Social Commerce: Women in China

Social Commerce in China: Female Consumers, Women's Day & Douyin

Social commerce has been experiencing a strong boom for quite some time, especially in China, with a predicted turnover of US$6.2 trillion by 2030. Women play a special role in this rise. But what exactly does social media shopping have to do with women's empowerment?

Article by Antonia Tönnies | March 05, 2024Download

Coming soon

Share

Women in Chinese Social Commerce: Key Insights

Gender Disparity: China's one-child policy and cultural preferences have led to a significant gender imbalance, with more men than women in the population.

China Leads in Social Commerce: Social commerce is thriving in China, with a staggering 75% of global revenue in 2023, contrasting with struggles in other nations.

Women’s Decision-Making-Power: Women in China not only drive consumption through their own purchases but also play a crucial role in family consumption decisions, with over 70% aiding in purchasing choices.

Commercialization of Traditions: Events like Women's Day have transformed into major shopping occasions, with Douyin successfully capitalizing on this trend, enhancing its position as a leading livestream commerce platform.

China's demographic landscape has been deeply shaped by its one-child policy, a regulation that historically favored the birth of male children over females. This preference is rooted in traditional expectations that sons will care for their parents in their old age. This has led to a current population where there are 720.32 million men to 689.35 million women.

Since relaxing this policy in 2016 and shifting towards encouraging larger families, the country has seen a dramatic reduction in birth rates. The government's new stance aims to encourage women to prioritize domestic roles and child-rearing, a move that has raised concerns about the regression of women's freedoms.

Yet, the rise of social commerce in China, especially among women, is empowering them in contrast to traditional expectations. This trend raises questions about its role amidst societal pressures on women.

Social Commerce Boom in China

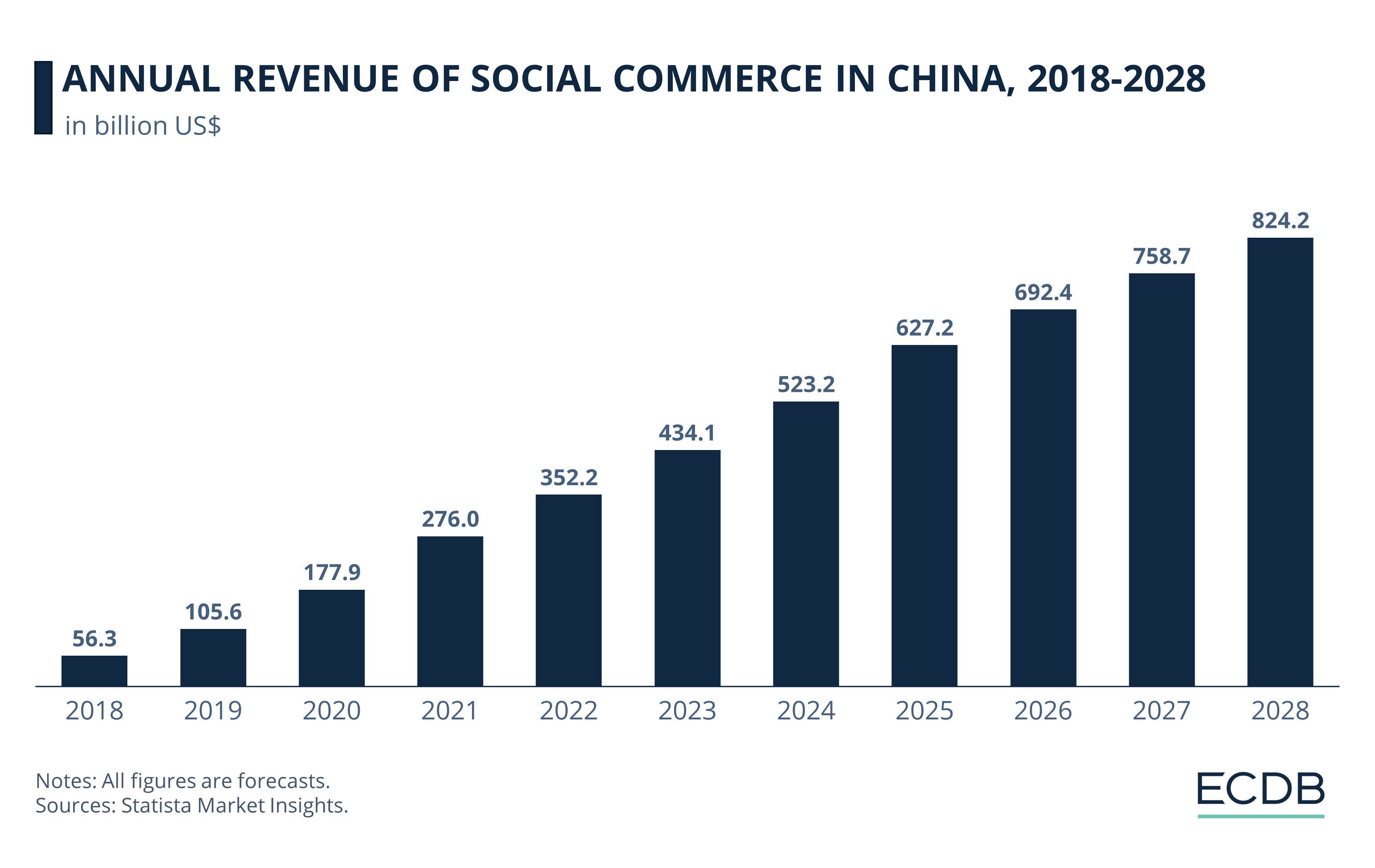

In recent years, social commerce has shown its growth worldwide, reaching, according to Statista Market Insights, revenues of US$570.7 billion in 2023 – four times as much as in 2019 (US$136.8 billion). The boom around shopping on social media extends so far that the market research company Grand View Research estimates an astonishing turnover of US$6.2 trillion by 2030 with an expected CAGR (2022-2030) of 31%.

Whereas this shopping trend struggles gaining a foothold in countries like the United States, social commerce is experiencing great popularity in China. With US$434.1 billion in revenue, China generates 75% of the global social commerce revenue in 2023. Until 2028, the revenue of the social commerce sector in China is forecast to reach US$824.2 billion worldwide.

Most of the Female Social Commerce Users Are Older than 50

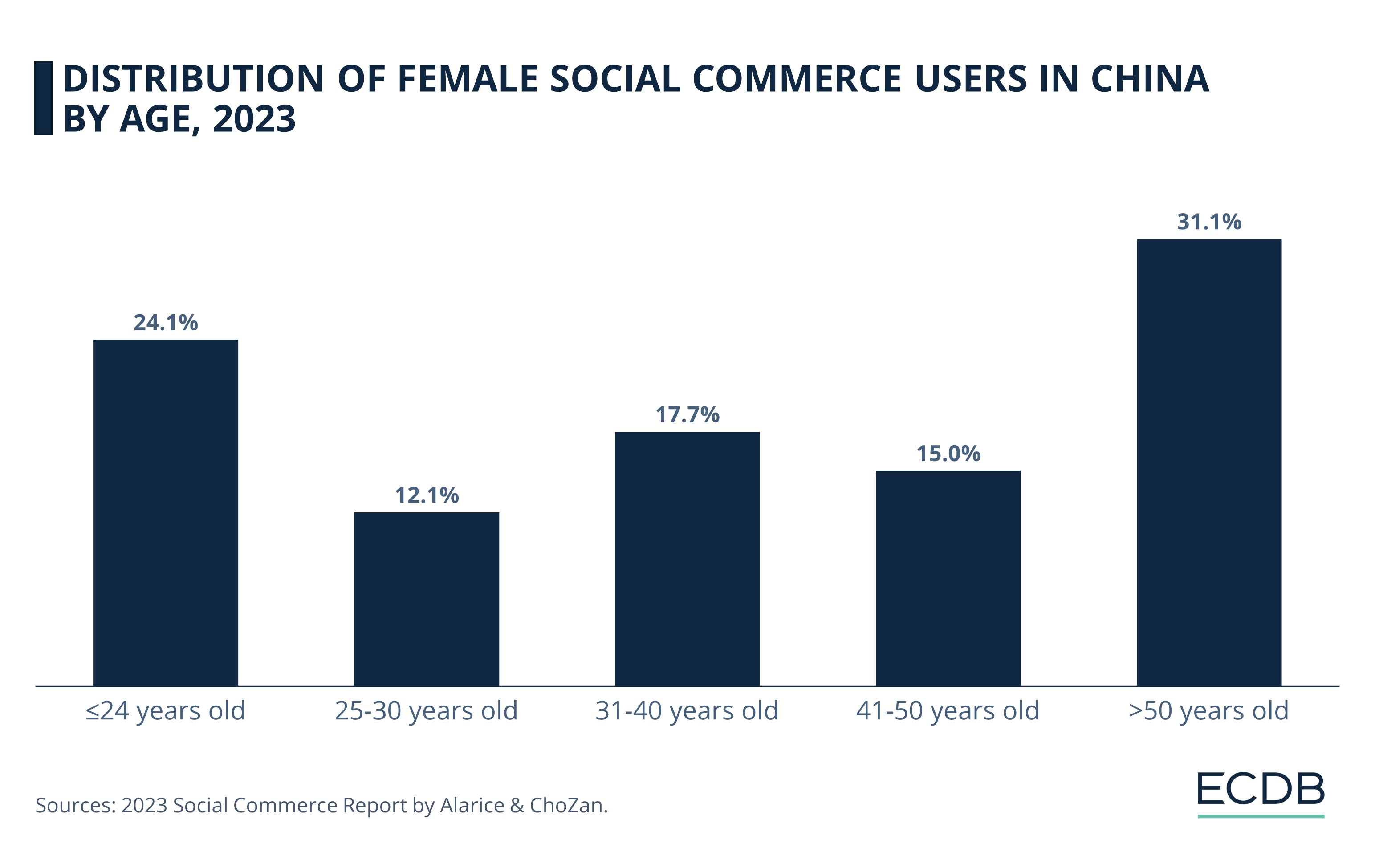

The recently published report of Alarice and ChoZan reveals that most of the female social commerce users in China are over 50 years old (31%). It might come as a surprise, but looking at the population distribution in China, one notices that over 35% of Chinese people are over the age of 50.

One reason is the long life expectancy of 81.3 years on average for Chinese women compared to 76.2 years for men. In addition, the retirement age in China lies at 55 years, meaning older women consequently have more spare time than younger ones.

Less surprisingly, the age group under 24 years follows with 24%, the age group which grew up with the internet and social media. In third place comes the group of 31-40 years old holding almost 18%, followed by 41-50 years old with 15%, and the 25-30 years old with 12%.

The Power of Women in Social Commerce

In addition to women interacting with social commerce by themselves, they also have a significant decision-making-power. More precisely, over 70% of female users help their families making consumption decision, according to the report.

Beyond that, over 60% of transactions on Taobao-related platforms, as for example Tmall and Taobao, are done by women. It could therefore be the case that women also shop for their families to save on shipping costs, among other things.

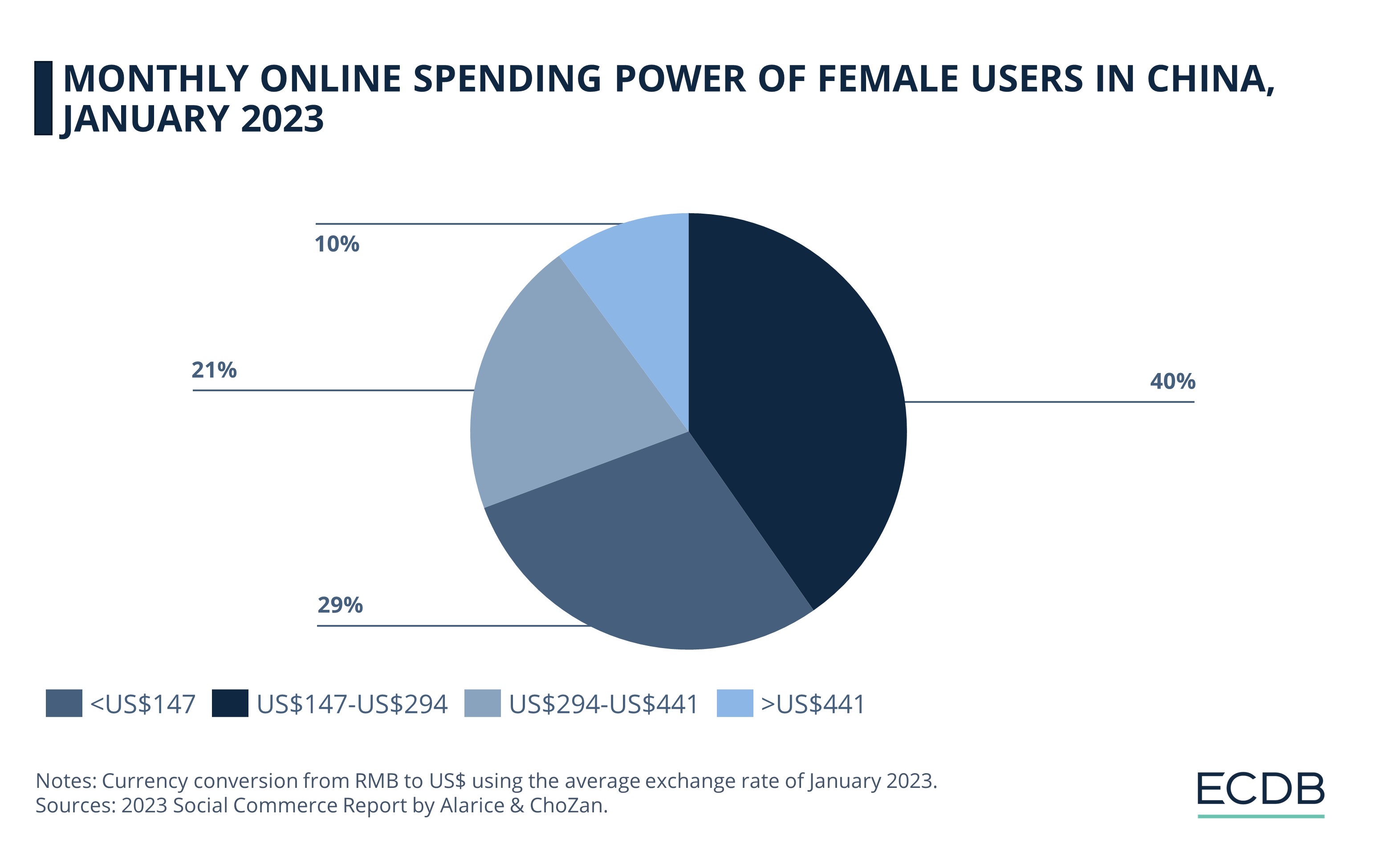

Overall, 40% of female users in China spend between US$147 and US$294 per month. Almost 31% even have a monthly online spending power of over US$294, followed by 29% with up to US$147. Overall, female users have a strong online purchasing power, demonstrating women's empowerment in Chinese eCommerce.

Douyin's successes on International Women's Day

What is empowerment for some is a lucrative business for others. The annual International Women’s Day on March 8 – once a festive for women empowerment – nowadays more known as Goddess Day or Queen's Day in China, has become the most attractive national shopping holiday, claims EGGsist.

Learn More About ECDB

Douyin has managed to follow the commercialization trend of the holiday, with success. According to Alarice and ChoZan’s report, Douyin increased its GMV in 2023 by 276% compared to the previous year. With 370 million female users and a growth rate of 5.4% YoY in 2023, women are more likely to stick with the platform Douyin, making it the leading livestream commerce platform.

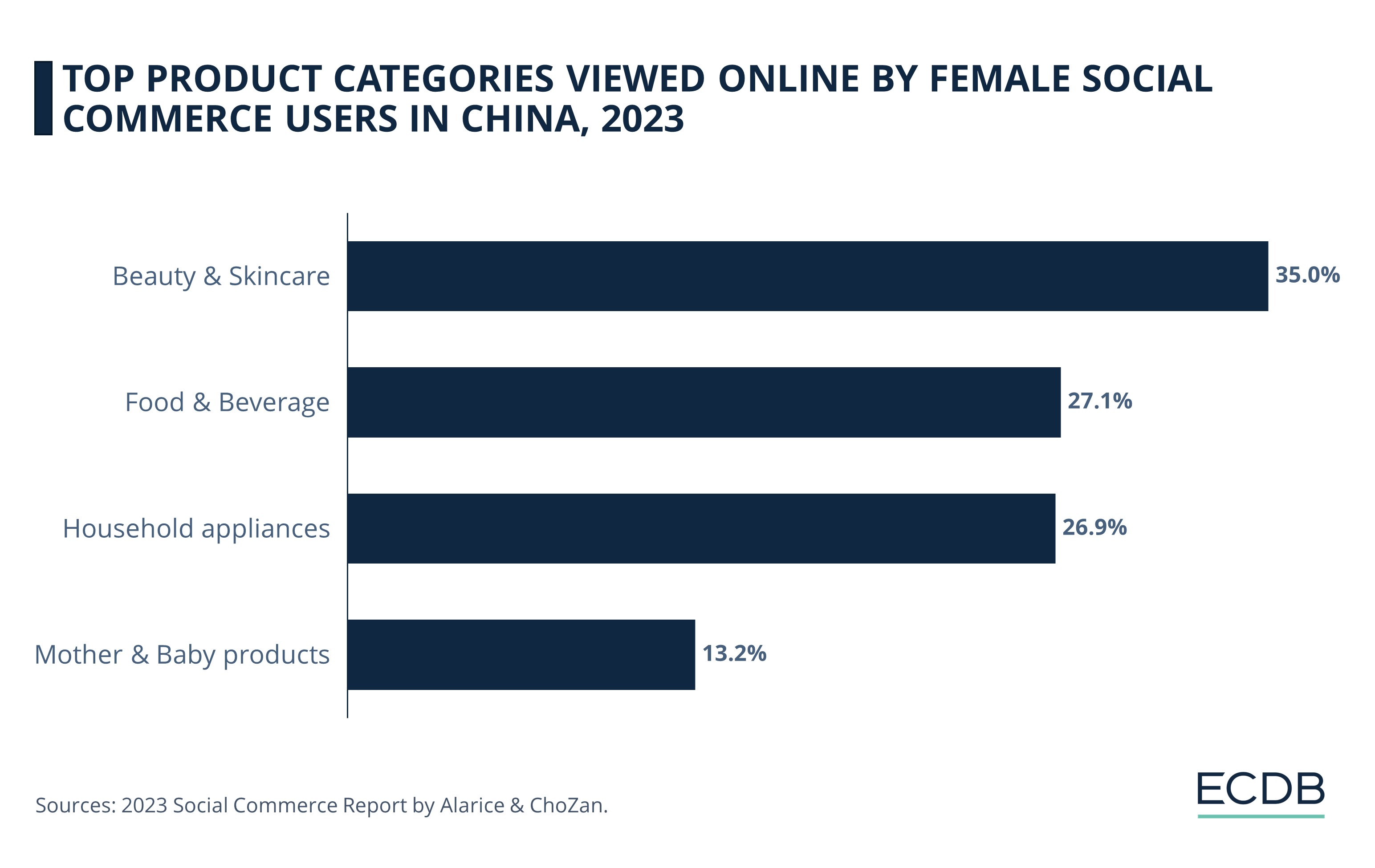

On International Women's Day, products of the most popular categories are promoted. This includes the beauty and skincare category at the top with 35%. Slightly further behind with 27.1% is food and beverage, closely followed by household appliances holding 26.9%. The ranking is completed with mother and baby products (13.2%), the fourth most popular category among online female users.

In general, women are strongly interested in beauty and skincare content, such as makeup tutorials, fashion tips, and beauty routine videos, the reports states. Hashtags like #skincaresharing and #makeup reached 22.83 billion and 8.3 billion views on Douyin alone in April 2023.

In light of this data, it remains to be seen how this year's Women's Day will impact the social commerce business, but it is likely that Douyin's sales will increase again this year.

Sources: World Economic Forum - Dao Insights - The New York Times - 2023 Social Commerce Report

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

Deep Dive

Gen Z Online Shopping Behavior: Consumer Habits, Preferences & Trends

Gen Z Online Shopping Behavior: Consumer Habits, Preferences & Trends

Deep Dive

Live Commerce in Italy: Consumer Behavior & Preferences

Live Commerce in Italy: Consumer Behavior & Preferences

Deep Dive

Trends in German eCommerce: Germans Like What They Know

Trends in German eCommerce: Germans Like What They Know

Back to main topics