eCommerce: Monthly Revenue Growth

Monthly eCommerce Market Revenue Growth: Online Retail Sales (September 2024)

Stay updated with our monthly eCommerce report on online retail sales and revenue growth for September 2024. Get the latest trends, insights, and data to stay informed.

Article by Cihan Uzunoglu | October 08, 2024Download

Coming soon

Share

eCommerce Market Revenue Growth: Key Insights

Global Market Trends: In September 2024, the global eCommerce market experienced a positive growth rate of 6.8%. Among the top three markets, China saw the highest growth with a 26% increase, with its strongest performance in the last 12 months. While the United States faced a significant degrowth of 7.2%, the United Kingdom posted a 9% growth. Additionally, the German eCommerce market, the second largest in Europe, saw a decline of 6.7%.

Category Performance: The top three eCommerce categories displayed varied performance in September 2024: Fashion led with a growth of 11%, Electronics followed with a 7% growth, while Hobby & Leisure had a modest growth of 0.4%. Despite some volatility earlier in the year, all three categories have shown signs of stabilization as of September.

Accurate data gives eCommerce businesses an edge by supporting better decision-making. At ECDB, we offer monthly revenue data for leading global eCommerce markets and product categories, spanning 59 countries and 34 categories.

Here’s a look at how the top 3 markets performed in September 2024.

Monthly eCommerce Revenue Growth

of the Top 3 Markets

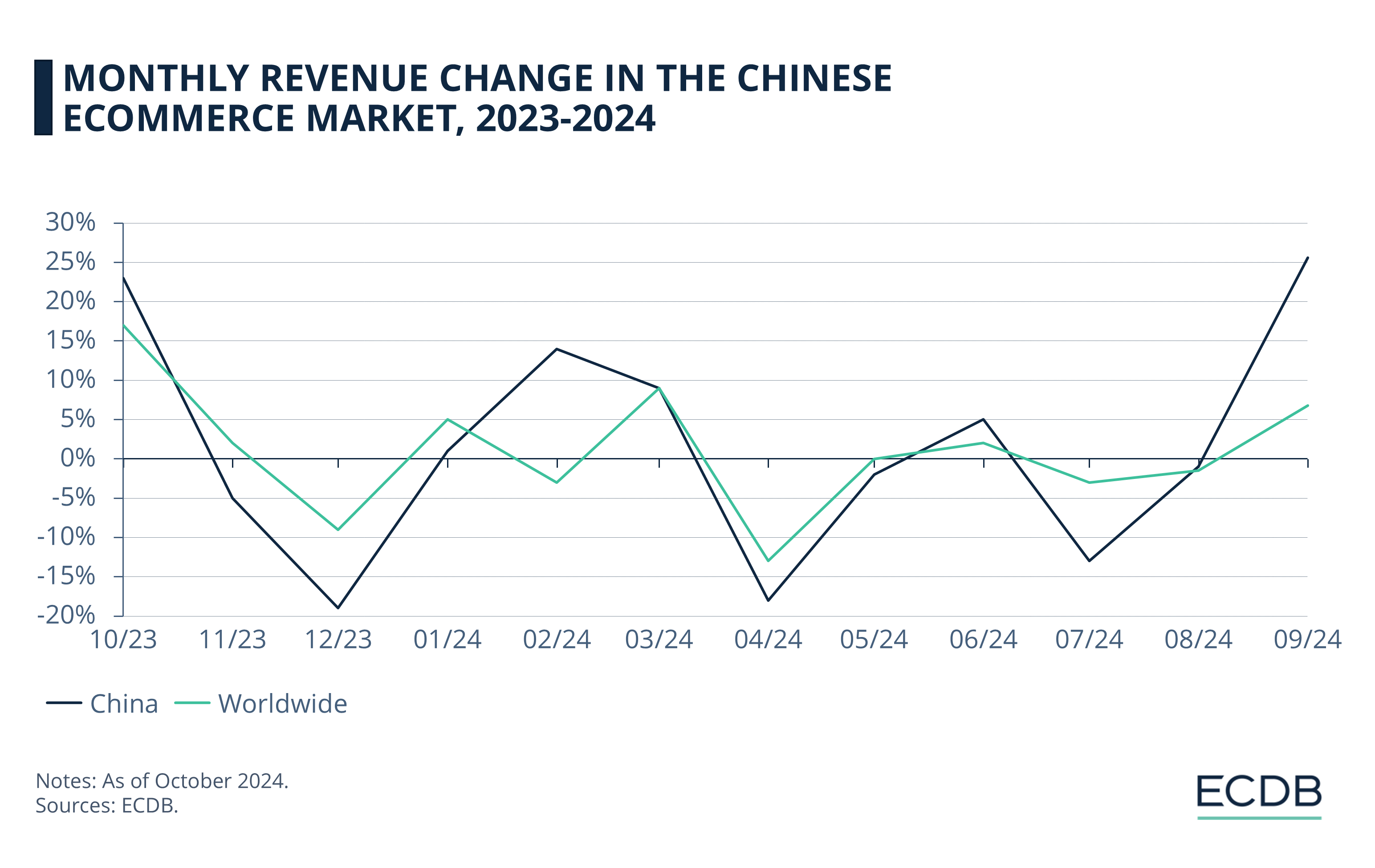

Globally, the eCommerce market showed a mix of ups and downs, with peaks in October 2023 and March 2024, and significant lows in December 2023 and April 2024. The latest data from September 2024 shows an increase of 6.8%.

Top 3 eCommerce markets, however, have their particular dynamics and changes.

1. China

China remains the top eCommerce market, expected to reach a revenue of US$2.02 trillion by 2024, surpassing the United States. The market experienced a growth of 26% in September 2024, the highest in the last 12 months.

After a sharp decline in August 2023, China's eCommerce market rebounded strongly in September and October.

The market faced another drop in November and December.

The beginning of 2024 saw a mix of slight growth and another dip, with significant negative performance in April.

While the market went through ups and downs from May to August, September's 26% growth marked the highest in the past year.

Shifts Toward Omnichannel Strategies in the

Chinese eCommerce Market

Many retailers in the country are expanding into offline channels to support growth and adapt to evolving consumer preferences. Major players like JD.com are increasingly blending online efficiency with physical retail, launching stores like 7Fresh and Huaguan Discount Supermarket to integrate fast delivery and in-store experiences.

Livestreamers are also shifting focus, with some moving into physical retail to diversify and expand. This omnichannel approach is seen as key to balancing consumer demands for convenience while offering more personalized shopping experiences.

