eCommerce: Temu Marketing Strategy

Temu Business Model 2024: Gaming, Gambling & Low Prices

What is Temu's business model? The online marketplace is much talked about for its strategy of offering a large quantity of goods at incredibly low prices. It is time for a thorough Temu marketing analysis.

October 02, 2024Download

Coming soon

Share

Temu Business Model: Key Insights

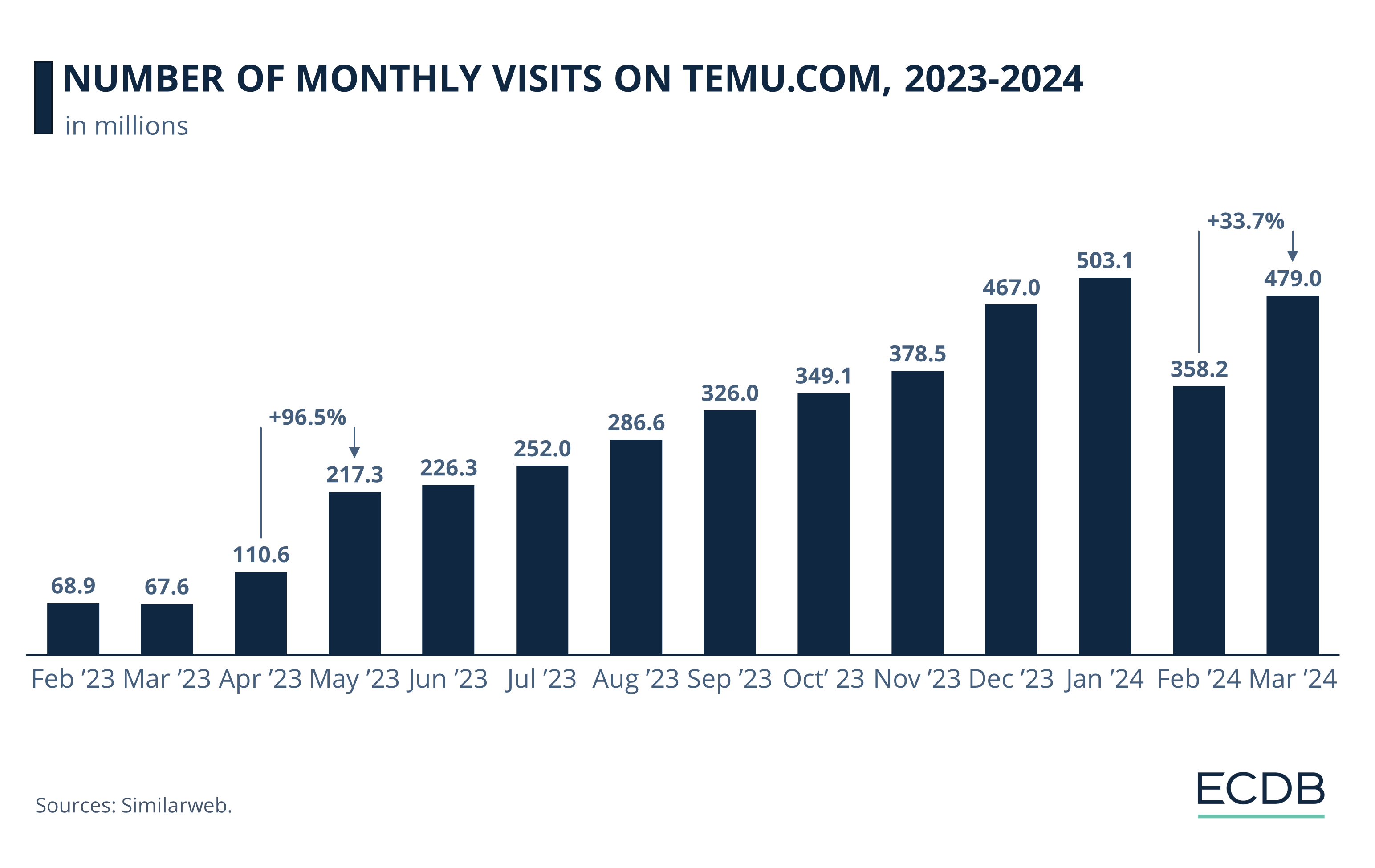

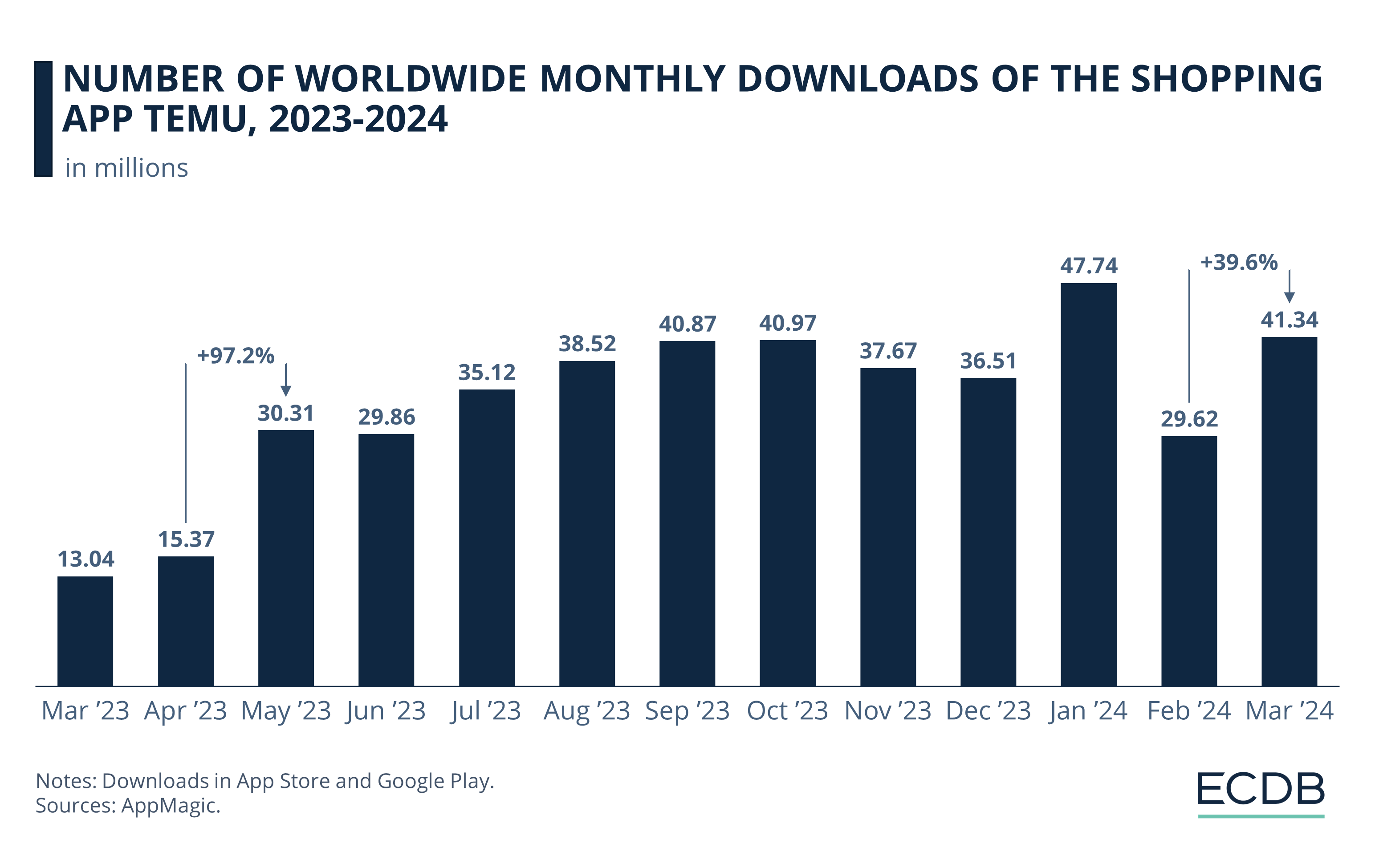

Temu's Success Came Quick: Parent company PDD Holdings launched its subsidiary Temu in September 2022. The largest increase in its website traffic and app downloads to date occurred in May 2023, when downloads and visits nearly doubled from the previous month.

Business Model and Marketing Strategy: Temu's marketplace is highly engaging. The platform has entertaining features like gamification, group buying and social referrals that encourage users to spend more time on Temu than on other well-known shopping apps.

Prevailing Controversy: Criticism of Temu's low-cost approach refers to its use of environmentally harmful materials, cheap labor, and copyright infringement. However, more than half of German consumers do not believe Temu could become eCommerce leader.

Temu (pronounced ‘teh-moo’) is an online marketplace from the United States that is owned by the Shanghai-based conglomerate PDD Holdings. Temu’s sister company is Pinduoduo.

Temu's business model is similar to that of the Chinese shopping platforms Shein, Wish, and AliExpress – but Temu has amassed attention, visits, and downloads in a whirlwind that turned heads everywhere. In part, this is due to its marketing strategy, which allows the app to reach its target audience and expand its customer base.

But how viable is Temu's approach really? Is the current buzz sustainable, or will Temu's relevance fade as quickly as it came about?

Quick Facts About Temu

You do not know anything about Temu yet? Temu is an online marketplace connecting sellers from China to Western customers. Here is a quick overview.

Established in the USA in 2022, Temu's parent company is PDD Holdings Inc., a business listed on Nasdaq and headquartered in Shanghai.

Temu functions as an internet marketplace similar to AliExpress, Walmart, and Wish, focusing on low-priced goods.

The company serves as an intermediary between sellers, predominantly from China, and buyers, without managing its own inventory.

Temu incentivizes prospective customers to recruit more buyers for them to unlock discounts (called social referral).

The app utilizes gamification to engage customers and offers free shipping by circumventing customs duties.

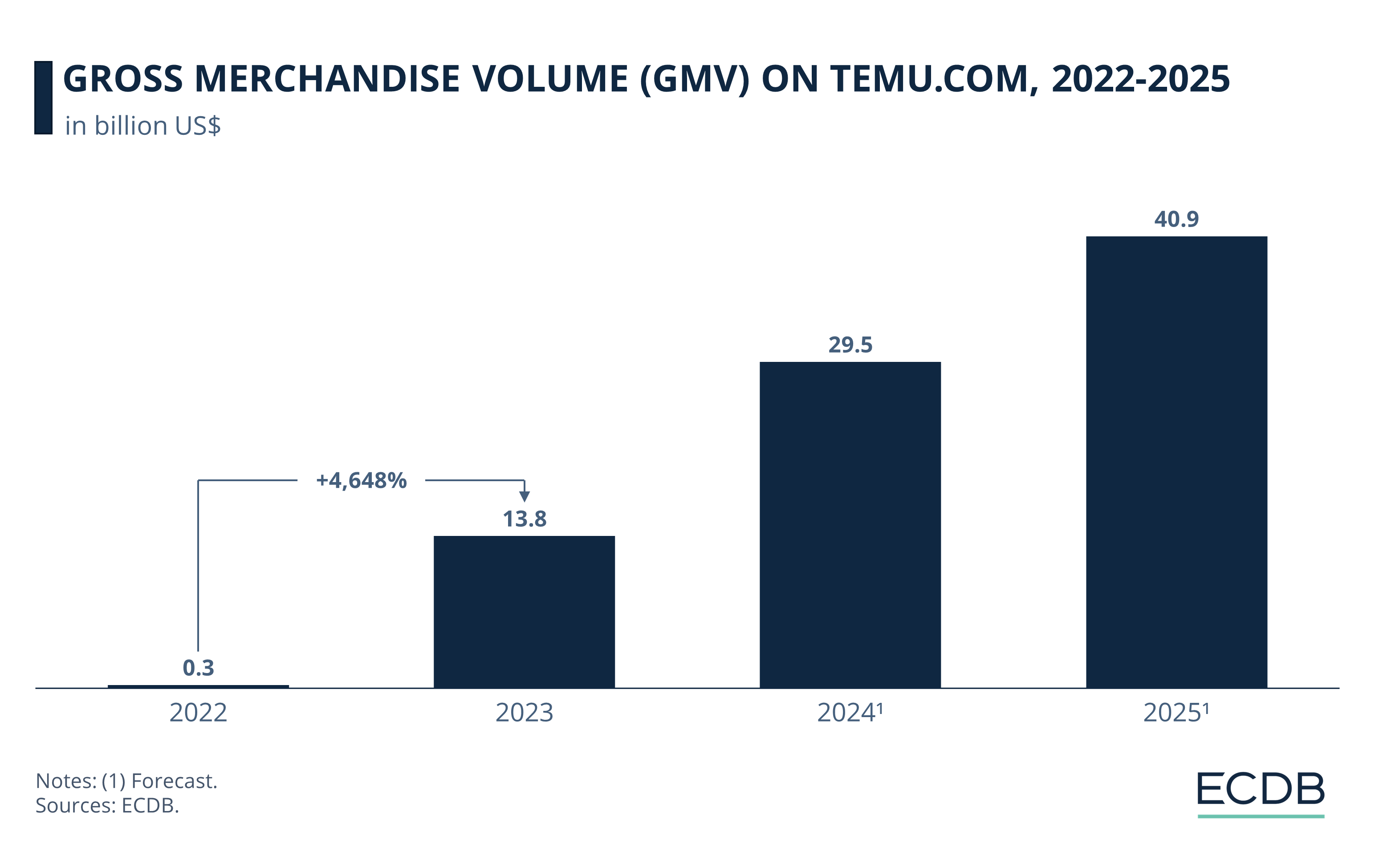

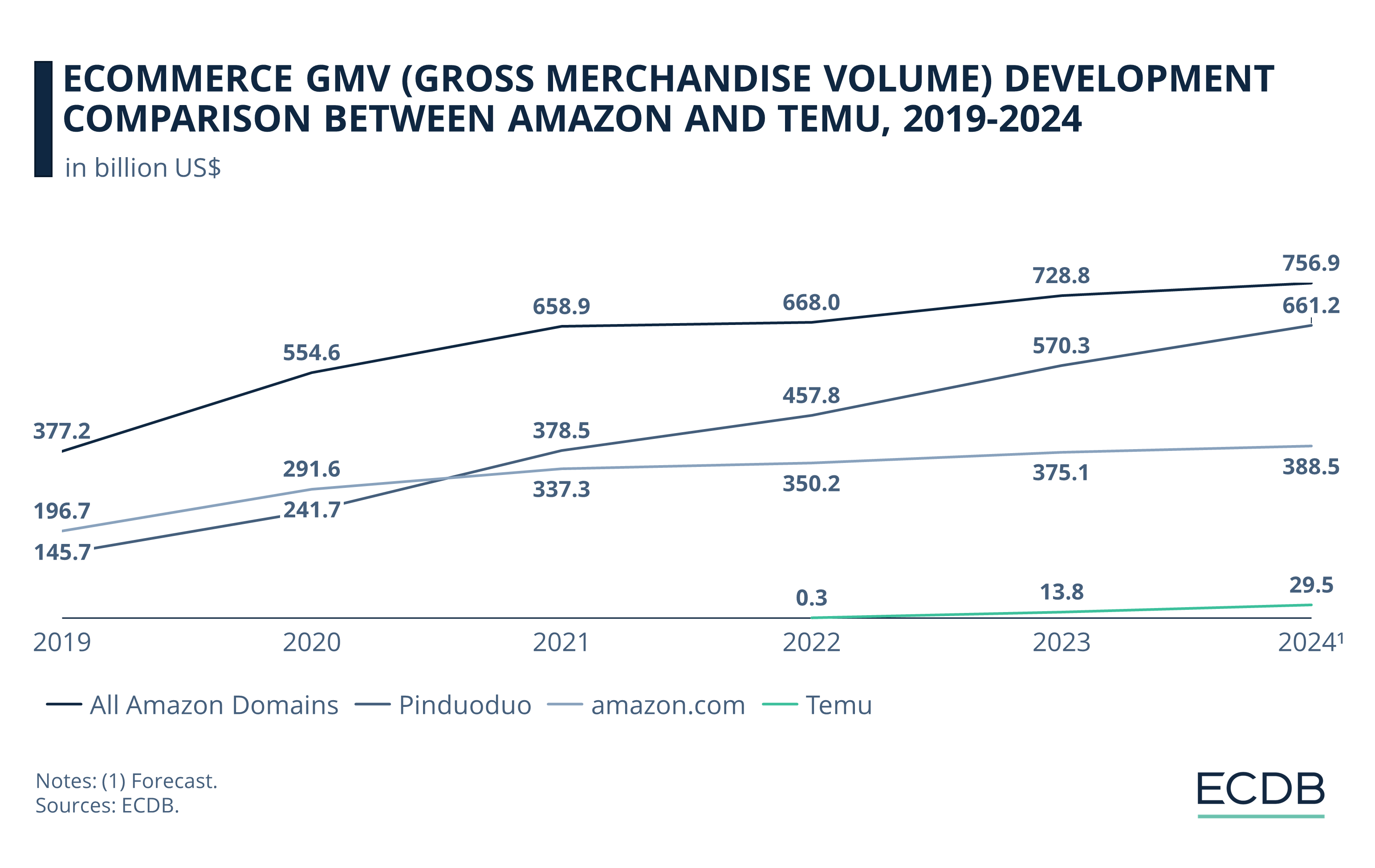

Temu.com: GMV Growth Is Set to Continue

ECDB recently added temu.com into the database, which started with US$290 million in gross merchandise volume (GMV) in 2022. Marketplace activity then increased over 4,500 times year-over-year to reach US$14 billion in 2023.

ECDB projections expect Temu's growth to continue, resulting in GMV forecasts of US$29.5 billion in 2024 and US$41 billion in 2025.

As we recently posted in our insight on Temu download numbers, the app has surged in popularity in early 2023 on Google Play and the App Store.

With about 440.000 downloads after the app's initial launch in September 2022, download numbers continued to rise steadily until April 2023, when they reached 15.3 million.

After that there was a sudden spike of about 98% month-over-month, so that by May 2023, the app had been downloaded more than 30 million times.

This was most likely due to the increased media attention Temu received.

After a short dip in June 2023, the number of downloads increased steadily again, reaching more than 40.5 million app downloads in September 2023.

Other notable surges occurred most recently, in January 2024 with 47.7 million downloads and in March 2024 with 41.3 million downloads, marking the two highest monthly download numbers so far.

But app downloads are not the only way to measure traffic on Temu. Recent data from Similarweb shows an additional perspective: The number of visits to Temu's browser site, temu.com.

Compared to app data, the number of visits to temu.com is significantly higher, but this is to be expected since visiting a website in a browser requires less effort than downloading the app on a mobile device.

The same surge from April to May 2023 occurred on the website, rising by 96.5% from 110.6 million visits in April to 217.3 million in May.

Similar to app downloads, the heightened global media coverage of Temu is expected to have had a major influence on website traffic.

While site visits increased steadily to reach 503 million in January 2024, visits dipped temporarily in February 2024, but recovered to 479 million in March 2024.

GMV: How Big Is Temu Already?

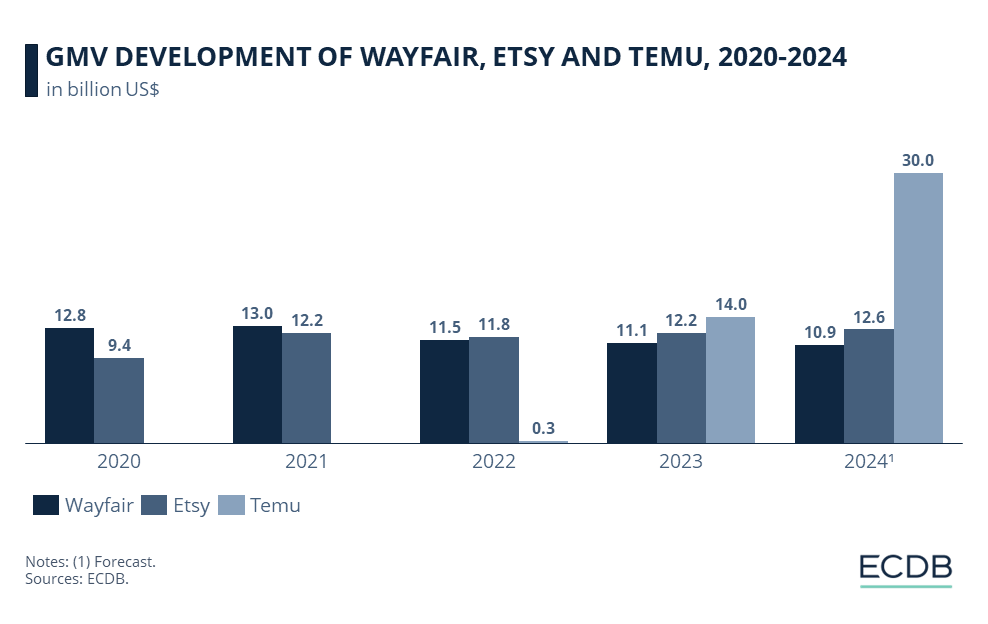

Temu is growing immensely fast, but the marketplace is still far from its main competitors, like eCommerce giant Amazon. However, Temu already surpassed Wayfair and Etsy in 2023, with Wayfair generating US$11.5 billion, Etsy US$11.6 billion, and Temu reaching US$13.8 billion. Projections for 2024 are bleak for competitors. While Wayfair and Etsy are expected to remain stable, Temu is projected to reach US$29.3 billion.

Temu Has an Immense Growth Potential

In a previous insight on Amazon’s move to introduce a low-cost segment on its platform as a response to Temu, a point of discussion was its potential for further growth.

Temu does not appear to pose a real threat to Amazon’s market leadership, at least not now: Its projected GMV of US$29.5 stands against Amazon’s US$756.9 billion in 2024.

A comparison with Pinduoduo shows a possible scenario that would justify the precautions taken by eCommerce leader Amazon: Since Temu is operated by the same parent company, PDD Holdings, it is not unlikely that Temu follows the same path as Pinduoduo. Both platforms have similar strategies, and Temu’s success is actually built on the experience Pinduoduo has gained over the years.

So far, the plan is working. Consumer awareness of Temu has grown significantly over the years.

More Insights? We keep our rankings up to date with the latest data, offering you valuable information to improve your business. Want to know which stores and companies are leading the way in eCommerce? Which categories are achieving the highest sales? Check out our rankings for companies, stores, and marketplaces. Stay one step ahead with ECDB.

Growing Consumer Perception

A recent investigation by IFH Köln, a German research institute, found out that an increasing share of German consumers are aware of and have bought from Temu. Compared to 2023, when 11% of consumers said they purchased products from Temu, this rate grew to 32% in 2024.

Typical reasons for consumers to shop at Temu are tied to its business model.

Why Is Temu so Interesting?

Temu’s wide range of products is particularly appealing to consumers, combined with a gamified online shopping experience that encourages customers to try their luck and spend more time on the website or app.

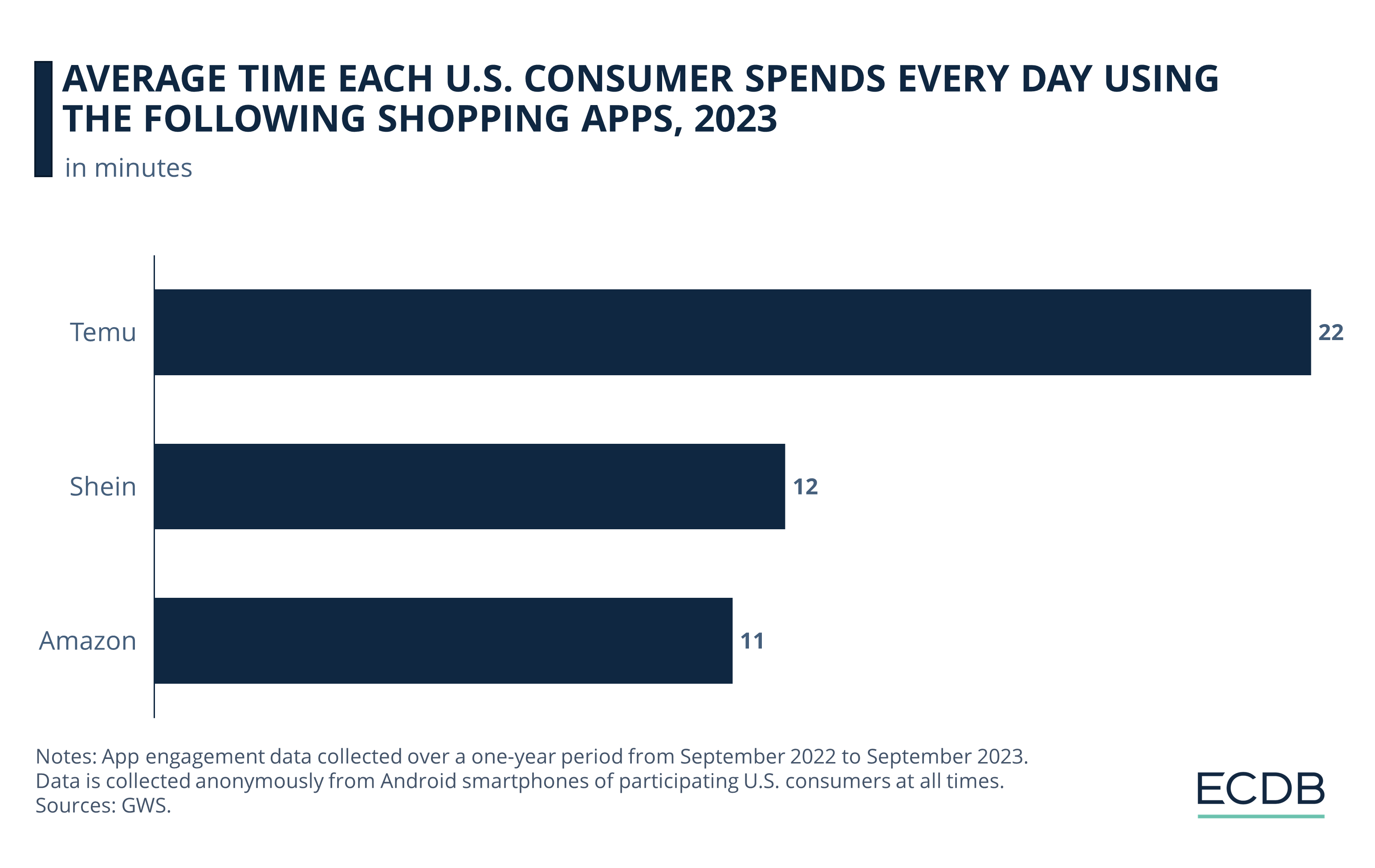

And this strategy seems to be working, as app engagement data analysis by GWS shows that Temu manages to capture user attention longer than other popular shopping apps. See the specifics below.

Over the course of one year, from September 2022 to September 2023, GWS traced consumer behavior on their Android smartphones 24 hours a day, seven days a week.

On average, users are spending double the amount of time per day on Temu (22 minutes) than on Amazon (11 minutes).

App engagement on Shein is similarly outpaced by Temu as Amazon, since users spend on average merely one daily minute more on Shein (12 minutes).

It looks like Temu has figured out how to motivate users to engage with their platform. But what is it exactly that Temu does different?

Temu: The Company's Five Core Strategies and Tactics

Here are five key aspects of what the app offers.

1. Competitive Prices & Discounts

The most obvious reasons to buy from Temu are low prices, free shipping, and discounts. Like Shein, Wish, and Alibaba, Temu’s business model is built on undercutting what consumers are used to spending on items. Temu differentiates itself from other platforms by offering free shipping and returns to customers, which is made possible by PDD Holding’s extensive network of suppliers and shipping partners.

An efficient logistics network is not to be underestimated, as problems with supply and distribution networks are seen as a major factor in the failure of Alibaba and Wish to break into the Western market. Undelivered packages and unresponsive customer service are just two ways to create dissatisfaction among online shoppers.

Temu offers even more discounts and lower prices than Shein, with special offers such as items sold for as little as one cent.

2. Fusing Shopping and Entertainment

One-fifth of online shoppers in the U.S. say they miss the in-store shopping experience when they shop online. Temu aims to bridge this gap by introducing games to the shopping process. By playing games like Fishland, Coin Spin, Card Flip, and others, you can win rewards that ultimately lead to more time spent on the site and a dopamine rush from winning free items.

To keep people playing these games, however, the app relies heavily on referrals, another core business strategy.

3. Shared Shopping Experience

Group Buying is a familiar concept in Asia that Temu is extending to its Western customer base. Essentially, it increases customers’ bargaining power by forming groups to share a bulk discount.

This plays into the referral program, which gives discounts to customers who bring new clients to the app and enables a shared shopping experience.

