eCommerce: Singles' Day

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Alibaba uses AI tools and massive discounts to boost Singles' Day sales, aiming to capture market share as competition intensifies among China’s leading eCommerce platforms.

Article by Cihan Uzunoglu | October 22, 2024Download

Coming soon

Share

Singles’ Day 2024: Key Insights

AI-Driven Sales Growth: Alibaba's AI tool, Quanzhantui, boosted Singles' Day sales by 66% on the first day, supporting 250,000 merchants with personalized strategies to increase GMV and consumer engagement.

Aggressive Promotions: Alibaba, JD.com, and Pinduoduo launched their Singles' Day campaigns early, with Alibaba offering CN¥30 billion in discounts and CN¥10 billion to subsidize merchants, aiming to drive consumer confidence.

Competitive Pressure: Facing stiff competition from new eCommerce platforms like Douyin, Alibaba and JD.com are battling to maintain market share with price cuts, tech innovations, and complex discount systems.

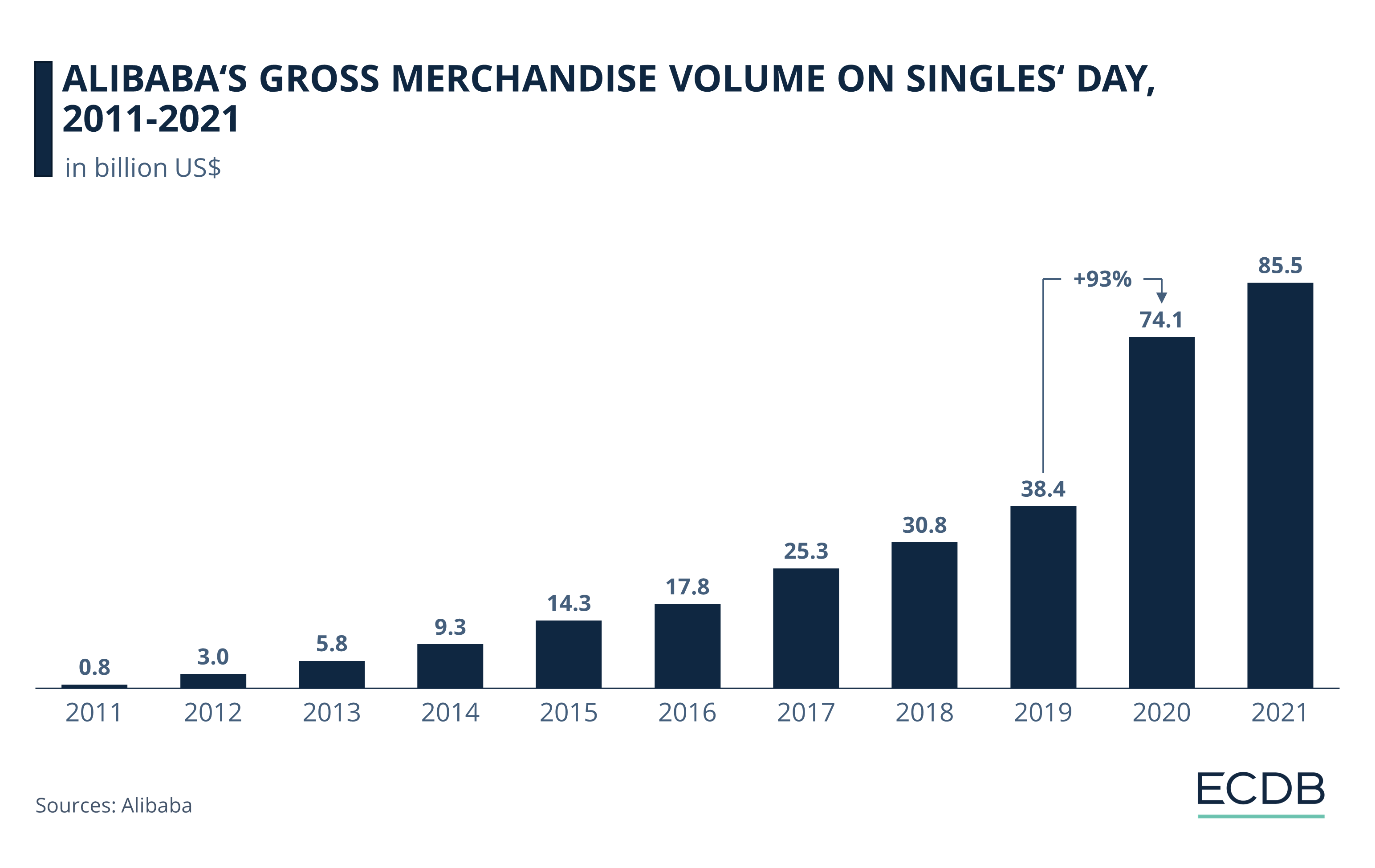

Singles' Day, celebrated annually on November 11, is the world’s largest online shopping event, surpassing even Black Friday in sales. Originally a celebration for singles, it has become a massive global retail phenomenon, with brands offering steep discounts and millions of consumers participating worldwide.

Alibaba, JD.com, and Pinduoduo are leading this charge in China, launching their campaigns earlier than usual this year as they aim to capture a larger share of consumer spending.

AI-Powered Tools and Massive Incentives

Alibaba is using its AI-driven tool, Quanzhantui, to support over 250,000 merchants and 1.3 million products during Singles’ Day.

Quanzhantui helped drive a 66% increase in gross merchandise value (GMV) on the first day alone, highlighting its crucial role in helping sellers optimize their sales strategies. In tandem with AI tools, Alibaba is offering aggressive spending incentives – over CN¥30 billion (US$4.25 billion) – to attract consumers.

More Insights? We keep our rankings up to date with the latest data, offering you valuable information to improve your business. Want to know which stores and companies are leading the way in eCommerce? Which categories are achieving the highest sales? Check out our rankings for companies, stores, and marketplaces. Stay one step ahead with ECDB.

The platform has also committed CN¥10 billion (US$1.4 billion) to boost traffic and subsidize merchants' marketing costs. With a US$142 million promotion waiving delivery fees for Taobao users in Hong Kong, the company is targeting both domestic and international markets.

JD.com and Pinduoduo have similarly launched their own campaigns earlier this year. All three companies are capitalizing on recent economic stimulus measures introduced by Beijing to boost consumer confidence. This year’s Singles' Day is expected to see higher engagement, with Alibaba aiming to drive high-quality growth across its platforms, Taobao and Tmall.

Looking Back at Singles’ Day 2023

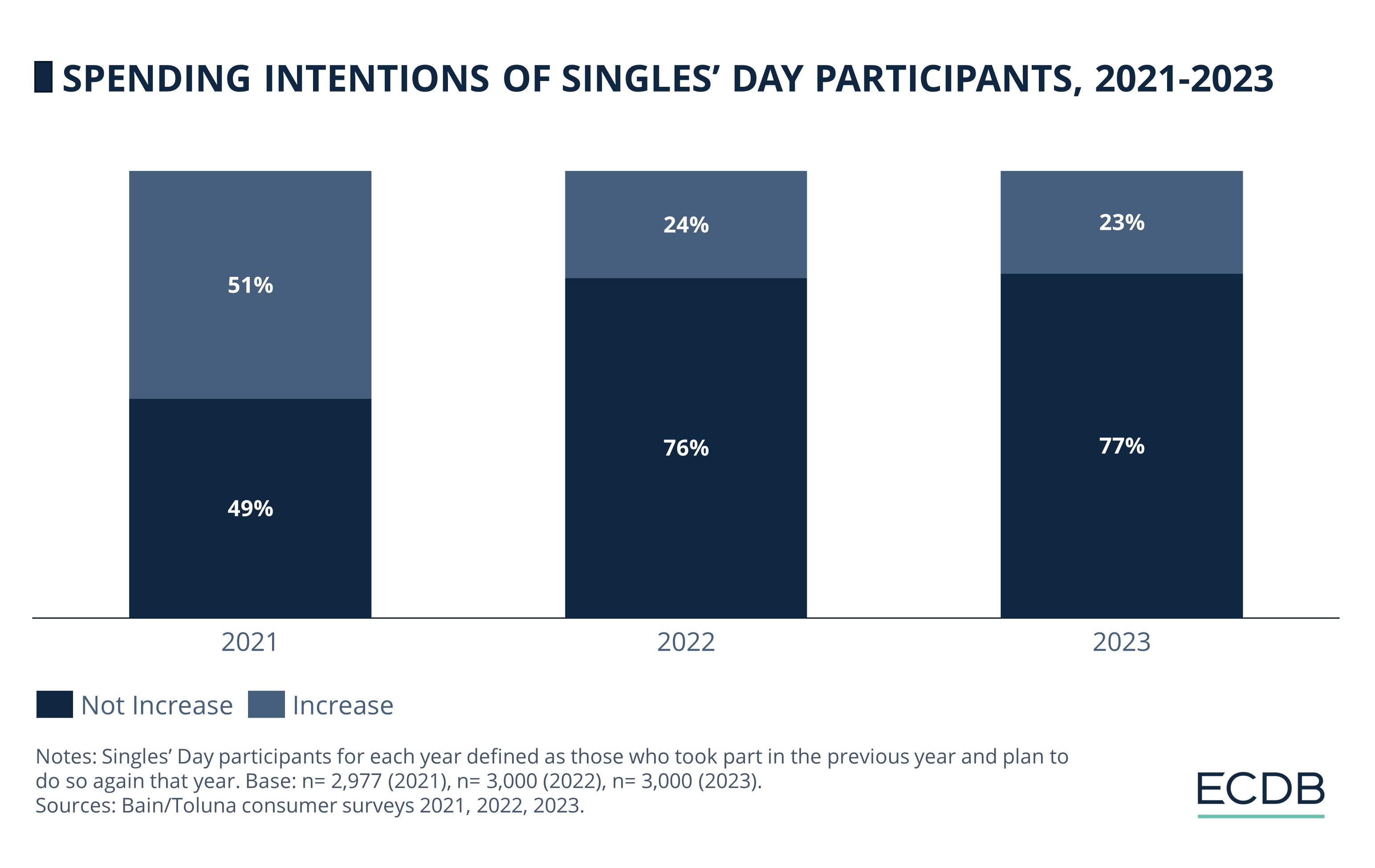

Singles’ Day 2023 saw record-breaking participation but lacked transparency in key performance metrics. Alibaba and JD.com did not disclose exact figures for gross merchandise value (GMV), leading many to speculate that the sales growth they had hoped for did not materialize.

Despite reports of strong engagement during the 19-day event, the lack of concrete data suggests that the performance may have mirrored 2022’s stagnant results. The uncertain economic climate and cautious consumer spending on non-essential items contributed to this, with many shoppers opting for household necessities over luxury products.

Singles’ Day remains the world's largest shopping event, but the 2023 edition highlighted the challenges Chinese retailers face in sustaining momentum post-pandemic.

Navigating a Competitive Market

This year, the competition is more intense than ever, with Alibaba, JD.com, and Pinduoduo not only facing each other but also newer platforms like Douyin and Xiaohongshu, which have integrated eCommerce with social media.

In 2023, traditional eCommerce platforms like Alibaba saw their market share shrink as livestream eCommerce platforms gained ground. To stay ahead, Alibaba has introduced new checkout periods and complex discount systems, offering CN¥50 (US$7) off every CN¥300 (US$42) spent, and up to a 15% discount on orders.

Despite the challenges, Alibaba remains optimistic. Liu Bo, Alibaba's vice president, described Singles' Day 2024 as a "critical moment," reflecting changing consumer sentiment in China, where shoppers are focused on value-for-money purchases. The platform's early promotions and tech-driven strategies are designed to capture this growing demand and restore Alibaba's position in the market.

As the festival progresses, Alibaba, JD.com, and Pinduoduo will continue to battle for market share in an increasingly competitive space, with price wars and innovative strategies shaping the future of eCommerce in China.

Sources: Benzinga, Barron’s, Sixth Tone, MSN, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Factors That Impact U.S. Holiday Shopping in 2024: Election, Deals, Weather, Number of Days

Factors That Impact U.S. Holiday Shopping in 2024: Election, Deals, Weather, Number of Days

Deep Dive

Peak Season of eCommerce & Air Cargo Capacity Crisis

Peak Season of eCommerce & Air Cargo Capacity Crisis

Deep Dive

Holiday Season Shoppers Turn to Discounts and Deals Early

Holiday Season Shoppers Turn to Discounts and Deals Early

Deep Dive

The Holiday Shopping Season Begins: How eCommerce is Preparing for Shopping Days

The Holiday Shopping Season Begins: How eCommerce is Preparing for Shopping Days

Deep Dive

How to Avoid Online Shopping Scams Ahead of the Holiday Season

How to Avoid Online Shopping Scams Ahead of the Holiday Season

Back to main topics