ECOMMERCE: SOCIAL COMMERCE

Community Group Buying in China: A Social Commerce Phenomenon

Why do Chinese shoppers team up to buy everyday products? This social commerce practice, particular to China, is called community group buying. We analyze its market development, target audience, and key platforms for community group buying in China.

Article by Nashra Fatima | June 25, 2024Download

Coming soon

Share

Community Group Buying: Key Insights

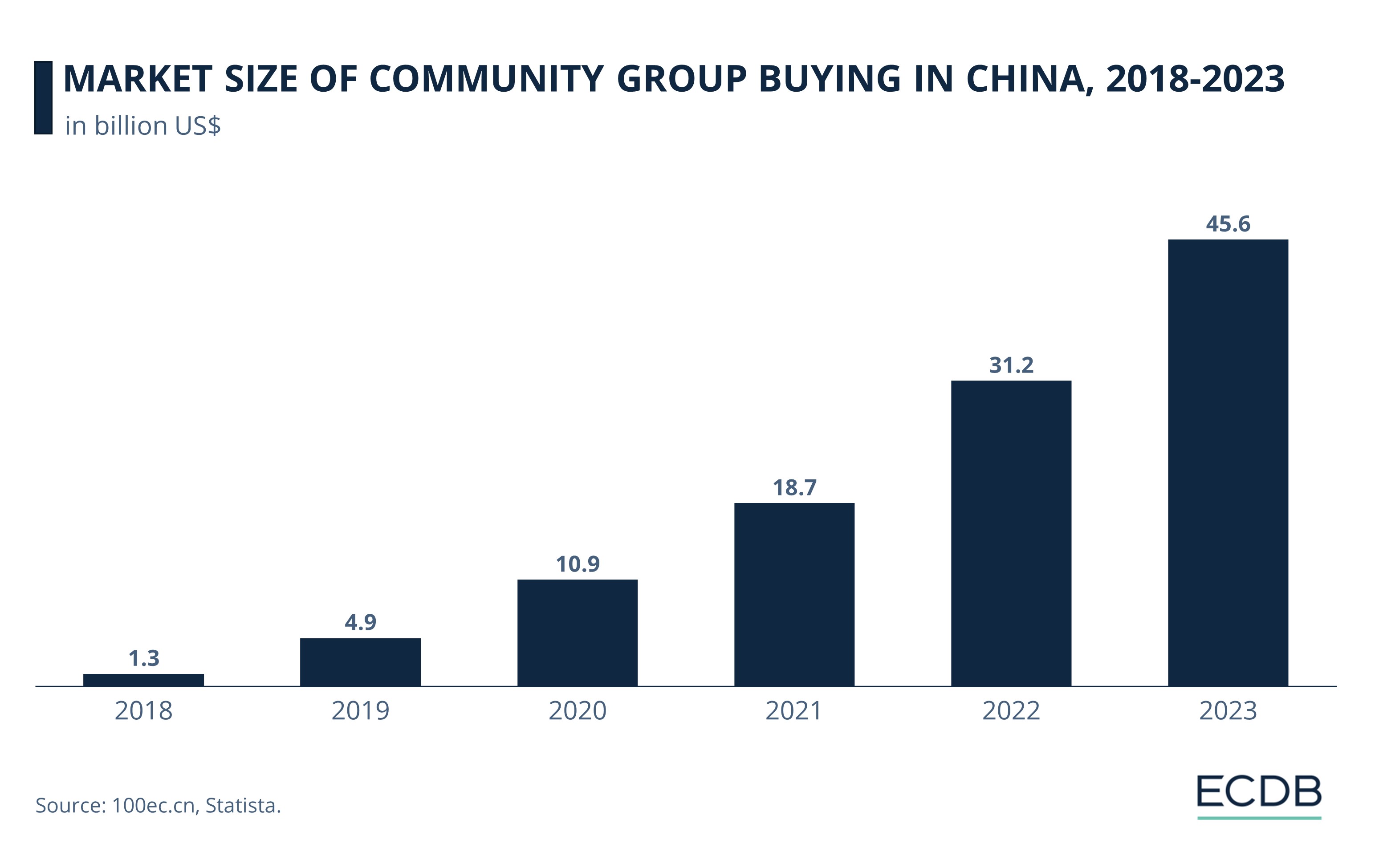

Market size: Group buying continues to expand in China, with its market size reaching US$45.6 billion in 2023. However, there has been a slowdown compared to its peak period (2019-2021), when yearly growth of nearly 300% was observed.

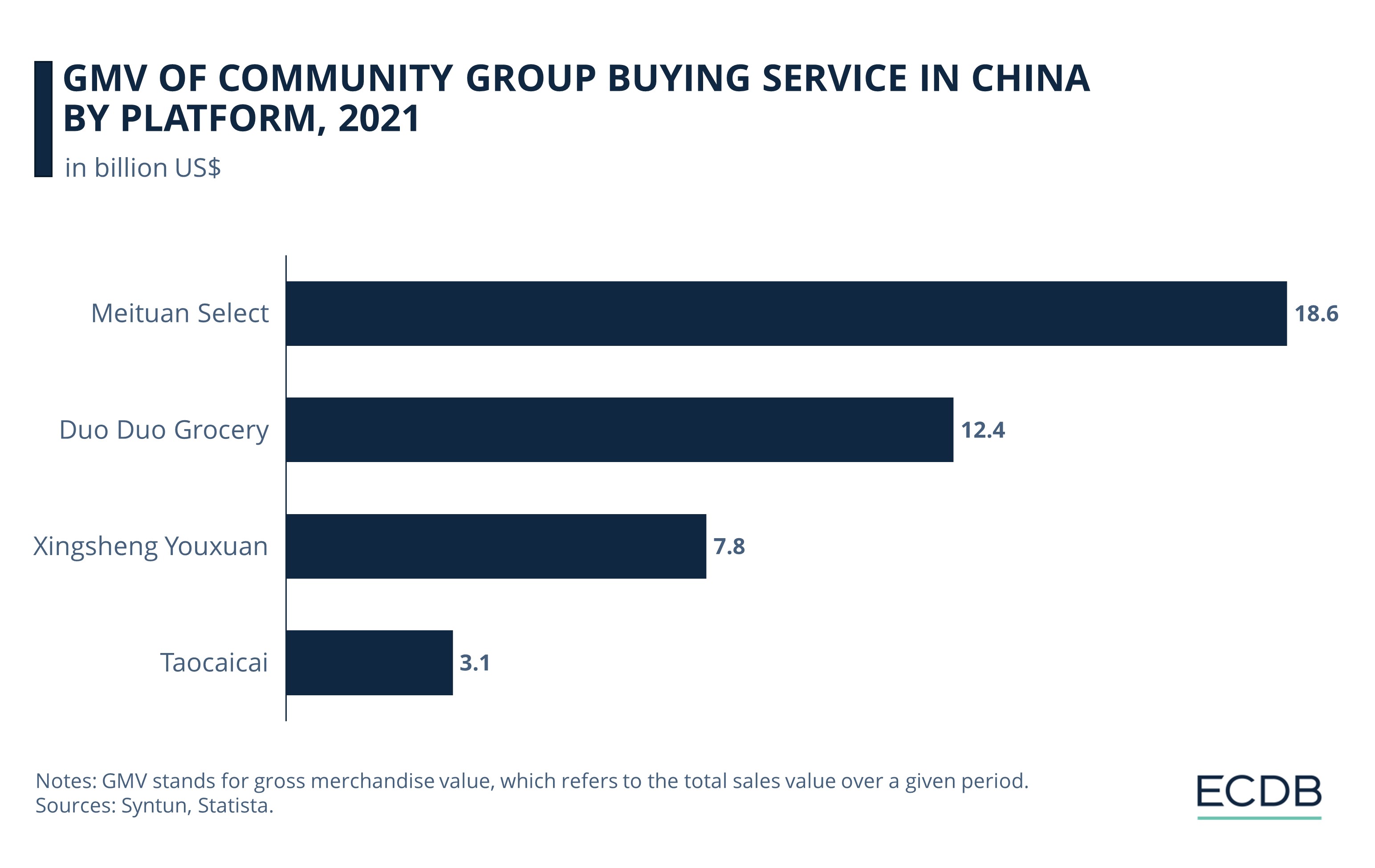

Key platforms: Meituan Select, owned by the qCommerce giant Meituan, tops the list with a GMV of US$18.6 billion in 2021. Duo Duo Grocery, owned by Pinduoduo, was second with US$12.4 billion.

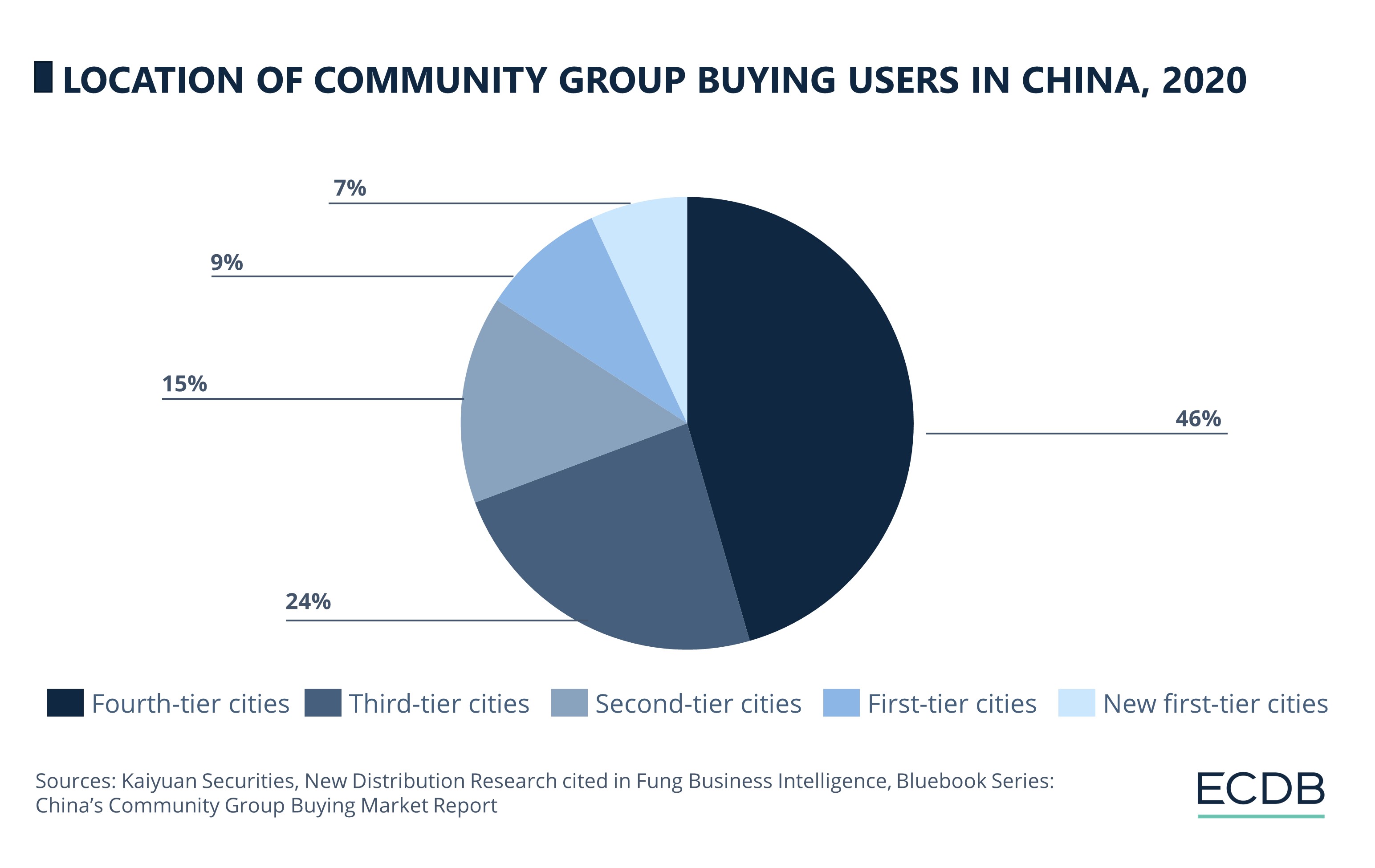

Target Demographic: Chinese consumers in smaller cities and towns are a prime audience for group buying. During the trend’s peak, 70% of all group buyers came from third- or fourth-tier cities in China.

Challenges: Despite growth, group buying has faced challenges including intense competition, price wars, losses, and government clampdown.

