eCommerce Top Rankings

Struggle in Top 10 U.S. Marketplace Ranking Most Intense in Lower Spots

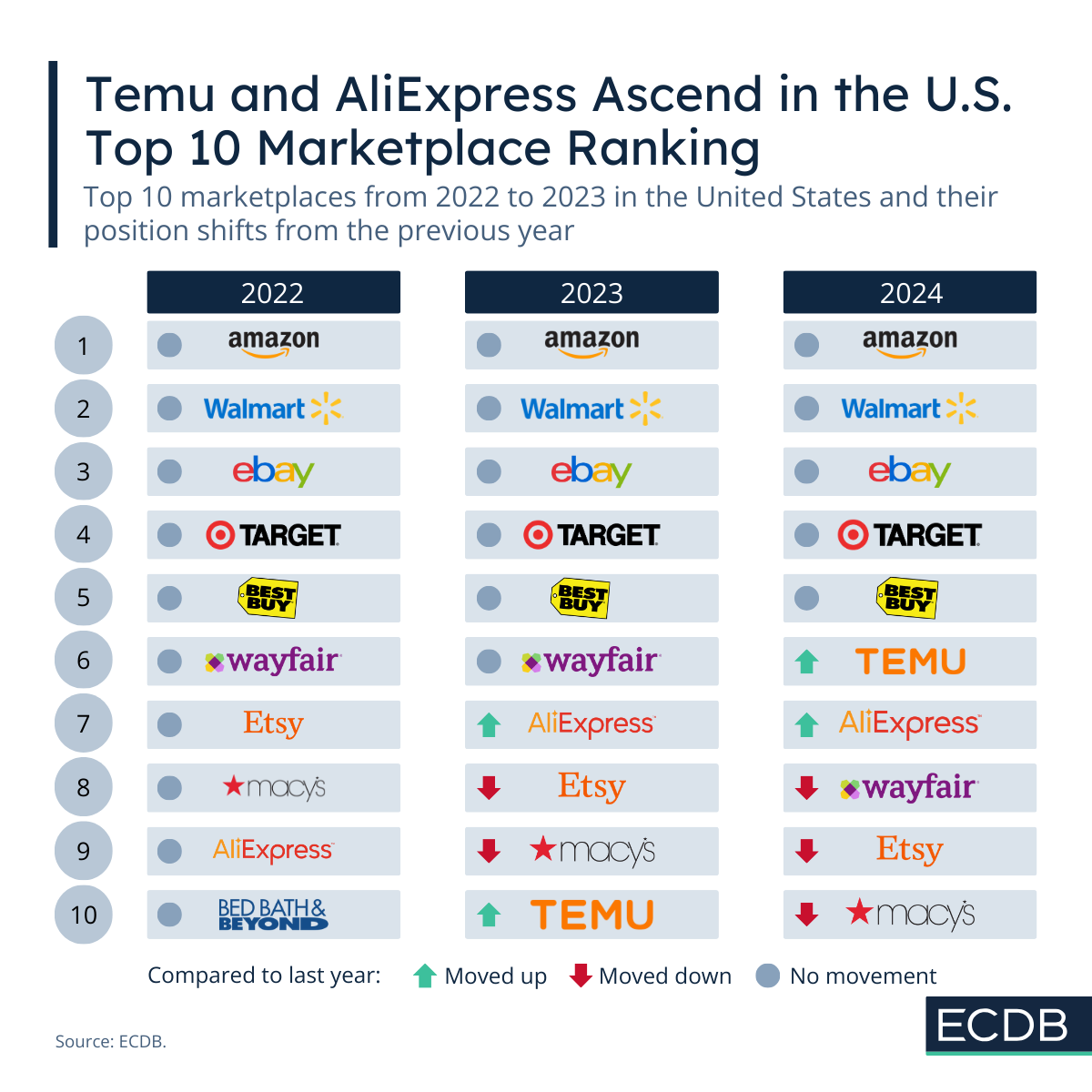

The top 10 marketplace ranking in the United States is being disrupted by two new entrants: AliExpress and Temu.

Article by Nadine Koutsou-Wehling | January 13, 2025

A few weeks into 2025 and it’s time for a recap. A frequent point of discussion in world eCommerce has been the proliferation and widespread success of the marketplace model. In the United States, 2023 and 2024 were characterized by two ascensions that displaced the remaining marketplaces in the top 10 ranking.

The two platforms shaking things up are AliExpress and Temu. Temu has had quite a remarkable climb in a span of just two years, while AliExpress has ascended more gradually and now arrived at a top spot.

But not everyone is equally affected by the news. What marketplaces are most immediately concerned by these shifts?

From Amazon to Target: Secure Spots in the Top Four

The leading four positions face least pressure from the growing competition in this highly disputed ranking. Amazon is and remains the number one above all others, as it defines market standards and shapes eCommerce trends with its all-encompassing eCommerce platforms. Amazon’s marketplace business was the driver of company growth in recent years.

Walmart in second position is also in no credible threat from lower aspirants, given its recent push to higher levels by becoming more like the market leader Amazon. It is just at the third spot with eBay that the outlook is a little shakier. eBay is also in no position to fear its descend in the near future, but GMV has been on a downward trend in the United States for a few years now, decreasing from US$30.5 billion in 2022 to US$29.6 billion in 2024.

Target in fourth place can currently also rely on a buffer to the lower spots, but the situation is a little different for Best Buy. While Target has had a fluctuating GMV in the past few years, its level is way higher than that of the other rankings, with US$23.3 billion. Best Buy, on the other hand, is barely hanging on to fifth place with a GMV that is US$10 billion lower, at US$13.8 billion in 2024.

Temu and AliExpress Take Over Places Six and Seven

The sixth position is where competition in the ranking intensifies. Wayfair was displaced by Temu in 2024, but Temu scrapes at the surface of the fifth place, with a U.S. GMV of US$12.7 billion. Since its launch in 2022, rising to sixth place in the U.S. marketplace ranking within just two years is a reflection of Temu’s low pricing, extensive marketing, engaging gamification features and social media prevalence.

AliExpress reached 7th place in 2023, where it stayed in 2024. All marketplaces that were displaced in this ranking, namely Wayfair, Etsy, Macy’s and Bed Bath & Beyond, are somewhat in peril from the offering of competitors like Temu and AliExpress, which sell products that are similar to identical to those of the former but at such low prices that it is next to impossible to compete with a profit margin.

But even the upper spots have taken precautionary measures to insulate from the impact of these new entrants. In the case of Amazon, that means reducing steps in the supply chain for a special discount segment, so that consumers stay there instead of migrating to Temu or AliExpress. Other retailers with fewer resources may not be able to compete in that way, which is why alternative points of distinction are necessary.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

After Zalando's Takeover of About You: How That Affects German eCommerce

After Zalando's Takeover of About You: How That Affects German eCommerce

Deep Dive

Watching the Super Bowl? Here Is the eCommerce Strategy of the Top Football Merch Retailer Fanatics

Watching the Super Bowl? Here Is the eCommerce Strategy of the Top Football Merch Retailer Fanatics

Deep Dive

ByteDance on the Fast Track With a High Level of Revenue and Strong Growth

ByteDance on the Fast Track With a High Level of Revenue and Strong Growth

Deep Dive

TikTok Shop’s Expansion Plan Extends to Europe and the Americas

TikTok Shop’s Expansion Plan Extends to Europe and the Americas

Deep Dive

Coupang’s Allround Approach Wins in South Korea, but for How Long?

Coupang’s Allround Approach Wins in South Korea, but for How Long?

Back to main topics