eCommerce: Social Commerce

ByteDance: TikTok Shop & Douyin – Market, Revenue Development, Data Analysis

Everyone in the eCommerce bubble is talking about ByteDance, TikTok Shop, and Douyin. What is the business strategy of ByteDance, the Chinese conglomerate that launched Douyin and TikTok? What markets do they aim for, and what is their revenue development? Will they conquer the U.S. and European markets? And what role does Temu play in this narrative? ECDB provides answers.

Article by Nadine Koutsou-Wehling | July 04, 2024Download

Coming soon

Share

ByteDance, Markets, TikTok Shop & Douyin: Key Insights

Two Platforms Created by ByteDance: Douyin is the predecessor and Chinese version of TikTok, the international platform. Both are very similar in design and features, but differ in terms of content focus and eCommerce maturity. Douyin is only usable on the Chinese mainland.

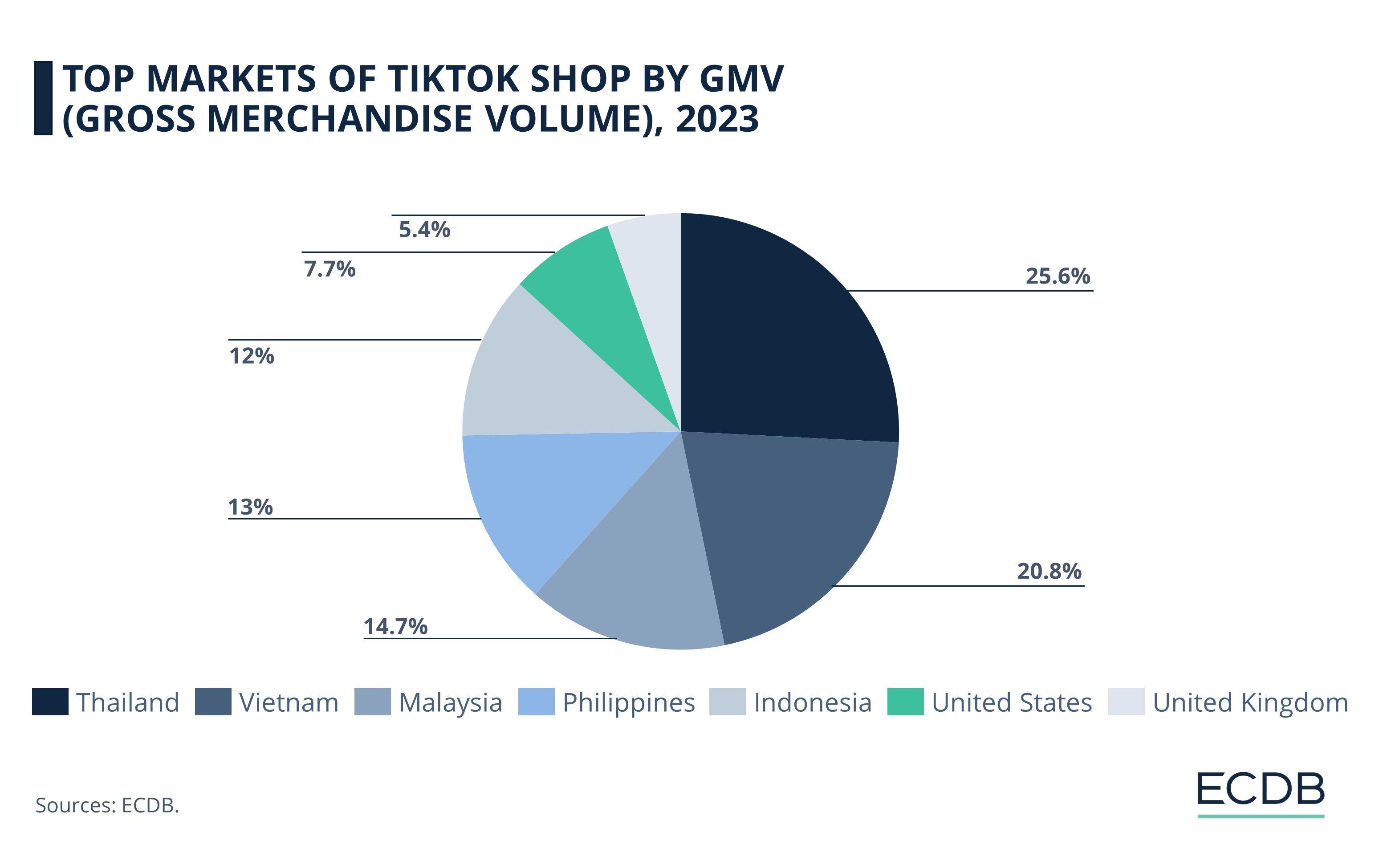

TikTok Shop Markets: TikTok Shop, launched in its first market in 2021, is most profitable in Thailand, Vietnam and Malaysia. It is still on its way to widespread recognition in the UK and the U.S.

