eCommerce: German Consumer Electronic Market

Coolblue: Dutch Consumer Electronic Retailer Challenges Ceconomy

Dutch leading tech retailer Coolblue wants to be the main force in the German consumer electronic market. With a unique strategy, Coolblue aims to overtake the struggling Ceconomy.

Article by Lukas Görlitz | April 09, 2024

Coolblue Expanding to Germany: Key Insights

Coolblue’s Market Expansion: Coolblue expands its delivery areas in the German market. Their market share in 2023 rose by 7.7% resulting in €188 million.

Differentiation Strategy: With a Net Promoter Score (NPS) that measures customer satisfaction and its own next-day delivery network, Coolblue aims to differentiate itself from its competitors.

Performance and Challenges in Germany: In a difficult market situation for consumer electronics in Germany, which declined by 4.9% in 2023, Coolblue was able to increase sales by 8%.

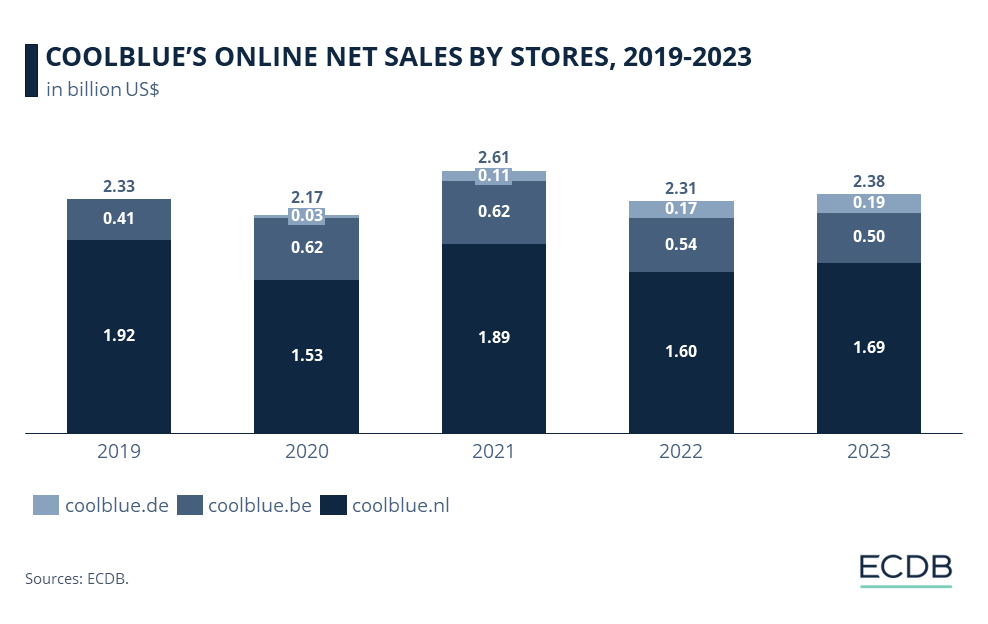

Coolblue is an eCommerce-focused retail company from the Netherlands, where the seller is also market leader in the consumer electronics market. After establishing itself as the leading force in Belgium as well, the Rotterdam-based company began to sell just in few areas in Germany since 2020.

The goal of Coolblue is to provide its accessibility in the whole country in the next 5 to 7 years. CEO Pieter Zwart predicts that when they are available throughout Germany, the retailer will make most of its sales in the German market. Their 2023 numbers went into the right direction as the retailer could extend its market share by 7.7% resulting in revenue of €188 million, coming from €174 million in 2022.

Coolblue Aims for the Market Lead

Since entering the German market, Coolblue has been able to steadily increase its net sales. From $30 million in 2020 to $190 million in 2023 represents a CAGR of 85%. However, Coolblue still has a long way to go to become a leading force in the German market.

Coolblue wants to differentiate itself from its competition through its fast delivery. In certain areas close to the southern Dutch border, Customers can receive their household appliances the very next day and can choose a suitable four-hour timeslot to receive their order. In some cases, bicycle delivery services are also offered, with smaller packages being delivered emission-free.

Coolblue‘s Strategy for Germany

Small items like phones and smartwatches are already available in their online shop throughout the country, while larger devices like TVs or washing machines are only available the mentioned area. Coolblue aims to double these areas in the recent future. In addition, Coolblue wants to open more physical stores in order to improve its brand awareness.

Another unique factor Coolblue uses is a Net Promoter Score (NPS) to ask its customers whether they would recommend the provider to others. With an NPS score of 71, Coolblue is below the overall German average of 82, but well above its competitors Media-Markt and Saturn with an NPS of 53.

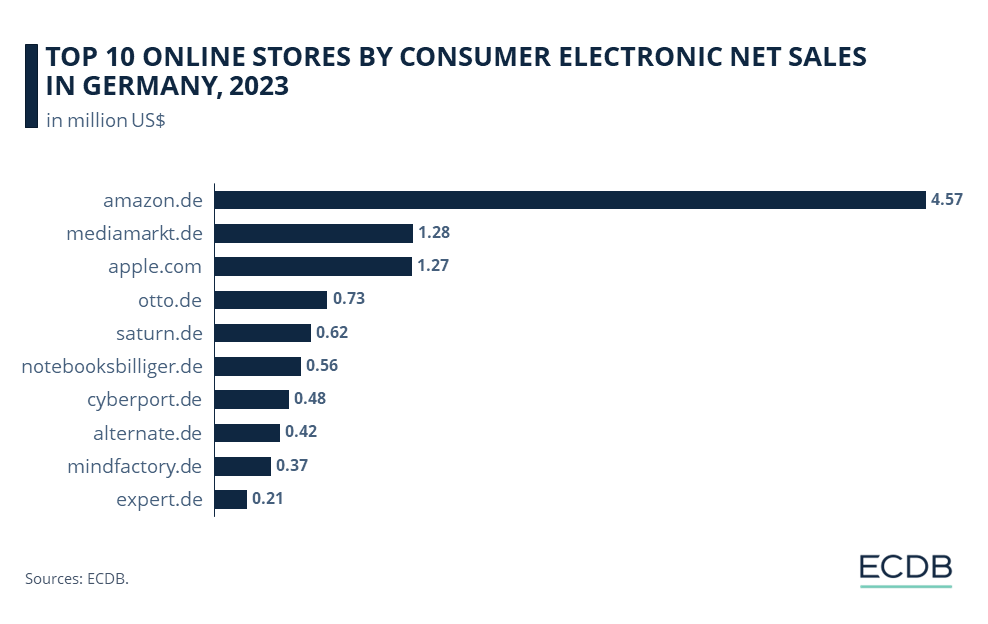

Those moves aims to place Coolblue among the top 10 online stores in the electronics category. The leader in this list is amazon.de with a revenue of US$5.9 million in 2022, followed by mediamarkt.de with US$1.75 million and apple.com with US$1.52 million in revenue. So far, coolblue.de is not yet in the top 10, as it generated revenues of US$171 million in 2022.

Is Ceconomy Leading Position at Risk?

Even though the electronics market in Germany is very crowded, Coolblue could benefit from the weaknesses of tech giants Media Markt and Saturn. Their sales in 2022 have not been higher than their figures from 10 years ago.

Both retailers' parent company, Ceconomy, has struggled over the past few years, recently posting red ink. This has led to other brands showing interest in acquiring Ceconomy, such as Asian eCommerce giant JD.com in late 2023, but so far, no serious talks have taken place.

Coolblue Challenging the German Market: Closing Remarks

Coolblue has a clear vision for its expanding German market. By focusing on customer satisfaction and offering ultra-fast delivery, the Dutch retailer aims to get into the top five in the consumer electronics market in Germany. Achieving brand awareness and establishing itself throughout the country will be crucial to Coolblue's success in the coming years.

If Ceconomy and its subsidiaries Saturn and Media Markt cannot stop the trend of writing red ink, there will be room for potential to take away their top spots in the list. Still, Coolblue is far behind the top competitors in Germany.

Sources: Handelsblatt, Coolblue, Börsenzeitung, manager magazin, WirtschaftsWoche

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

High Growth Rate, Low Online Share: Grocery eCommerce on Track for Future Expansion

High Growth Rate, Low Online Share: Grocery eCommerce on Track for Future Expansion

Deep Dive

European eCommerce Market Size 2024: Top Players & Market Size

European eCommerce Market Size 2024: Top Players & Market Size

Deep Dive

Largest Product Categories in German eCommerce: Fashion Tops the List

Largest Product Categories in German eCommerce: Fashion Tops the List

Deep Dive

Monthly eCommerce Market Revenue Growth: Online Retail Sales (September 2024)

Monthly eCommerce Market Revenue Growth: Online Retail Sales (September 2024)

Deep Dive

Top Best Buy Competitors & Alternatives

Top Best Buy Competitors & Alternatives

Back to main topics