Cross-Border eCommerce

Global Cross-Border eCommerce: Top Markets, Countries & Marketplaces by GMV

Buying and selling online across borders is an integral part of global eCommerce. The specifics of this market are discussed here.

Article by Nashra Fatima | May 27, 2024Global cross-border eCommerce is growing, with its market value predicted to reach a staggering US$7.9 trillion by 2030. Consumers prefer to shop abroad because of product variety, affordability, or sometimes plain novelty. In response, international marketplaces are proliferating.

What are the top markets for cross-border shopping? What are the top destination countries and marketplaces by cross-border GMV?

We answer these questions, but first, we explain what cross-border eCommerce is, its benefits, and challenges.

What is Cross-Border eCommerce?

Cross-border eCommerce refers to the process of buying and selling products internationally. For retailers, this means selling to consumers abroad through online channels.

Typical platforms for cross-border eCommerce are brand websites and marketplaces like Amazon, eBay, and Etsy.

Cross-border eCommerce is growing rapidly, with many companies now tapping into consumer markets outside of their domestic countries.

Benefits of Cross-Border eCommerce

The advantages of cross-border eCommerce for sellers include:

Access to new markets: Through cross-border eCommerce, retailers can explore new markets and build a global consumer base.

Brand visibility: By reaching an international audience, companies can build their brand identity and enhance their visibility beyond their domestic markets.

More sales opportunities: With access to bigger and newer consumer markets, retailers are well positioned to increase their sales as well as profit margins.

Challenges of Cross-Border eCommerce

Cross-border eCommerce comes with its set of challenges:

Legal regulations: Each country has different rules regarding product quality and safety. Some products may be illegal or prohibited, for which sellers would need authorization.

Payment issues: Many markets across the world still have cash-based economies, with customers preferring to pay in cash upon delivery. Sellers may struggle in finding secure payment methods and avoid fraud risks.

Shipping complexities: Sellers may encounter custom delays or technical problems when shipping orders internationally. This may cost time and money.

