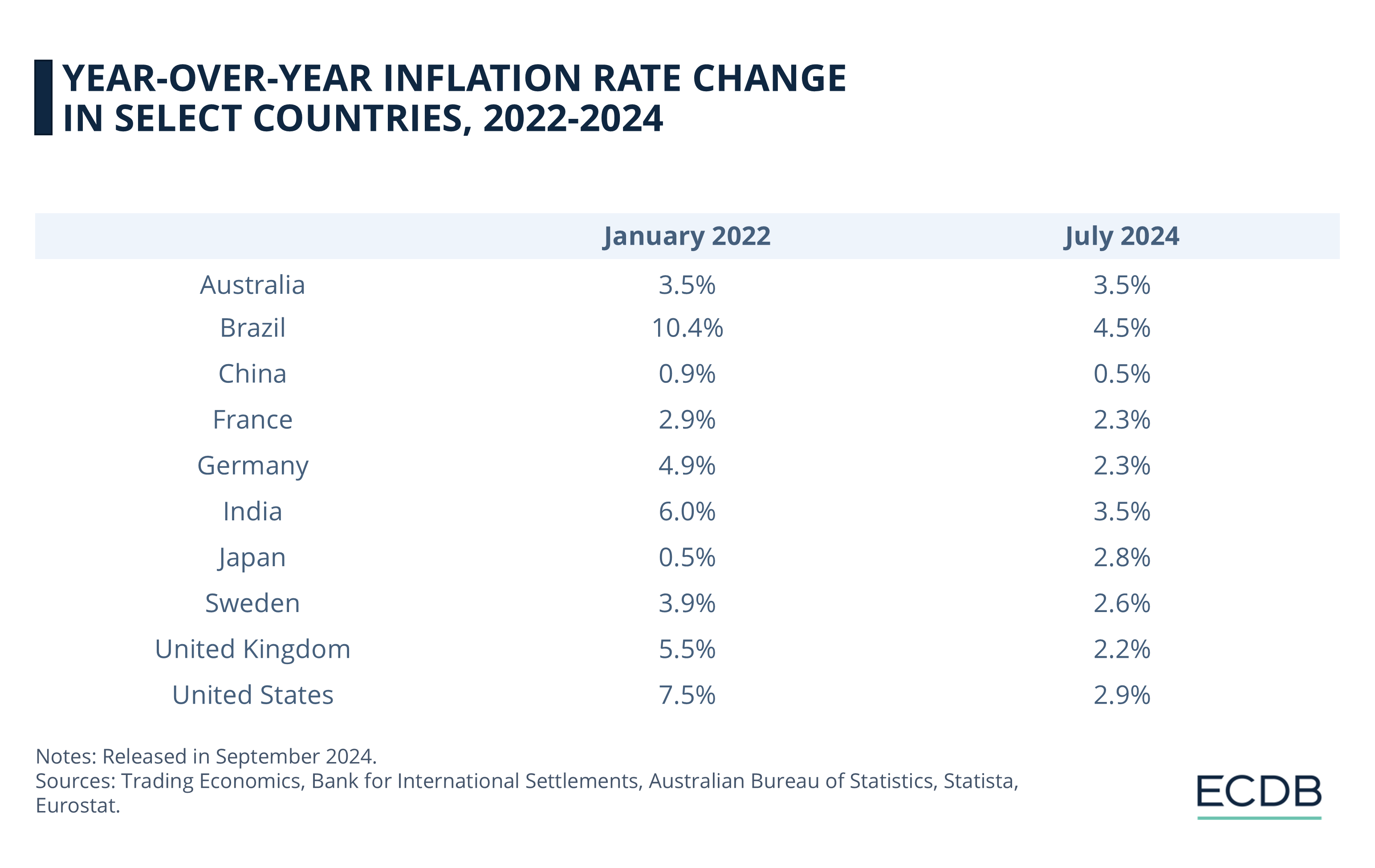

Inflation trends have varied significantly across countries from 2022 to 2024. Statista data shows a breakdown based on geographic regions:

North America and Europe: The United States saw a drop from 7.5% in January 2022 to 2.9% by July 2024. In Europe, Germany’s inflation decreased from 4.9% to 2.3%, France saw a decline from 2.9% to 2.3%, the UK from 5.5% to 2.2%, and Sweden from 3.9% to 2.6%.

Asia-Pacific: Japan experienced a significant rise from 0.5% to 2.8%, while China saw a modest drop from 0.9% to 0.5%. India’s inflation decreased from 6% to 3.54%, and Australia remained stable at 3.5% over the same period.

Latin America: Brazil saw a sharp decline from 10.4% to 4.5%, reflecting strong inflation control measures.

But how exactly has inflation affected the eCommerce market, are consumers buying less now?

