eCommerce: Social Commerce Fraud

Social Commerce Scam: Half of U.S. Consumers Distrust Online Shopping on Social Media

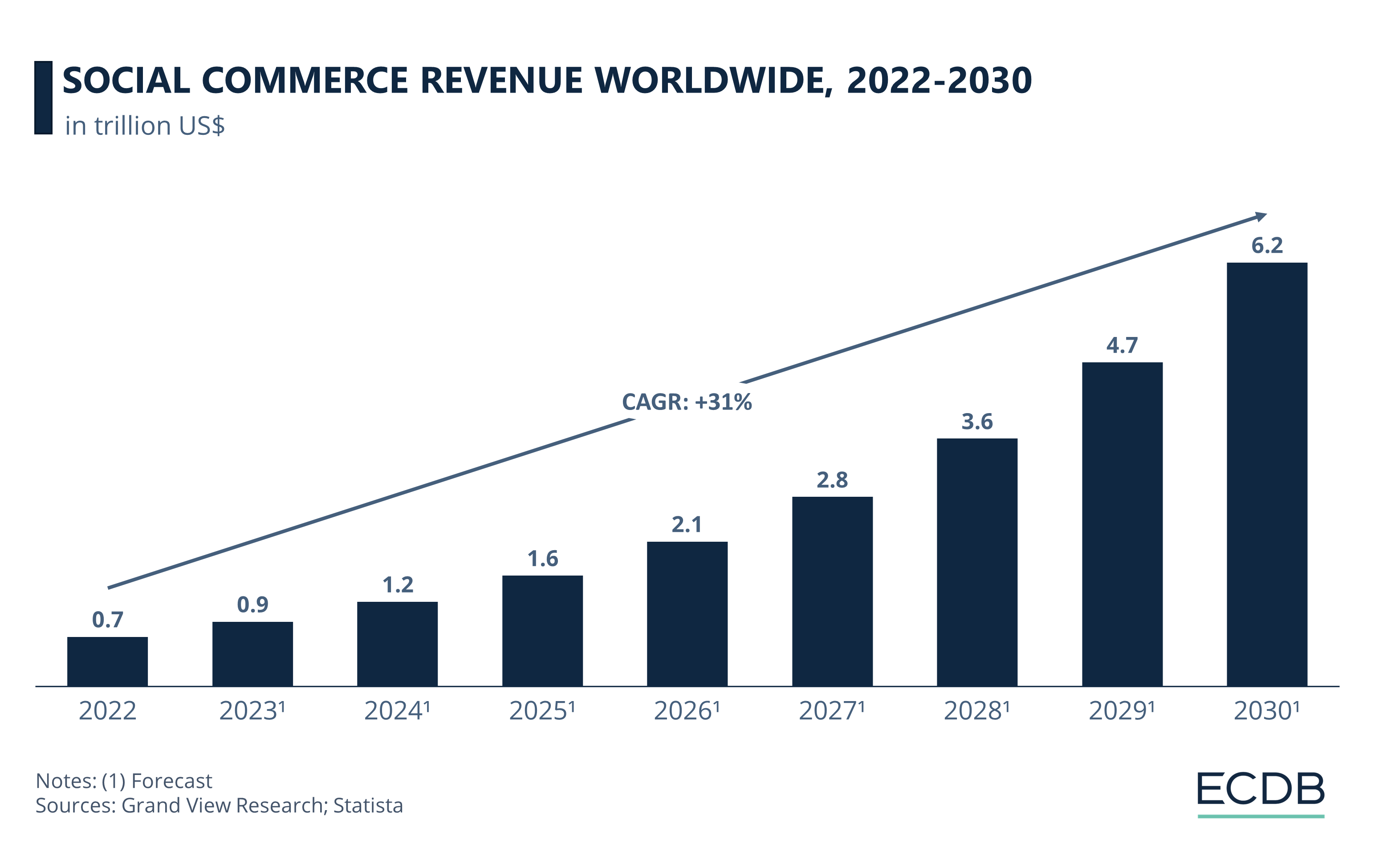

Consumers don't trust the social commerce market due to fears of fraud. Despite trust issues and other challenges, the social commerce market is expected to surpass global revenues of US$6 trillion by 2030. Here is why.

June 18, 2024Download

Coming soon

Share

Social Commerce Challenges: Key Insights

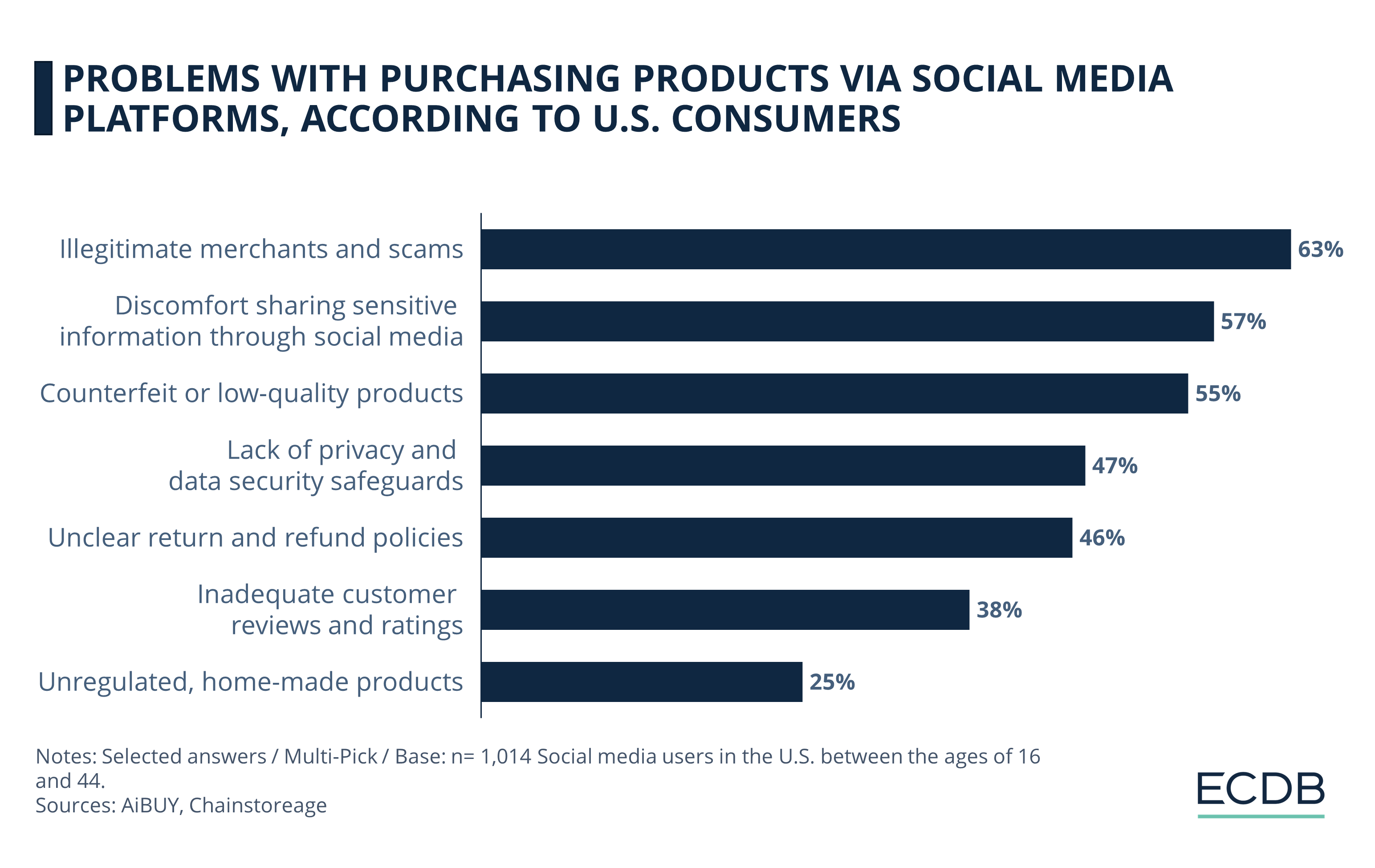

Common Distrust: Over half of U.S. users don't trust the products sold on social media platforms, citing reasons such as illegitimate merchants and offers (63%), discomfort with sharing sensitive information (57%), and concerns about counterfeit or low-quality products (55%).

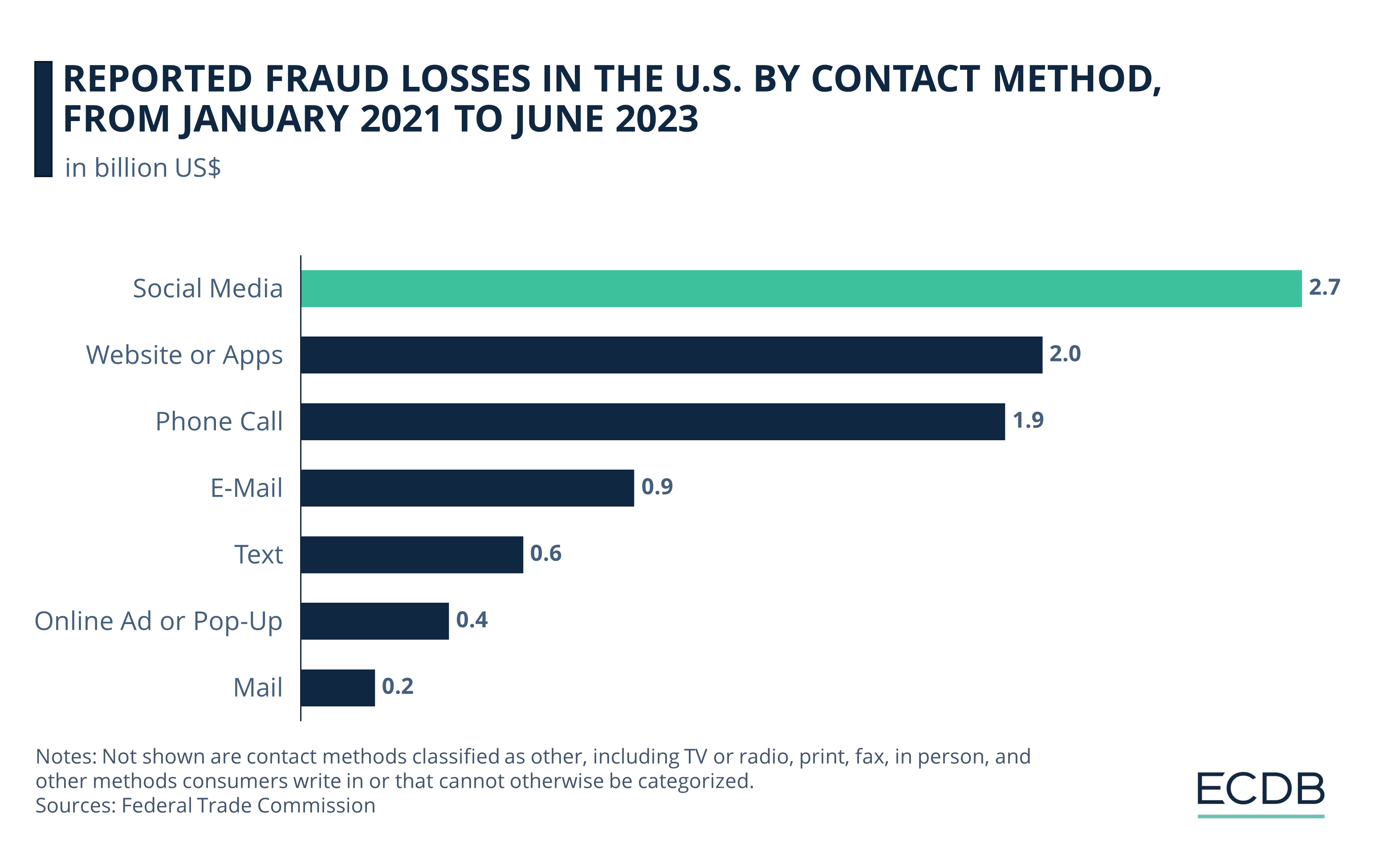

Social Media Scams Are Growing: The U.S. Federal Trade Commission (FTC) validates these concerns. A recent report shows that since January 2021, US$2.7 billion were lost to social media fraud, along with an additional US$2 billion lost through websites or apps.

Social Commerce Rise: Grand View Research predicts global social commerce revenues to exceed US$6 trillion by 2030. But social commerce can only succeed with the effective technological integration of payment and security mechanisms.

Social commerce – or purchasing products on social media platforms – is a growing world trend that has been embraced by some shoppers and avoided by others.

With last year's launch of TikTok Shop in the U.S., social commerce is becoming increasingly known in the West: A global region where social commerce adoption tends to be lower, compared to others. The launch of TikTok's new in-app shopping feature encounters multiple challenges, several of which are discussed in this analysis.

Social Media Users: Concern About Social Commerce Fraud

A 2023 AiBUY survey revealed that over half of U.S. consumers (53%) do not trust products sold on social media platforms. This level of distrust is similar among Millennial and Gen Z users, at around 52%.

AiBuy also asked participants about the reasons for their distrust when purchasing products through social media. See the most common responses in the chart below.

Illegitimate merchants and scams: A majority of 63% is worried about fake sellers and scams. Users fear they may be paying for items they won't get, or falling victim to other dishonest tactics. Fake accounts are quite common social media, which is why users are used to false promises and fishy products on their social feeds.

Discomfort sharing sensitive information through social media: 57% of participants said they are hesitant to share sensitive information on social media platforms.

Counterfeit products or low-quality items: 56% of respondents worry about the possibility to receive counterfeit products. This concern stems from the minimal regulation and easy access on social media, which can make it challenging to verify the authenticity and quality of products.

Lack of privacy and data security safeguards: Additionally, 47% of respondents are deterred from making purchases via social commerce due to insufficient privacy and data security measures.

Unclear return and refund policies: Another 46% of consumers are discouraged by unclear return and refund policies on social commerce platforms.

On the lower end of concerns, 38% of shoppers mention inadequate customer reviews and a lack of trustworthy ratings. Furthermore, 25% are reluctant to order homemade products that are not regulated.

As one can see, the most prevalent issues U.S. consumers have with online shopping on a social commerce platform pertain to the novelty of the phenomenon. This leads to a lack of regulation and uncertainty in regards to product quality and safety of customer data. One might receive a counterfeit product or pay for an item that never arrives. Because sellers on Facebook, Instagram, or TikTok can operate via fake accounts that elude market control, it is easier for insincere offers to go unnoticed.

Social Media Is the Leading Channel for Fraud in the U.S.

The prevalence of social media fraud proves that customers are right to be concerned.

Here are the three most common channels through which fraud occurred:

1. Social Media

Research by the FTC found that since the beginning of 2021, US$2.7 billion has been reported lost due to fraudulent practices on social platforms. This does not mean that social commerce is responsible for all of the lost funds. Social media scams can also include hacked accounts that ask for payments in the friends network and other scams.

But what’s important to note is that the anonymity on social platforms and the added impossibility of regulating this vast space of internet interactions provides fertile ground for illegitimate practices, aimed at obtaining money from unsuspecting users.

2. Websites or Apps

The second most common channel through which U.S. consumers lost money is also online, namely websites and apps. A total of US$2 billion was reported lost to website or app scams.

3. Phone Call

Whether receiving calls from a real person in a callcenter or from a bot, US$ 1.9 billion were lost through phone call fraud. A higher penetration of mobile devices facilitates scams of this kind.

Other Channels

Following the top 3 ranking are other channels, including e-mail scams (US$900 million) and text messages (US$600 million).

Online ads and pop-ups are less prevalent, however, with US$400 million reported lost to fraud. Keep in mind that the dark figure made up of unreported cases will be much higher than the FTC’s published figures, as many customers avoid reporting scams, either because they do not expect tangible results from reporting the case, or for personal reasons such as shame at having been duped.

Despite these apparent pitfalls of social commerce, the market is forecast to grow globally throughout the decade. Check out the data published by Grand View Research.

Social Commerce Could Reach US$6 Trillion in Global Revenue by 2030

Market research firm Grand View Research has released its forecast for global social commerce revenues through 2030. With an expected CAGR (2022-2030) of 31%, this could result in an astounding US$6.2 trillion in revenue by 2030.

While it is important to remember that forecasts are not definitive and thus should always be taken with a grain of salt, the assumptions behind these figures are reasonable: As social media and digital payments become more intertwined, as security around authorization methods increases, and as brands find ways to adapt their offerings and product marketing to Western tastes, it is not impossible that social commerce will gain significant traction by 2027.

While it is important to remember that forecasts are not definitive and thus should always be taken with a grain of salt, the assumptions behind these figures are reasonable: As social media and digital payments become more intertwined, as security around authorization methods increases, and as brands find ways to adapt their offerings and product marketing to Western tastes, it is not impossible that social commerce will gain significant traction by 2027.

Buying items through social media is easy and can be fun when combined with consumer preferences and personal interests, so this segment of eCommerce may become more commonplace and natural to users over time.

Social Commerce Challenges: Closing Thoughts

TikTok Shop's Western rollout faces hurdles as more than half of U.S. consumers distrust social commerce due to fears of fraud and privacy breaches, a concern underscored by the FTC's findings on the prevalence of social media fraud. While it is possible that the predictions have been thoroughly overstated, it is also likely that social commerce will become more commonplace in the West.

With a growing prevalence of social channels enabling social commerce, user-generated content encouraging users to try it out, and an integrated shopping experience, the eCommerce industry adapts to regional consumer tastes. When various platforms offer more elaborate transaction security, customer engagement grows with it.

Sources: AiBUY – Chainstoreage – Forbes – FTC – McKinsey – Time

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics