eCommerce: Fashion Leader

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein's business model is based on low prices, fast-changing trends and extensive social media marketing. The fast-fashion online store is growing in popularity around the world. Learn more about its strategy here.

Article by Nadine Koutsou-Wehling | October 23, 2024Download

Coming soon

Share

Shein's Business Model: Key Insights

Growing Net Sales: Shein's net sales accelerated quickly within just a few years. It increased its online net sales of US$2.5 billion in 2019 to reach an estimated US$48 billion by 2024.

Shein's Audience Tends to Be Younger: Shein's hype is biggest among younger users, particularly Gen Z. The platform matches its business model and marketing to address the preferences of younger demographics.

Social Media & Technological Innovation: Shein uses modern instant-feedback algorithms for frequent style updates and preference testing. The platform promotes itself through influencer collaborations. Shein tends to partner with a lot of nano- and micro-influencers to become known among its target user base.

Shein is a recurring topic here at ECDB. The low-cost online fashion store with ties to China but headquarters in Singapore is a prominent example of a fashion brand that expands globally. But Shein's noteworthiness extends beyond its international success. The store's most remarkable features include its business model and marketing strategy, with which the brand attracts and retains consumer interest.

Just how much did Shein grow in recent years? Why is even Amazon starting to emulate this company with Asian origin now? And what is it about Shein that youngsters seem to go crazy for? ECDB has the answers.

Stay Competitive: Our constantly updated rankings provide you with the latest insights to improve your business strategy. Discover which stores and companies are at the top of the eCommerce world and which categories are driving the highest sales. Dive into our rankings for companies, stores, and marketplaces. Stay a step ahead in the market with ECDB.

