eCommerce: Consumer Electronics

Online Consumer Electronics Market: Top Stores, Market Revenue & Analysis

Consumer electronics have become a big part of our lives. What are the top online shops consumers buy their gadgets from? We provide answers based on our data.

Article by Cihan Uzunoglu | July 04, 2024Download

Coming soon

Share

Online Consumer Electronics Market: Key Insights

Market Trends & Growth: Online consumer electronics market, the largest sub-category in the total eCommerce market, is projected to increase its eCommerce revenue share, with remarkable growth during the pandemic aiming for a trillion-dollar revenue by 2028.

Product Types: Telecommunications products are at the forefront of eCommerce revenue in the global consumer electronics market, followed by computing devices and a varied array of other electronics.

Top Names: Apple.com consistently leads in online consumer electronics, closely followed by Amazon.com and JD.com, all significantly outperforming other competitors despite occasional ranking changes over the years.

Curious about how the rise of online shopping has transformed our gadget purchases? From its early days to today's sophisticated digital platforms, online consumer electronics have secured a major place in virtual retail.

What does this mean for the broader electronics industry and your easy access to top gadgets? Explore ECDB’s insights on online consumer electronics sales.

What is Consumer Electronics Market?

The Consumer Electronics market, as defined by ECDB, encompasses the online sale of a wide range of electronic devices but excludes household appliances, personal care appliances, and mobile contracts or tariffs.

This category includes computers, TVs, smartphones, cameras, headphones, loudspeakers, printers, scanners, game consoles, and wearables.

