Business eCommerce Strategy of Nike 2024

Nike Business Model: Nike.com eCommerce Revenues Way Stronger Than Adidas

Nike is one of the top online fashion stores in the world and the brand's success goes way beyond that. Here is what makes the athletic wear company so special.

Article by Nadine Koutsou-Wehling | July 17, 2024Download

Coming soon

Share

Nike eCommerce Business Model: Key Insights

Steady Online Revenue Growth: Nike.com's eCommerce net sales jumped during the pandemic and continued to increase in the years after. By 2024, growth slowed but is expected to stay positive. The online expansion is accompanied by a steady decline in the number of physical Nike store locations.

Nike's Strategies for Success: Factors contributing to Nike's market leadership include its clear product focus and high-profile collaborations, value communication through effective storytelling, and its interactive social media approach.

Challenges to Nike's Sustained Online Growth: Competition from established and trending brands is one of the most pressing challenges Nike is facing. But there are other issues.

"Nike – Just do It": Chances are high that you know this slogan and associate it with one of the world's best–known athletic clothing brands. While Nike has been around since 1964 and is well established as a brick-and-mortar brand, its online business is thriving.

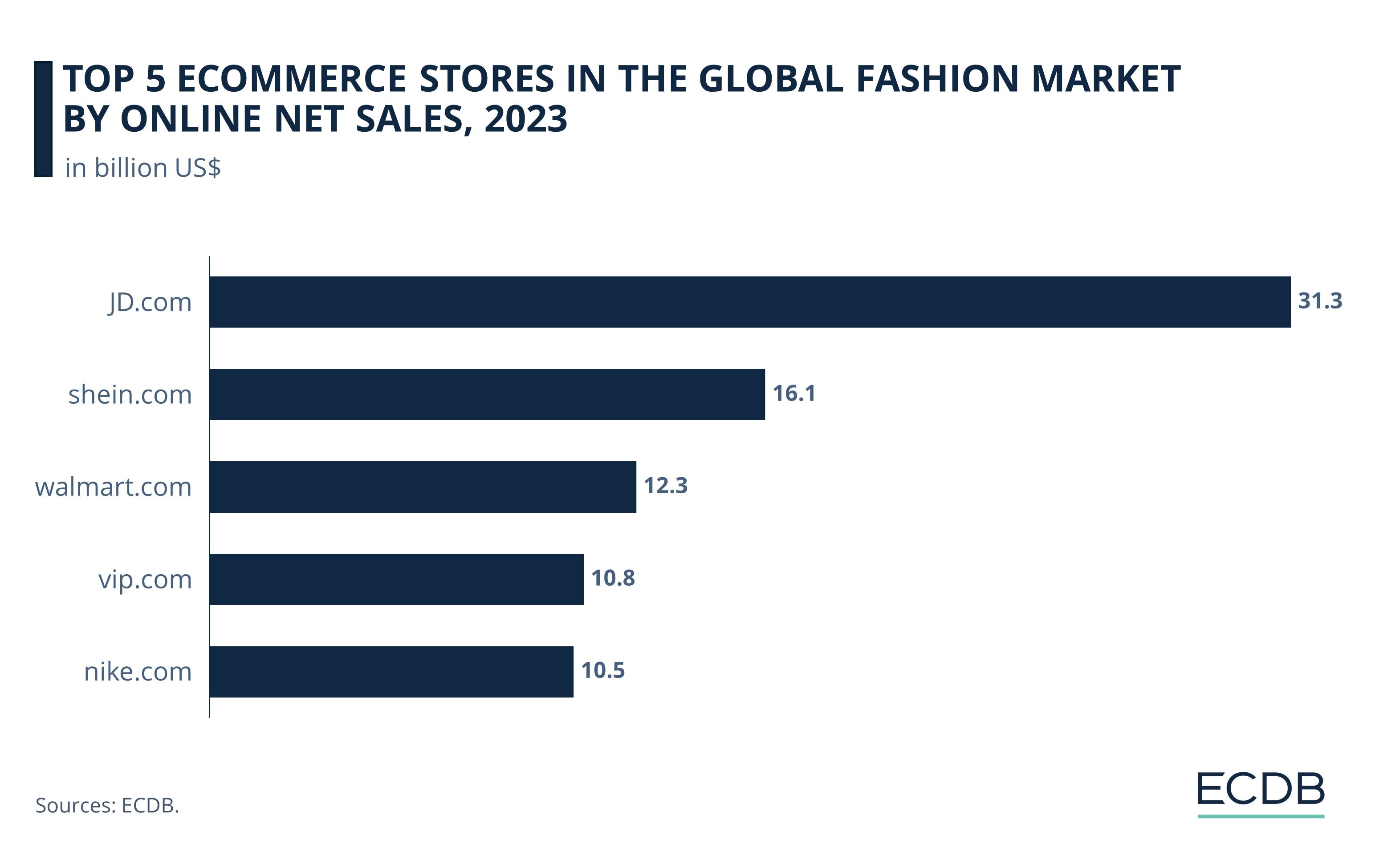

Not without a reason is nike.com the fifth-largest eCommerce store in the global fashion industry, with online net sales of US$10.5 billion in 2023.

What makes Nike’s online platform stand out from its competitors? Learn about its online revenue development, the marketing strategies that are helping Nike stay relevant, and the challenges that lie ahead.

Nike.com: Steady Online Revenue Increase

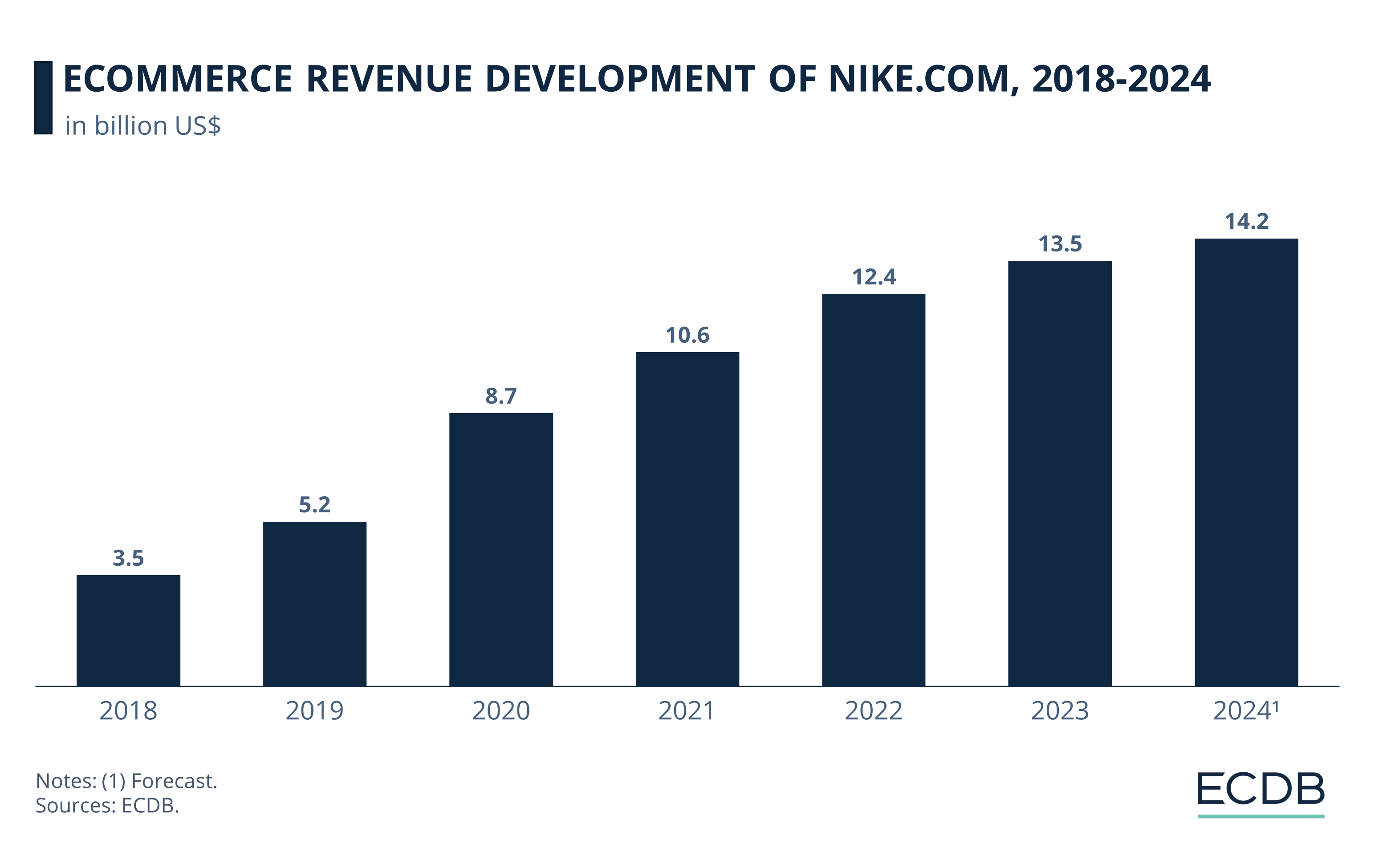

Unlike other brands, nike.com has been able to sustain its pandemic online revenue growth.

In 2018 and 2019, nike.com generated revenues of US$3.5 billion and US$5.2 billion, respectively.

The pandemic accelerated online sales on nike.com: With a 67% year-over-year increase, eCommerce revenues reached US$8.7 billion in 2020.

The following years saw strong increases, even after the restrictions ended: Nike.com generated US$10.6 billion in 2021 and US$12.4 billion in 2022.

While growth continues into 2024, it slowed notably: Rising first to US$13.5 billion in 2023 and a projected US$14.2 billion in 2024.

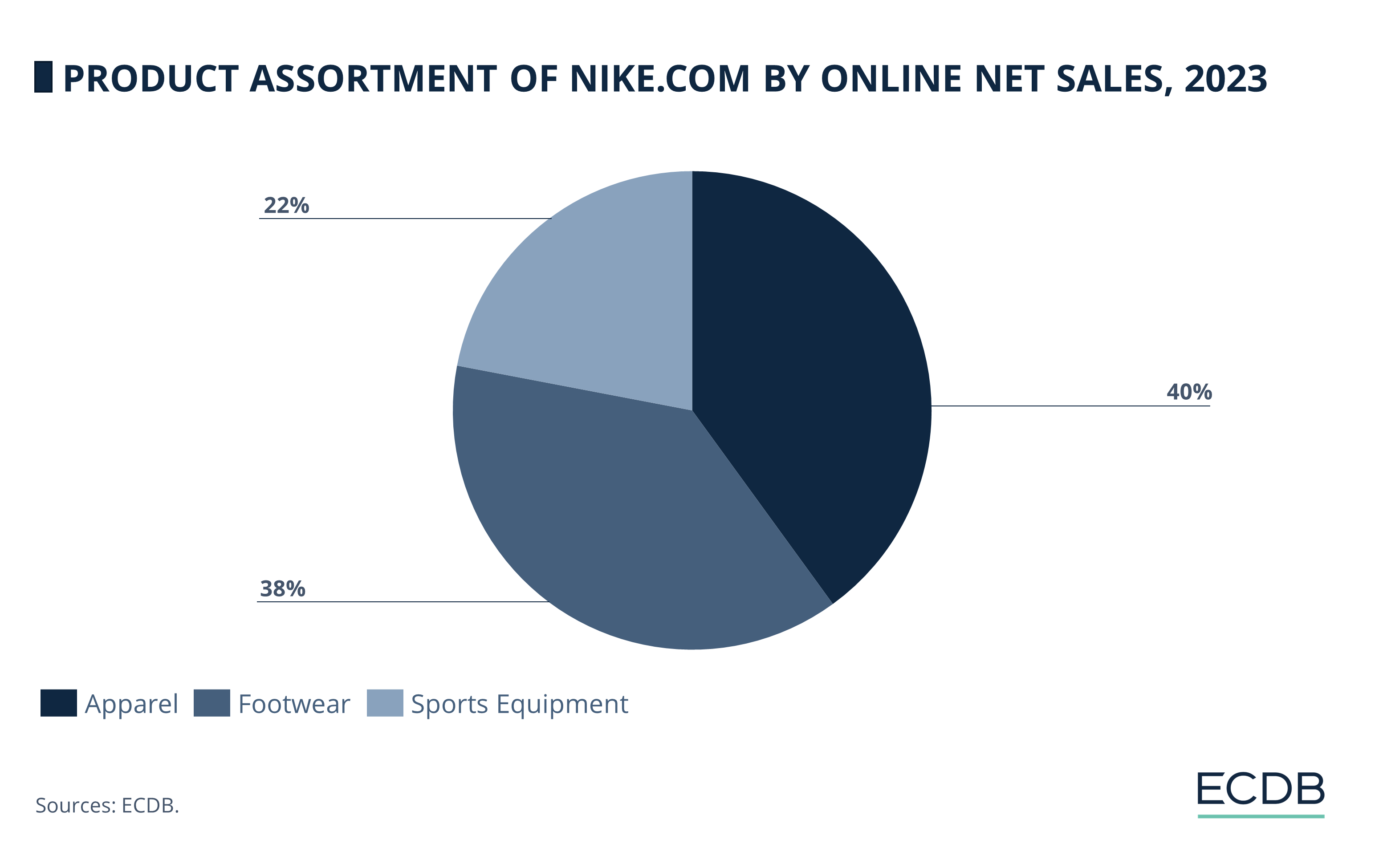

Nike is an athletic wear brand, but what products does that include specifically?

Nike.com: Fashion Products Biggest Source of Revenue

On its online platform, Nike generates the majority of its sales through apparel:

Apparel: Sports clothing accounts for 40% of net sales on nike.com.

Footwear: The company's signature footwear is a close second, generating 38% of net sales.

Sports Equipment: This includes fitness equipment, team sports equipment, or specific apparel or shoes like soccer shoes or goalkeeper gloves. 22% of online net sales are made by sports equipment.

Technological innovations like virtual try-ons and personalized product recommendations add to the appeal of shopping online at nike.com. As a result, the number of physical stores is declining in tandem with eCommerce net sales growth.

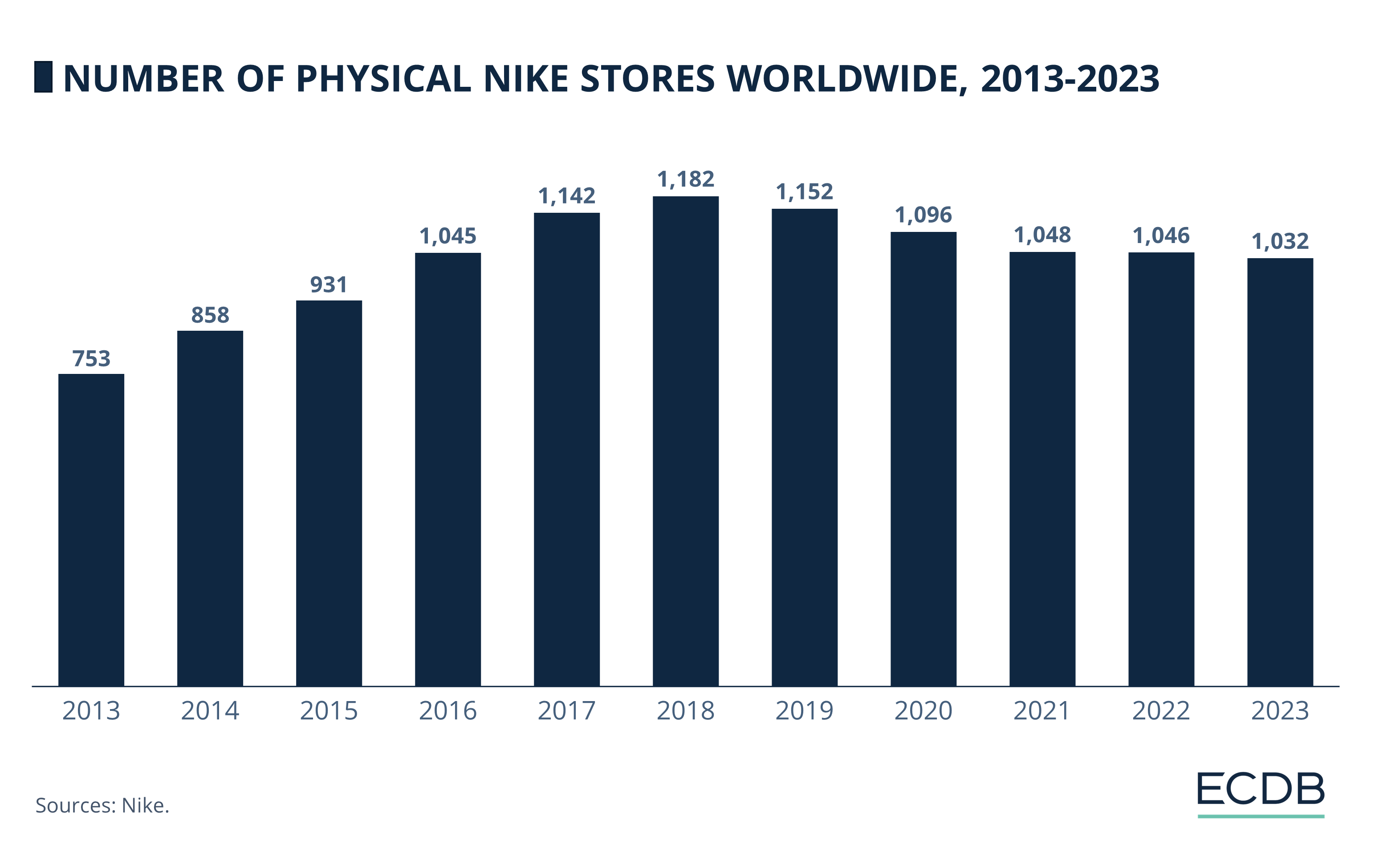

Nike’s Store Count Has Declined 13% Since 2018

A decline in store numbers is a typical development in the industry. Check out Nike’s case:

A peak in global store numbers occurred in 2018, with 1,182 Nike retail stores worldwide.

Since 2019, that number has steadily fallen: From 1,152 in 2019 to 1,032 in 2023.

And that number is likely to decrease further. Nike has an effective online marketing strategy that complements its overall sales. In this way, the company saves costs by reducing the number of stores and increases customer convenience with multichannel services.

What are the key strategies behind Nike’s online success? Here are 3 aspects that explain its relevance.

Nike’s Business Model: Success Strategies

Know your niche: The first requirement for an effective strategy is to know what one is aiming at. In Nike’s case, it is quite clear:

1. Product Segmentation: High-Profile Sportswear

Nike’s focus on athletic wear is reflected at every step of the customer’s online journey: The website has a clean, sleek look and references current sporting events that its customers are likely to care about.

This includes Nike's frequent collaborations with successful athletes: The impact of these collaborations is tremendous. When consumers see their favorite athletes wearing a particular brand, they want to emulate their idol and buy the same product.

Sponsoring top athletes has another advantage, especially when it comes to committing oneself entirely to one’s niche: In 2019, Nike’s Vaporfly 4% running trainers were considered so beneficial to top running times that even teams sponsored by other brands allowed their members to wear Nike shoes with a covered logo at the following year's Olympics.

The controversy and the ensuing discussion of whether a shoe can be considered doping, is what keeps Nike at the top of the athletic wear game. It is not just the advertising, but the product standing behind it that lives up to its promise: Top quality at a fair price. Everything else revolves around this brand focus, and it is reflected in every step of how Nike presents itself.

2. Brand Storytelling: Communicating Values to Build Loyalty

One of the most memorable moments in Nike’s brand history is its partnership with NFL player Colin Kaepernick, who refused to stand for the national anthem to protest police violence against black Americans. Nike’s decision to support Kaepernick in advertising campaigns took a clear political stance, which was all the more remarkable as it came during the time of Donald Trump’s presidency in the U.S.

According to analysts, Nike's core demographic is young, affluent urbanites: The audience most likely to support movements like Black Lives Matter and appreciate such a political statement, especially at the time it was made.

The side effect of this strategy, however, is that there is also a significant portion of consumers who either disagree or do not want to take a political stance. For them, Nike’s stance has become a reason not to engage with the brand. Ultimately, it is up to each company to decide whether to alienate customers who do not share its values – the positive effect of this is that it strengthens brand loyalty for those who do.

3. Interactive Social Media Communication

Nike is accessible on social media. The brand interacts with users on platforms like X or Instagram and organizes events like local running clubs. Not only does this increase brand awareness and make consumers more likely to shop there, but users participate with their own posts. As a result, Nike gets free marketing through UGC (user-generated content).

All of these aspects show that Nike has a lot going for it – but there are also challenges the company faces.

Nike’s Competitors: Adidas and Lululemon Stand Out

For all the factors that contribute to Nike’s dominant market position, there are also issues the company must deal with.

These include the intense competition from established and emerging players: The sportswear market is large and growing. While Nike has the upper hand over its traditional rival Adidas, new up-and-coming players such as Hoka and On Running are gaining popularity, especially among the younger crowd and those angered by Nike's political involvement.

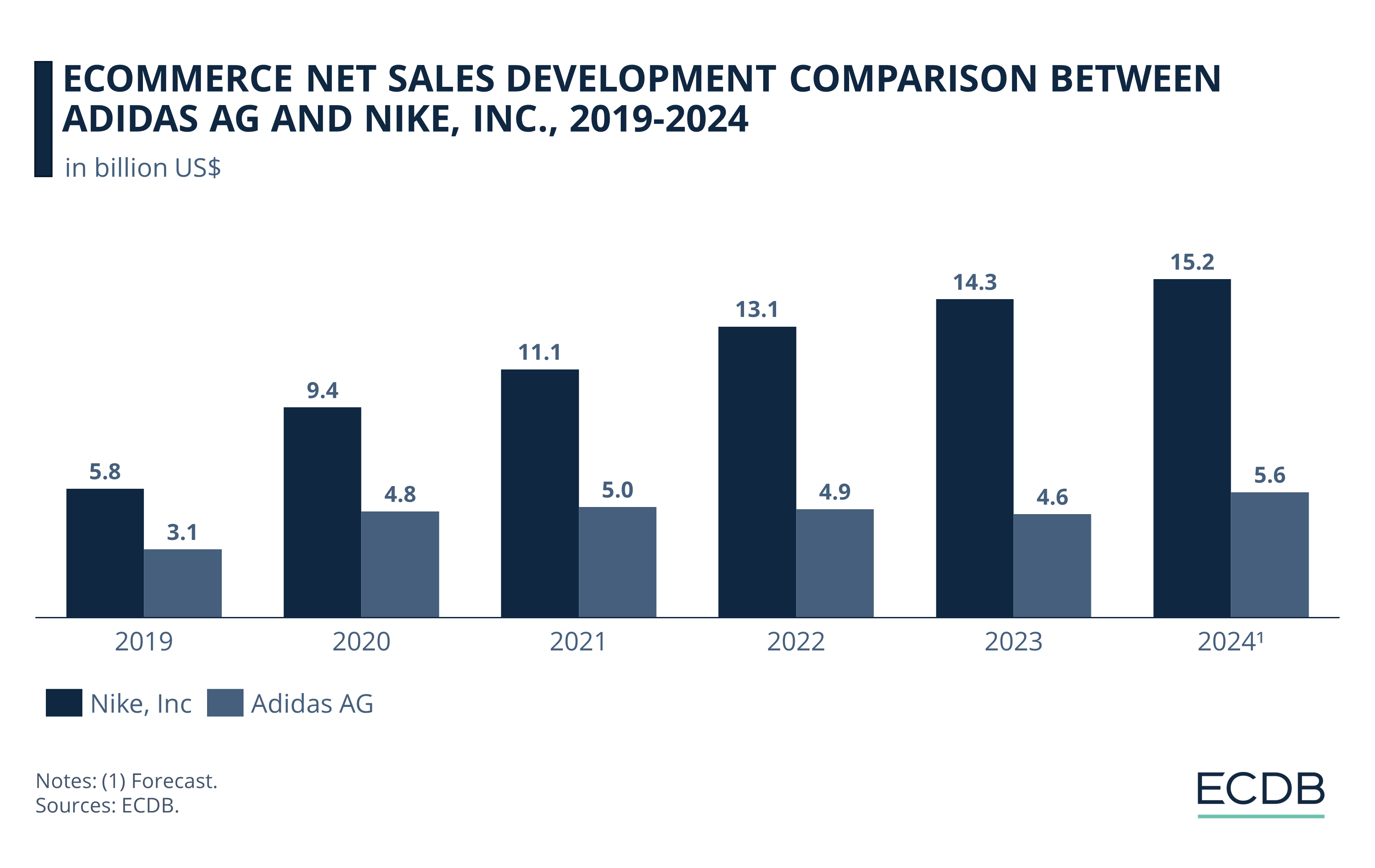

As of now, none of these stores seem to be approaching the revenues Nike is generating across all its domains. Not even direct competitor Adidas:

Adidas is well below the revenue that Nike makes online: Less than a third of Nike’s overall eCommerce revenue of US$14.3 billion in 2023 is equivalent to what Adidas made, i.e. US$4.6 billion.

The other brands Hoka and On Running are still small and neither pose a real threat with eCommerce net sales of around US$200 million and US$600 million, respectively.

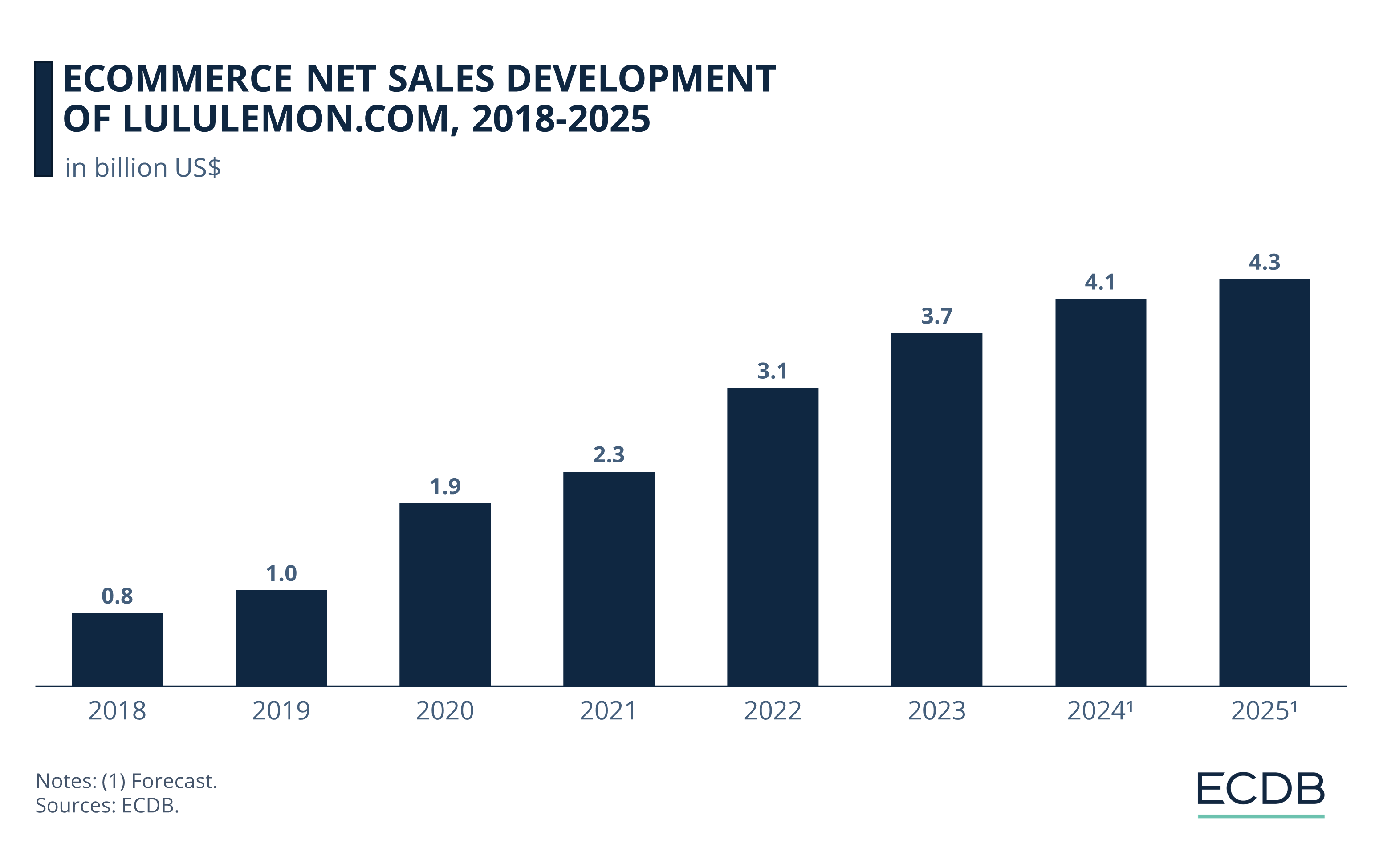

Rather, another sportswear brand is gaining traction with its online platform, lululemon.com:

Surpassing US$1 billion in eCommerce net sales in 2019, lululemon.com’s online revenues further surged during the pandemic.

After 2021, online net sales growth continued, reaching US$3.1 billion in 2022.

By 2024, forecasts expect eCommerce revenues to exceed US$4 billion.

Lululemon has a similar focus on health and fitness at an affordable price range that still leaves credible room for quality products. Therefore, its steady growth over previous years will not have gone unnoticed by market leader Nike. But especially Adidas, whose eCommerce revenues are near the range that lululemon generates, is in dire need of a strategic shift.

Other Challenges to Nike’s Growth

For now, Nike’s years of recognition and success in the global market ensure its dominant position. But for how long? In addition to the above, here are some other challenges the brand is likely to face in the coming years:

Slowing Growth: The growth of other brands affects Nike’s ability to soar. At a certain level, it becomes more and more difficult to increase revenues in a way that inspires investor confidence.

Innovation Slump: Nike’s signature sneakers and running shoes are what make the brand so popular with athletes and athleisure fans. The emergence of new players with a fresh air of trends and confidence makes Nike look stale in comparison.

Fast Fashion Allegations: While not unique to Nike, growing concerns about product sourcing and worker conditions in manufacturing regions are turning consumers away from the brand. This is in stark contrast to Nike's socially conscious image.

Stay Competitive: Our constantly updated rankings provide you with the latest insights to improve your business strategy. Discover which stores and companies are at the top of the eCommerce world and which categories are driving the highest sales. Dive into our rankings for companies, stores, and marketplaces. Stay a step ahead in the market with ECDB.

As the market leader, Nike is expected to prove that its products and innovative capabilities are indeed above the rest. Given Nike's popularity with young people and new consumers entering the market, the experienced sportswear company is likely to hold its own.

Nike Business Model: Wrap-Up

Nike is exemplary for a brand that is instantly recognizable by a single slogan and sign: Just Do It and the swoosh create a mental association with fitness, sports and fairness. While there have been recent market shifts and entries that have challenged Nike's dominant position as the number one sports fashion brand, the company is unlikely to crash anytime soon. Its commitment to quality and unique styles fascinates even the youngest demographic, making the company, founded in 1964, an evergreen if ever there was one.

Sources: Fastcompany – Financial Times – Mageplaza – NY Times – Vox – WSJ

FAQ: Nike Business Model

What is Nike's business strategy?

Nike's business strategy focuses on targeting athletic wear with a sleek, sports-focused website and frequent collaborations with top athletes to boost brand image and drive sales. It uses powerful storytelling, such as the partnership with Colin Kaepernick, to connect with young, urban consumers who value social justice, thereby enhancing brand loyalty. Nike also emphasizes producing high-quality products that meet the needs of both athletes and casual wearers. Additionally, Nike engages actively on social media platforms like X and Instagram, interacting with users and organizing events to increase brand awareness and encourage user-generated content.

What makes Nike so successful?

Nike's success is due to its products being a standard in major sporting events and affiliations with high-profile athletes. Its stylish designs resonate with athletes and casual wearers alike, while the well-integrated site seamlessly connects online and offline shopping experiences. These factors, combined with innovative technology and active social media engagement, ensure Nike's strong brand presence and customer loyalty.

Who is Nike's biggest competitor?

Nike's biggest competitor is Adidas. Adidas is a major player in the sportswear market, offering a wide range of athletic and casual wear products. While Nike holds a dominant position, Adidas continues to compete strongly with its own high-profile athlete endorsements, innovative products, and significant market presence. Other emerging competitors like Lululemon and brands like Hoka and On Running are also gaining traction, but Adidas remains the primary rival in terms of global reach and market share.

Who sells more Nike or Adidas?

Nike sells more than Adidas. In 2023, Nike's online net sales reached approximately $14.3 billion, with which it significantly surpasses Adidas, which made around $4.6 billion in eCommerce revenue. This demonstrates Nike's stronger market presence and higher overall sales compared to its biggest competitor, Adidas.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Deep Dive

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Deep Dive

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Deep Dive

South Korean Online Fashion 2024: Revenue, Stores & Trends

South Korean Online Fashion 2024: Revenue, Stores & Trends

Back to main topics