Cross-Border Marketplaces

Which eCommerce Company Is Dominating Cross-Border Activities?

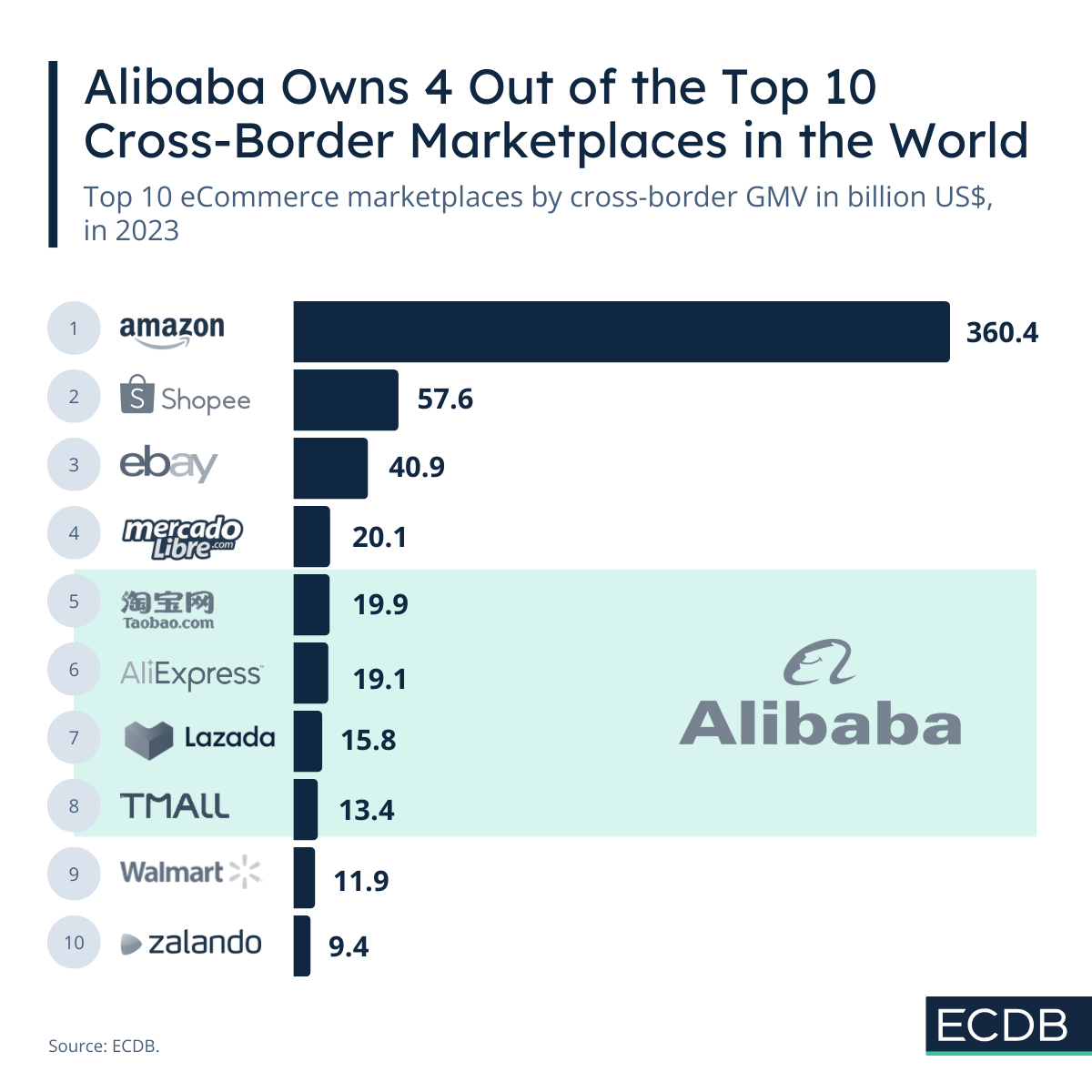

Amazon rules the cross-border ranking with the highest GMV, while Alibaba stands out due to the variety of players it has involved.

Article by Nadine Koutsou-Wehling | January 21, 2025

Which eCommerce conglomerate wins the cross-border race? For any eCommerce specialist, the range of possible answers can only include two names: Amazon and Alibaba. Both are eCommerce leaders on their side of the globe, but one clearly overshadows the other.

Each marketplace page on ECDB features a list of countries in which the platform operates. But a large variety of international markets does not immediately imply that the marketplace generates a high cross-border GMV. This distinction becomes evident when taking a closer look at the top 10 cross-border marketplaces.

How Amazon and Alibaba Drive Cross-Border eCommerce

Amazon and Alibaba are the two biggest cross-border companies in the world. Both are leaders in their own right: Amazon's customer-centric approach has made it highly successful in a wide variety of countries. As a result, Amazon's cross-border GMV dwarfs that of any other eCommerce company by such a wide margin that it is almost unimaginable for any competitor to match Amazon’s size.

In 2023, Amazon generated over US$360 billion across borders. That alone is comparable to the GDP of a medium-sized economy like Egypt. In comparison, Alibaba’s cross-border GMV does not approach Amazon’s activity.

But the Chinese eCommerce leader distinguishes itself in another way: Alibaba owns 4 out of the top 10 cross-border marketplaces in the world. Of these, Taobao and Tmall are Alibaba’s two domestic marketplaces that operate primarily in China. The dedicated ECDB profiles show that Taobao and Tmall generate up to 5% of their GMV in Southeast Asia.

These are not large percentages, but due to the sheer size of their marketplace transactions, even small percentages are enough to place Taobao and Tmall among the top 10 of global cross-border platforms. In 2023, US$19.9 billion worth of products were sold cross-border on Taobao, while Tmall reached US$13.4 billion.

The remaining two marketplaces under Alibaba’s management in the cross-border top 10 are Lazada and AliExpress. The former is mainly active in Southeast Asia, especially Indonesia, while the latter covers more diverse markets around the globe. Both are successful cross-border players, known internationally as marketplaces where consumers can strike a bargain on a wide range of products.

Top 10 Cross-Border Marketplaces: Wide Distribution Meets Narrower Focus

Aside from Amazon and Alibaba, most of the cross-border marketplaces in the top 10 have different affiliations. Shopee is operated by Sea Ltd., a Singaporean multinational eCommerce conglomerate. Most of its regions of operation are in Latin America and Southeast Asia with a strong focus on China, Vietnam and Thailand.

The remaining rankings among the top 10 cross-border marketplaces include eBay with a cross-border focus on Europe, which also goes for Zalando in 10th place. MercadoLibre serves a Latin American audience, while Walmart’s international markets are few, but large, consisting of Canada and Mexico.

The top marketplaces illustrate that it is not necessarily a large number of international markets that generate cross-border success. A narrower focus on key regions can be just as effective.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

U.S. and China With High Exports, While European Countries Show Opposite Trend

U.S. and China With High Exports, While European Countries Show Opposite Trend

Deep Dive

Cross-Border eCommerce Growth Reflects Growing World Trade Tensions

Cross-Border eCommerce Growth Reflects Growing World Trade Tensions

Deep Dive

How Local Competition Defeated U.S. Retail Giant Amazon

How Local Competition Defeated U.S. Retail Giant Amazon

Deep Dive

Global Cross-Border eCommerce: Top Markets, Countries & Marketplaces by GMV

Global Cross-Border eCommerce: Top Markets, Countries & Marketplaces by GMV

Deep Dive

Amazon & eBay: China-Based Sellers on Western Marketplaces Grow

Amazon & eBay: China-Based Sellers on Western Marketplaces Grow

Back to main topics