eCommerce: Quick Commerce

Top Quick Commerce Providers in Germany 2023: Flink, Gorillas & More

Dive into the findings from the 2023 ECDB & Statista survey in Germany, uncovering trends in quick commerce, consumer habits, and how metrics such as age and gender play a role.

Article by Cihan Uzunoglu | January 16, 2024Download

Coming soon

Share

Top Quick Commerce Providers in Germany 2023:

Key Insights

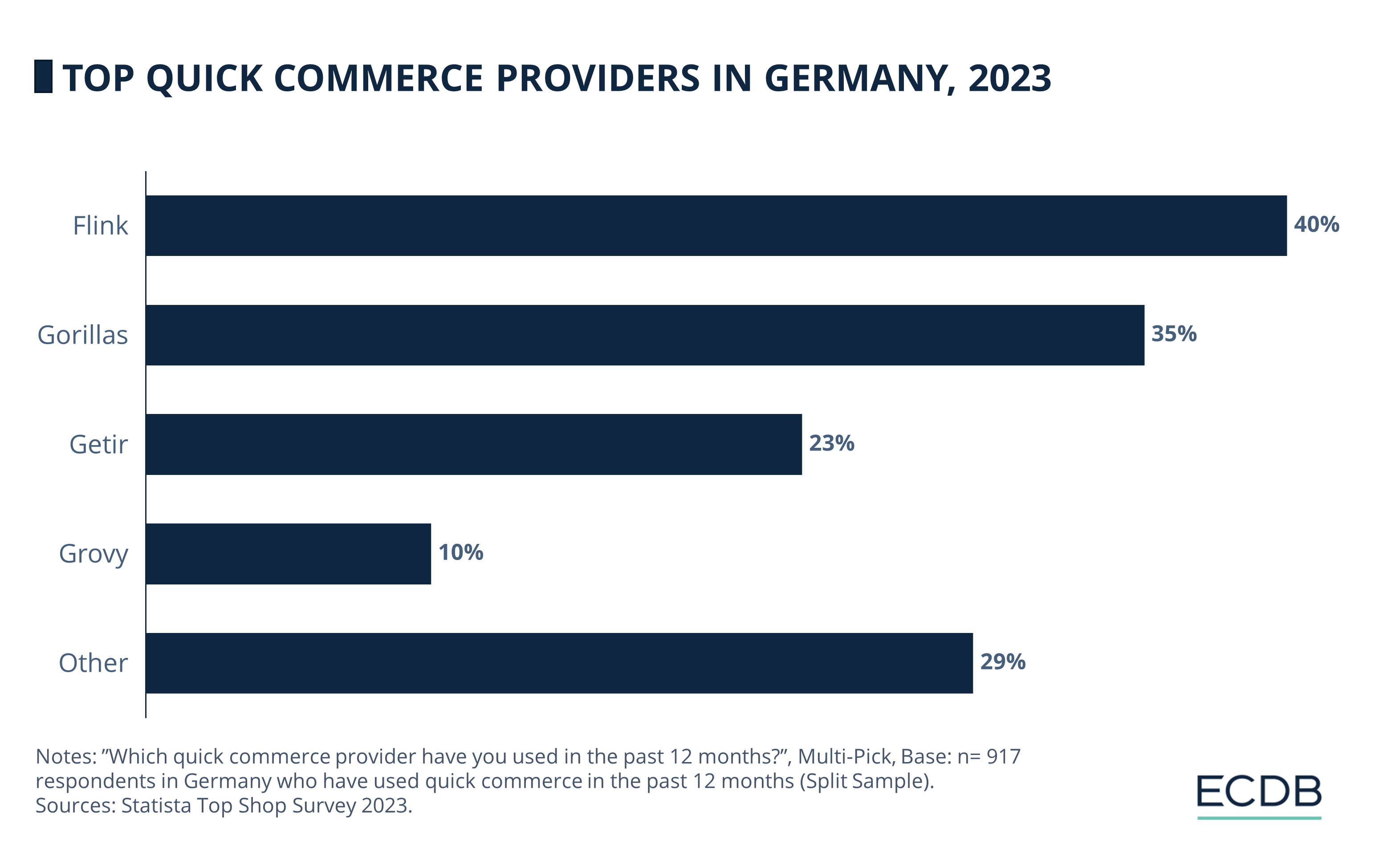

Top Providers: Flink and Gorillas emerge as the top quick commerce providers in Germany, leading the market with usage rates of 40% and 35%, respectively.

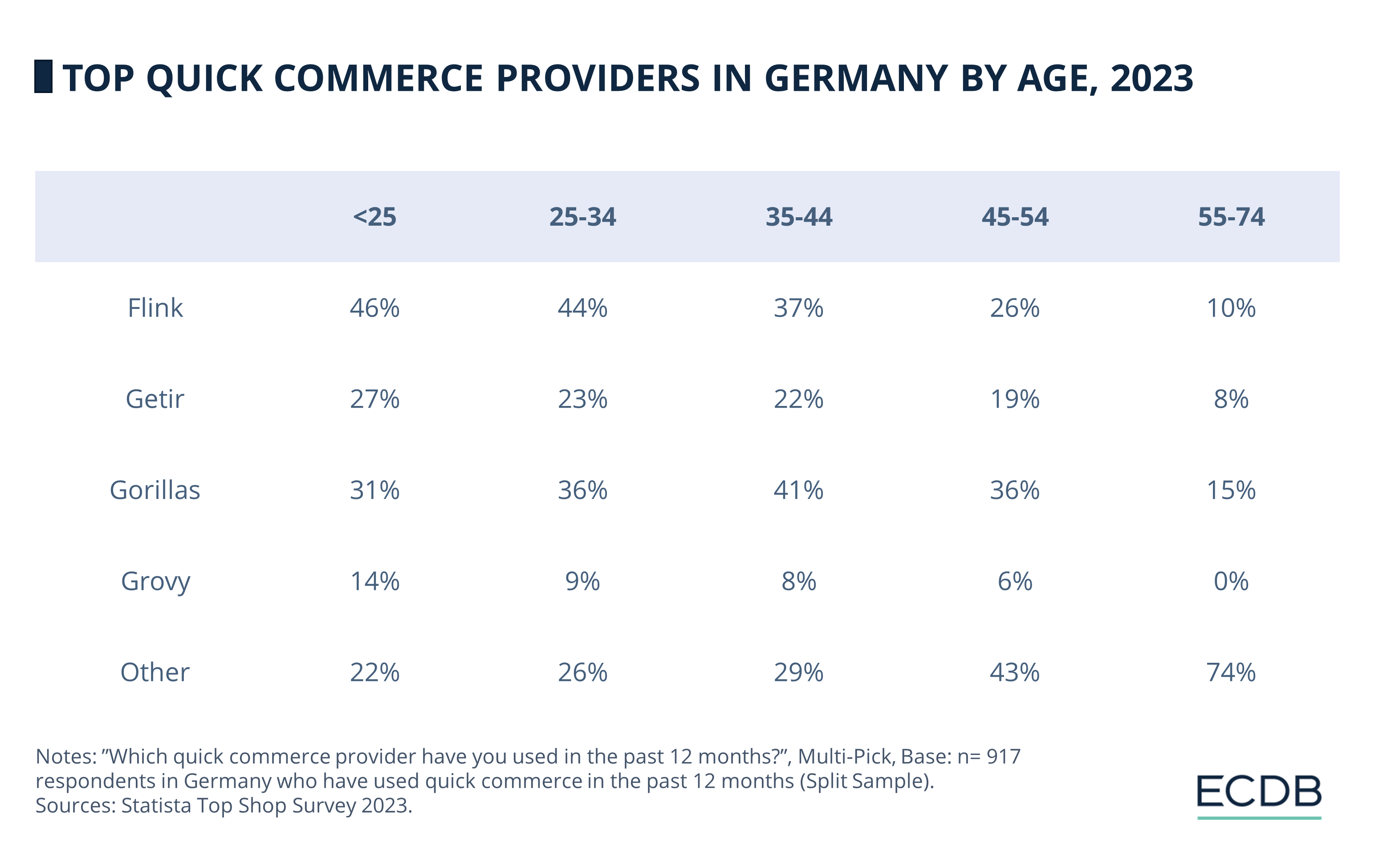

Gender & Age: In Germany's quick commerce sector, Getir is favored more by males, Gorillas leads among 35-44 year-olds, and the preference for "other" providers increases with age.

Household Factors: Household income and size significantly influence quick commerce provider choice in Germany, with Flink favored by lower and higher-income groups, Gorillas preferred by mid-income ranges, and "other" providers more popular among 2-person households.

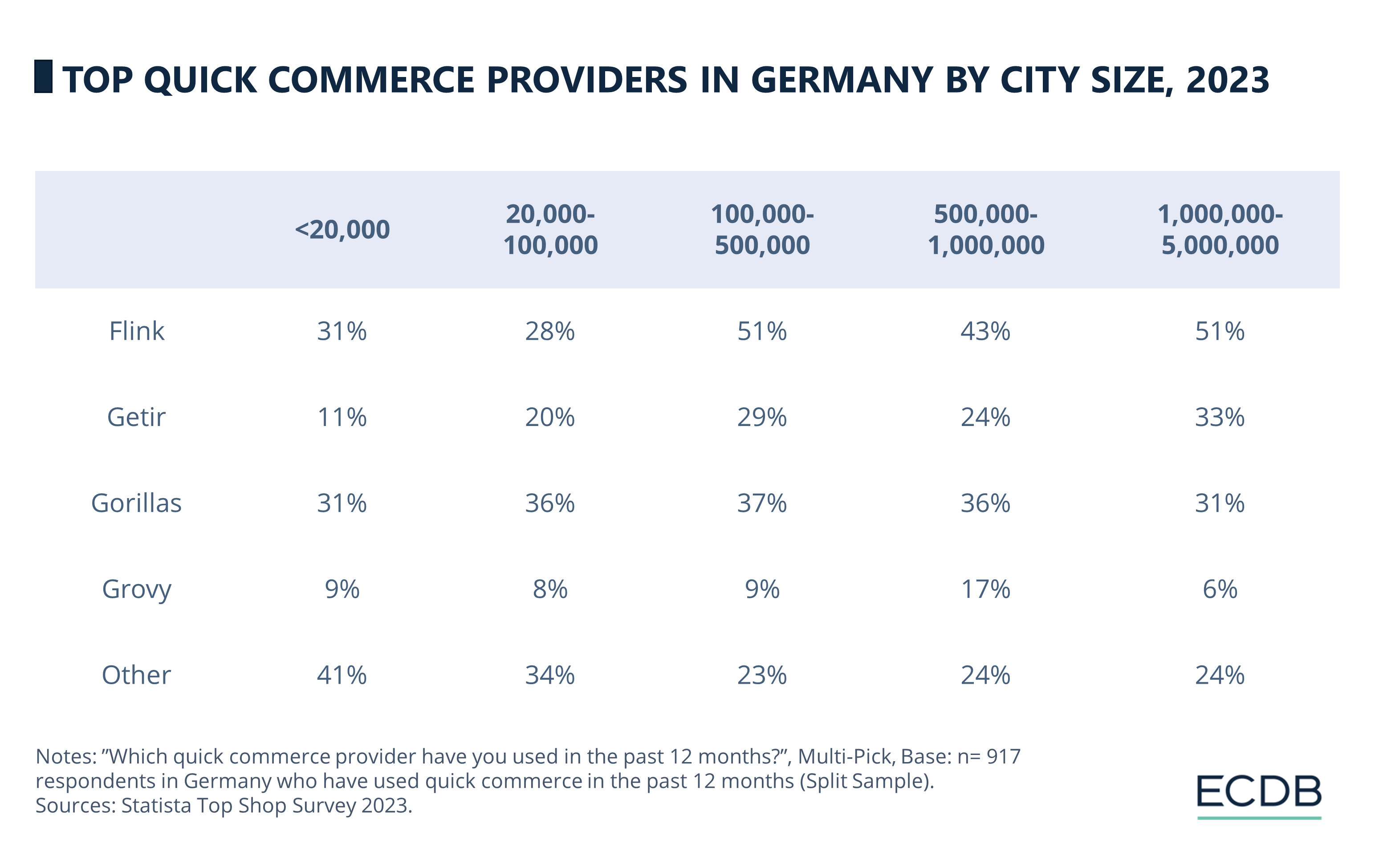

City Size: In German cities with over 100,000 residents, Flink is the leading quick commerce provider, while smaller cities prefer "other" providers, and Gorillas shows high penetration in cities with 20,000 to 1,000,000 inhabitants.

ECDB and Statista conducted a survey in Germany to gain valuable insights into consumer shopping preferences and behaviors related to quick commerce. The results of the survey provide critical information for businesses seeking to understand consumer perceptions and usage patterns in this rapidly evolving market.

Who dominates Germany's quick commerce scene? How do metrics like age, gender, and income play into this? Our analysis below dives into the survey results to unveil the answers to these questions.

Quick Commerce Providers in Germany:

Flink on Top

According to the findings of the survey, Flink and Gorillas are the most used providers among quick commerce users in Germany, with usage rates of 40% and 35% respectively.

They are followed by the Turkish start-up Getir with 23% and Frankfurt-based Grovy with 10%, while nearly one third of users stated that they use "other" providers.

Getir is More Popular Among Males

When it comes to quick commerce provider preference by gender, Flink, Gorillas, and Grovy seem to have a balanced usage distribution between male and female users in Germany.

In addition to this, the data shows that Getir is more popular among male users, while female users are more likely to favor “other” providers.

Gorillas: Most Popular for Users Aged 35–44

In comparison to other age groups, findings reveal that quick commerce shoppers younger than 25 are more likely to buy through Flink, Getir, and Grovy, while Gorillas seems to be the most popular in the 35-44 age group.

Additionally, as we move from the “<25” age group to “55-74”, share of shoppers using “other” providers increases from just under one quarter (22%) to almost three quarters (74%), indicating that the likelihood of choosing “other” providers is directly proportional to age.

Top Quick Commerce Providers in Germany: Household Factor

In terms of annual disposable net household income, survey findings point out that quick commerce users with an income of less than €20,000 prefer to shop with "other" quick commerce providers.

Furthermore, Flink appears to be strong among households with an income of less than €15,000 and more than €30,000, while those with an income between €20,000 and €50,000 prefer to use Gorillas.

With respect to household size, 2-person households are the most likely to use "other" providers, compared to other households. All providers explicitly named in the survey appear to be the strongest in households with 3 persons – with the exception of Grovy being slightly more popular in households with 4 persons and more.

Learn More About ECDB

Half of Users in Big Cities Prefer Flink

By its very nature, quick commerce is intrinsically tied to urban areas of different sizes. So, it is not surprising that different providers come to the forefront when we talk about areas with different populations.

Looking at the data, we see that "other" providers are particularly strong in cities with less than 100,000 inhabitants. The absence of big players in these smaller areas can be linked to local competition, lack of infrastructure, or limited market size.

In cities with more than 100,000 inhabitants, however, Flink is the most used provider. Further analysis of the findings indicate that Gorillas has the highest penetration in cities with between 20,000 and 1,000,000 inhabitants, in comparison to other city sizes.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics