eCommerce: Top Marketplaces

Top Online Marketplaces in the World: GMV, Top Markets, Product Categories

Explore the top contenders in online shopping as marketplaces battle for the top spot. Learn who’s leading and what they sell the most.

July 18, 2024Download

Coming soon

Share

Top Online Marketplaces in the World: Key Insights

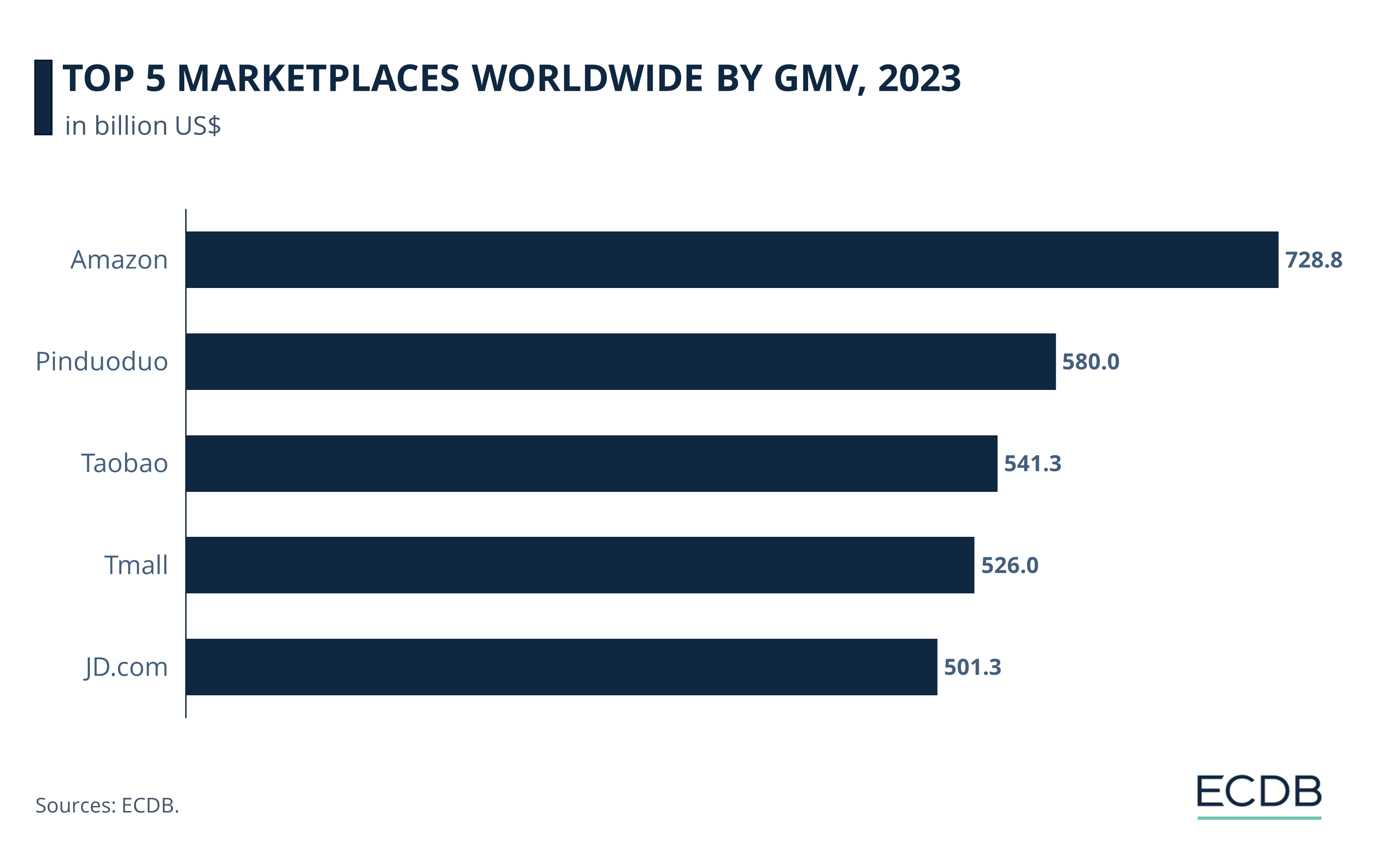

Amazon Dominance: Amazon leads global online marketplaces with a 2023 GMV of US$728 billion, up from US$144 billion in 2014, focusing primarily on the U.S. market.

Pinduoduo Surge: Pinduoduo rapidly grew to a GMV of US$580 billion last year, with fashion as its largest category at 56%.

