eCommerce: Holiday Season

The Holiday Shopping Season Begins: How eCommerce is Preparing for Shopping Days

As the holiday season approaches, consumer demand remains strong, and the supply chain has regained stability after recent years' challenges. Will we see a record-breaking holiday season?

Article by Patrick Nowak | October 17, 2024Download

Coming soon

Share

The Holiday Shopping Season Begins -

Key Insights:

Stable Volumes: According to Patrick Kelleher, eCommerce volumes are steady and similar to last year, with no sign of weakened consumer demand.

Holiday Shipping Adjustments: Retailers are spreading out shipments over several days instead of same- or next-day delivery, aiming to cut labor costs and manage peak season demands smoothly.

Growth in Nearshoring: More companies are relocating production to Mexico, as a way to navigate U.S. tariffs and prepare for possible trade changes after the election.

According to the new CEO of DHL Supply Chain in North America, Patrick Kelleher, eCommerce is experiencing stable volumes that are comparable to previous years. “Overall, we’re seeing volumes very similar to what we’ve seen in past years, especially last year,” Kelleher told CNBC. Although more promotional items are making their way out of warehouses to retailers, Kelleher doesn’t see this as a sign of consumer weakness.

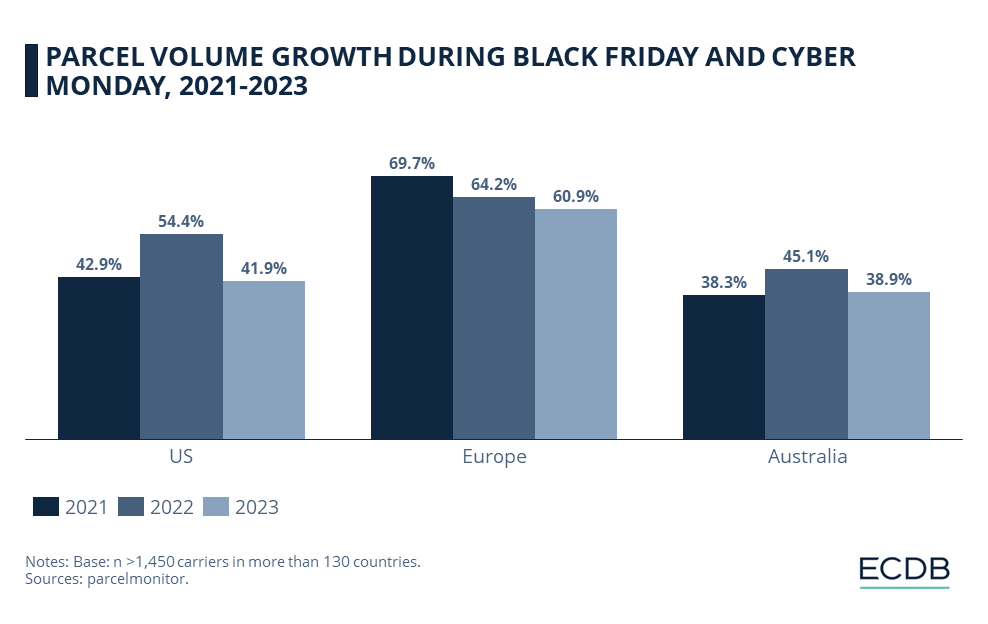

Parcel Monitor conducted an analysis of the number of parcels delivered across regions, spanning the years 2021, 2022, and 2023 (projected). In the U.S., parcel volume growth was projected to decline from 54.4% in 2022 to 41.9% in 2023. A similar story unfolds in Europe and Australia, where parcel volume growth is expected to decline from 64.2% to 60.9% and from 45.1% to 38.9%, respectively. However, the downward trend may stop in 2024.

The National Retail Federation projects holiday season spending to grow by 2.5 to 3.5 percent compared to 2023, potentially bringing total spending in November and December to as much as US$989 billion. This should also influence parcel volume.

Stay Competitive: Our constantly updated rankings provide you with the latest insights to improve your business strategy. Discover which stores and companies are at the top of the eCommerce world and which categories are driving the highest sales. Dive into our rankings for companies, stores, and marketplaces. Stay a step ahead in the market with ECDB.

Logistics: Delivery Changes for Black Friday and Cyber Monday

One significant change this year is in retailers’ logistics strategy. While in the past, there was an expectation to ship orders the same day or next day, now there is a willingness to spread out shipments over a few days. This new approach aims to reduce labor in warehouses and counter the rising costs brought on by inflation. “These changes enable us to handle the peak season profitably,” Kelleher explained. For customers, this may mean a delay of one or two days in some cases, though it won’t appear as a delay "due to clear communication about delivery times".

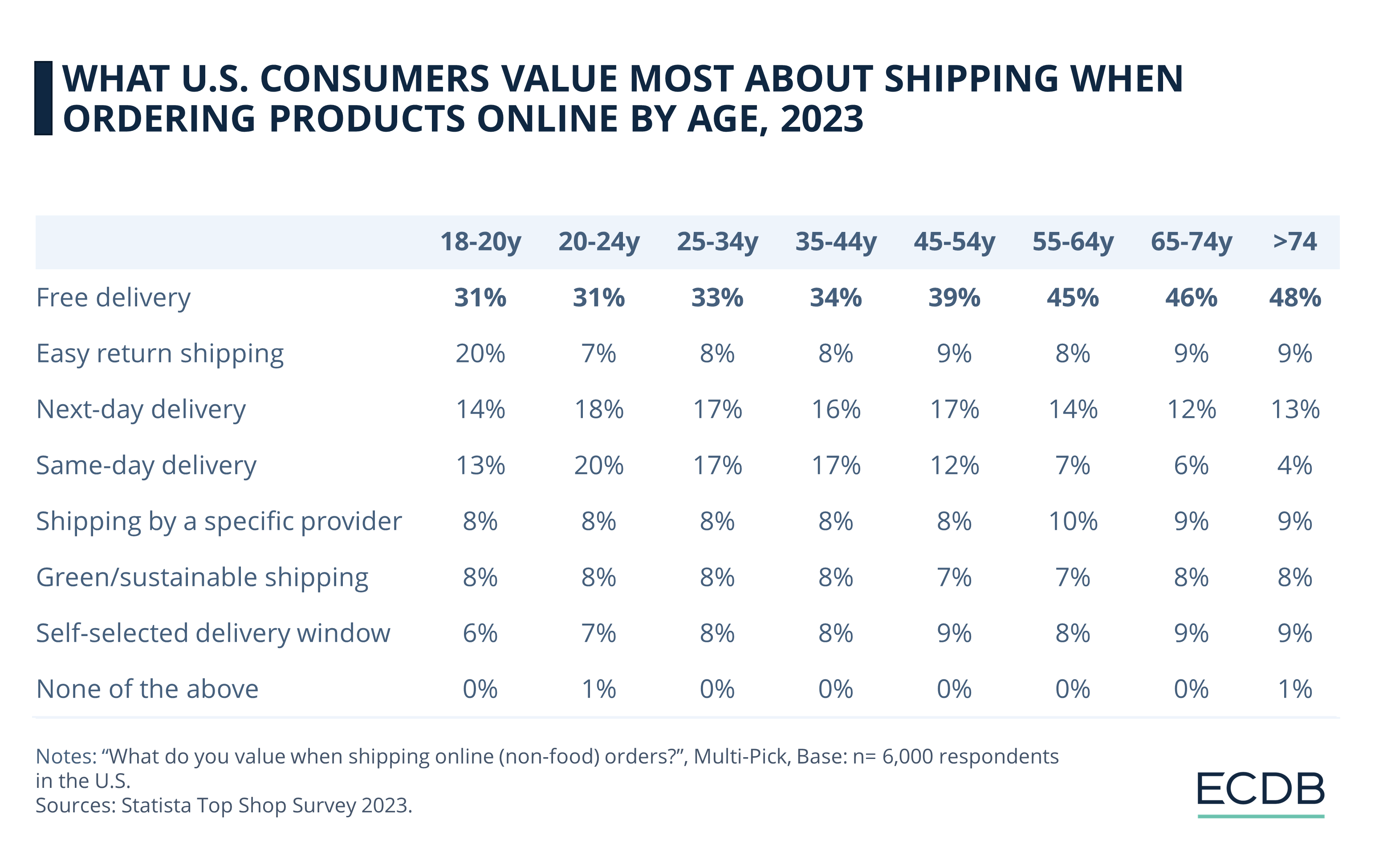

A Statista survey from 2023 on U.S. consumers shows that while there is demand for next- or same-day delivery, people prioritize free shipping even more. Older generations, in particular, are reluctant to pay for delivery, while younger consumers prefer easy return shipping. Only 16-17 percent of Millennials truly depend on next- or same-day shipping.

Nearshoring and Mexico’s Role

The common practice of relocating production facilities closer to the U.S. is called "nearshoring" and the demand has increased. Kelleher reports a growing presence of Chinese companies in Mexico and increased interest from Asian manufacturers to move production to Mexico. Some companies see this as a way to mitigate existing U.S. tariffs and as a buffer against potential trade barriers after the upcoming U.S. presidential election.

Supply Chain Stability: Widespread eCommerce Optimism

Kelleher is optimistic about the supply chain through the end of the year, stating, “Barring unforeseen circumstances, supply chain disruptions have stabilized. We are well-positioned to meet the demands of the peak season.” Companies are adjusting their logistics and production strategies to handle rising costs and geopolitical uncertainties, while eCommerce is ready to meet consumer needs this holiday season.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics