Online Car Market

Online Car Buying Market Valued at Around US$326 Billion - What's Behind the Trend?

eCommerce has reached the car selling and buying market: It is now quite common to sell and buy cars over the internet. The reason? Shoppers can search for products, compare prices, and make a purchase without leaving the comfort of their own homes. Here is more on the trend.

Article by Nadine Koutsou-Wehling | August 07, 2024Traditional car dealerships without an online strategy need to adjust, or they may be out of business soon. This statement is not as far-fetched as it might seem, because the online auto retailing market is growing. According to market researchers, online car sales are expanding as fast as an Audi R8 V10 can accelerate. Here is why:

1. Convenience: Online car buyers can shop from the comfort of their homes and directly compare prices from a variety of sellers. They can also read reviews and research different models before deciding which one to buy.

2. Affordability: Online car sellers often sell at lower prices than traditional dealerships. This is because they have less overhead and can sell cars directly to consumers.

3. Broader product range: Online car sellers offer a wider selection of cars than traditional dealerships. This is because they can distribute cars from all over the country.

4. Transparency: Online automotive dealerships are more transparent, as they typically post detailed information about the cars they sell, including the car's history, condition, and pricing.

5. Customer service: Online car sellers offer excellent customer service. They are available to answer questions and help buyers throughout the car buying process.

As a result, the online car market is expected to generate increasing revenues in the coming years. This development is being driven by the widespread acceptance of eCommerce, and rising consumer demand for convenience and transparency.

Online Car Buying Market: Valued at Around US$326 Billion in 2023

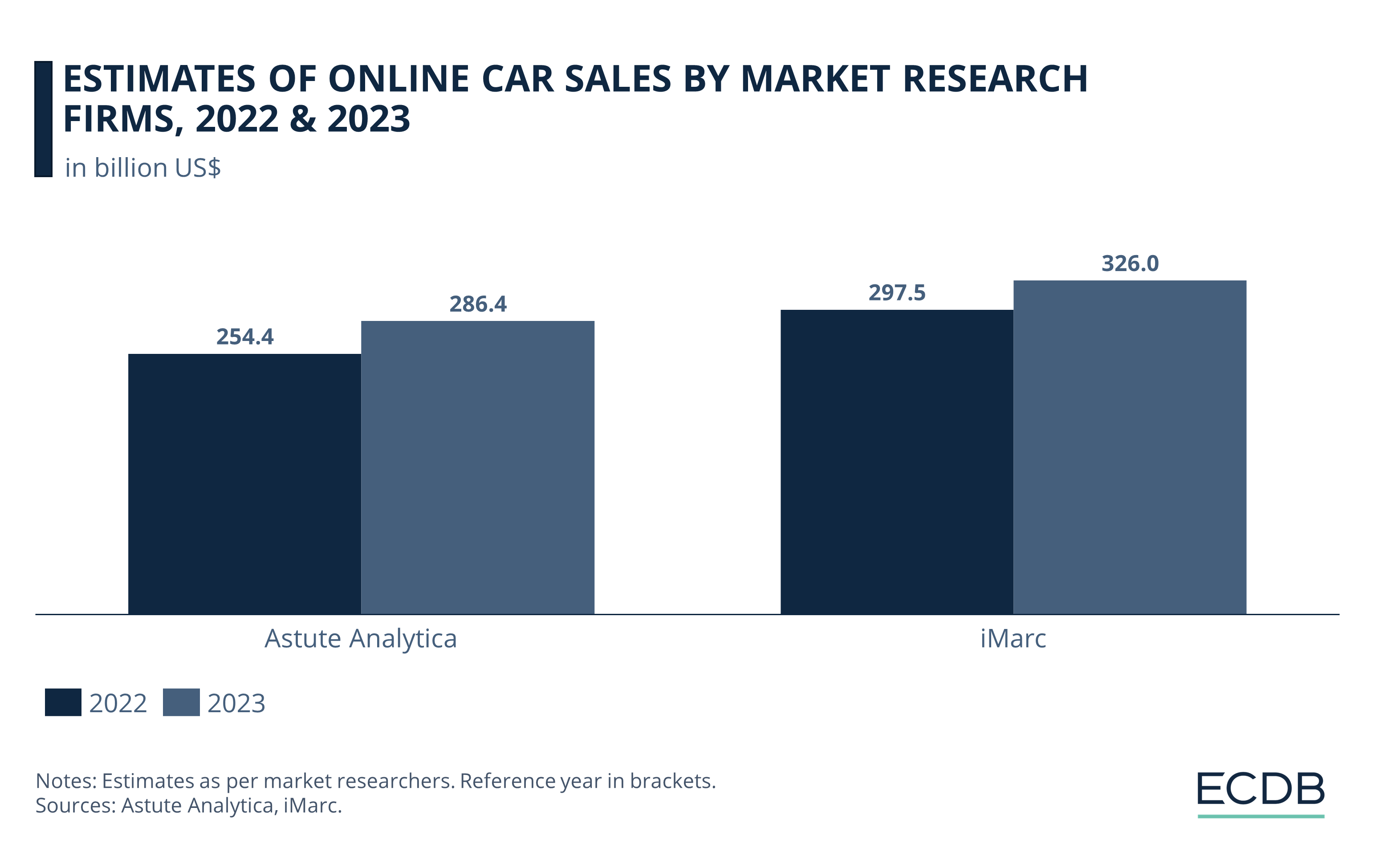

Let's take a look at the data. But keep in mind: Calculating market value is a complex process, and estimates can vary widely. This is because different publications use different data sources, methodologies, and market definitions. Additionally, any economic model relies on assumptions about market development and dynamics, as well as estimates of consumer preferences. Ultimately, when forecasting, external factors such as inflation and innovation further influence market projections.

But what are the latest assessments of the global online automotive market and its development? According to the market research firms Straits and Report Ocean, the online used and new car market generated sales between US$256 billion and US$261.9 billion in 2021. For the online car buying market in 2023, research firm iMarc reckons a market value of US$326 billion, while Astute Analytica pinpoints online car sales at US$286.4 billion, which is roughly in line with the previous estimates.

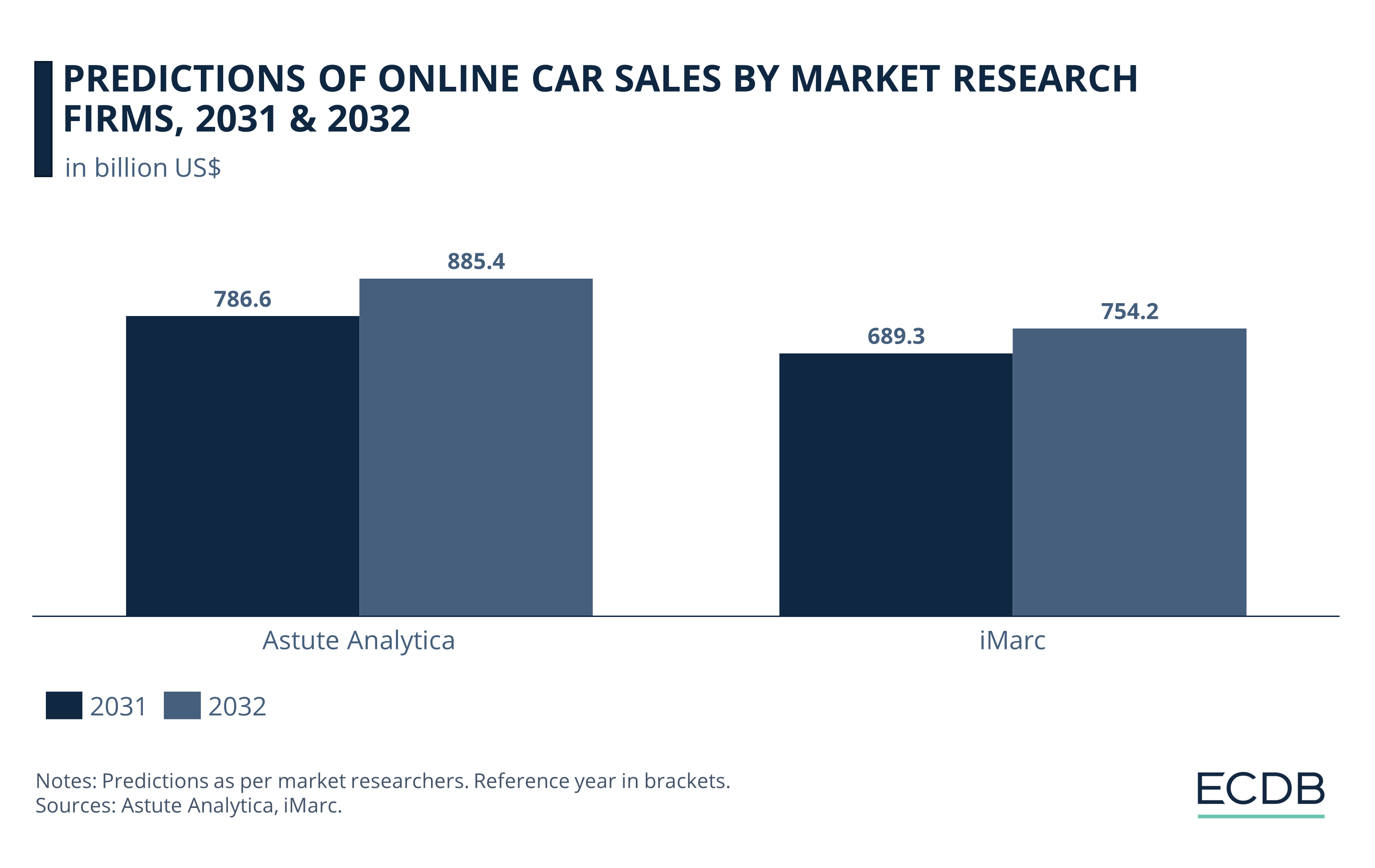

Online Automobile Sales to Reach Around US$820 Billion by 2032

Researchers at iMarc predict that the online car market will reach US$754.2 billion in 2032, at a CAGR (2024-2032) of 9.6%. Astute Analytics expects higher sales at a steeper CAGR (2024-2032) of 12.6%, resulting in forecast values of US$787 billion in 2031 and US$885 billion in 2032.

What all researchers agree on is that online car sales will grow in the next decade. This is due to a number of global market trends that are changing the way cars are bought and sold.

U.S. Online Car Rental Market Proves Resilient

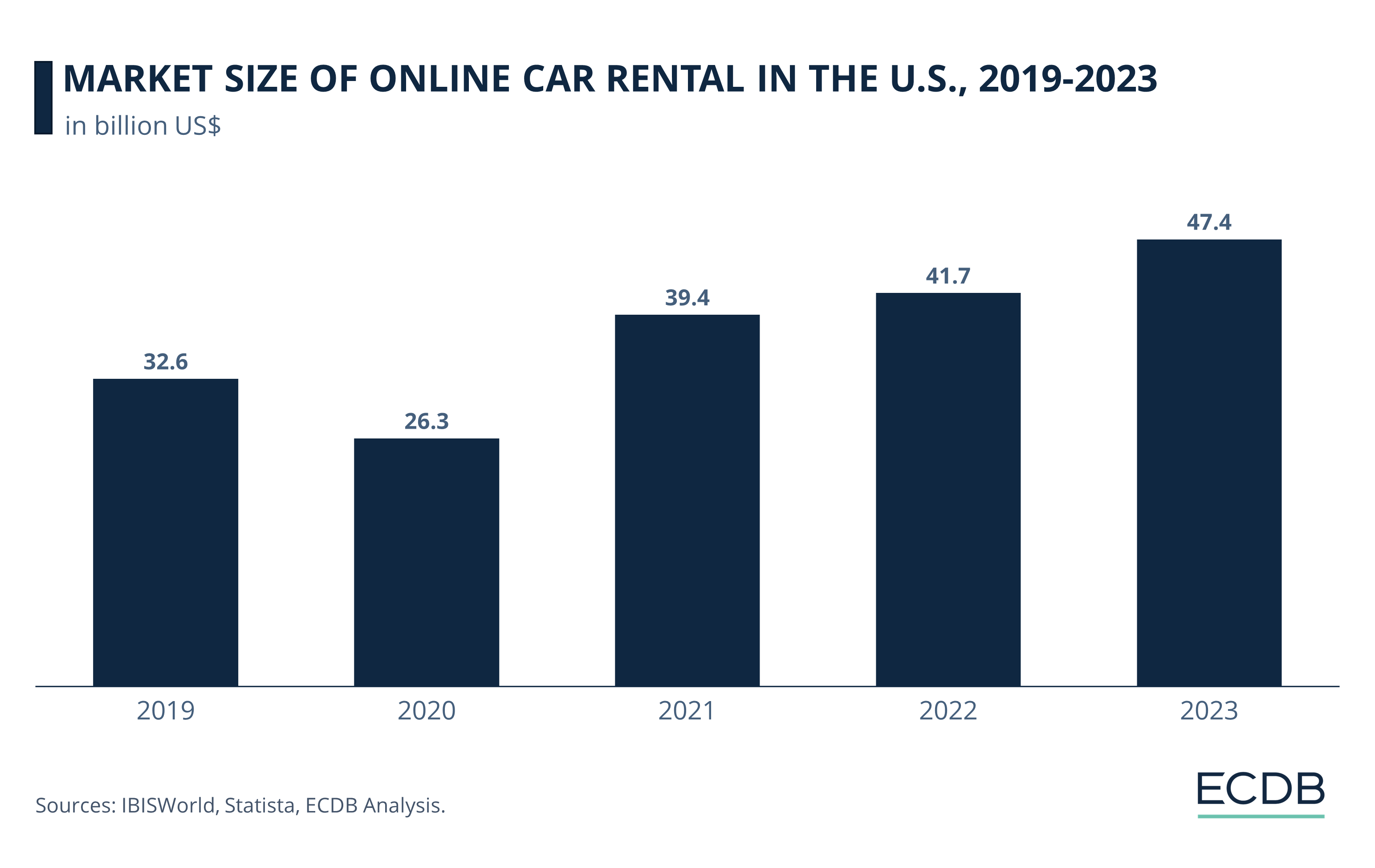

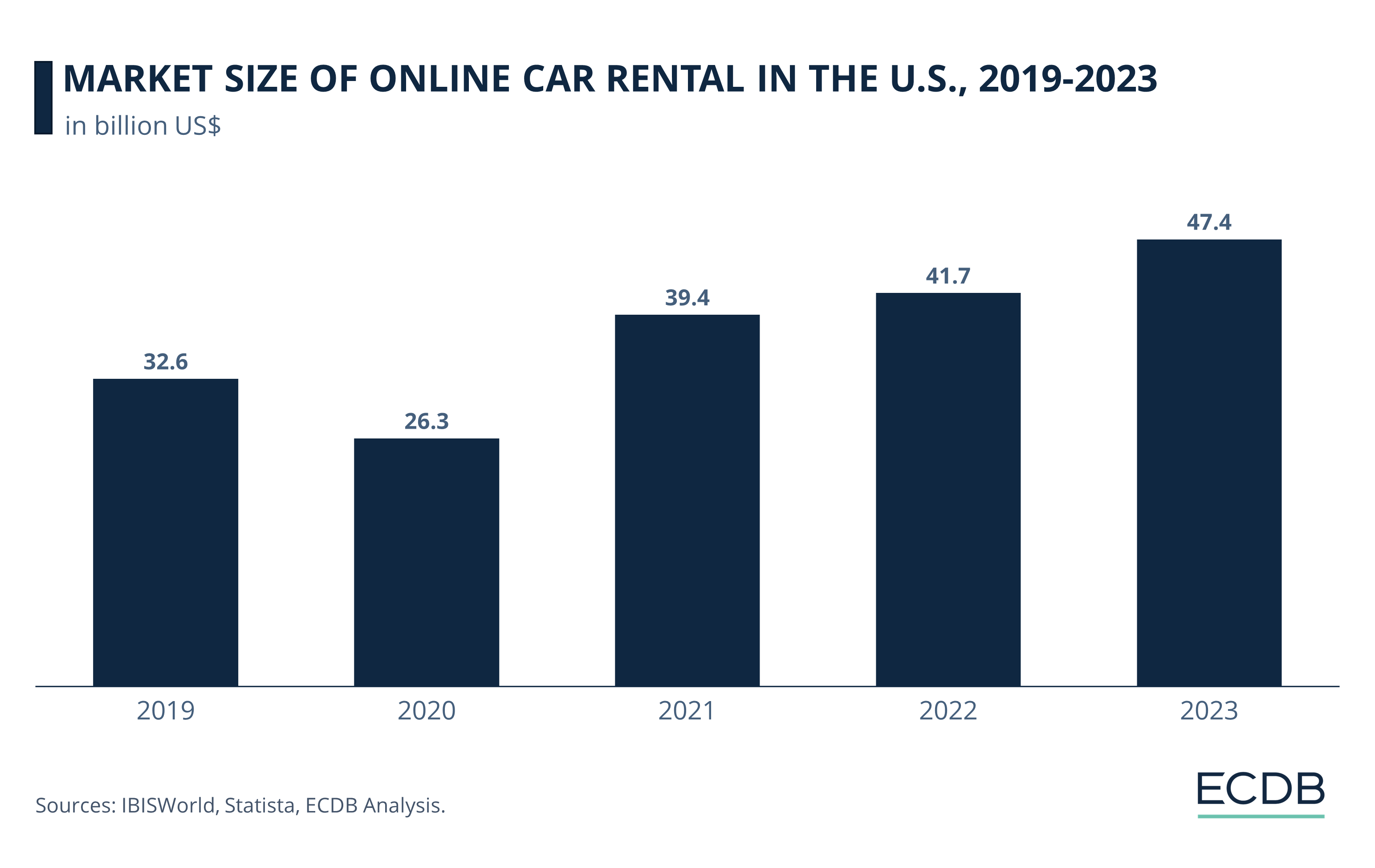

Car rental offers a low-commitment alternative to buying a car, freeing consumers from fixed monthly fees for insurance and gas. Whether for business or leisure, car rental continues to thrive. This is evidenced by the market's revenue growth following the lifting of pandemic restrictions. What's more, revenues have surpassed pre-pandemic levels:

While market revenues fell by 19.3% from 2019 to 2020, the following year, 2021, saw revenues increase by 49.8%. In absolute terms, online car rental services generated US$39.4 billion that year, up from US$26.3 billion in 2020. Subsequently, in 2022, revenues grew slightly, reaching US$41.7 billion.

This positive development over the past few years is particularly noteworthy given the competition that online car rental services face from car sharing and taxi/transportation apps.

However, there is another, more economical, alternative to buying a new car: Finding a pre-owned vehicle. And the used car market has also been positively impacted by the pandemic.

Online Used Car Market: Pandemic Pushed Sales

An economic branch never stands isolated in the market. There are always other economic and external factors that play into the development of said sector. For the online market of new and used cars, it is a mix of general and category-specific factors that influence online sales.

The Pandemic Positively Impacted Online Car Sales

Automotive sales have not been exempt from the pandemic increase in online purchases. As brick-and-mortar retailers closed and consumer purchasing power declined, more shoppers turned to online stores to compare prices, check product availability and circumvent shop closures.

In addition to labor shortages, the pandemic also led to shortages of semiconductors and raw materials. This hampered production capacity and increased the price of new vehicles entering the market, creating the need for alternative sales channels.

Online Share of U.S. Auto Sales to Reach 18% by 2025

The still growing popularity of personal automobiles is accelerating demand for pre-owned and electric vehicles (EVs). When buying a car from an offline retailer, buyers typically have to sift through large amounts of paperwork and wait months for their purchase to be finalized.

However, when buying a car online, the process is much simpler and faster. Buyers can easily compare offers from different sellers, and they can choose to have their car delivered within just a few days. In addition to being more convenient, buying a used car is also better for the environment.

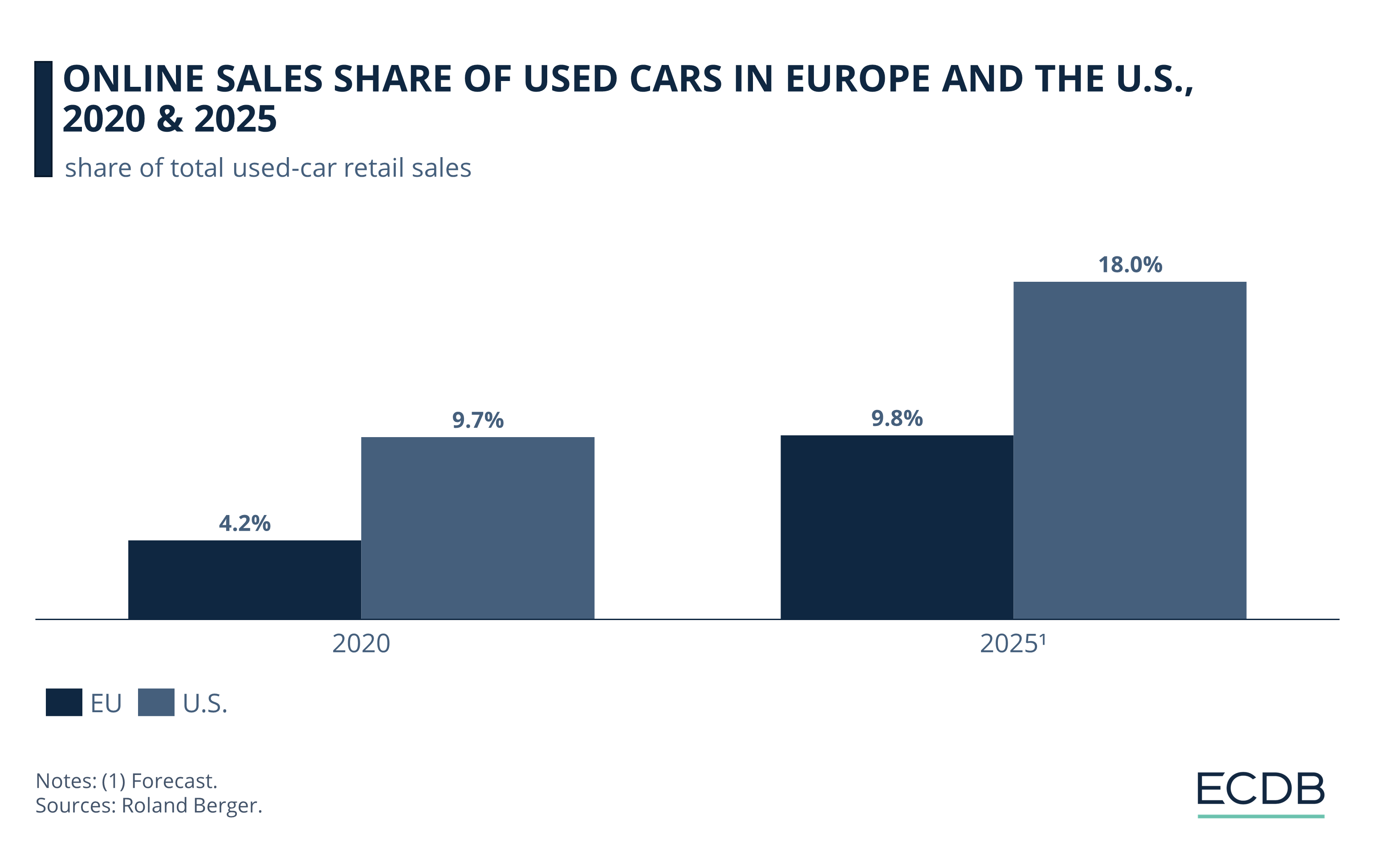

To better visualize the shift to online, we use data from the German consulting firm Roland Berger. The chart shows the past and projected development of the online share of used car sales in Europe and the United States.

At the start of the pandemic in 2020, the share of used cars being sold online in the U.S. was 9.7%. The European figure was 4.2%. The price of cars rose during the pandemic because car producers were unable to meet the demand for new cars due to shortages of materials and electronics. This led many people to sell their used cars at a profit.

Looking ahead to 2025, Roland Berger predicts continued growth in both markets. Building on its head start, the U.S. used car market is expected to reach an online share of 18%. In Europe, 9.8% of all used cars are forecast to be sold online by then.

In addition to external circumstances and consumer preferences, the constant emergence of new players in the online car buying market will likely contribute to the exceptional growth of online car sales.

This is especially true as auto manufacturers, also known as original equipment manufacturers (OEMs), have recognized the potential of the online market and are developing their own online strategies by offering B2C sales online. As the online car buying market is still considered to be in its infancy, let us examine the types of key players that are shaping this trend.

Online Car Marketplaces Dominate Retail

The online car buying market is highly diverse and competitive, resulting in market fragmentation as the most successful online automotive retailers tend to specialize in specific regions for their sales rather than selling globally.

Furthermore, there are different types of car retailers with a successful online strategy.

First are the online marketplaces that specialize in buying used cars from customers or offering on-site used car sales. Second is the distribution of brand new cars from OEMs, where the marketplace acts as an intermediary.

Online Marketplaces Redistributing Used Cars

Carvana (U.S.)

Fair (U.S.)

Vroom (U.S.)

Wirkaufendeinauto (Germany)

Motorway (UK)

Cinch (UK)

Cazoo (UK)

Online Marketplaces Selling Used and New Vehicles

Asbury Automotive (U.S.)

Autonation (U.S.)

Cargurus (U.S.)

Carsdirect (U.S.)

Cars.com (U.S.)

Cox Automotive (Europe & UK)

Group 1 Automotive (U.S. & UK)

Hendrick Automotive (U.S.)

Lithia Motors (U.S.)

Truecar (U.S.)

An important feature of online car marketplaces is that they are not only focused on selling vehicles, but also tend to offer additional services such as selling auto parts, as well as replacement and collision repair. In most cases, online marketplaces offer financing and insurance services, which is important for consumers who want to ensure financial liquidity and property protection.

Digital Sale Adoption Among OEMs Is Less Advanced

While online automotive marketplaces are popping up, traditional OEMs are lagging behind in their online strategies. Some companies, such as VW and Daimler, have already announced their move to online sales, but online marketplaces tend to have a head start through experience, technological advancements such as the use of big data and a comprehensive online platform, and, most importantly, by addressing consumer needs and preferences.

Online Car Purchases: Convenient but Risky

A key aspect driving online sales is convenience.

Brick-and-mortar auto dealerships are often linked to high costs, mistrust due to a lack of transparency in the purchasing process, and fewer choices compared to online marketplaces. Online, however, consumers can easily draw comparisons between a wide range of offers across platforms in real time and trade in old vehicles for the next.

Moreover, customers can receive their online orders directly to their homes, rather than having to travel to a manufacturing facility or dealership to pick up their purchase. Digital payment options and an integrated payment plan, including the option of insurance, further benefit consumers by managing their assets with less hassle.

Online Car Shopping: Consumers Prefer In-Person Demo Drives

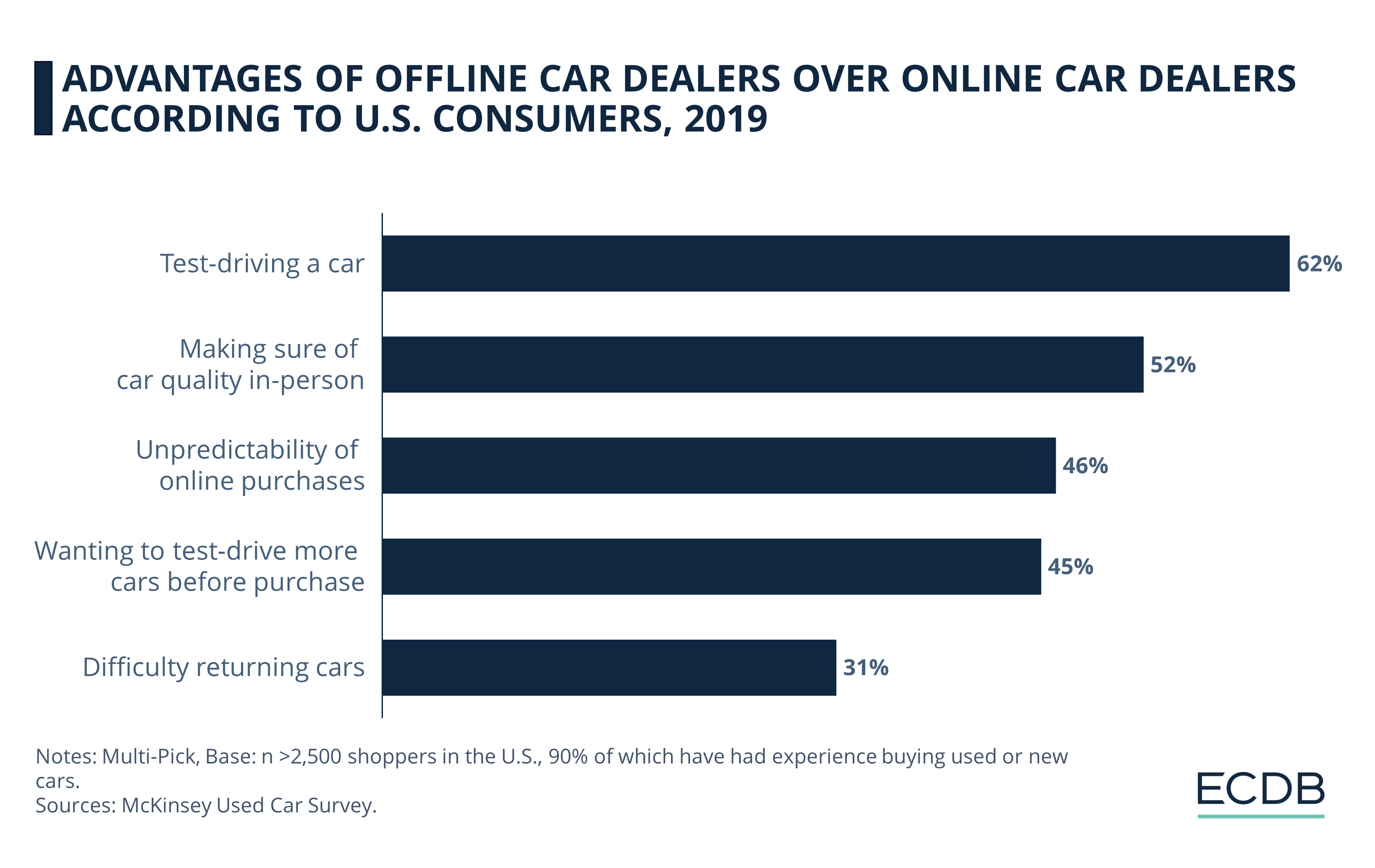

Despite all benefits, the online retail model lacks some features that are important to consumers and cannot easily be replaced. The chart below shows the advantages that offline car dealerships have over their online counterparts, according to the 2019 McKinsey Used Car Survey.

A big advantage of offline dealerships is that consumers can test drive vehicles. Despite the advent of AR and VR technology, the authentic feel of trying out a car for the first time in real traffic is pretty much irreplaceable. 62% of U.S. shoppers agree.

Online Shoppers: Lack of Personal Quality Control Is a Problem

Another drawback of online-only interactions is the lack of interpersonal negotiation and quality control, especially when shopping a big-ticket item. More than half of U.S. consumers (52%) would like to verify the quality of the automobile in person.

Following on from this, 46% of survey respondents cite the unpredictability of online purchases as a reason for sticking with offline dealerships. Close behind are 45% of users who want to test drive multiple vehicles before deciding which one to purchase.

Finally, 31% of users say that it would be difficult to return cars purchased online, something that would not be as much of an issue if they were able to take a road test and ensure quality in person.

These findings tell us that online retailers who want to establish their online car sales business need to find ways to build trust in the online platform, such as offering warranties and the option for in-person quality checks or certifications by affiliate professionals.

Online Car Rental: Revenues to Exceed US$100 Billion by 2030

Renting a car is a low-commitment alternative to purchasing one. With growing awareness and trust in online platforms, revenues from online car rental in the U.S. have grown steadily since 2021:

While the pandemic caused a slump in U.S. online car rental revenues, they have rebounded since the restrictions were lifted. IBISWorld calculated revenues of US$39.4 billion in 2021 and US$41.7 billion in 2022, and our ECDB analysis expects revenues to have increased further to US$47.4 billion by 2023.

The growth in online revenues and the online share is driven by easier access to online rental services, a seamless rental process, and an increasing number of providers for consumers to choose from.

In the future, convenience is expected to improve:

The Future of the Online Car Buying Market

As noted in the first section of this article, market research firms agree on the immense growth potential of the online car buying market.

Multichannel Combines the Best of Both Worlds

Despite the growth of online car sales, offline retailers will not disappear completely, as some advantages of buying a car the traditional way prevail. Rather, the most successful automotive retailers will adopt a multichannel strategy.

This means that consumers will be able to search for the car they want online and complete much of the purchasing process online, but visit an affiliated local dealer to try out the car for a demo ride.

Online Vehicle Subscriptions Are Gaining Popularity

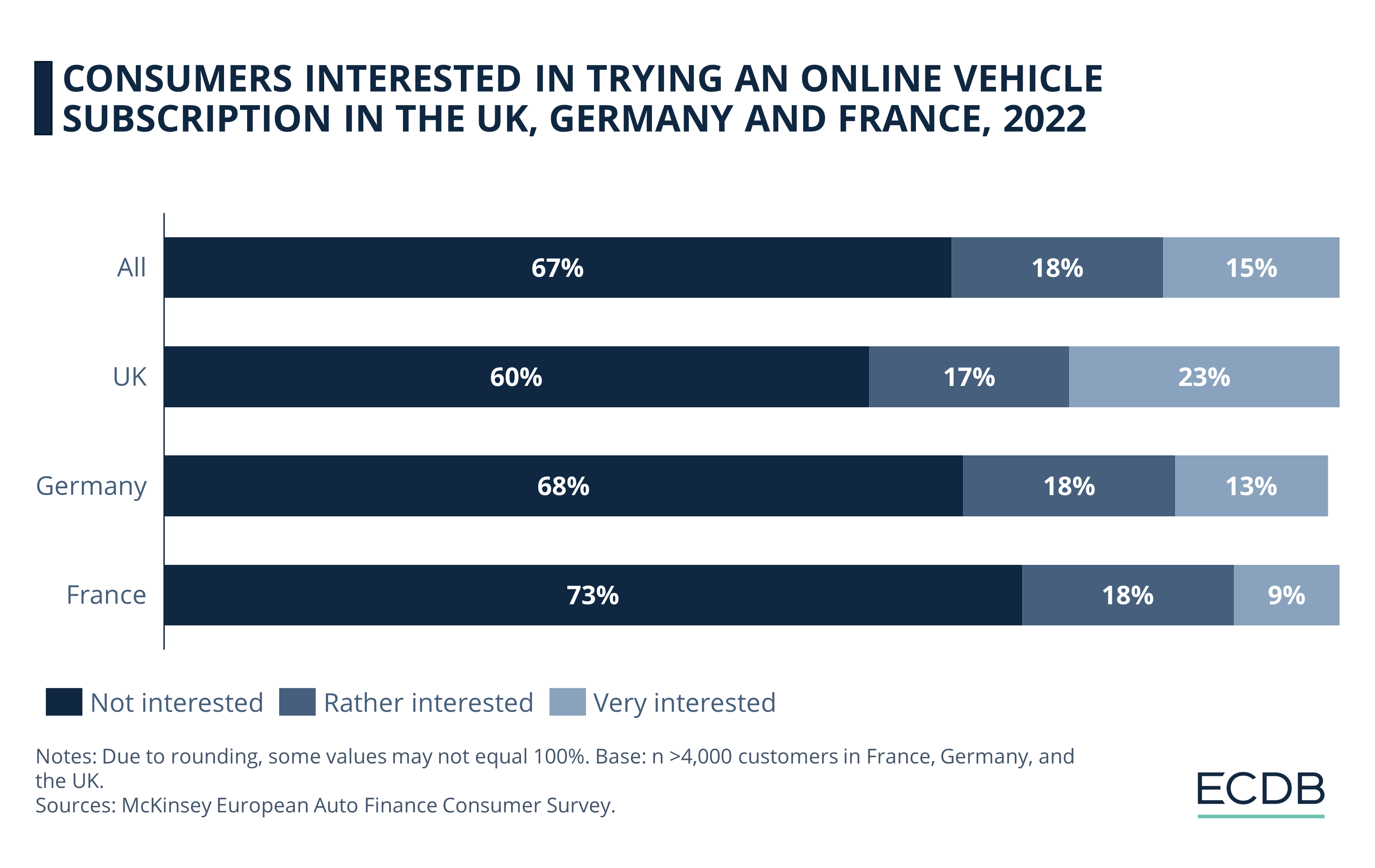

Another important development is the emergence of online car subscriptions. This relatively new phenomenon brings increased convenience and flexibility, as users can choose to renew or cancel their subscription or select a new car model each month. Vehicles are available within minutes of ordering and typically offer a short-term commitment, unlike car ownership.

Providers like Quiklyz in India are specializing in selling online car subscriptions to consumers, meeting the growing demand for transportation options that are personalized and accessible to users.

European consumers are not opposed to the concept either: According to the 2022 McKinsey European Auto Finance Consumer Survey, UK consumers are the most inclined to try out an auto subscription, with 40% of respondents saying they are interested.

Consumers in Germany follow with 31% interested in a car subscription, while users in France lag behind at 27%.

Finally, the ongoing trend toward electric vehicle adoption, fueled by both government efforts and consumer preferences, is likely to lead to increased demand for online EV sales. As users are given the opportunity to select the features of their new car on a store website, including purchasing directly from OEMs, this trend is expected to shape online car sales over the coming decade.

Online Car Sales: Closing Thoughts

The online car buying market is thriving due to a convergence of factors including the aftermath of the pandemic, technological advances, and changing consumer tastes. The result is a competitive online car market influenced by emerging trends and platforms.

One trend to watch is certainly online car subscriptions, which are responding to growing consumer preferences that are shifting away from ownership and toward more communal transportation solutions.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Valentine’s Day Drives eCommerce Revenues for Flowers & Gifts

Valentine’s Day Drives eCommerce Revenues for Flowers & Gifts

Deep Dive

Shopify Is the Most Used Shop Software Globally, But Magento Dominates in Europe

Shopify Is the Most Used Shop Software Globally, But Magento Dominates in Europe

Deep Dive

Why the Online Pharmacy Trend Has Continued Beyond the Pandemic

Why the Online Pharmacy Trend Has Continued Beyond the Pandemic

Deep Dive

Why eCommerce and Luxury Sales Are Tough to Unite

Why eCommerce and Luxury Sales Are Tough to Unite

Deep Dive

What Countries Are Driving Revenues in the Global Online Smartphones Market?

What Countries Are Driving Revenues in the Global Online Smartphones Market?

Back to main topics