Global eCommerce Market

Global eCommerce Market 2024: Market Growth, Top Players & Online Share

Discover how online shopping is transforming retail, as eCommerce sales are projected to reach US$5 trillion by 2024. Learn about the role of AI and emerging tech trends in driving this growth.

Article by Cihan Uzunoglu | June 24, 2024Download

Coming soon

Share

Global eCommerce Market 2024: Key Insights

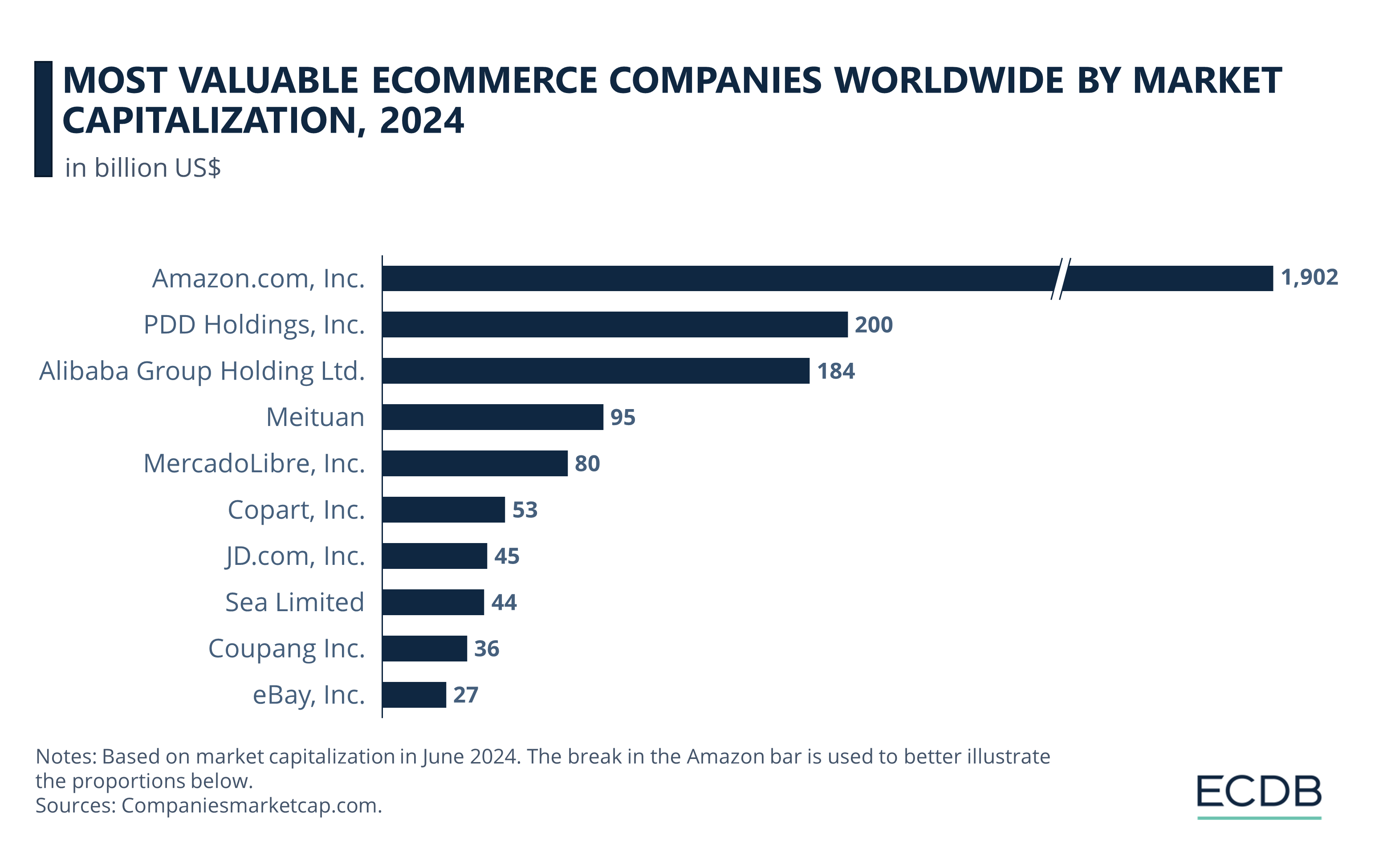

Amazon's Dominance: Amazon leads the global eCommerce sector with a market cap of US$1.9 trillion, followed by Pinduoduo at US$200 billion and Alibaba at US$184 billion.

