eCommerce: Sports Wear

Adidas: Stagnant Online Sales Development

Adidas lost sales in 2023. The sports wear brand has maintained a consistent 20% online sales share since the pandemic, but it has not been enough to offset other losses. Read more about Adidas' sales figures here.

April 29, 2024Download

Coming soon

Share

Adidas' Stagnant Sales: Key Insights

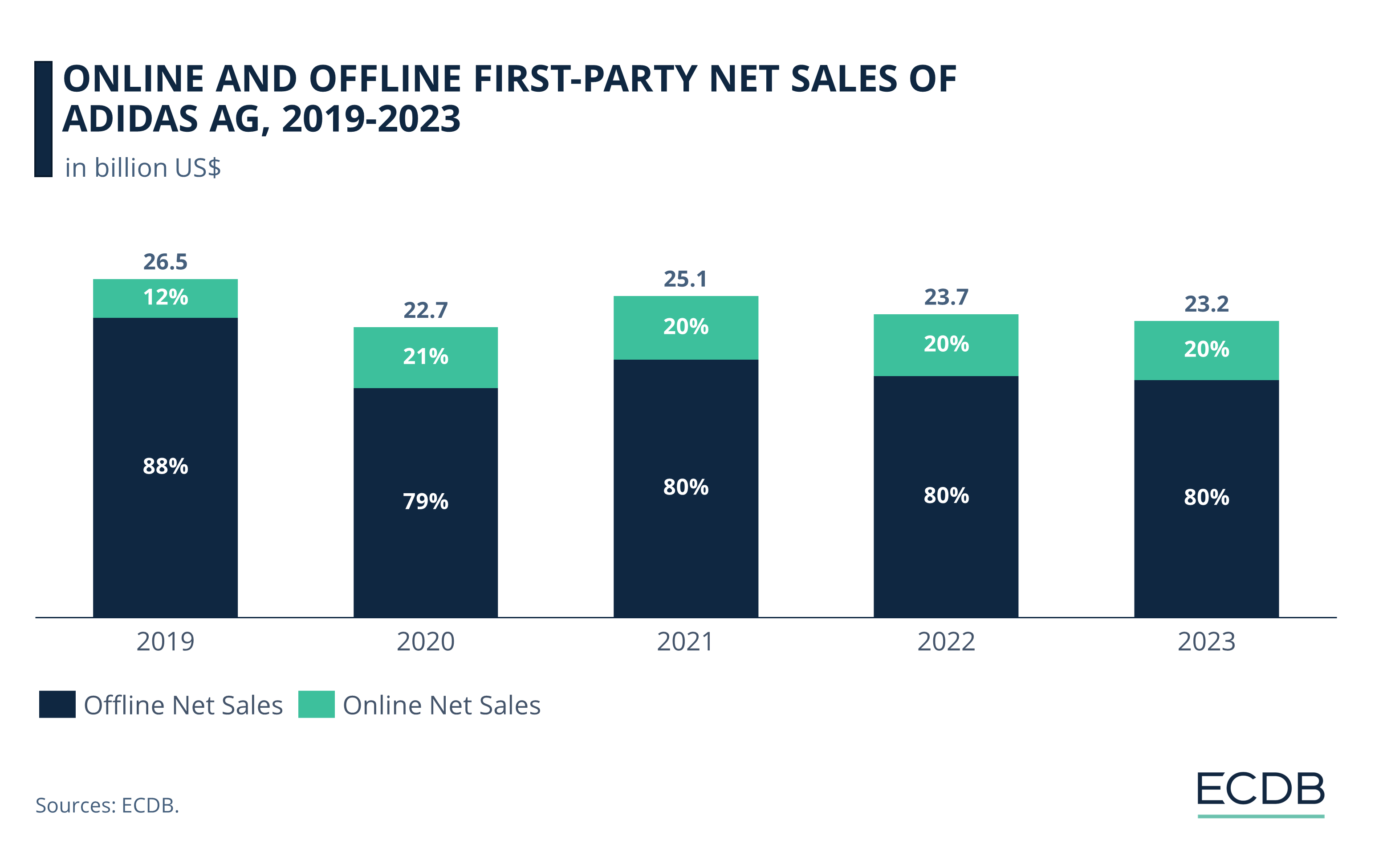

Adidas Sales Continue Modest: Adidas AG lost net sales in 2023, which undermined expectations of returning to pre-pandemic sales levels. The share of online sales remained stable.

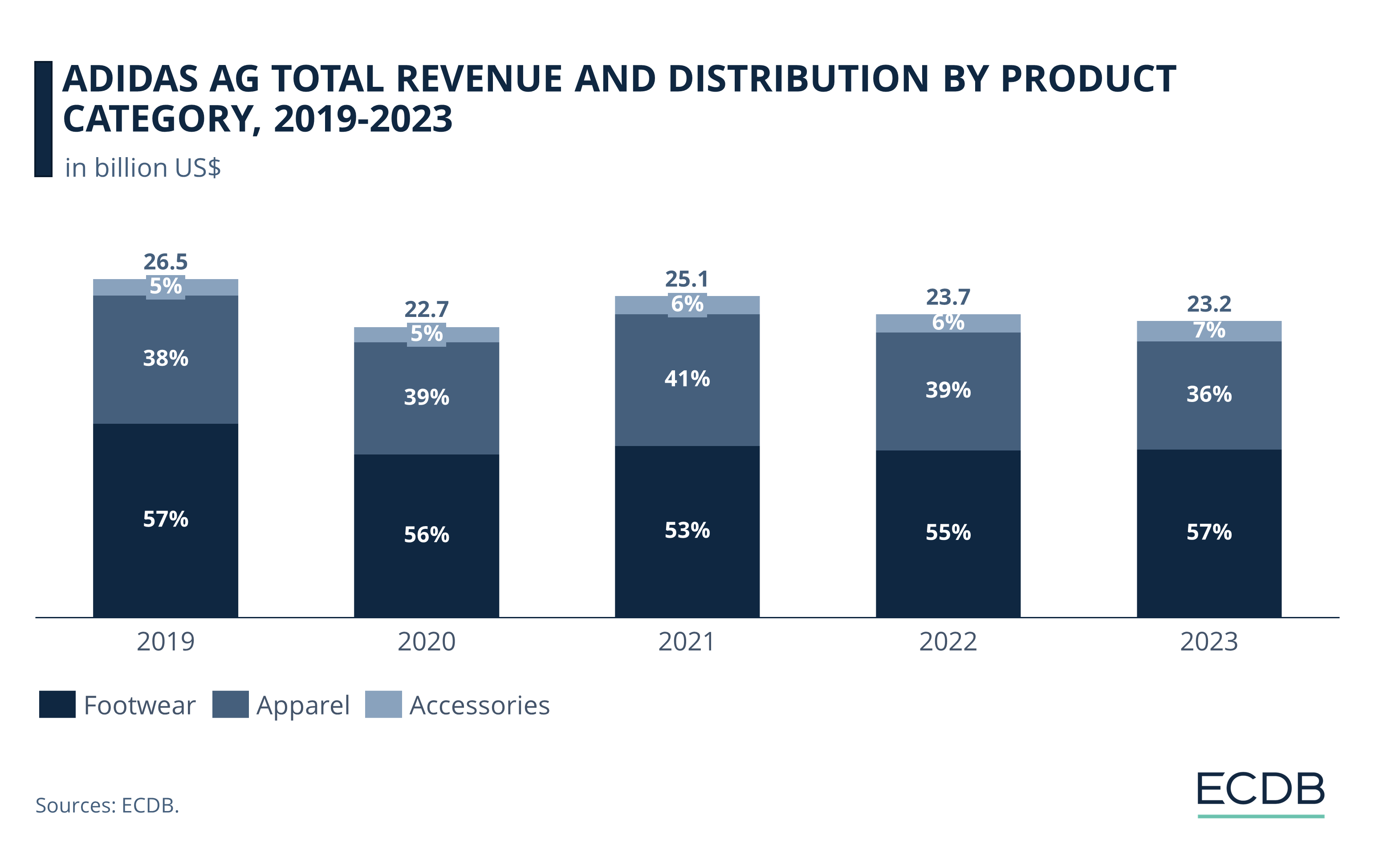

Footwear Remains Strongest Category: Shoes contribute over 50% to overall net sales. While apparel and accessories have shown some growth in recent years, the overall trend remains unchanged.

Physical Stores Remain Important: Adidas sells most of its products offline, which is linked to its strong footwear segment.

Adidas was one of the companies with a hopeful outlook during the pandemic, as the sportswear company gradually increased its sales through 2022.

But the company's most recent numbers show that Adidas suffered more losses in 2023. See what this means for Adidas' bottom line.

Online Share of Net Sales at 20% Since 2020

According to data on the Adidas AG store page, the pandemic led to an increase in the share of online net sales generated by the Group.

While Adidas AG was hit hard by Covid lockdowns, which reduced total net sales by 14% from US$26.5 billion in 2019 to US$22.7 billion in 2020, the online share of net sales increased to 21%. Previously, online channels accounted for no more than 12% of total net sales.

While the outlook was positive, leading to hopes of increased revenues after 2022, Adidas AG reported further losses in 2023. With US$23.2 billion in sales that year, 20% of which were online, pre-pandemic sales weren't reached.

See which product category sales accounted for what percentage of revenue.

Shoes Make Up More Than 50% of Net Sales

Footwear has traditionally been Adidas AG’s strongest product segment. It has consistently contributed more than 50% to the company’s revenue.

This pattern continues to this day, as evidenced by the fact that 57% of Adidas' sales were generated by shoes in 2023, increasing the share from 55% in 2022.

In recent years, there has been a slight shift towards the other two product categories, apparel and accessories, but footwear drove 57% of sales in 2023.

Since 2020 the brand does not seem to reach the customers in the same way as before, which did not change notably when physical stores reopened. Nike does not appear to have this problem.

Adidas Stagnant Growth: Wrap-Up

The competitive nature of the online fashion market extends to athletic wear brands. Despite an increasing number of opportunities to sell products through multiple channels, some players are unable to reverse the downward trend.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

H&M Revenue: Online Net Sales Remain High Through 2023

H&M Revenue: Online Net Sales Remain High Through 2023

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Deep Dive

Walmart eCommerce Revenue: The U.S. Retail Giant Surpassed US$100 Billion

Walmart eCommerce Revenue: The U.S. Retail Giant Surpassed US$100 Billion

Back to main topics