eCommerce: Market Insights

eCommerce in Spain and Portugal: Top Stores, Market Size & Trends

eCommerce in Spain and Portugal is similar, but there are also differences. One major contrast lies in their different market sizes. But there are other defining characteristics. Find out what these are here.

Article by Nadine Koutsou-Wehling | June 17, 2024Download

Coming soon

Share

eCommerce in Spain and Portugal: Key Insights

Market Size and Growth: Spain's eCommerce market is significantly larger and grows faster than Portugal's, with 2023 revenues of US$29.7 billion compared to Portugal's US$6.1 billion, and a projected CAGR (2024-2028) of 11% for Spain versus 9% for Portugal.

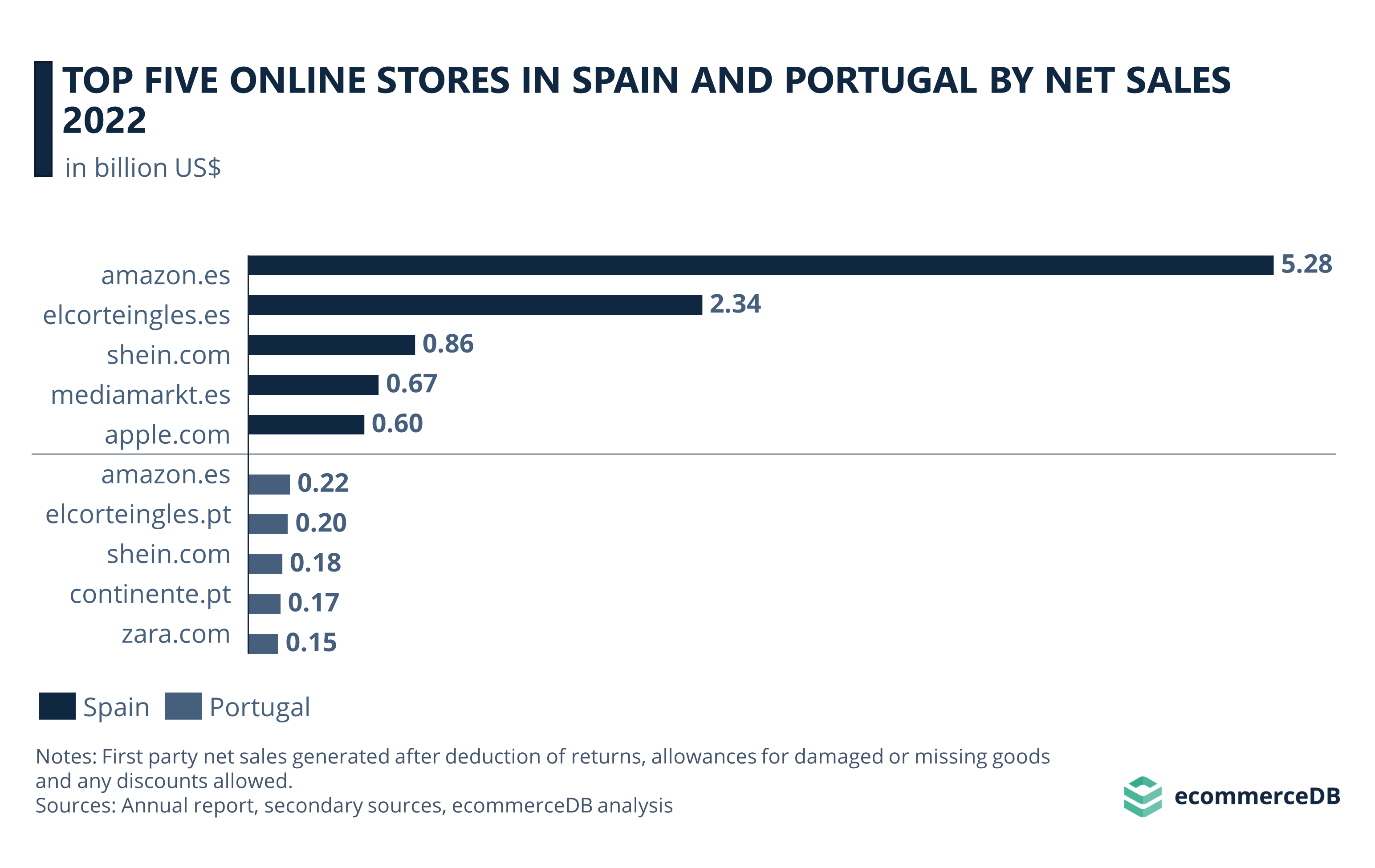

Top eCommerce Players: Amazon and Shein dominate both markets, with Amazon leading in Spain and Shein in Portugal. Local retailers, particularly those with strong offline networks like El Corte Inglés and Mercadona in Spain, and Continente and Worten in Portugal, also rank high.

Successful Strategies: Key factors for success in both markets include offering convenience, a wide product range, and low costs. The rise of grocery eCommerce is notable and significant growth is expected in both countries by 2028.

Spain and Portugal are geographically and culturally close in proximity, but a deciding factor that determines the differences in their eCommerce markets is their size: Spain is a much larger economy. It therefore also generates higher eCommerce net sales in comparison to Portugal. But similar consumer preferences and a shared industry contribute to overlapping top stores in the market.

Here are the top eCommerce players in Spain and Portugal and what trends contribute to their success.

Portuguese eCommerce Market One-Fifth the Size of Spain's in 2023

A comparison between eCommerce market revenues in Spain and Portugal shows that Spain's revenues are five times higher than Portugal's. In addition, Spanish eCommerce grows slightly faster:

Spain's eCommerce revenues were higher in 2018 and jumped more significantly during the pandemic. In comparison, Portugal's development was more moderate.

In 2023, the eCommerce market in Spain generated revenues of US$29.7 billion. In Portugal, revenues were at US$6.1 billion.

With a CAGR (2024-2028) of 11%, Spain's eCommerce market is expected to grow faster than Portugal's, which has a projected CAGR (2024-2028) of 9%.

Let's take a closer look at the top eCommerce stores in each market.

Spain's Top 5 eCommerce Stores: Amazon.es on Top

The following stores generated the highest revenues by selling products online in Spain:

Amazon.es exceeds the other stores by a wide margin, with online net sales of US$3.9 billion.

In second place is the ultra-fast fashion retailer Shein. It generated US$1.6 billion in Spain. Spain is Shein's fourth-largest market.

Home-grown department store group El Corte Inglés follows in third place with its online platform, closer behind Shein with US$1.4 billion online net sales.

Another domestic player, this time the supermarket chain Mercadona, generated US$703 million in 2023.

Closely behind in fifth place, with US$697 million in eCommerce net sales is carrefour.es.

The first two ranks take the lead in Portugal's eCommerce market as well:

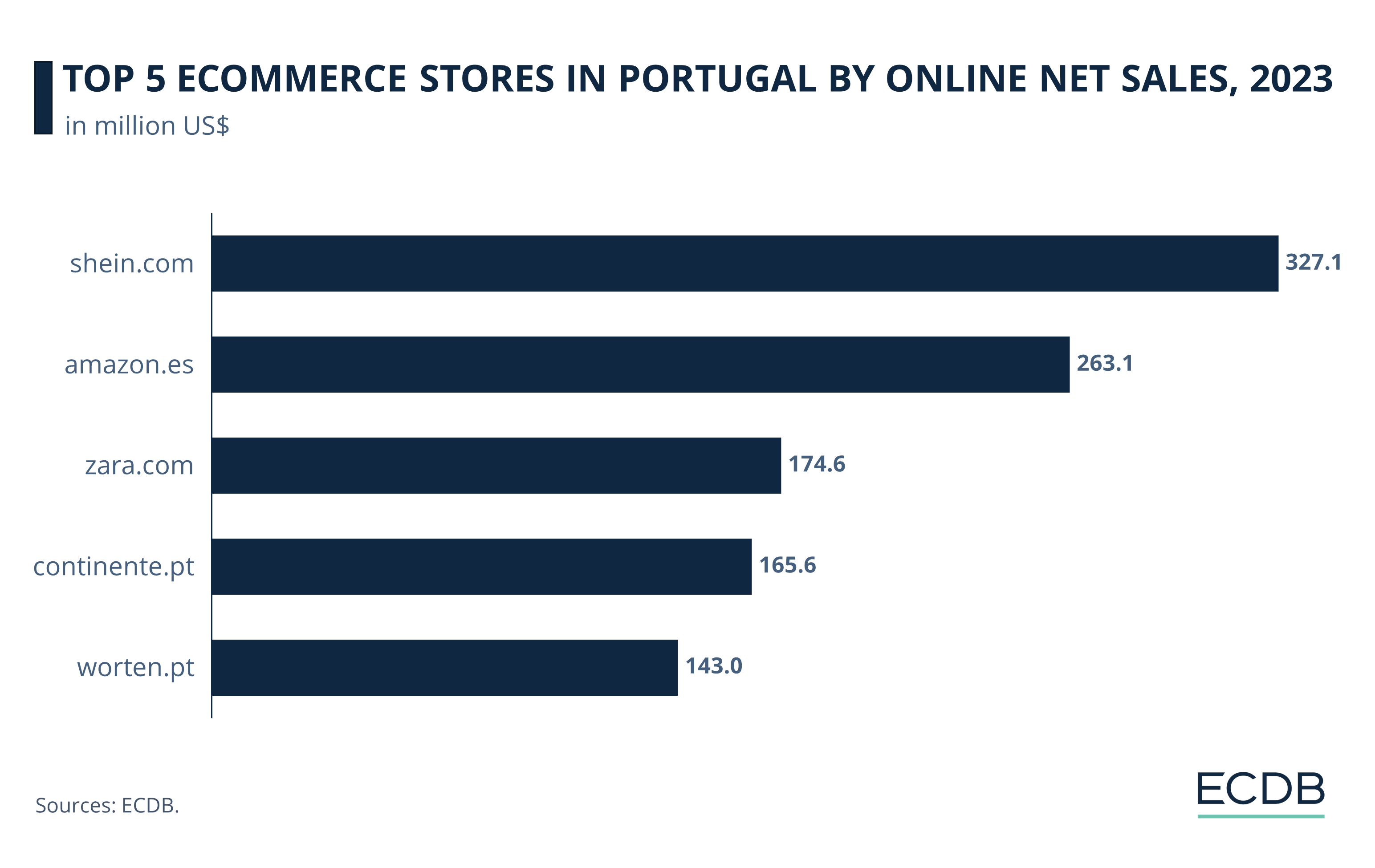

Portugal's Top 5 eCommerce Stores: Shein.com Takes the Lead

While the order differs, both Amazon and Shein are also the leading players in Portugal's eCommerce market. According to its overall lower market revenues, however, eCommerce net sales are notably lower in Portugal. No store exceeds US$1 billion.

Shein ranks first, with eCommerce net sales of US$327.1 million.

Amazon.es follows, having generated US$263.1 million in Portugal.

The flagship brand of the Spanish fashion conglomerate Inditex, Zara, ranks third in Portuguese eCommerce at net sales of US$174.6 million.

Domestic hypermarket chain Continente ranks fourth, with online net sales of US$165.6 million in 2023.

Electronics retail chain Worten takes the fifth spot in Portugal's eCommerce market, having generated US$143 million in 2023.

What are common strategies that prove successful in both markets?

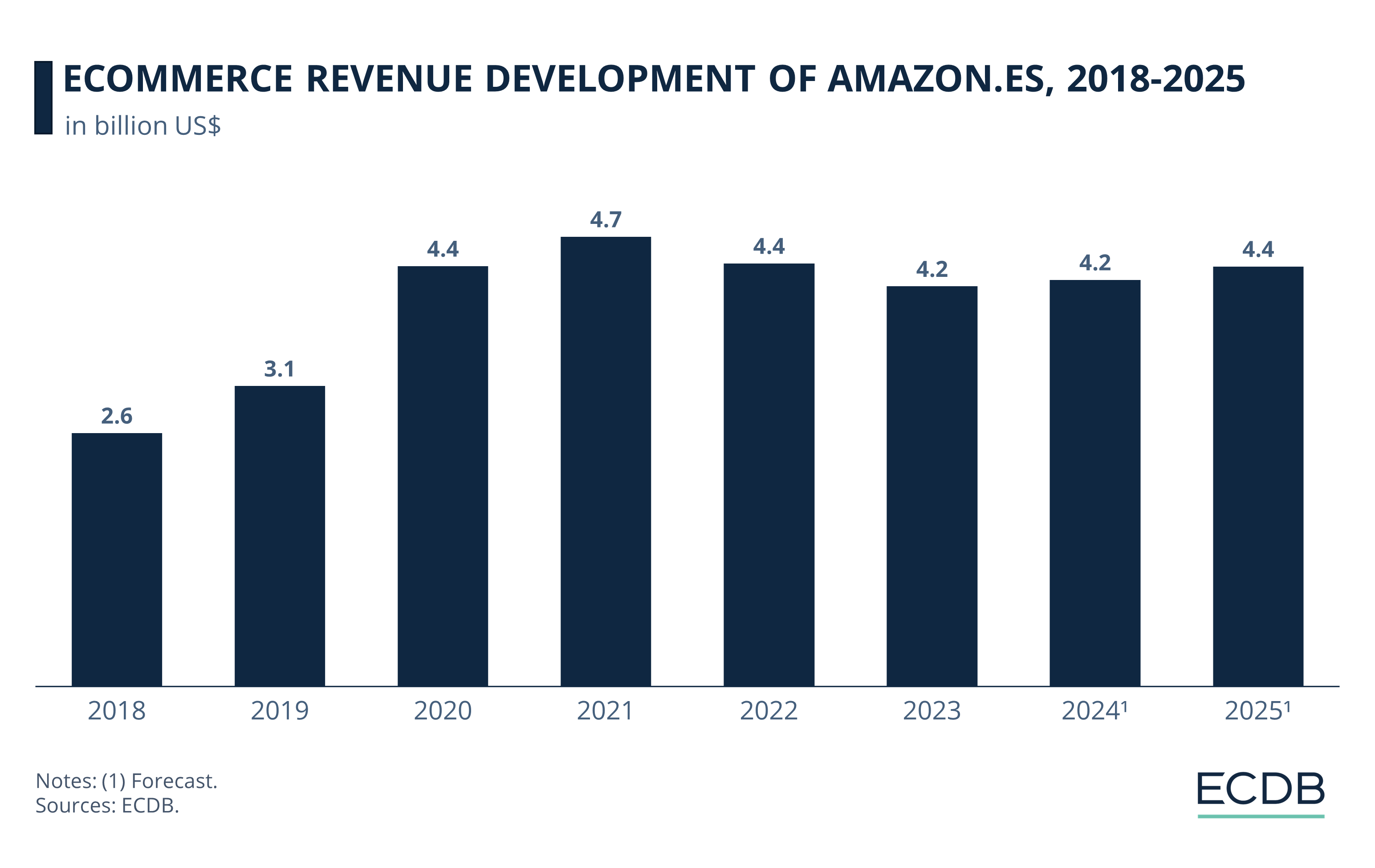

1. Amazon.es

Ranked number one in Spain and number two in Portugal, Amazon is taking its typical market leadership position in both countries. Its eCommerce business has a lasting impact on consumer expectations for convenience, speed, and large product assortments.

Check out the past and projected revenue development of its .es domain:

Before the pandemic, online revenues of amazon.es were around US$3 billion.

The typical revenue increase during Covid resulted in revenues of US$4.4 billion in 2020 and US$4.7 billion in 2021.

In the years after, revenues dropped to around US$4.3 billion. This decrease suggests a continued relevance of offline channels for purchases in Spain and Portugal. Relatively low online shares between 10% and 8% corroborate this assumption.

Both Amazon and El Corte Inglés offer consumers a wide variety of products across all categories. El Corte Inglés started out as a department store that already had an online strategy in the early 2000s. However, Amazon’s entry into the Spanish market in 2011 prompted El Corte Inglés to develop a more sophisticated online presence to rival its direct competitor online. This included lowering shipping costs, internationalizing the company, and continually launching its own products and brands to meet a wider variety of consumer needs. This development is typical across world regions, also called "Amazonization" of markets.

Another dominant player in the region is Shein:

2. Shein

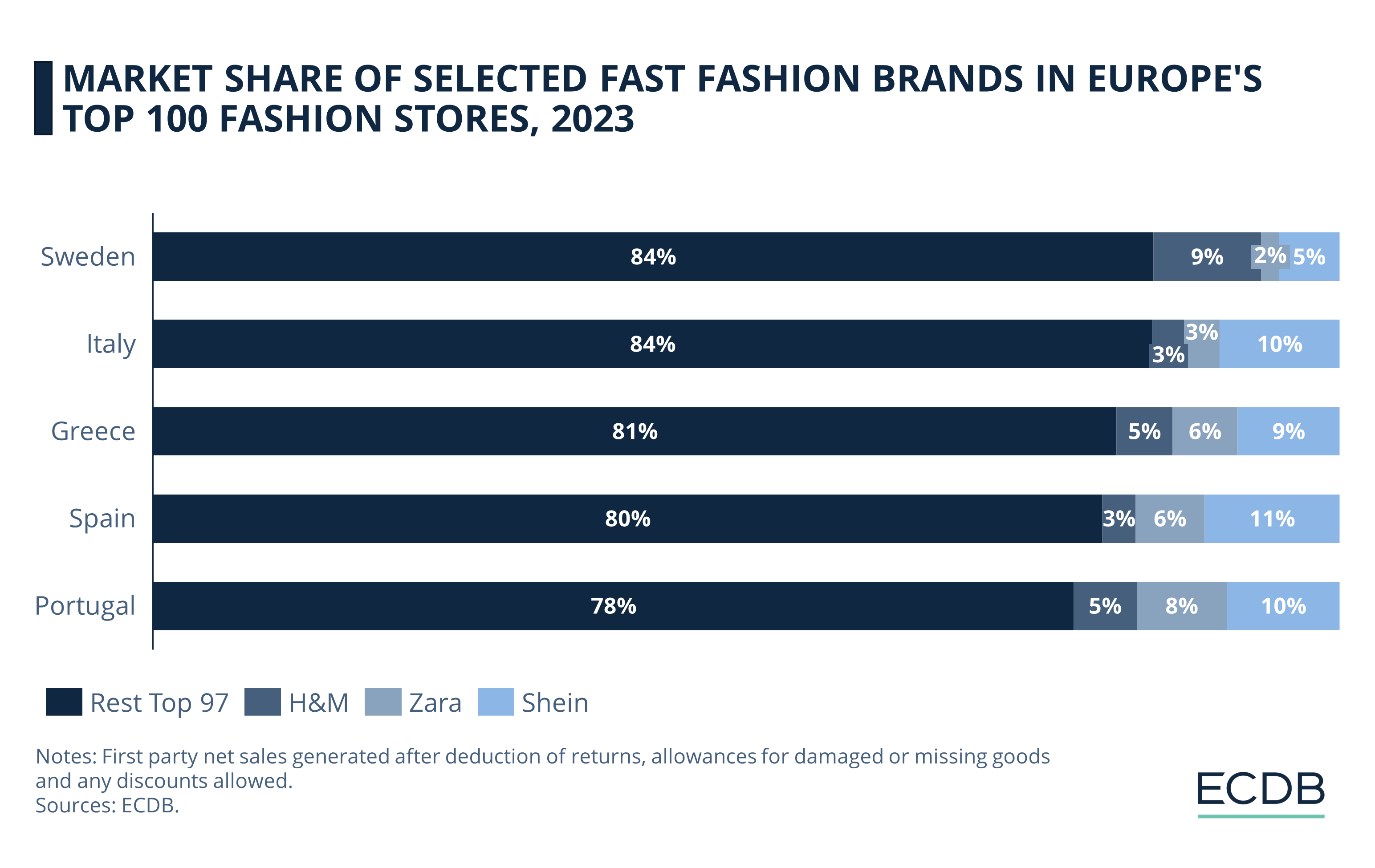

Other than Amazon, Shein has only taken the top spots in the eCommerce market in Spain and Portugal in the last few years. In our analysis on the role of fast fashion in European eCommerce, we hypothesized that economic circumstances play a role in the success of low-cost retailers. We showed that three of the most popular fast fashion brands are particularly successful in Portugal and Spain:

H&M, Zara and Shein have combined market shares of 22% in Portugal, making it the eCommerce market which is most susceptible to the influence of these brands in Europe.

Spain ranks second by market share, where the three brands account for 20% of the top 100 fashion stores.

An added factor for fast fashion success is proximity to production hubs. The next point relates to this:

3. Domestic Retailers and the Impact of Grocery eCommerce

In both Spain's and Portugal's eCommerce markets, ranks three to five belong to domestic retailers. Most of these are either department stores or hypermarket chains with an established network of physical store locations. A large part of their offerings is grocery. ECDB forecasts expect grocery online net sales to exceed US$5 billion in Spain by 2028, and approach US$800 million in Portugal at the same time.

Grocery eCommerce is growing universally, which is due to an increase in providers and shifting consumer preferences. Thus, it is no wonder that established supermarket and department store chains rank among the top spots in Spain and Portugal as well.

Key Players in Spain and Portugal: Wrap-Up

Three characteristics stand out in both markets: A preference for convenience, a large product assortment and low costs. Next to Amazon and Shein, primarily domestic retailers with an established offline network generate highest revenues in both markets.

A notable trend to watch is grocery: While it is clear that a preference for offline purchases prevails in Spain and Portugal, hypermarket and supermarket chains belong to the leading online platforms in both markets.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Back to main topics