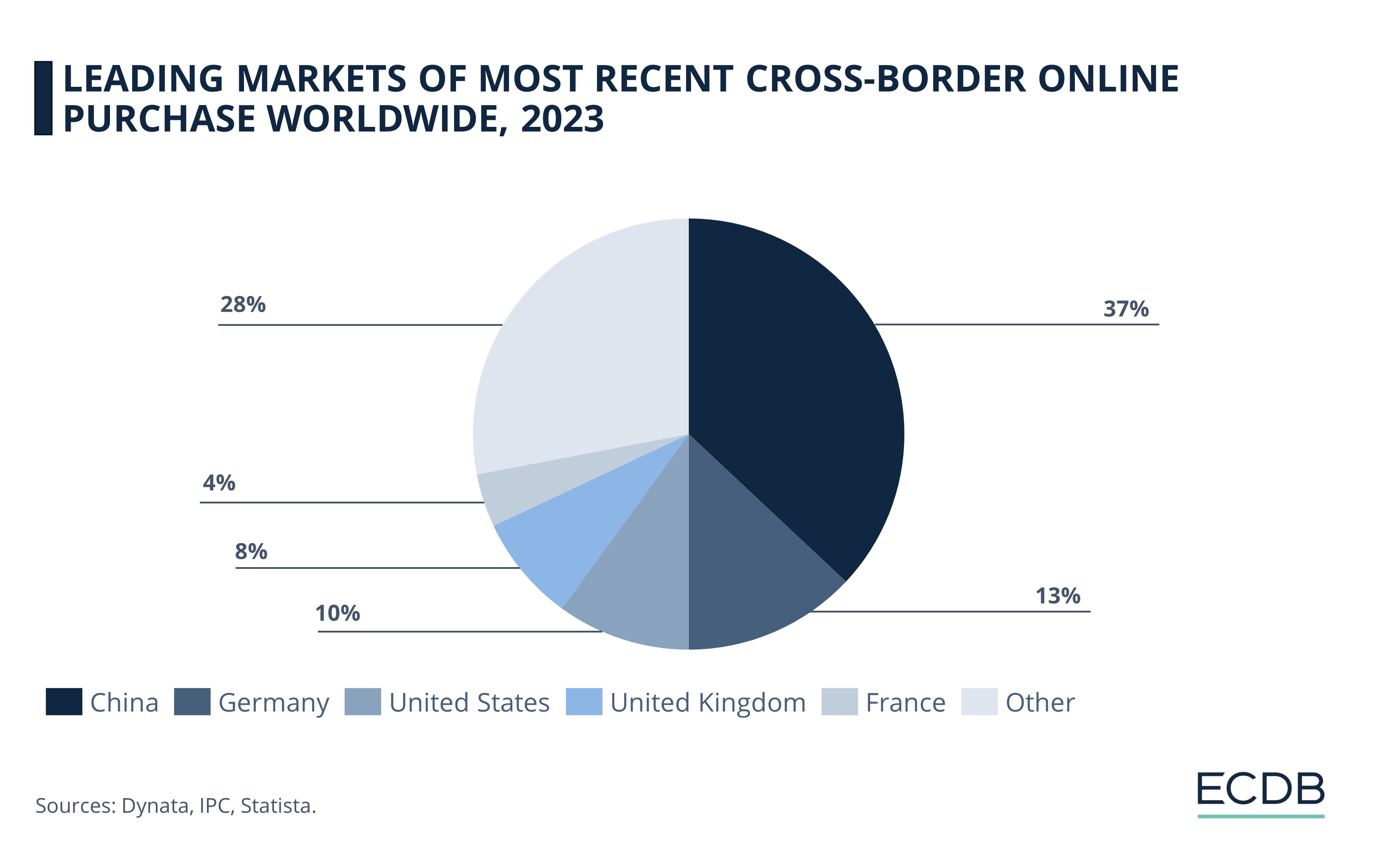

Top 5 Markets for Cross-Border Shopping

Not only is China the largest market for eCommerce, but it is also the most popular market amongst cross-border shoppers.

According to Dynata, 37% of international consumers surveyed in 41 countries said that they made a purchase from a China-based eCommerce platform in the past year. Growing eCommerce exports GMV in China further support this finding.

Germany is second, with 13% of cross-border shoppers having made their purchases here.

The United States stands third, at 10%.

The United Kingdom and France follow, at 8% and 4% respectively.

Despite the smaller shares of cross-border shoppers per country, Europe emerges as a significant regional hub for cross-border eCommerce: three countries in our top five list are in Europe.

Most cross-border consumers who shop in Europe also reside there. For example, half of UK’s cross-border shoppers were from Ireland (52%) and the remaining from Iceland (27%).

Similarly, Germany’s main cross-border shoppers came from within the EU: Luxembourg (75%) and Austria (58%). Relaxations on tariffs and duties as well as fewer supply chain expenses encourage cross-border eCommerce in the EU. Nonetheless, for most European consumers, China remains the top choice for cross-border shopping.

The United States has two big cross-border consumer markets. The first is its neighbor Canada, which makes up 47% of its total market. South Korea is second, at 38%.

Meanwhile, China is a favorite for shoppers from all over the world. Latin American consumers from Brazil (72%) and Chile (72%) take the lead. Indonesian (56%) and U.S. (53%) shoppers are next. Consumers from Poland, Spain, and Germany are not far behind, with between 50% and 53% of them having bought from China in the past year

For your information: We regularly update our rankings with the latest data from our models, providing valuable insights to help improve your company. Which stores and companies are leading eCommerce? Which categories are driving bestsellers and high sales? Find out for yourself on our rankings for companies, stores, and marketplaces. Stay a step ahead of the market with ECDB.

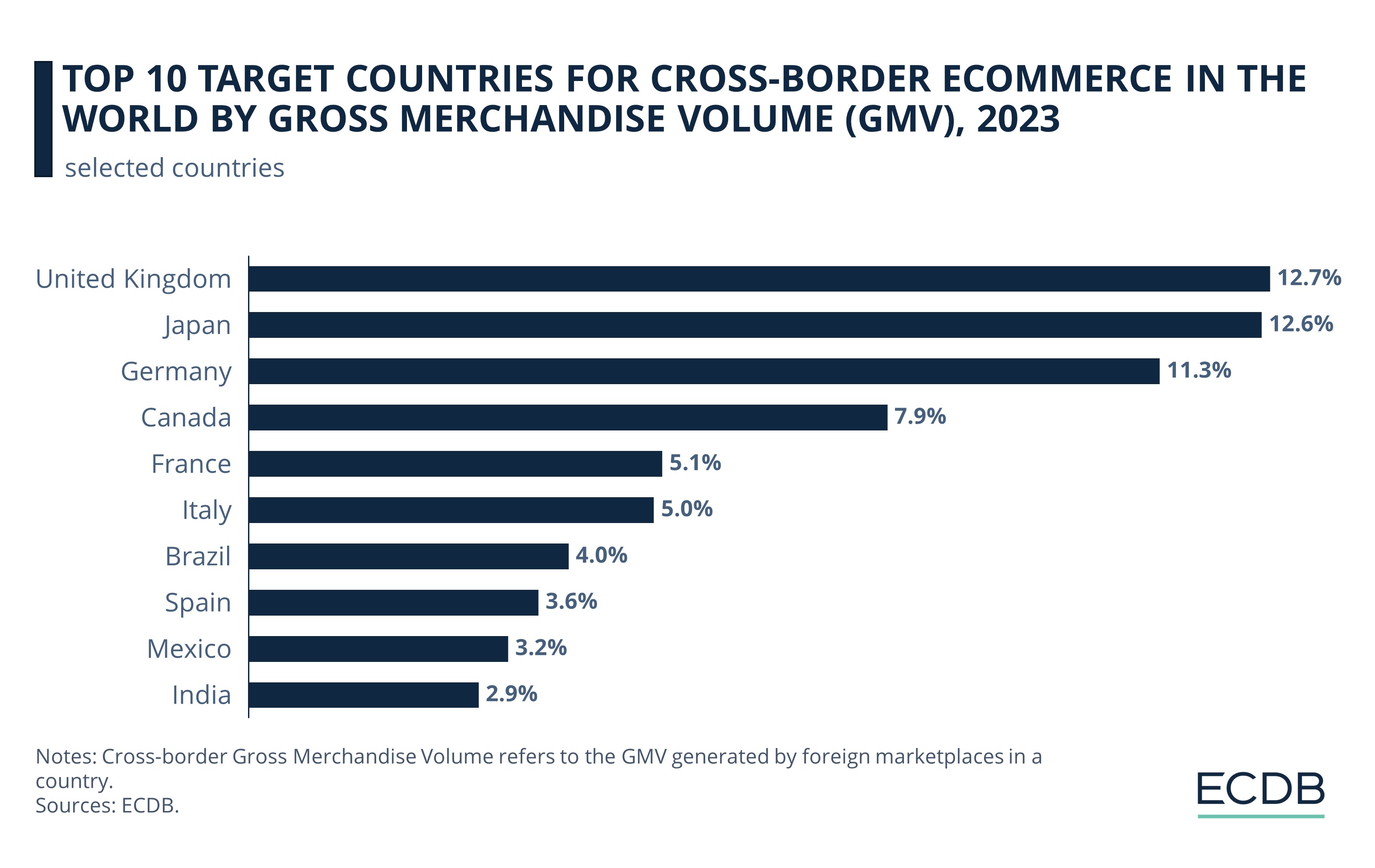

Top 10 Target Countries for Cross-Border Marketplaces

In 2023, the global GMV of cross-border marketplaces collectively amounted to US$634 billion. Our ECDB data reveals the top target countries in terms of the share they had of the total global cross-border marketplace GMV.

The United Kingdom was the top destination country for cross-border platforms in 2023. Foreign marketplaces generated 12.7% of the total global cross-border GMV - or US$80 billion - there, making it their friendliest market for cross-border activity.

Japan was a close second, with a share of the cross-border marketplace GMV of 12.6%, or US$79.7 billion.

Germany was the third most receptive destination, with 11.3% (US$71.6 billion).

Canada ranked fourth, accounting for 8% of the global cross-border marketplace GMV, worth US$50 billion.

France was fifth, with a cross-border marketplace GMV share of 5.1%, amounting to US$32.5 billion.

Italy, Brazil, and Spain fell in the middle range, where foreign marketplaces made approximately 4 to 5% of the total cross-border GMV.

In comparison, India and China ranked low, at tenth and eleventh positions respectively. Here, foreign marketplaces generated less than 3% of the total cross-border GMV. The findings suggest that in these countries, local and nationally focused marketplaces have stronger popularity.

National marketplaces are competitive in both these markets. Also, customers may prefer localized service due to language support and payment options. Government policies also boost local platforms by imposing taxes and import duties on foreign goods. Thus, cross-border marketplaces are likely to face greater challenges in penetrating the market and capturing consumer interest.

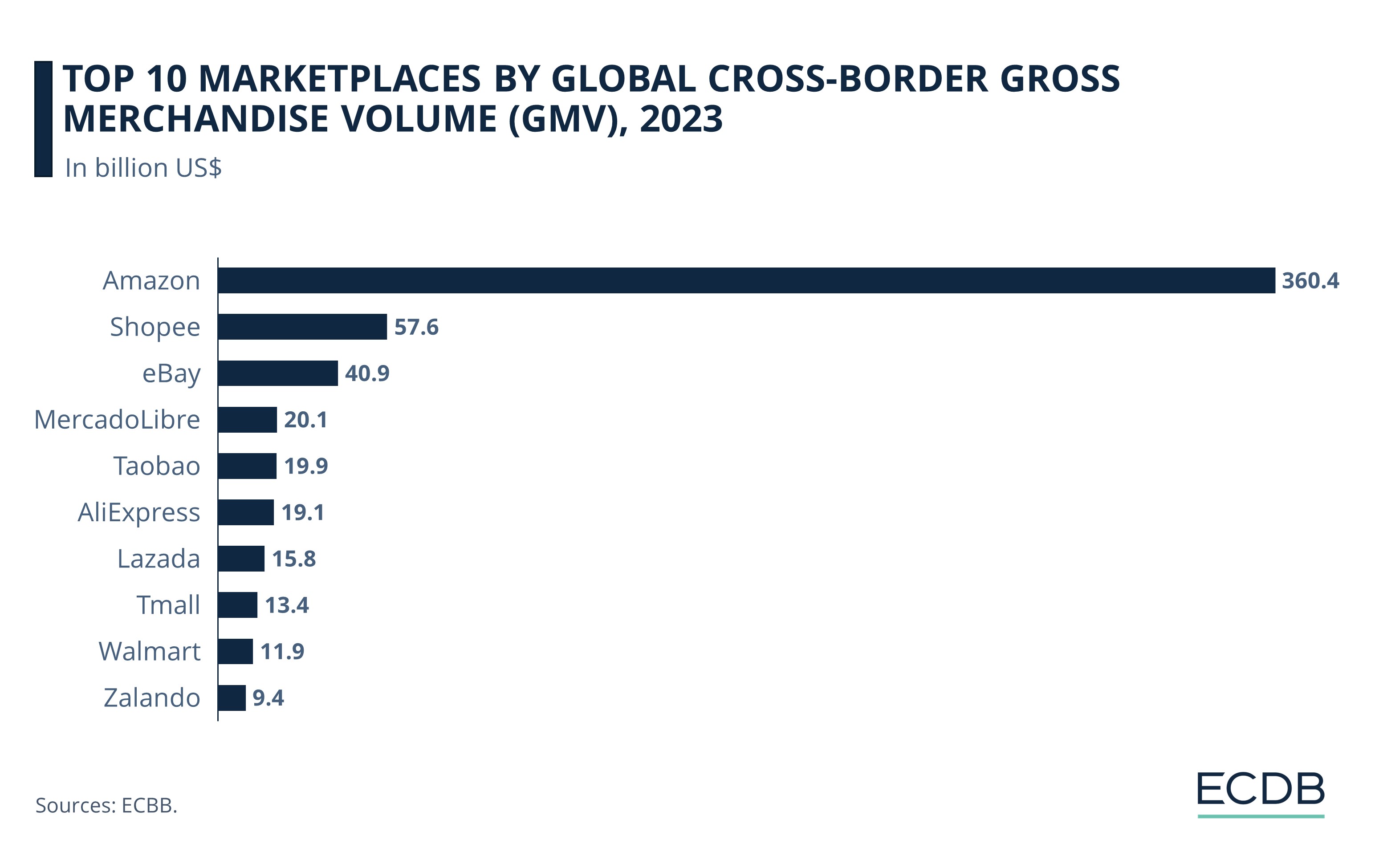

Top 10 Marketplaces by Cross-Border GMV in 2023

Marketplaces play a central role in driving cross-border eCommerce. Per Statista, in 2022, marketplace was the second most chosen platform type for cross-border online shoppers, behind brand websites.

Our ECDB data shows the top ten marketplaces in terms of their cross-border GMV:

Amazon

The world’s biggest marketplace by total GMV, Amazon also had the highest cross-border GMV of US$360.4 billion in 2023.

It generated nearly half (49.4%) of its total GMV through cross-border eCommerce activity, with the leading countries being Japan (9%) and the UK (8%). The other half of it is generated in the United States, its main market.

Shopee

Far behind Amazon and in the second position is Shopee, with a cross-border GMV of US$57.6 billion. However, Shopee’s cross-border share is much higher than Amazon’s: it generates nearly three-fourth of its GMV (73%) outside of its main market of Indonesia.

Shopee is the eighth biggest marketplace globally. Its leading international markets that are the biggest contributors to its total GMV are in the Asia Pacific – China (17%), Vietnam (15%), and Thailand (10%).

eBay

eBay is the third biggest marketplace by cross-border GMV, at US$40.9 billion. This marketplace, which ranks ninth globally, generates more of its GMV abroad (57%) than in its main market of the United States (43%).

The UK and Germany are eBay’s major international markets, making up for 17% and 14% of its total GMV. Australia is next, with 6.6%, while other European markets like Italy, France, and Spain account for smaller shares, between 1 and3.7%.

Apart from the top three, other platforms have relatively small cross-border GMVs. For instance, at US$20 billion, fourth-ranked Mercado Libre generates less than half the GMV of third-ranked eBay.

Similarly, Walmart, which is the seventh-largest marketplace globally, has a cross-border GMV of only US$11.9 billion. This marketplace maintains a domestic focus, generating less than 9% of its total GMV abroad.

Marketplaces with notably high cross-border GMV shares include Lazada (74%), Zalando (69%), and eleventh-ranked Temu (57%) which has seen a meteoric rise since its recent launch.

Chinese Marketplaces

Three Chinese owned marketplaces rank in the top ten: AliExpress, Taobao, and Tmall. But these Chinese platforms are notable for their diverging cross-border focuses.

Out of these, only AliExpress generates most of its GMV – a remarkable 88% – abroad.

In comparison, Taobao and Tmall have very modest cross-border GMV shares, at 3.7% and 2.5% respectively. These two marketplaces are focused on their main market of China, from where they derive the lion’s share of their GMVs.

Global Cross-Border eCommerce: Closing Remarks

Although an expanding market, global cross-border eCommerce is vulnerable to fluctuations in world trade, inflation, and increased cost of living. It is further complicated by custom delays and regulations as well as added supply chain costs.

To retain customers and grow in new markets, retailers and marketplaces must adapt their models. This includes strategies to show all costs upfront, minimize shipping fees, shorten delivery times, and accept diverse payment methods.

Having developed their national eCommerce ecosystems, domestic eCommerce remains much stronger in large markets like China and the U.S. Popular for consumers to shop in, they are not so beneficial for cross-border marketplaces, which have not yet gained traction in these countries.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

U.S. and China With High Exports, While European Countries Show Opposite Trend

U.S. and China With High Exports, While European Countries Show Opposite Trend

Deep Dive

Which eCommerce Company Is Dominating Cross-Border Activities?

Which eCommerce Company Is Dominating Cross-Border Activities?

Deep Dive

Cross-Border eCommerce Growth Reflects Growing World Trade Tensions

Cross-Border eCommerce Growth Reflects Growing World Trade Tensions

Deep Dive

How Local Competition Defeated U.S. Retail Giant Amazon

How Local Competition Defeated U.S. Retail Giant Amazon

Deep Dive

Amazon & eBay: China-Based Sellers on Western Marketplaces Grow

Amazon & eBay: China-Based Sellers on Western Marketplaces Grow

Back to main topics