4. Affiliate Programs and Heavy Advertising

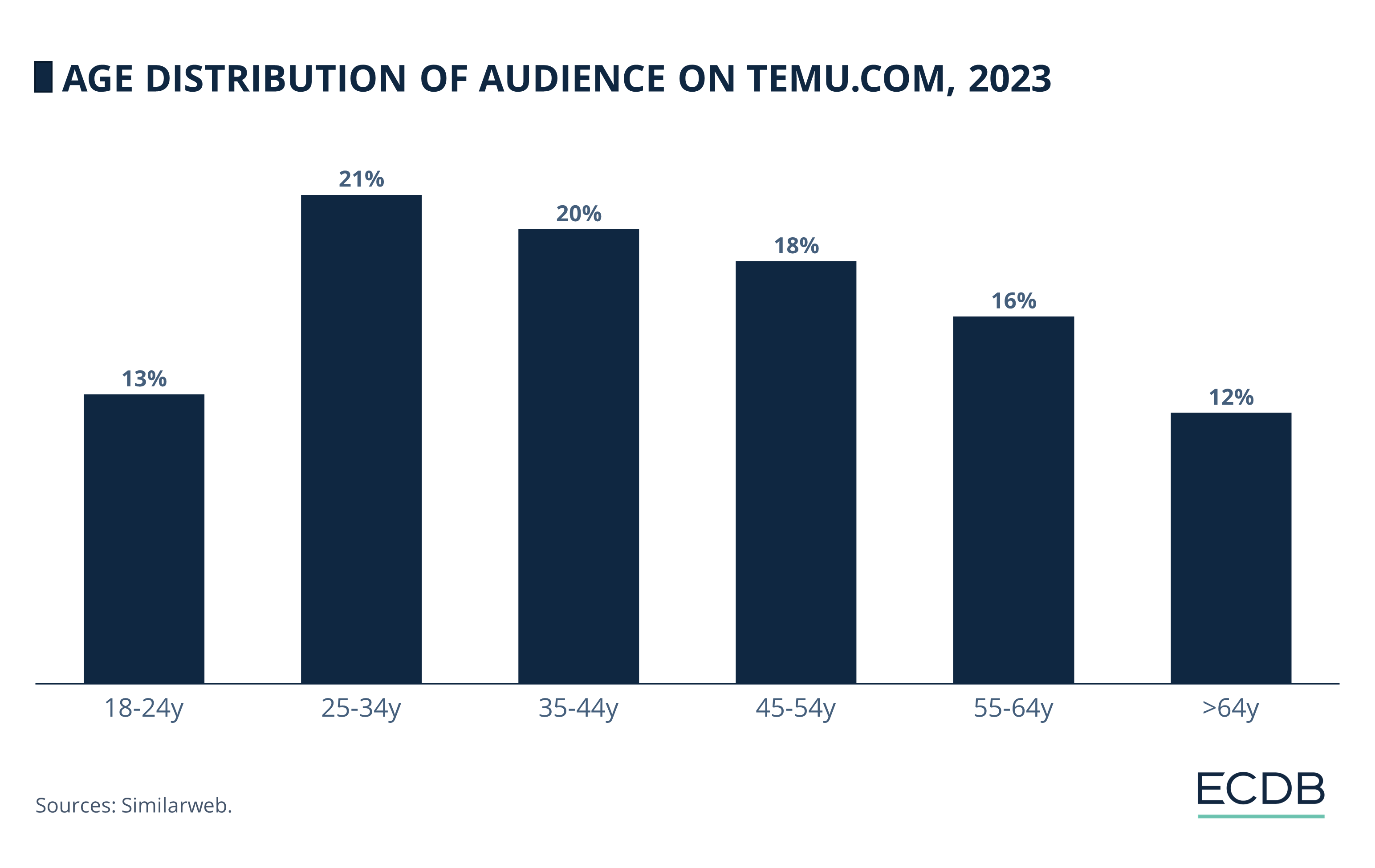

As Shein has already proven effective, Temu sends free items to a large number of influencers and micro-influencers to promote Temu on YouTube and TikTok. A younger customer base of users under the age of 35 is particularly attractive to Temu, as younger users are typically less able and willing to pay large sums for products.

Similarweb’s data on the age distribution of Temu’s audience confirms this claim. But there is more to it. Have a look below.

The data shows that the largest age segment of shoppers using temu.com are 25-34 year olds, representing 21% of the audience.

This is followed by the next largest age group (35-44) at 20%.

While older age groups are incrementally less represented in the audience, as seen with 18% of 45-54 year olds and 16% of users aged 55 to 64,

the youngest age group (18 to 24 years) is next to lowest among the age groups using the site (13%).

Only consumers over 64 years are less represented (12%).

It becomes clear that the shopping site attracts consumer interest across a wide age range.

Although heavy social media influencer marketing is known to reach mostly younger shoppers, the site's low-price strategy and addictive gamification feature seem to resonate with older users as well.

As a final tactic, there is the instant relay of consumer feedback, already popularized by competitor Shein.

5. Real-Time Shopping: Cost-Effectiveness

Temu’s most innovative and effective strategy is also highly ambivalent and criticized. Similar to Shein, Temu uses a reverse-manufacturing model that relays customer feedback directly to manufacturers. Starting off with smaller quantities that are offered on the marketplace, products in high demand are reordered, while others are replaced.

According to Temu, this results in environmental efficiency because product inventory is aligned with customer demand in real time. In addition, a greater variety of products can be offered than with traditional retail strategies. With this method, Shein was able to launch 150,000 new items in 2020, beating its competitors by a wide margin. Temu’s emergence with a similar strategy in global eCommerce appears to be taking the spotlight away from Shein. This is also true for the criticism directed at the company.

Plagiarism & Exploitation: Temu Faces Criticism

Critics point to several detrimental effects of Temu’s and Shein’s "ultra-fast" eCommerce: To ensure low prices, manufacturers must keep costs down, contributing to the continued poverty of workers in manufacturing countries.

The same goes for product quality and environmental friendliness: Cheap products that break easily contribute to increasing amounts of waste, returned products tend to be dumped rather than recycled or resold, and the high number of new products sold is only possible by ripping off SME fashion designers and creators.

But these are not the only problems with Temu. An investigation by a German public broadcaster conducted product tests with items purchased from Temu, and the results were devastating: Not only were the products made of inferior materials and prone to quick breakage, but one item of clothing ordered by the investigators contained a toxic substance. Specifically, a plasticizer (called dibutyl phthalate) was found at 40 times the level allowed for commercial distribution in the EU and U.S., which can cause liver or kidney damage if used over an extended period.

Another improper aspect of imports from Temu is that the origin of the products is not declared on the packaging materials. This makes it difficult to hold manufacturers accountable for issues with product quality and other concerns.

Consumer Mistrust of Temu & Legislative Responses

Asking consumers in Germany, more than half think it unlikely that Temu will pose a serious threat to incumbents. A quarter (25%) doubt the extensive discounts and more than half (51%) feel manipulated by the site's pushy advertising.

In 2024, 54% of respondents said that they do not believe that Shein, Temu or others will be more successful than the likes of Amazon and Zalando. While the incumbents are winning consumers over with data security, seamless delivery and product search, just one year ago, 64% of consumers did not believe in Temu's potential for sustained success.

Price dumping by Temu, AliExpress, Shein and other competitors in eCommerce is being criticized by domestic entrepreneurs in Europe and the U.S. While Asian-origin marketplaces currently enjoy tax exemptions in the EU for import packages under €150 (about US$160), governments across the EU are negotiating to impose greater controls on incoming products and lower thresholds for tax exemptions.

The French government recently passed a fast-fashion law that adds a €5 (US$5.4) surcharge to each fashion item deemed environmentally harmful.

Temu Takes the World by Storm:

A New Era of Online Shopping?

Temu stands out for its low-cost products, free shipping, and gamified shopping experience. Its strategies include group buying, referrals, and social media ads. However, its real-time shopping model, similar to Shein's, is drawing criticism for potential environmental harm and worker exploitation. Independent tests reveal short product life spans and harmful chemicals that exceed regulatory thresholds.

The longevity of Temu's approach is uncertain: The low-cost platform spends heavily on marketing, conveniences like free returns and delivery, and low product prices. But the fact that Temu's parent company is PDD Holdings, which also operates Asia's fourth-largest marketplace, helps alleviate some of the financial pressure that comes with this high-spending approach.

Without a crystal ball, it is difficult to predict where Temu will go from here. While consumer surveys show a widespread distrust of the app and a preference for established, homegrown retailers when it comes to quality, Temu's usage numbers have skyrocketed in recent years, and its low-cost approach is very appealing to younger audiences and those struggling financially. A ban may keep the currently thriving marketplaces in place, but open the door to similar businesses of domestic origin. Either way, stay tuned to the ECDB for our insights and data.

Sources: Daxueconsulting: 1 2 – DCCEEW – The Guardian: 1 2 – IFH Köln – Kake – PULS – SensorTower – ZDNet

FAQ

What is Temu's business strategy?

Temu's business strategy focuses on attracting customers through competitive pricing, gamification, social buying, and heavy advertising. The site offers low-cost products with free shipping and discounts and engages users with games that reward them with discounts and free items. Social and group buying features encourage users to recruit new customers and benefit from bulk discounts. Temu also invests heavily in influencer marketing and advertising to reach a broad audience, leveraging social media to attract younger shoppers. This combination of low prices, engaging shopping experiences, and extensive marketing drives Temu's rapid growth and popularity.

What makes Temu successful?

Temu's success is driven by its low prices, engaging gamification features, and social buying options. These strategies attract cost-conscious consumers and keep them engaged. Additionally, heavy investment in influencer marketing and advertising broadens Temu's reach, particularly among younger shoppers. Press coverage and high-profile Super Bowl ads also boost its visibility. This mix of affordability, entertainment, and effective marketing fuels awareness of Temu and its popularity.

What's the Temu concept?

The Temu concept combines low-priced goods with an engaging shopping experience. The platform attracts consumers with affordable products, free shipping, and frequent discounts. Gamification and social buying features keep users entertained and encourage referrals. Extensive marketing, including press coverage and Super Bowl ads, boosts visibility.

How does Temu target consumers?

Temu targets consumers with low prices, free shipping, and frequent discounts. The platform engages users through gamification features and social buying options that encourage referrals. Extensive marketing, including press coverage and Super Bowl ads, boosts visibility. Additionally, the criticism Temu faces sparks curiosity, drawing more attention to the platform.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

Deep Dive

Gen Z Online Shopping Behavior: Consumer Habits, Preferences & Trends

Gen Z Online Shopping Behavior: Consumer Habits, Preferences & Trends

Deep Dive

Live Commerce in Italy: Consumer Behavior & Preferences

Live Commerce in Italy: Consumer Behavior & Preferences

Deep Dive

Trends in German eCommerce: Germans Like What They Know

Trends in German eCommerce: Germans Like What They Know

Back to main topics