Social media is the new battleground for online retailers. But what happens when companies use social platforms to address groups of buyers rather than individual buyers?

The community group buying model in China reveals how such an approach works. China’s rising middle class, armed with stronger buying power and wider internet access, spur the growth of this social commerce practice.

What exactly is community group buying and why does it attract Chinese shoppers? What is its market size, key platforms, and target demographic? Find out.

What is Community Group Buying?

Community group buying integrates eCommerce with the offline community experience, bringing people to shop together online.

To place a group order, people must first self-organize into a team, online or offline. They may go to a social platform and view the items they wish to buy. Typically, merchants offer two price points for products: one for individual purchase and another discounted rate for team purchases.

Customers can join an existing team on an app of their choice or a WeChat mini program. Alternatively, they can form their own team, proactively inviting friends and family to join.

Once the order volume increases, the group becomes eligible for discounts and deals. The merchant confirms and processes the order, typically shipping it within 48 hours.

Popular items bought on group buying platforms include groceries and fresh food like meat, eggs, and dairy, non-food daily necessities like paper towels, and agricultural goods.

What Are the Advantages of Community Group Buying?

For consumers:

Attractive prices: By purchasing in bulk, customers get discount prices, coupons, and lower delivery costs.

Better and reviewed products: People can access a wide range of merchandise online with reliable recommendations of community leaders and their social circle.

Interactive shopping: Although conducted online, the process remains social. It particularly helps senior citizens who may find it difficult to navigate complicated purchasing apps.

For retailers:

Reduced costs: Group buying reduces the number of intermediaries, decreasing supply-chain challenges and logistics expenses.

Expanded buyer base: Through community leaders, merchants acquire customers relatively quickly. Incentivizing sharing links with friends and family further improves their visibility among potential buyers in a neighborhood.

Enhanced brand recognition: Social buying, done alongside family and friends, encourages frequent and repeat purchases. It boosts brand recognition and strengthens loyalty.

Market Size of Community Group Buying in China, 2018 to 2023

Although the model of group buying was launched in 2014, it was not until 2018 that it experienced accelerated growth. The pandemic further boosted its spectacular rise in 2020.

Between 2018 and 2019, the scale of community group buying in China skyrocketed. The market hit US$4.9 billion in 2019, recording a year-on-year increase of 283%.

In 2020, the market climbed to nearly US$11 billion. At 72%, although the growth rate was moderate in 2021, it pushed the market size to US$18.7 billion. During these pandemic years, superstores and traditional fresh (wet) markets were forced shut. As Chinese consumers turned to online shopping, group buying played a role in changing how they bought everyday products.

Tech eCommerce heavyweights like Alibaba, Meituan, and Pinduoduo hopped on the group buying bandwagon from 2020 onwards, eager to tap into the large but under-served consumer market in lower tier cities of China.

The market continued to expand in both 2022 and 2023, although slower than before. Notably, the positive development occurred despite stricter government regulations and intense competition. Market size was US$31.2 billion in 2022 and US$45.6 billion in 2023.

Discover Our Data: Our frequently updated rankings provide essential insights to help your business thrive. Wondering which stores and companies are excelling in eCommerce? Interested in the top-performing categories? Find the answers in our rankings for companies, stores, and marketplaces. Stay competitive with ECDB.

Who Are the Big Players in Group Buying?

The top four group buying service providers collectively generated a gross merchandise value of around US$42 billion in 2021.

Meituan Select, operated by the shopping platform Meituan, topped the list by a large margin, generating US$18.6 billion in 2021.

Duo Duo Grocery, run by Pinduoduo, stood second, with a GMV of US$12.4 billion.

Xingsheng Youxan came in third, with US$7.8 billion.

Taocaicai, owned by Alibaba Group, ranked fourth with US$3.1 billion.

The large-scale platforms that came to dominate the group buying landscape followed in the lead of original community buying apps. Often, they were backed by tech money. For instance, internet giant Tencent Holdings is an investor in both Meituan and Pinduoduo.

A closer look at the top two contenders – Meituan Select and Duo Duo Grocery – shows their impressive growth trajectory at the height of the group buying rage in China.