Top Online Stores for Consumer Electronics

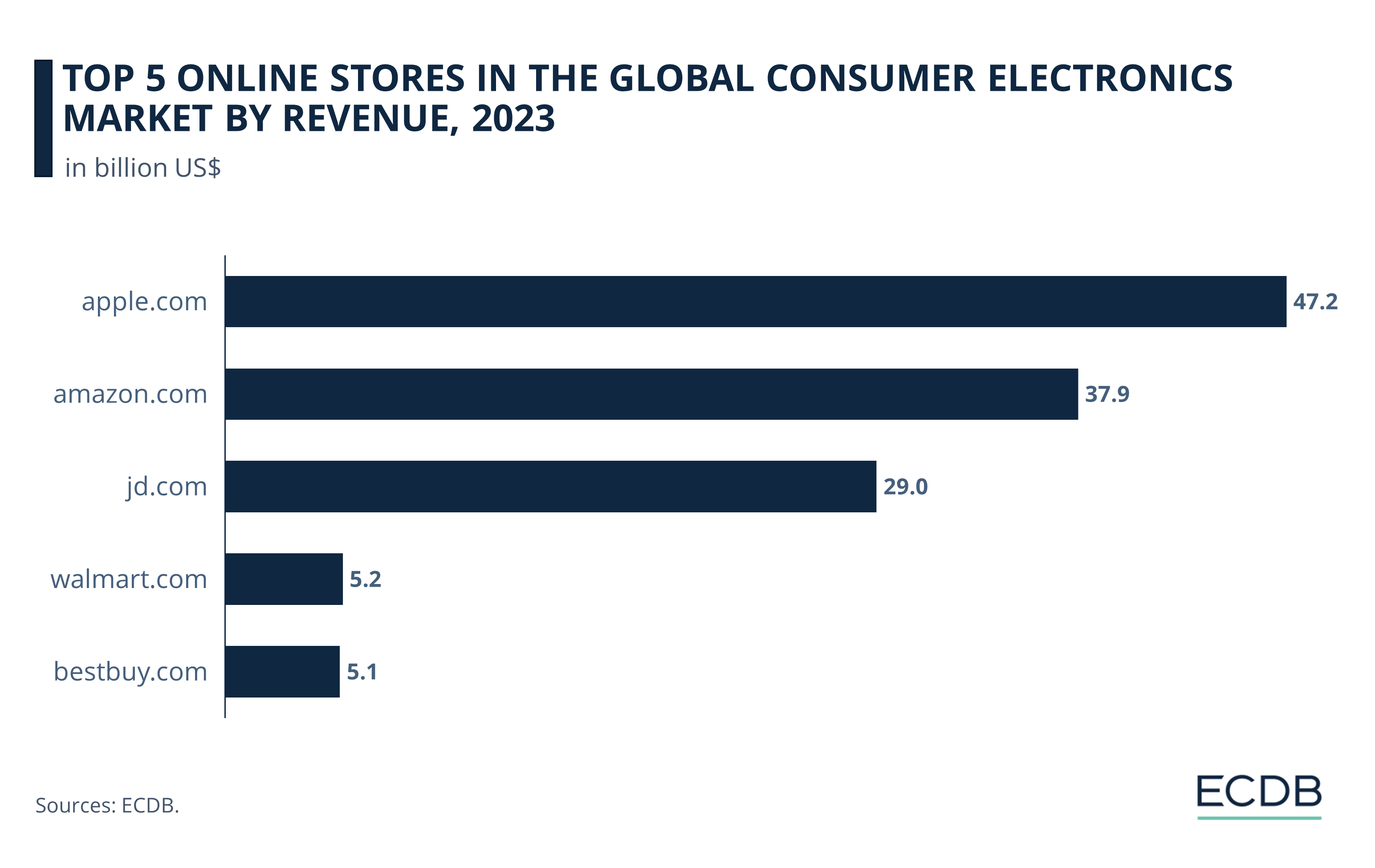

As per our 2023 numbers, following are the top online stores for consumer electronics worldwide. Top three online stores not only lead in revenue but also set themselves apart by a wide margin compared to other competitors:

Apple.com leads the market with a substantial revenue of US$47 billion.

Following closely, amazon.com generated US$38 billion,

While JD.com holds the third spot with US$29 billion.

Walmart.com and bestbuy.com round out the list with respective revenues of US$5.2 and US$5.1 billion.

1. Apple.com

Despite a small hiccup in 2020 when amazon.com jumped to #1, apple.com has been at the top of the market for a few years now.

In June 2024, Apple Vision Pro launched in China, Hong Kong, Japan, and Singapore. This innovative device, merging digital and physical realms, enhances work, collaboration, and entertainment. Personal demos at Apple Stores and online bookings boost engagement and sales, driving growth in these key markets.

2. Amazon.com

After its claim to the top of the global consumer electronics market, amazon.com found itself back in second place in 2021 and has been there ever since.

Once the go-to for reliable products and fast shipping, Amazon is now resembling Temu, leading to issues for small businesses and consumers. The shift towards cheaper products, often from China, is impacting Amazon's growth, especially compared to rapidly expanding Chinese marketplaces like Pinduoduo.

