Louis Vuitton eCommerce Analysis

Louis Vuitton Analysis: Net Sales, Online to Offline, B2B vs. D2C

Louis Vuitton is a leading brand for fashion and leather goods, known globally for its luxury status. What people do not know: Louis Vuitton's online net sales performance, the importance of the online channel to its revenue, and how it differentiates itself from traditional luxury brands in direct-to-consumer (D2C) and business-to-business (B2B) sales - but ECDB knows.

Article by Nadine Koutsou-Wehling | June 21, 2024

Louis Vuitton eCommerce Strategy: Key Insights

Online Sales Lead: At the forefront of luxury brands, Louis Vuitton reached the highest online net sales in 2022, totaling US$2.6 billion through online platforms.

Online Share of Revenues: Online sales make up a relatively small portion, accounting for 10.5% of Louis Vuitton's total revenue, consistent with trends observed in ultra-exclusive luxury brands.

Unusual D2C Sales: In an uncommon departure for luxury brands, Louis Vuitton relies primarily on direct-to-consumer sales for its revenue. During the period from 2020 to 2022, despite the growth in net sales, B2B sales remained relatively stable at around 23%.

Louis Vuitton is a household name for luxury goods. Consumers around the world spend their income to display the trademark Louis Vuitton Monogram on their bags, clothes, and footwear. From fashion shows to music videos, wearing a piece of this brand represents affluence and a refined sense of style that is instantly recognizable to many.

ECDB recently published the Luxury eCommerce Market Report, which details rare metrics on the world’s top luxury brands and provides analysis on industry characteristics and leading players. Needless to say, Louis Vuitton is one of the brands included in the report. With a category focus on Bags, the 19th century French trunk master has established the brand as a premium global luxury player. Nowadays Louis Vuitton operates under the conglomerate LVMH which includes Moët & Chandon champagne, Hennessy cognac, and more than 70 other renowned luxury brands such as Dior, Fendi, Givenchy, and Marc Jacobs.

To preview the results, let us dive into the case of Louis Vuitton. ECDB has the metrics you won’t find anywhere else, namely how much revenue the brand generated between 2020 and 2022, what portion of that was sold online, and how much of the revenue came from B2B vs. D2C sales.

Louis Vuitton Is a Classic Luxury Brand With Ultra-High Exclusivity

The ECDB Report on Global Luxury eCommerce, now available for purchase, ranks the world’s top luxury brands along two dimensions: brand positioning and exclusivity. Positioning defines how a brand represents itself and its products, which in the case of Louis Vuitton is the “Classic” level, meaning that the company’s rich heritage serves as a point of reference to this day.

Exclusivity, on the other hand, refers to how accessible the products are. Here, Louis Vuitton ranks in the first quintile of “ultra-high exclusivity”. Each brand included in this study was assigned an exclusivity score through a meta-ranking consisting of a number of industry-leading luxury exclusivity rankings. Louis Vuitton is among the top 20% of global luxury brands in terms of exclusivity.

Having defined the brand’s placement within the report’s two basic categories, the next section provides a more general perspective of the top ten luxury brands with the highest online revenue.