Douyin's Popularity in China Serves as a Blueprint: Douyin is one of the first platforms that comes to mind when consumers in China are asked about their favorite livestreaming sites. The cultural tendency to engage in live commerce in China contributes to its success, which is harder to achieve elsewhere.

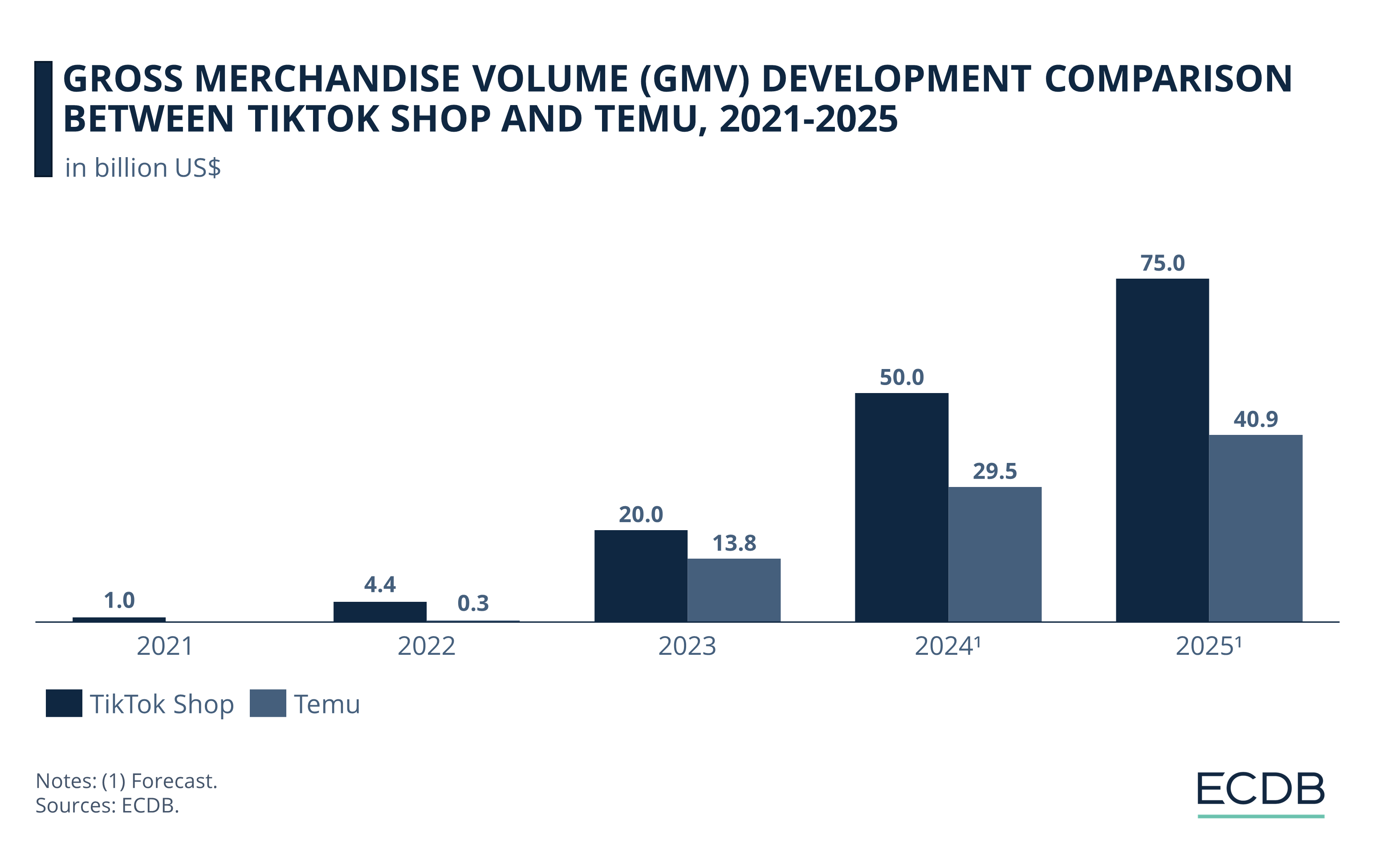

TikTok Shop Generates Higher Global Revenues Than Temu: Temu is the younger of the two platforms and does not have the same level of recognition among users that TikTok has through its social media platform. While TikTok currently is ahead of Temu's GMV by a little more than US$6 billion, its head start is expected to become larger as the years go by.

ByteDance is a Chinese tech conglomerate that operates TikTok and Douyin, two similar social media apps that both also have eCommerce features. Douyin is only accessible in China, while TikTok is available in the rest of the world.

Because TikTok Shop is currently growing around the world, it provides an opportunity to closely examine its parent company, ByteDance.

ByteDance: The Parent Company of Douyin and TikTok Grows

ByteDance is a tech development company that was founded in 2012 by Zhang Yiming and Liang Rubo. The company created a few smaller sites before achieving the first big breakthrough with a news aggregator called Toutiao that delivered a personalized news feed to users by leveraging machine learning.

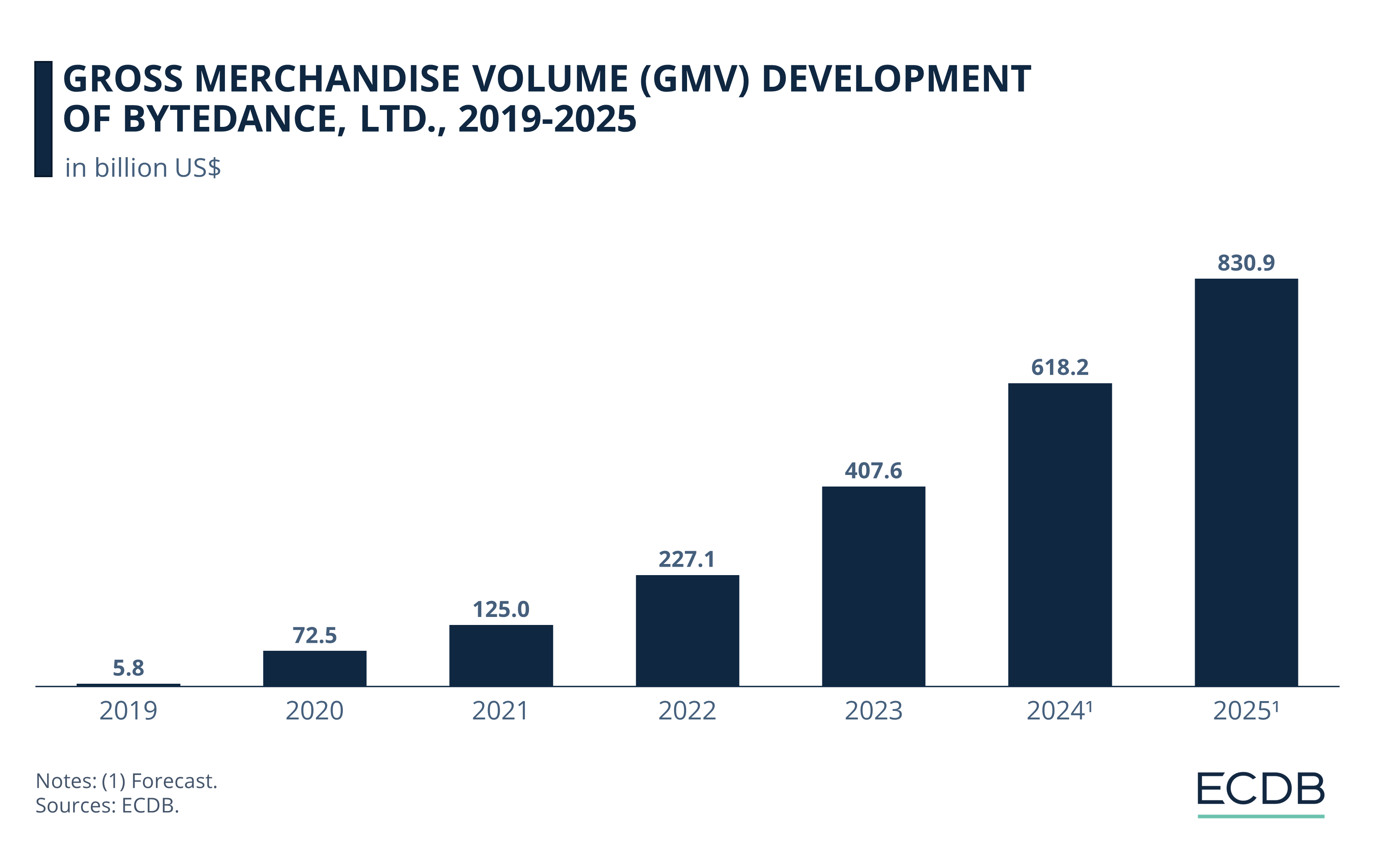

ByteDance's first video-sharing app was Douyin, launched in 2016. By 2018, eCommerce features were introduced. Together with TikTok Shop, which was launched in its first market in 2021, these are the two eCommerce platforms operated by ByteDance. Analyzing ByteDance's GMV therefore necessarily means adding up TikTok Shop's GMV and Douyin's GMV:

Until 2021, GMV is identical to Douyin's transactions, being the only eCommerce marketplace in ByteDance's portfolio.

In the years after, ByteDance's GMV combines both Douyin's and TikTok Shop's figures.

Douyin can be seen as TikTok’s predecessor, as some of the core features of the site are akin to TikTok’s design. The outstanding element of both platforms is the addictive algorithm that makes users spend significantly more time on Douyin or TikTok than on comparable sites.

Differences Between Douyin and TikTok

On first glance, Douyin and TikTok seem like the same site, but there are some fundamental differences that primarily pertain to content focus and technology.

1. Live Shopping Is More Commonplace on Douyin

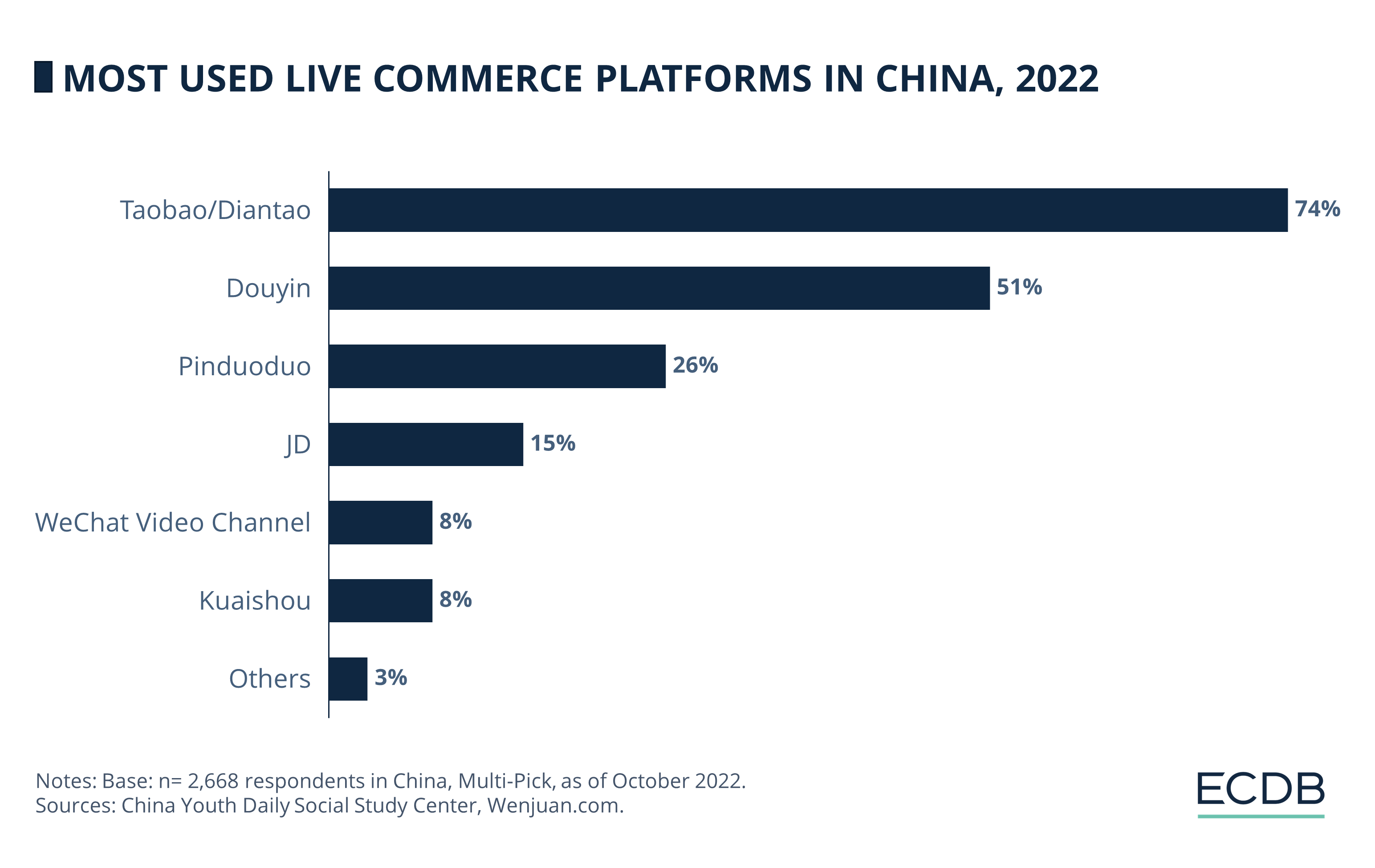

While TikTok Shop was only launched in 2021 and is therefore just getting started, social commerce has been a part of Douyin since before the pandemic began. Live commerce (i.e., selling products via livestreams) is particularly lucrative in China, and Douyin is one of the main platforms that consumers in China like to visit for this purpose:

2. Stricter Content Restrictions on Douyin

The content on Douyin is tailored to fit the CCP’s (Chinese Communist Party) line, which means that certain rhetoric that goes against the party line is prohibited. But the restrictions are not limited to political content; children and teens are also subjected to limitations regarding their time spent on the app. Minors are also shown more educational content. TikTok does not have these restrictions and does not feature the inherent promotional content for the CCP, although it does remove criticism of the CCP.

3. More Integrated Technological Innovation on Douyin

Likely due to its longer existence, Douyin has more technological features than TikTok. These include a display of top-ranked content for each search term, automatic beauty filters, facial recognition searches, and a more integrated on-screen display of items available for purchase.

Knowing what sets both platforms apart, there remains one major difference. Due to Douyin's being in business for a longer time and existing in highly favorable conditions for live commerce in its home market of China, GMV is significantly higher:

Douyin: Marketplace Transactions Resembling the GDP of a Mid-Sized European Economy

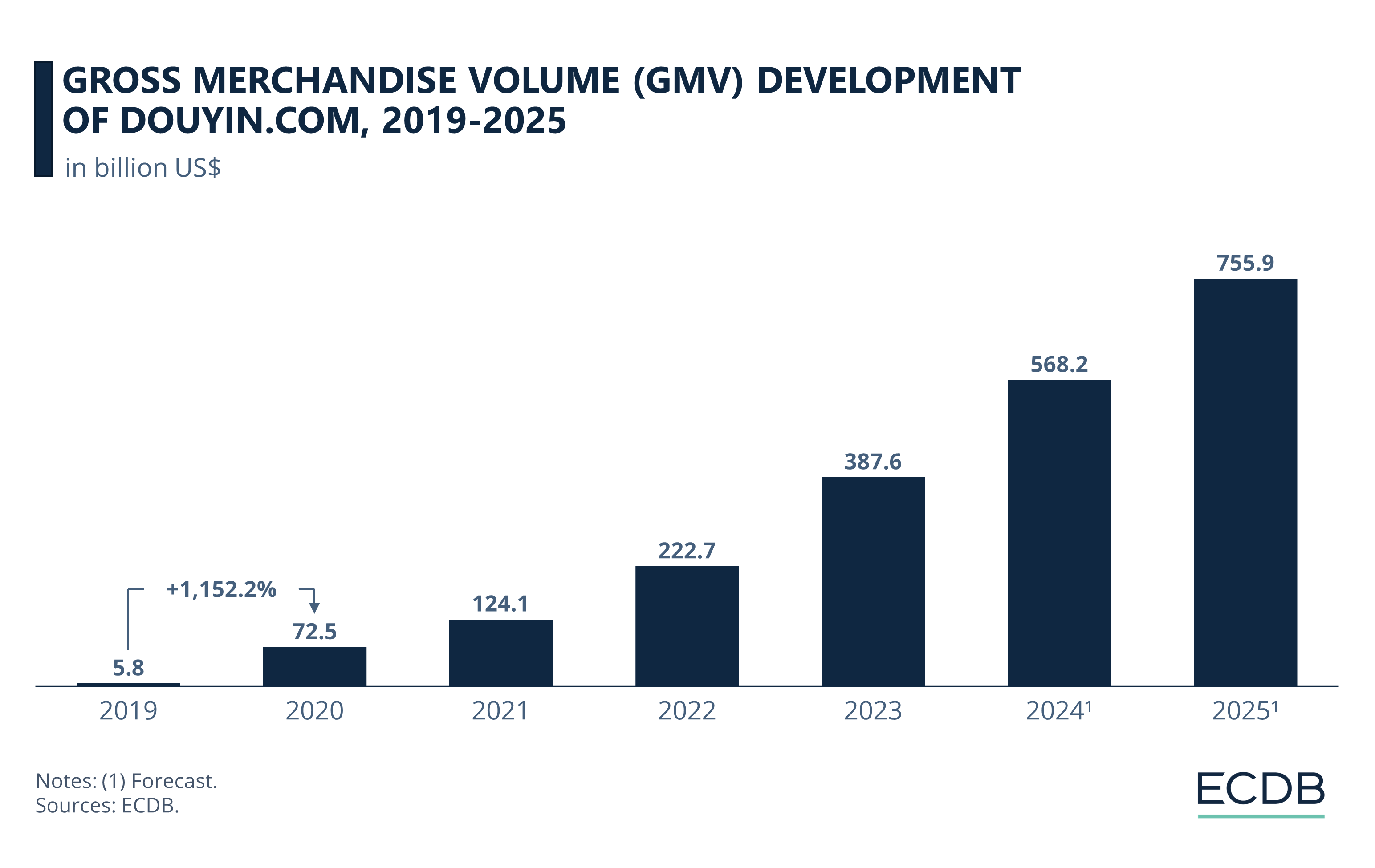

In its first year, Douyin marketplace transactions exceeded US$1 billion already. And growth continues:

GMV on douyin.com surged in 2020, with a growth rate of 1,151% compared to 2019.

In the following years, GMV increased at rates of around 75%. As a result, transactions on douyin.com reached US$387.6 billion in 2023.

Forecasts for 2024 and 2025 expect growth to continue, but at a more moderate pace. By 2025, GMV is projected to reach US$756 billion. This figure is equivalent to the current GDP of a mid-sized European economy like Poland.

Discover Our Data: Our frequently updated rankings provide essential insights to help your business thrive. Wondering which stores and companies are excelling in eCommerce? Interested in the top-performing categories? Find the answers in our rankings for companies, stores, and marketplaces. Stay competitive with ECDB.

What products do consumers in China like to buy via Douyin?

Douyin: Popular for Care Products and Grocery

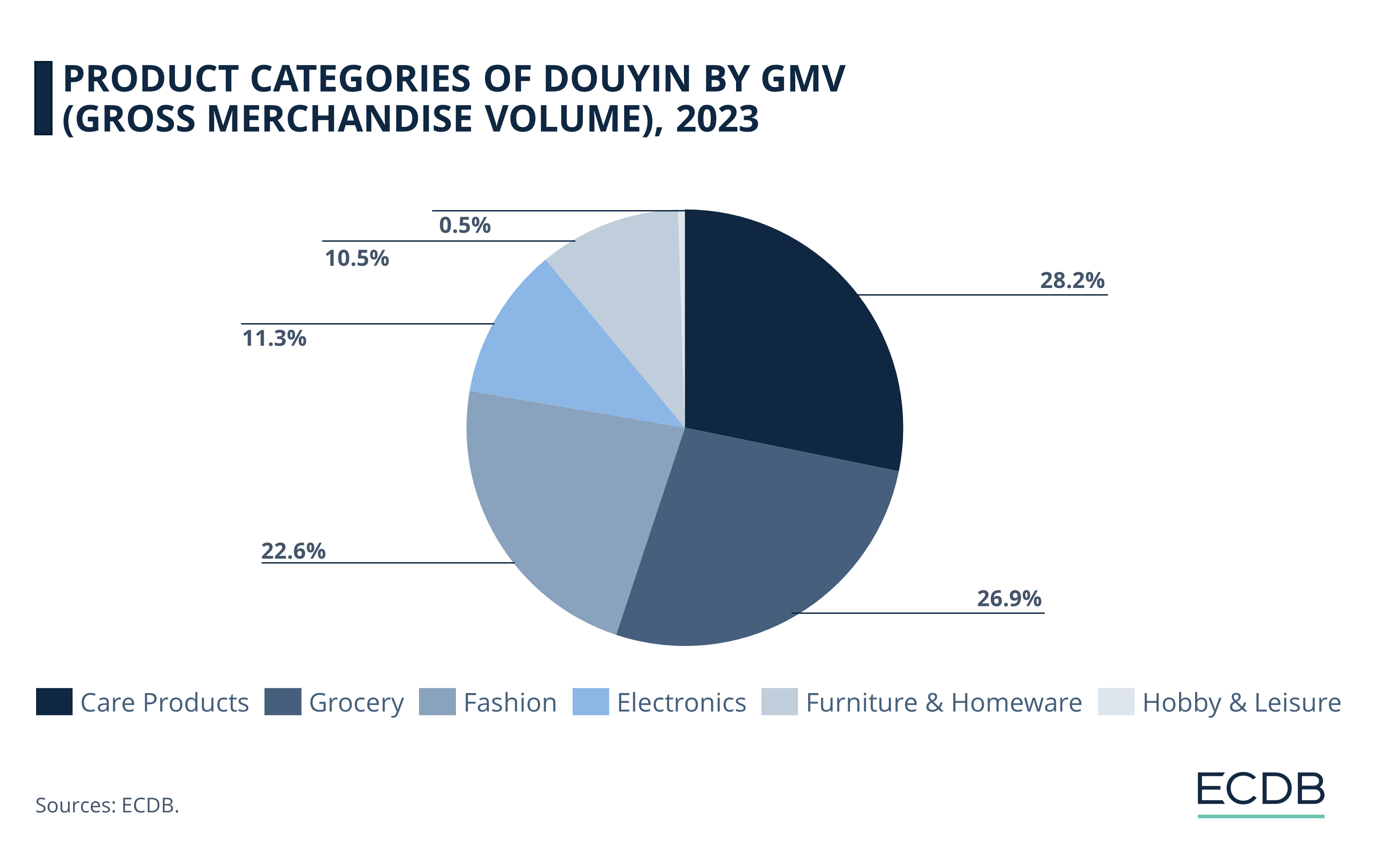

Because of Douyin's content being largely centered around lifestyle and skills, its product assortment differs somewhat from that on TikTok Shop. Here is the product mix on Douyin:

Care products is still the largest category (28.2%), but its GMV share is closely followed by grocery (26.9%). Of the former, personal care makes up only 20.7%, followed by health care (4.5%) and household care (3%).

Fashion follows not too far behind (22.6%), but apparel is less significant with a share of 10.2%. Bags & accessories are almost as prevalent (9.7%), while shoes are similarly irrelevant as at TikTok Shop (2.7%).

Another notable difference is that electronics generate a moderate share on Douyin (11.3%), while this category is least relevant on TikTok. A similar relation emerges for furniture & homeware, which scores 10.5% of Douyin’s GMV. Hobby & leisure is the least significant, with a share of only 0.5%.

The high penetration of live shopping among Chinese consumers is reflected in the best-selling product categories on Douyin: Groceries make up a large portion of GMV, which is also due to the prevalence of villages farmers looking for an additional sales channel.

In contrast, TikTok Shop has a more international focus:

TikTok Shop Is Most Profitable in Southeast Asian Markets

Leveraging the technological know-how on Douyin, ByteDance launched TikTok in 2017. A year later, the app became more widely known through ByteDance’s acquisition of musical.ly.

TikTok Shop was launched later than eCommerce on Douyin, in select Asian markets in 2021. The markets where TikTok Shop first launched back then are now contributing to the highest GMV shares:

Indonesia was the first market to launch. The country now accounts for 12% of GMV generated on TikTok Shop.

The following markets ranked highest, and were launched in 2022, when GMV increased by 363% year-over-year. These markets were Thailand (now accounting for 25.6% of GMV), Vietnam (20.8%), Malaysia (14.7%), and the Philippines (13%).

The comparison with Douyin is easy: the only market in which the site operates is China.

But markets are not the only distinction between the two platforms. See also how product categories offered on both diverge:

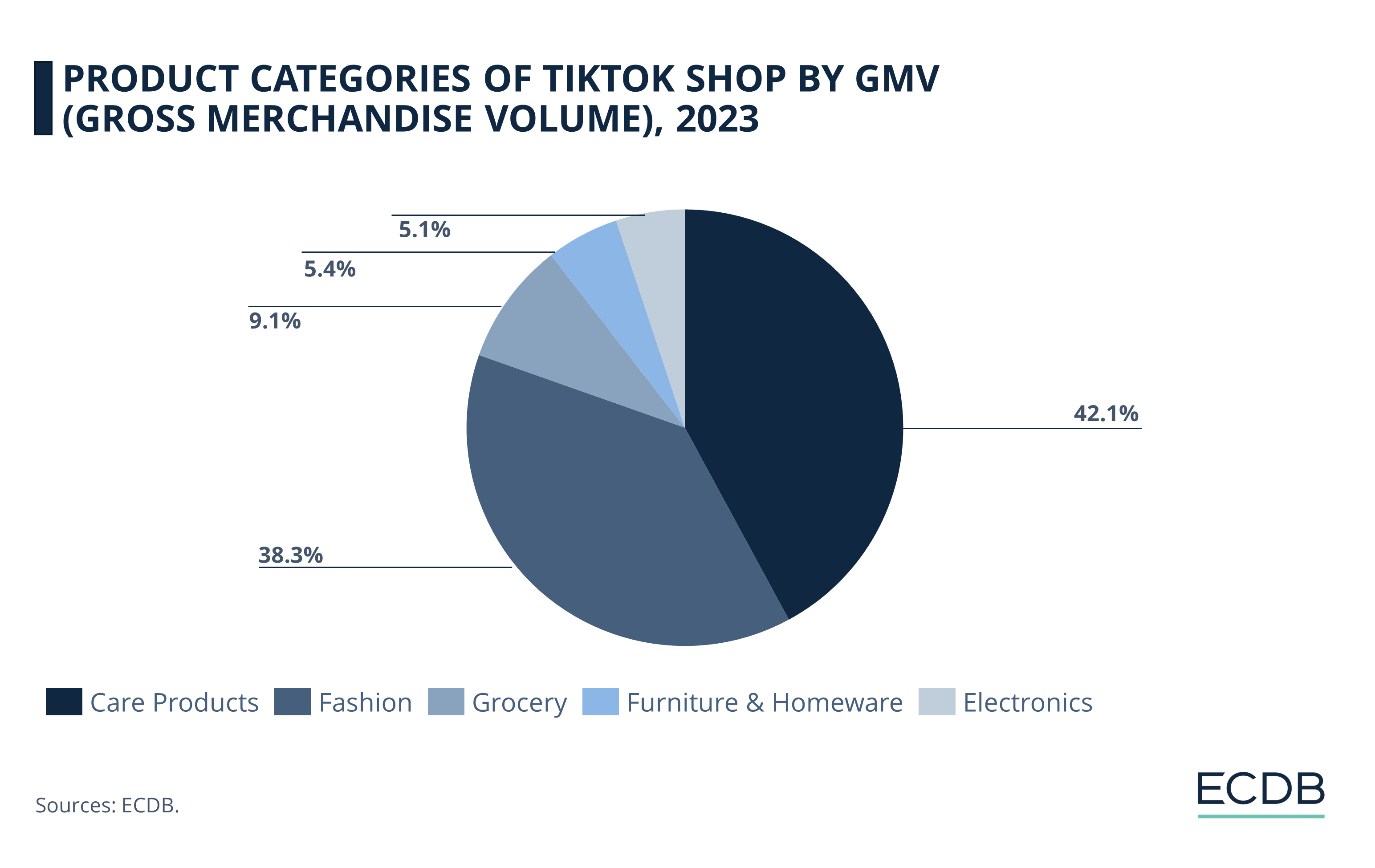

TikTok Shop’s Focus Is Beauty and Fashion

A direct comparison between TikTok and Douyin shows that the former platform has a larger share of artistic posts (i.e. singing and dancing content), while the latter has a higher focus on lifestyle and skills.

These different tendencies contribute to a corresponding product focus:

Products sold on TikTok Shop include a majority of style-related products, such as beauty or personal care products (30.1%), which are subsumed under the care products category (42.1%).

Another product focus is fashion (38.3%), including the very popular sub-category apparel (33.5%) and only a minor share of footwear (4.8%).

Smaller GMV shares come from grocery (9.1%), furniture & homeware (5.4%), and electronics (5.1%).

While TikTok Shop is still quite small in Western Europe and the U.S., it has the potential to become a significant social commerce platform. As live commerce is in its infancy in Western market, TikTok Shop's proliferation could grow with the trend. Some aspects support the notion:

TikTok Generates Higher eCommerce Revenues Than Temu

It seems that TikTok Shop has become the new focus of criticism for retailers around the world, replacing Temu as the primary platform of concern.

News outlets initially questioned TikTok’s potential to beat established eCommerce marketplaces in their field, highlighting its failed entry into the UK in early 2022. Now, however, TikTok Shop seems to have the upper hand over other players disrupting the global market, like Temu.

Why is that? There are several reasons:

TikTok by default has a larger audience through its social media platform and therefore more potential customers from the get-go.

A common figure shown is 1.5 billion monthly active users in 2024. Temu, on the other hand, has to promote its site on external platforms, which is more advantageous for external providers who earn additional revenue. TikTok is well known and does not need a campaign as extensive as Temu's.

TikTok engages users more effectively than Temu

Temu is known for its gamification features that incentivize users to spend time on the site. But TikTok is an addictive social media platform in and of itself. Users spend a lot of time on TikTok, so it is easy to sell them products, especially if they are promoted by content creators they know, admire and trust.

TikTok already generates higher eCommerce revenues than Temu

Check the chart below to see how TikTok Shop’s GMV surpasses that of Temu by quite a few billion dollars. The immersive and trendy nature of livestream shopping certainly contributes to TikTok Shop’s lead.

Temu started a year later than TikTok Shop, which already generated a GMV of US$4.4 billion when Temu launched in 2022.

Tik Tok Shop’s head start is only set to become a bigger advantage as the years progress, at GMV of US$50 billion vs. US$29.5 billion in 2024, respectively.

By 2025, TikTok Shop is expected to have a GMV of US$75 billion, compared to Temu’s US$40.9 billion.

Basically, this competition reflects a race to the top by both parent companies, ByteDance and PDD Holdings, in international markets. Both companies have experience with a highly successful platform in China and are using their technological and financial capabilities to replicate their successes abroad.

ByteDance eCommerce: Wrap-Up

The different operational focus between Douyin, which is China-focused, and TikTok, which is accessible to the rest of the world, reflects the setup and content orientation of the two sites.

Douyin eCommerce serves prevailing consumer preferences in China, where livestreaming is already an integral part of eCommerce. Douyin is one of the preferred platforms for consumers in the country who like to watch livestreams.

TikTok Shop, on the other hand, has been known in Southeast Asia for several years, but is only now gaining traction in Western markets like the U.S. and the UK. It has to overcome some hesitancy among consumers, who are still rather untrustful about social commerce. But TikTok’s wide penetration and high acceptance are working in its favor. In that way, it is set to become more influential than Temu, causing incumbent retailers additional headaches.

Sources: ABC News – CNN – Daoinsights – Daxue Consulting – East Media – Kolsquare – MIT Technology Review – Statista – Tech Crunch

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

H&M Revenue: Online Net Sales Remain High Through 2023

H&M Revenue: Online Net Sales Remain High Through 2023

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Deep Dive

Walmart eCommerce Revenue: The U.S. Retail Giant Surpassed US$100 Billion

Walmart eCommerce Revenue: The U.S. Retail Giant Surpassed US$100 Billion

Back to main topics