Online Consumer Behavior Shifts

Due to Inflation

Inflation has pushed nearly two-thirds of online shoppers to change their habits. In June 2024, Forter and Talker Research reported that 61% of respondents adjusted their behavior due to rising costs, and 90% said their cost of living increased over the past five years.

Shoppers are more cautious, prioritizing savings through free shipping, frequent sales, and loyalty incentives. They are also turning to cheaper alternatives, such as private-label brands, particularly in grocery, clothing, and home goods.

More Insights? We keep our rankings up to date with the latest data, offering you valuable information to improve your business. Want to know which stores and companies are leading the way in eCommerce? Which categories are achieving the highest sales? Check out our rankings for companies, stores, and marketplaces. Stay one step ahead with ECDB.

In this period, private labels have also gained traction as inflation-sensitive consumers seek cost-effective options. The Food Industry Association's 2024 report found that the majority (55%) of grocery shoppers now prefer private-label brands, up from previous years when name brands held more sway.

We see a broader trend where consumers are willing to compromise on brand loyalty to reduce costs, and retailers are capitalizing on this shift by expanding their private-label offerings.

Trust in eCommerce

In the middle of all this, trust remains a major issue in eCommerce. While brick-and-mortar stores have regained consumer trust as inflation cools, online shopping continues to struggle.

Morning Consult‘s June 2024 research highlights that eCommerce brands face low trust, especially among Gen Z, who are wary of online-only brands. The lack of face-to-face interactions, counterfeit products, and misleading reviews hurt eCommerce platforms. However, despite low trust, Gen Z and millennials continue to shop online, driven by convenience.

For Gen Z, trust is especially important in eCommerce. This generation grew up with digital shopping but remains skeptical of online-only brands due to concerns about fake reviews and inconsistent quality. Millennials, meanwhile, value convenience above all, balancing busy lives with the efficiency of online shopping.

Online Grocery Trends in the Face of Inflation

One of the most notable trends in the inflationary landscape is the drop in online grocery prices.

