eCommerce: Singles’ Day Shopping Festival

Alibaba, Pinduoduo, JD.com Prepare For Singles’ Day Shopping Festival

It's that time of year again: Singles' Day, Black Week, and Cyber Week are coming. The Asian eCommerce giants Alibaba, Pinduoduo, and JD.com are launching their campaigns early.

Article by Patrick Nowak | October 15, 2024

Alibaba, Pinduoduo, JD.com; Singles’ Day Shopping Festival - Key Insights

Singles' Day is the World’s Largest Shopping Event: Originally celebrated for singles, Singles' Day on November 11 has transformed into the largest online shopping day globally, surpassing Black Friday in sales. Now a global phenomenon, it features major discounts, with brands and retailers worldwide joining in.

Early Campaign Launch by Top Chinese Platforms: Leading platforms Alibaba, JD.com, and Pinduoduo kicked off their Singles’ Day campaigns on October 14, earlier than in past years. This launch, bolstered by China’s recent stimulus measures, anticipates high consumer participation.

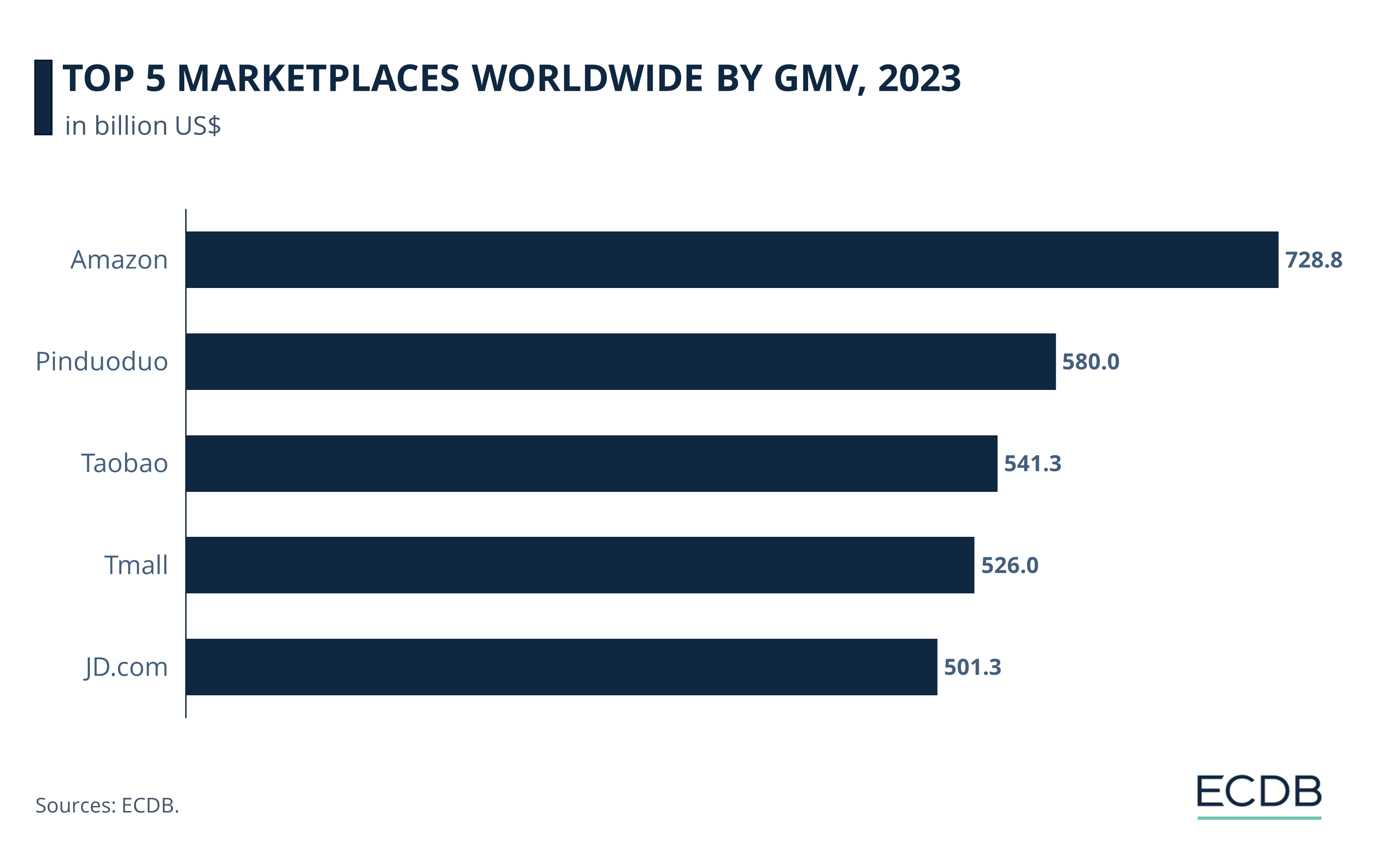

Singles' Day is a major shopping event originating in China, celebrated on November 11 each year. Initially created as a celebration for singles, it has transformed into the world's largest online shopping day, surpassing even Black Friday in sales. Many retailers offer huge discounts, and the event is now a global phenomenon, with brands worldwide participating. This marketing strategy isn’t new, but it works well and has helped Chinese marketplaces grow quickly, becoming very large in a short time.

Alibaba, Pinduoduo, JD.com Launching Campaign

The leading Chinese eCommerce platforms Alibaba, JD.com, and Pinduoduo began their Singles’ Day campaigns on Monday (October 14th), following China’s recent economic stimulus measures. Alibaba’s domestic platforms, Taobao and Tmall, launched their presale events at 8 p.m., anticipating record user participation.

“This year’s 11.11 arrives as consumer confidence is on the rise,” said Liu Bo, Alibaba's vice-president and Tmall's president. “We’re making unprecedented investments to incentivize users and support brands and merchants for high-quality growth.”

JD.com and Pinduoduo, owned by PDD Holdings, launched their Singles’ Day promotions simultaneously this year, a shift from past campaigns. Previously, these eCommerce giants staggered their promotions, partly to avoid direct sales comparisons leading up to November 11.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

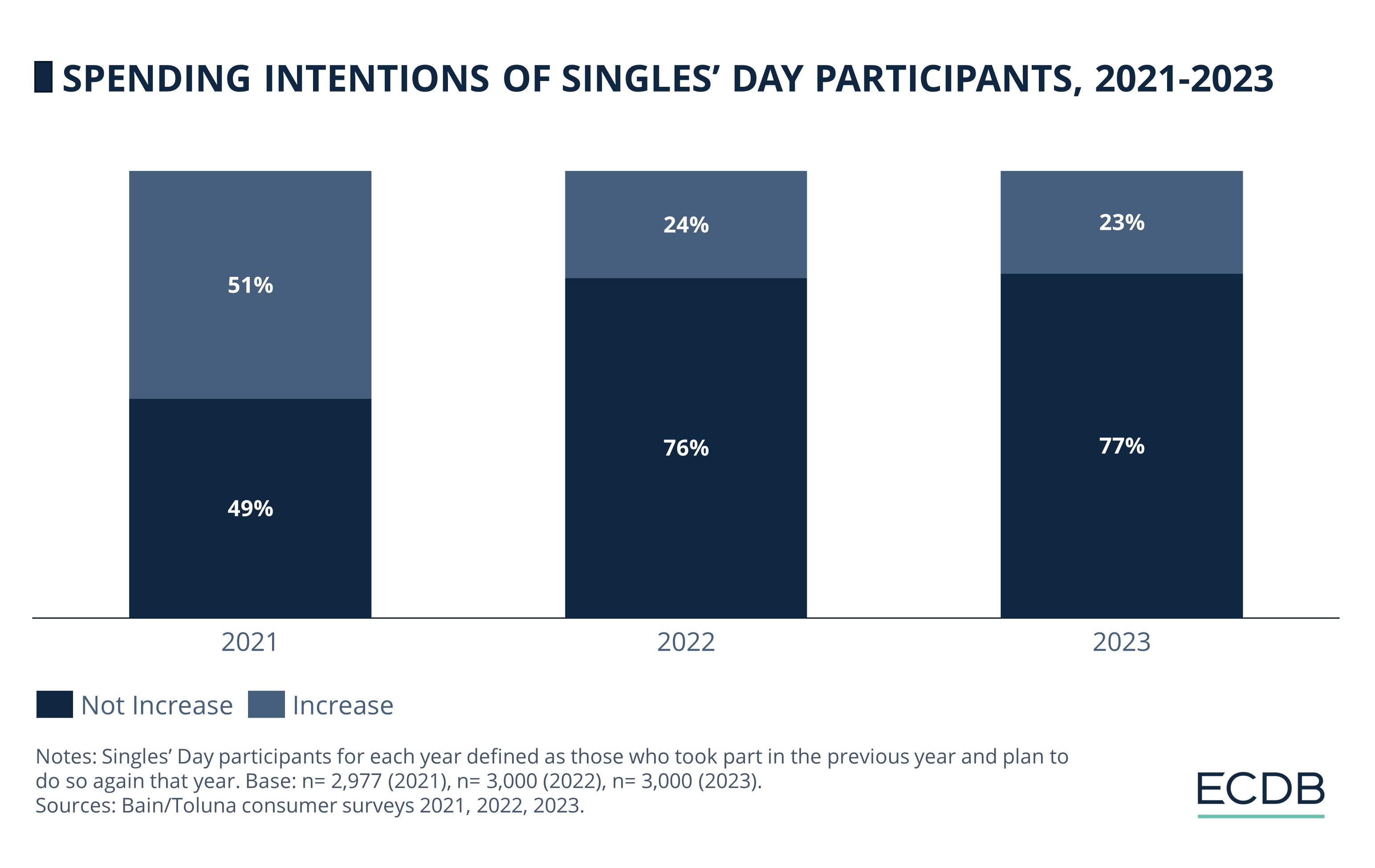

Spending Intentions Of Singles' Day Participants

The chart below shows data from Bain on consumer attitudes toward Singles’ Day from 2021 to 2023. Reflecting reports of stagnant results in 2022, a large share of consumers (76%) in the Bain/Toluna survey said they wouldn’t spend more that year, and that percentage rose slightly to 77% in 2023.

Last year’s forecasts anticipated lower Singles’ Day sales compared to pandemic levels. Instead, Chinese consumers focused on stocking up on essentials like household items, cleaning supplies, and durable foods. A trend that may change in 2024.

Alibaba Started The Singles’ Day

Alibaba first introduced Singles’ Day as an annual online shopping event in 2009, with high discounts and free nationwide shipping. Today, Singles’ Day has evolved into a major consumer spending event. Over the years, campaigns have expanded to span weeks, including both online and physical stores.

This year, the competition has intensified with platforms starting promotions earlier than usual. In 2022 and 2023, major campaigns by Alibaba and JD.com began no sooner than October 20. Now, just weeks after China’s largest post-pandemic stimulus package, consumer spending has surged across popular platforms like Alipay, WeChat Pay, Meituan, Douyin, Trip.com, and Fliggy during the National Day "golden week."

Last month, Alibaba allocated over 40 billion yuan (US$5.7 billion) to attract consumers to Taobao and Tmall, including 30 billion yuan in vouchers. Its campaign will span two checkout periods (October 21-24 and October 31-November 11) and offers a 15% discount with an additional “50 yuan off every 300 yuan” promotion.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Which eCommerce Company Is Dominating Cross-Border Activities?

Which eCommerce Company Is Dominating Cross-Border Activities?

Deep Dive

Struggle in Top 10 U.S. Marketplace Ranking Most Intense in Lower Spots

Struggle in Top 10 U.S. Marketplace Ranking Most Intense in Lower Spots

Deep Dive

ByteDance Is Big on Personal Care, Powered by Content on Douyin and TikTok Shop

ByteDance Is Big on Personal Care, Powered by Content on Douyin and TikTok Shop

Deep Dive

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Back to main topics