Meituan Select

Launched in 2020, Meituan Select is an initiative of Meituan, China’s leading quick commerce player which used a couponing strategy to gain market share. The company leveraged its delivery platform – which remains the largest in China – to penetrate the country’s rural areas.

By 2021, the platform reportedly covered 30 out of 34 provincial administrative regions in China. Its parent company Meituan’s annual revenue rose to US$27.7 billion in 2022, from US$9.9 billion in 2018.

Duo Duo Grocery

Launched in 2020 by the online retailer Pinduoduo, Duo Duo Grocery became active in China in 2015. The company led to a so-called retail revolution, battling giants like Alibaba and JD.com. It used a social commerce strategy to rapidly capture an audience in smaller cities and rural areas.

The platform connects consumers to local farmers and distributors directly, offering next-day grocery pickups at low prices. Its parent company Pinduoduo’s annual revenue soared to nearly US$19.3 billion in 2022, from just US$2 billion in 2018.

The Target Demographic of Community Group Buying

Community group buying primarily targets Chinese customers residing outside of big cities.

Per a Fung Business Intelligence report, 70% of community group buying users lived in third or lower tier cities (smaller cities and rural regions), as of 2020.

In comparison, only 16% of users hailed from first tier cities (large and developed urban hubs like Beijing and Shanghai) and new-first tier cities (emerging places like Wuhan and Nanjing).

What are Third or Lower-Tier Cities?

Often referred to as sinking markets, third and lower tier regions include smaller cities and rural areas in China.

In comparison to larger urbanized areas, these regions have a smaller population size, limited economy, and less developed infrastructure. However, they have good growth potential, particularly as digitalization strengthens.

Thus, community group buying evolved to address the specific needs of price-sensitive Chinese customers residing in small cities and rural areas. That’s because:

The digital divide in China is shrinking, which gives residents of lower tier regions better access to smartphones and dependable internet service.

Residents of smaller towns want to boost their lifestyle within budget and often look for bargains.

Connected to their neighborhoods, they tend to experience a higher level of community interactions than those living in major city centers.

All these factors make small-town residents likely candidates for group buying. Another important aspect for the model is community leaders.

Community Leaders in Group Buying

Community leaders act as the linchpin of the group buying model in China:

Generally, they are grocery store owners or housewives. A social platform recruits them to act as the point of contact between their local community and wholesalers.

They are responsible for collecting and initiating orders from the neighborhood households.

Once the aggregated order is processed, sellers ship the goods to a designated collection point. The community leaders pick and unpack the bulk order and alert the members to pick up their purchase or deliver it door-to-door.

They typically earn a commission of 10-12% on the GMV or sales.

They also provide customer service, promote deals, and acquire new customers. The social aspect boosts the customer conversion rate as people in the neighborhood already know and trust community leaders.

Challenges for the Group Buying Model

Despite its phenomenal success, group buying has faced several challenges over the years. They range from quality control to fierce competition in the form of price wars to government scrutiny.

The arrival of tech companies forced out several small and medium-sized platforms, which either had to scale down their operations or declare bankruptcy.

Companies operating in the group buying segment often spend huge sums of money while suffering losses as they rush to meet customer demand for subsidies. This has compelled even resource-rich players to either shut down or scale back their operations in less profitable parts of the country. This includes Alibaba’s Nice Tuan, JD.com’s Jingxi Pinpin, and Didi’s Chengxin Youxuan.

Moreover, the Chinese government intervened in 2021, imposing regulations on community group buying to stop the mounting price wars. Some platforms were fined for setting too-low prices, pricing fraud, and false advertising.

Community Group Buying: Closing Thoughts

China’s community group buying model saw a high level of interest from local customers, particularly in the pandemic years. As a social commerce strategy, it took off in China, but the model may not be equally successful in every consumer market.

Even in China, despite market expansion, group buying platforms like Meituan Select are shifting their strategies. Struggling to meet growth targets, they are reported to be focusing on cost-cutting and reorganizing their group buying platforms rather than on capturing bigger market shares.

Although its heyday appears to be over, the group buying industry is anticipated to evolve as the eCommerce environment and economic trends change in China. As consumer preferences also shift, existing group buying platforms will have to target receptive populations, whether in mega cities or smaller regions, to ensure growth.

Sources: Statista, Fung Business Intelligence, Alarice International Limited

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics