eCommerce Trends

Social Commerce: U.S. Figures, Global Revenues & Market Trends

Social commerce is a recent trend that allows users to purchase products through social media platforms. While an increasing number of providers offer social commerce, its global implementation varies. Here you will find everything you need to know about social commerce.

Article by Nadine Koutsou-Wehling | January 02, 2024Download

Coming soon

Share

Social Commerce Trend: Key Insights

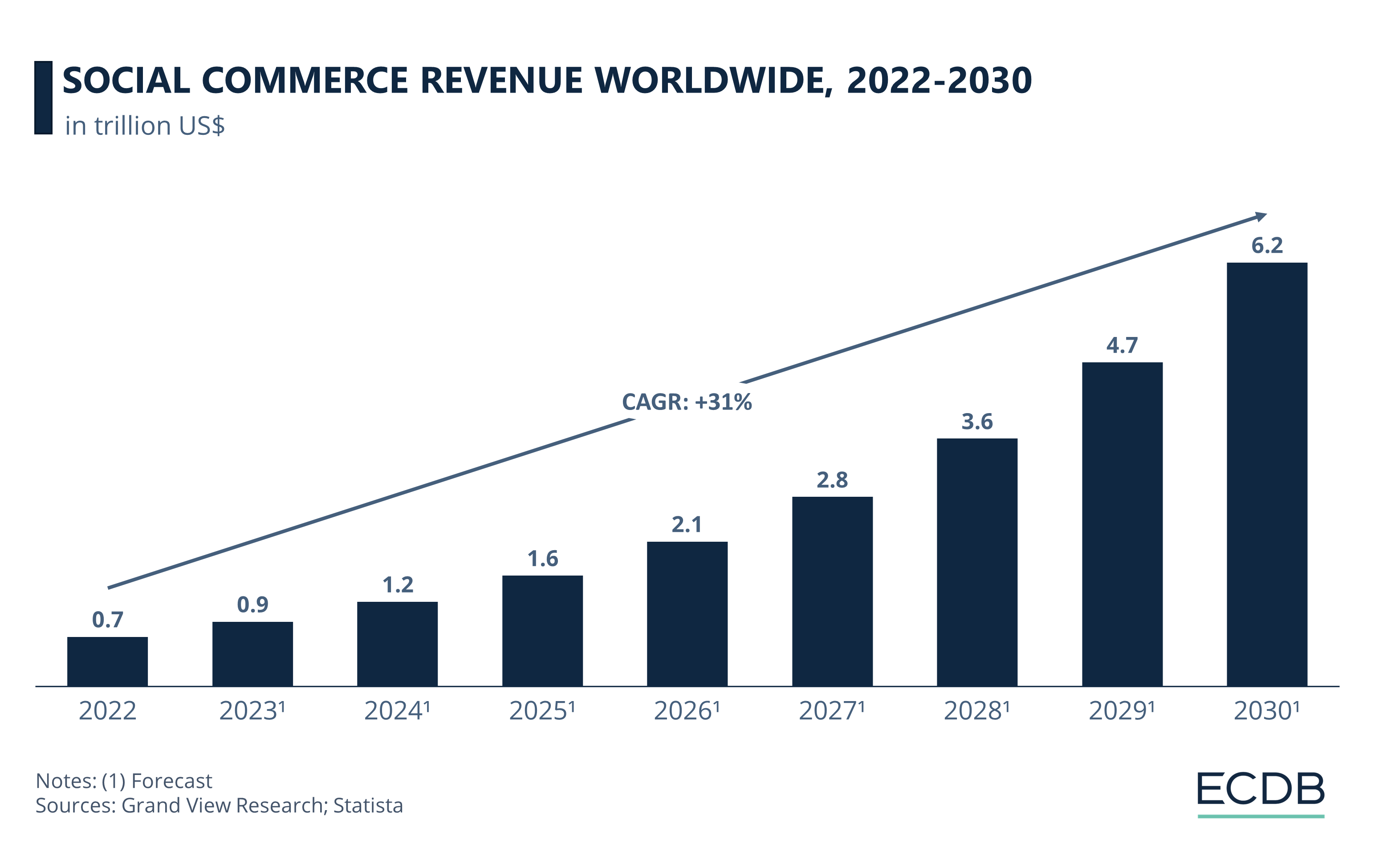

Defining Social Commerce: The entire buying process, from discovery to checkout, occurs within social platforms in social commerce. Global revenues of social commerce are predicted to surpass US$6 trillion by 2030.