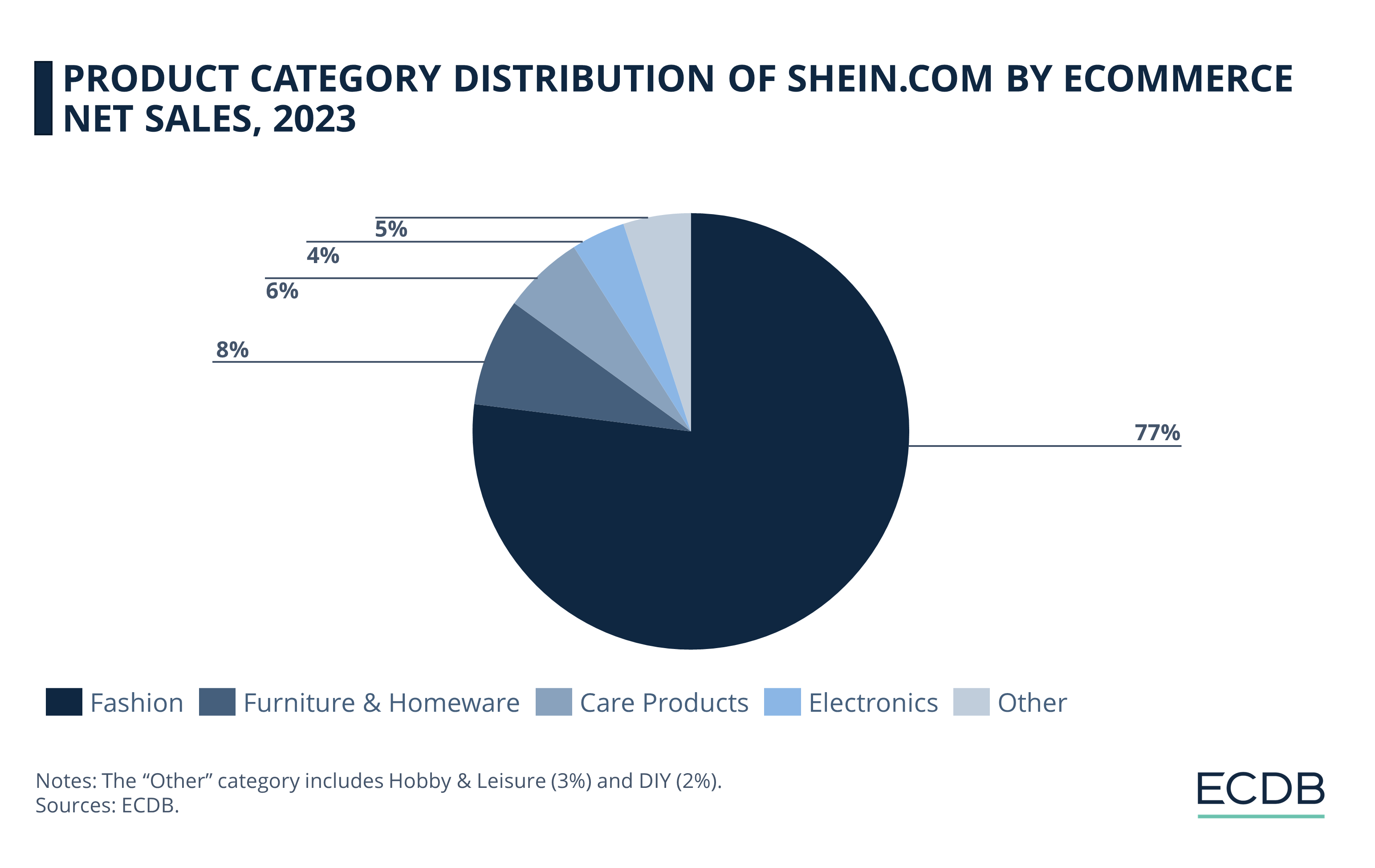

Shein: A Fast-Fashion Company With a Diverse Product Mix and Automated Reordering

Shein is a fast-fashion online store, so most of its revenue is being generated by fashion products. But its product mix is more diverse than just fashion.

Most products are fashion: 77% of products sold on Shein belong to the fashion category, of which 56% is Apparel, 14% Bags & Accessories and 7% Footwear.

Other categories: But there are also smaller numbers of other categories sold on the platform: Furniture & Homeware (8%), Care Products (6%), Electronics (4%), Hobby & Leisure (3%) and DIY (2%).

What is making Shein stand out from all the other fashion stores is its usage of technology to gauge consumer interest in real time. As a result, the company speeds up production processes and provides instant feedback to manufacturing facilities on which items are generating the most consumer response. Shein calls it a ‘large-scale-automated test and re-order' (LATR) model, which relies on producing small batches in a first step, and then building up the order volume later, after seeing which pieces are worth distributing on a larger scale.

It is the use of big data that helps Shein assess which styles are popular with users and which can be discontinued. While this practice can increase manufacturing efficiency by ceasing production of styles that do not resonate over time, it is the sheer number of new styles and items uploaded to the site that has drawn the brand’s primary criticism. According to Rest of the World, between 2,000 and 10,000 new looks are uploaded to the platform every day.

The strategy is highly effective. See how Shein's revenues are surging, outpacing its direct competitors at breakneck speed.

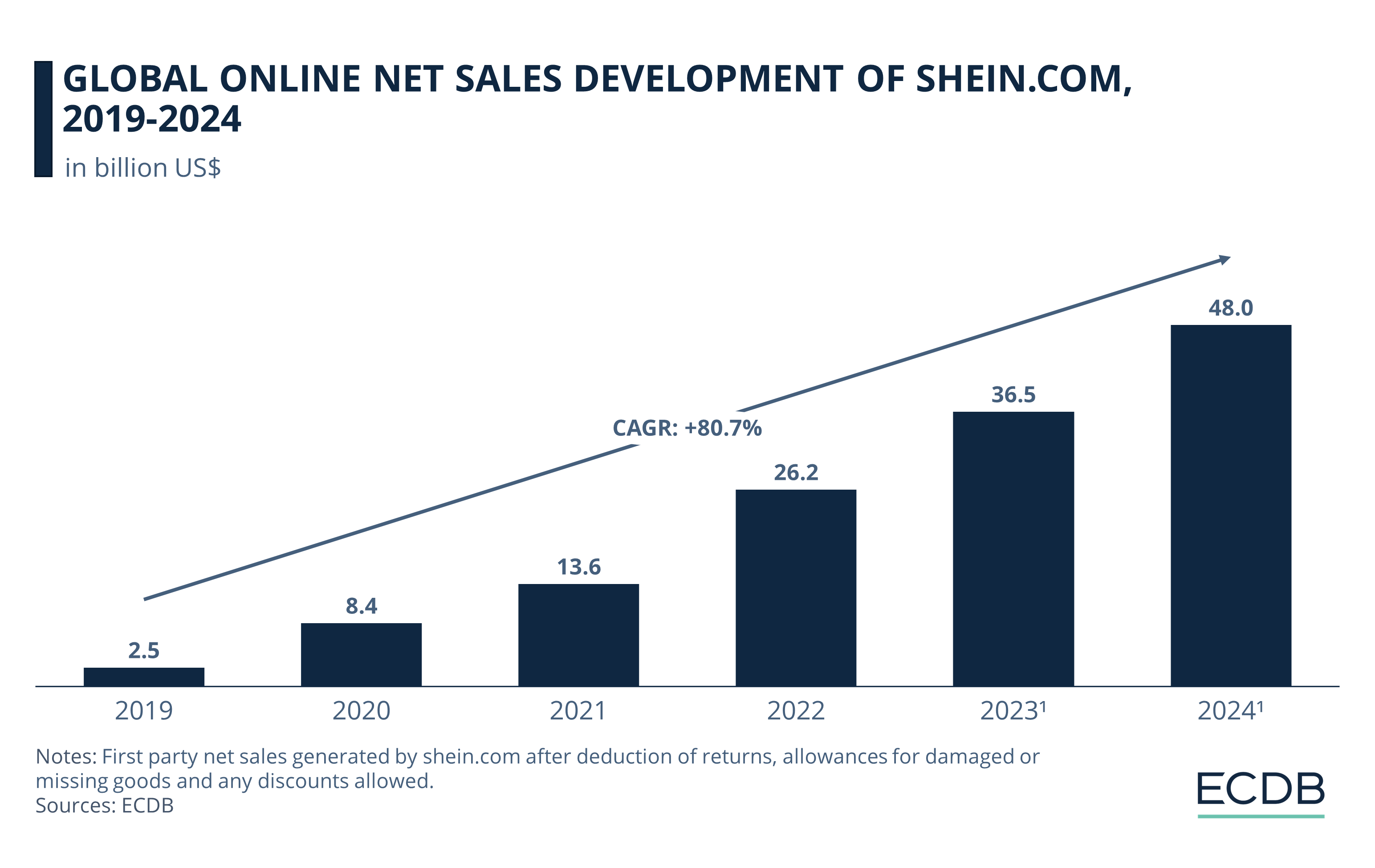

Shein Is Forecast to Generate US$48 Billion in Online Revenue by 2024

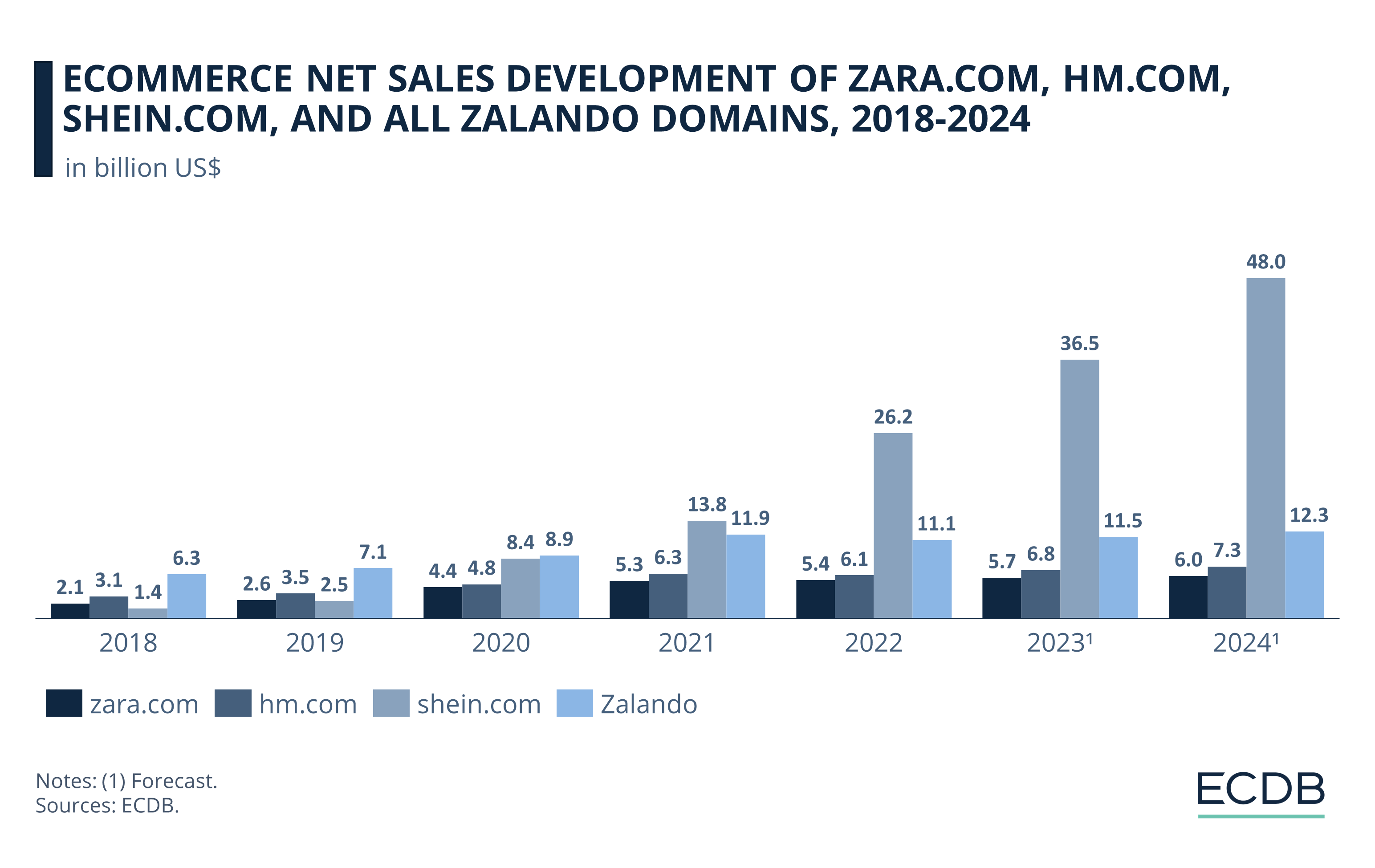

Shein’s online net sales over the past few years are interesting in and of themselves, but when compared to competing platforms, the disparity becomes even more pronounced:

Shein.com has made its first leap during the pandemic, jumping from online net sales of US$2.5 billion in 2019 to US$8.4 billion in 2020. That’s a 236% year-over-year increase.

Consistent Growth: While the following year saw a slower, but still significant, growth of 64% from US$8.4 billion in 2020 to US$13.8 billion in 2021, revenues surged from 2021 to 2022, indicating about 90% growth.

According to forecasts, Shein will likely make continuous leaps in online revenue in the years to come. With projected online net sales of US$48 billion by 2024, Shein is expected to dwarf its competitors in the online fashion market.

In contrast, Shein’s rivals cannot keep up with the company’s explosive growth. As seen in the chart above, Zalando’s online net sales in 2022 did not even reach half Shein’s online revenues, while H&M’s and Zara’s online platforms lurk at around a quarter of what Shein generated that year.

Plotting Shein's online revenue growth on an isolated graph including the CAGR (2019-2022) shows a compound annual growth rate of about 81%. Considering the staggering growth that shein.com is expected to maintain, it is no wonder that the distance to its competitors is becoming even more pronounced.

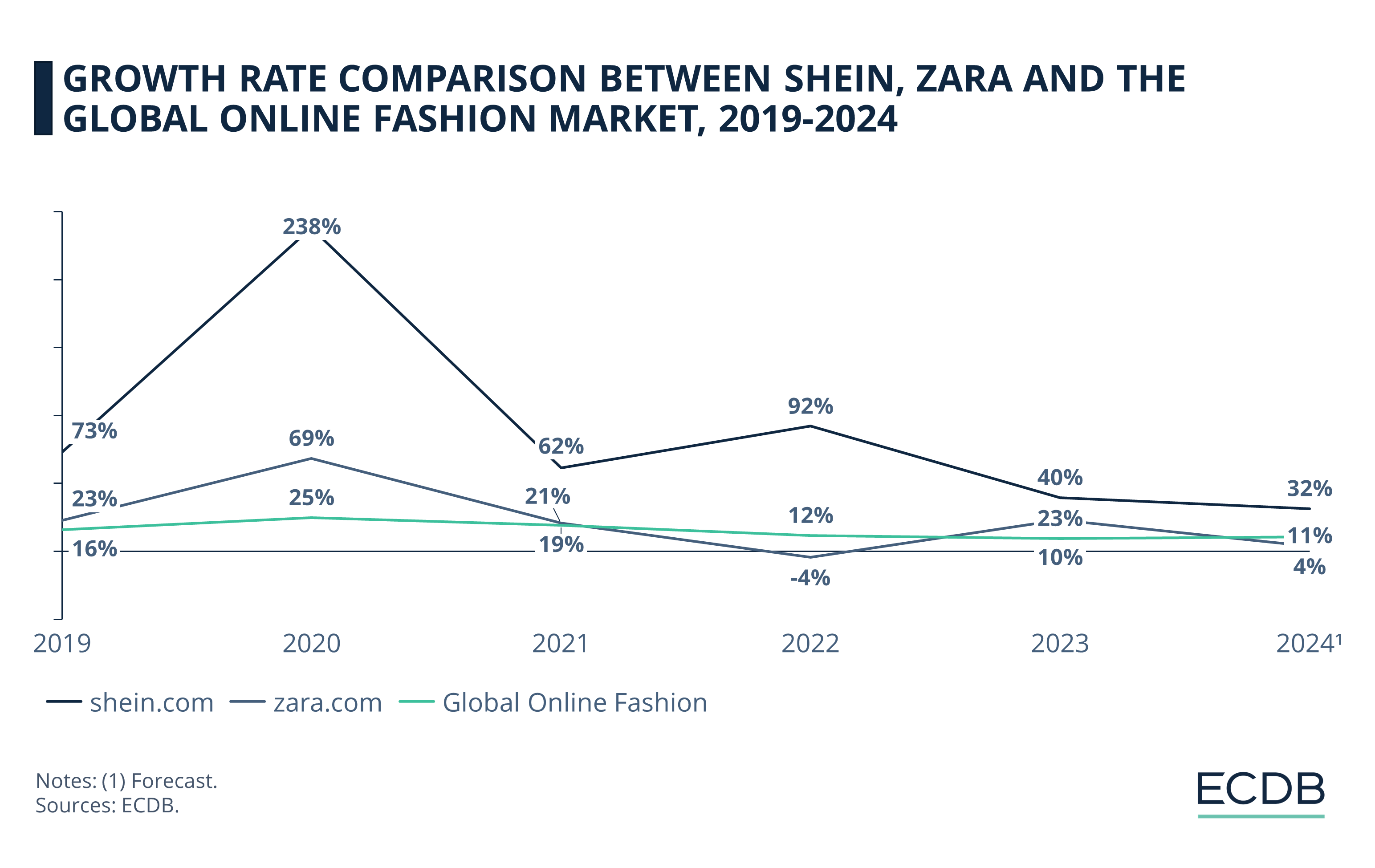

In a direct comparison between Zara, an arguably successful online store of the "traditional" fast fashion model, the overall fashion market and Shein, it is no question who takes the lead over all others. Even in comparison to global online fashion, Shein is outperforming Zara, which is more in line with the global average.

Shein's growth rates were high before the pandemic, but skyrocketed in 2020: While it was a profitable year for Zara and the online fashion market as well, Shein overshadowed the others with a 238% increase in revenues.

The following years were also fruitful for Shein: While for most eCommerce businesses the reopening of physical stores meant declining sales, Shein's revenues grew by 92% (i.e. almost doubled) in 2022 and saw 2-digit growth in 2023 and 2024.

Shein vs Temu: Race to the Bottom in Pricing

While Shein outperforms established retailers with its consumer-to-manufacturer (C2M) model, other platforms with a similar strategy are all the more competitive. These include Temu, with whom Shein has engaged in a bitter battle to see who can out-sue the other. Both brands accuse each other of copying their brand marketing and using unfair strategies to dominate the other.

Fact is that both platforms are incredibly successful around the globe. So successful in fact, that their deliveries are clogging international air transports and lead to logistics chaos in emerging eCommerce countries like Mexico.

Certainly, low pricing strategies are what convince many customers to try out these sites. But what makes Shein so different from other online fashion stores that would account for this huge advantage? An age-based representation of the company’s primary consumer base can help answer this question.

U.S.: Shein Is Best Known Among Gen Z and Gen Y Users

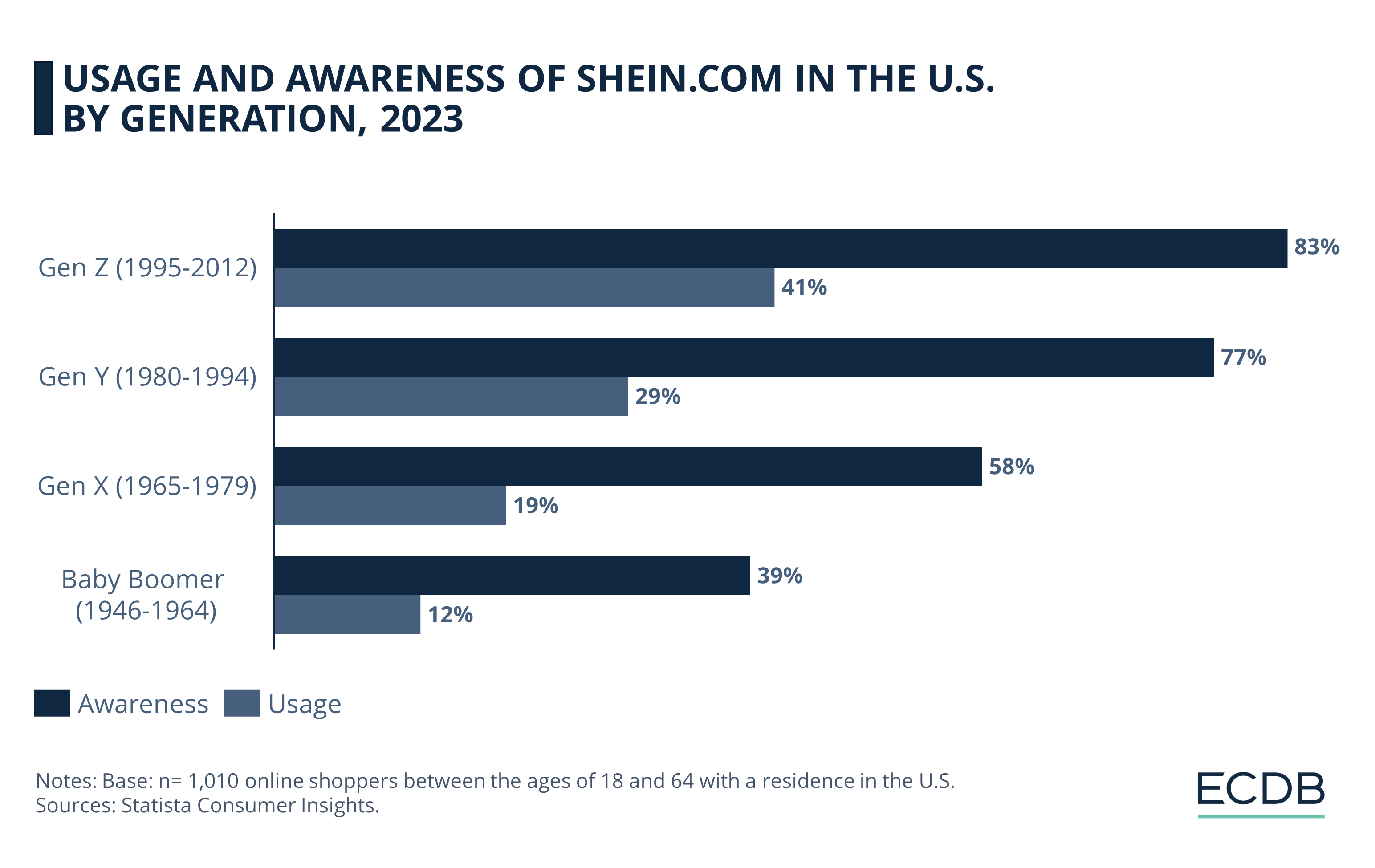

When Statista asked U.S. consumers if they were aware of or used Shein, a clear tendency towards a younger user base emerged:

Young audience: Gen Z and Gen Y consumers are the most aware of the brand at 83% and 77% respectively.

Gen Z are the most frequent users: The younger cohorts are also the most likely to use the site, at rates of 41% for Gen Z and 29% for Gen Y.

Older generations shop less often: Gen X and baby boomer respondents are less aware and less likely to have ordered products from Shein.

The company's low-cost model which enables highly competitive prices, is directly related to Shein's popularity among younger users. This knowledge has also reached established retailers in the fashion industry, who are struggling to attract a younger audience despite emulating some of the techniques Shein has perfected.

Influencer Marketing: Working With Many Small Fish in the Sea

Meeting consumers where they are and working with trusted personalities who vouch for the products you want to promote is essential to success. In a digitally connected world, influencer marketing is the perfect solution to combine both accessibility and personalization to introduce users to a brand’s merchandise.

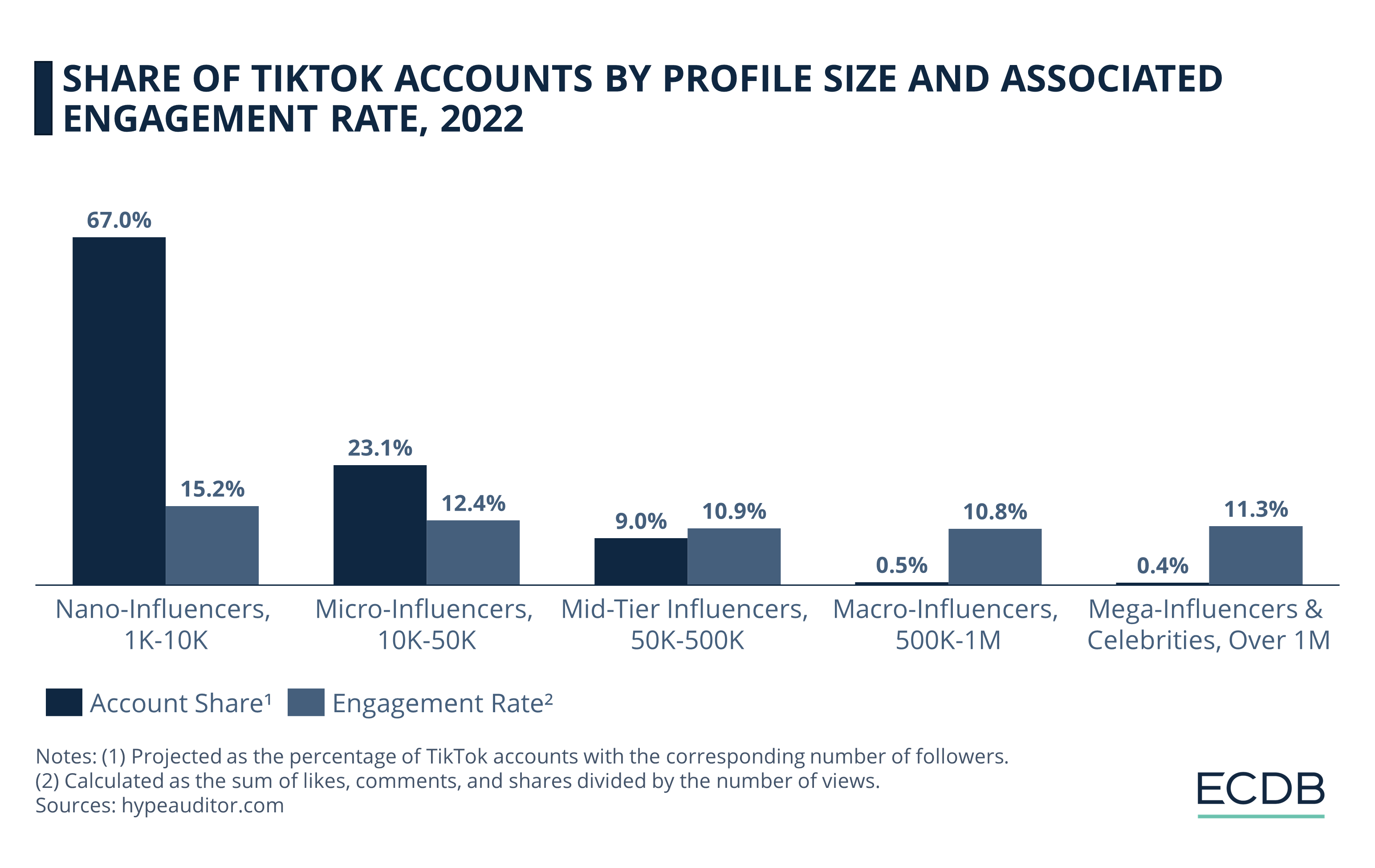

Mutually beneficial agreement: Similar to emerging marketplaces like Temu, Shein relies heavily on distributing free samples to nano- and micro-influencers, who together account for about 90% of TikTok accounts.

Engagement rates do not vary significantly by follower size: In fact, Hypeauditor’s projections suggest that smaller influencers attract slightly higher engagement rates, which may be due to their approachability, as opposed to mega-influencers or celebrities who may not even manage their own accounts, let alone read or reply to comments.

There are other aspects that contribute to the success of Shein’s influencer marketing strategy: The relatability of nano- to mid-tier influencers, which encourages audiences to emulate them more easily. It is also more affordable for brands to reach out to smaller influencers, as opposed to larger ones who may demand a hefty check to promote products.

