Shein, Walmart, Amazon, Macys, Nike

Top Online Fashion Stores in the United States: Shein Surpasses Walmart and Amazon

The online fashion market in the United States is expanding. The stunning rise of fast fashion company Shein to the top ranks, upsetting established giants like Walmart and Amazon, shows that the competition is fiercer than ever.

Article by Nadine Koutsou-Wehling | August 14, 2024Download

Coming soon

Share

Top Online Fashion Stores in the USA: Key Insights

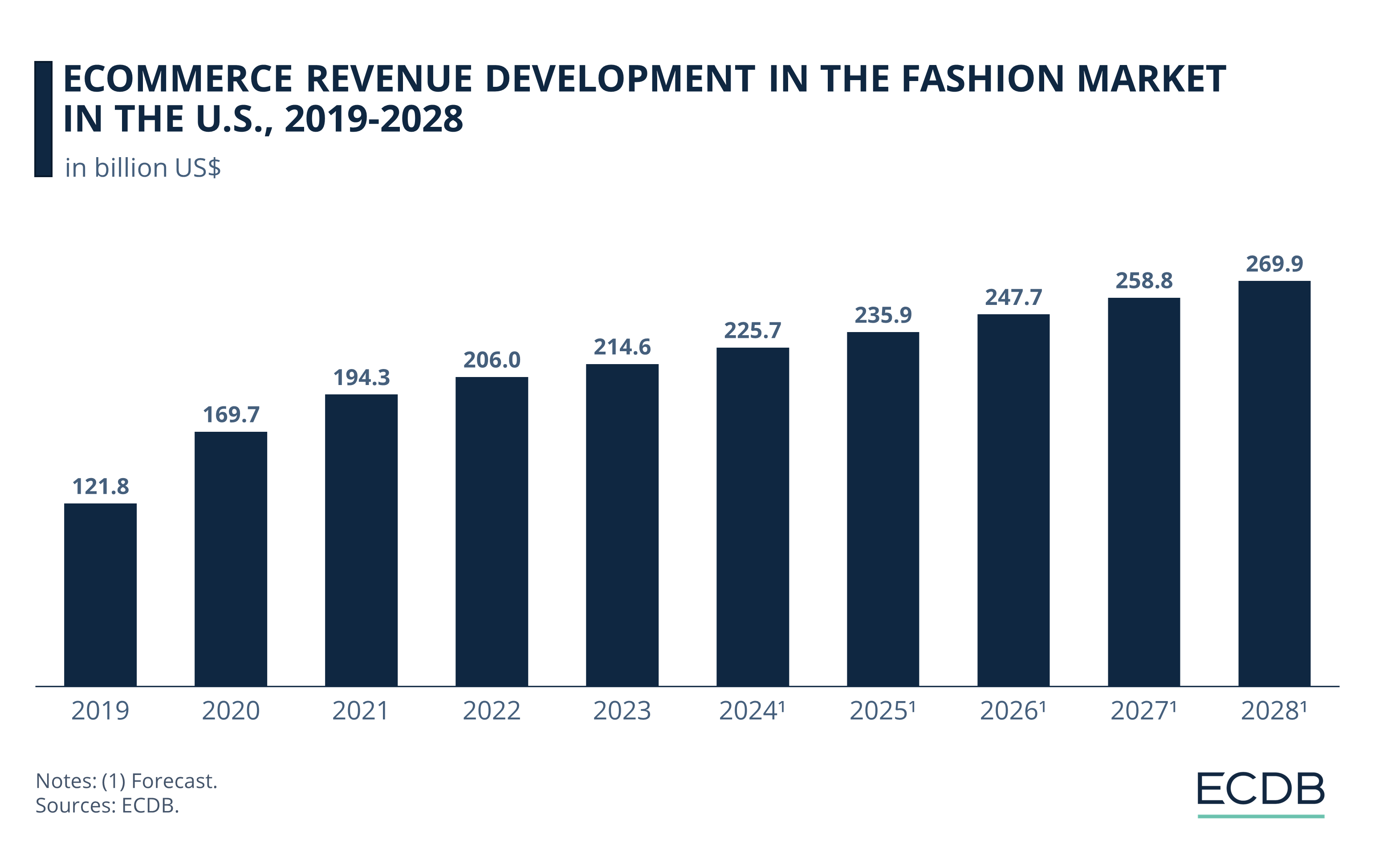

Market Revenues: Sales in the online fashion market surged during the pandemic. They continued to grow in the years after, but at a more moderate pace.