Taobao Stability: Taobao maintains a strong presence in China with a GMV of US$541 billion, focusing on third-party sellers, primarily in fashion and electronics.

Tmall Trends: Tmall's GMV peaked during the pandemic but slightly decreased to US$526 billion last year, focusing on care products and fashion in China.

JD.com Growth: JD.com reached a GMV of US$501 billion in 2023, with electronics as the top category, primarily serving China.

An eCommerce world without online marketplaces is hard to imagine. Early online marketplaces reinvented the classic concept of convenient one-stop shopping for the digital age.

Online marketplaces now represent a significant portion of global eCommerce, accounting for over a third (35%) of online shopping orders worldwide. In regions like Germany and Italy, marketplaces make up 44% of eCommerce transactions.

Our analysis identifies a clear leader in global online marketplace GMV.

Top Marketplaces Worldwide: Amazon in Its Own League

Although Chinese marketplaces are taking the top 5 by storm, Amazon has been at the top for some time.

Amazon has the lead in the global online marketplace world, with a 2023 GMV of US$728.8 billion.

Following closely, Chinese platform Pinduoduo holds the second spot with a GMV of US$580 billion.

Taobao, another major player from China, is third with US$541.3 billion.

Alibaba’s B2C platform Tmall is in fourth place, posting a 2023 GMV of US$526 billion.

Chinese JD.com rounds out the top 5, with US$501.3 billion in 2023.

But what are the unique dynamics of each marketplace?

1. Amazon

Standing out as a key player in the online marketplace space for a long time now, Amazon offers a wide range of products both from its own inventory and from third-party sellers.

It's primarily managed by Amazon.com, Inc., and focuses heavily on sales within the United States, which make up the largest portion of its Gross Merchandise Volume (GMV). The American market dominates, contributing 50.1% to Amazon's GMV, with Japan being the second major contributor at 9.4%. Other big markets include the United Kingdom (8.4%), Germany (7.7%), and Canada (4.4%).

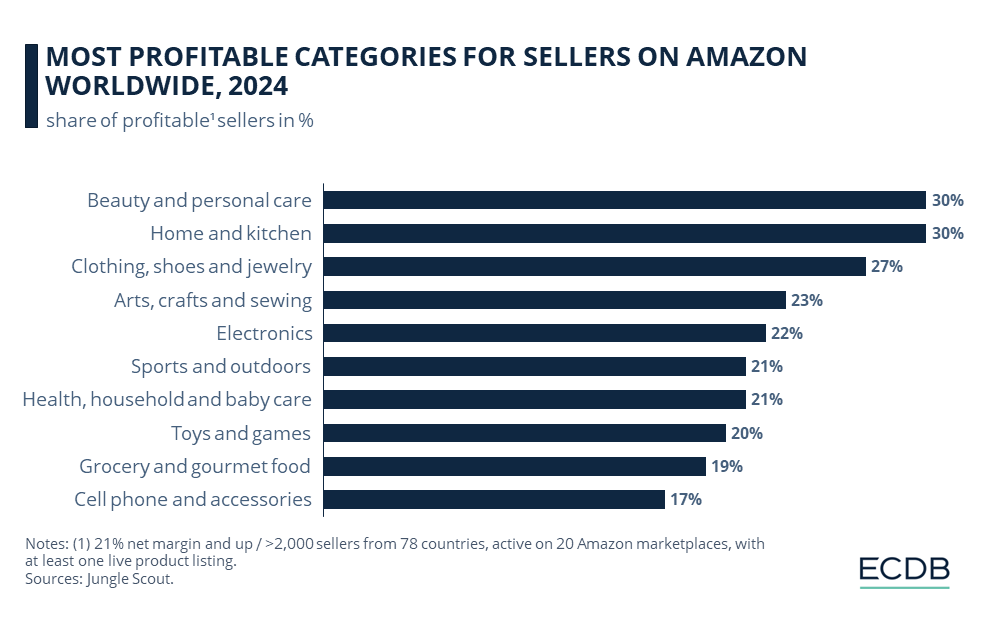

Amazon's product offerings span various categories, with Hobby & Leisure and Electronics being the most prominent, accounting for 37.1% and 36% of the 2023 GMV, respectively. Other notable categories include Fashion, Furniture & Homeware, and Care Products.

Looking at Amazon's financial performance over the years, the GMV shows significant growth. In 2014, the GMV was US$144.45 billion, increasing to US$377.18 billion by 2019. The COVID-19 pandemic saw a major boost in 2020, with the GMV jumping to US$554.58 billion.

This upward trend continued into 2023, reaching US$728.85 billion. Forecasts for 2024 and 2025 predict further increases to US$755.39 billion and US$769.47 billion, respectively, indicating a steady rise in Amazon's eCommerce dominance.

2. Pinduoduo

Pinduoduo, operating under Pinduoduo, Inc., is a marketplace that sells products both from its own inventory and through third-party sellers. Its sales are mainly focused on the Greater China region. Launched in 2015, the platform has seen substantial growth over the years.

Looking at the GMV, 2016's numbers stood at US$3.04 billion. The successful marketplace's GMV surged to US$145.71 billion by 2019. The following year, 2020, saw a remarkable rise to US$241.65 billion. By 2023, the GMV had reached US$580.04 billion, and it's forecasted to grow further to US$654.52 billion in 2024.

As for product categories, in 2023, Fashion dominated with 56% of the GMV. Electronics followed at 22%, and Care Products accounted for 12%. Both Grocery and Furniture & Homeware each made up 5% of the total GMV.

3. Taobao

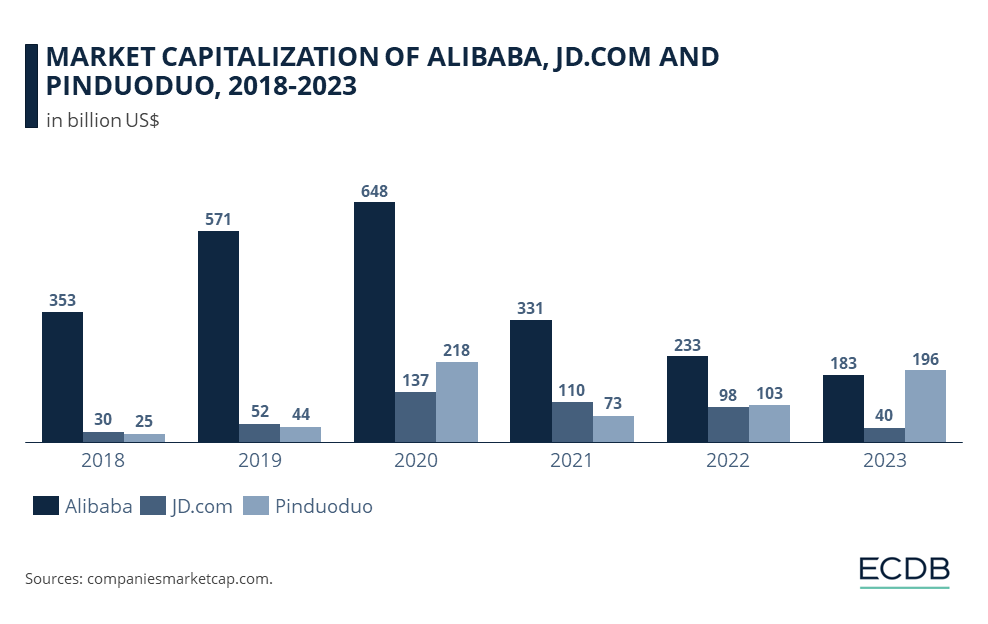

Taobao, launched in 2003, operates as a marketplace that only hosts third-party sellers. It is part of the Alibaba Group Holding, Ltd.

Looking at Taobao's GMV, there's been notable growth and fluctuation over the years. In 2014, the GMV was US$259.95 billion, which climbed to US$490.27 billion by 2019. The onset of COVID-19 saw an increase to US$568.36 billion in 2020. However, there was a decline afterwards, with 2023 recording a GMV of US$541.28 billion. The forecast for 2024 is slightly higher at US$542.62 billion, indicating a stabilization after recent drops.

In terms of geographic market share, Greater China dominates with 95.8% of Taobao's GMV, followed by smaller contributions from South Korea and Japan at 1% each, Singapore at 0.6%, and Malaysia at 0.5%. As for product categories, in 2023, fashion led with 35% of the GMV, followed by hobby and leisure at 21%, and electronics at 14%. Furniture and homeware accounted for 10%, while care products made up 9%.

4. Tmall

Tmall, launched in 2008, operates as a marketplace selling products from its own stock and from third-party sellers. Like Taobao, Tmall is also a part of Alibaba Group Holding, Ltd., and focuses primarily on the Chinese market.

Looking at Tmall's GMV, we see noticable growth over the years, followed by a recent slowdown. In 2014, the GMV was US$137.87 billion. By 2019, pre-Covid, this figure had risen to US$463.50 billion. In 2020, during the Covid-19 pandemic, GMV jumped to US$546.52 billion, reflecting the boost in online shopping during the pandemic. However, in 2023, the GMV dipped to US$525.98 billion, and it's forecasted to slightly recover to US$528.38 billion in 2024.

Accounting for 96.1% of Tmall's total GMV, Greater China is the most important market for the online marketplace. Singapore follows at a distance with only 0.6%. The main product categories in 2023 were Care Products (41%), Fashion (31%), and Grocery (18%), indicating a strong consumer preference for personal care and fashion items on the platform.

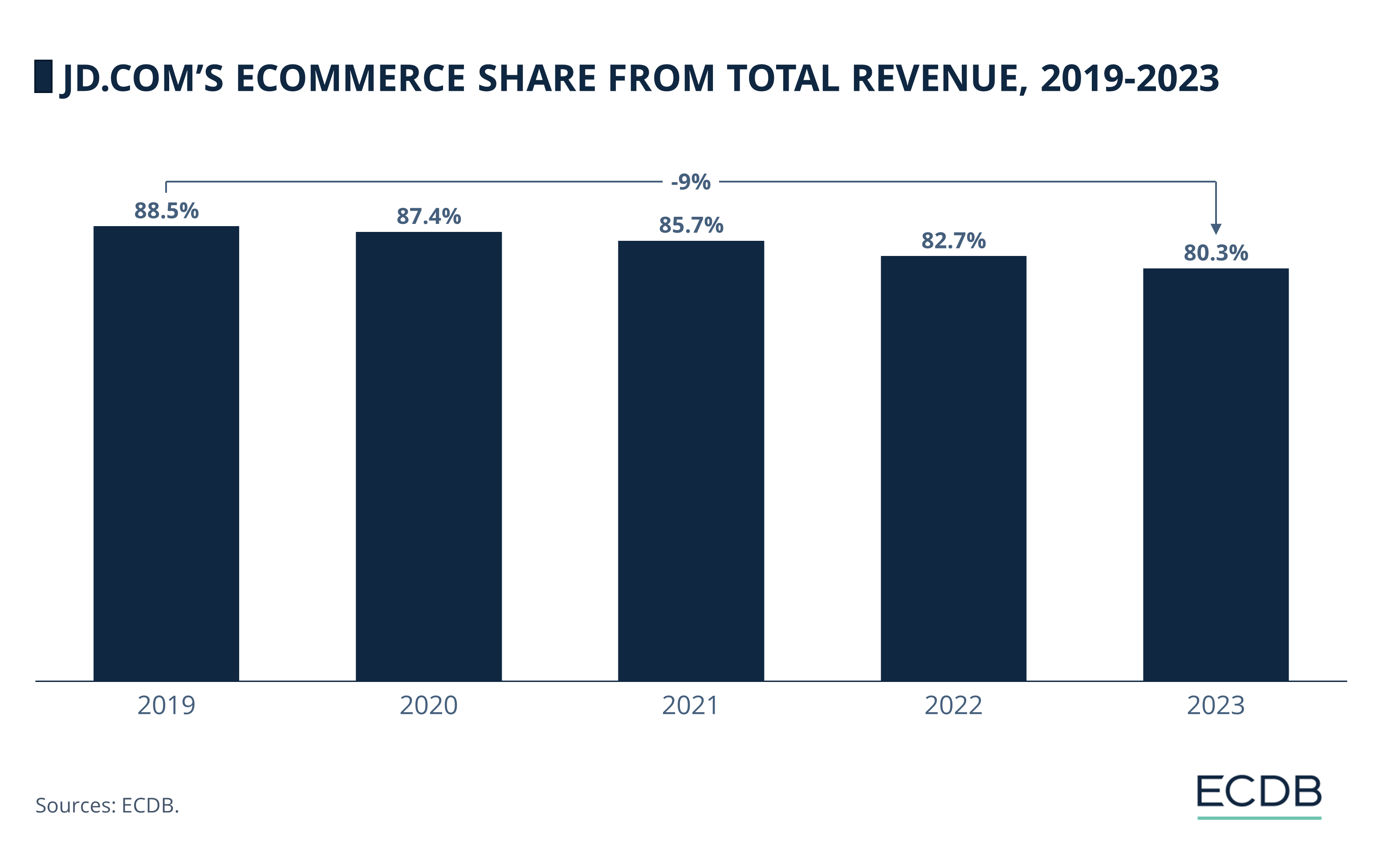

5. JD.com

JD.com, an online marketplace operating primarily within Greater China, facilitates sales from both its own inventory and that of third-party sellers, with its main operations being tied to its website jd.com.

In terms of GMV, JD.com has shown significant growth over the years, though there have been fluctuations. 2014's GMV of US$42.4 billion nearly doubled by 2015 and continued to grow, reaching US$301.9 billion by 2019. After a sharp increase to US$378.6 billion in 2020, the GMV stabilized with a slight rise in 2021 before a minor dip in 2023 to US$501.3 billion. The forecast for 2024 shows a modest increase to US$502.5 billion.

In 2023, the distribution of sales across categories highlighted electronics as the leading category, making up 45% of total GMV. Fashion followed with 27%, while care products accounted for 11%. Furniture and homeware, and DIY contributed 10% and 5%, respectively.

Valuable Insights: Our data-driven rankings are regularly refreshed to provide you with crucial insights for your business. Find out which stores and companies are performing will in the eCommerce space and which categories are topping the sales charts. Stay ahead of the market with our rankings for companies, stores, and marketplaces.

Future of Online Marketplaces

Online marketplaces are constantly evolving, presenting both opportunities and challenges. In this context, what are consumers' key concerns, and how does AI play a role in overcoming these obstacles for improving the overall online shopping experience?

Addressing Product Liability

The growth of global eCommerce brings new challenges in product liability. Online marketplaces, unlike traditional retailers, often escape accountability for defective products, leaving consumers at risk.

Policymakers are debating whether to hold these platforms liable. They must consider how marketplaces handle products, their role in sales, and their buyer protection policies. Many marketplaces already offer refunds and returns for defective items, aiming to build trust and stay competitive.

Yet, the effectiveness of these policies varies globally. Differences in customer satisfaction between U.S. and China-based marketplaces highlight the need for standardized consumer protection. Establishing best practices and improving data-sharing between retailers and consumer protection agencies can enhance safety and satisfaction.

As online marketplaces shape global eCommerce, strong liability frameworks and effective consumer protection are essential. These measures will create a safer, more reliable shopping experience for everyone.

Overcoming Consumer Fears

Despite the conveniences offered by online marketplaces, consumers worldwide harbor certain fears. A recent survey by Spokeo highlighted that 98% of U.S. shoppers have at least one concern when using these platforms. Their top fears include receiving fake products, item misrepresentation, and sellers disappearing after payment.

Receiving fake or incorrect product (55% fear, 15% experienced).

Seller misrepresenting item condition (51% fear, 21% experienced).

Seller disappearing after receiving payment (50% fear, 17% experienced).

Having payment info exposed/stolen (47% fear, 15% experienced).

Difficulties with returns/refunds (45% fear, 16% experienced).

Interestingly, the actual occurrence of these issues is much lower than the fear suggests. But these fears are still not unfounded. Concerns about secure payments, unsolicited offers, and the potential exposure of payment information contribute to a sense of unease. The discrepancy between fear and experience underscores the need for better consumer education and enhanced security measures on these platforms.

To address these fears, online marketplaces must continue to improve security protocols, enforce strict seller verification, and provide robust buyer protection policies. By doing so, they can build greater trust and offer a safer shopping experience for all users globally.

The Role of AI in Enhancing Shopper Experience

Leading platforms like eBay, Etsy, and ThredUp are harnessing AI to enhance both the buyer's and seller's journey.

Etsy's "Gift Mode" uses AI to suggest perfect gifts based on a few user inputs, helping shoppers navigate its vast inventory and discover unique items effortlessly.

eBay's generative AI feature, "shop the look," curates outfits from over 2 billion listings based on users' shopping history, streamlining the browsing process. Additionally, the "magical listing" feature uses generative AI to create detailed product descriptions quickly, reducing the friction of listing items and boosting sales.

ThredUp, dealing with the complexity of 100,000 new daily listings, employs AI to tag and cluster items, greatly improving search capabilities. This intuitive search system has increased user engagement and satisfaction.

However, challenges remain. Large language models used in AI can be slow, potentially testing the patience of shoppers accustomed to instant results. Additionally, implementing AI technology is costlier than traditional methods.

Despite these hurdles, AI is set to profoundly impact online marketplaces, making shopping more personalized and efficient while supporting sellers with streamlined operations. As AI technology evolves, its role in enhancing the global eCommerce industry will only grow.

Sources: Data Center for Innovation, CSA, PYMNTS, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Temu Is the Second Most Visited eCommerce Website in the World

Temu Is the Second Most Visited eCommerce Website in the World

Deep Dive

Indonesia Urges Apple and Google To Restrict Temu

Indonesia Urges Apple and Google To Restrict Temu

Back to main topics