eCommerce in Greece – Market Trends, Top Players & Consumer Preferences

Download

Coming soon

Share

Greece and eCommerce – they seem an unlikely pairing when discussing this country with its deep cultural roots and picturesque landscapes. And yet, eCommerce has become a habit for many consumers in Greece.

Economic hardship is an aspect that a lot of people will think of when reflecting on past news from Greece. While it is true that online shopping has never been an inherently Greek phenomenon, the previous years have contributed to significant developments for eCommerce in the country.

To paint a comprehensive picture of the Greek eCommerce landscape, this article shows the status quo of how Greeks prefer to shop online and what dynamics characterize the market. As is often the case, the genesis can be traced back to the onset of the pandemic.

Pandemic Restrictions Drove eCommerce Development in Greece

An overview of online market dynamics in Greece, as found in our Markets section, suggests that the pandemic has had an accelerating impact on eCommerce penetration.

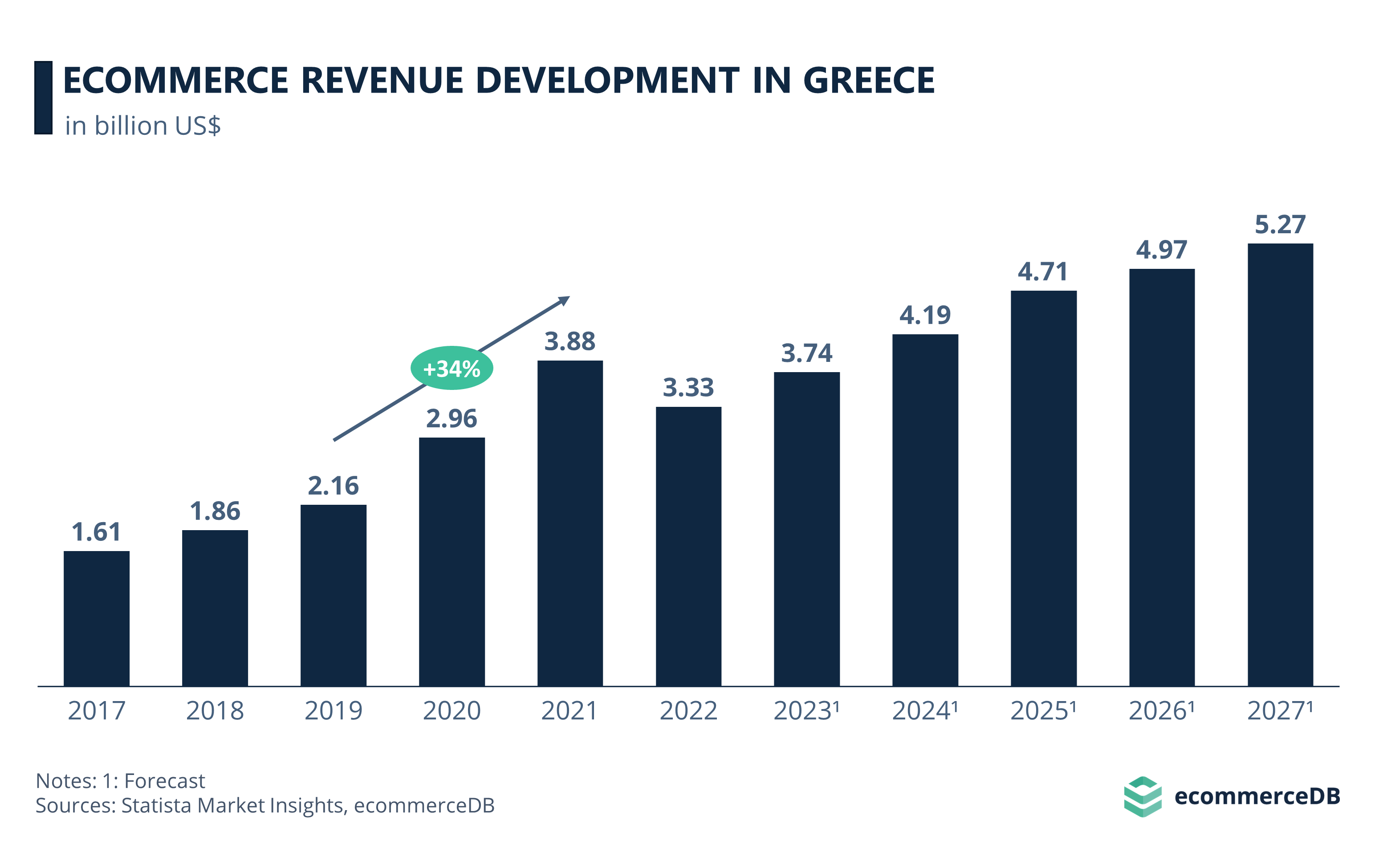

While online market revenues in Greece were at around US$2.2 billion in 2019, this value soared during the pandemic years until 2021. With a CAGR (2019-2021) of 34%, the market has added more than a third of its revenue in just three years.

Of course, this is a phenomenon seen in almost every country in the world, as governments have largely followed similar paths in restricting social gatherings and encouraging employees to work from home when possible. As consumers stayed home more often and non-essential brick-and-mortar businesses closed, selling and buying products online provided a way to avoid the inconvenience.

A Temporary Post-Pandemic Downturn and the Impact of Inflation

After the pandemic, however, the surge in online purchases declined, another global phenomenon that affected Greece as much as other countries. Nonetheless, the projected figures show that the pandemic set in motion a trend that is unlikely to be reversed in the long term.

As far as inflation is concerned, opinions differ among publications. KPMG and Eurobank Equities predict that inflation will reduce overall revenue growth due to lower demand and higher costs, while others argue the opposite. OT, a Greek affiliate of the Financial Times, views rising prices coupled with increased demand in certain sectors as beneficial for revenue growth, while increased costs are less influential. Convert Group concedes that while higher prices can indeed increase revenues, the effect is marginal due to the accompanying increase in costs.

To reconcile these conflicting views, it is clear that inflation can have a variable impact on revenue growth. It largely depends on contextual factors such as product assortment, supply chain cost management, consumer demand and the competitive structure of the specific submarket. Established players will find it easier to keep costs down by leveraging existing structures and contractual agreements, while smaller and newer stores may face greater challenges in this regard.

Despite this lingering uncertainty, our ecommerceDB market forecast predicts a positive development for the Greek online market in the coming years. With a projection of over US$4 billion in eCommerce revenues by 2024, the post-pandemic downturn is expected to be reversed quite soon.

Another important factor of an eCommerce market is the major stores that dominate it. What are the trends that can be seen in Greece?

Top Five Stores in Greece: Fashion First

A look at the top players shows that the Greeks love fashion. Among the top five online stores on the Greek market, three stores are pure fashion players. And what's more - all of these retailers (Shein, Zara, and H&M) operate under the fast fashion business model.

However, there are quite some other interesting developments when it comes to the most successful players and their strategies in Greek eCommerce. If you are interested in that, make sure to read our upcoming insight on that topic.

As we have seen, the pandemic has spurred eCommerce development in Greece, and offering cheap products is a well-advised strategy for businesses looking to enter the Greek online market. Another basic metric that one should consider when trying to gauge a market's trajectory is eCommerce penetration.

Accordingly, let us put the Greek market into a global perspective.

Greece Ranks at the Bottom of eCommerce Penetration Worldwide

Looking at the percentage of the Greek population that regularly engages in eCommerce, we draw a global comparison based on our ecommerceDB Country Reports.

The three countries with the highest percentages of online shoppers, that is users who have bought at least one product online in the past year, are Norway (82%), UK (81%), and Germany (80%).

The three countries with lowest eCommerce penetration are Bulgaria (48%), Malaysia (47%), and South Africa (45%).

Greece’s share of online shoppers is at the lower end of this list. According to our 2022 Country Report on Greece, 56% of consumers in Greece are online shoppers. This figure is on a par with Slovenia and Thailand. One percentage point higher are Brazil, Hungary, and Serbia with 57%, and below is Lithuania with 54%.

Considering the predicted development for the coming years, it is expected that the share of online shoppers in Greece will increase accordingly. But what will convince those consumers who are still hesitant about eCommerce to start shopping online?

Cost Savings and Ease of Purchase Motivate Users in Greece to Shop Online

Inquiring more thoroughly about what motivates users in Greece to buy products online, the chart below illustrates data from GWI. The most common responses indicate that saving money, a straightforward shopping process, and confidence in product quality are of a concern to consumers in Greece.

A whopping 74% of users say they would be more likely to buy products online if they were offered free delivery, combining convenience and cost savings in one aspect. Similarly, 55% of users see discounts as a motivator to shop online.

Another driver related to affordability is loyalty points (42%). However, only 23% of users cite installment options as a reason for engaging in eCommerce, indicating a low importance of Buy Now, Pay Later (BNPL) services in Greece.

Convenience in the checkout process (48%) and product returns (37%), as well as not having to register an account (30%), are further compelling aspects of online shopping for Greek consumers. In addition, customer reviews are considered important by 47% of users, underscoring the significance of assessing product quality before making a purchase.

As seen in the following section, despite the benefits of online shopping, users in Greece also have their inhibitions when it comes to eCommerce.

Users in Greece Tend to be Wary of Privacy Issues

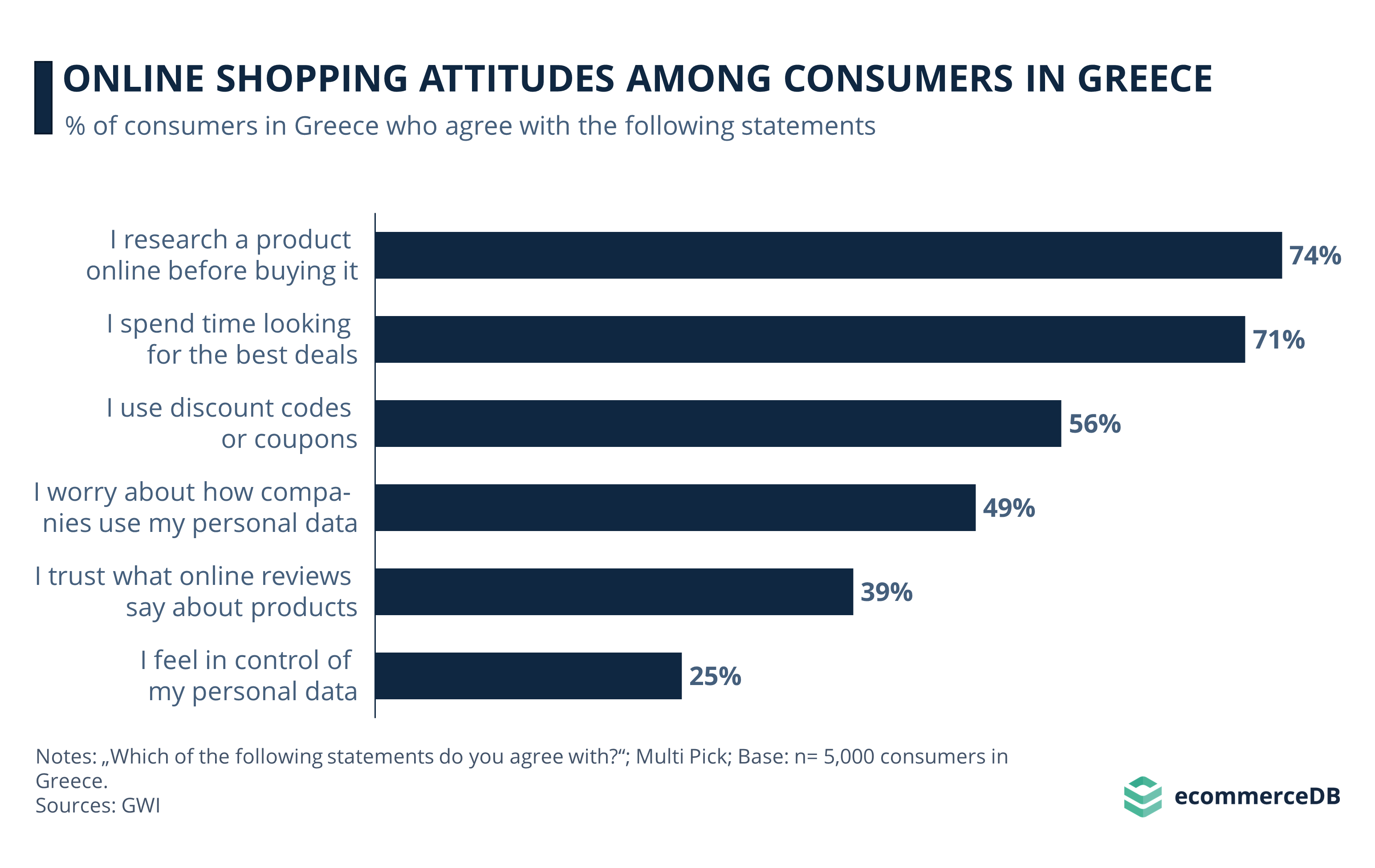

Other data from the GWI study examines the general attitudes of Greek consumers towards online shopping. With a continued emphasis on frugality, another critical aspect comes to the fore: the apprehensions associated with online privacy.

In the context of confirming product quality, a widespread approach among respondents in Greece is to conduct online research before acquiring an item (74%). However, there is still a substantial portion of consumers who do not trust what online reviews say about a product (39%).

Skepticism about online shopping is not uncommon in Greece, with 49% of users saying they worry about how companies use their personal information. Likewise, only 25% of Greek consumers say they feel in control of their personal data.

Fostering Customer Loyalty in the Greek Online Market

Businesses looking to enter the Greek market can reap long-term benefits by taking these concerns related to privacy issues seriously, offering easy checkout and guest profiles to avoid alienating potential customers, and being more transparent about how they handle customer data.

This, combined with comprehensive product information, affordable prices, and attractive discounts, can help to consolidate a successful presence in the bourgeoning Greek online market.

Greek eCommerce - Key Takeaways

Greece's eCommerce landscape has been significantly shaped by the pandemic, leading to substantial growth in online sales and changes in consumer behavior. Despite a temporary post-pandemic downturn and (as yet) low eCommerce penetration, Greece has seen positive trends, and online shopping seems poised to play a momentous role in its economy.

Pandemic Impact and Future Projections: The pandemic restrictions drove a sudden increase in eCommerce in Greece, with revenues soaring, and a projected growth that indicates a promising future. The health crisis has set a lasting change in consumer behavior, likely to exceed US$4 billion in sales by 2024.

Consumer Behavior and Preferences: 74% of Greek consumers cite free delivery as a key incentive to shop online. Convenience, cost savings, and quality are essential factors for online shoppers in Greece. However, concerns about online privacy are prevalent, with 49% of users worried about how companies handle their personal information.

Strategies for Market Success: For businesses seeking to enter or expand within the Greek online market, emphasizing affordability, transparency in data handling, easy checkout processes, and customer loyalty strategies could pave the way for long-term success. Addressing local consumer concerns and preferences is essential to gaining a foothold in this growing market.

Sources: Eurobank Equities – GWI

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Back to main topics