eCommerce: Walmart

Walmart Sells JD.com Stake: Trouble in the Chinese Market

Walmart's US$3.6 billion sale of its JD.com stake marks a strategic shift, highlighting challenges in the Chinese market and refocusing on its core operations.

Article by Cihan Uzunoglu | August 22, 2024Download

Coming soon

Share

Walmart Sells JD.com Stake: Key Insights

Strategic Shift in China: Walmart’s US$3.6 billion sale of its stake in JD.com signifies a significant strategic change, as the retailer shifts focus on China after an eight-year partnership.

Impact on JD.com and Broader Market: The sale of 144.5 million shares at an 11% discount caused an 8% drop in JD.com’s Hong Kong-listed shares and reflects Walmart’s wider withdrawal from unprofitable markets like Japan, Brazil, and the UK.

Sam's Club Takes the Lead: Walmart’s initial investment in JD.com in 2016 aimed to strengthen its position in China’s eCommerce market, but as Sam’s Club gained popularity, reliance on JD.com has diminished. Sam’s Club now accounting for half of Walmart’s online sales in China.

Walmart has sold its entire US$3.6 billion stake in JD.com, one of China’s largest eCommerce platforms, signaling a significant strategic shift as the U.S. retail giant refocuses its efforts in China.

The divestiture comes after eight years of partnership with JD.com, during which Walmart attempted to strengthen its presence in the highly competitive Chinese market. This move marks a departure from Walmart’s initial strategy, where the retailer invested in JD.com to leverage the platform's expansive distribution network and bolster its eCommerce operations in China.

Impact on Chinese Tech Stocks

The sale involved 144.5 million shares at US$24.95 each, representing an 11% discount on JD.com’s closing U.S. share price the day before. The sale not only caused JD.com’s Hong Kong-listed shares to plummet by 8% but also contributed to a broader decline in Chinese tech stocks.

