eCommerce: Temu Customer Retention

Temu is Attracting Less Customers This Year

Having entered the market not too long ago, Temu has quickly become one of the most talked about players. But how does it fare when it comes to customer retention?

Article by Cihan Uzunoglu | September 18, 2024Download

Coming soon

Share

Temu Customer Retention: Key Insights

Temu's Customer Drop-Off: Temu experienced a 25% decline in customer activity by August 2024, marking a slowdown in its sales growth despite a strong start and heavy advertising, including a Super Bowl ad.

Shein and TikTok Shop Growth: In contrast, Shein and TikTok Shop continued to expand throughout 2024, with TikTok Shop capitalizing on summer sales events, while Temu faces increasing competition and challenges in retaining its customers.

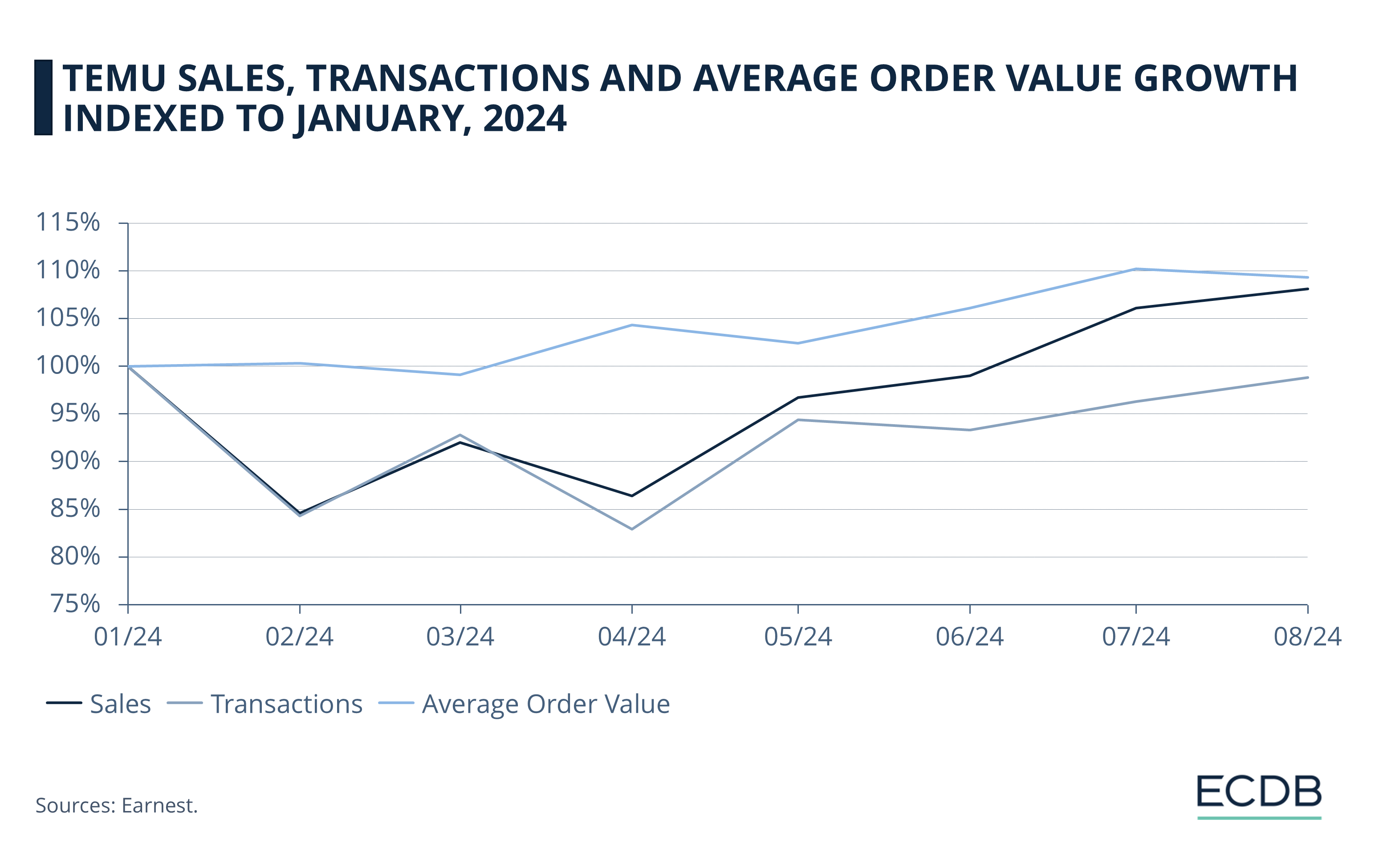

Sales and AOV Trends: Although Temu lost customers, its 2024 data shows a rebound in sales and transactions by mid-year, with average order value (AOV) peaking in July, indicating that remaining customers are spending more, though attracting new users remains difficult.

Temu saw a significant drop in customer activity in August 2024, with around 25% fewer shoppers compared to January, according to Earnest credit card data.

This marks a sharp shift for a company that initially made waves across several industries, including Hobbies, Party Supplies, and Discounters. Despite a strong start, including a high-profile Super Bowl ad, Temu’s sales growth has slowed in 2024.

Competition is Ahead of Temu

Rivals Shein and TikTok Shop, on the other hand, have seen steady growth. Both platforms attracted more customers in the first eight months of 2024, with TikTok Shop benefiting from participation in the summer sales frenzy alongside retail giants like Amazon, Walmart, and Target.

Discover Our Data: Our frequently updated rankings provide essential insights to help your business thrive. Wondering which stores and companies are excelling in eCommerce? Interested in the top-performing categories? Find the answers in our rankings for companies, stores, and marketplaces. Stay competitive with ECDB.

While Temu’s customer acquisition value remains high, the challenge now lies in maintaining long-term customer loyalty, according to a study by Associate Professor Daniel McCarthy. Retention will be crucial for Temu as competition intensifies from other eCommerce platforms.

Sales Trends for Temu in 2024

Despite the overall decline in customer numbers, Temu’s sales, average order value (AOV), and transaction volume have shown some interesting patterns throughout 2024. Here’s a breakdown of the data:

Sales and Transactions Rebound Mid-Year: While sales dipped in early 2024, falling to 85% of January levels in February, they recovered by mid-year, reaching 108% in August. We can infer that while fewer customers are using the platform, those who remain are making larger or more frequent purchases.

AOV Steady with Growth: Average order value (AOV) stayed relatively stable, fluctuating slightly but peaking at 110% in July, even as transactions and sales varied. It appears that the shoppers Temu has retained are spending more per transaction, which may indicate a more loyal, higher-value customer base.

Retention Over Acquisition: The growth in AOV combined with steady sales suggests that Temu’s challenge is not necessarily with individual spending but with attracting new customers. The focus may need to shift toward customer retention strategies to maintain and grow its base as competition intensifies from Shein and TikTok Shop.

Sources: Earnest, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Temu Is the Second Most Visited eCommerce Website in the World

Temu Is the Second Most Visited eCommerce Website in the World

Deep Dive

Temu Revenue: Does Temu Really Lose US$30 per Order?

Temu Revenue: Does Temu Really Lose US$30 per Order?

Deep Dive

Indonesia Urges Apple and Google To Restrict Temu

Indonesia Urges Apple and Google To Restrict Temu

Deep Dive

Temu Launched in Vietnam and Brunei, Now Available in 5 Southeast Asian Markets

Temu Launched in Vietnam and Brunei, Now Available in 5 Southeast Asian Markets

Deep Dive

Temu Business Model 2024: Gaming, Gambling & Low Prices

Temu Business Model 2024: Gaming, Gambling & Low Prices

Back to main topics