Chinese eCommerce Giants

ByteDance Is Big on Personal Care, Powered by Content on Douyin and TikTok Shop

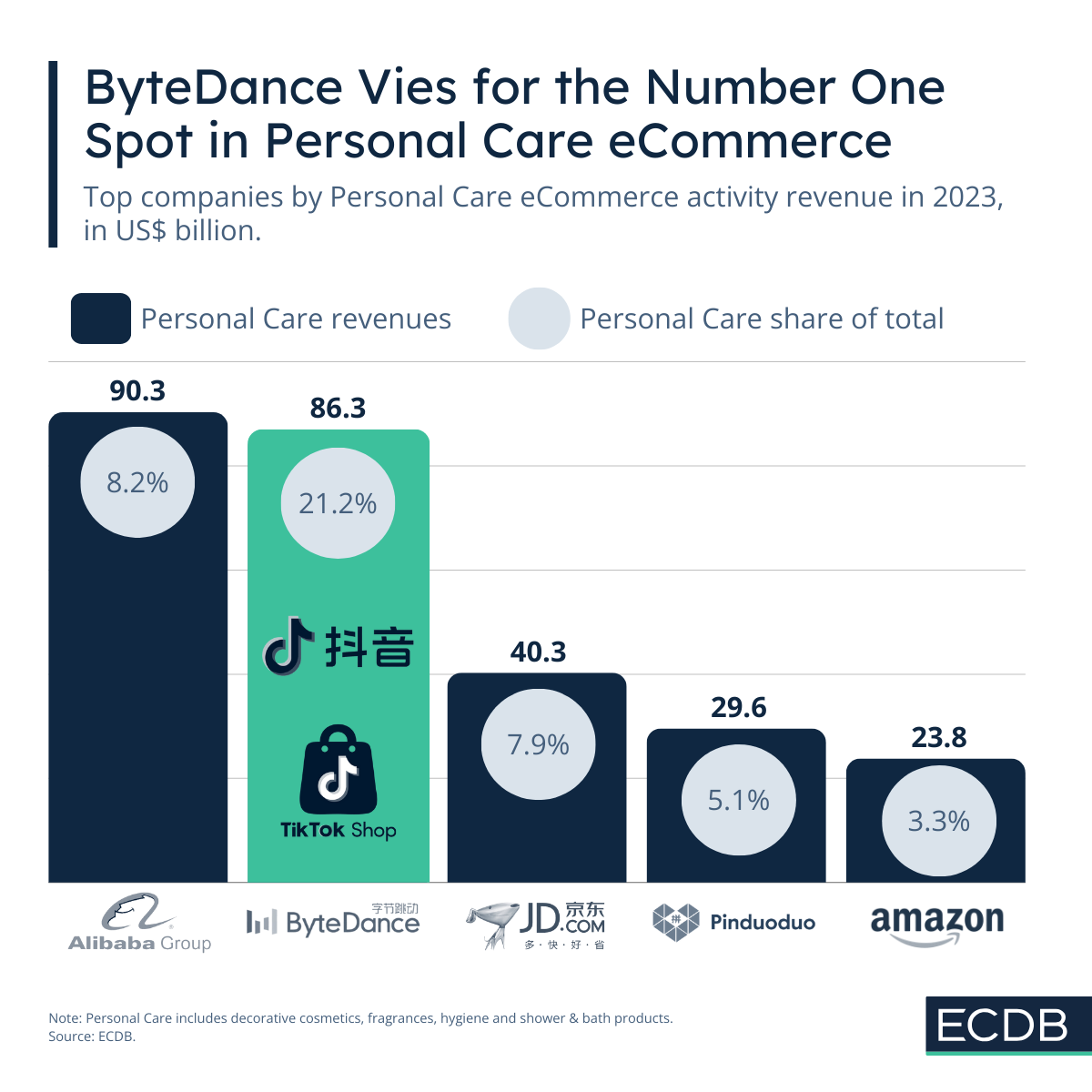

Following close behind market leader Alibaba, ByteDance closes the gap to the number one Personal Care eCommerce company.

Article by Nadine Koutsou-Wehling | December 09, 2024

ByteDance – it brings to mind TikTok and Douyin, dance videos and skits, quick infomercials linked to shopping for products, all in short succession. There is one eCommerce product category with which ByteDance has a mutually beneficial, even symbiotic, relationship: Personal Care, including cosmetics, hygiene, bath & shower and fragrances.

In global eCommerce, ByteDance is the second largest company in the Personal Care category, following just a few billion U.S. dollars behind market leader Alibaba. Personal Care is quite significant for ByteDance, given its high standing in that field. On a broader scale, across all categories, ByteDance ranks fifth and generates revenues well behind Alibaba’s.

Personal Care Is the Largest Category on Douyin and TikTok Shop

Of the US$86.2 billion that ByteDance generated in Personal Care over the course of 2023, US$80.2 billion were generated on Douyin. TikTok Shop is much smaller, so it contributed US$6 billion. Care Products and its subcategory Personal Care are the largest contributors to total GMV on both platforms. On Douyin, 20.7% of GMV is generated by Personal Care, while Personal Care accounts for 30.1% on TikTok Shop.

None of the other eCommerce companies in the top 5 for Personal Care have this focus. Alibaba’s main category is Fashion (37.0%), JD.com’s biggest category is Electronics (28.9%), PDD Holdings has a Fashion focus (55.7%), while Amazon’s largest category is Hobby & Leisure (37.0%). The reason that ByteDance is the only company where Personal Care is the number one revenue generator has to do with the nature of its platform content.

The Nature of the Content Benefits Beauty Product Presentation

Douyin and TikTok are especially suited to promoting grooming products due to the beauty-focused nature of their content. Beauty products can be easily integrated into the videos, where the promotion is not an end in itself, but rather a byproduct: Applying makeup while talking about another, unrelated topic, wearing a face mask while discussing private events – products are used in a natural setting, so their presentation does not feel forced or contrived.

Because of the role model function that creators tend to have on their audience, particularly if it is a regular following, the viewers often seek to buy the products creators use. That effect is not as refined on the other platforms in the top 5, as they are pure eCommerce platforms. The live commerce streams shown on Tmall, Taobao, Pinduoduo, JD.com or Amazon are more obvious advertisements than the content on Douyin or TikTok Shop, where the focus on entertainment keeps the product advertising more subtle.

Looking Ahead: Personal Care Focus Likely to Continue

Douyin and TikTok are sister companies, both operated by ByteDance. Douyin was launched in 2016 and is only available in the Chinese market. Its eCommerce business has been activated just a few years later, in 2018, which is why Douyin is way more successful than TikTok Shop.

TikTok follows in the footsteps of Douyin, but it is only available outside of China. Due to its recent launch, in 2021, its development is still underway. If it follows the path of its sister company Douyin, one can expect the focus on Personal Care to continue on TikTok Shop. As the platform is predicted to grow rapidly in the coming years, revenues generated on TikTok will especially benefit those who align with platform preferences.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

After Zalando's Takeover of About You: How That Affects German eCommerce

After Zalando's Takeover of About You: How That Affects German eCommerce

Deep Dive

Watching the Super Bowl? Here Is the eCommerce Strategy of the Top Football Merch Retailer Fanatics

Watching the Super Bowl? Here Is the eCommerce Strategy of the Top Football Merch Retailer Fanatics

Deep Dive

ByteDance on the Fast Track With a High Level of Revenue and Strong Growth

ByteDance on the Fast Track With a High Level of Revenue and Strong Growth

Deep Dive

TikTok Shop’s Expansion Plan Extends to Europe and the Americas

TikTok Shop’s Expansion Plan Extends to Europe and the Americas

Deep Dive

Struggle in Top 10 U.S. Marketplace Ranking Most Intense in Lower Spots

Struggle in Top 10 U.S. Marketplace Ranking Most Intense in Lower Spots

Back to main topics