Market Expansion: The global eCommerce market, growing rapidly since 2020, is projected to reach US$5 trillion by 2024, with a 15% annual growth rate from 2019 to 2024.

Outpacing Retail: eCommerce growth, accelerated by the pandemic, is forecasted to continue, growing 8% by 2028, outpacing the total retail market's 3% growth.

Market Share Growth: eCommerce's share of the total retail market increased from 8% in 2017 to 16% by 2021, and is expected to reach nearly 25% by 2028.

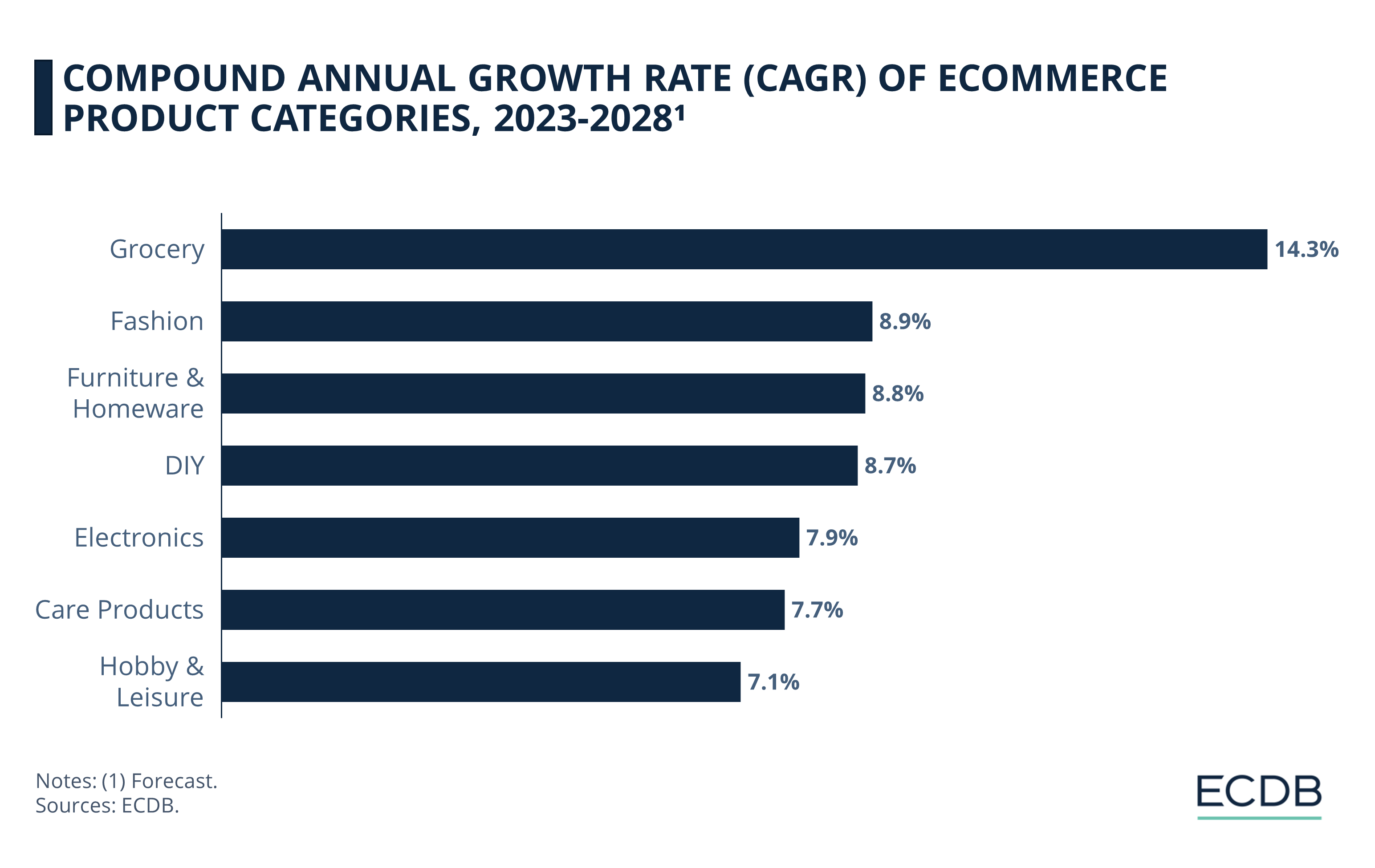

Grocery Leads: Grocery is the fastest-growing eCommerce category, with a projected annual growth rate of 14.3% through 2028, outpacing fashion and electronics.

Online shopping is undoubtedly changing the way we shop, but to what extent? Physical stores still exist, yet online sales are claiming a larger share of the retail market annually.

This trend motivates us to examine the factors driving the growth of online shopping and the types of products that are increasingly being purchased online. Diving into the dynamics of niche markets and the hottest startups, it's easy to forget just how impactful eCommerce has been in recent years.

Top eCommerce Companies by Market Cap

Before diving into the market, first let's take a look at the top eCommerce companies by market cap.

1. Amazon

With a stunning market cap of US$1.9 trillion, Amazon leads the top 10 global eCommerce companies.

Amazon is enhancing its AI-driven recommendations, making shopping more personalized and intuitive by considering broader user behavior. The company's "Climate Pledge Friendly" program also boosts visibility for eco-friendly products, aligning with rising consumer demand for sustainability. Amazon's social commerce efforts include platform updates to mimic social media and partnerships with platforms like Facebook and Instagram.

Additionally, Amazon is expanding globally through its Amazon Global Selling program, simplifying cross-border transactions with new tools. Lastly, advancements in advertising, such as Amazon DSP, provide sellers with more targeted and automated ad campaigns.

2. PDD

Amazon is followed by the Chinese company PDD at number 2, with a market cap of US$200 billion.

The parent company of Pinduoduo and Temu is rapidly expanding its global presence. Temu, PDD’s cross-border eCommerce platform, has launched in several new markets including France, Germany, Italy, and various countries in Europe, Africa, and the Middle East. This expansion has driven Temu to become one of the top downloaded apps in multiple regions.

In China, PDD's grocery delivery service, Duoduo Maicai, is also contributing to growth and is expected to reach profitability soon. The company has been investing heavily in technology to combat counterfeit goods and improve its service offerings.

3. Alibaba

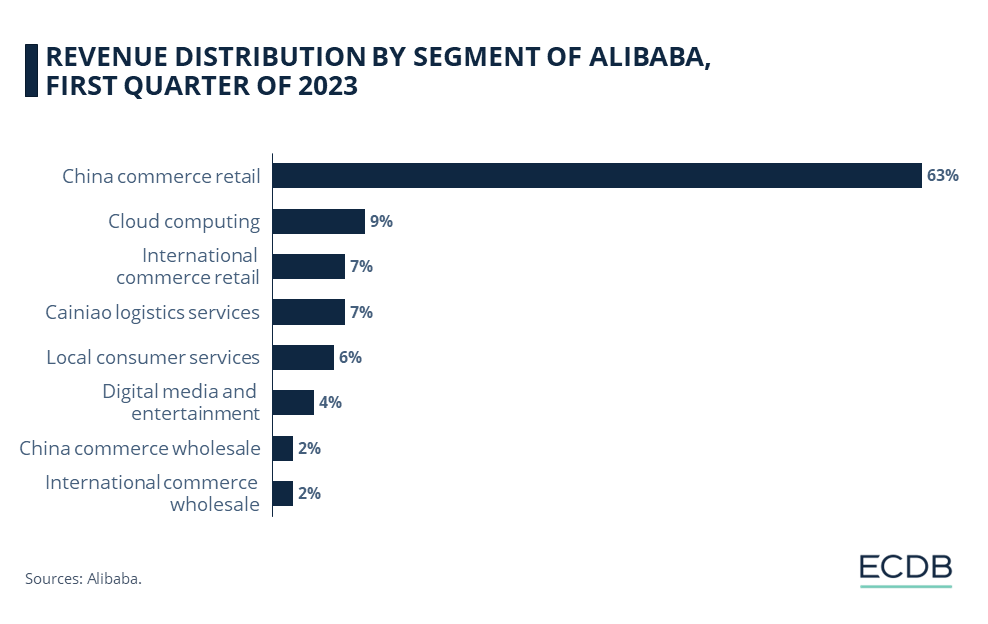

Alibaba, another Chinese company, comes in the third spot with a market cap of US$184 billion.

The retail giant has been focusing on enhancing its international commerce and AI capabilities. In Q4 2023, Alibaba's International Digital Commerce Group saw a 45% year-over-year revenue growth, driven by cross-border initiatives and platforms like AliExpress. This growth highlights Alibaba's commitment to expanding its global footprint and improving logistics through partnerships with companies like Cainiao for faster delivery times.

Additionally, Alibaba has been investing heavily in AI. The company’s Cloud Intelligence Group recorded significant growth, with AI-related revenues increasing by triple digits. These advancements are part of Alibaba’s strategy to leverage generative AI for enhancing supply chain efficiency and customer experience.

4. Meituan

Meituan, the last Chinese company in the top 5, ranks fourth with US$95 billion.

Aiming to rival giants like Alibaba and JD, the company is actively expanding its eCommerce offerings. Recently, Meituan launched a new direct sales model, opening several "self-operated stores" to sell various products, ensuring better control over product quality and delivery. They have also relaunched its shopping review feature, now called Guangguang, to tap into content-driven eCommerce trends. This feature, similar to Taobao’s review platform, aims to boost traffic and conversion rates by leveraging user-generated content and recommendations.

Additionally, Meituan is enhancing its cross-border eCommerce operations with a global shopping channel offering products from countries like the U.S., Japan, and Australia. This move aligns with its strategic shift towards broader retail and technology integration.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

5. MercadoLibre

MercadoLibre, an important player in Latin America, holds the fifth position at US$80 billion.

The company is significantly expanding its operations in Latin America, with substantial investments planned for 2024. The company announced it will invest US$4.6 billion in Brazil, its largest market, marking a 21.1% increase from the previous year. Additionally, MercadoLibre is set to hire 6,500 people in Brazil and 18,000 across Latin America to bolster its growth efforts.

The company's growth strategy also includes significant investment in Mexico, where it plans to spend US$2.5 billion in 2024, up from US$1.6 billion in 2023. This investment will help enhance its eCommerce platform and Fintech services, which include digital payments and financial solutions through MercadoPago.

Other Companies in the Top 10

While the U.S. company Copart is sixth, having a cap of US$53 billion, JD.com from China is seventh at US$45 billion, followed by Singapore's Sea with US$44 billion.

The South Korean company Coupang, in the ninth place, has a cap of US$36 billion, and the list is rounded out by eBay at number 10 with a value of US$27 billion.

Global eCommerce Market Will Reach

US$5 Trillion This Year

Our data shows that the global eCommerce market has undergone a significant transformation in recent years and is expected to continue growing.

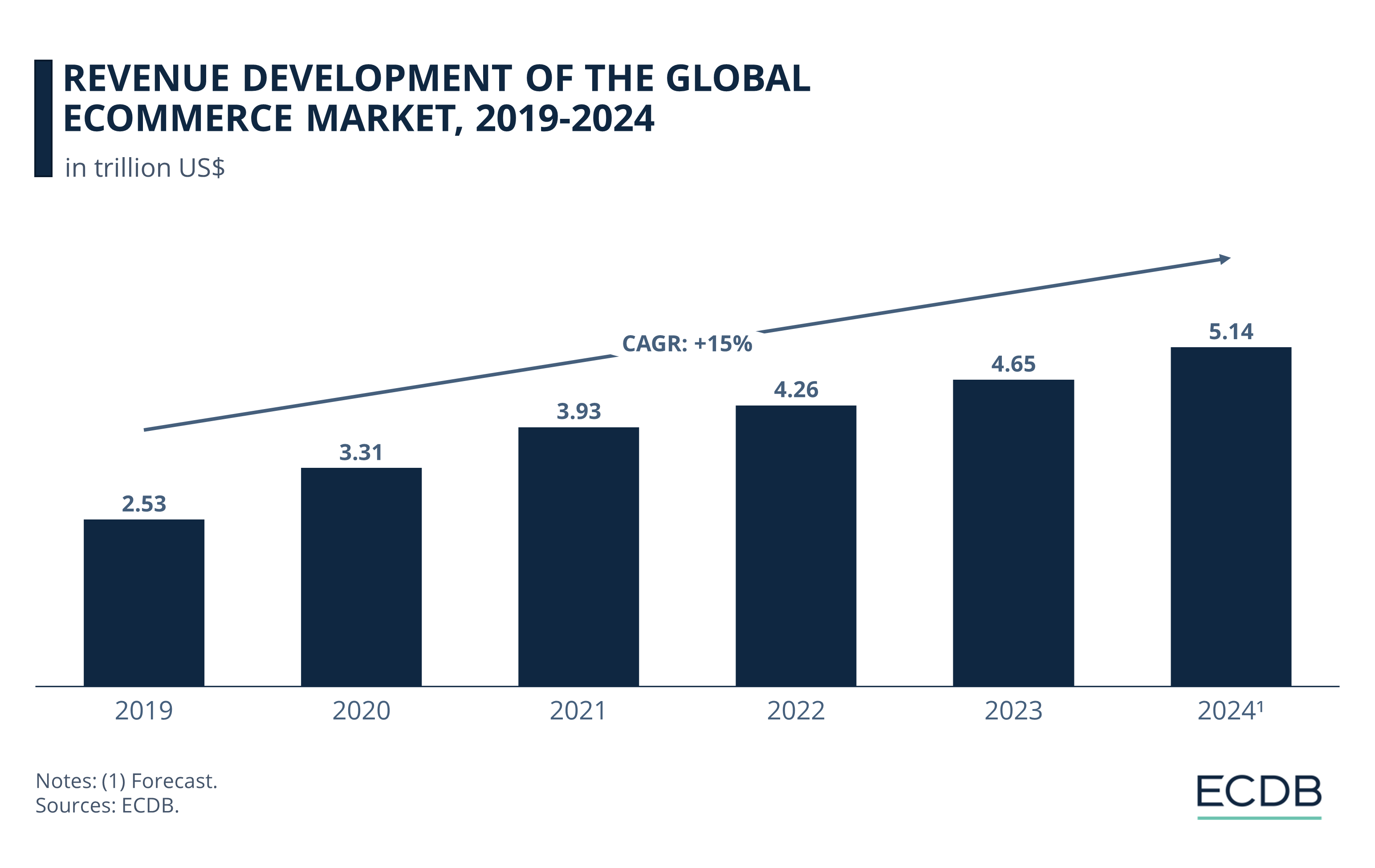

Looking back to pre-pandemic times, the global eCommerce market revenue in 2019 was US$2.53 trillion.

This figure rose to US$3.31 trillion in 2020, representing a market growth of 31%. To fully understand the impact of this, it is important to note that the growth rates in 2018 and 2019 were much lower, at 22.2% and 15.1%, respectively.

Albeit at a slower pace, the rise of online shopping continued in 2021, with growth of 18.5%, bringing market revenues to US$3.93 trillion.

2022 was a year in which the market expansion was even slower - market revenues reached US$4.26 trillion with an increase of 8.5%. As for 2023, the growth rate was 9.2% and the global eCommerce market size stood at US$4.65 trillion.

While the unprecedented growth seen in 2020 isn't expected to happen again anytime soon, future predictions aren't pessimistic. By the end of 2024, the market is forecast to reach US$5.14 trillion, with a healthy growth rate of 10.4%. For the 2019-2024 period, that’s a CAGR (compound annual growth rate) of 15%.

Based on our analysis, global eCommerce revenues will exceed the GDP of Japan by 2024 and surpass India's GDP by 2028.

For exploring revenue trends and growth rates in the global eCommerce market, download our free whitepaper Global eCommerce Market 2024. With this report, you can identify leading countries while analyzing the largest product categories and key retailers.

eCommerce Market Growing Faster Than Total Retail Market

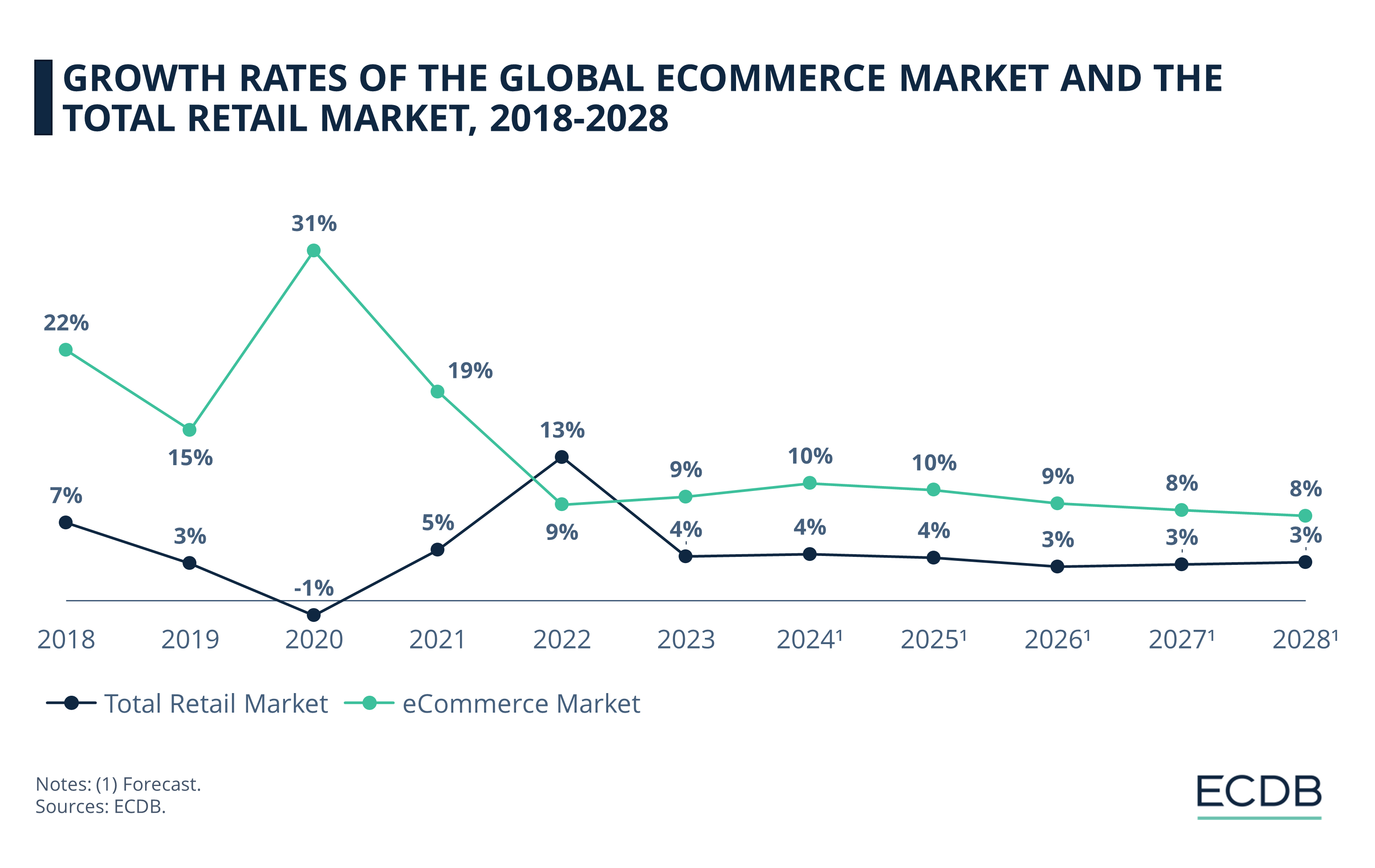

Compared to the dynamics of the overall retail market, the recent growth of the global eCommerce market stands out even more.

Before the pandemic, the growth rates of both the total retail market and the online retail market slowed to 3% and 15%, respectively, by 2019. With the onset of the pandemic, the total retail market shrank by -1% that year. As discussed in the previous section, online retail flourished during this period, growing by 31% through 2020.

As pandemic restrictions began to be lifted, the overall retail market began to recover, reaching 13% growth by 2022, and the growth of the eCommerce market slowed significantly over the same period. While overall retail market growth slowed to 4% last year, online market growth remained at the about same level of 2022’s 9%.

Over the next few years, both the total and online retail markets are not expected to deviate much from their current growth rates, except for a slight slowdown. By 2028, the total retail market is expected to grow by 3%, while online retail is expected to grow by 8% in the same year.

Online Share of Retail Market Will Increase: Currently Close to 20%

While numbers give us an understanding of the big picture, more context is needed to better comprehend the impact of online shopping on the overall retail market.

While online share of the overall retail market was minimal at 8% in 2017, this figure increased to 11% in 2019. As eCommerce sales increased with the pandemic, so did the online share of the total retail market, reaching 16% by 2021 and remaining at that level until last year.

According to our projections, eCommerce will become even more important to the overall retail market in the coming years. By 2028, online is expected to account for nearly a quarter (23%) of the total retail market.

Grocery Will be the Fastest Growing Product Category of eCommerce

When we look at the eCommerce product category that is expected to grow the most in the coming years, the quick commerce trend comes to mind.

With an expected CAGR of 14.3%, Grocery is the eCommerce product category we expect to grow the fastest until 2028. This is followed by Fashion, Furniture & Home and DIY with CAGRs of around 8.8%. The Electronics, Personal Care and Hobby & Leisure categories have lower CAGRs of 7.9%, 7.7% and 7.1% respectively.

Global eCommerce Market 2024:

Closing Thoughts

The global eCommerce market shows no signs of slowing down. With online sales projected to reach US$5 trillion by 2024 and continue to grow at a compound annual rate of 15%, the digital shopping landscape is becoming increasingly dominant.

Interestingly, while physical stores still hold their ground, the convenience and variety offered by online shopping are drawing more consumers each year. Notably, emerging technologies like AI and augmented reality are expected to further enhance the online shopping experience, altering the way consumers interact with eCommerce platforms and driving even greater growth in the sector.

Sources: Productsup, JungleScout, MarketSplash, About Amazon, BizNews, The China Project, KrASIA, Tech in Asia: 1, 2, Digital Commerce 360, Alibaba Cloud, Alibaba Reads, TechNode: 1, 2, Stock Analysis, GlobeNewswire, ECDB

eCommerce Market: FAQs

What is the eCommerce market?

"eCommerce," also known as "electronic commerce," refers to buying and selling goods and services online. It transforms your traditional city center or physical store into a digital marketplace accessible through the internet.

How big is the eCommerce market?

The global eCommerce market is projected to reach US$5.14 trillion in revenue by 2024. With an annual growth rate (CAGR 2024-2028) of 8.5%, the market volume is expected to hit US$7.11 trillion by 2028.

What is the best market for eCommerce?

The United States and China are the leading eCommerce markets worldwide. These countries have maintained their top positions for many years and are expected to continue dominating the eCommerce landscape.

What is the number 1 eCommerce business?

Amazon is the top eCommerce business globally, with an impressive market value. In 2023, Amazon's revenue reached US$733 billion, showcasing its consistent growth over the years.

What sells the most on eCommerce?

Fashion and Electronics are the most popular categories among global online shoppers. The range of products available for online purchase is continuously expanding, but these two categories remain the top choices for consumers.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Deep Dive

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Back to main topics