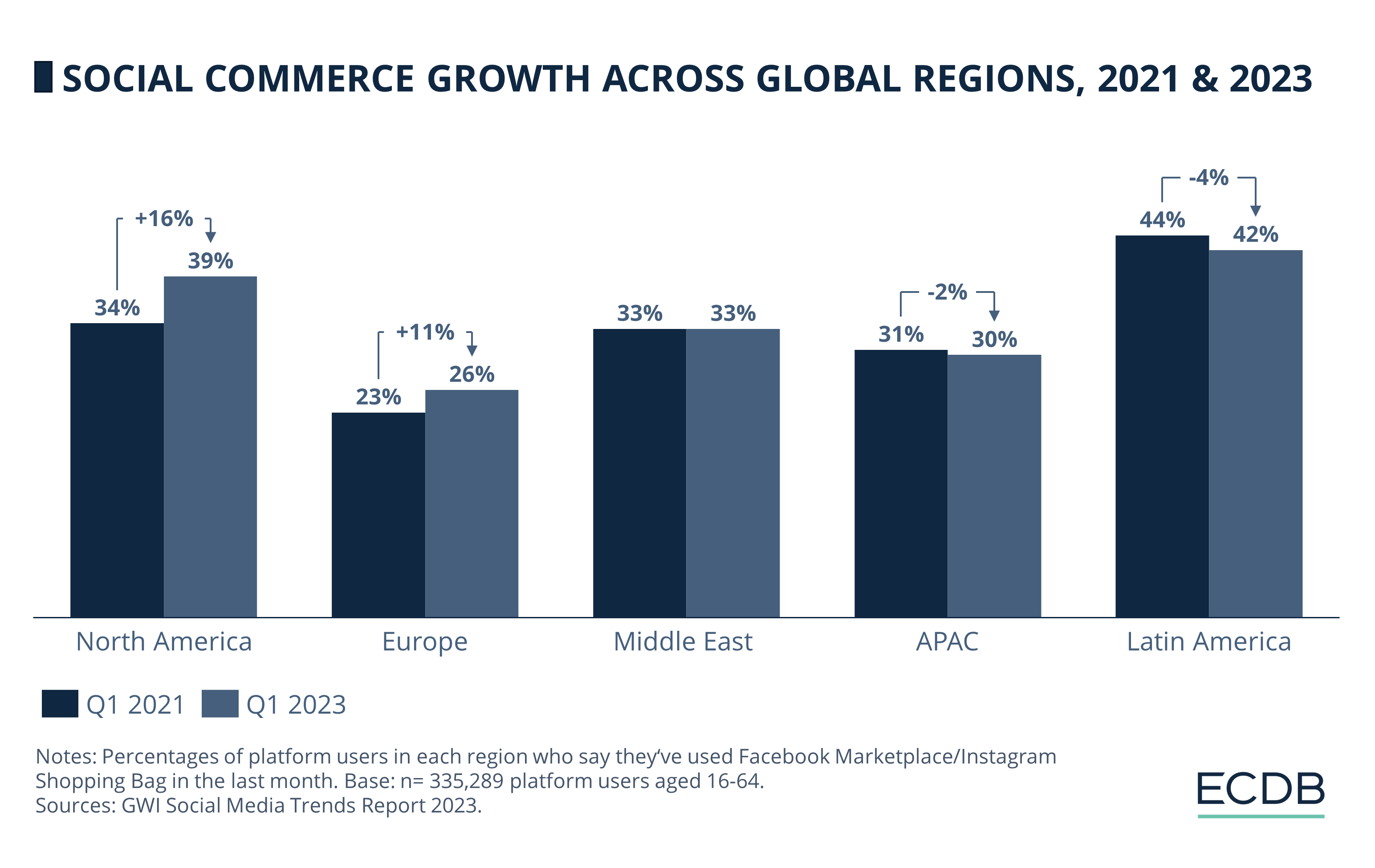

Social Commerce Usage Differs Globally: Latin America leads the way among global regions in terms of social commerce adoption, with 42% of Latin American consumers having used social commerce recently. In Europe and North America, however, the trend is just emerging.