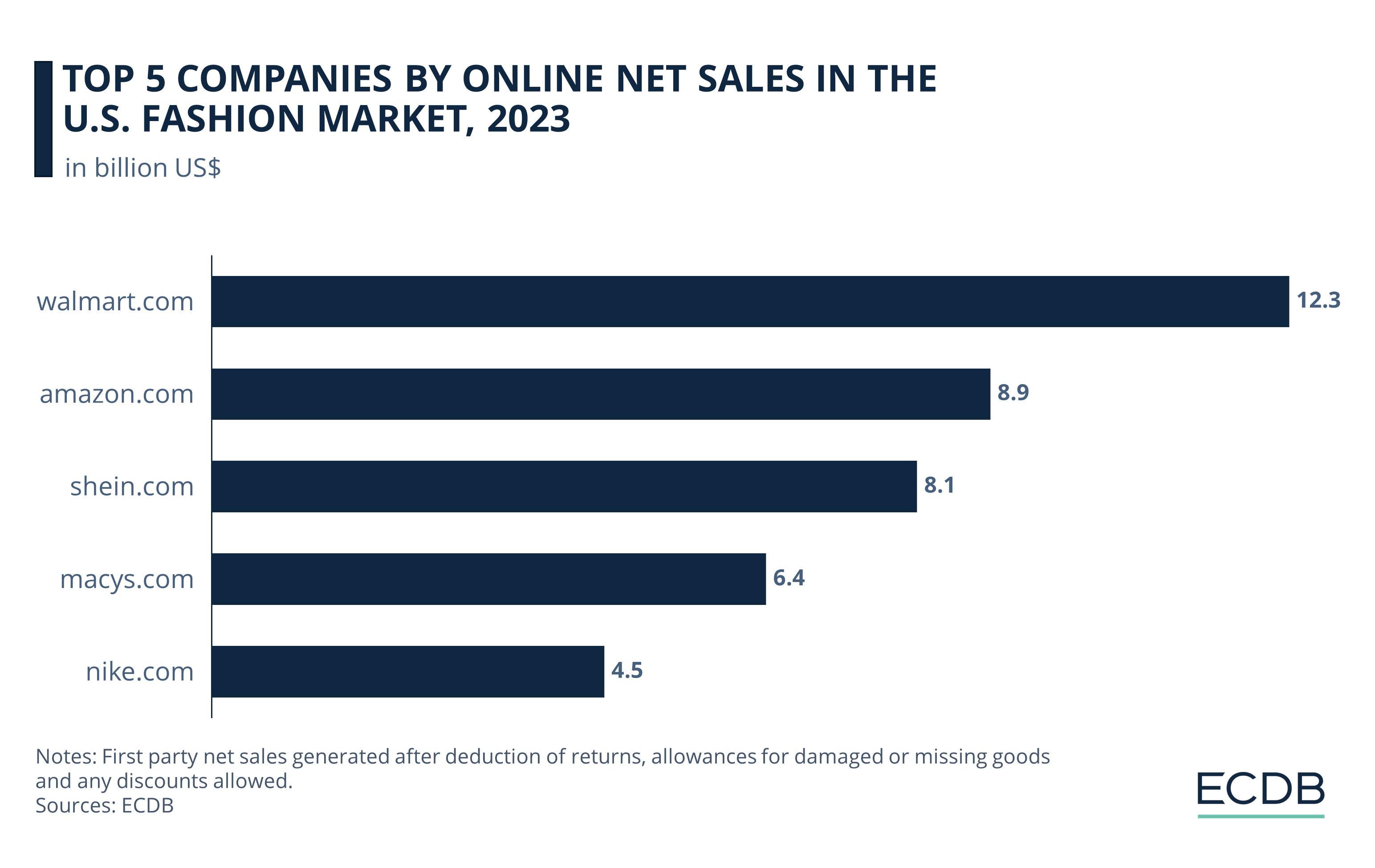

Shein on Top: With net sales of US$14.4 billion in 2023, Shein.com takes the lead over all other stores in U.S. Fashion eCommerce. Walmart.com ranked second and Amazon.com third, with their sales between US$9-12 billion.