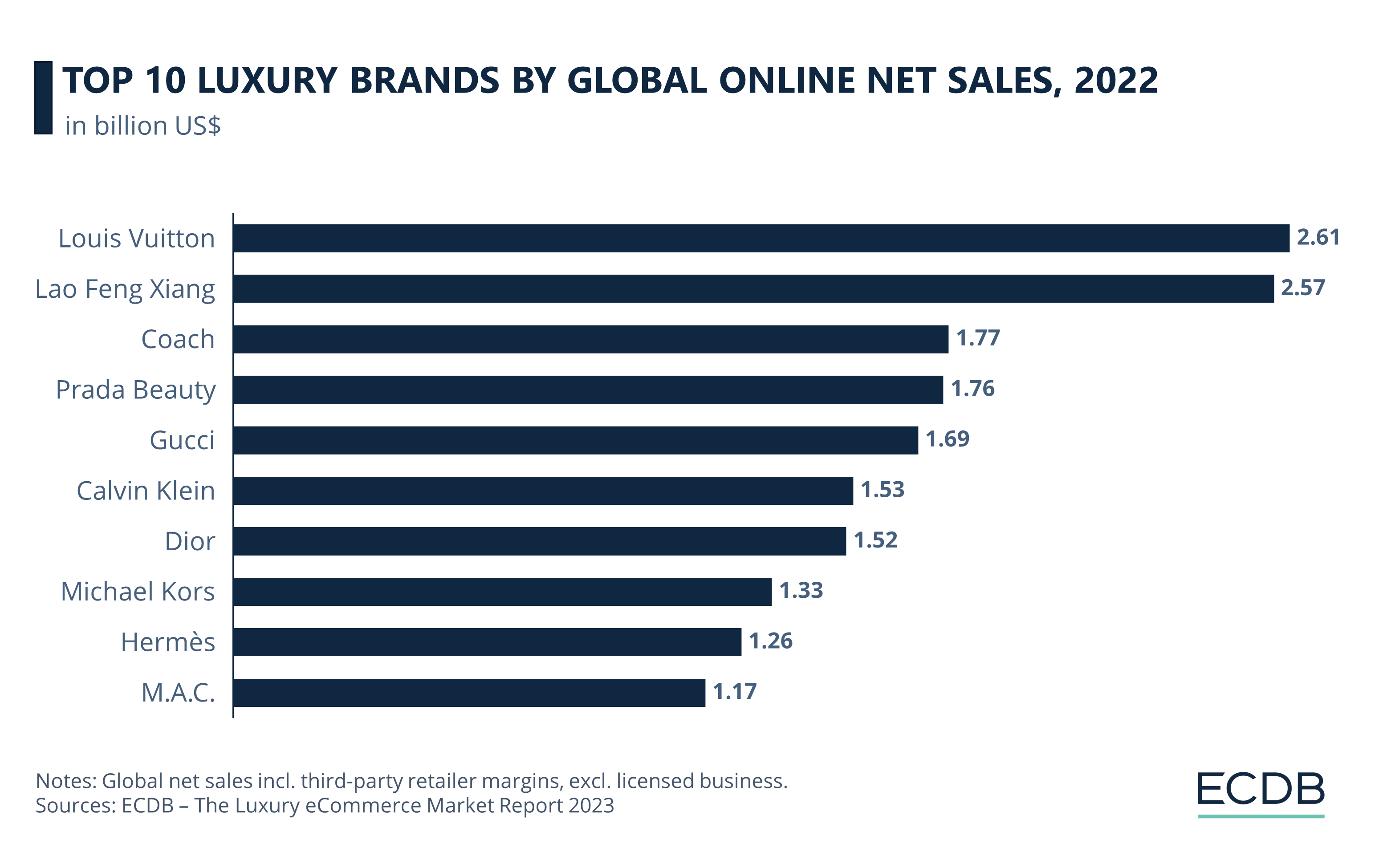

Louis Vuitton Is the Leading Luxury Brand by Online Net Sales in 2022

A ranking of the top 10 luxury brands can look different depending on the defining metric used to create the list. In this case, we used online net sales, but ECDB data also provides the ability to sort by total net sales or other variables such as B2B and D2C sales.

In our analysis, ECDB assessed the total market value of a product, which includes mark-ups from third-party sales, rather than focusing solely on a brand's retail price.

Looking at online net sales, we see that Louis Vuitton emerges as the top luxury brand in 2022, with US$2.61 billion generated through digital channels. Close behind is the Chinese jewelry brand Lao Feng Xiang, with online earnings of US$2.57 billion in 2022.

Rankings three through seven are all close in terms of online net sales for that year, starting with Coach New York (US$1.77 billion) in third place and ending with Dior in seventh place (US$1.52 billion). The next three brands on this list fall below the US$1.5 billion mark: Michael Kors with US$1.33 billion, Hermès with US$1.26 billion, and finally cosmetics brand M.A.C. with US$1.17 billion.

Louis Vuitton’s prominent position among competing luxury brands warrants a closer look at its development over the past few years. How have online net sales changed since 2020? And how do online sales compare to total net sales? The following part explores these questions.

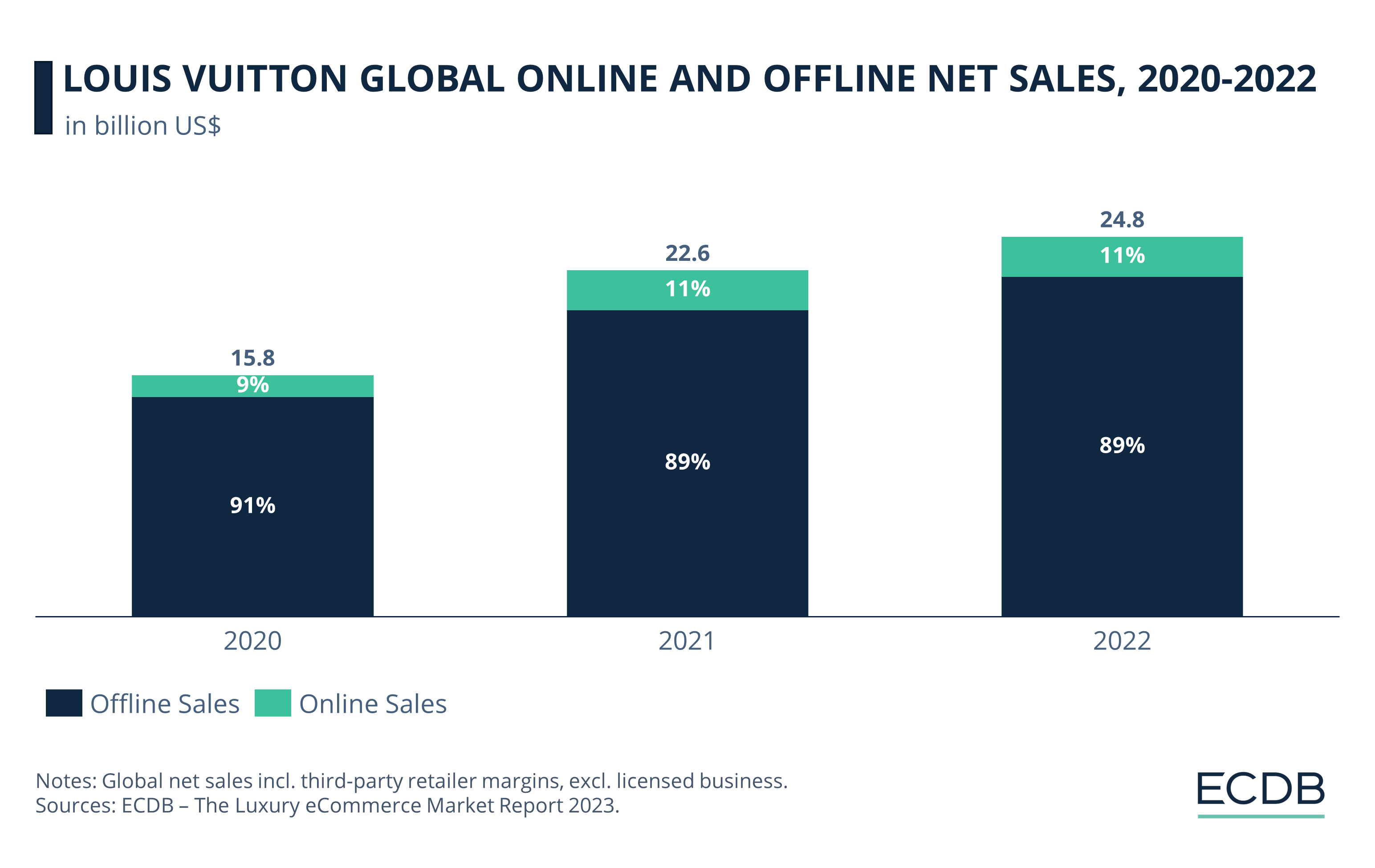

Louis Vuitton Generated 10.5% of Its Revenue Online in 2022

The chart below shows Louis Vuitton’s revenue from 2020 to 2022, including both online and offline shares.

The overall development of net sales was positive during the pandemic years, growing from US$15.8 billion in 2020 to US$24.8 billion in 2022. There was a sharp increase from 2020 to 2021, where net sales grew by US$6.8 billion to US$22.6 billion.

What’s more, the pandemic appears to have also affected the online revenue share. From 9.2% of total net sales in 2020, representing just over US$1.4 billion in online sales, 11.5% were sold online in 2021, for an absolute total of US$2.59 billion in online revenue. In 2022, online earnings grew only slightly to US$2.61 billion, but as overall revenue also increased, the online share fell to 10.5%.

The ECDB Luxury Report puts the online revenue shares of the world’s leading luxury brands into perspective in relation to variables such as exclusivity, brand positioning, and product categories. One finding is that exclusivity is negatively correlated with online sales, meaning that the higher a brand ranks in exclusivity, the less likely it is to sell online. As one of the most exclusive brands, Louis Vuitton is among the companies that derive only a small portion of their sales from online channels.

Another important variable is the ratio of D2C to B2B sales. The next section examines this relationship.

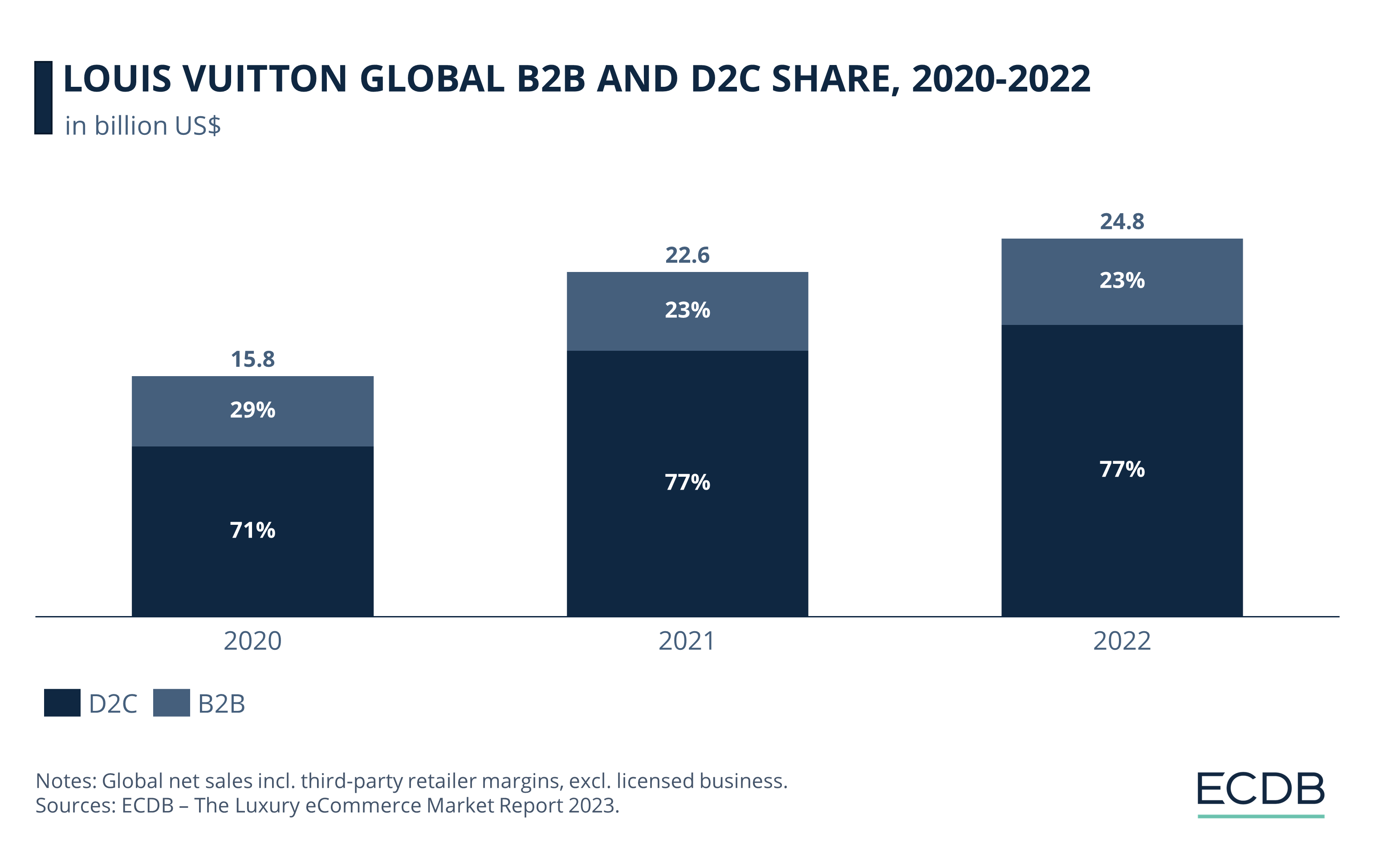

D2C Is Most Important for Louis Vuitton Sales

Whether brands sell primarily D2C (direct to consumer) or B2B (to other businesses) is a matter of brand identity, as it determines which partners a brand will work with to sell its products. While B2B has traditionally been the primary channel for luxury brands, represented by intermediary retailers who resell the brand’s products to customers over online or offline channels, D2C sales are growing. By selling directly to customers, luxury brands gain greater control over the customer experience and how products are marketed to them.

In the case of Louis Vuitton, how have B2B and D2C sales evolved in the past few years? The chart below illustrates this split.

It is immediately clear that Louis Vuitton differs from the common observation that luxury brands tend to focus more on B2B sales. Direct-to-consumer sales are consistently in the majority for Louis Vuitton, as seen by 70.8% of sales in 2020, and this share increases in the following years. While the D2C ratio was 77.2% in both 2021 and 2022, with net sales rising in 2022, corresponding sales through D2C channels increased accordingly, from US$17.4 billion in 2021 to US$19.1 billion in 2022.

Of course, this means that B2B sales are less of a focus for Louis Vuitton. The share of products sold directly to other businesses for resale fell from 29.2% in 2020 to 22.8% in 2022. In absolute terms, however, B2B sales increased steadily, but at a slow pace. Specifically, this means a rise from US$4.6 billion in 2020 to US$5.7 billion in 2022.

The data suggests that Louis Vuitton may place more emphasis on controlling the customer experience by selling directly to them, rather than relying on third-party sellers. Another advantage of focusing on D2C sales is the ability to better control marketing and ensure that the brand image is conveyed more in line with the company's vision.

The ECDB Luxury Report: Available for Purchase

The 2023 Luxury eCommerce Market Report by ECDB provides the comprehensive data set for 250 leading luxury companies in an additional Excel spreadsheet, which includes sales channels, product categories, brand exclusivity and positioning over the three-year-period from 2020 to 2022.

Order the report here for the full data set, including complete market analysis from our experts.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Yoox Net-a-Porter Is Sold to Mytheresa by Richemont: What the Acquisition Means for the Online Luxury Brands

Yoox Net-a-Porter Is Sold to Mytheresa by Richemont: What the Acquisition Means for the Online Luxury Brands

Deep Dive

Cartier Business Strategy: Global Revenue, Ranking, Competitors

Cartier Business Strategy: Global Revenue, Ranking, Competitors

Deep Dive

Forbes Asia 100 To Watch 2024: 9 Retailers to Follow

Forbes Asia 100 To Watch 2024: 9 Retailers to Follow

Deep Dive

Luxury Goods Market: Revenue, Net Sales, Online & Offline Sales

Luxury Goods Market: Revenue, Net Sales, Online & Offline Sales

Deep Dive

Luxury Goods Market: Which Countries Have the Highest Online Sales?

Luxury Goods Market: Which Countries Have the Highest Online Sales?

Back to main topics