Leading Sites in the U.S.: Despite high social media usage in the U.S. across age groups, social commerce adoption is lower. The top platforms are Facebook and Instagram, but new entrants like Amazon and startups that focus on live shopping events signal potential for growth.

Buying products online has never been easier. Instead of visiting your favorite retailer's website, you can now do your shopping while browsing platforms like Facebook and TikTok.

Does that sound interesting to you? Well, it should depend on where you’re at. While social commerce is an established trend in Asia and South America, it does not seem to have taken off as much in the U.S. and Europe.

The following insight examines the reasons for this disparity. First, however, what do we mean by social commerce?

Defining Social Commerce

It’s really quite simple: Social commerce is the purchase of products through social media platforms. What makes it different is that the entire buying process takes place on a social commerce platform, from discovery to checkout.

Whereas in the past, brands would simply advertise products on social media and link consumers to a retailer's online store, with social commerce sales consumers never leave the social media site to make a purchase.

Of course, this is of interest to providers who want to maximize the time users spend on their social network.

Social Commerce Is Growing, but Revenue Estimates Vary

The total amount of revenue generated by social commerce platforms is difficult to predict. We reported last year that social commerce reached US$724 billion in global revenues by 2022 and is expected to exceed US$6 trillion by 2030. See the corresponding chart below.

Other publications predict different numbers, which includes estimates that social commerce will surpass US$1 trillion by 2023 or US$1.2 trillion by 2025. Despite these varying projections, it is clear that social commerce has an enormous potential for the future of eCommerce, not least because of the growing number of global players in the scene.

Social commerce encompasses several types of shopping experiences, some of which are categorized below.

Social Commerce: Based on Content, Experience, or Network

Accenture defines three types of social commerce:

Content-Driven: These are posts from companies, influencers, or social media users that allow consumers to order an advertised product by clicking through the post or making an in-app purchase, as is possible on Pinterest, YouTube, TikTok, Facebook, and Instagram, among others.

Experiential: Consumers can buy products while being part of an event or happening, which includes games, AR or VR shows, and livestreaming services where users can interact with hosts via chat.

Network-Driven: This subcategory leverages the social aspect by driving social commerce sales through community purchasing incentives that enforce bulk discounts, referral programs, and secondhand selling / shopping platforms.

A global perspective on the usage of social commerce reveals a disparity between global regions. The following section explores this in more detail.

Social Commerce and Smartphones: A Match Made in Heaven?

There are a number of advantages to social commerce that are driving its development, including its mobile orientation, ease of access, range of low-cost offers and personalization, as consumers can choose who or what brands they want to follow.

In addition, as technology advances in this area, the shopping experience becomes more tailored to personal preferences through the use of AI, providing the opportunity to offer more relevant products and thereby increase social commerce sales.

Social Commerce Most Prevalent in Latin America

The inherent mobile applicability of social commerce is what experts say essential to its high penetration in regions such as Asia Pacific (APAC) and Latin America. In 2023, Latin America is the region with the largest share of social commerce shoppers, with 42% of consumers having recently purchased products from a site such as Facebook Marketplace or Instagram Shopping Bag. This figure was even higher in 2021, after a 4% decline in 2023.

Social commerce was at its peak during the pandemic in APAC, but has since declined by 2% and now shows a 30% usage share. The Middle East indicates consistency, with 33% of social commerce shoppers in both 2021 and 2023.

North America and Europe, on the other hand, are just now becoming part of the trend. While Europe has the lowest share of social commerce shoppers among the regions observed, its share has still grown by 11% since 2021. North America, at 39%, appears to have integrated social commerce more thoroughly, marking the largest leap of 16% since 2021.