Common Trends: Three of the top 5 online stores are successful offline retailers with an additional online presence. Find out what other strategies are working in U.S. online fashion.

Fashion products account for more than 21% of eCommerce sales in the United States. It is therefore the bestselling product category in U.S. eCommerce. Who are the top online fashion stores in the United States?

Shein, with its low-cost approach, has risen to the top of the market, outrunning established retailers in the game like Walmart and Amazon.

Learn about market sales, growth, top store performers and strategies for success in the U.S. online fashion world.

Top Online Fashion Stores in the USA: Sales Grow Steadily

But first, a broader look at revenues in the U.S. online fashion market:

In line with typical market developments, online fashion net sales jumped during the pandemic.

From US$121.8 billion in 2019 to US$194.3 billion in 2021, revenues grew at a CAGR (2019-2022) of 26%. This means that, on average, the market grew by more than a quarter of its initial value each year.

After the pandemic, consumers had the chance to return to physical venues to shop for fashion. As a result, the growth in fashion eCommerce slowed, but remained positive.

The post-pandemic slowdown is reflected by a slight increase of revenues to US$206 billion in 2022 and US$214.6 billion in 2023.

Projections for the coming years expect growth to accelerate again. For the entire post-pandemic period up to 2028, ECDB anticipates a CAGR (2022-2028) of 5%.

Top 5 Stores in the U.S. Fashion Market

The ECDB Market Page for the U.S. online fashion market includes the following ranking of top 5 eCommerce stores:

A notable observation is that two of the top five online platforms for U.S. fashion are established brick-and-mortar hypermarkets with an online presence: walmart.com and macys.com.

1. Shein

Shein generated US$14.4 billion fashion revenues in the U.S. in 2023.

Shein was projected to cross big retailers like Amazon and Walmart in the Fashion market - a milestone it finally achieved in 2023. Its net sales far exceed those of U.S.-origin retailers including Walmart and Amazon.

The basis of Shein’s business model is an acceleration of the fast fashion concept, which means that customer demand is instantly relayed to adjust production capacities. This method keeps costs down, reduces waste from excess inventory, and speeds up the production cycle. But it is also the source of growing criticism.

2. Walmart

The presence of Walmart among the list of leading online stores reflects the importance of omnichannel business strategies. Walmart generated US$12.3 billion in online fashion revenues in the United States.

Recent initiatives by U.S. hypermarkets Walmart, Macy's, and Kohl's to appeal to a younger demographic coincide with Shein's rise in the global fashion market. Their prevalence also shows that U.S. online shoppers value convenience when shopping for fashion products.

As Walmart is the retailer that stands out for integrating modern features such as live shopping, this points to the importance of adapting one's offering to consumer preferences and market trends.

3. Amazon

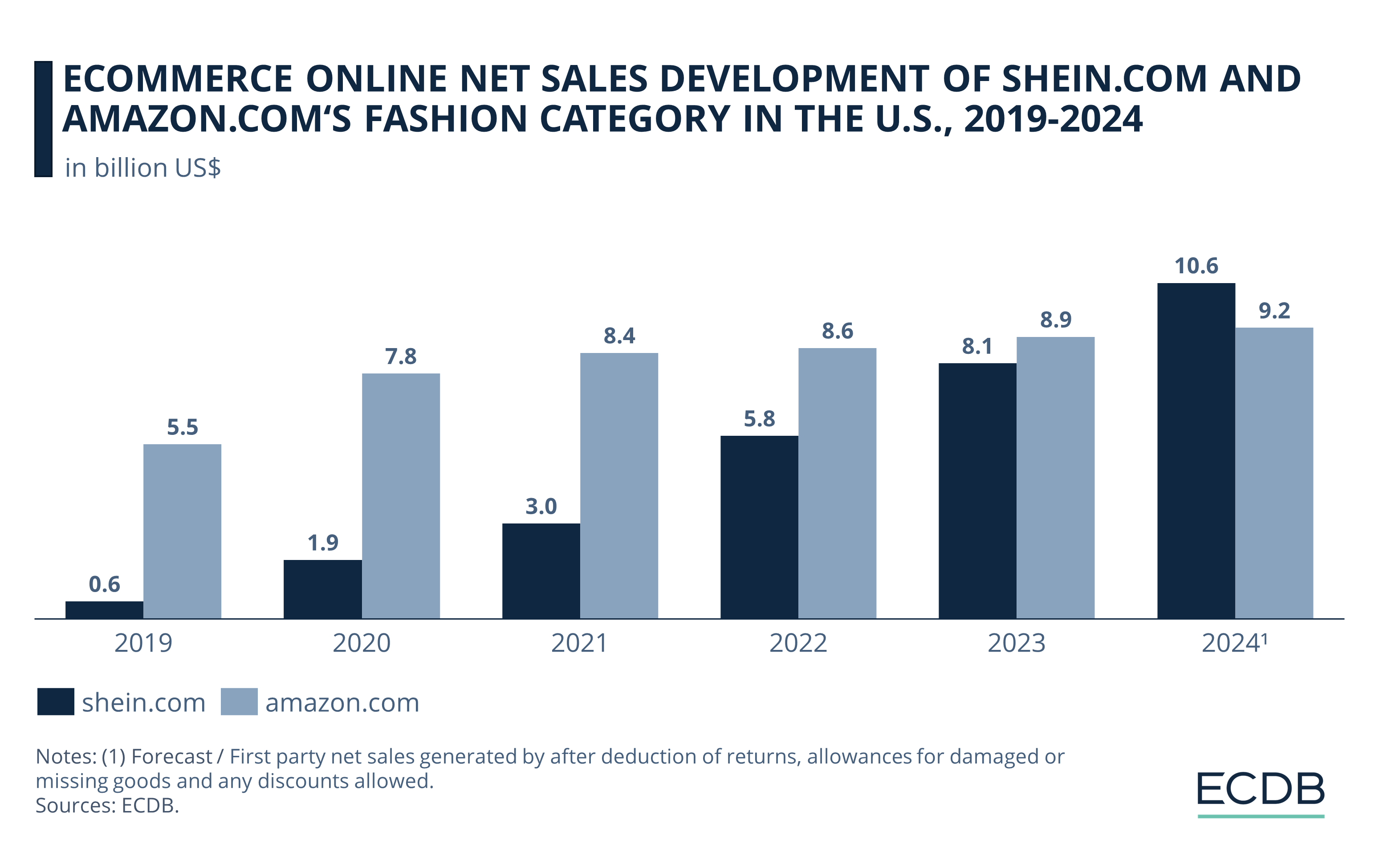

Amazon’s online fashion revenues are now behind both Shein and Walmart.

Amazon’s U.S. eCommerce fashion revenues have surpassed Shein's significantly until 2022, with US$10.3 billion for Shein versus US$8.4 billion for Amazon, respectively.

In 2023, Shein widened the gap with a US$5 billion difference in U.S. fashion revenues between the two.

Ultimately, ECDB analysts expect Shein to increase its lead over Amazon. With expected revenues of US$21.3 billion in 2025, Shein's growth is steeper than Amazon's.

Amazon opened two Amazon Style fashion retail stores to complement its online offering in a hybrid bid, but both stores were shuttered again at the end of 2023.

The move came amid a wave of store closures in the books and devices segment, as well as layoffs to cut costs. The closure of the Amazon Style locations shows that while the stores were praised for their innovative setup and new technology, consumer response was not sufficient to continue with this concept.

Recent collaborations, such as with luxury secondhand online store Hardly Ever Worn It, show that Amazon is recalibrating its approach to succeed in online fashion.

Criticism: Worker’s Rights, Copyright Infringement, and Tariff Evasion

With instant consumer feedback technology, Shein offers more products at lower prices than other fast fashion retailers.

But there are less obvious costs elsewhere: To ensure high-volume production at low cost, workers produce garments in conditions widely considered inhumane, working long hours for very little pay.

Also common among low-cost fashion brands are allegations of copyright infringement, meaning that designs are taken from larger brands and lesser-known designers.

Growth Despite Criticism

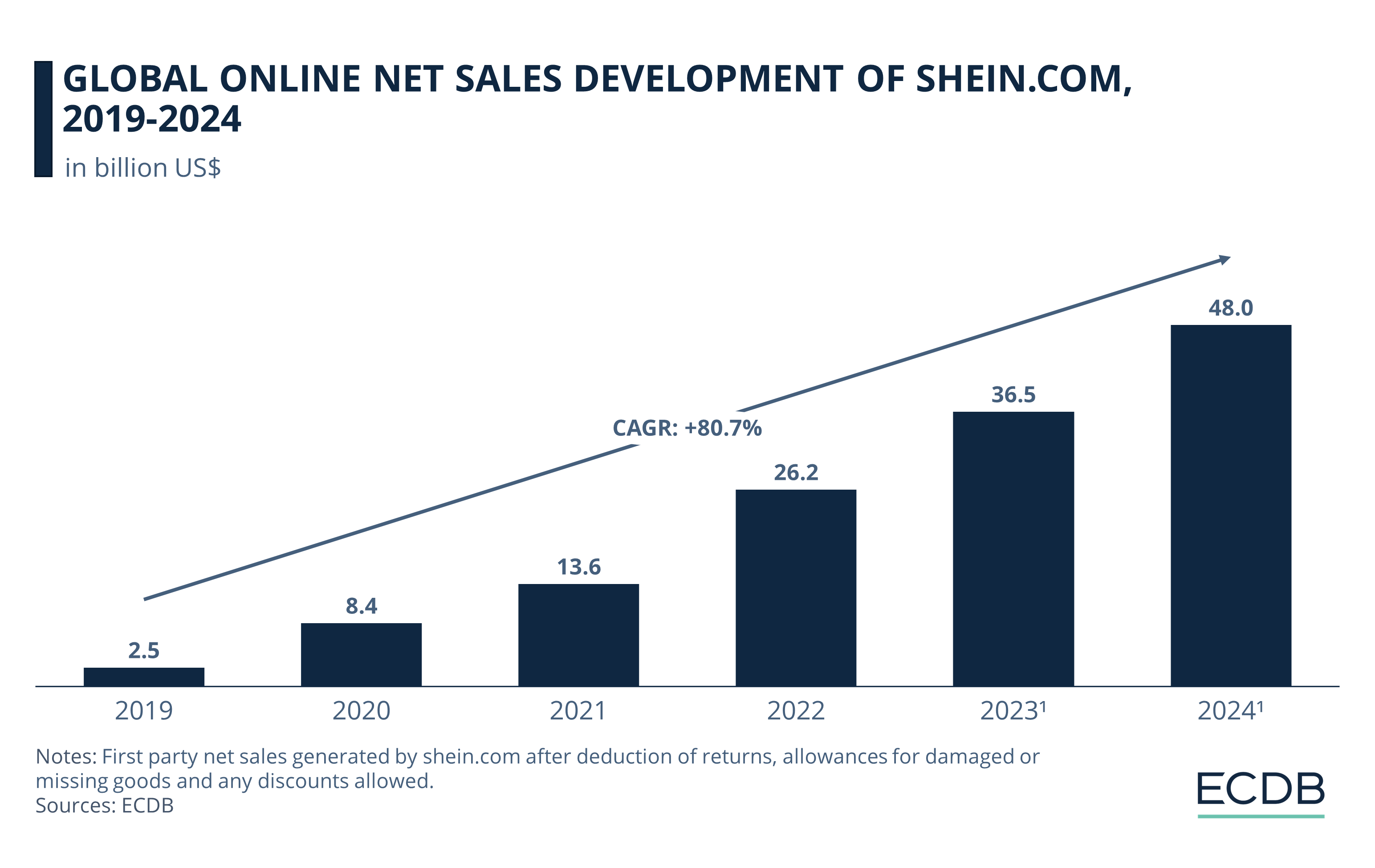

Shein’s global online net sales grew at a compound annual growth rate (CAGR 2019-2021) of 133.7% during the pandemic, meaning that the company increased its revenue by more than 1.3 times its starting value each year during this period.

After the pandemic, growth continued, but at a slower pace.

With US$26.2 billion net sales in 2022, shein.com increased revenues by more than one third its value each year, at a CAGR (2022-2024) of 35.5%.

Taken together, this represents a CAGR (2019-2024) of 80.7% for the entire period. We predict US$48 billion in online revenues by 2024.

Why does Shein grow so rapidly? It is due to the company's retail strategy, which lures consumers with low prices, as well as extensive discounts and giveaways. Shein also has a highly trend-driven product assortment that swiftly changes and adapts to consumer demand in real time.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

Almost Half of Gen Z Online Shoppers Have Purchased Items From Shein.com

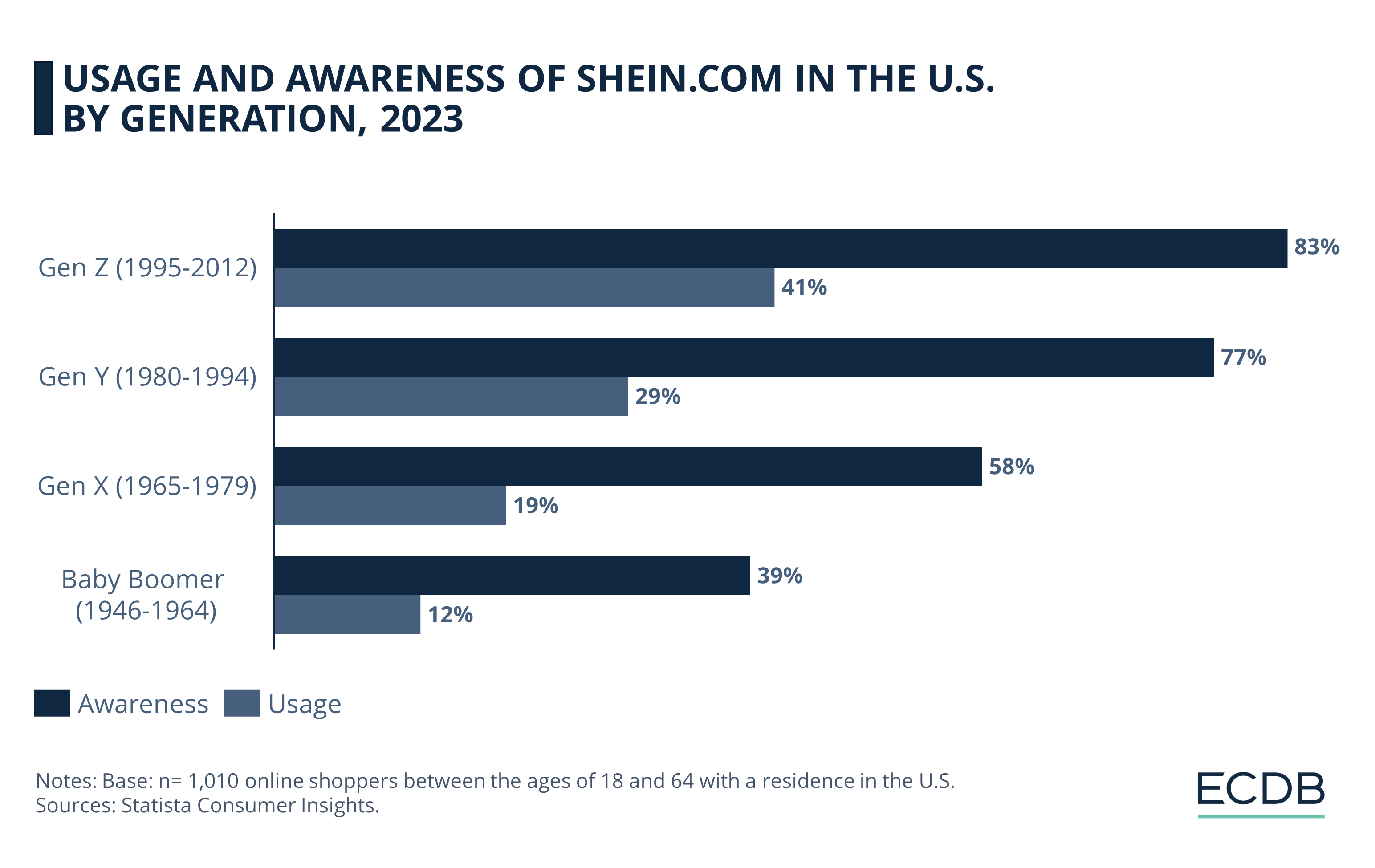

The company is particularly popular among young consumers, as evidenced by data from Statista's Consumer Insights.

See how aware U.S. consumers are of Shein and what percentage of consumers has used the site. The results are broken down by generation.

The data shows an inverse relationship between age and familiarity with Shein.

Younger consumers, especially Gen Z, exhibit higher recognition and usage than older users: 83% are aware of Shein, with 41% having made a purchase.

While 77% of millennials recognize Shein, only 29% have shopped there.

Recognition drops to 58% for Gen X, with a 19% purchase rate.

For baby boomers, 39% are aware and just 12% have bought from Shein.

Shein's business model and extensive social media marketing is another factor responsible for the brand's tremendous success with younger users.

4. Macy's

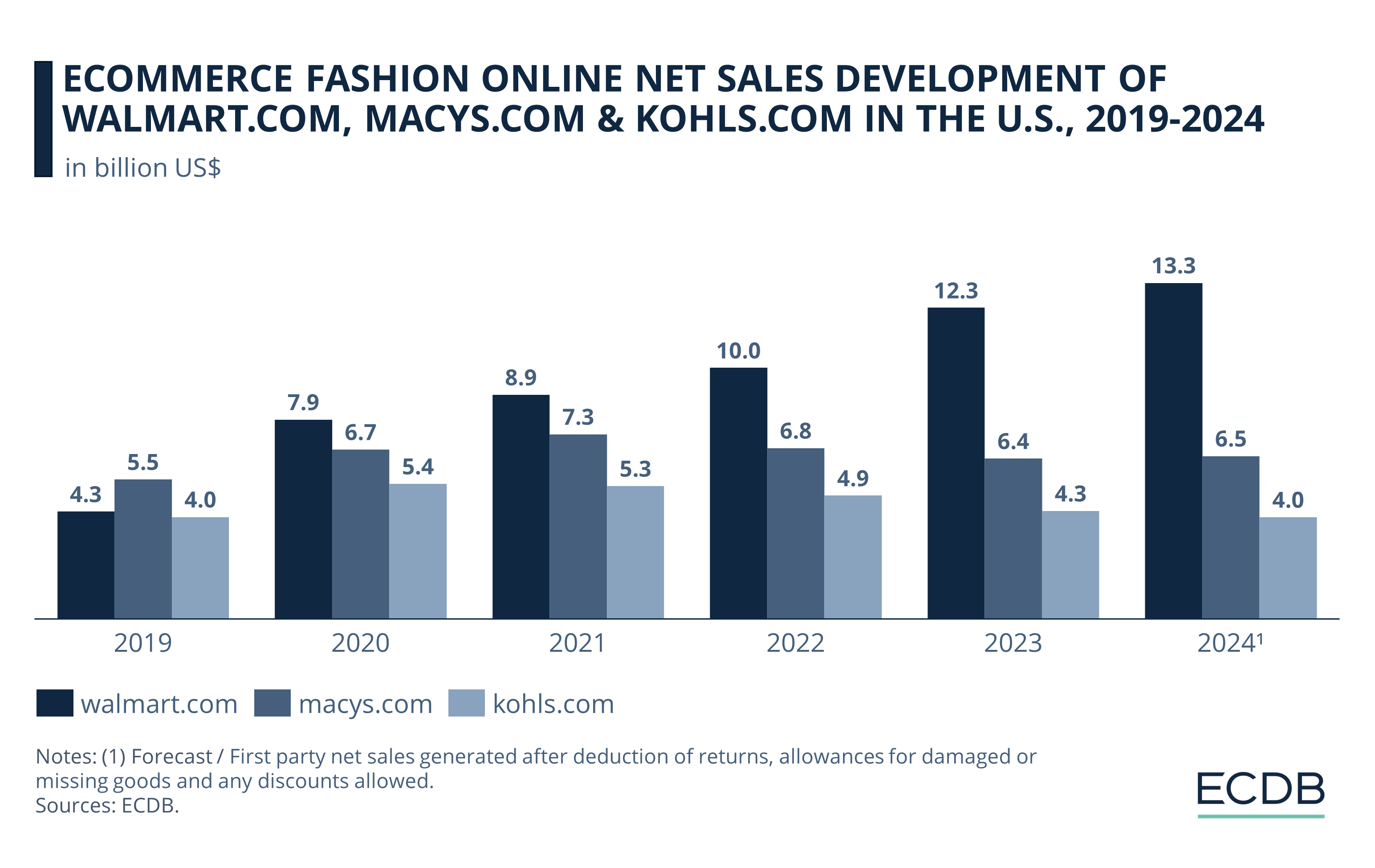

Walmart, Macy’s and Kohl’s are three generalist retailers that operate primarily offline, but their online offerings are increasingly supplementing their overall revenues.

This growth has been particularly evident since the pandemic, but the development below shows a clear trend:

Walmart.com is outpacing its direct competitors: With US$7.9 billion in 2020 to US$8.9 billion in 2021 and US$10 billion in 2022, online fashion sales gained traction during the pandemic.

By 2023 and projected 2024, Walmart.com is expected to have solidified its lead over Macy's and Kohl's.

Macys.com ranked fourth in the U.S. online fashion market by 2023, with US$6.4 billion in revenues. But its growth is expected to remain stagnant.

Kohls.com is the unfortunate tail light among the three, as online fashion net sales declined since 2020. They are expected to decline further into 2024, reaching US$4 billion in online fashion revenues.

5. Nike

Athletic fashion brand Nike's main operating country is the United States. It generated US$4.5 billion in online fashion net sales in the country by 2023.

Check out the dedicated ECDB Store Page for nike.com. Future revenues are projected to keep growing, making Nike's prospects more positive than those of its direct competitor, Adidas.

Closing Thoughts: U.S. Online Fashion

Three out of the five top online stores in U.S. fashion are generalist retailers. This suggests the high value U.S. online shoppers place on convenience, i.e. one-stop shopping.

However, incumbents are looking out for low-cost competitor Shein. The ultra-fast fashion store ranked third in 2023 and is expected to surpass Amazon's fashion segment by 2024.

Shein's meteoric rise in the U.S. market reflects the importance of a trend-led product assortment and effective marketing: Younger users are driving the trend, because the low prices and social media marketing are most attractive to them.

Sources: About Amazon: 1 2 – CNBC: 1 2 3 4 – Fashion Network – Forbes – PYMNTS – Reuters

FAQ: Top Online Fashion Stores in the USA

Is Shein bigger than Amazon?

No. Shein is not bigger than Amazon. Based on data from the U.S. online fashion market, Amazon's fashion revenues are higher, with US$9.2 billion compared to Shein's US$8.1 billion in 2023. However, Shein is expected to surpass Amazon by 2024, with projected revenues of US$10.6 billion, compared to Amazon's US$9.2 billion.

What is the disadvantage of Shein?

Shein's main disadvantages include poor working conditions with low wages for factory workers, frequent allegations of copying designs from other brands and designers, and significant environmental impact due to the fast fashion model, which contributes to waste and pollution. Products break easily and are therefore quick to discard. These ethical and legal concerns could affect Shein's long-term reputation and sustainability.

Who is Shein's biggest customer?

Shein's biggest customers are young consumers, particularly Gen Z. Data shows that 83% of Gen Z are aware of Shein, and 41% have made a purchase. This demographic is drawn to Shein's low prices, trendy products, and extensive social media marketing.

How big is the online fashion market in the U.S.?

The online fashion market in the U.S. was valued at US$214.6 billion in 2023. It experienced significant growth during the pandemic and is projected to continue growing, albeit at a more moderate pace, with an expected CAGR of 5% from 2022 to 2028.

What is the biggest fashion e-commerce in the US?

The biggest fashion e-commerce in the U.S. is Walmart, which generated US$12.3 billion in online fashion revenues in 2023. It ranks first in the U.S. fashion eCommerce market, followed by Amazon in second place.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Back to main topics