The influx of low-quality items, confusing search results, and questionable reviews are diminishing customer trust. To regain its edge, we think that Amazon should focus on sustainability, quality, and better management of resellers, aligning with Western consumers' preference for eco-friendly and durable products.

3. JD.com

The Chinese JD.com at #3 has been very consistent and has held the position since 2019, unfazed by the pandemic. In addition, the company has been busy this year:

JD.com is planning to acquire British parcel delivery company Evri, facing competition from Alibaba's Cainiao and InPost.

Focusing on its budget platform Jingxi, JD.com aims to better serve small-town consumers by managing operations and logistics, challenging competitors like PDD Holdings.

Enhancing its one-hour delivery service, JD.com launched Miaosong in May this year, boasting delivery times as quick as nine minutes, amid fierce competition with Alibaba and Douyin in China's on-demand market.

4. Walmart.com

Walmart.com in 4th place is a success story: the U.S. online store has climbed decisively from 11th place in 2019 to 4th place in 2023.

Walmart's first quarter of fiscal year 2025 saw strong growth in online sales, driven by high-income customers valuing convenience. The company expanded its eCommerce reach globally, with notable increases in pickup and delivery services.

Efforts to appeal to affluent shoppers through improved product quality and convenience paid off, despite workforce adjustments. Sam’s Club and Walmart’s third-party marketplace also contributed significantly to the growth, highlighting Walmart's successful strategy to broaden its market appeal and enhance customer experience across different income segments.

More Insights? We keep our rankings up to date with the latest data, offering you valuable information to improve your business. Want to know which stores and companies are leading the way in eCommerce? Which categories are achieving the highest sales? Check out our rankings for companies, stores, and marketplaces. Stay one step ahead with ECDB.

5. Bestbuy.com

After climbing up from 7th place to 4th in 2020, Bestbuy.com maintained its position in the global online consumer electronics market until last year, where it went down to the 5th spot.

Best Buy is integrating generative AI into customer support to enhance self-service options and assist service agents, aiming to provide personalized tech support experiences. Collaborating with Google Cloud and Accenture, the AI will help with troubleshooting, delivery scheduling, and managing subscriptions.

Financially, Best Buy saw a decline in revenue and sales for fiscal 2024 but remains focused on leveraging AI to improve operational efficiency and customer satisfaction.

Now that we have an understanding of the top players in the market, let's focus on the market itself and see how it has evolved over time.

Online Consumer Electronics Market Analysis

Consumer electronics represents the larger of two sub-categories within the broader electronics market (the other sub-category is electrical appliances), accounting for nearly 60% of the total electronics market.

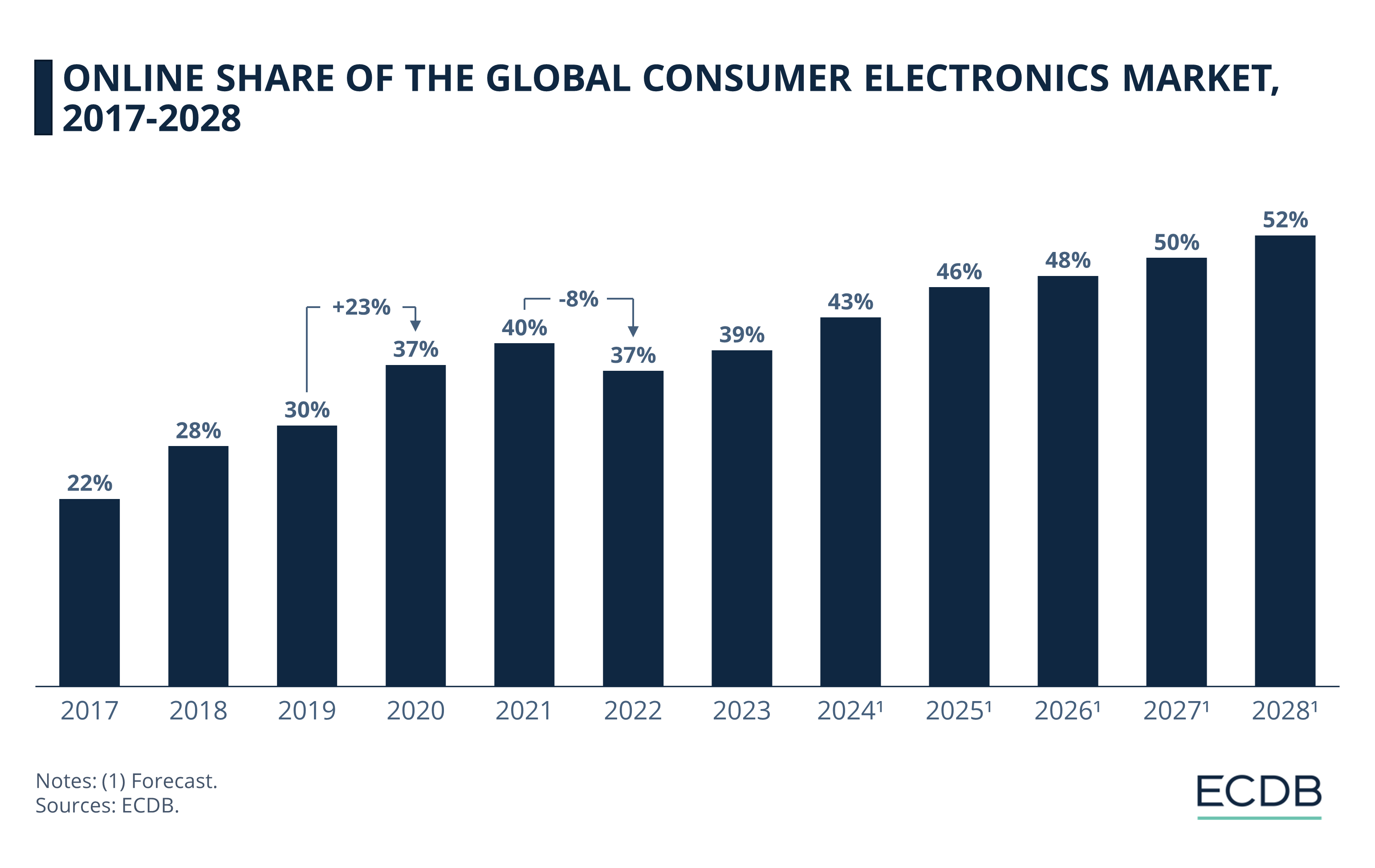

By 2023, the online segment of the consumer electronics retail market had a share of about 39%. After a big jump from 30% in 2019 to 37% in 2020, the online share continued to grow in 2021, reaching nearly 40%, before dropping to 36% the following year. Since last year, however, it has regained momentum and is forecast to grow by an average of 5% annually, reaching 52% by 2028.

Financially, the broader online electronics market is on a strong upward trajectory. Already accounting for almost a quarter (23.8%) of the total eCommerce market, it's projected to reach a total value of US$1.22 trillion by the end of this year. Within this, the online consumer electronics market alone is anticipated to hit US$721 billion.

But how has the market performed in terms of revenue over the past few years?

Online Consumer Electronics Market: Trillion Dollar Mark in a Few Years

Online consumer electronics market has come along a long way, enjoying a substantial boost during the pandemic.

While Consumer Electronics is the largest sub-category in the global eCommerce market, it is followed by Apparel (under the Fashion category) with sales of US$644 billion and Electrical Appliances with US$450 billion.

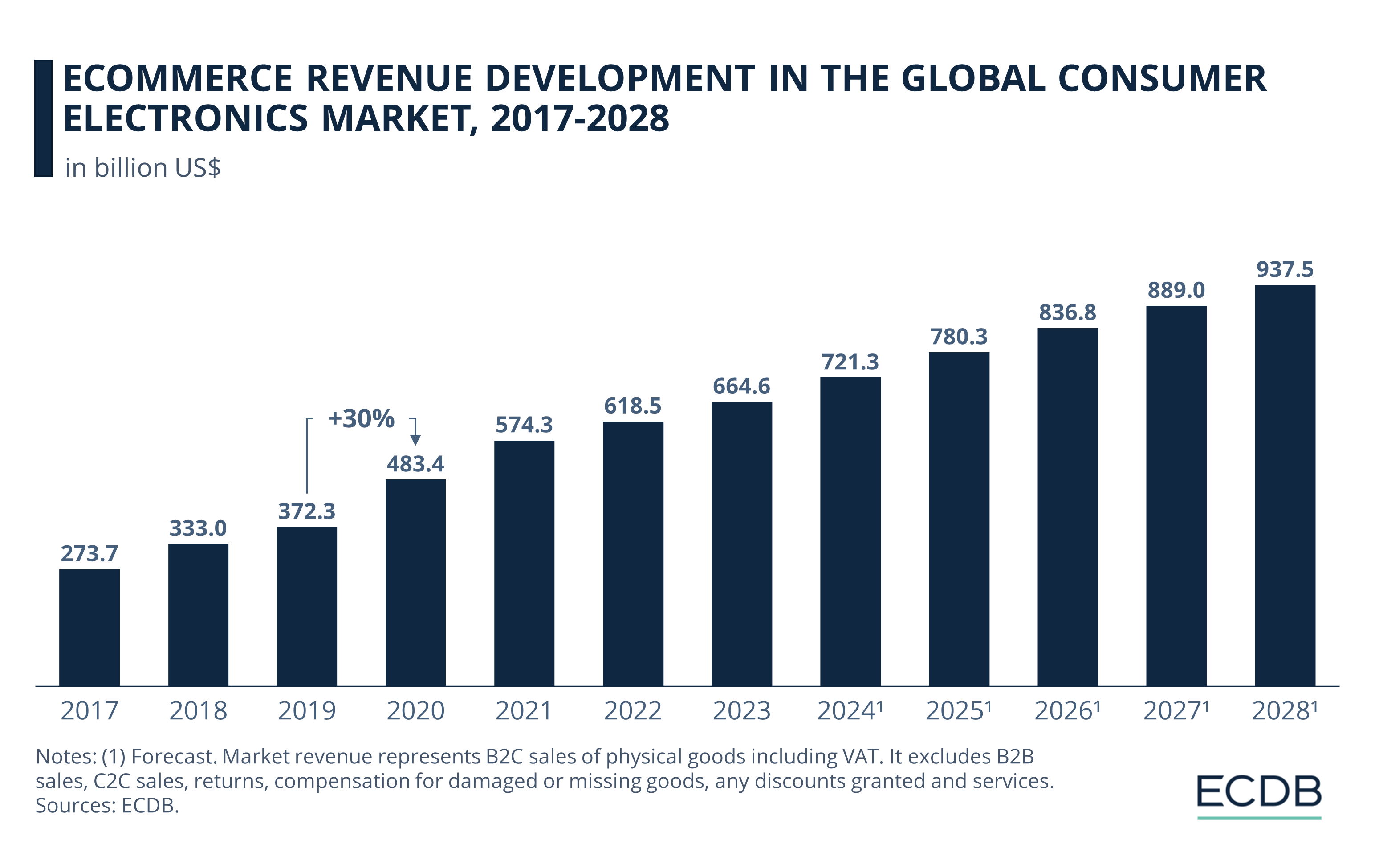

Back in 2017, revenue stood at US$273 billion. By 2019, just before the COVID-19 pandemic, this figure had risen to US$372 billion, showing steady growth. The pandemic marked a pivotal year for online consumer electronics with a dramatic 30% jump in revenue, reaching US$483 billion in 2020.

Post-pandemic, the growth continued: By 2023, the market revenue reached US$665 billion. The upward trend is projected to continue, with the revenue forecast to increase to US$721 billion by the end of 2024.

With an anticipated revenue of US$938 billion, the market is expected to nearly reach the trillion-dollar mark by 2028, at which point the share of online consumer electronics revenue in the broader online electronics market is expected to be slightly lower, at 57.6%.

Telecommunications is the Largest Category of the Online Consumer Electronics Market

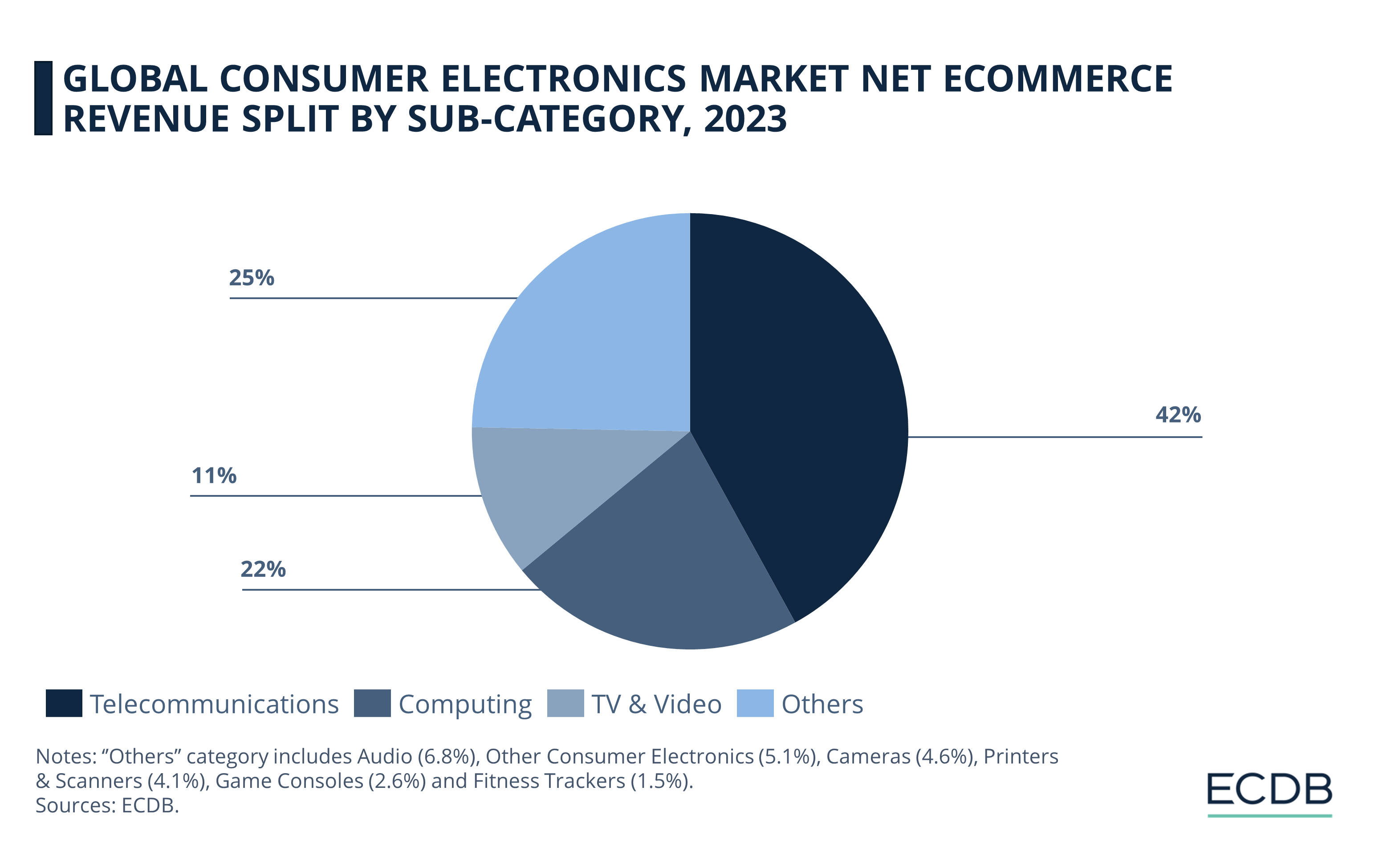

According to our 2023 numbers, telecommunications products hold the largest share of the net eCommerce revenue in the global consumer electronics market, accounting for 42%. Computing devices, including laptops, desktops, and tablets, represent the second-largest category, contributing 22% of the revenue.

TV and video products, encompassing everything from smart TVs to streaming devices, account for 11.3% of the market revenue, while the “Others” category, which includes a variety of products such as audio equipment, cameras, printers, scanners, game consoles, and fitness trackers, collectively contributes 24.7% to the market revenue.

Online Consumer Electronics Market: Closing Thoughts

The smartphone craze that began with the release of the 1st generation iPhone in June 2007 doesn't seem to be going anywhere. Even in some struggling economies like Turkey, people can’t just give up on buying the latest version of their favorite smartphone.

As we discussed in our mobile commerce analysis, mobile devices are becoming increasingly important for online shopping. They're not just a trend, but rather a staple of our digital lives, reshaping the way we shop and interact. With the online share of the total consumer electronics market on the rise (39% in 2023, expected to reach 52% in 2028), it's safe to assume that online consumer electronics is a topic we'll be discussing for a long time to come.

Sources: Apple, Reuters, SCMP, Yahoo Finance, Digital Commerce 360, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Top Online Payment Methods in the United Kingdom: Cards & eWallets

Top Online Payment Methods in the United Kingdom: Cards & eWallets

Deep Dive

Inside Apple Revenue: Latest Sales Figures and Key Insights

Inside Apple Revenue: Latest Sales Figures and Key Insights

Deep Dive

eCommerce in the United States: Top 5 Companies by Revenue

eCommerce in the United States: Top 5 Companies by Revenue

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Back to main topics