eCommerce: Luxury Report

Chanel Analysis: Sales, Online to Offline, B2B vs. D2C

Chanel products are known worldwide for their classic heritage and timeless designs. Naturally, Chanel is mentioned as an important aspect in the ECDB Luxury Report. We discuss the results here.

Article by Nadine Koutsou-Wehling | February 09, 2024Download

Coming soon

Share

Luxury Brand Chanel: Key Insights

Classic Brand With High Exclusivity: Chanel, positioned as a high-exclusivity brand, emphasizes in-store sales. This reflects a minor online sales share, showing that the brand prioritizes face-to-face customer interactions.

Positioning by Online and Offline Sales: While Chanel holds the second position among the world's top 250 luxury brands in overall net sales, its restricted online presence places it at 26th in eCommerce net sales.

Growth in D2C Business: Between 2020 and 2022, Chanel's direct-to-consumer (D2C) sales mirrored the growth in total net sales. D2C sales climbed from US$3.7 billion to over US$6 billion, maintaining a consistent percentage of overall sales.

The House of Chanel was established by Gabrielle (Coco) Chanel, who opened her first boutique in Paris in 1910. Initially known for her trendsetting hats, popular among French actresses, the store “Chanel Modes” quickly gained renown in French couture. Just five years later, in 1915, Chanel expanded into haute couture, crafting unique, handcrafted pieces for the upper class.

Today, Chanel’s legacy has outlived its founder, and its designs are among the most coveted styles on global runways. It is only natural, then, that our recently released ECDB Luxury eCommerce Market Report includes industry-relevant statistics on Chanel’s positioning and performance over the past three years.

This insight examines Chanel’s placement among the top 250 global luxury brands, its online and offline focus, as well as the distinction between B2B (business-to-business) and D2C (direct-to-consumer) sales. But first, how is the brand being identified in the luxury market?

Chanel Is a Classic Brand with High Exclusivity

Our ECDB Luxury eCommerce Market Report categorizes brands along two dimensions: positioning and exclusivity. Positioning describes how the brand characterizes itself and its products. In the case of Chanel, it is the “Classic” level, meaning that the brand’s history and refined heritage are defining traits of its corporate identity.

The other dimension is the exclusivity quintile. Here, each brand was assigned an exclusivity score based on a meta-ranking of a number of industry-leading exclusivity rankings. From this list, the brands were grouped into five quintiles, ranging from lowest to ultra-high exclusivity. Chanel is in the 2nd highest quintile, defined as “high exclusivity”.

Chanel Ranks 2nd in Terms of Net Sales

Previously, we reported on prominent luxury brands in our ECDB report. There we rank the top 10 luxury brands by global online net sales. Considering only online sales, Chanel ranks 26th among the top 250 global luxury brands.

Another perspective, based on total net sales including online and offline sales, places Chanel high. Specifically, Chanel is the second highest brand in terms of total net sales, between Louis Vuitton in first place and Dior in third.

With combined online and offline net sales of US$19.8 billion in 2022, Chanel positions itself significantly ahead of third-ranked Dior. The gap between the second and third rank is more than US$5 billion in annual net sales. However, it is clear that Chanel’s online sales share alone is not enough to compete with the other brands on this list, most of which generate 11-12% of their net sales online.

In the following section, Chanel's online sales share is discussed in more detail.

Chanel: Constant Online Share of Net Sales

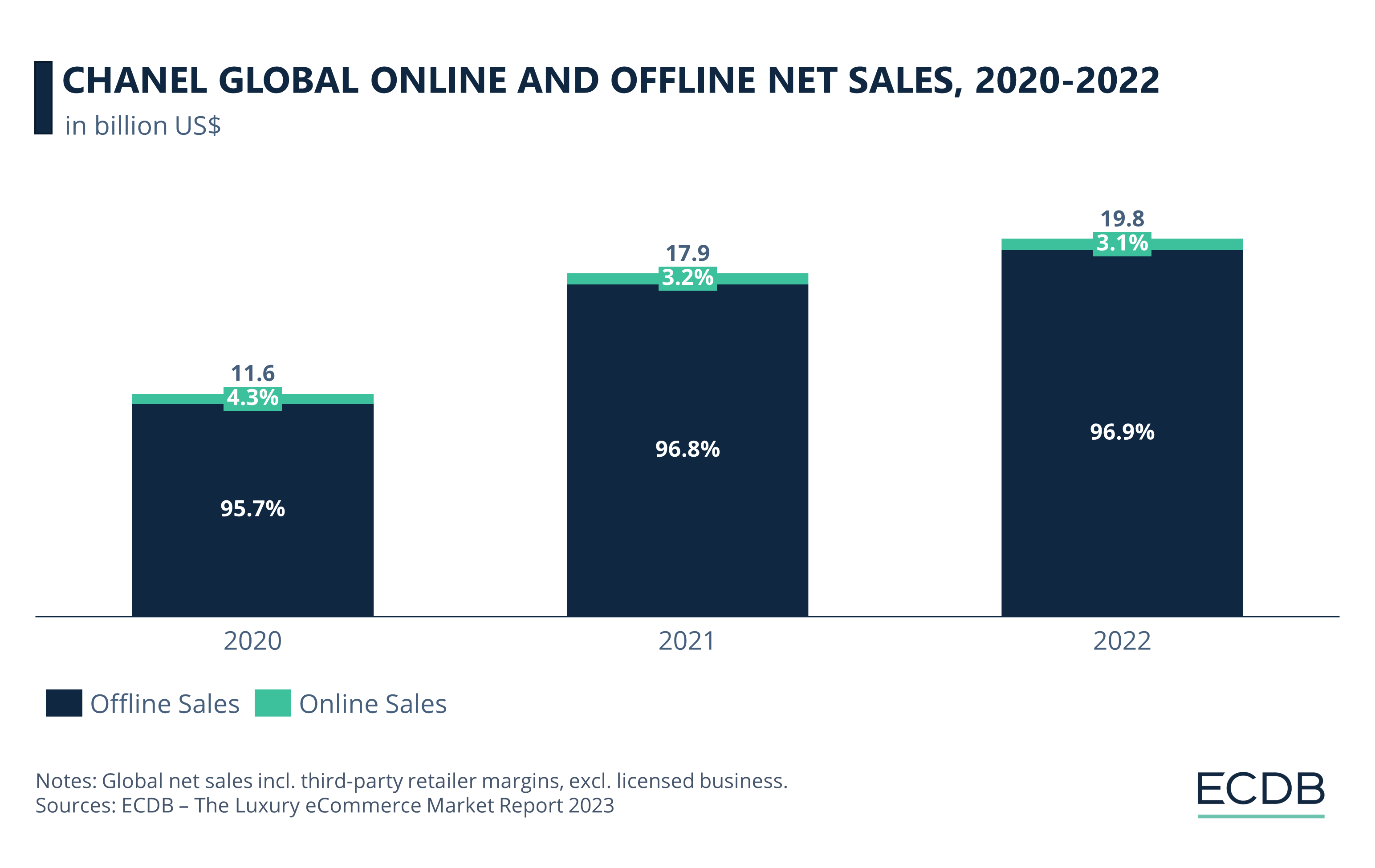

In line with the findings of the previous section, we can see that Chanel’s primary sales channel is offline. Despite the sharp increase in sales between 2020 and 2022, the brand’s share of online sales did not increase accordingly. On the contrary, online sales shrank in relative terms, from 4.3% of overall sales in 2020 to 3.1% in 2022.

While the Luxury Report finds a negative correlation between exclusivity and online sales share, Chanel deviates somewhat from this pattern. As a highly exclusive brand in the 2nd tier of exclusivity, the brand has very low online shares, which are typically associated with ultra-high exclusivity brands.

In absolute terms, however, Chanel’s online sales increased from 2020 to 2022. After generating net sales of US$501 million online in 2020, the brand expanded its online net sales to US$572 million in 2021 and to US$620 million in 2022. But due to the overall higher net sales increase, the share of online sales decreased. As a result, a whopping 97% of net sales are generated offline, highlighting the importance of the in-store experience when purchasing Chanel products.

Having established Chanel’s online-to-offline ratio, the next part examines the relationship between business-to-business (B2B) and direct-to-consumer (D2C) sales.

Chanel: D2C Growth During the Pandemic

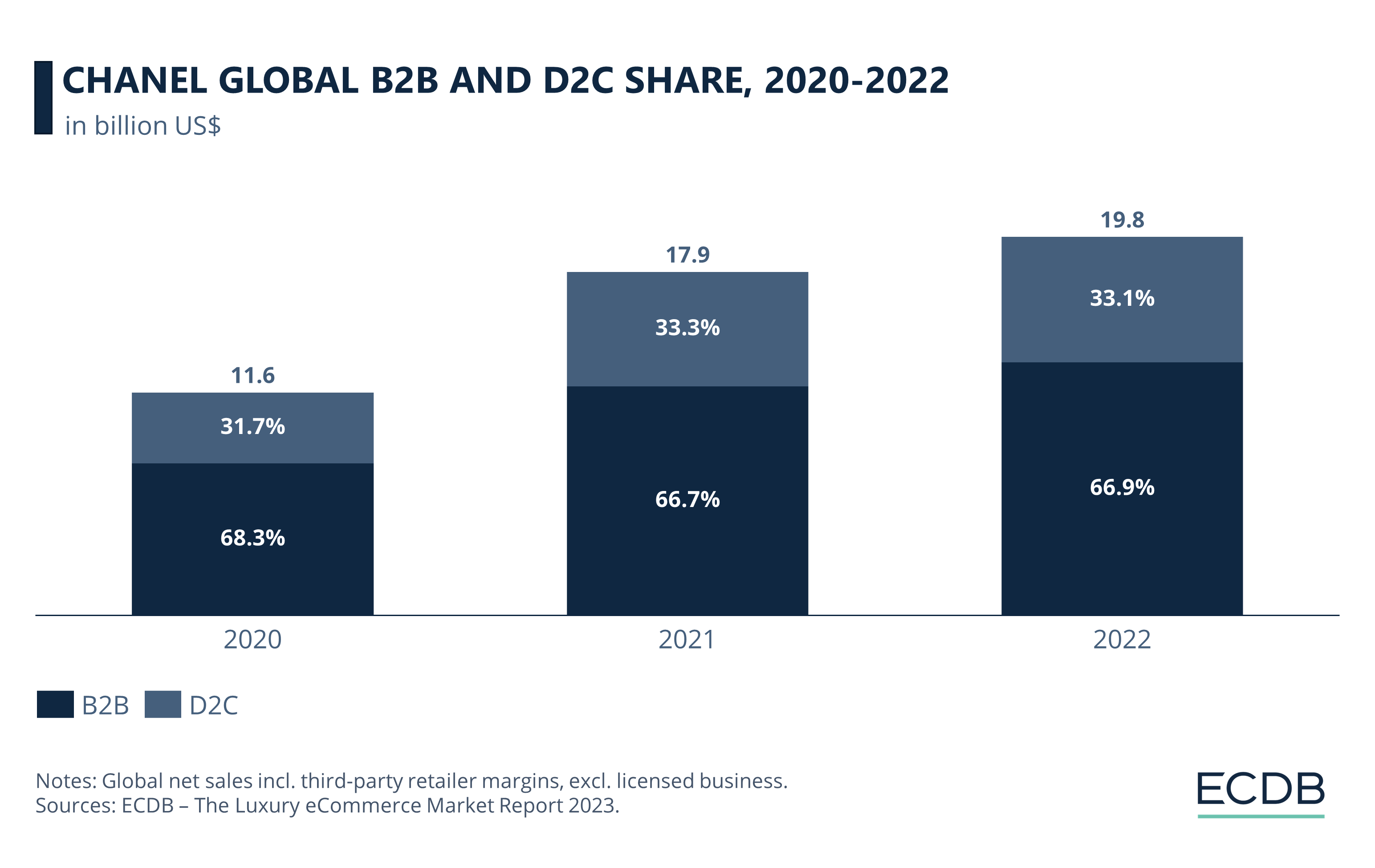

Another important metric in our ECDB Luxury eCommerce Market Report is the ratio of B2B to D2C sales. Traditionally, luxury brands have tended to generate the majority of their net sales through B2B channels. These are typically third-party retailers who sell the products through their own offline or online stores. Moreover, these retailers apply their own profit margins to the initial retail price, which is also the final price taken into account when our team of ECDB analysts assessed the amount of total net sales generated by each brand.

On the other hand, D2C sales are usually less prevalent in the luxury sector. But there are certain benefits to selling products directly to consumers, including greater control over brand marketing and the customer experience.

In Chanel’s case, the share of D2C sales remained constant at around one-third of total net sales in the period from 2020 to 2022.

While Chanel’s D2C share grew from 31.7% in 2020 to 33.3% in 2021, a corresponding increase in overall net sales implies that D2C sales did grow very significantly in absolute terms over this period. More specifically, while D2C revenues were US$3.7 billion in 2020, they jumped to US$6 billion by 2021. Although the share of D2C business shrank again to 33.1% by 2022, absolute D2C revenues grew by a small margin to reach around US$6.5 billion in 2022.

In particular, the jump from US$3.7 billion to US$6 billion from 2020 to 2021 suggests that the pandemic period may have had an impact on the way Chanel did business with its customers. As factors such as in-store accessibility and customer loyalty may have changed during the pandemic, brands like Chanel found lasting benefits in marketing products directly to customers and meeting potential clients where they are, whether online or offline.

The ECDB Luxury eCommerce Market Report

To gain further insight into net sales, positioning, exclusivity, and online to offline as well as D2C to B2B shares of the top 250 luxury brands, order the report here. Purchasing the report also gives you access to the comprehensive Excel datasheet with detailed statistics for each brand.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Yoox Net-a-Porter Is Sold to Mytheresa by Richemont: What the Acquisition Means for the Online Luxury Brands

Yoox Net-a-Porter Is Sold to Mytheresa by Richemont: What the Acquisition Means for the Online Luxury Brands

Deep Dive

Cartier Business Strategy: Global Revenue, Ranking, Competitors

Cartier Business Strategy: Global Revenue, Ranking, Competitors

Deep Dive

Forbes Asia 100 To Watch 2024: 9 Retailers to Follow

Forbes Asia 100 To Watch 2024: 9 Retailers to Follow

Deep Dive

Luxury Goods Market: Revenue, Net Sales, Online & Offline Sales

Luxury Goods Market: Revenue, Net Sales, Online & Offline Sales

Deep Dive

Louis Vuitton Analysis: Net Sales, Online to Offline, B2B vs. D2C

Louis Vuitton Analysis: Net Sales, Online to Offline, B2B vs. D2C

Back to main topics