eCommerce: Company Analysis – Pinduoduo, Temu and More

PDD Holdings: Risks Potential Investors Should Know About

PDD Holdings' stock prices are very low right now, and you might be considering investing in Pinduoduo and Temu's parent company. However, you should think again. There is significant uncertainty about the legality of their corporate structure in China, and Europe is beginning to combat the import of cheap goods from China. Here is why and what it means for Temu's future.

Article by Nikolai Surminski | May 28, 2024

PDD Holdings: Risks & Dangers for Investors – Key Insights

Foreign Company in China: PDD Holdings operates half of its subsidiaries in China, but faces restrictions from the Chinese government due to PDD's international orientation. Chinese investment laws rarely approve of foreign-owned companies.

Loophole Through VIEs: A VIE (Variable Interest Entity) is a legal structure that grants control of a company over contracts. PDD Holdings' Chairman and Counsel, two Chinese nationals, own the VIE "Hanghzou Aimi" for the government of China to recognize as a Chinese company, which in turn is controlled by PDD Holdings.

Why Is That Problematic? There is no overarching legal structure that specifically allows for the existence of VIEs to do business in China. Because many of the larger eCommerce companies do business this way, it is currently being accepted but may be subject to change.

You might not have heard of it, but PDD Holdings Inc. is the hottest eCommerce company on the market right now. The reason for that is Temu, the fast-growing online marketplace operated by PDD.

After its launch in 2022, the marketplace shot to US$14 billion in GMV (Gross Merchandise Volume) for its first full year. We predict Temu to continue this trend and grow to US$ 30 billion in 2024.

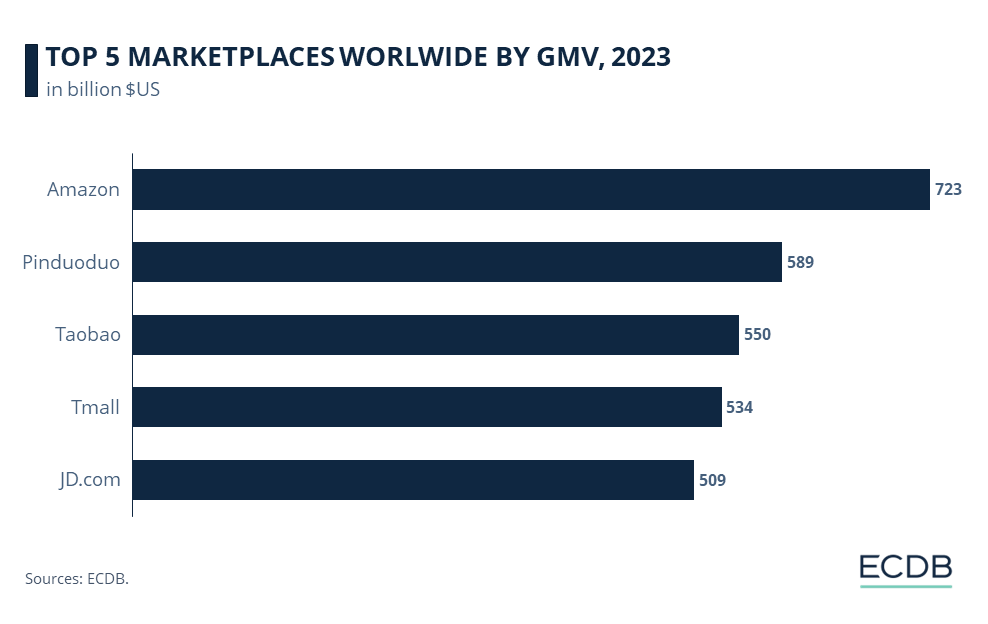

PDD Holdings is currently also the eCommerce company with the third-highest market capitalization with US$151 billion, only behind Amazon and Alibaba. Despite its recent global expansion, PDD still has its roots in China where it generates roughly 98% of its GMV. At the core of its business is the marketplace Pinduoduo, the second-largest marketplace in the world.

Since its founding in 2015, it has grown to US$580 billion in GMV by 2023. But this growth has not come without major challenges. As a consequence, there is a giant unknown risk at the core of PDD’s business.

PDD Holdings Corporate Structure and Business Strategy

PDD Holdings Inc. is a global holding company, meaning it does not conduct notable business itself but has controlling interest in various subsidiaries. Despite its Chinese origins, the company is incorporated in the Cayman Islands, similar to JD.com Inc. and Alibaba Group Holding, and headquartered in Dublin, Ireland. This has a number of reasons: beneficial tax structure, improved access to financial markets and an easier way to conduct business in Europe and the Americas.

In addition, PDD Holdings Inc. is listed on the Nasdaq, a large American stock exchange. PDD is not the only Chinese company as eCommerce giants such as Alibaba and JD.com are also listed in the U.S.

Why does a company that conducts most of its business in China decide to list shares in the United States instead of China?

This has multiple reasons:

American and European capital markets are among the largest and most liquid markets with the potential to raise more capital.

Listing in the U.S. allows PDD to attract a more diverse range of investors such as institutional investors and retail investors.

The regulatory environment in China can be subject to sudden change and companies are carrying the risk of government intervention.

The split between officially being a non-Chinese company and conducting the largest share of business in China represents one of the biggest challenges for PDD as there are certain restrictions on doing business in China as a foreign company.

People’s Republic of China (PRC) law restricts foreign investment and ownership in “value-added telecommunications business” (VATS) such as online data processing services. These laws cap foreign ownership at 50% and require a license, often called the VATS license, that is only rarely approved to foreign investors. As such, PDD Holdings (a foreign company) is not able to operate its core business itself while also having its headquarter outside the PRC.

PDD Holdings: Suspicious Bookkeeping Practices

To solve this issue (operating in China while also keeping access to American capital markets), PDD had to get creative in structuring its network of companies following in the footsteps of other Chinese tech giants.

The parent company PDD Holdings, registered in the Cayman Island, established a wholly owned subsidiary in Hong Kong called HongKong Walnut Street Limited. Both of these companies, PDD and HongKong Walnut Street Ltd., are operating outside the PRC. HongKong Walnut Street Limited then established various wholly foreign-owned enterprises (WFOE) that are registered in the PRC. Together with other subsidiaries, these WFOE subsidiaries are referred to as Other Subsidiaries of PDD Holdings Inc. in the PDD Holdings annual report.

But since these subsidiaries are still considered under foreign ownership, PDD introduced another company layer to the structure by establishing a “Variable Interest Entity” (VIE) called Hangzhou Aimi Network Technology Co., Ltd. (Hangzhou Aimi).

Popularized in the early 2000s, VIEs are legal structures where control over a company is not demonstrated through equity rights but contractual obligations.

In short: the company is owned by one party, but a number of contracts grant profits, losses, and corporate control to another party.

In the case of Hangzhou Aimi and PDD this works as follows:

PDD’s chairman of the board and PDD’s general counsel, two Chinese citizens and employees of PDD Holdings, privately hold 100% of all equity in Hangzhou Aimi.

As owners of the VIE, they sign a number of contracts that basically give PDD full control over Hangzhou Aimi and its subsidiary while Hangzhou Aimi remains an independent Chinese company.

Hangzhou and its subsidiary (“VIE and Its Subsidiaries”) hold the necessary VATS license to conduct data-driven eCommerce business in China and are therefore the operators of the majority of Pinduoduo’s business, the economic benefits of which is then received by PDD Holdings.

PDD Holdings Revenues: More Than Half of All Revenues Are Generated Through VIE

But what does this corporate structure mean in terms of eCommerce business?

According to PDD’s last annual report, their main areas of business are online marketing services (performance-based marketing and retail media ads) and transaction services (anything around operating on the marketplace such as fees and logistics). Following PRC telecommunications law, it is mostly online marketing services that require a VATS license.

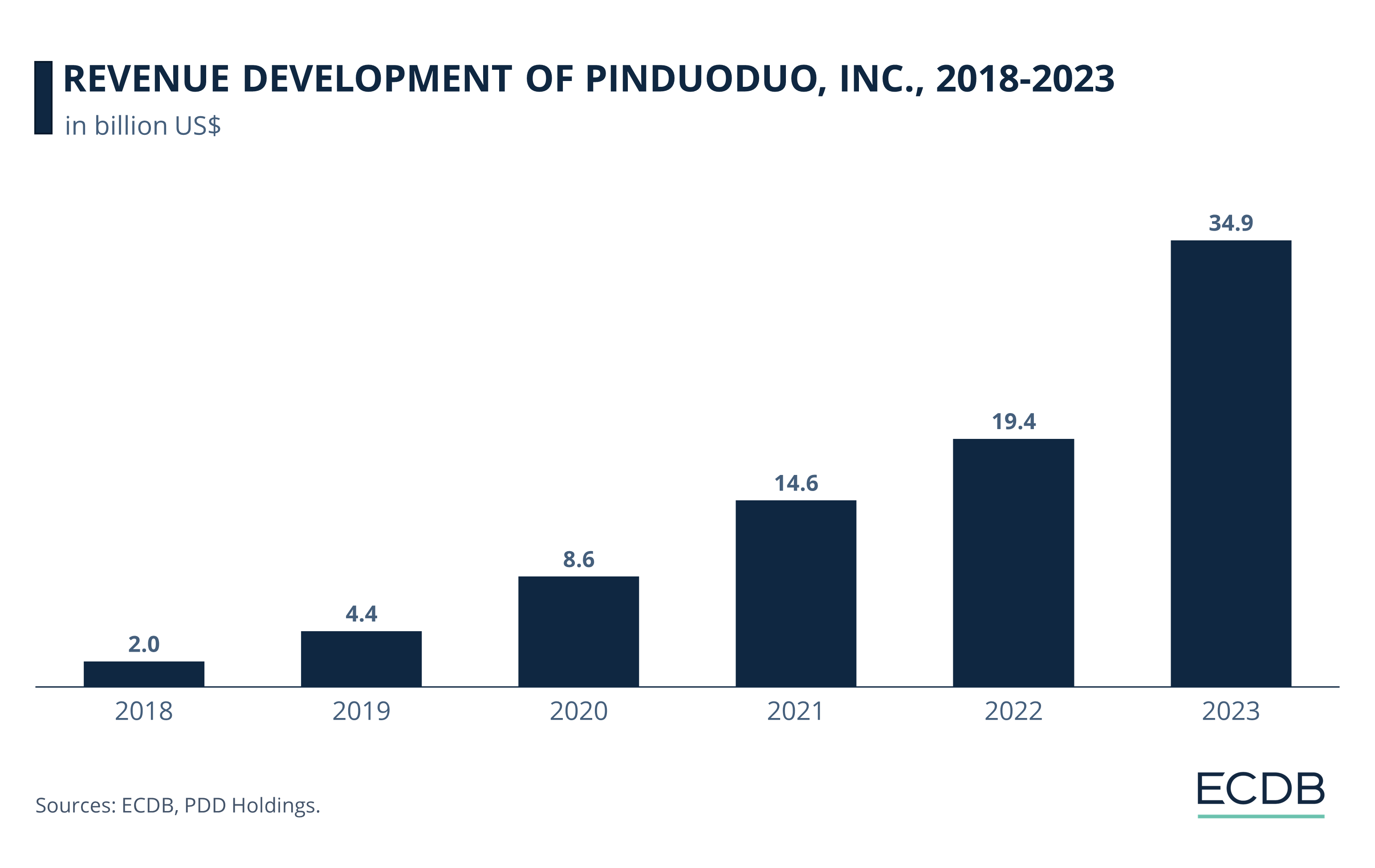

The PDD segment VIE and its Subsidiaries generated 45.7% of all revenues in 2023 (roughly US$ 17 billion) and covered most of the online marketing services of the company as these require a VATS license. The online marketing services segment grew by an impressive 49% in 2023. Other subsidiaries of PDD Holdings, which are fully owned by PDD, generated 54.3% of all revenues in 2023 and covers most of the transaction services.

Risks for Investors: What Does All of This Mean for PDD’s Business?

To keep it simple, this means that PDD does not own 45.7% of its revenues directly but only controls this substantial share through contracts. Following this structure, investors who buy PDD’s American shares do not have any direct or indirect equity interest in 45.7% of the company’s business.

According to PDD, “…any control that we have over […] the VIE depends on the enforceability of the contractual arrangements that we have entered into with the VIE and its shareholders.”.

This means that the entire structure, and with that PDD’s success as a business, is only as secure as these underlying VIE contracts. That is, of course, true for almost all businesses and not a problem in and of itself. But mixed with the special situation of doing business in China it becomes a large question mark: nobody really knows if these contracts are legal!

To quote PDD: “As of the date of this annual report, the legality and enforceability of these contractual arrangements, as a whole, have not been tested in any PRC court.” There is just no guarantee that this framework is legal within PRC law. Consequently, it is also unclear whether these arrangements could actually be enforced resulting in potentially substantial losses.

There is also no certainty that the government of the PRC will not outright ban the use of VIE in the future. Or in the words of PDD: “In addition to the uncertainties under PRC laws and regulations regarding […] our contractual arrangements with the VIE, the PRC authorities may also disallow the use of VIE structures.”

According to PDD, consequences could include revoking of the operating license or discontinuing of the VIE’s operations (i.e., PDD’s core business) causing significant harm to PDD’s shareholders. Importantly, companies write all kinds of possible risk to their annual report to fulfil their fiduciary duties. But in the case of Chinese eCommerce companies there should be some extra scrutiny.

PDD: Chinese Law Is Unpredictable

There are two main reasons that this might be relevant for eCommerce investors:

Tech crackdown by the PRC government and legal uncertainties

Since November 2020 the PRC has been on a continuous crackdown against tech companies in the name of national security and curbing market power. This crackdown affected various of the largest tech companies using VIE structures and many of the taken measures fall not far from the issues around VIEs.

Ant Group’s IPO, the financial arm of Alibaba Group, was called off last minute after concerns over financial regulations. The Chinese government also forced the ride hailing app DIDI to delist citing violations around collection and usage of personal data. The company had gone public shortly before on an U.S. stock exchange through a VIE structure.

Other measures include the extended halt of new media approvals and harsh limitations to digital business models. All of these represent a break with established practices that were at the core of all Chinese tech companies. And just as with these measures, there is no guarantee that the use of VIEs will not share this fate in the future.

Or to say it in the words of PDD: “If the PRC government […] imposes additional restrictions on any part of the operations of the Pinduoduo platform, the PRC government has the power to […] require the Pinduoduo platform to discontinue its relevant business.”.

Regulatory challenges in the rest of the world

Due to the VIE structure, PDD is an international company without real ownership in its core business while the VIE falls under Chinese jurisdictions. This brings with it substantial uncertainty, as the Public Company Accounting Oversight Board (PCAOB), a U.S. agency overseeing the audit of U.S.-listed public companies, is unable to conduct inspections of Chinese auditors. This is a standard practice to assure that the companies auditing the books of public companies are following the same principles. But since the Chinese VIE does not fall under the PCAOB’s jurisdiction, this poses some challenges.

Quoting PDD: “Our shares may be prohibited from trading in the United States […] if the PCAOB is unable to inspect or investigate completely auditors located in China.” And while this is currently not a major concern, similar to VIEs there is no guarantee that this might not change in the future.

One cautionary tale highlighting this risk is the case of Luckin Coffee. One of the largest Chinese coffee companies operating through a VIE structure was delisted from the Nasdaq in 2020 after it was revealed that the company had inflated sales by millions of dollars.

Why does this matter for the eCommerce industry?

PDD Holdings, and its subsidiary Temu, is the hottest piece on the eCommerce market right now. Both Temu and Pinduoduo are driving everyone from Amazon to Alibaba to change their ways. This VIE structure allows PDD to have the best of both worlds: access the massive Chinese eCommerce market and continuously grow their global eCommerce business. Without its VIE, PDD would be unable to become an Irish company or list on an American stock exchange. But this comes with the drawback that the company needs to implement additional measures to mitigate regulatory risks, all with the off chance that the rules might change anyway.

Its core market, China, is the largest eCommerce market in the world and some of the largest eCommerce companies hail from the country, many of which are using similar VIE structures. This means that the same risks hold for companies like Alibaba or JD.com. Large parts of their business are operated by VIEs with only untested contractual structures ensuring their continuous existence. Just as these rules could suddenly be changed for PDD Holdings Inc., they could similarly affect all other Chinese eCommerce giants. It is therefore important for investors and competitors to be aware of the risks and challenges that come with strong ties to Chinese companies. If you want to break into the Chinese eCommerce market, you need to understand that VIEs are driving the global reach of Pinduoduo, Alibaba and Co.

Sources: ECDB Analysis, PDD Holdings Annual Report 1

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

H&M Revenue: Online Net Sales Remain High Through 2023

H&M Revenue: Online Net Sales Remain High Through 2023

Deep Dive

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Deep Dive

Live Commerce: Top Chinese Platforms, Revenue & Market Analysis

Live Commerce: Top Chinese Platforms, Revenue & Market Analysis

Back to main topics