Shein's vast network of influencer collaborations has recently been used to counter some of the criticism the company has faced. But can anything the company says really distract from the fact that its products are produced cheaply and discarded just as easily?

Shein Takes Action Against Accusations

While Shein has countered allegations of design copying with extensive social media campaigns and marketing moves such as investing in design scholarship programs, critics have questioned the credibility of these actions. This applies in particular to the real-world application of Shein’s marketing gimmicks, such as the recently announced influencer visit to the company's manufacturing facilities to disprove human rights violations.

It seems that Shein can’t do anything right to counter the criticism directed at them, right? Not quite. Wall Street analysts are emphasizing the company’s high potential to change the direction of the global online fashion market. This is especially true now that Shein is venturing into omnichannel retailing, having acquired minority stakes in the fashion brand Forever 21, which filed for bankruptcy in 2020, and buying British fast fashion rival Missguided.

In a recent interview with the German news magazine Spiegel, company representative Donald Tang emphasized Shein's stated aim to stop emitting greenhouse gases until 2050, despite the common conception that Shein actually contributes to landfills and high transporting emissions through its quick-to-dispose products. It seems that for Shein and similar brands, the low product quality is hidden under a layer of colorful words, to distract from the obvious fact that the trade-off between quality and affordability is clearly skewed toward the latter in this case.

Another recent issue has been the company’s strategy of shipping large quantities of small items directly across the border to U.S. consumers in order to comply with the de minimis rule. In that way, Shein circumvents higher bulk tariffs and comprehensive product declarations. In Europe, the tax exemption applies for packages below €150. Both the U.S. and Europe are currently in talks to remove the tax exemption. But will this really impede the success of retailers benefiting from the rule? The truth is: Not really. Already, Shein and Temu are finding alternative routes or production and logistics centers in target markets.

Shein’s Success: An Outlook

Shein is generally believed to have taken the fast fashion model to a new level. And indeed, by accelerating the product cycle through technological innovation, the company is uploading more styles to its platform than any major fashion company before it.

While this model is designed to be very efficient, avoiding excess inventory in warehouses, the speed of production comes at the expense of design originality and workers’ rights. The same goes for the very low cost of the products, which is achieved by denying manufacturers basic wages and using cheap, health-damaging materials.

What fashion companies can learn from Shein is that big data optimization is indeed an efficient way to assess which styles work for consumers. Social media therefore plays an important role not only in informing consumers about new products, but also in seeing which products generate attention/likes and which styles can work on a commercial basis.

Companies can do even better than Shein by adopting its highly efficient technology, while shedding its disregard of workers’ rights, the use of harmful materials, and disposable products. The future of fashion retail is likely to become a big data playground, while highly artistic designers may be relegated to the high-end niche.

Sources: Guardian – Rest of the World – TIME

FAQ

What is SHEIN's business model?

Shein's business model focuses on low costs, rapid production cycles, advanced technology, and influencer marketing. The brand uses a 'large-scale-automated test and re-order' (LATR) model to quickly adapt to consumer preferences by producing small batches and scaling up successful styles.

What is SHEIN's marketing strategy?

Shein's marketing strategy revolves around targeting a younger audience, particularly Gen Z and Gen Y, through social media influencer marketing. Shein particularly focuses on nano- and micro-influencers to promote its products. This approach allows Shein to reach a broad audience at a lower cost, as smaller influencers often have higher engagement rates and are more relatable to their followers.

What is the competitive advantage of SHEIN?

Shein's competitive advantage lies in its combination of low prices, rapid production cycles and effective influencer marketing. By utilizing real-time feedback technology Shein minimizes excess inventory and assesses which styles work for consumers. Shein is an online-only brand but appears once in a while in world cities through pop-up stores, which creates a sense of exclusivity. The pop-up stores are optimized for posts on social media. The controversies surrounding Shein, particularly regarding design copying and low manufacturing costs, have increased its visibility and piqued consumer curiosity.

What are the criticisms of SHEIN?

Shein faces several criticisms, including widespread accusations of design copying from other brands and independent designers. The company has been criticized for poor working conditions and low wages for factory workers. Shein's "ultra-fast" fashion model contributes to significant environmental impact due to the high volume of production and disposable nature of its products. The company has also faced scrutiny for using cheap, health-damaging materials. Despite efforts to counter these criticisms through marketing campaigns and social initiatives, many question the credibility and effectiveness of these actions.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics