eCommerce: Market Insights

Top Online Stores in Greece: Domestic Retailers & Fast Fashion, But No Amazon

Greece's eCommerce market is growing, but despite its small size, some aspects of it are highly innovative. Learn about Greece's top eCommerce stores, reasons for their success and Amazon's absence, and why quick commerce is one of the more fascinating aspects.

Article by Nadine Koutsou-Wehling | June 19, 2024Download

Coming soon

Share

Greece's Top Online Stores: Key Insights

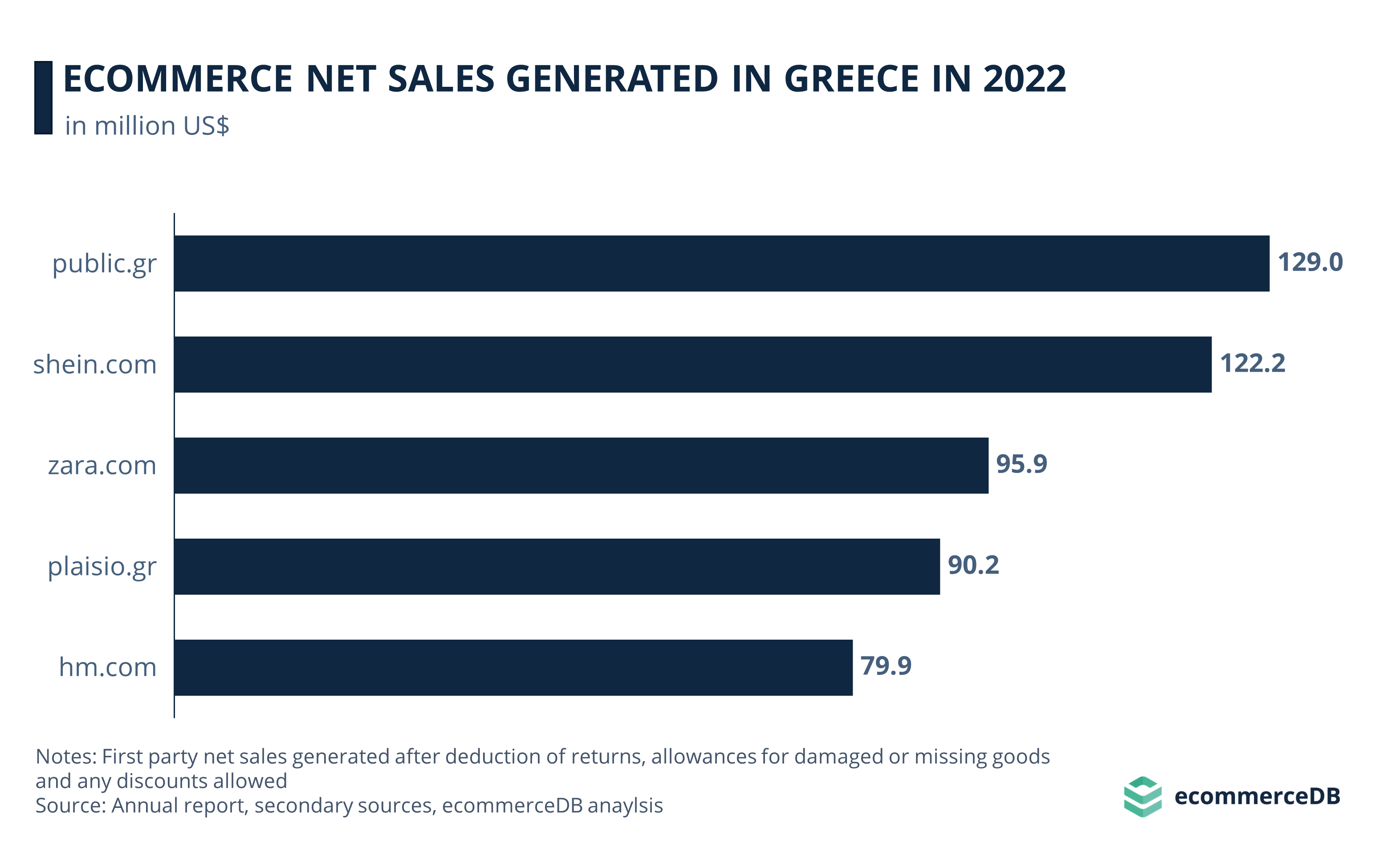

Leading eCommerce Players: Shein generated highest eCommerce sales in Greece, with online revenues of US$227.1 million in 2023. Following its lead are domestic retailers, Zara and one German store.

Success Strategies: Low costs, a large product assortment, immediacy and omnichannel services define business success in Greek eCommerce. Also find out why Amazon does not operate in Greece with an own domain.

Quick Commerce Trend: Leading supermarket chains and delivery services in cooperation with smaller businesses boost quick commerce to new heights in Greece. Perks like 24/7 availability are what makes the market incredibly progressive.

Greece is known for its amazing scenery and delicious cuisine – but what about eCommerce? Using the data provided on our ECDB Markets section, this insight examines the top eCommerce stores in the country and related trends. These include quick commerce, omnichannel services and Amazon's impact, even though there is no Greek Amazon domain.

Greece's Top 5 Online Stores: Fashion and Low Costs

In 2023, eCommerce generated US$8.8 billion market revenues in Greece. Here are the top online stores in the country.

Shein, which ranked second in 2022, rose to the first spot in Greek eCommerce a year later. Its low-cost, trend-led product assortment appears to have captured the interest of Greek online shoppers most effectively, resulting in an annual revenue of US$227 million.

The Greek electronics retailer Public fell to second rank in 2023. It generated online revenues of US$134.5 million.

In third place is Zara, with eCommerce net sales of US$97.5 million in 2023.

Following close behind is domestic electronics and office supply store Plaisio with eCommerce net sales of US$94.8 million.

The fifth spot belongs to Praktiker, a German home improvement store that is operating in Greece with an omnichannel presence. Praktiker.gr made US$79.9 million online in 2023.

So what are the dominant strategies that these top stores use to consolidate their position in the Greek online market?

Success Strategies of the Top Online Players in Greek eCommerce

A closer examination of the common strategies employed by the top 5 online stores in Greece results in four core techniques. Each of the leading players uses at least one of these aspects.

1. Affordability: A Low-Cost Assortment

In a previous insight into Greek market dynamics, we discussed the importance of low-priced products in the country.

Given the relatively low income level in Greece and its economic struggles, it figures why online retailers with a low-cost strategy thrive. A similar pattern is visible in Portugal and Spain, where Shein also takes one of the upper rankings in eCommerce.

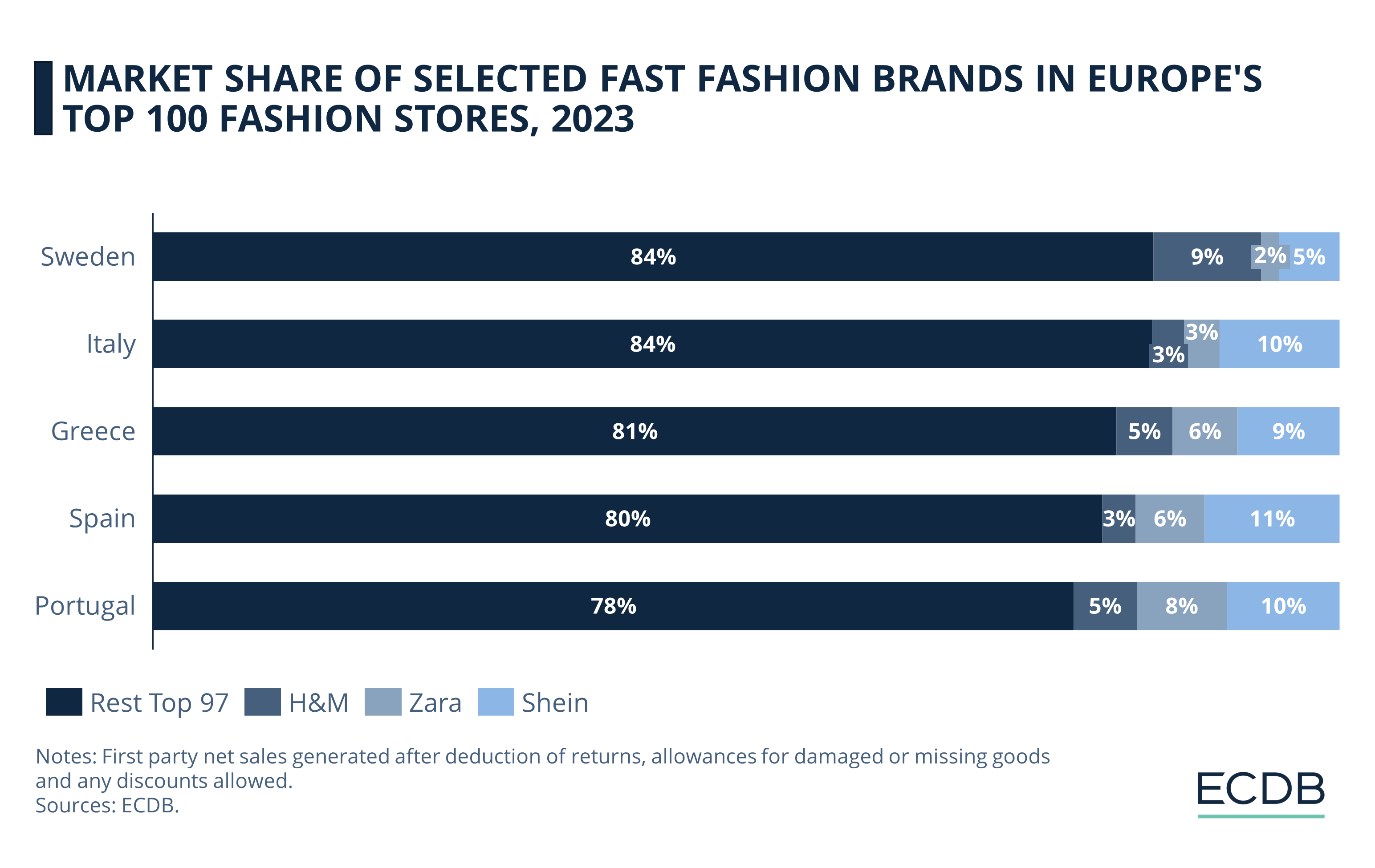

In terms of market share, fast fashion retailers have the third-largest impact in Greece:

Two of the fashion stores considered in this chart rank among Greece's top 5:

Shein accounts for 9% of the top 100 fashion stores' net sales in Greece.

Zara's online revenues make up 6% of Greece's top 100 fashion stores.

Together, H&M, Zara and Shein generate 19% of the fashion top 100 in Greece.

Reasons for their significance can be found in the market's economic circumstances, proximity to production hubs, and overall size of the fashion market.

2. Large Product Assortment

Fast fashion brands succeed by offering consumers more items than traditional stores, allowing them to stock up on the latest fashion trends several times a year. Shein has taken this method to an extreme, using more than 6,000 garment factories in China to continuously offer new products on its website.

Public, Greece's most recognized electronics retailer, is not a fast fashion company. Still, its main appeal lies in its vast product offering. Electronics & Media is the company’s main focus, but it also includes Toys, Hobby & DIY.

In 2018, Public launched Greece’s first online marketplace, with which it expanded its product range and gave smaller retailers the opportunity to reach a wider audience.

3. Omnichannel Services

An omnichannel strategy is one in which companies offer customers multiple ways to receive their orders, including home delivery and in-store pickup of online purchases. The flexibility of this method helps customers receive their orders according to their daily schedules.

The two home-grown stores in Greece, Public and Plaisio, solidified their position during the pandemic with an extensive logistics network and exclusive brand partnerships. As a result, both stores use the newest technologies to offer seamless multichannel services to customers.

Given that Zara and Praktiker are also established retailers with both a physical and an online presence, it can be inferred that larger retailers often have advantages in providing omnichannel services to customers. This advantage stems from the need for streamlined logistics and sophisticated technology, requirements that tend to reach beyond the financial capabilities of new or small businesses. As a result, smaller enterprises tend to rely on external platforms to manage these tasks for them.

But this is not the only logistics-related aspect that contributes to the success of Greece’s top online players.

3. Fast Delivery, or the "Amazonization" of the Greek Market

In a fast-paced world, the quicker orders get to customers, the better: The ability to deliver packages in days or even hours can make or break a business.

A report on Plaisio’s financial position by Eurobank Equities notes that even though Amazon does not operate in the Greek market with a .gr domain, its cross-border impact has emphasized the need for faster delivery in the country. Thus, the most successful online players on our list have developed their own capabilities, both technological and logistical, to meet consumer demand.

Instead of Greek consumers ordering products on an international Amazon domain and waiting less than a week for their delivery, Plaisio and Public undercut the time it takes to deliver the package. The benefits of this are obvious: Ranked second and fourth, respectively, Public and Plaisio generate viable profits in Greece and solidify their online success in this way.

Valuable Insights: Our data-driven rankings are regularly refreshed to provide you with crucial insights for your business. Find out which stores and companies are performing will in the eCommerce space and which categories are topping the sales charts. Stay ahead of the market with our rankings for companies, stores, and marketplaces.

Why has Amazon not entered the Greek eCommerce market with its own domain?

Reasons for Amazon's Absence in Greek eCommerce

Amazon’s dominance in Europe is particularly striking: The U.S. eCommerce behemoth generates significantly more sales than other European and national players in most markets. Thanks to its wide range of products, fast delivery, competitive prices and widespread brand recognition, Amazon overshadows any other online store in the West.

In Greece, however, the situation is different. An article by Capital, a Greek affiliate of Forbes, explains Amazon’s lack of a Greek domain. Two factors are most salient: The first is an inadequate infrastructure for Amazon’s operations, which would require large sums of investment and time to build. Due to the Greek landscape, which consists of mountains and islands, Amazon could not offer the same convenient and fast services that it does in other countries.

The second reason, related to the first, is the size of the Greek online market. With relatively low expected online sales compared to other European countries where annual net sales per store are in the billions, Greek eCommerce does not generate enough profit for the retail giant to spend billions investing in sufficient infrastructure.

However, Amazon is not completely absent from the Greek market. Instead of its own domain, the company moved its operations to Athens in 2021 to offer its cloud service, or AWS (Amazon Web Services), to businesses in the market. Ensuring a viable internet connection not only helps more businesses enter the online market, but also provides Amazon with big data insights that can be analyzed to further expand and optimize its services.

But before you despair, there are other innovations in the Greek online market that may compensate for the lack of an amazon.gr domain: A burgeoning quick commerce revolution!

Quick Commerce: Round-the-Clock Availability of Products

Quick commerce is a relatively new phenomenon and refers to the delivery of goods that takes less than an hour. In Greece, quick commerce has taken over most eCommerce stores, which aim to satisfy consumer needs for quick delivery, easy purchasing processes, and even 24/7 availability.

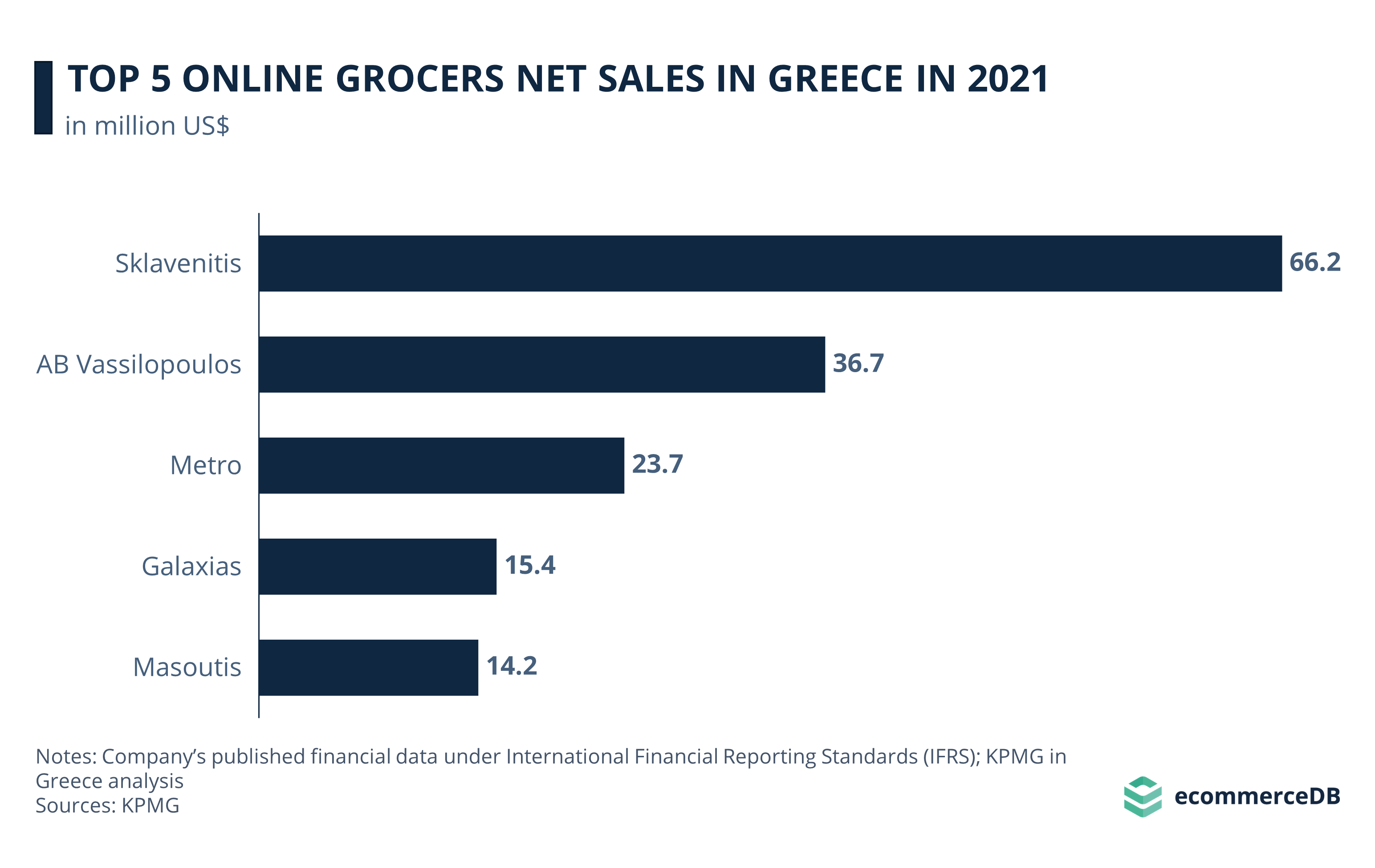

The quick commerce scene in Greece is diverse and growing, having started with traditional grocery stores offering delivery services, but limited by working hours. Below are the 2023 net sales of the 5 top online grocers in Greece.

Sklavenitis dominates the online grocery market with net sales of US$41.7 million in 2023.

AB Vassilopoulos ranks second, with US$33.6 million in eCommerce revenues.

Mymarket is in third place, having generated US$22.3 million in 2023.

In fourth and fifth ranks are market-in.gr and e-fresh.gr, with respective net sales of US$9.6 million and US$7.4 million.

As previously discussed, most small businesses that engage in quick commerce do not have the financial or technological resources to set up an own storefront. A common solution lies in cooperating with delivery services.

New Entrants Into the Quick Commerce Market Disrupt Online Grocers' Offering

The influence of platforms such as InstaShop, Pop Market, Rabbit, and Wolt Market is growing in Greece. These quick commerce players offer even more flexibility than their online grocer counterparts, as they provide delivery from affiliated local retailers, which allows for a greater variety of the products to be purchased.

Affiliate retailers include restaurants and cafes, pharmacies, kiosks, supermarkets, and others. Because kiosks in particular tend to open 24 hours a day, consumers can place their orders at any time of the day or night – and receive their products within minutes either way.

As a result, the rise of quick commerce is playing a major role in accelerating online shopping in Greece and has reached a point that may herald unimaginable levels of accessibility, availability, and convenience in the future.

Top Online Players in Greece: Wrap-Up

Shein has surpassed Public in 2023 as the most successful online store in Greece. The prevalence of fast fashion stores and retailers with an expansive offline network underlines the importance of low prices and an omnichannel approach.

However, quick commerce is on the rise in Greece and its highly accessible, convenient offering serves as an illustration of a burgeoning market with a highly promising prospects for the coming years. With this outlook, having an own Amazon domain in Greece is not even necessary: Amazonization has already played its part in the market.

Sources: Convert Group - Group Olympia

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

H&M Revenue: Online Net Sales Remain High Through 2023

H&M Revenue: Online Net Sales Remain High Through 2023

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Deep Dive

Walmart eCommerce Revenue: The U.S. Retail Giant Surpassed US$100 Billion

Walmart eCommerce Revenue: The U.S. Retail Giant Surpassed US$100 Billion

Back to main topics