eCommerce: Black Friday & Shopping Days

Black Friday Analysis 2023: U.S. Online Sales, CAGR & Retailer Plans

What strategies do customers and merchants use for Black Friday? U.S. online sales, CAGR & retailer plans: This article explores the success of eCommerce and the countries with the most engaged shoppers during this sales event.

Article by Nashra Fatima | November 22, 2023Download

Coming soon

Share

Black Friday 2023: Key Insights

In 2022, more than half the consumers surveyed in the United States intended to shop for holiday presents on Black Friday.

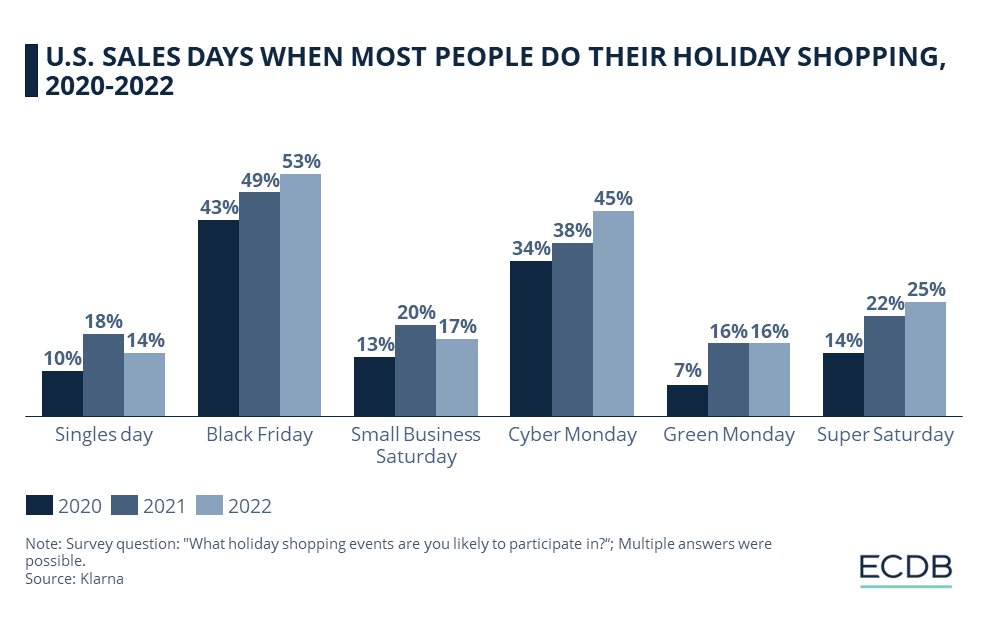

Black Friday’s popularity as a sales event has climbed consistently from 2020 to 2022. It is more popular among consumers than other sales days such as Cyber Monday and Super Saturday.

Retailers also anticipate Black Friday, and a large share of them strategize to launch promotion campaigns on this sales event.

Online sales on Black Friday have surged in recent years, with the highest online sales yet recorded in 2022.

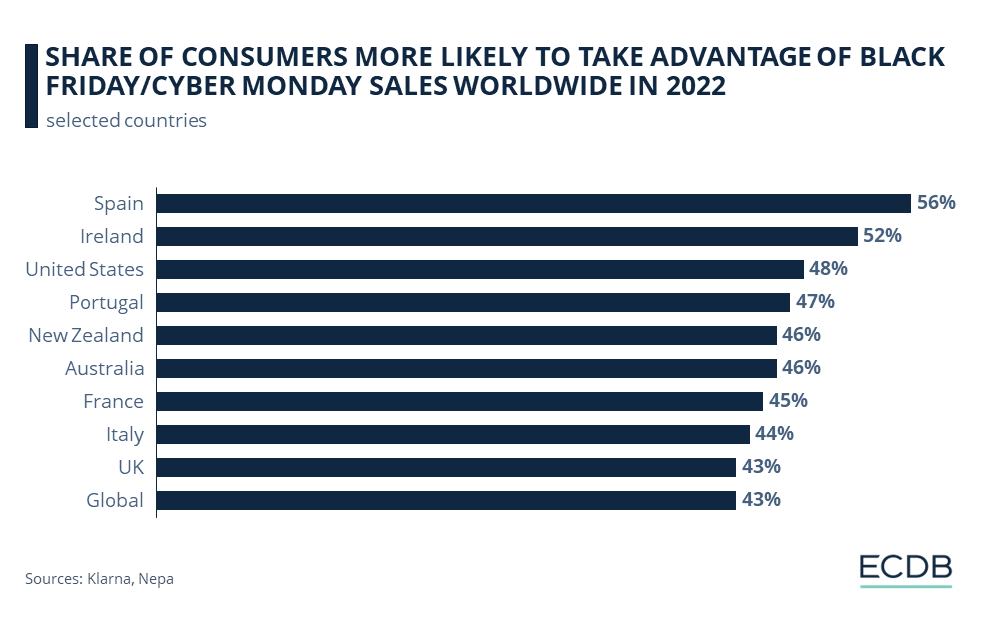

From a country-level perspective, the largest share of consumers more likely to shop for the holiday season on Black Friday come from Spain and Ireland. They are followed by shoppers in the U.S., Portugal, and New Zealand.

Black Friday enjoys global popularity, as indicated by 43% of consumers across the world who expressed their intent to conduct their holiday shopping at this sales event.

What jumpstarts holiday season shopping if not Black Friday sales? Now established as a mega shopping event of the year, Black Friday tempts customers with big deals on an assortment of products and gives companies an opportunity to drive sales with strategic discounts. Online shopping platforms have only galvanized the day’s popularity.

Black Friday is the day immediately after Thanksgiving. This year, it falls on November 24. Going by previous records, retailers and marketplace giants are expected to participate and incentivize shopping for customers. As both consumers and businesses wait in anticipation, we bring you insights beyond what Black Friday promises to how it is perceived and how it has evolved.

How do consumers and retailers approach Black Friday? What role has eCommerce played on the day? How does its appeal differ across countries? We give you data-backed answers.

USA: Consumer Attitudes Towards Black Friday

In the United States, Black Friday enjoys a high level of visibility. Particularly when it comes to conducting their holiday shopping, more consumers set their eyes on Black Friday than on any other sales event of the year.

In 2022, over half the consumers surveyed in the U.S. intended to shop for holiday presents on Black Friday. The day’s popularity has only increased in the past three years, jumping from 43% in 2020 to 53% in 2022. Significant bargains and the chance to get big-ticket items at steal prices that this event offers, unlike any other sales day of the year, may explain customers’ enthusiasm for it.

In comparison to Black Friday, other sales events like Cyber Monday (45%) and Super Saturday (25%) fall behind in popularity. Customers favor Singles Day (14%) and Green Monday (16%) the least when it comes to holiday shopping, although the latter underwent the largest proportional increase in popularity from 2020 to 2022.

Black Friday: Retailer Plans

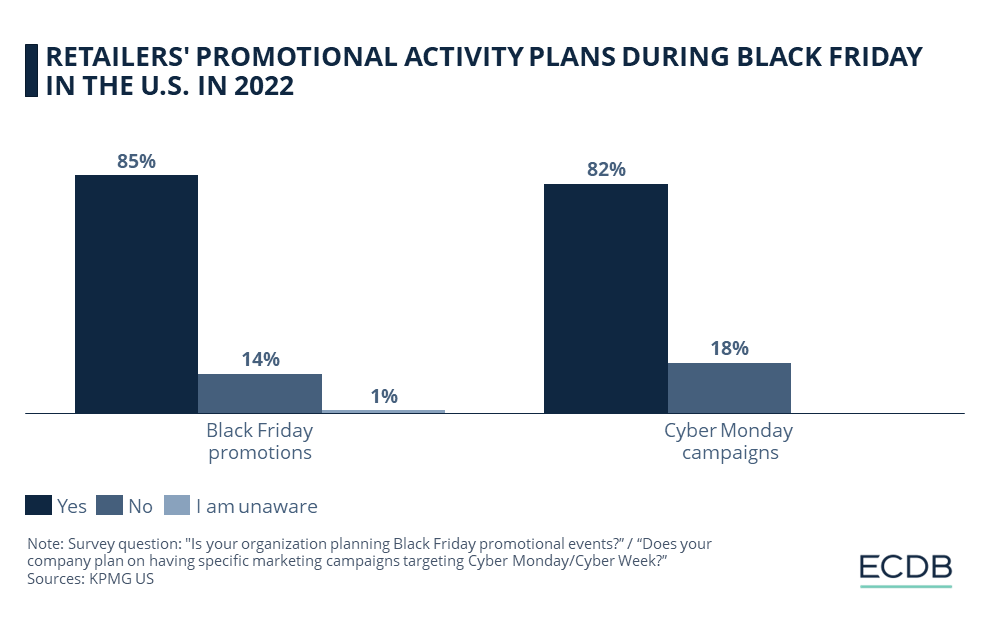

Not only customers but also businesses strategize for Black Friday, which speaks to its cross-sectional appeal. Many retailers recognize its revenue-generating potential and seize the chance to capitalize on it.

Per the results of a study on retail executives, a notable 85% planned to launch promotional campaigns on Black Friday 2022. This is higher than the 82% of retailers who were planning marketing activities for Cyber Monday, a more online-focused sales day which follows the weekend after Black Friday.

Businesses utilize the hype around Black Friday to offer door-busting deals which get customers into their stores, whether brick-and-mortar or online. Once customers are through the door and adding items to their carts, there is a higher likelihood of enticing them to buy other higher-value items alongside.

Additionally, retailers may use the occasion to sell off less popular inventory sitting on their shelves, motivating purchases through discounts.

Online Sales Development on Black Friday

In the past, Black Friday used to be a strictly in-store shopping event. Customers would camp outside stores and shop in a frenzy once the doors opened. However, as it did with shopping overall, digital retail also transformed Black Friday.

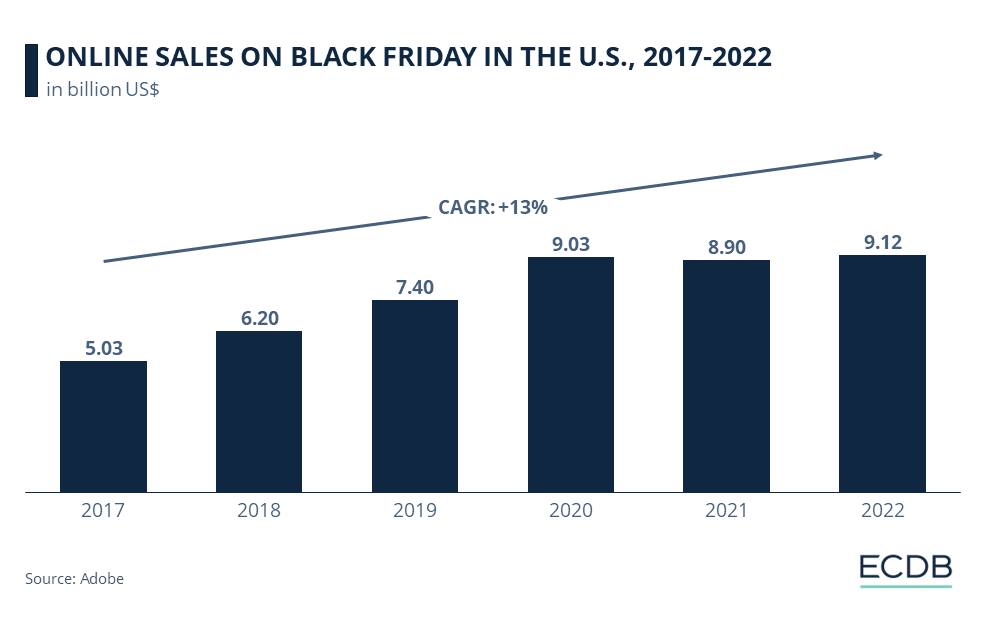

As the data shows, more sales are now occurring online on Black Friday in the United States than they did just five years ago.

Online sales worth US$ 9.12 billion took place on Black Friday in 2022, which is the highest figure yet in the years between 2017 and 2022. In this period, absolute online sales jumped by a massive 81.3%. This means that online sales on Black Friday in the US grew at an average annual rate of 14.86% from 2017 to 2022.

eCommerce sales on Black Friday demonstrate an upward trend. A notable year-on-year development occurred between 2019 and 2020, when online sales climbed by more than 22%. This progress can be credited to the COVID-19 pandemic, which accelerated the adoption of online shopping across the world.

The only exception to the positive trend occurred in 2021, when online sales declined to US$ 8.9 billion from US$ 9.03 billion in 2020. This occurrence was part of the larger context. In 2021, reportedly, eCommerce growth in the U.S. lagged behind brick-and-mortar retail, since strict lockdowns were lifted and people returned to in-store shopping. Moreover, Black Friday is generally seen as a yearly shopping event for holiday presents rather than for essential items. Economic adjustments to the then-ongoing pandemic impact and looming recession threats may have also prompted shoppers to cut back on discretionary spending.

Nonetheless, recovery was swift: in 2022, as retail spending surged, eCommerce sales on Black Friday also picked up and in fact, reached record levels. In the U.S., an unprecedented US$ 9.12 billion came from online channels on Black Friday, up 2.5% from the previous year. The creeping recession and the fear of the consequences in the U.S. could be the reason for the stagnation and could continue in 2023 as well.

Online marketplaces continue to be drivers of eCommerce sales on Black Friday. For instance, Amazon reported a "record-breaking holiday shopping weekend" on Thanksgiving, including Black Friday, on its platform in 2022. Like its successful Prime Day shopping events this year, customers may expect Amazon to offer attractive deals and improved shopping features, such as same-day delivery and diverse payment options, on Black Friday 2023 as well.

With the option to shop online from the comfort of their homes, customers interested in deals no longer have to camp outside stores, wait in long queues, or quite literally fight fellow shoppers for fast-selling items. Thus, consumer preference for shopping via eCommerce channels on Black Friday is expected to strengthen in the coming years.

Black Friday: Popularity Across Countries

When it comes to making the most of Black Friday deals for holiday shopping, not all countries display the same level of eagerness. Shoppers from Spain, Ireland and the United States are in the top three of those more likely to take advantage of Black Friday sales.

Per the survey results of 2022, people in Spain and Ireland are most likely to avail themselves of Black Friday deals. At 56% and 52% respectively, over half the respondents in these two countries were thinking to shop on this sales day.

Consumers in the U.S. came in third, where nearly half (48%) the respondents said they would participate in Black Friday sales. They are closely trailed by Portugal and New Zealand, with 47% and 46% of consumers saying the same, respectively.

Amongst those least likely to take advantage of Black Friday sales are consumers from Sweden, Norway, and the Netherlands.

This survey was conducted in 17 countries in 2022. The results also underline the overwhelming positive perception that Black Friday now enjoys worldwide, with 43% of consumers across the globe stating their interest in taking advantage of Black Friday deals for holiday season shopping.

Black Friday 2023: Summary

Heading towards Black Friday 2023, sales – online or offline – across the world are not expected to fall drastically. On the other hand, it is likely that Black Friday 2023 will attract more consumers through big-sale prices and targeted promotions, considering that many may be tightening their purse strings due to cost-of-living crisis.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Factors That Impact U.S. Holiday Shopping in 2024: Election, Deals, Weather, Number of Days

Factors That Impact U.S. Holiday Shopping in 2024: Election, Deals, Weather, Number of Days

Deep Dive

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Deep Dive

Peak Season of eCommerce & Air Cargo Capacity Crisis

Peak Season of eCommerce & Air Cargo Capacity Crisis

Deep Dive

Holiday Season Shoppers Turn to Discounts and Deals Early

Holiday Season Shoppers Turn to Discounts and Deals Early

Deep Dive

The Holiday Shopping Season Begins: How eCommerce is Preparing for Shopping Days

The Holiday Shopping Season Begins: How eCommerce is Preparing for Shopping Days

Back to main topics