Live Shopping: Driver of Social Commerce

Livestreams, in particular, are expected to shape the development of social commerce, as they offer brands a way to interact directly with audiences and leverage influencer marketing, lending an air of familiarity and trustworthiness to the products being promoted.

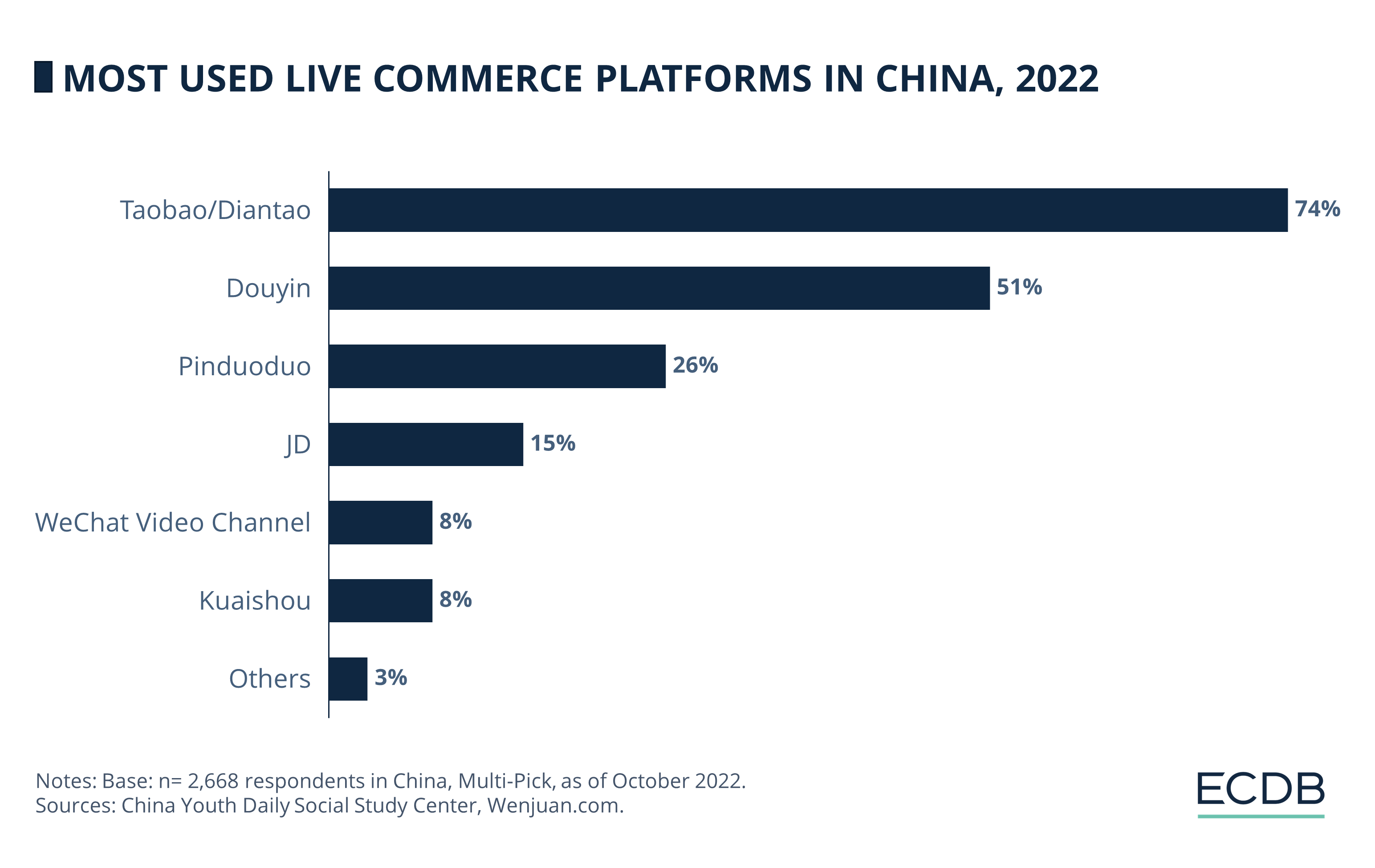

China is known for its vast livestreaming scene, as also seen in our recent insight. Taobao Live is the most widely used platform, but other providers such as WeChat, Pinduoduo, and Douyin also have significant user shares.

The rise of livestreaming platforms in China was proliferated during the pandemic, when internet users who craved social interaction engaged with streamers to pass the time and discover products to buy, and this trend has continued to this day.

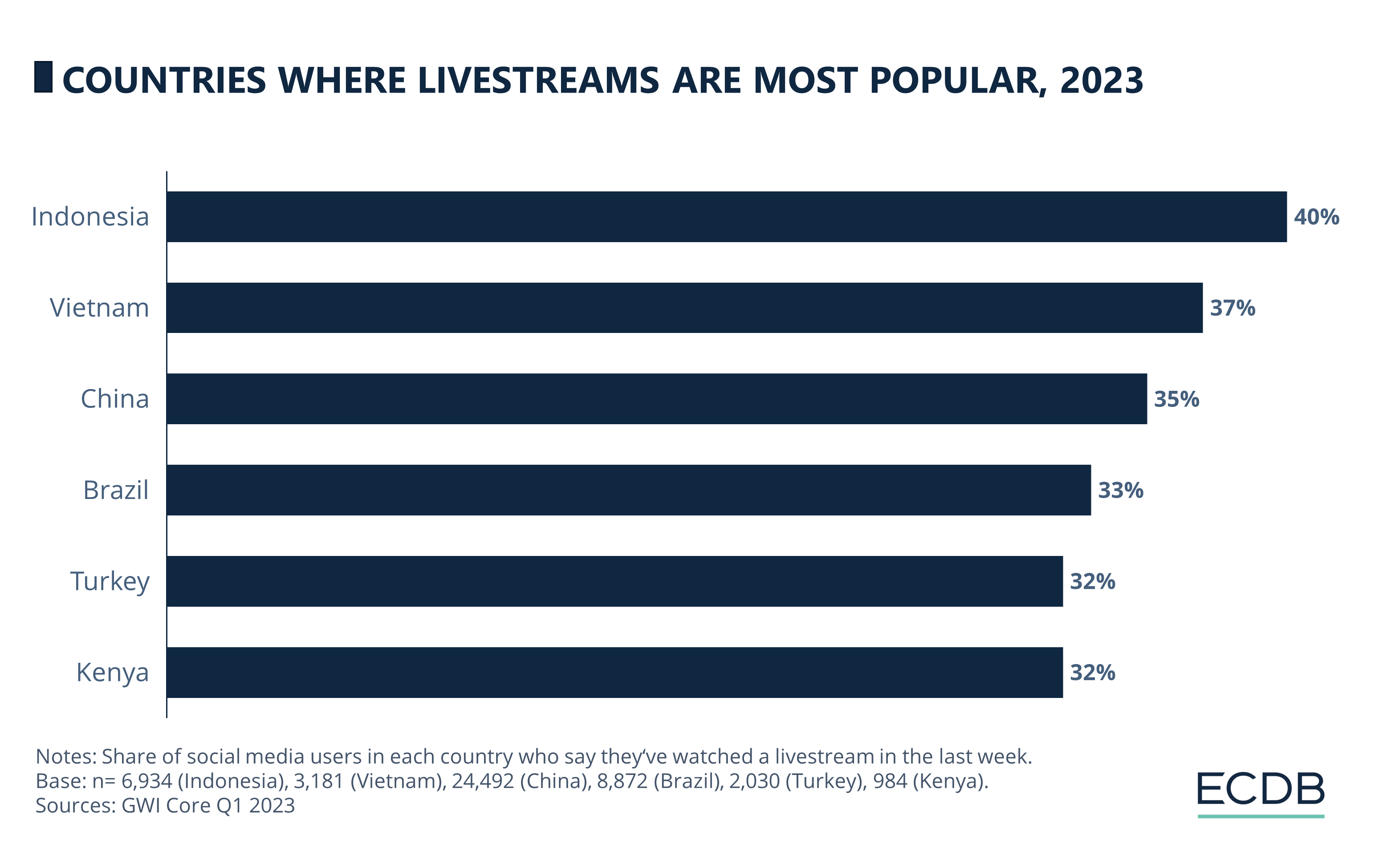

But China is not the only country where livestreaming has gained notable traction. Indonesia leads the way with 40% of social media users saying they’ve watched a livestream in the past week. China ranks third (35%), behind Vietnam (37%).

Other countries with a high preference for livestreaming include Brazil (33%), as well as Turkey and Kenya, both at 32%. GWI’s research has shown that users who identify as gamers or who are interested in e-sports are the most likely to watch livestreams regularly, but the audience is growing as more and more providers seek to capitalize on this trend.

Will social commerce in the U.S. be as popular as it is in the East? Some of the key ingredients are in place, but barriers remain.

Social Media Remains Relevant to U.S. Users

It is no mystery that social media penetration in the U.S. is high and includes older generations such as baby boomers who log on to social networks to connect with friends, get the latest news, and also find products to buy.

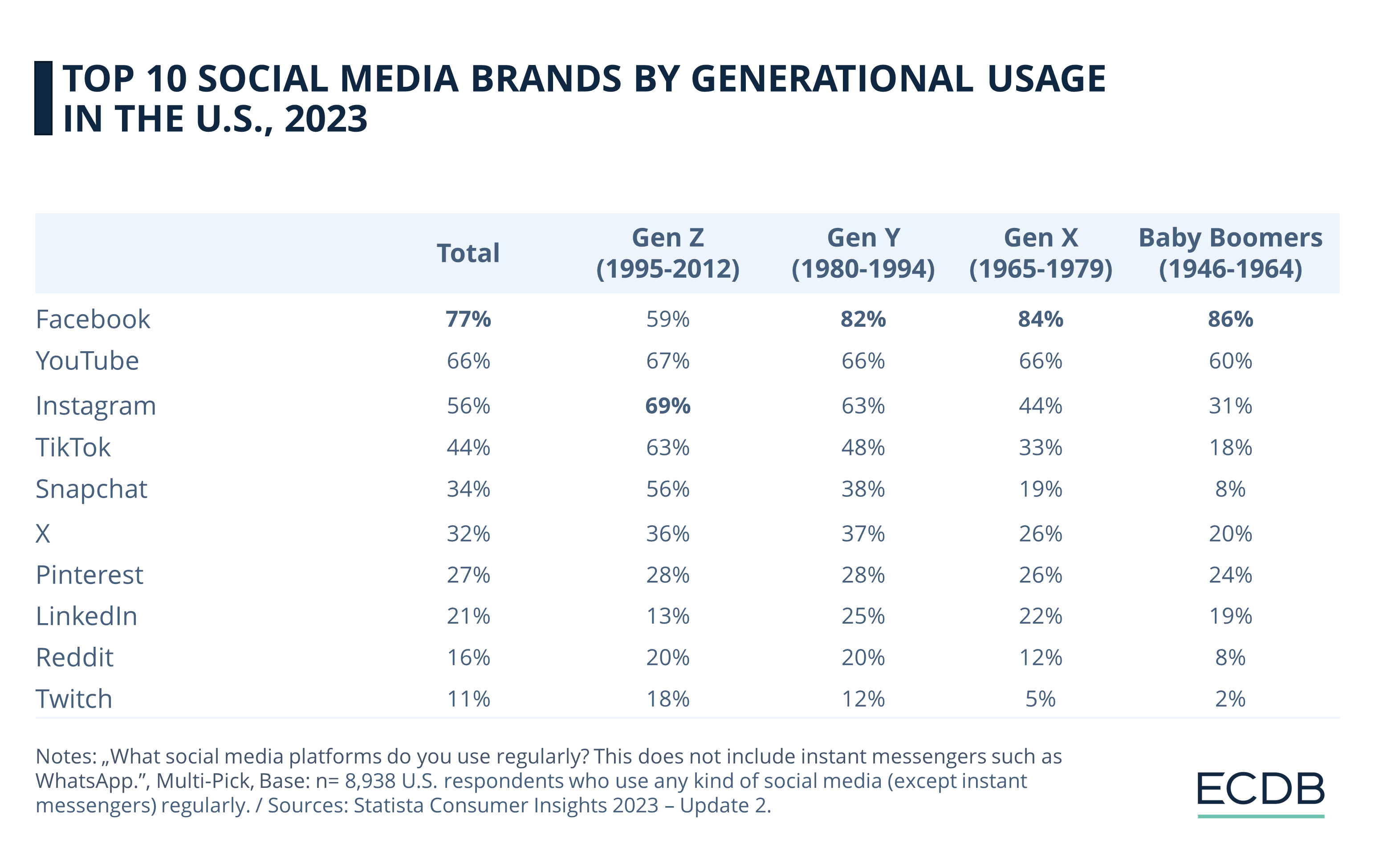

Of the top social media brands that U.S. consumers interact with most often, Facebook tops the list, with 77% of respondents saying they use it regularly.

Two-thirds of U.S. consumers frequent YouTube, while Instagram comes in third at 56%. TikTok is used by 44%, followed by Snapchat (34%) and X at 32%. Pinterest and LinkedIn are at usage rates of 27% and 21% respectively, with Reddit and Twitch at the bottom of the list.

However, there are generational differences: Gen Z leans toward Instagram, YouTube, and TikTok and away from Facebook. Meanwhile, baby boomers' top three align with the general rankings, but they prefer Pinterest in fourth place.

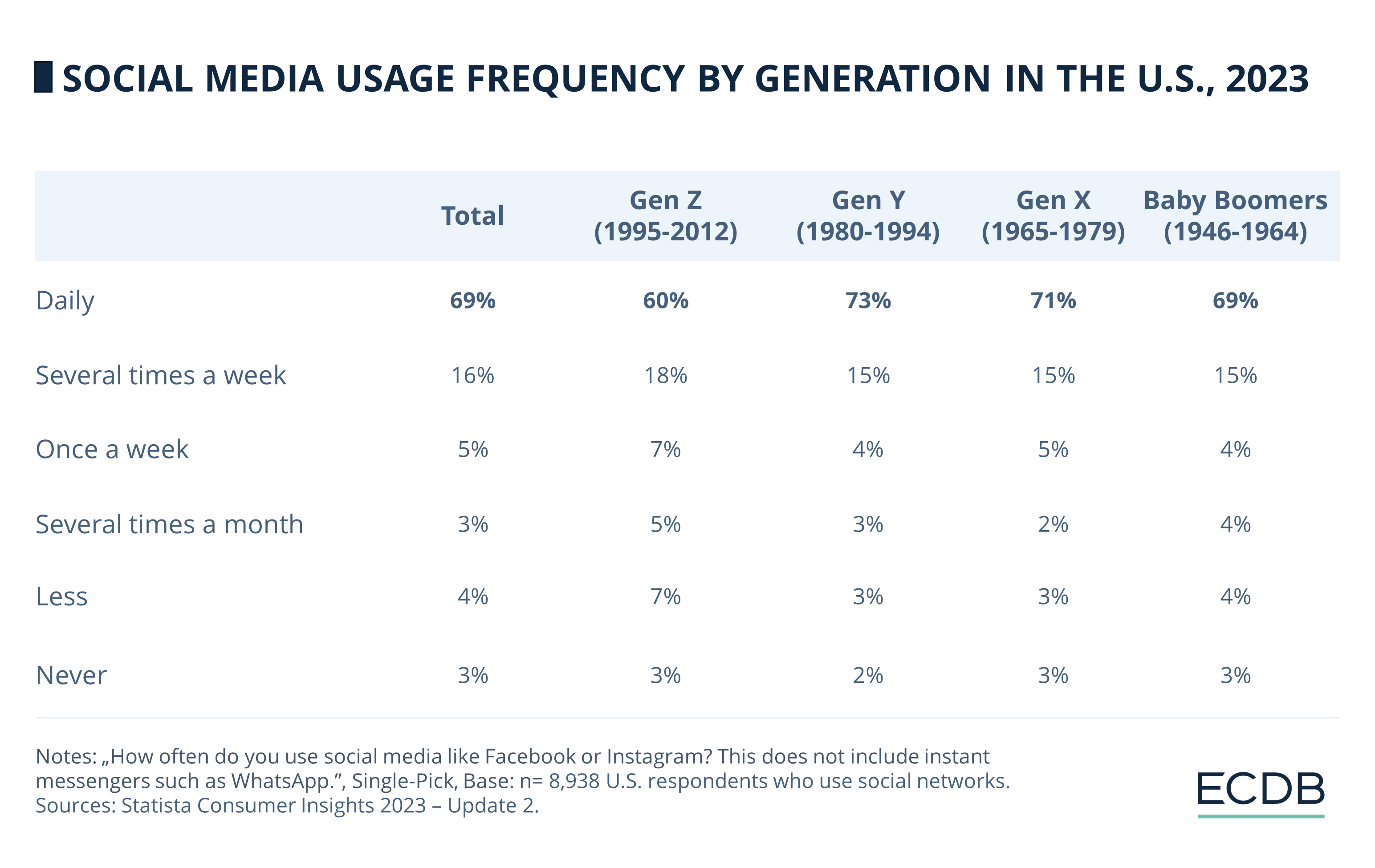

Notably, while most respondents visit social platforms daily, Gen Z shows a growing reluctance to do so, suggesting a potential trend toward de-digitalization among this age group.

High social media penetration does not mean that audiences will automatically engage in social commerce. So what factors are shaping the social commerce landscape in the U.S.?

Who Is the Leader in U.S. Social Commerce?

Despite the large proportion of U.S. internet users who regularly visit social media platforms, the adoption of social commerce in the U.S. lags significantly behind the rapidly emerging landscape in China. Currently, Facebook and Instagram dominate the social commerce landscape in the West, but the market appears to be rather unregulated and prone to fraudulent product offerings and sellers.

TikTok's new livestreaming commerce platform, TikTok Shop, has been unsuccessful in the UK and is not expected to make much of an impact in the U.S. While TIME points to the immense potential of this platform in the West due to its vast user base, there are doubts. These mainly relate to user preferences and habits, which do not show the same level of interest in live shopping events as consumers in the Asian market.

But this could change. As social commerce is expected to grow in the coming years (remember the trillions of U.S. dollars in revenue projected in the first section), the number of platforms and sellers is also likely to increase.

New Entrants Driving Social Commerce Growth

Amazon has already launched its live shopping service Amazon Live in 2016, featuring popular content creators and celebrities who endorse the products. In 2020 and 2021, Walmart partnered with TikTok for a livestreaming event showcasing new fashion items and creators, with the second event generating seven times the expected views.

And there are also startups that aim to drive the live shopping trend by introducing new platforms, some of which include:

Ntwrk, specializing in sneakers and collectibles.

Supergreat and Trendio, promoting beauty products.

TalkShopLive, the largest platform to date. It has partnered with Walmart for 150 shopping events in 2022, featuring celebrities such as Dolly Parton, Oprah Winfrey and Tim Tebow.

As seen in the Chinese market, when livestreaming hosts are successful, they can gain incredible popularity and commissions from their engagement, similar to how some vloggers and content creators on social media platforms have become wealthy from advertising revenue.

The prospect of fame and fortune may further incentivize individuals to contribute to this burgeoning market, which in turn has the potential to lift the live shopping trend into the mainstream. So, despite its current triviality, this new trend, as it grows and caters to Western preferences and tastes, could strongly shape the social commerce industry in the U.S.

U.S. Social Commerce in 2023: Closing Remarks

Social commerce is especially prevalent in Asian and Latin American markets, while adoption in the U.S. and Europe is slower. However, the growth potential of social commerce becomes increasingly evident, especially with the emergence of new social commerce platforms and trends.

For more on this topic, check out our recent insight on why most U.S. consumers are still hesitant to buy products via social media.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics