eCommerce: Key Player Insights in Germany

eCommerce Success Stories in Germany: How Flaschenpost, Redcare & Birkenstock Succeed

There are many eCommerce success stories in Germany. They all have one thing in common: online brands must be familiar and trustworthy to succeed. Flaschenpost, Redcare and Birkenstock have all built their brands in different ways by following this rule.

Article by Nadine Koutsou-Wehling | September 04, 2024Download

Coming soon

Share

eCommerce Success Stories Germany: Insights

Germany is the 6th largest eCommerce Market: By 2024, German eCommerce market revenues are expected to reach US$111 billion. Common consumer preferences highlight trustworthiness through familiarity or social proof.

Three Different Approaches to eCommerce Success: The brands featured in this insight are excelling in their fields with different strategies. Flaschenpost and Redcare deliver customer convenience, while Birkenstock builds a strong product buzz.

International Reach: Redcare has become a European online pharmaceutical hub, Birkenstocks are available worldwide, but Flaschenpost maintains a regional focus in the DACH region.

eCommerce success is achieved by giving online shoppers what they need in a way that makes it more convenient to buy through online channels than to go to a local store. The global success stories ECDB recently posted feature three different companies with varying approaches to generating corporate hype.

The German eCommerce market is the 6th largest in the world. Its most successful companies tend to have an international strategy, at least venturing into other European companies to expand their operations.

Three success stories from Germany show how smart adaptation to market gaps can ensure lasting relevance in eCommerce.

The eCommerce Market in Germany

German eCommerce is predicted to reach US$111 billion in revenues by 2024, reflecting the ease with which consumers in Germany fulfill their product needs through online shopping.

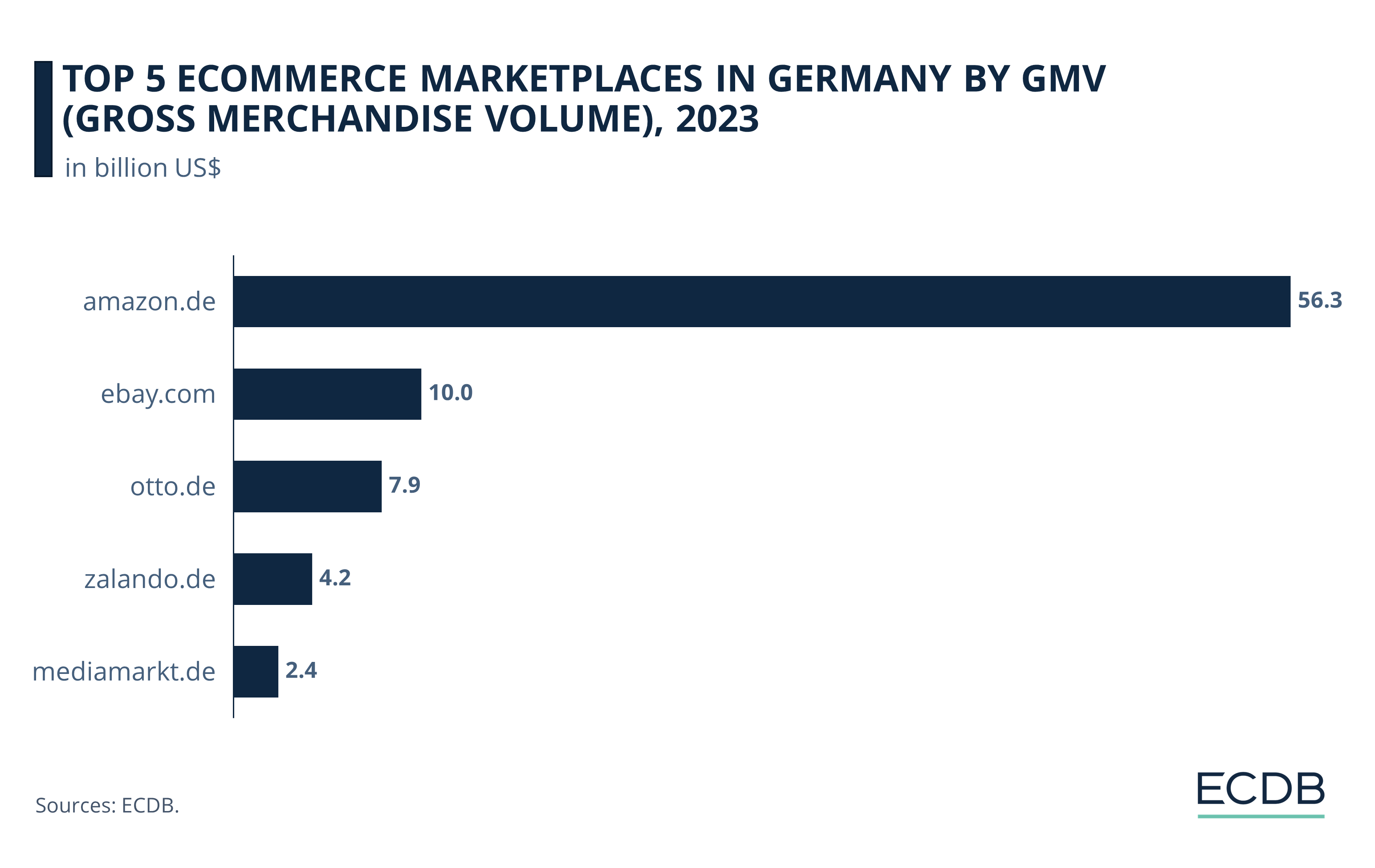

The top stores and marketplaces in German eCommerce highlight a widespread preference for familiarity and trustworthiness in the market: Amazon and eBay are two of the most recognized eCommerce platforms in the world, while Otto, Zalando and Media Markt are highly trusted domestic players.

Aside from these established players, it is of interest to examine three stores with successful approaches to eCommerce that are not listed in the top rankings with the usual suspects.

1. Flaschenpost

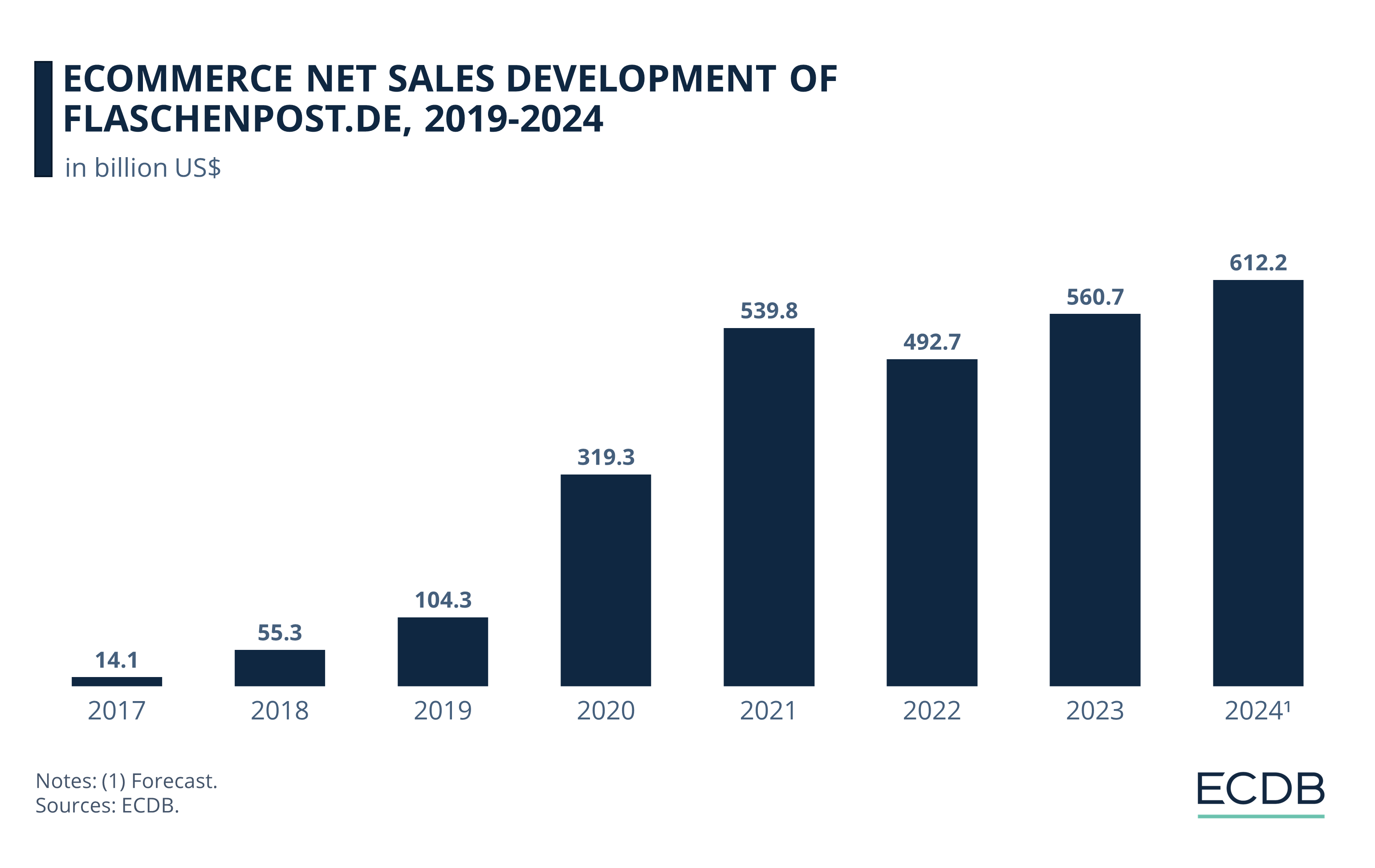

Flaschenpost is a former beverage delivery service that has expanded its offerings to encompass groceries. In 2020, the German food conglomerate Dr. Oetker acquired its former rival Flaschenpost, which had hit a vulnerable spot in the shopper base during the pandemic. Rather than compete with the beverage delivery service, Dr. Oetker decided to merge its own durstexpress.de with flaschenpost.de.

The acquisition proved successful, especially due to the restructuring of the quick commerce market, which spit out smaller startups without large conglomerates' backing. Because quick commerce requires high fixed costs for warehousing, infrastructure and staffing, players without a viable strategy soon opted out of the market. The most notable cases include Getir and Gorillas, leaving the remaining players to pick up the scraps.

Dr. Oetker’s acquisition of Flaschenpost in 2020 was marked by a jump in annual net sales, which reached US$319.3 million. The two pandemic years unsurprisingly saw the highest growth for Flaschenpost, which generated US$540 million in 2021.

Despite the reopening of stores and reduced consumer demand for grocery delivery, Flaschenpost quickly recovered from the typical dip in 2022. By 2023, the company had surpassed its 2021 peak.

Flaschenpost’s success in the German eCommerce market illustrates how prioritizing customer convenience with a strategy that meets the needs of modern times can ensure business growth. The acquisition by Dr. Oetker provided Flaschenpost with the financial resources that insulated it from the common pitfalls of the quick commerce market.

2. Redcare (Shop Apotheke)

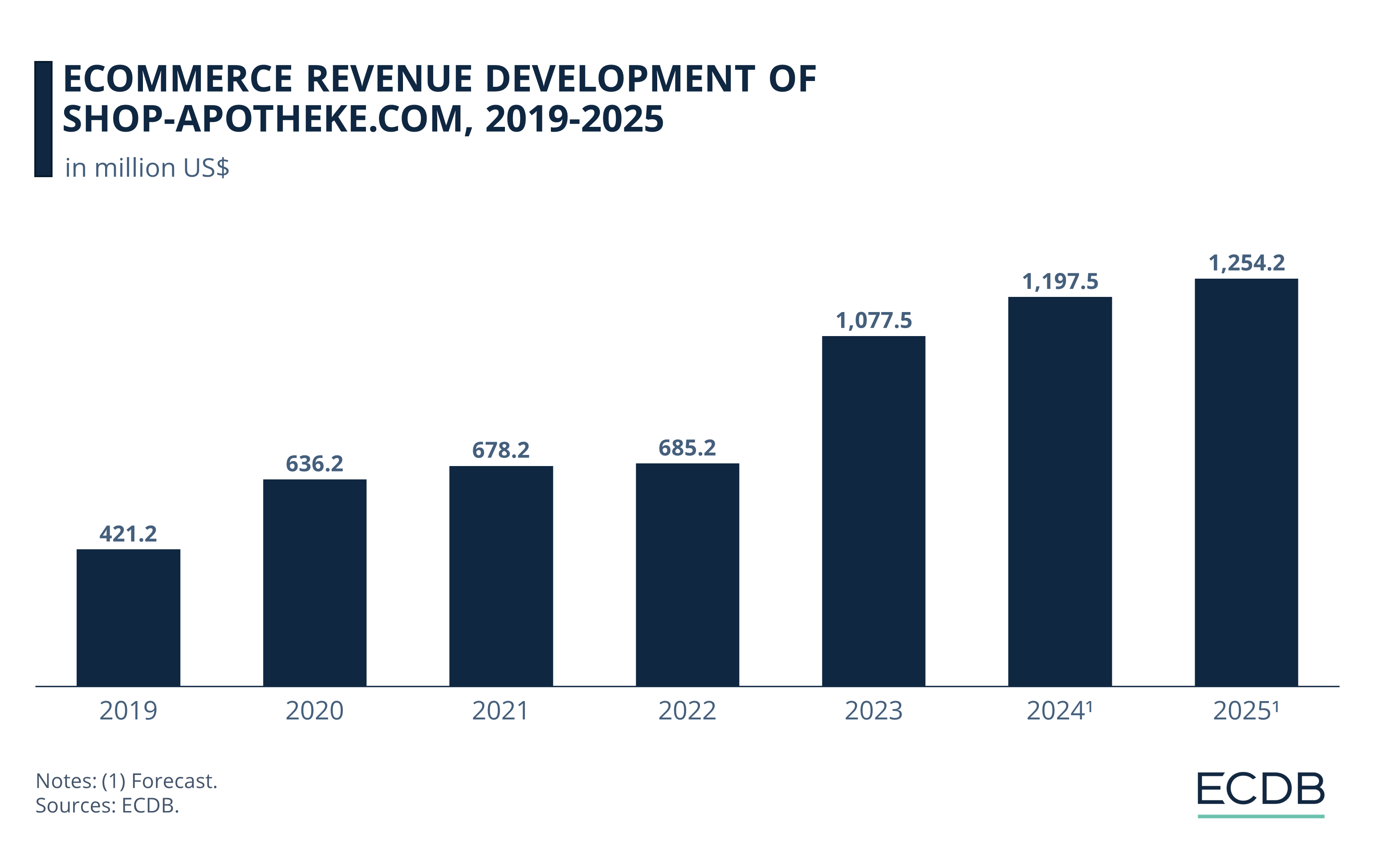

Shop Apotheke has introduced the e-pharmacy model to the German market long before the pandemic accelerated the need for such solutions. Already in 2016, the company went public. It is now present in seven European markets under the rebrand Redcare Pharmacy.

The success of the former Shop Apotheke, now Redcare, can be attributed to meeting consumer needs, similar to Flaschenpost, but in a different field. The delivery of pharmaceutical products, whether over-the-counter (OTC) or prescription, can be vital for consumers who do not have the time or energy to physically pick up the products. On top of that, the steady decline of pharmacy locations in Germany increases the need for alternative solutions, especially in rural areas.

Shop-apotheke.com grew during the pandemic, generating stable net sales between US$630 million and US$690 million from 2020 to 2022.

After the pandemic, revenues rose even further, surpassing US$1 billion for the first time in 2023. Growth is expected to continue in 2024 and 2025.

Redcare has by now ventured outside of its home market of Germany into European countries with a similar offering. The success in Germany provides Redcare with the necessary know-how to be successful in neighboring markets.

Vertical acquisitions of digital prescription management companies aim to transform Redcare into a healthcare ecosystem that goes beyond product delivery. With such high ambitions, it is a bold move, but not unlikely to solidify its position in the European online pharmacy market.

3. Birkenstock

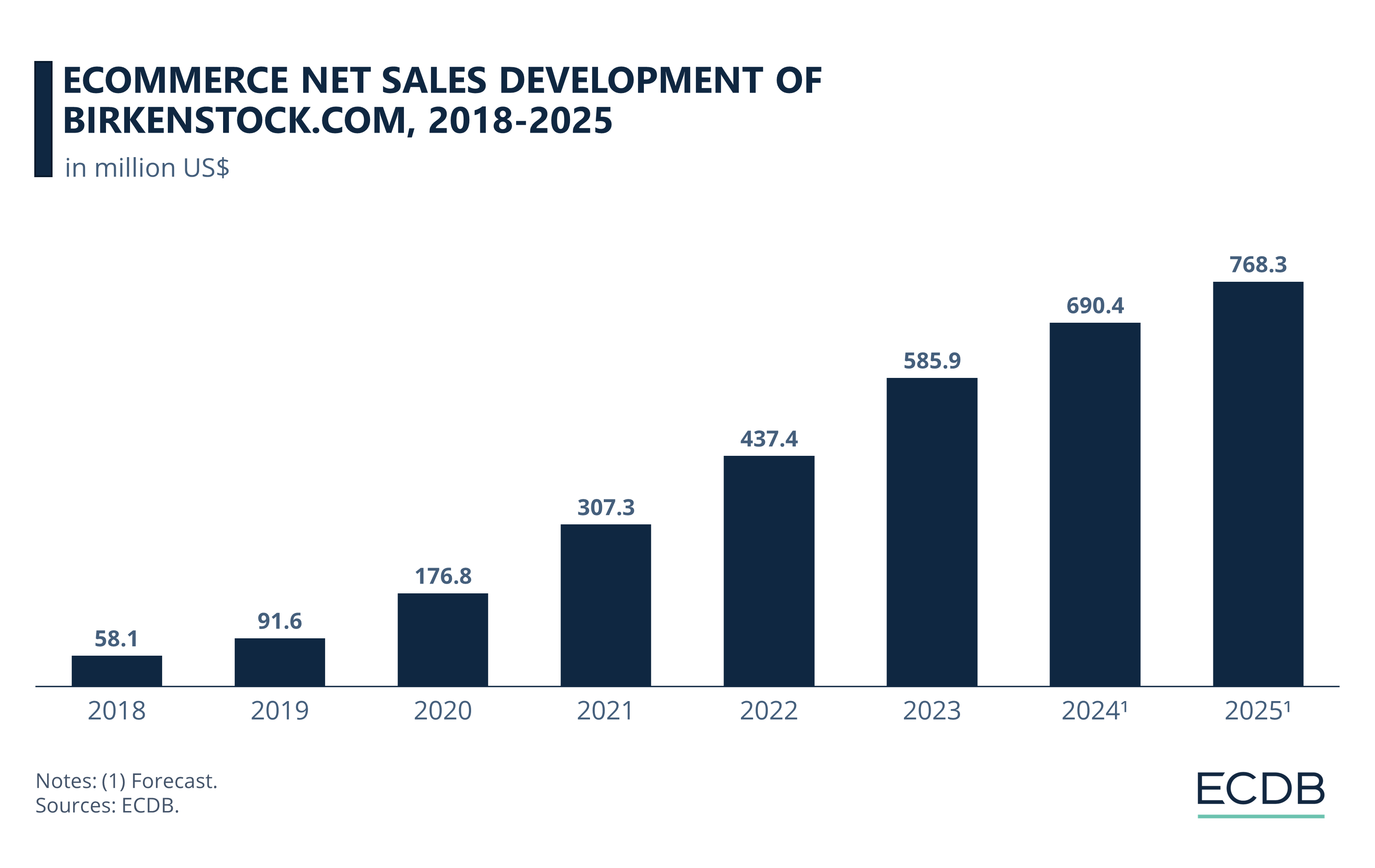

Birkenstock has made the transition from hippie sandal to luxury item. The company’s origins date back to the 18th century. It came to North America in the 1960s, where it was sold only in health stores, hence the “hippie” label. In 2021, LVMH acquired a majority stake in Birkenstock.

Online sales spiked during the pandemic, but growth continued in the subsequent years. From US$91.6 million in 2019 to US$176.8 million in 2020, and US$307.3 million in 2021, the strides birkenstock.com made in just a few years did not lose momentum post-pandemic: In 2022, the platform made US$437.4 million.

In 2023, net sales grew further to reach US$586 million. Forecasts for 2024 and 2025 expect birkenstock.com to approach US$800 million.

Birkenstock is the only omnichannel brand on this list, but its long heritage and sustained hype show how companies can move with the times to remain relevant amid changing market conditions and consumer preferences. The sandal maker is a German success story in eCommerce, a brand that sells quality products in 21 markets and 17 languages.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

Success Stories in German eCommerce: Closing Remarks

The three companies in this insight each represent a piece of the German spirit of innovation. In the context of eCommerce, these companies have found ways to become relevant in their specific field, whether by offering consumer convenience or by finding a differentiating feature of their product.

Flaschenpost is one of the survivors in the harsh reality of quick commerce in Germany with high fixed costs and fluctuating consumer demand. Redcare delivers pharmaceutical products to consumers in Europe who are seeing their traditional healthcare structures shrink. Birkenstock is a comfortable sandal with ties to the luxury sector. These companies have different focuses, but find common ground in successfully adapting online channels to sustain their businesses.

Sources: Abda – Excitingcommerce: 1 2 – Redcare Pharmacy – Reuters

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Deep Dive

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Back to main topics