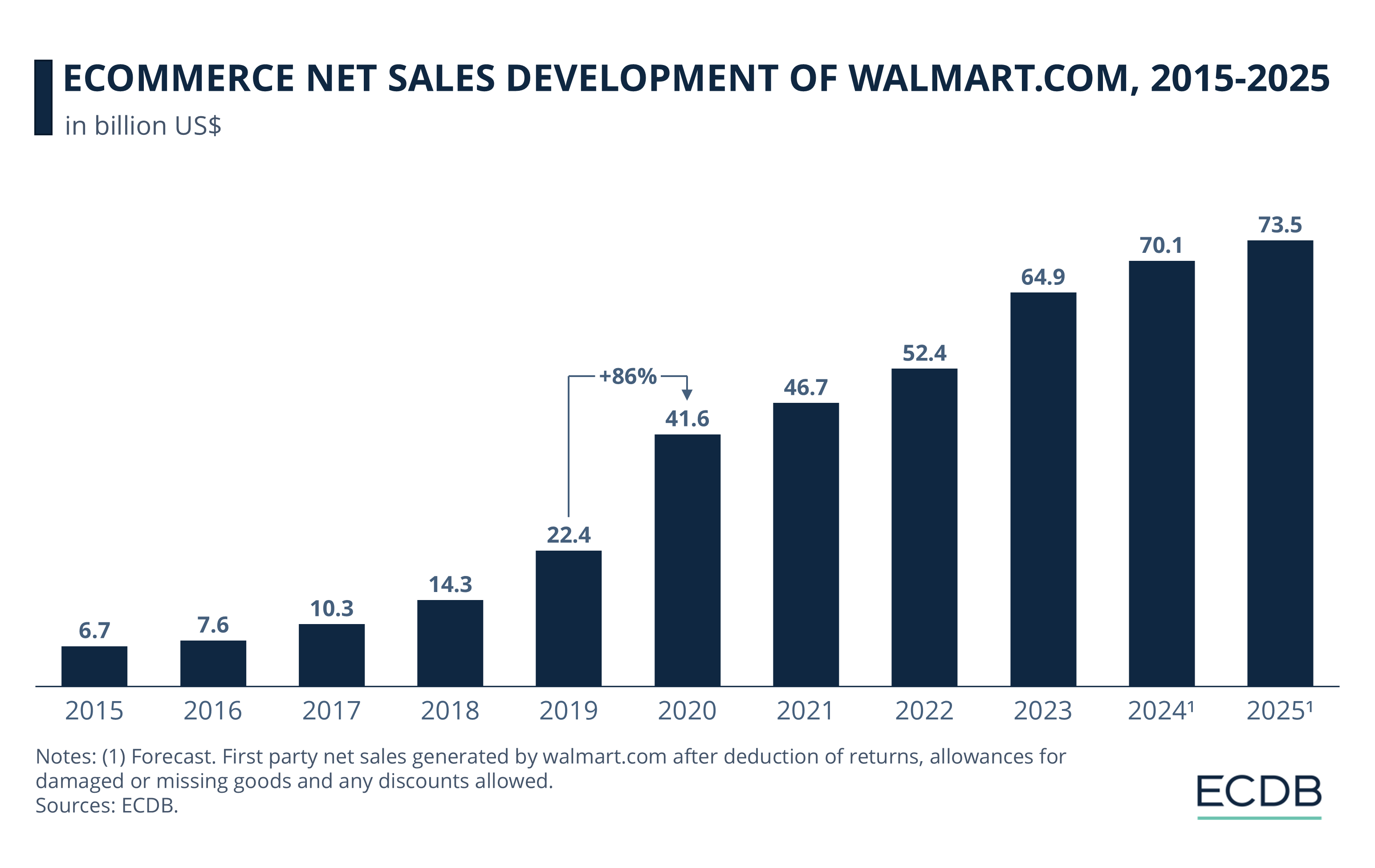

After steadily increasing its net sales growth from 2015 to 2020, walmart.com's growth dropped to 12% in 2021 and 2022.

Although the online store made a comeback in 2023 with 24% growth, our forecasts show minimal growth (4-8%) for this year and next.

The divestment reflects Walmart’s broader strategic withdrawal from markets where profitability has proven challenging, a trend seen in its exits from Japan, Brazil, and the UK in recent years.

Walmart Strategy: Shift in the Chinese eCommerce Market

Walmart initially entered the Chinese eCommerce market by acquiring a 5% stake in JD.com in 2016, a move that followed the retailer's struggle to scale its own platform, Yihaodian. At the time, the partnership was seen as a way to enhance Walmart’s competitiveness in China’s retail sector.

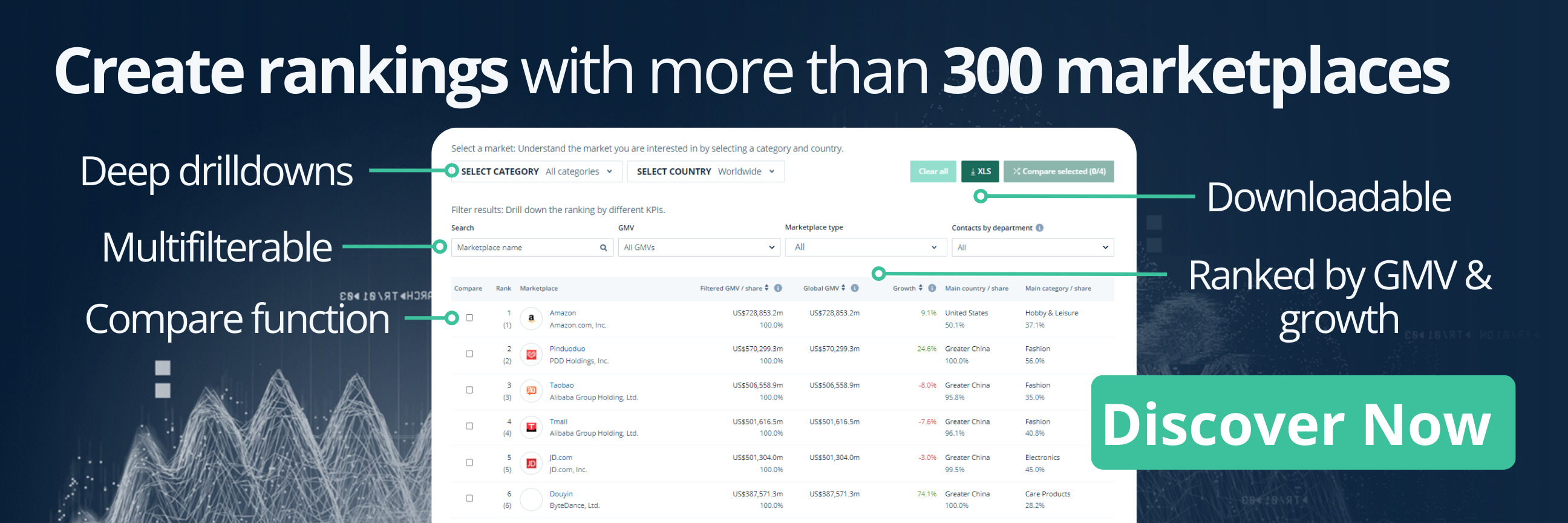

More Insights? We keep our rankings up to date with the latest data, offering you valuable information to improve your business. Want to know which stores and companies are leading the way in eCommerce? Which categories are achieving the highest sales? Check out our rankings for companies, stores, and marketplaces. Stay one step ahead with ECDB.

However, the reliance on JD.com has diminished, particularly as Walmart’s Sam’s Club has grown increasingly popular in China, especially during the pandemic. Today, Sam’s Club is a leading warehouse chain in China, with half of Walmart’s sales in the country coming from online channels.

Walmart Sells JD.com Stake: Closing Thoughts

Walmart's decision to sell its stake in JD.com is also influenced by rising U.S.-China trade tensions and geopolitical uncertainties, prompting the company to reallocate resources to other priorities. These include expanding its operations in India and preparing for an IPO of its marketplace Flipkart.

Despite the sale, Walmart plans to maintain a commercial relationship with JD.com as it continues to adapt to the market.

Sources: MarketWatch, CNBC, Yahoo Finance, WSJ, Reuters, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Back to main topics