eCommerce: Luxury Market

Luxury Goods Market: Revenue, Net Sales, Online & Offline Sales

Curious about the luxury goods market's revenue, net sales, and how it spans online and offline sales? Using our report, we answers these questions with data.

Article by Nashra Fatima | August 08, 2024Download

Coming soon

Share

Luxury Goods Market: Key Insights

Significant Shift:

In 2021, the luxury goods market saw a 38% increase in online sales, reaching US$58 billion, indicating a growing trend towards eCommerce despite the resurgence of physical stores.

Rapid Growth:

From 2020 to 2022, the online luxury goods market grew at a 17% CAGR, significantly outpacing the non-luxury segment's 8% CAGR, showing the industry's rapid catch-up with eCommerce.

Digital Integration:

The luxury goods market is rapidly adopting eCommerce and omnichannel strategies, integrating online and offline experiences, driven by advances in technology and consumer demand for digital shopping.

Luxury markets used to focus on offline sales, but this changed with the COVID-19 pandemic. Store closures in 2020 hit the luxury industry hard. Since then, eCommerce has grown in the luxury goods market. Even with offline sales bouncing back in 2022, online sales remain strong.

Our analysis of online market share in luxury goods is important, given the lack of solid data. The growth rate of eCommerce in luxury vs. non-luxury segments varies. Let us explain why using our findings.

Online Market Share in Luxury Goods

While not as large as physical store sales, eCommerce revenue in the luxury sector has remained stable. Our figures indicate a groundbreaking shift occurred in the luxury market in 2021: more people than before began shopping online in an industry where in-store shopping has ruled.

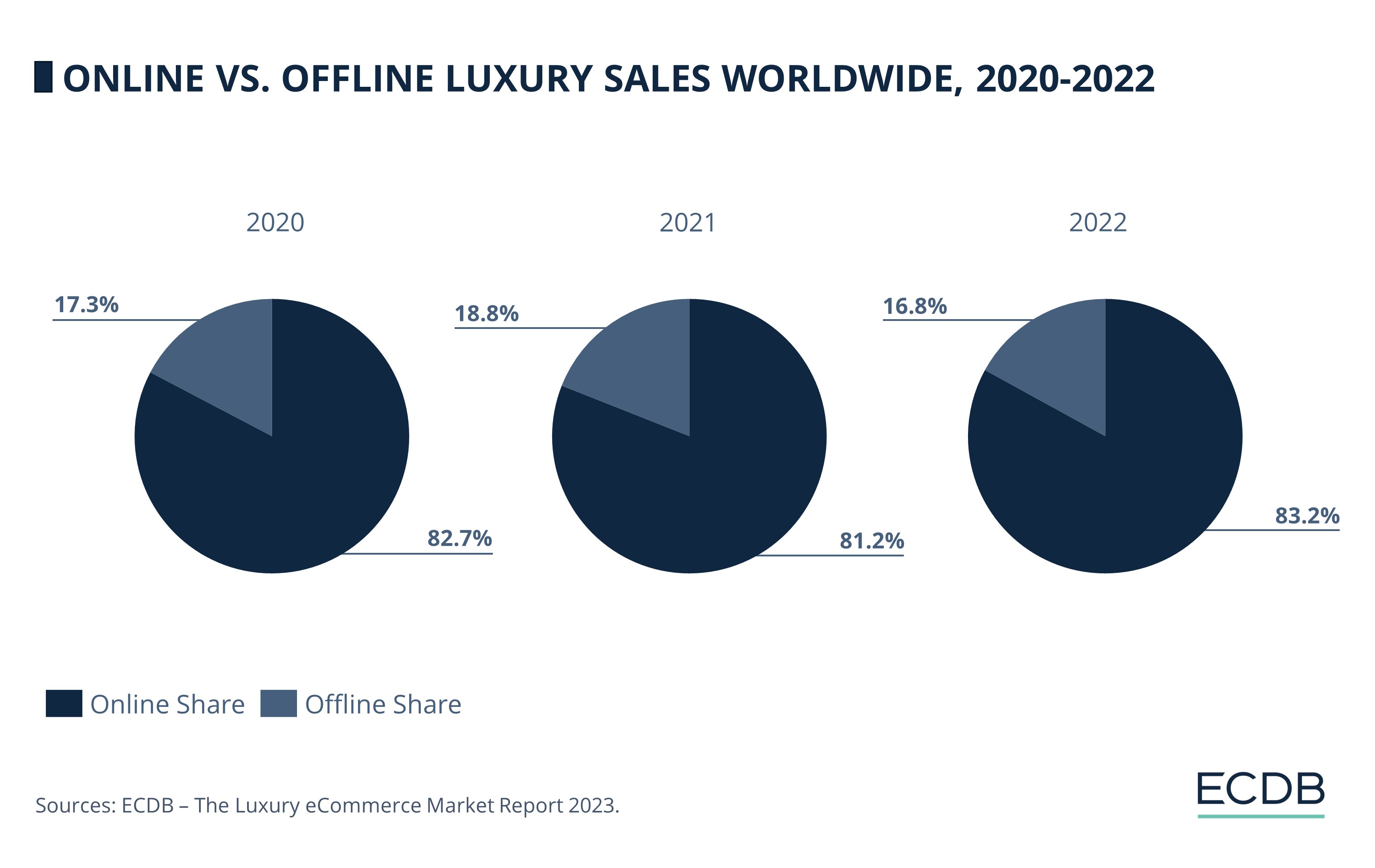

After the start of the pandemic, the online share in luxury jumped by 38% in 2021, to make up 18.8% of all luxury sales. From US$42 billion in 2020, the online market reached an unprecedented US$58 billion in 2021.

The following year, even with the reopening of stores, the online segment remained largely stable and generated US$57 billion in sales. These trends indicate that the shift from offline to online in the luxury market may grow in the upcoming years, despite the return of brick-and-mortar stores to normal operations.

Shift From Offline to Online

Offline shopping dominates in luxury for several reasons. Luxury companies and consumers alike have preferred shopping in stores because it ensures greater exclusivity.

By selling predominantly in stores, brands make sure their exclusive products remain out of mass reach. Moreover, they can exercise better control over the customer’s journey from start to end. For consumers, shopping in boutiques offers a remarkable experience, complete with sensory engagement and exceptional service.

Nevertheless, the pandemic incited interesting transformations within the luxury market. As storefronts across the globe shut down, online channels emerged as a viable alternative for companies to connect with their consumers.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

Consumers Started Buying More Luxury Items Online in 2021

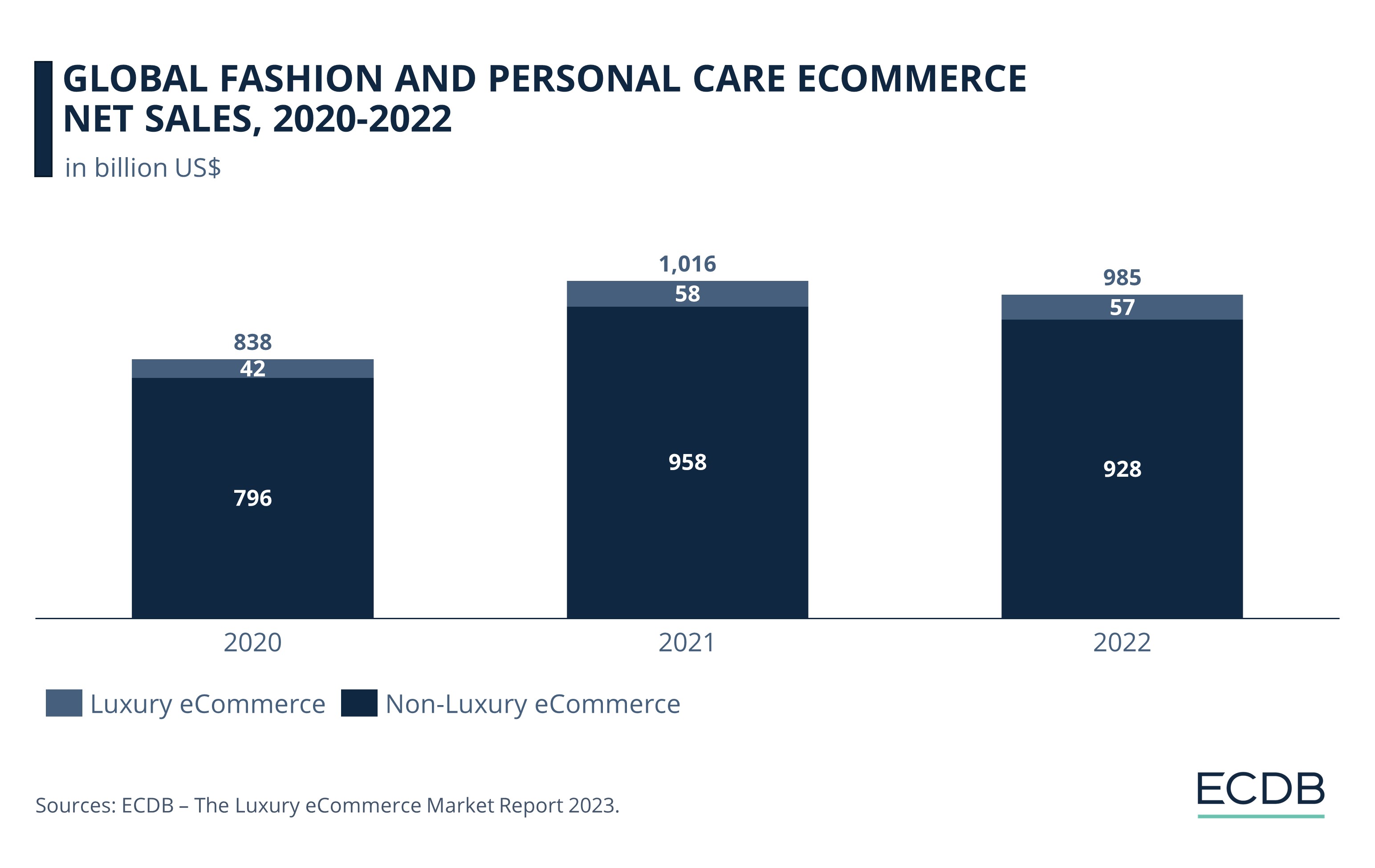

The average yearly growth of online sales in global luxury (fashion and personal care segments) indicates that although late to integrate eCommerce, the industry is catching up.

Between 2020 and 2022, the online market growth of the luxury goods market was significantly larger than that of the non-luxury segment:

In 2020, the first year of the pandemic, luxury products accounted for 5% of the total eCommerce market for fashion and personal care goods. However, the online share rose steadily in the next two years to constitute 5.8% of the same market by 2022.

In absolute terms, the size of the luxury eCommerce market grew from US$42 billion in 2020 to US$57 billion in 2022. Its compound annual growth rate (2020-2022) is 17%, well above the 8% CAGR for its non-luxury counterpart (fashion and personal care goods).

In contrast, non-luxury eCommerce, while more mature than luxury, had a significantly lower CAGR for the same period. The online share of non-luxury grew from 2020 to 2021, but as stores reopened in most regions, the eCommerce market shrank from US$958 billion in 2021 to US$928 billion in 2022.

With a CAGR of 17%, the online market for personal luxury goods is miles ahead of its non-luxury counterpart (CAGR: 8%). The luxury goods eCommerce market is also ahead of the overall eCommerce market for fashion and personal care goods (CAGR: 8.4%).

The retail sector has undergone a technology-driven evolution in recent years. Digital penetration, the ubiquity of mobile phones, and COVID-induced changes in consumer behavior have all boosted online shopping. See how this is expected to impact innovations in the online luxury market.

Luxury Goods Market: Future of the Market

Exclusivity is one of the main concerns of luxury companies. Not only high price points, but also an exclusive in-store distribution strategy have made it easier for brands to gate keep their products or sell only to a certain type of consumer.

The offline-to-online transition for luxury brands has finally reached this industry as a result of the eCommerce trend.

Now that both luxury companies and consumers have tasted the benefits of digital shopping, the globalization of the industry through online platforms is well underway. High-end brands with strong capital backing have dabbled in AI-driven personalization, experiential or immersive luxury, and virtual fashion such as the Metaverse Fashion Week – all made possible by advances in eCommerce technology.

Brands are also rapidly adopting omnichannel strategies to serve their customers through online-offline integration. The relevance of technology to the luxury segment is no longer deniable. As online shopping dynamics evolve and companies find new ways to create meaningful engagement with their audiences, the luxury eCommerce market will continue to grow in the coming years.

The Luxury Goods Market: Players & Category Insights 2023 – Available Now

Are you searching for an in-depth analysis of the online market for luxury goods? Order ECDB’s exclusive report on The Luxury eCommerce Market: Players and Category Insights 2023 here.

The study provides a comprehensive overview of the personal luxury market with a focus on eCommerce. Next to an in-depth market analysis, readers will learn about the impact of Covid on the global luxury market, regional dynamics, sales channels (Business-to-Business and Direct-to-Consumer), as well as insights into different product categories.

The study further features an exclusive list of 250 leading luxury brands, including detailed performance metrics and brand properties, such as exclusivity and brand positioning. All sales numbers are provided for 2020 to 2022.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Yoox Net-a-Porter Is Sold to Mytheresa by Richemont: What the Acquisition Means for the Online Luxury Brands

Yoox Net-a-Porter Is Sold to Mytheresa by Richemont: What the Acquisition Means for the Online Luxury Brands

Deep Dive

Cartier Business Strategy: Global Revenue, Ranking, Competitors

Cartier Business Strategy: Global Revenue, Ranking, Competitors

Deep Dive

Forbes Asia 100 To Watch 2024: 9 Retailers to Follow

Forbes Asia 100 To Watch 2024: 9 Retailers to Follow

Deep Dive

Louis Vuitton Analysis: Net Sales, Online to Offline, B2B vs. D2C

Louis Vuitton Analysis: Net Sales, Online to Offline, B2B vs. D2C

Deep Dive

Top 5 Online Jewelry & Watches Stores in the United States: Top Online Stores, Market Development

Top 5 Online Jewelry & Watches Stores in the United States: Top Online Stores, Market Development

Back to main topics