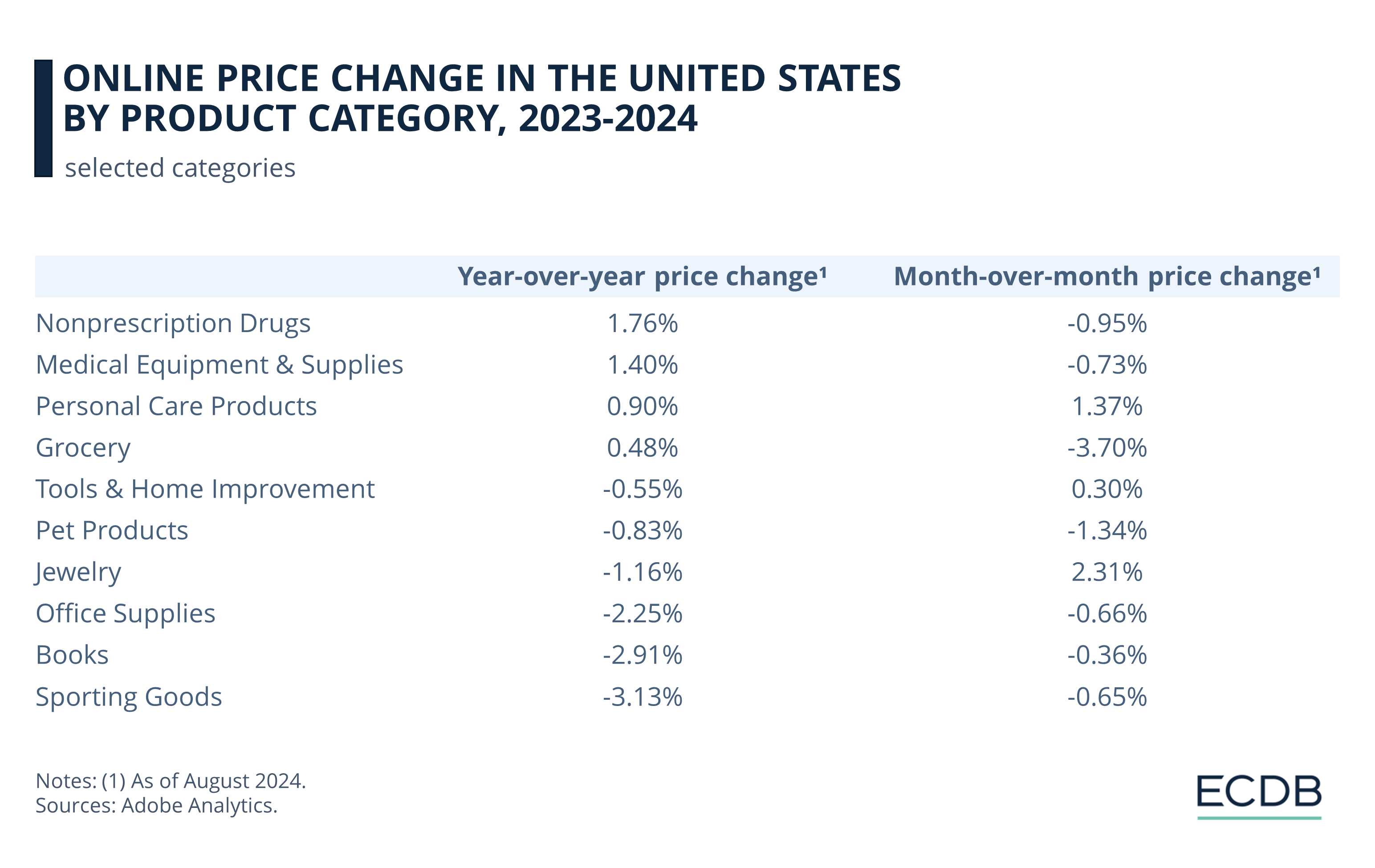

Adobe's Digital Price Index (September 2024) reported a 3.7% decline in U.S. online grocery prices in August, marking the largest drop since tracking began in 2014. While this offers short-term relief for consumers, it also reflects how volatile pricing can be in the online grocery market, driven by fluctuating demand, supply chain issues, and inflationary pressures.

That said, platforms like Instacart and Walmart continue to dominate online grocery, with nearly half of digital grocery sales coming from in-person pickups. Despite the price drop, inflation-driven price increases since 2019 remain significant – over 20% in some cases – and a return to pre-pandemic price levels is unlikely.

The growing popularity of online grocery, combined with inflation's unpredictable effects, suggests ongoing volatility in this sector.

Lipstick Effect: Cosmetics Defy Inflation

While most product categories saw consumers trading down to cheaper options, cosmetics have defied this trend.

According to Adobe Analytics, consumers are still splurging on high-end cosmetics like fragrances and lipsticks. Sales of these products grew 8.8% year-over-year in the first five months of 2024, reflecting a unique consumer behavior: the desire to indulge in small luxuries even as they cut back elsewhere.

This is a clear example of the "lipstick effect," where consumers treat themselves to affordable luxuries like cosmetics during tough economic times. Prestige cosmetics, particularly in the high-priced quartiles, saw strong growth. Lipstick and fragrance sales surged, with daily sales up 49% and 53% respectively between April and May 2024. This contrasts with categories like electronics and apparel, where consumers opted for cheaper alternatives in response to inflation.

Global Consumer Spending Adjustments

Inflation's impact on eCommerce is obviously not confined to the United States. A 2023 survey by Oliver Wyman revealed that consumers across the globe are adapting to rising prices. In Europe, over half of respondents reported buying cheaper alternatives, particularly in grocery categories. In countries like the UK, shoppers are shifting to private-label goods at unprecedented rates, with two-thirds of consumers reporting such behavior.

Bulk purchasing, a popular trend in North America, has also gained traction in other parts of the world. In Asia, platforms like Pinduoduo have embraced group buying, allowing consumers to team up for bulk purchases. This model is gaining popularity as a cost-saving method, especially as inflation affects basic goods. In the Middle East, countries like the UAE are seeing similar trends, with 43% of consumers opting for bulk buying to reduce prices.

Challenges Facing Online Retailers

in Germany

Inflation remains a biggest challenge in Europe's largest economy. According to a report by Händlerbund, 75% of online retailers in Germany cited inflation and consumer reluctance to buy as their biggest hurdle in 2024.

Competitive pressure affects over half (52%) of retailers, forcing them to differentiate through pricing, marketing, and customer experience.

Supply bottlenecks remain a problem for 29% of retailers, reflecting ongoing global issues with inventory management and delays, as highlighted in the online grocery and general eCommerce trends.

Online marketing and legal certainty also pose challenges, impacting how retailers attract and retain customers in an increasingly crowded and regulated market.

The Long-Term Outlook

Looking ahead, inflation’s effects on eCommerce will continue to evolve. While price volatility is expected to persist, consumers are likely to remain cautious in their spending. Retailers will need to adapt by offering more flexible pricing, expanding private-label ranges, and leveraging promotions to maintain customer loyalty.

Despite recent price drops, particularly in groceries and electronics, inflationary pressures are far from over. Supply chain disruptions and geopolitical tensions could lead to further price fluctuations, keeping both consumers and retailers on edge. The ongoing challenge for eCommerce businesses will be navigating this uncertain environment while meeting consumer demand for affordability and convenience.

Sources: Morning Consult, Retail Dive: 1, 2, Oliver Wyman, Progressive Policy, Chain Store Age, IMF, Forter and Talker Research, The Food Industry Association, Statista, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics