eCommerce: Shopping Days

Singles’ Day 2023: Stagnant Growth or Surprising Sales Surge?

Singles' Day: A global shopping event of discounts and new product launches took place again on 11/11. But why are major eCommerce platforms in China reluctant to report results? And how is Singles' Day faring in the West? Learn more here.

Article by Nadine Koutsou-Wehling | January 10, 2024Download

Coming soon

Share

Singles' Day 2023: Key Insights

Singles' Day GMV Not Specified: Alibaba and JD's decision to withhold sales figures for both 2022 and 2023 Singles' Day indicates that their performance may not have met anticipated levels. This could be attributed to the economic deceleration and consumer caution, leading to reduced spending on non-essential products.

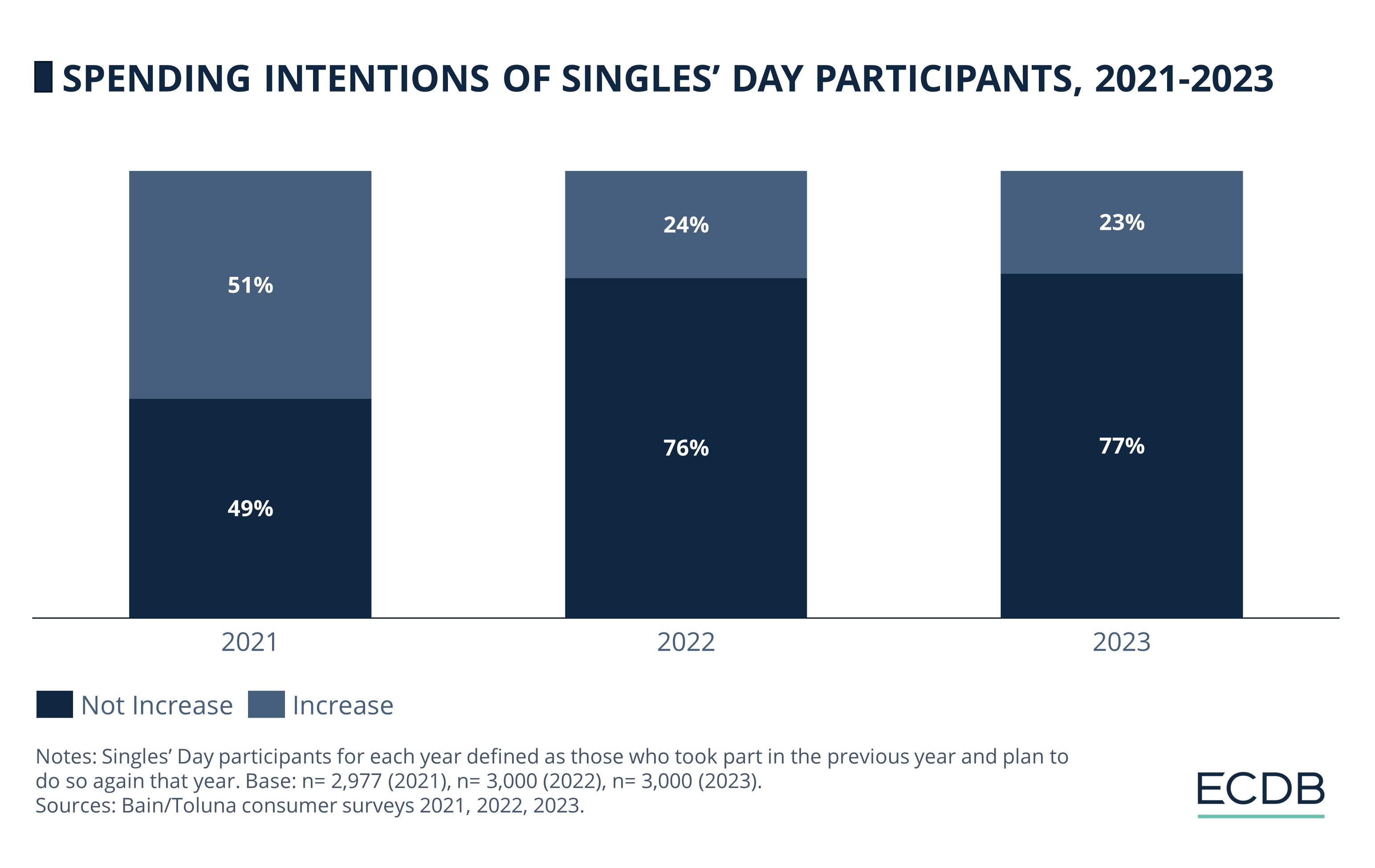

Consumer Spending Stable: Continued flat growth was expected in 2023, as evidenced by a Bain/Toluna survey showing that 77% of consumers had no intention of increasing their spending.

Western Markets Lag Behind: Singles' Day has not garnered significant momentum in Western markets, especially when compared to established shopping events like Black Friday and Cyber Monday. However, due to the vast Chinese consumer base, Singles' Day has the potential to drive sustained industry-wide sales.

Singles’ Day, a shopping event that offers consumers discounted items across a variety of product categories, was introduced by the Chinese eCommerce giant Alibaba in 2009. Since then, not only have Chinese retailers jumped on the bandwagon, but it has also become an accepted shopping day in the West.

Originally, Singles’ Day began in the early '90s as “Bachelor’s Day”, a mock holiday for unmarried individuals who used the occasion to treat themselves to gifts and good times. But in the 21st century, Singles’ Day has become much more than that: An incentive for retailers to expand their customer base and drive sales, regardless of marital status. In particular, major eCommerce platforms in China use the special date of 11/11 to introduce discounted products, using innovative marketing and the latest technology.

ECDB has gathered the latest statistics and forecasts to gauge the performance of Singles’ Day in the here and now. Check out the results below.

Alibaba and JD Keep GMV Results for Singles’ Day 2022 and 2023 to Themselves

Statistics for the last two Singles’ Day sales are hard to come by, as neither market leaders Alibaba nor JD have released exact sales figures or GMV (Gross Merchandise Value) for both years. The underlying assumption is that business did not take off as expected, so both eCommerce players prefer to keep the details to themselves.

In 2023, despite reports of record-breaking sales during the 19-day period from October 24 to November 11, the lack of information on exact GMV and revenue figures suggests that the sales surge these companies were hoping for failed to materialize.

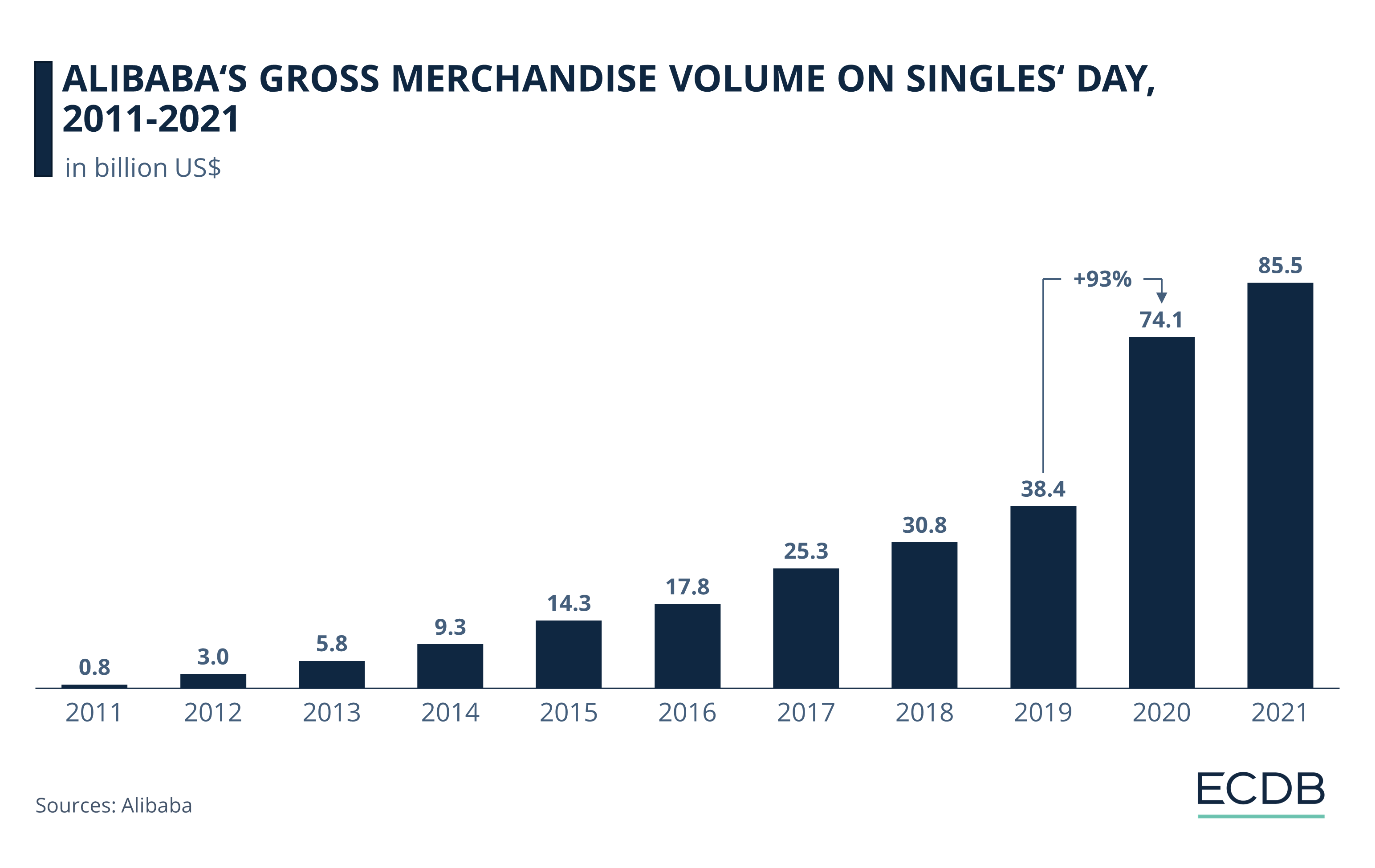

Singles’ Day has traditionally been a significant driver of annual sales, as seen in Alibaba’s example below.

While the pandemic served as a major accelerator for 11/11 eCommerce sales, as evidenced by the 93% annual increase in GMV from 2019 to 2020, market estimates and company press releases suggest that 2022 roughly mirrored 2021 sales.

With high hopes for 2023 to reverse the previous year's stagnation, both Alibaba and JD fed the public with vague numbers after the fact. For instance, Alibaba's newsroom Alizila reported the number of parcels shipped and the number of orders for certain discount classifications, but none of these details allow for concrete conclusions about either GMV or revenue.

Market analysis indicates that Chinese consumers did not plan to spend large amounts of money for Singles' Day 2023. See the next section for more details.

Economic Climate: Consumer Reluctance to Increase Spending

There are underlying macroeconomic reasons for this. In the case of China, it is a slowing economy coupled with consumer demotivation to spend large amounts of money on non-essential items. See the following chart for data from Bain showing consumer responses to Singles’ Day since 2021.

Consistent with statements suggesting stagnant results for the 2022 Singles’ Day event, a clear majority of consumers in the Bain/Toluna survey (76%) stated they did not intend to increase their spending in 2022. And the same goes for 2023, where one percentage point more (77%) declined spending more than last year.

On the same note, forecasts for this year’s Singles’ Day did not expect sales to increase as much as during the pandemic. Rather, in China’s case, consumers said they were planning to stock up on everyday necessities such as household goods, cleaning supplies, and durable foods.

Coinciding with the month in which other shopping days take place, namely Black Friday and Cyber Monday at the end of November, let’s see how Singles’ Day compares to these retail holidays.

Black Friday & Cyber Monday: Most Popular Among U.S. Users

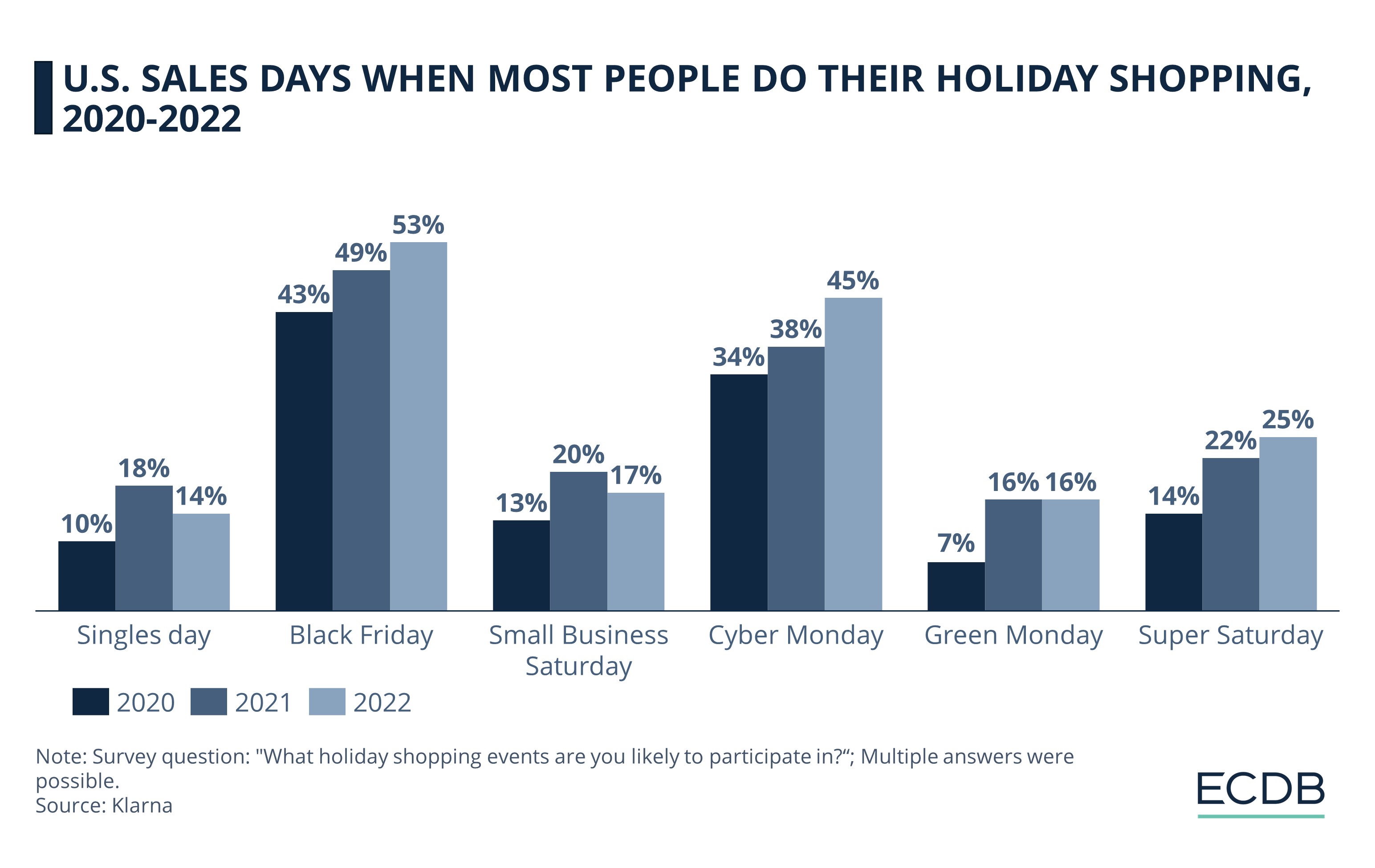

Klarna’s data on shopping intentions during selected shopping days shows that Singles’ Day has a subpar relevance in the U.S., according to consumers:

All of the shopping days displayed in the chart fall between November and December, perfectly aligned with the holiday season. This period, encompassing Thanksgiving, Hanukkah, and Christmas, is traditionally marked by consumers purchasing gifts for family, friends, and themselves.

However, one cannot fail to notice a trend in consumer participation levels. Black Friday and Cyber Monday lead in popularity, with 53% and 45% of consumers respectively expressing their intention to shop on these days in 2022. Singles’ Day, along with other shopping events like Small Business Saturday, Green Monday, and Super Saturday see comparatively lower levels of engagement.

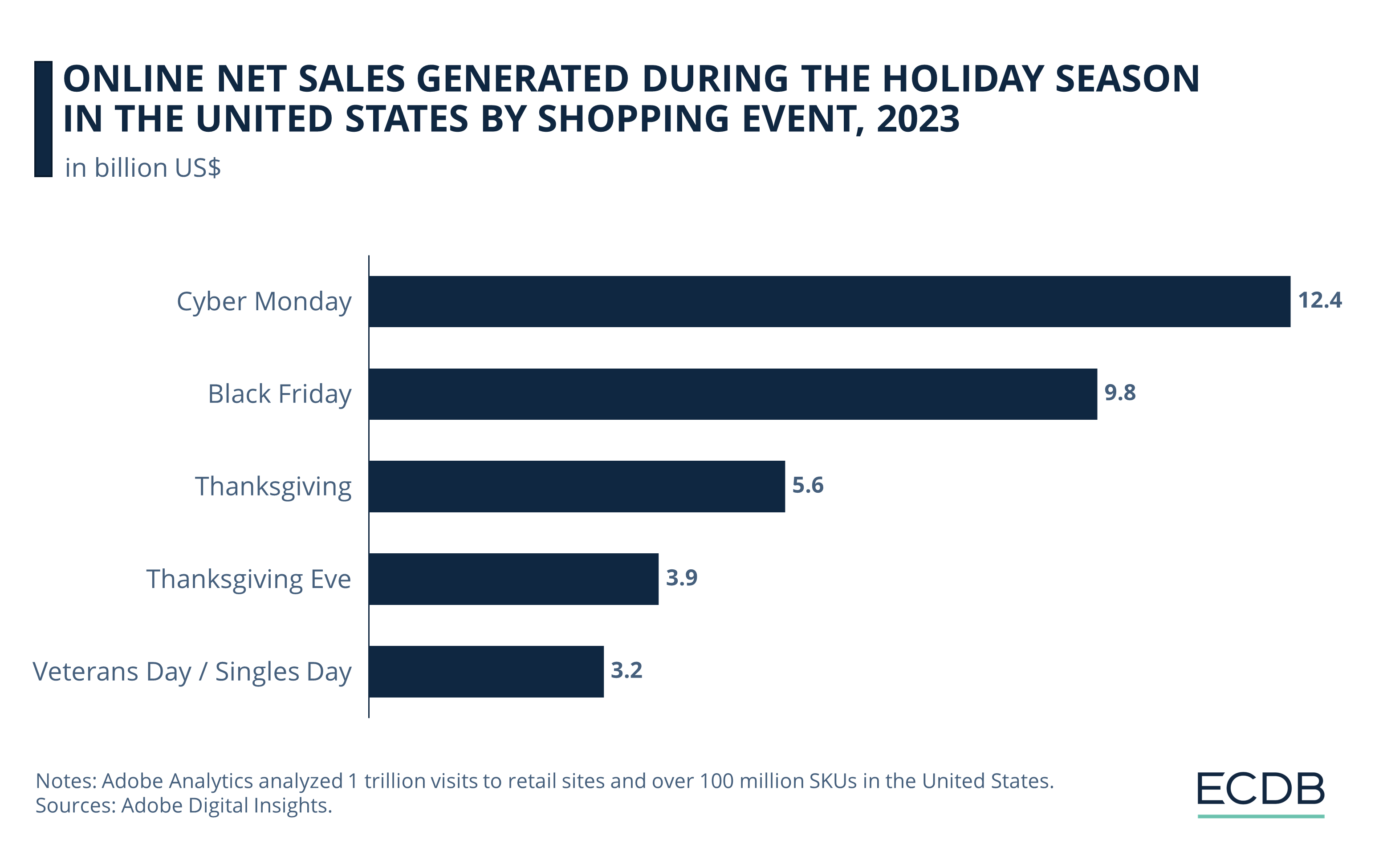

Adobe's data on online net sales during the holiday season in 2023 corroborate these findings:

While Cyber Monday and Black Friday lead the way with respective online net sales of US$12.4 billion and US$9.8 billion, Singles' Day ranks last among all shopping days considered. Only US$3.2 billion in online net sales were generated in the United States on November 11, 2023, numbers that are not even remotely comparable to what Singles' Day typically generates in China.

This disparity can be attributed to the phenomenon of demand saturation. Consumers often defer purchases to these major discount days, perceiving other shopping events as secondary opportunities primarily suited for impulse purchases or discovering new products. Given the additional cost of discounted items compared to not buying at all, it is unlikely that consumers participate in all these shopping events.

Singles’ Day 2023: Concluding Remarks

Despite the relatively low relevance of Singles’ Day in the West, the sheer magnitude of the Chinese consumer base is enough for major players such as Tmall, Taobao, JD and Pinduoduo to fill their coffers for another year of holiday sales. In fact, Alibaba Group's recently released 3Q 2023 quarterly results show that September revenues were up 9% YoY. This comes at a time of restructuring within the organization and efforts to modernize by integrating AI into business operations, which was also a key feature of 2023 Singles' Day.

Other features specific to the Chinese market are worth mentioning as well, such as the growing livestream shopping sector. ECDB has reported on this phenomenon, which is being used by Chinese platforms on Singles’ Day to market products to customers. Despite a growing penetration of livestream watchers, however, the average spend has not increased in line with the growing audience. Major concerns cited by consumers were insufficient delivery times, clunky app interfaces, and unclear return policies.

To meet consumers where they are, platforms will need to up their retail game and offer more relevant, higher-quality products with accommodating terms for users. While the integration of AI and the hosting of major events reflect an effort to provide consumers with remarkable shopping experiences, it remains questionable how far Singles' Day's influence can reach, especially from a global perspective.

Sources: Alizila – Bain – Beauty Matter – NASDAC: 1 2

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics