eCommerce: Cross-Border

eCommerce in Europe: Top Cross Border Countries & Consumer Trends

Where do Europeans turn when domestic options fall short? Learn about eCommerce in Europe, top cross-border shopping destinations and consumer trends.

Article by Cihan Uzunoglu | August 07, 2024Download

Coming soon

Share

Cross-Border eCommerce in Europe: Key Insights

China Dominates: China is the leading destination for European cross-border online shopping, with the U.S. coming in second.

Diverse Interests: Europeans shop across various categories online, with clothing and electronics being the most popular.

Operational Hurdles: More than half of European companies encounter difficulties in cross-border eCommerce due to customs regulations and Harmonized System (HS) codes.

The EU Duality: The European Union supports cross-border eCommerce through regulatory alignment, but faces issues like Brexit and adapting to new trade codes.

With today's technology, ordering a product from China and having it delivered quickly is easy. In the past, this would have taken months, but that's no longer the case.

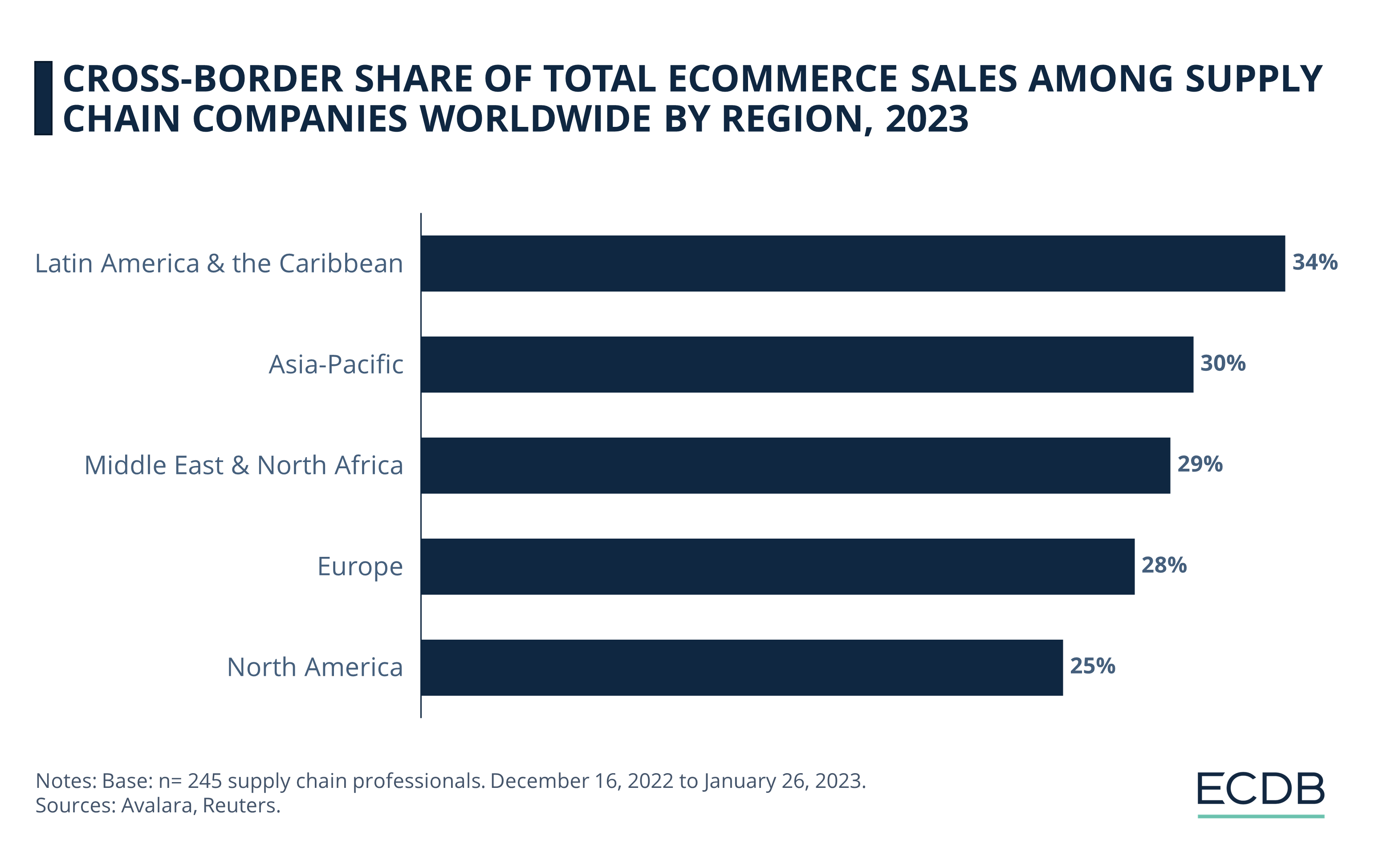

How significant is cross-border eCommerce in Europe? It accounts for 28% of sales in Europe. Over half (55%) of Europeans already shop cross-border, and 20% plan to increase their cross-border purchases in the next year.

China is a dominant force in cross-border eCommerce, but is it the same for all major European markets? Mostly, but other players and factors are also important to consider.

eCommerce in Europe:

Top Cross Border Countries

According the report “European Online Shopper Survey” by DHL, 45% of European online shoppers have bought items from China, making it the leading choice for shopping outside of Europe, followed by the U.S. at 28%.

The interest in shopping from international retailers differs greatly across Europe. For example, 61% of shoppers from Spain frequently make purchases from abroad, in contrast to 31% from the UK. Despite this, the UK emerges as a favored location for shoppers from other European countries, with 17% choosing to buy from British stores.

Europeans Shopping Global: China on Top

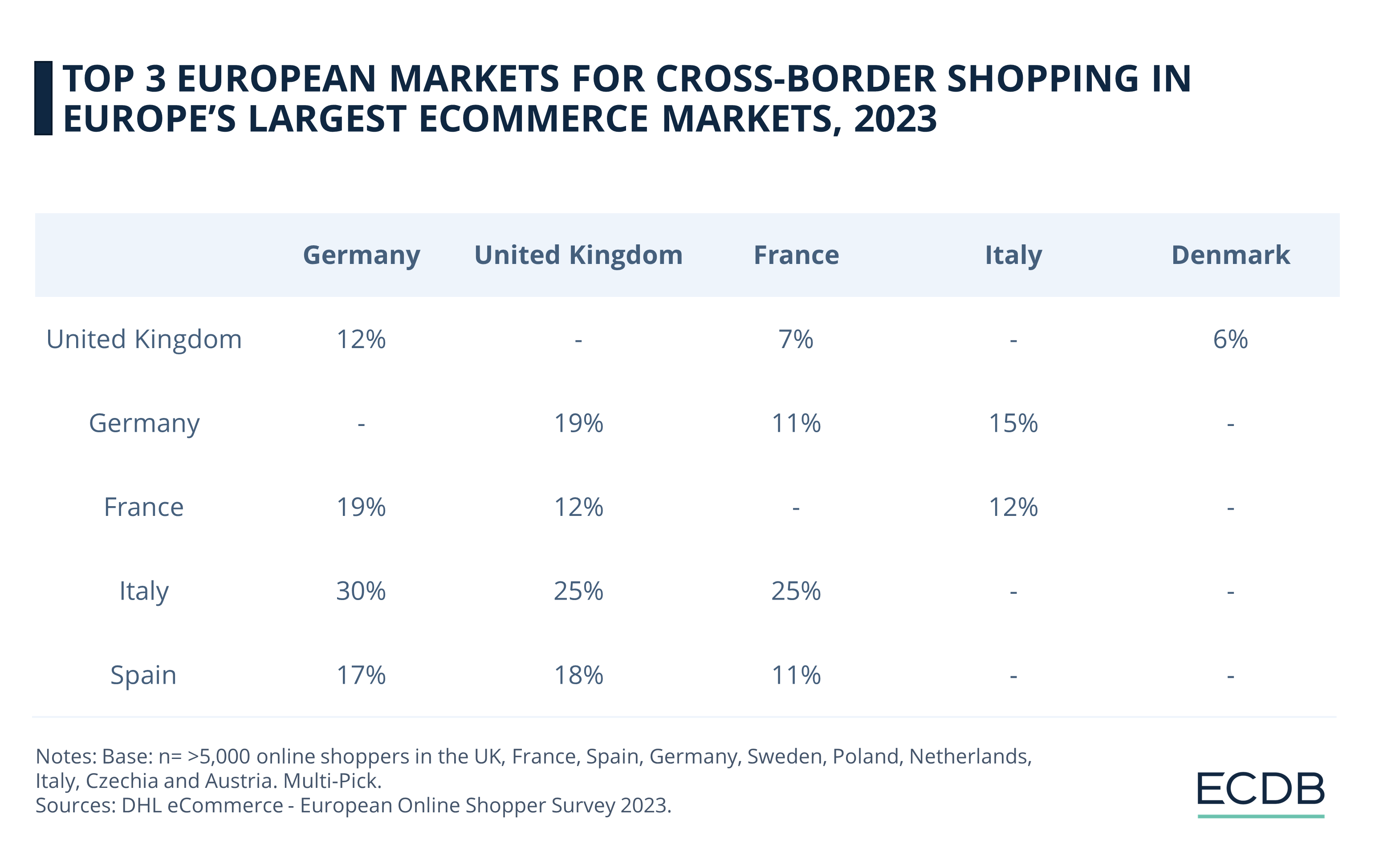

What are the top choices for cross-border shopping among Europe's leading eCommerce markets? Let's take a look:

In the UK, 41% of cross-border online shopping comes from the U.S. and 40% from China. With 12%, Germany rounds out the top 3 markets British online shoppers buy cross-border from.

For Germany, 42% of international online shopping takes place with China, and 31% is with the U.S. German shoppers also purchase products from the UK, making up 19% of their cross-border purchases.

In France, almost half (48%) of the shopping from other countries is with China, and 21% is with the U.S. Germany is also a popular choice for the French, with almost a fifth (19%) of cross-border shopping coming from the country.

For Italian shoppers, top 3 markets they shop cross-border from are China (40%), the United States (31%), and Germany (30%), showing a fairly even distribution among these three.

Spain, on the other hand, has the highest percentage for China, with the majority (56%) of their international online shopping coming from there. The United States follows with 21%, while the UK is at 18%.

When we focus on Europe only and take other countries out of the equation, which are essentially China and the United States, results provide valuable insights.

For your information: We regularly update our rankings with the latest data from our models, providing valuable insights to help improve your company. Which stores and companies are leading eCommerce? Which categories are driving bestsellers and high sales? Find out for yourself on our rankings for companies, stores, and marketplaces. Stay a step ahead of the market with ECDB.

Europeans Shopping European:

Germany vs. the UK

In the UK, the biggest eCommerce market in Europe, 12% of European cross-border online shopping is with Germany, and 7% is with France. Denmark also appears as a choice for UK shoppers, making up 6% of their cross-border purchases within Europe.

As for Germany, the UK is a significant shopping destination, accounting for 19% of their cross-border online shopping in the continent. Italy and France are also popular, with 15% and 11% of purchases, respectively.

French shoppers favor Germany the most for their shopping from other European countries, with 19% of their cross-border purchases. The UK and Italy are also popular, each making up 12% of France's cross-border shopping.

Italian shoppers show a diverse interest, with 30% of their cross-border online shopping coming from Germany and 25% each from the UK and France. Albeit at a lower level, Spain also shows a balanced interest in European shopping, with 18% of cross-border purchases from the UK, 17% from Germany, and 11% from France.

Top Cross-Border Product Categories

in Europe

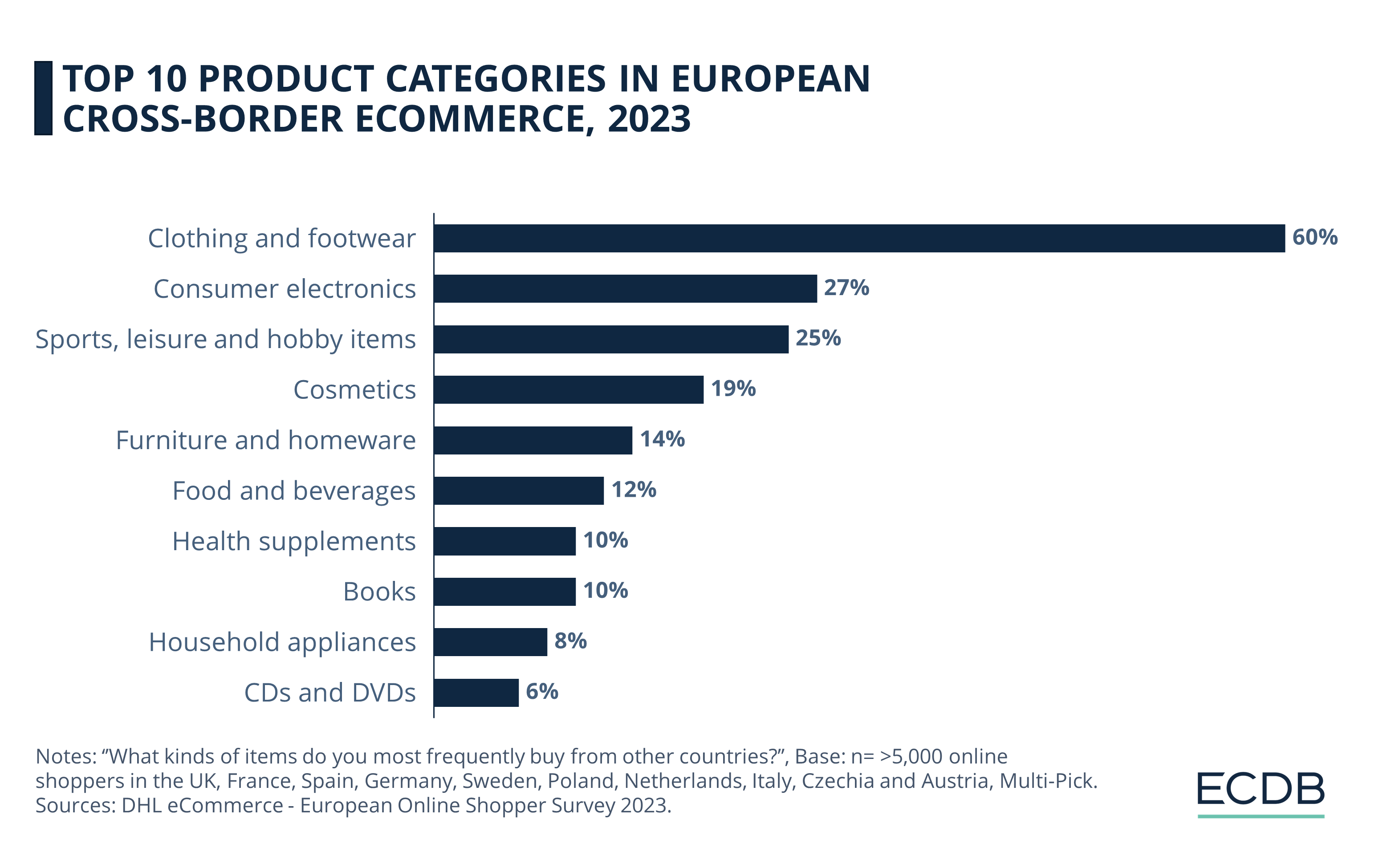

The top 10 product categories for cross-border online shopping in Europe show a wide range of interests:

60% of shoppers buy clothing and footwear from other countries.

27% purchase consumer electronics; 25% are interested in sports, leisure, and hobby items.

19% buy cosmetics; 14% buy furniture and homeware.

12% shop for food and beverages; 10% for health supplements and books.

CDs and DVDs account for 6% of cross-border purchases.

Role of End-to-End Tracking

When we buy a product from another country, we naturally want to know if the seller has shipped it, where it is in transit, and when it will arrive. An essential part of the supply chain on the consumer side is end-to-end tracking, and it plays a big role in European cross-border shopping.

The DHL study shows that nearly half of the shoppers, 49%, find tracking most important for items costing over €100. 41% of shoppers, on the other hand, value tracking for items they buy cross-border and for items purchased as gifts. When it comes to buying from local retailers, 34% of shoppers find tracking important. Lastly, for items costing under €100, 29% of shoppers think tracking is important.

![]()

Zooming in on the European countries included in DHL’s study, we see that end-to-end tracking of items over €100 comes on top in each of these markets. The UK has the largest share of consumers (55%) agreeing with the second most popular item type in the survey, which is items purchased from retailers in another country, while Sweden is at the top for items purchased as gifts, with 48% of Swedes agreeing.

France and Poland share the top spot with 38% of consumers in each country agreeing that end-to-end tracking is a must-have when it comes to items purchased from retailers in their countries. For the least popular item type, items under €100, it is Sweden again with 40%.

Challenges in European

Cross-Border eCommerce

Cross-border eCommerce in Europe is facing a series of challenges that impact the efficiency and cost-effectiveness of operations for European organizations. As per a valuable study conducted in late 2022 to early 2023 by Avalara, over half (55%) of these organizations report difficulties operating in the cross-border trade environment, highlighting the complexity of international eCommerce.

The main challenges identified include compliance with customs regulations and HS codes – unique identifiers for products traded internationally, reported by 41% of European organizations. This is closely followed by the issue of shipments being delayed in customs, affecting 38% of respondents. Additionally, the cost of returns (32%), added supply chain costs (29%), and the added costs of tariffs and duties (28%) are significant hurdles that complicate the process of sending eCommerce goods across borders.

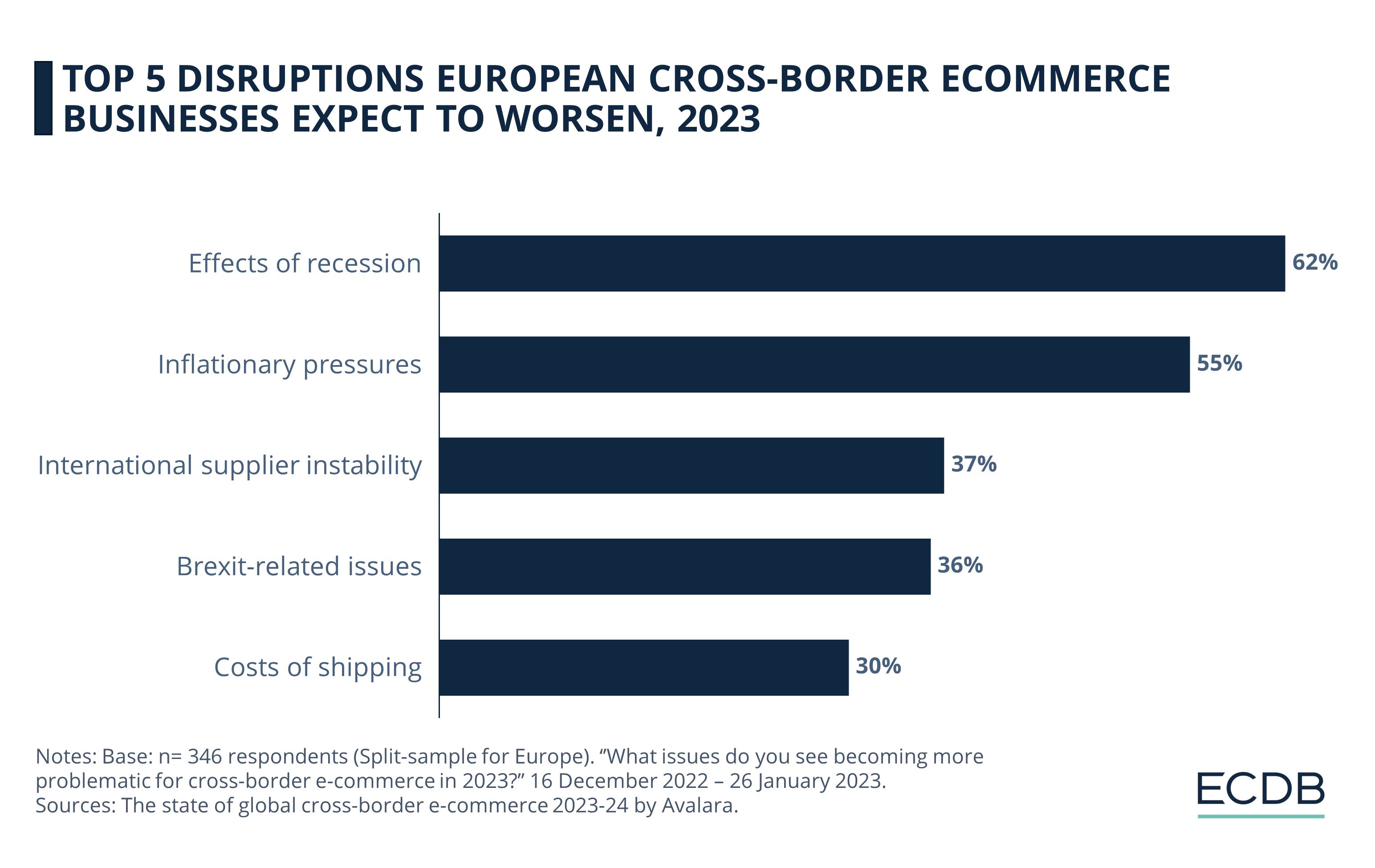

In the same Avalara study, European organizations expected several disruptions to worsen over the course of the last year:

The effects of recession (62%) and inflationary pressures (55%) top the list.

Other concerns included instability of international suppliers (37%), Brexit-related issues (36%), and the costs of shipping (30%).

A 2023 survey conducted by Reuters Events revealed that 91% of Logistics Service Providers (LSPs) planned to pass on increased costs to their customers in the next 12 months, with a quarter intending for these cost pass-throughs to be significant.

On a more positive note, technology is playing a key role in addressing some of the challenges of cross-border eCommerce. While a third of European organizations cited delays due to incorrect classification and documentation, 87% of these companies use technology tools to process or file trade documentation and 80% automate invoicing for duties and taxes.

Lasting Effects of COVID-19

The lasting effects of COVID-19 also contribute to the challenges, particularly in terms of securing reliable, competitively priced ocean freight. The pandemic's impact is still felt in regions like Asia-Pacific, the Middle East, and Africa, where securing shipping at competitive rates has been a major hurdle.

This contrasts with Europe and North America, where COVID-19 is seen as a minor risk at this point by a little over 10% of respondents. However, the prioritization of containers for routes to these regions from Asia-Pacific ports, often congested or backlogged, continues to affect shipping dynamics and costs among European businesses who deal with cross-border eCommerce activities.

The situation is further complicated by Houthi attacks in the Red Sea, affecting cargo prices and delivery times by forcing ships to reroute, adding potential weeks to delivery times.

European Union: Blessing & Curse

for Cross-Border eCommerce

The European Union stands as both a pillar of support and a point of contention for cross-border eCommerce within Europe. Its Customs Union has notably eased the financial burdens of international eCommerce by minimizing the costs associated with tariffs, duties, and added supply chain expenses.

According to the Avalara study, European businesses experience significantly fewer issues related to these costs compared to their counterparts in other regions. For instance, only 29% of European respondents identified additional supply chain costs from external shipping as problematic, a stark contrast to the 44% in North and South America. Similarly, while just 28% of Europeans cited tariffs and duties as a concern, this figure jumps to 45% in North America.

The de minimis rule exempts low-value international shipments from duties, simplifying and reducing costs for cross-border eCommerce. It impacts 69% of worldwide shipments, with 80% of consumer purchases below thresholds in Europe, going as low as €150 for customs duties in many EU countries.

This ease of trade is largely attributed to the market integration and regulatory alignment within Europe, which has fostered more favorable trading conditions for companies and diminished cultural and language barriers.

However, the scenario is not without its challenges, especially when considering Brexit's impact on cross-border eCommerce.

Brexit as an Obstacle

The Avalara study revealed that 36% of European respondents viewed Brexit as a significant hurdle for the year 2023. Despite the referendum occurring in 2016, Brexit continues to present a complex obstacle for businesses across the UK and mainland Europe, due to the introduction of new trading requirements and adjustments over the last couple of years.

The repercussions of Brexit are profound, with a 2022 survey by Avalara and the Centre for Economic and Business Research highlighting its economic impact. UK businesses faced approximately £47.6 billion (US$60.5 billion) in lost revenue due to the complexities of tax compliance for exporters to Europe.

Additionally, the fear of fines and compliance challenges has led three out of five UK exporters to retract plans to sell in certain European countries, signaling ongoing difficulties that European businesses must navigate in 2023 and beyond.

Struggles with HS Codes

One of the more specific challenges post-Brexit relates to compliance with HS codes. European respondents to the Avalara study reported a significant struggle with HS codes, with 43% finding them challenging, a rate second only to the Asia-Pacific region.

This struggle is likely due to HS codes being a relatively new requirement for trade between the EU and UK. Previously, within the EU Customs Union, commodity codes were not required, leading to a lack of familiarity and increased difficulties in applying these codes for external trade. The imposition of HS code declarations for trade between the UK and the Customs Union, starting from 2021, has accentuated this friction, marking a period of adjustment for European businesses.

Cross-Border eCommerce in Europe:

Closing Thoughts

Despite hurdles like Brexit and HS code compliance, there's a hopeful outlook for the future of cross-border eCommerce in Europe.

With 41% of European organizations optimistic about an improved cross-border eCommerce environment and 73% anticipating market growth over the next years, the future appears promising. As Europe continues to adapt and evolve, these positive expectations suggest a path toward a more integrated and flourishing cross-border eCommerce ecosystem.

Sources: Avalara: 1, 2, Broekman Logistics, DHL, ECDB, Reuters, Statista

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Back to main topics