eCommerce: Social Commerce

TikTok's Growth in eCommerce: TikTok Shop, Asian Market & Expectations

Social Commerce on the rise: TikTok is expanding in Southeast Asia with its latest move to buy Tokopedia. What is this strategic move about and why is the China-based social media app focusing on the Asian market?

Article by Lukas Görlitz | January 09, 2024Download

Coming soon

Share

TikTok's Growth in eCommerce: Key Insights

TikTok's Indonesia Investment: ByteDance acquires a 75.01% stake in Tokopedia for US$781 million to revive its shopping business post-government ban. The partnership aims to establish an "Indonesian eCommerce champion," merging TikTok's large user base with Tokopedia's platform.

Consolidation and Competition: TikTok will integrate TikTok Shop into Tokopedia for US$340 million, targeting consumers and MSMEs. Amidst growing competition from Shopee and Temu, this move positions them strongly in Indonesia's burgeoning online market.

US$781 million – that's how much ByteDance, the parent company of Chinese social media company TikTok, paid for a 75.01% stake in Indonesian marketplace Tokopedia. The marketplace, which focuses on C2C and B2B, was previously owned by technology company GoTo. The investment comes after the Indonesian government banned TikTok's online store, TikTok Shop, in September 2023. The reason was to protect smaller online shops and merchants.

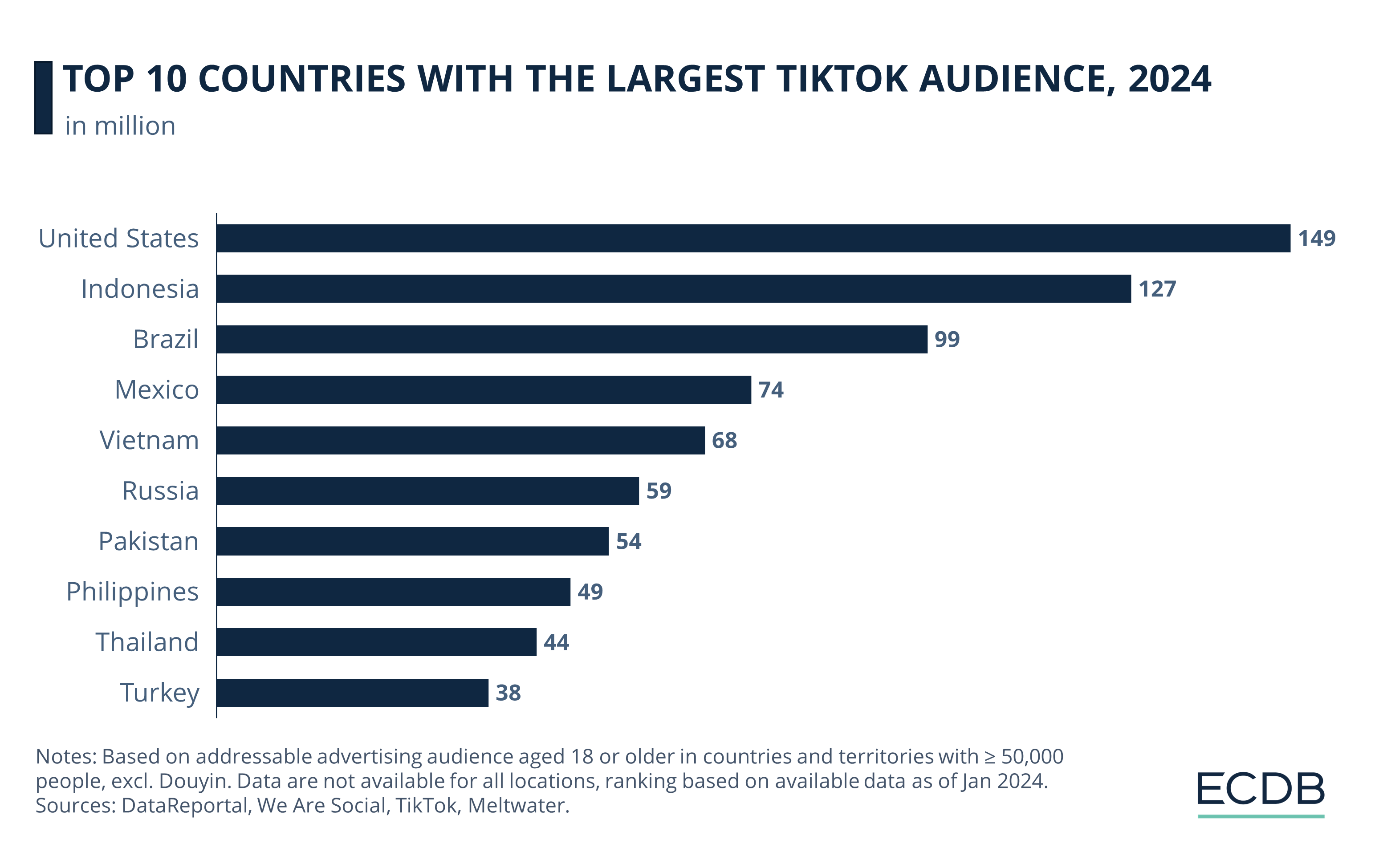

Indonesia is not only the fourth most populous country in the world. With a young and well-connected population, it has the second most TikTok users and the therefore a large audience for the TikTok Shop market. With 127 million TikTok users in Indonesia, TikTok and GoTo aim to create an "Indonesian eCommerce champion," said GoTo CEO Patrick Walujo. The two companies plan to invest more than US$1.5 billion in Tokopedia.

TikTok's Partnership with GoTo

As part of the deal, Tokopedia will acquire TikTok Shop's Indonesian business for US$340 million, expanding its presence in the Indonesian eCommerce market. The two businesses will be combined under the existing PT Tokopedia entity, in which TikTok will hold a majority stake. The shopping features on the TikTok app in Indonesia will be managed by this combined entity.

This agreement aims to provide comprehensive services to Indonesian consumers and micro, small and medium enterprises (MSMEs). GoTo will continue to be an ecosystem partner for Tokopedia through its digital financial services and on-demand services through Gojek. GoTo will also receive an ongoing revenue stream from Tokopedia based on its scale and growth.

The strategic partnership will begin with an initial pilot phase in collaboration with the relevant regulatory authorities. The first campaign was scheduled to launch on December 12, coinciding with Indonesia's National Online Shopping Day, a government initiative to boost the country's digital economy by supporting local MSMEs.

What is TikTok Shop?

TikTok Shop is currently only available in the U.S., UK and a few Asian markets including Malaysia, Philippines, Singapore, Thailand, Vietnam and most recently Indonesia. Those selected countries are not randomly named, since five of them are in the top ten countries with the most users on TikTok – including Indonesia in second place. The idea in combination with the main TikTok app is to discover new products and buy them in the implemented online store. Instead of the usual way where consumers know what they want to buy before they buy it, they'll look inside TikTok and find new products while browsing.

TikTok presents products for purchase within the app through four interfaces. The first two are embedded in video content, specifically livestreams and videos, where products are tagged and clickable. Apparently, TikTok is currently testing bundling such product videos into a dedicated shopping feed. The third interface is a shopping tab on the user's account page, which provides an overview of the entire "inventory" of that account. The most recent addition is the product showcase tab, where consumers can shop directly from brand or creator accounts within the app.

TikTok Shop takes a percentage of the revenue generated from purchases made within the app. According to media reports, the commission rate is in the low single digits for the first 90 days and increases to five percent after that. This is lower than Amazon, where the exact percentage varies by product category, but is generally between 8 and 15 percent. In addition, many Amazon sellers must invest in paid advertising to make their products visible, which is not explicitly mentioned as a requirement for TikTok Shop.

In the summer of 2022, TikTok planned to launch the shopping feature in European countries, but the plans were canceled due to missing internal targets and influencers refusing to participate.

TikTok's Investment in Indonesia

Due to the recent success of TikTok Shop, the Chinese player ended its partnership with Canadian eCommerce giant Shopify. In 2020, the two launched a partnership that allowed merchants on Shopify to run and optimize TikTok marketing from within Shopify. In 2021, the partnership expanded to allow sellers in the US and UK to create storefronts on their TikTok profiles. As of September, users can only sell through TikTok's own online store, as it no longer supports sellers' independent websites or other external stores.

According to The Information, TikTok Shop is expected to lose more than US$500 million in the U.S. alone by 2023. Its parent company, ByteDance, has invested in hiring staff, building a fulfillment network, and offering free shipping, zero commissions, and warehouse space. As TikTok seeks to create a closed-loop model with full control and responsibility for traffic, it lost 26 cents per share at the end of September.

Is TikTok a Threat for Sea?

Sea Limited may be facing a new competitor with its Southeast online store Shopee. Last year's third quarter results showed an aggressive strategy, nearly doubling its sales and marketing to US$918 million for its Shopee player, which accounts for 70% of its revenue. Like rival TikTok, Sea has been investing in its eCommerce live streaming. "The entry of new players has intensified competition in our markets ... we will prioritize investment in the (eCommerce) business to increase our market share and further strengthen our market leadership," said CEO Forrest Li, according to Reuters. The investment in its growth meant a 17% drop in shares.

Indonesia can look forward to a strong competition in the eCommerce market, as besides the established Sea and the beforementioned Tokopedia Shop, Pinduoduo's Temu will also launch its app in the Indonesian market sooner or later. After entering the Southeast Asian market with countries like Malaysia, Indonesia in the second half of 2023, its still to add Indonesia as well.

Room to Grow in the Indonesian Market

The future will show who ramps up the orders in the growing Indonesian market, as forecasts expect revenue growth from US$65 million in 2022 to US$92.4 million in 2027. The share of online eCommerce is also expected to increase from 8.8% last year to 11.1% in 2027, meaning that online shopping will become increasingly important in Indonesia.

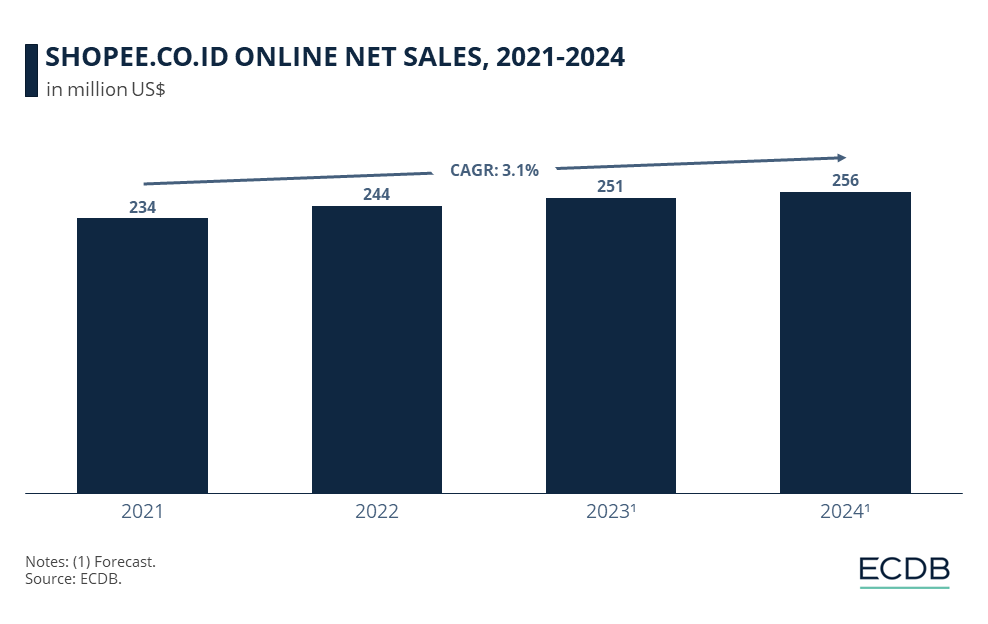

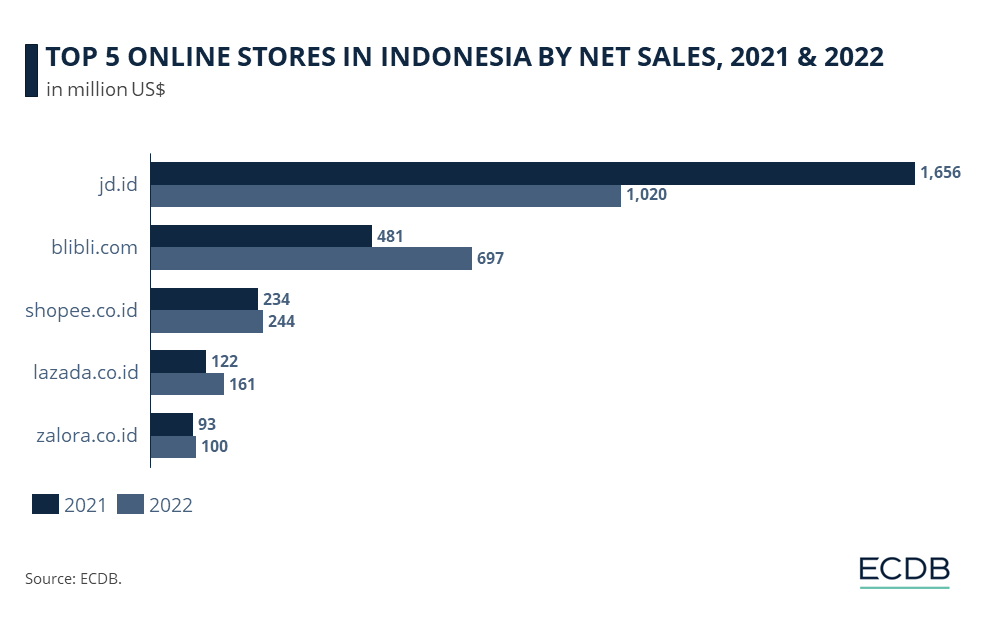

So far, jd.id, a local site of jd.com, is the market leader in Indonesian eCommerce with net sales of US$1 billion in 2022.The market leader reduced its figures by 38.4% from the previous year. Followed by blibli.com with net sales of US$697 million, another online shop focusing on fashion, electronics and hobby & leisure improved its numbers by 47.3% from 2021. With net sales of US$244 million, Shopee has the third largest net sales.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

H&M Revenue: Online Net Sales Remain High Through 2023

H&M Revenue: Online Net Sales Remain High Through 2023

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Deep Dive

Walmart eCommerce Revenue: The U.S. Retail Giant Surpassed US$100 Billion

Walmart eCommerce Revenue: The U.S. Retail Giant Surpassed US$100 Billion

Back to main topics