2. United States

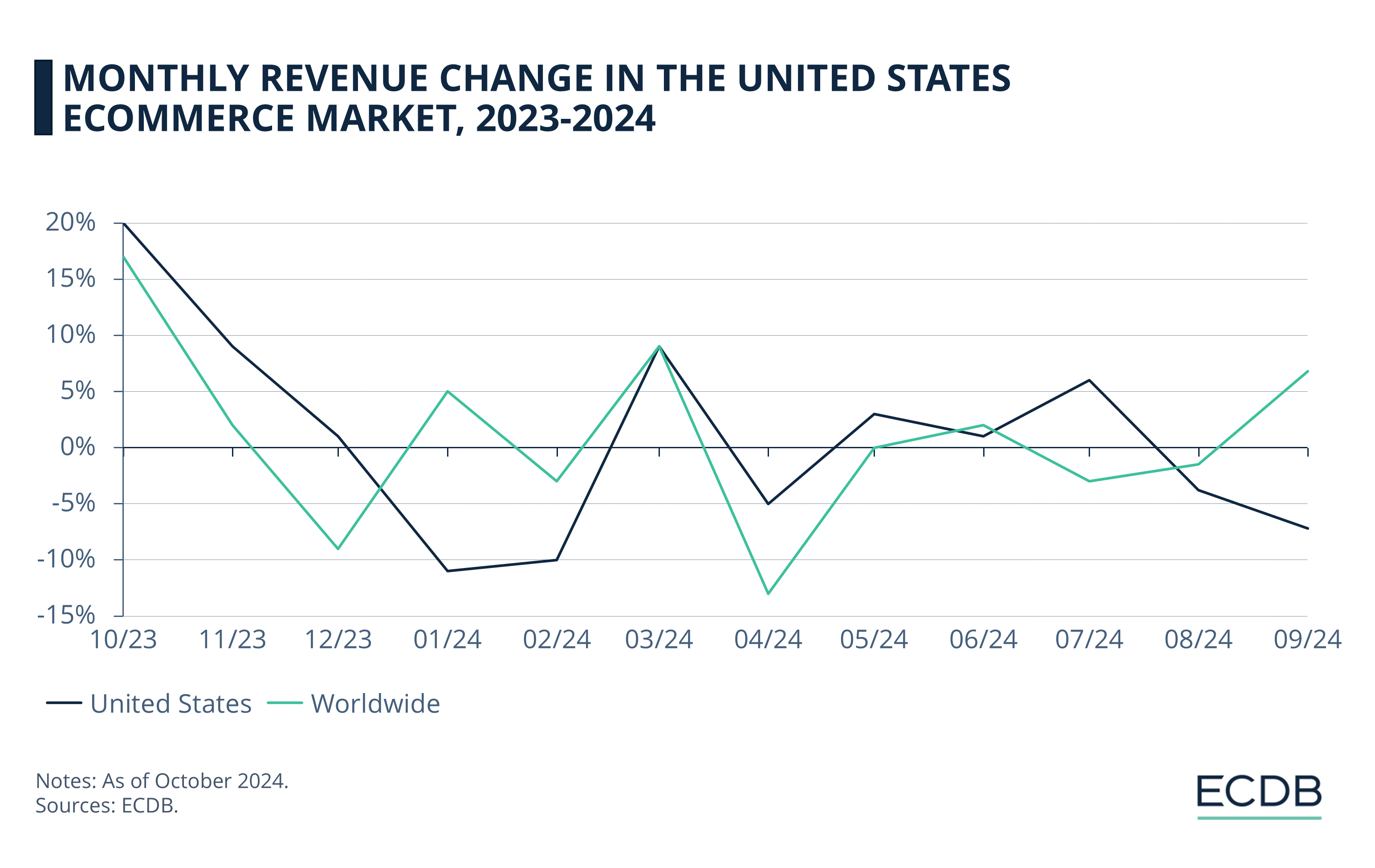

Ranked second, the United States is projected to generate US$1.06 trillion in eCommerce revenue by 2024, outpacing the United Kingdom. Our September 2024 data shows a degrowth of 7.2% for the market.

After a significant spike in October 2023, the U.S. eCommerce market experienced slower growth in November and near stagnation in December.

While early 2024 saw a sharp decline, the market bounced back in March with 9% growth, but experienced volatility throughout the rest of the year.

August saw a 4% decline, and September ended with another 7.2% drop, marking a challenging period for U.S. eCommerce.

U.S. eCommerce Growth: Major Players

Lead the Charge in Q2 24

In Q2 2024, the U.S. eCommerce market continued to evolve, driven by notable gains from industry leaders like Amazon and Walmart.

While overall eCommerce sales in the U.S. grew by 6.6% year-over-year, Walmart outperformed this growth with a 22% increase in its U.S. online sales.

Meanwhile, Amazon's North American sales rose 9%, showing its sustained dominance in the sector. Both companies are leveraging advanced fulfillment technologies and customer-centric innovations to maintain their competitive edge.

3. United Kingdom

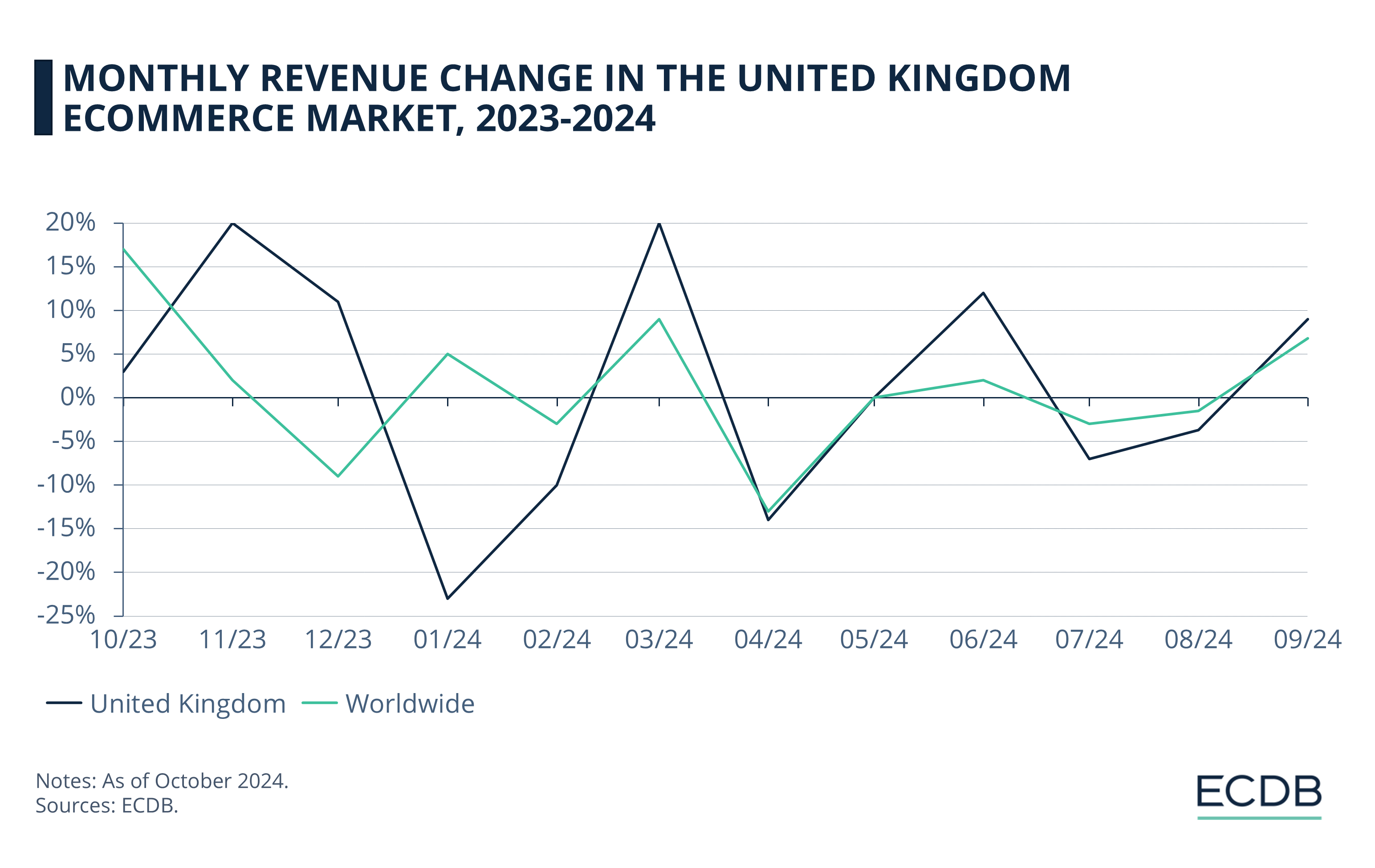

The United Kingdom, holding the third spot, is forecast to achieve eCommerce revenues of US$152.55 billion by 2024. In September 2024, the UK eCommerce market posted a 9% increase, performing above the global trend.

Among the top 3 markets we’re looking at, the United Kingdom arguably displayed the most variability in regard to monthly revenue changes.

With declines in July and August 2023, the market experienced a significant recovery in September and October.

November saw a strong increase, but it faced another decline in December and a sharp drop in January 2024.

Since then, the market improved its growth, going as high as 20% in March this year, before going down to around -15% the next month.

The market recovered in May and June. Although July and August brought decline, the market finished September with significant growth.

Amazon Is in Trouble in the UK

In the UK, Amazon faces a significant legal challenge as the British Independent Retailers Association (BIRA) has filed a £1 billion (US$1.28 billion) collective lawsuit on behalf of thousands of small retailers.

The lawsuit alleges that Amazon misused non-public data from these retailers and manipulated the Buy Box feature to favor its own products, thereby diverting sales and profits away from independent merchants. This practice has reportedly had a detrimental effect on smaller businesses, especially during tough economic times, as many retailers were pushed out of the market.

The case highlights growing concerns over Amazon’s market dominance and its impact on the UK retail sector.

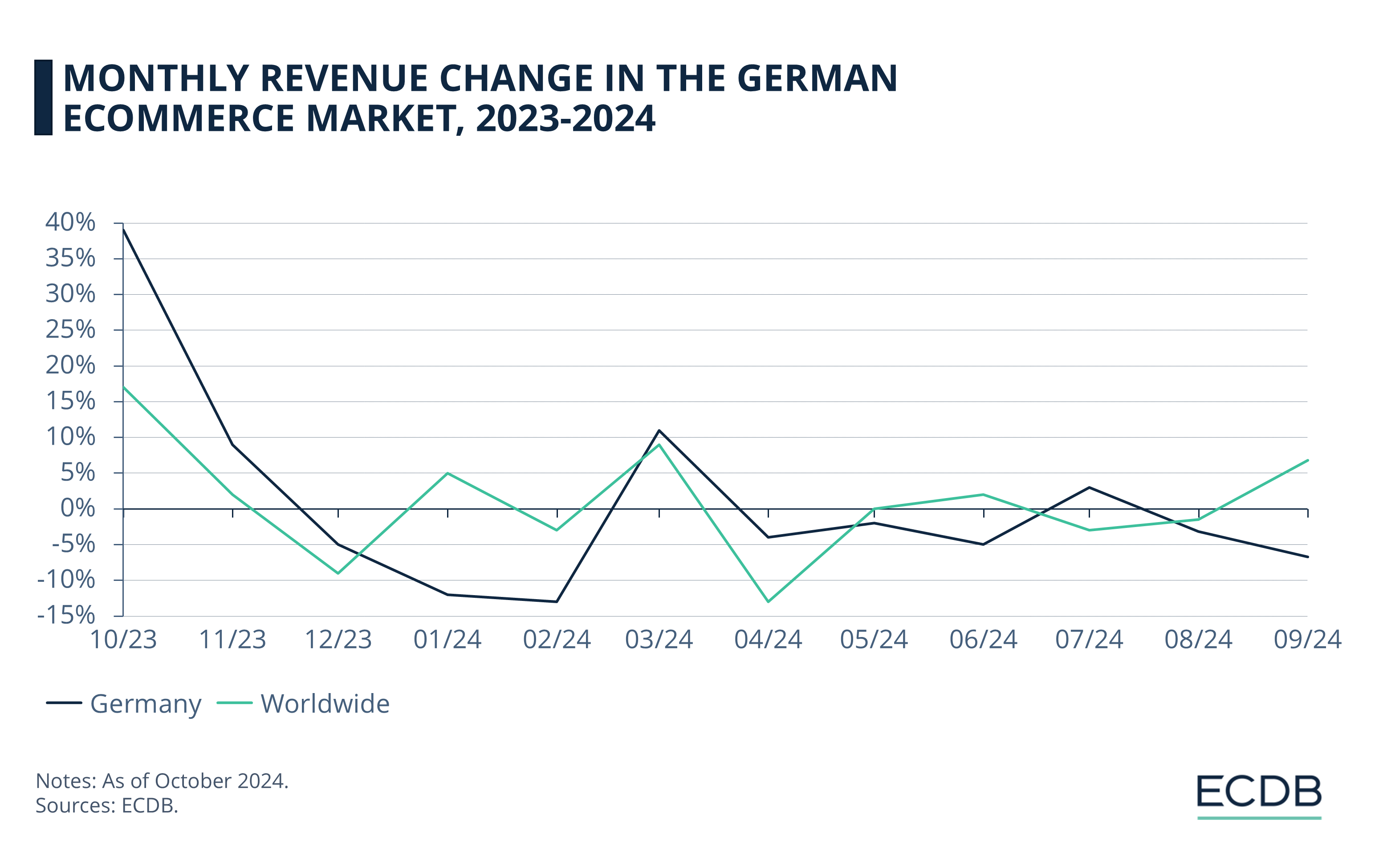

Monthly eCommerce Revenue Growth

of the German Market

Apart from the top 3 markets we just analyzed, the German eCommerce market is another significant market in our scope. The second largest eCommerce market in Europe declined by 6.7% in September 2024.

3% growth in July 2023 did not last, as the market started declining up until October last year.

With an impressive 39% growth in October, the market continued its growth in the next month (9%), before experiencing degrowth in December.

Although 2024 started rough for the market, March brought 11% growth. Since then, the market has been relatively stable.

Success Stores in the German eCommerce Market

We recently covered the dynamic state of the German eCommerce market in an article featuring success stories of local companies. Germany is predicted to reach US$111 billion in eCommerce revenues by 2024, underscoring its importance as the 6th largest eCommerce market globally.

Key players such as Amazon, eBay, and domestic giants like Otto and Zalando continue to dominate, while innovative companies like Flaschenpost, Redcare, and Birkenstock exemplify how businesses can thrive by adapting to market demands. These companies have successfully leveraged digital strategies to sustain growth and relevance, even in a highly competitive market.

Monthly eCommerce Revenue Growth

of the Top 3 Categories

Having covered the top eCommerce markets, let’s now dive into how the top 3 eCommerce categories worldwide have been progressing in terms of monthly revenue.

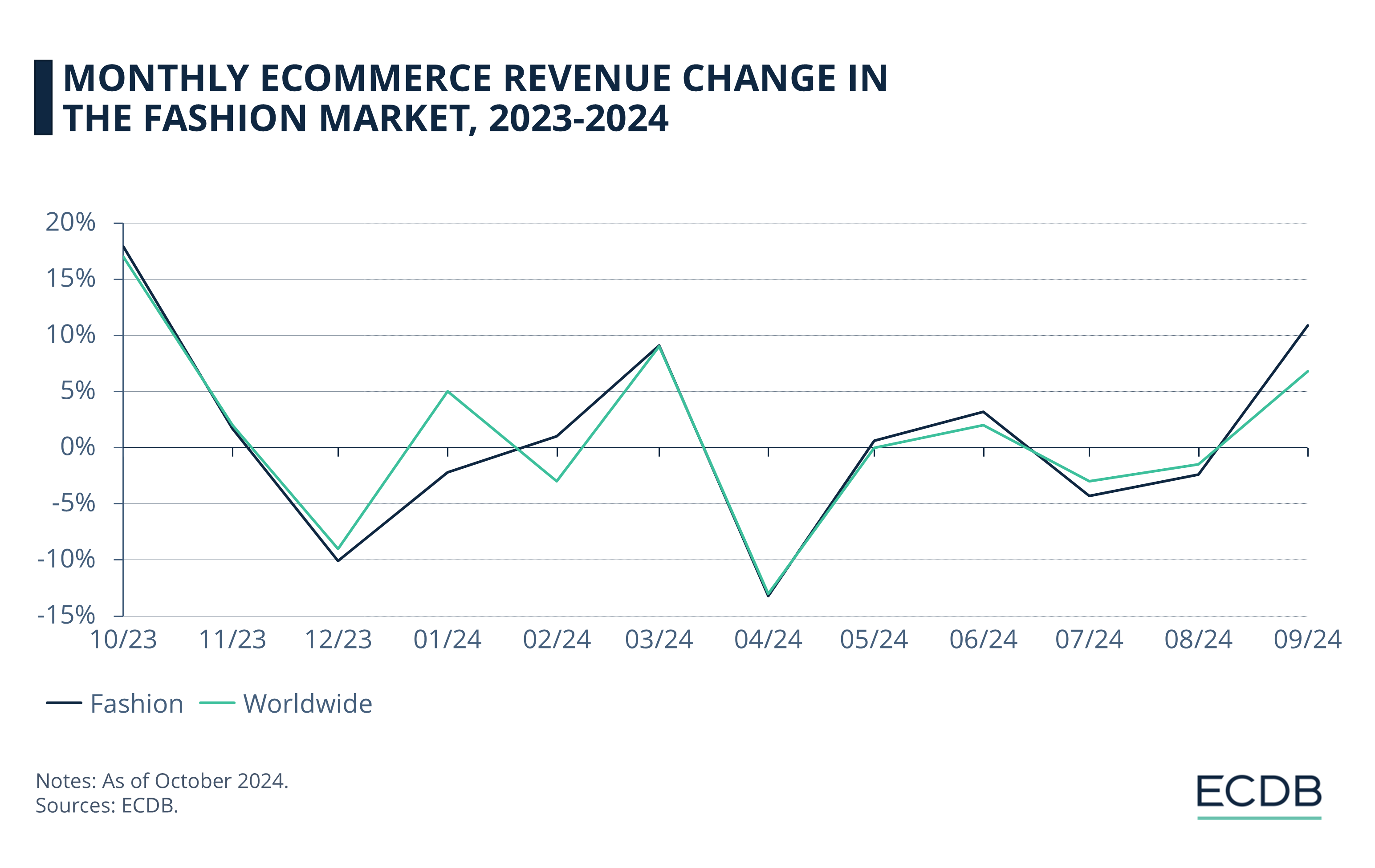

1. Fashion

The online fashion market is on track to hit US$1.25 trillion by 2024. Generating almost US$104 billion in revenue in September 2024, it is the top eCommerce category in terms of monthly revenue. The market finished the month with a growth of 11%.

After declines last summer, the market made a strong recovery in September (11%) and October (18%). November saw a rise, but December faced a sharp decline (-10%).

Compared to the global market trends, Fashion often outpaced global growth.

After peaking at 9% in March, the market fell 13% the following month. Having remained relatively stable since then, the market reached a new peak in monthly sales growth in September.

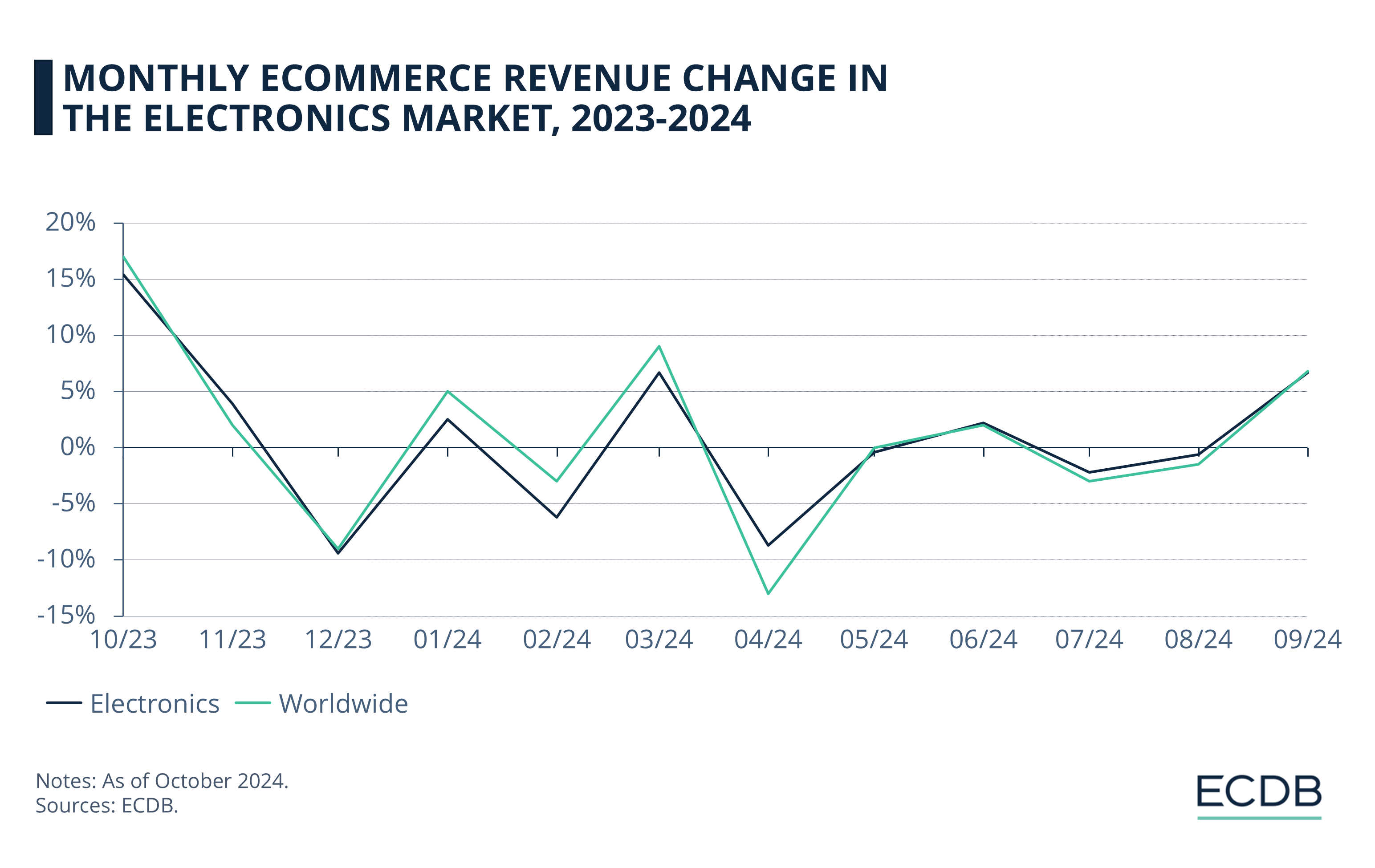

2. Electronics

Expected to reach US$1.1 trillion by 2024, the online electronics market earned US$90 billion in September 2024, making it the second highest revenue generator among top eCommerce sectors. After August's minimal decline of 0.6%, the market finished September 2024 with 7% growth.

After a minor decline in July and August 2023, the online electronics market saw a recovery in September. This was followed by robust growth in October (15%), while November maintained this momentum with a rise, and December experienced a sharp drop.

Generally growing faster than the global market during recovery months like September and October but declining more sharply in December, Electronics showed similar patterns to the Fashion market.

While the first 4 months of 2024 were characterized by constant ups and downs, the market has been more stable since May, matching March's peak of 6.7% growth in September.

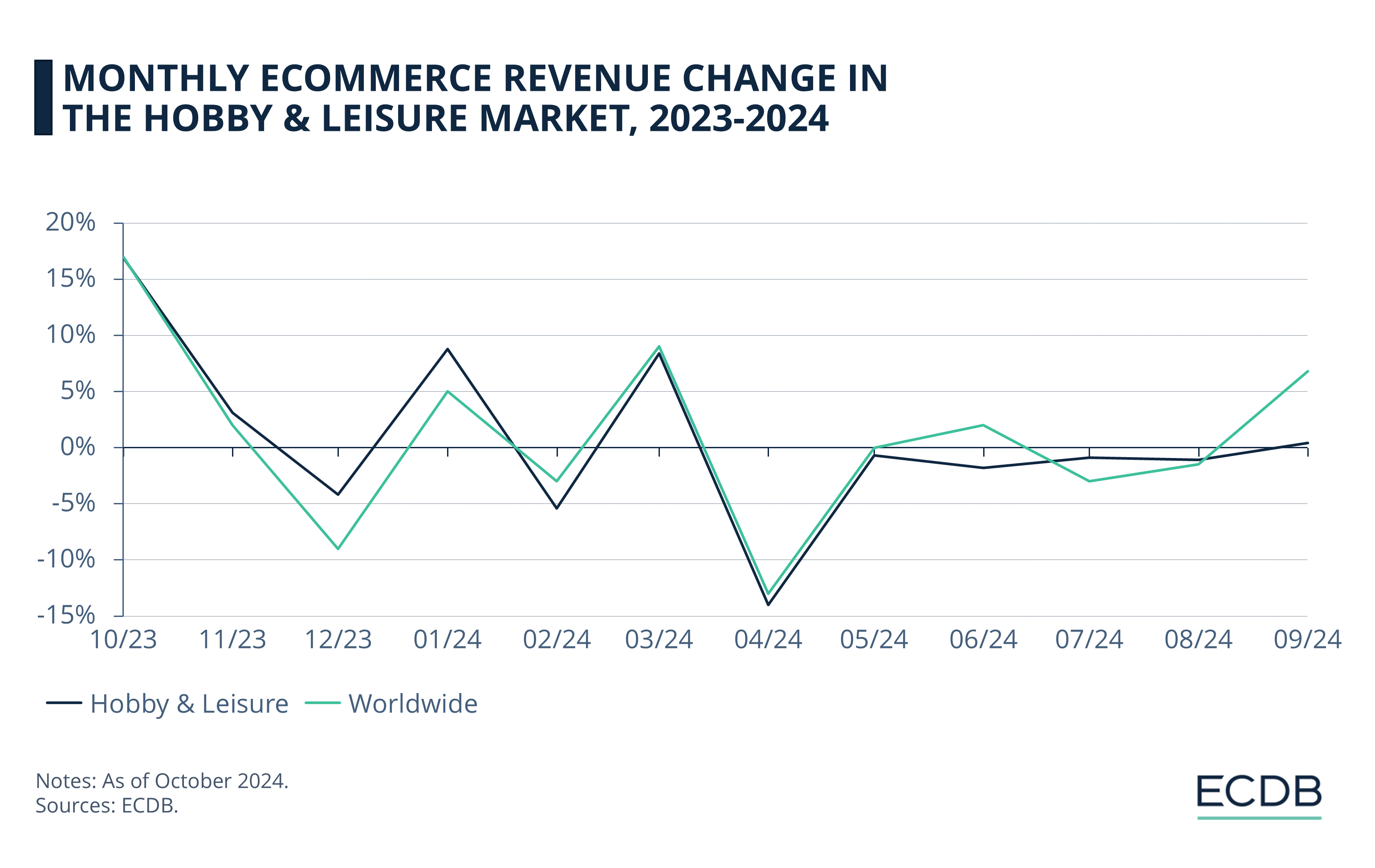

3. Hobby & Leisure

Forecasts suggest the online hobby & leisure market will grow to US$638 billion by 2024. In September 2024, the market pulled in nearly US$49 billion, ranking it third among the top revenue-generating eCommerce categories, ending the month with a slight growth of 0.4%.

The market faced its own set of ups and downs as well:

It experienced small declines in July and August 2023, followed by a significant increase in October (17%).

November posted a modest increase, but December faced a decline. Similar to other top categories, the global online hobby & leisure market also had peaks and valleys through the first few months of 2024.

Since May, the market has become more stable, reflecting the global trend.

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

Why Monthly Revenue Data Matters

for eCommerce Businesses?

Having monthly revenue data is handy for eCommerce businesses to stay competitive and make informed decisions. Regular updates provide valuable insights into market trends and consumer behavior.

Timely Data in eCommerce: Timely data helps businesses identify emerging trends and shifts in consumer preferences quickly. ECDB provides monthly data on 59 countries and 34 categories, enabling businesses to react swiftly to changes.

Business Agility: Frequent data updates allow companies to remain agile, adapting their strategies to meet current market demands. This agility is vital for maintaining a competitive edge.

Strategy Adjustments: Regular revenue data supports strategic planning and decision-making. Businesses can fine-tune their marketing, inventory, and sales strategies based on the latest insights, ensuring they are always aligned with market realities.

Sources: Digital Commerce 360, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Deep Dive

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Deep Dive

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Deep Dive

South Korean Online Fashion 2024: Revenue, Stores & Trends

South Korean Online Fashion 2024: Revenue, Stores & Trends

Back to main topics