ECOMMERCE: UNITED STATES

eCommerce in the United States: Top 5 Companies by Revenue

The U.S. has a thriving eCommerce market. Many companies compete for the coveted top ranks, but the market is presently dominated by a few players. Here are the top five eCommerce companies in the United States.

Article by Nashra Fatima | October 14, 2024Download

Coming soon

Share

Top eCommerce Companies in the U.S.: Key Insights

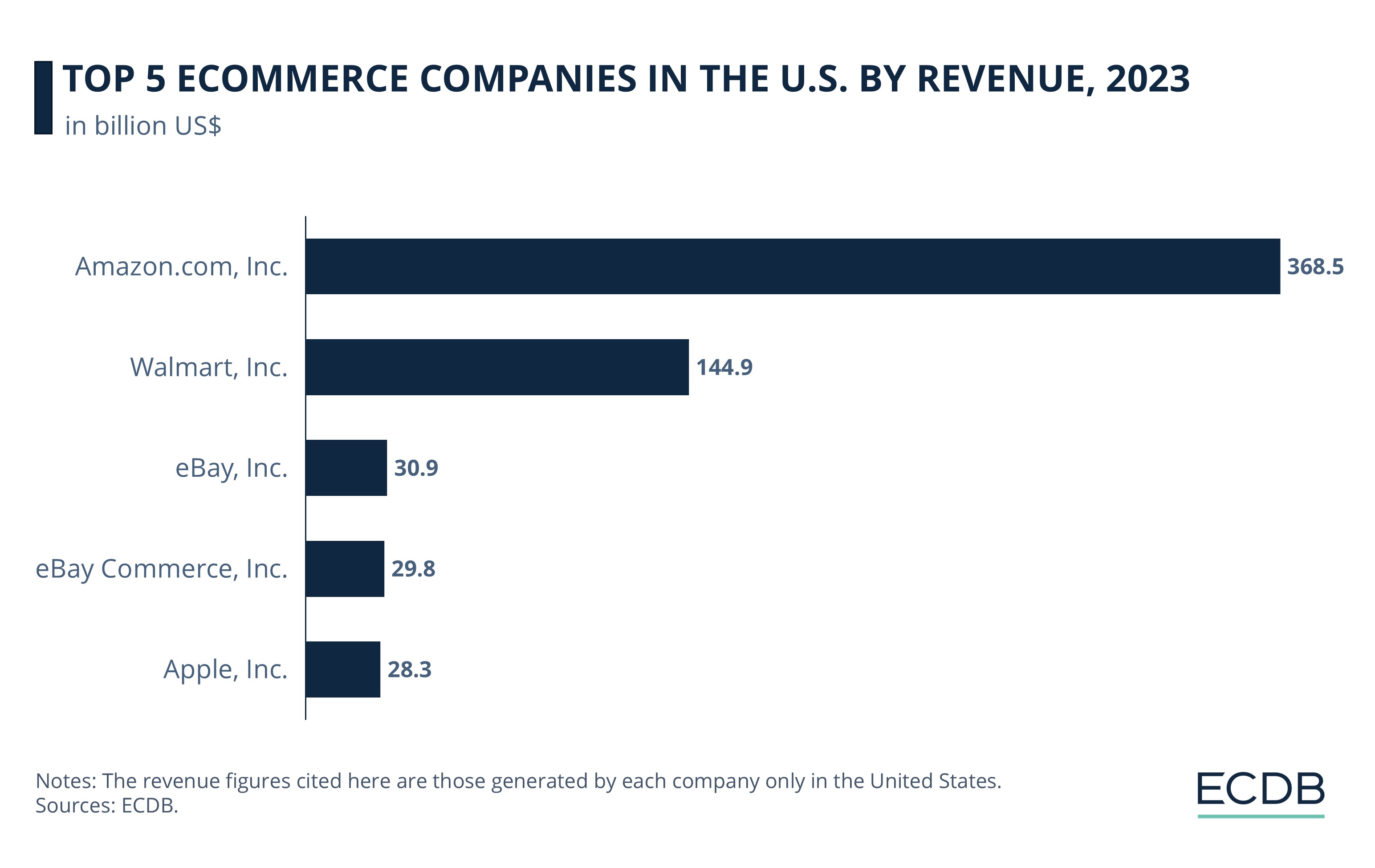

Leading companies: Amazon.com, Inc. is the biggest eCommerce company in the U.S., where it generated US$368 billion in 2023. Walmart Inc. is second, but with revenues less than half that of Amazon’s.

Mid-Level Players: Ranking next are the internationally focused eBay, Inc., the domestically focused eBay Commerce Inc., and Apple, with their revenues in the U.S. ranging between US$28-31 billion.

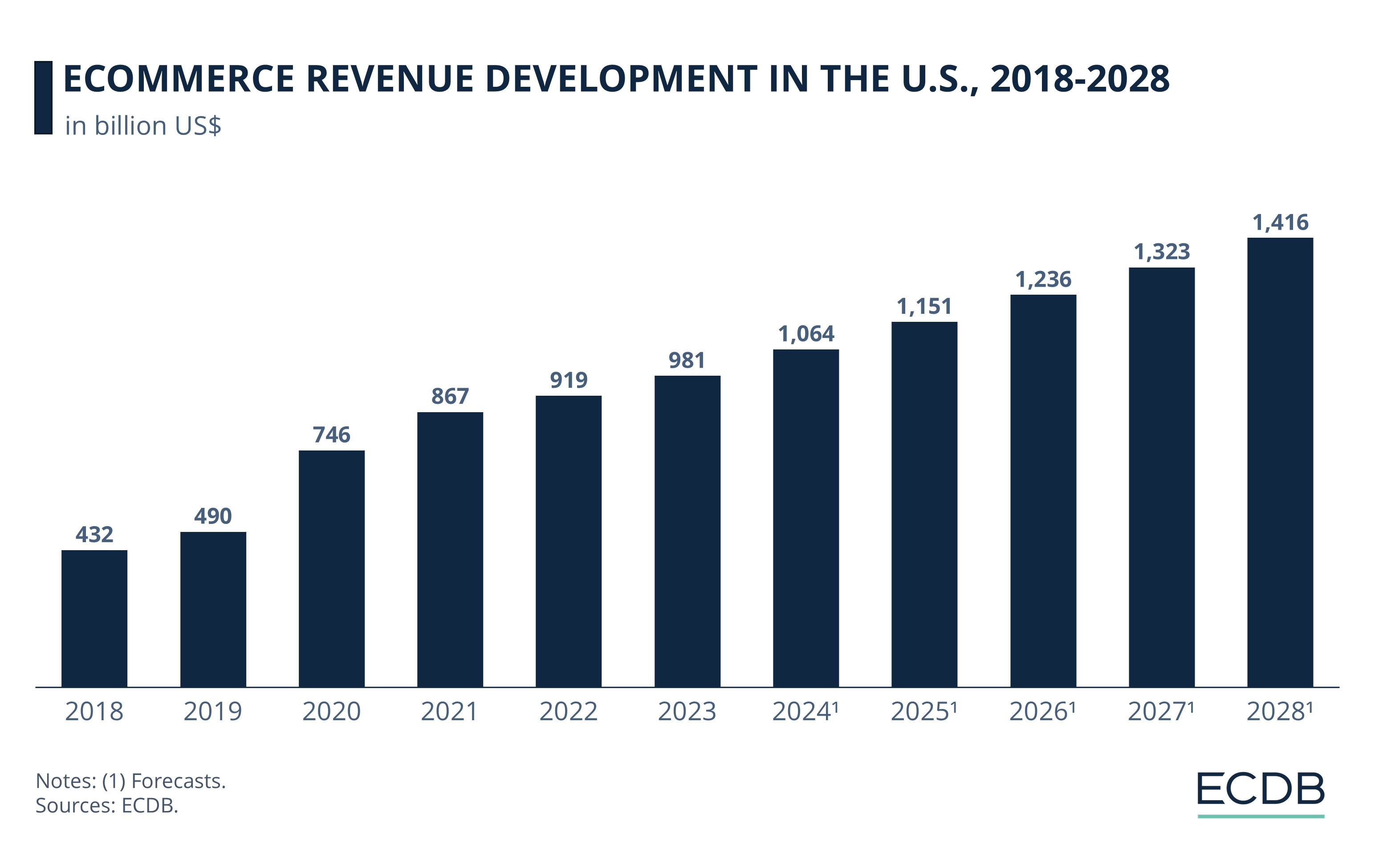

Market Growth: The U.S. eCommerce market is expected to grow at a CAGR (2024-2028) of 7.4%, with revenues projected to cross the US$1 trillion mark in 2024.

The United States is home to eCommerce trailblazers, like Amazon and eBay. It is also the second largest eCommerce market in the world, surpassing revenue worth US$981 billion in 2023.

But how concentrated is the industry?

Our ECDB data indicates a trend of market domination by the top two eCommerce companies, while the rest trail far behind. So, which companies are leading in the U.S. eCommerce market?

Top eCommerce Companies in the U.S.

In 2023, the top eCommerce companies in terms of revenues generated in the United States were:

Amazon.com Inc. is not only top but is also miles ahead of its competitors. It generated half of its online revenues in the U.S., amounting to US$368.5 billion.

Walmart Inc. is second. At 76.6%, it derives a higher share of its revenues in the U.S. (US$144.9 billion) and is the only other company apart from Amazon to have revenues over US$100 billion.

eBay Inc., the internationally focused company, is third, with revenues of US$30.9 billion.

eBay Commerce Inc., with a largely domestic focus (85%), is next with US$29.8 billion.

Apple Inc. is fifth, with US$28.3 billion. The U.S. is its largest market, where it generated nearly 55% of its total revenues in 2023.

1. Amazon.com, Inc.

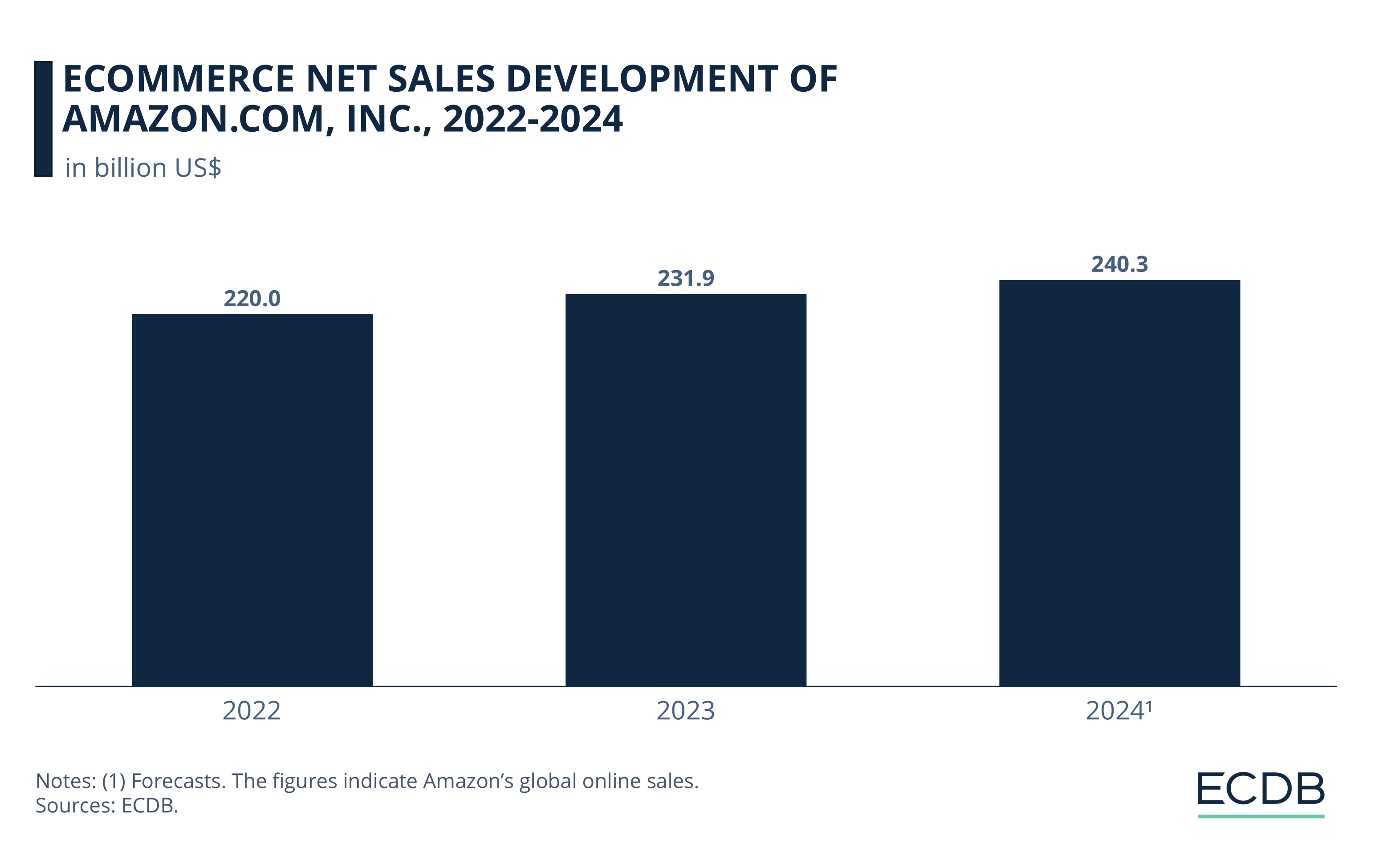

Amazon.com, Inc.’s global online revenues grew every year from 2019, except for 2022 when it saw a small decline.

The largest revenue growth for Amazon.com, Inc. had occurred between 2019 and 2020 – the peak pandemic period during which eCommerce activity surged globally. Its online sales increased by an impressive 40% and crossed US$197 billion in 2020.

The momentum slowed in the following years. A market decline of 1% was reported in 2022. This year saw a stagnation in eCommerce globally as the industry adjusted after the pandemic boost.

After recovery in 2023, eCommerce net sales for Amazon reached US$232 billion. Our projections put the company’s online sales at over US$240 billion in 2024.

Apart from its large revenues, what is notable about Amazon, Inc. is its predominantly online focus. During the pandemic years, over half of its revenues came from online channels. While the online share in total revenue decreased in the following years – it dropped to 40.3% in 2023 – it is still considerable compared to other companies on our list.

2. Walmart, Inc.

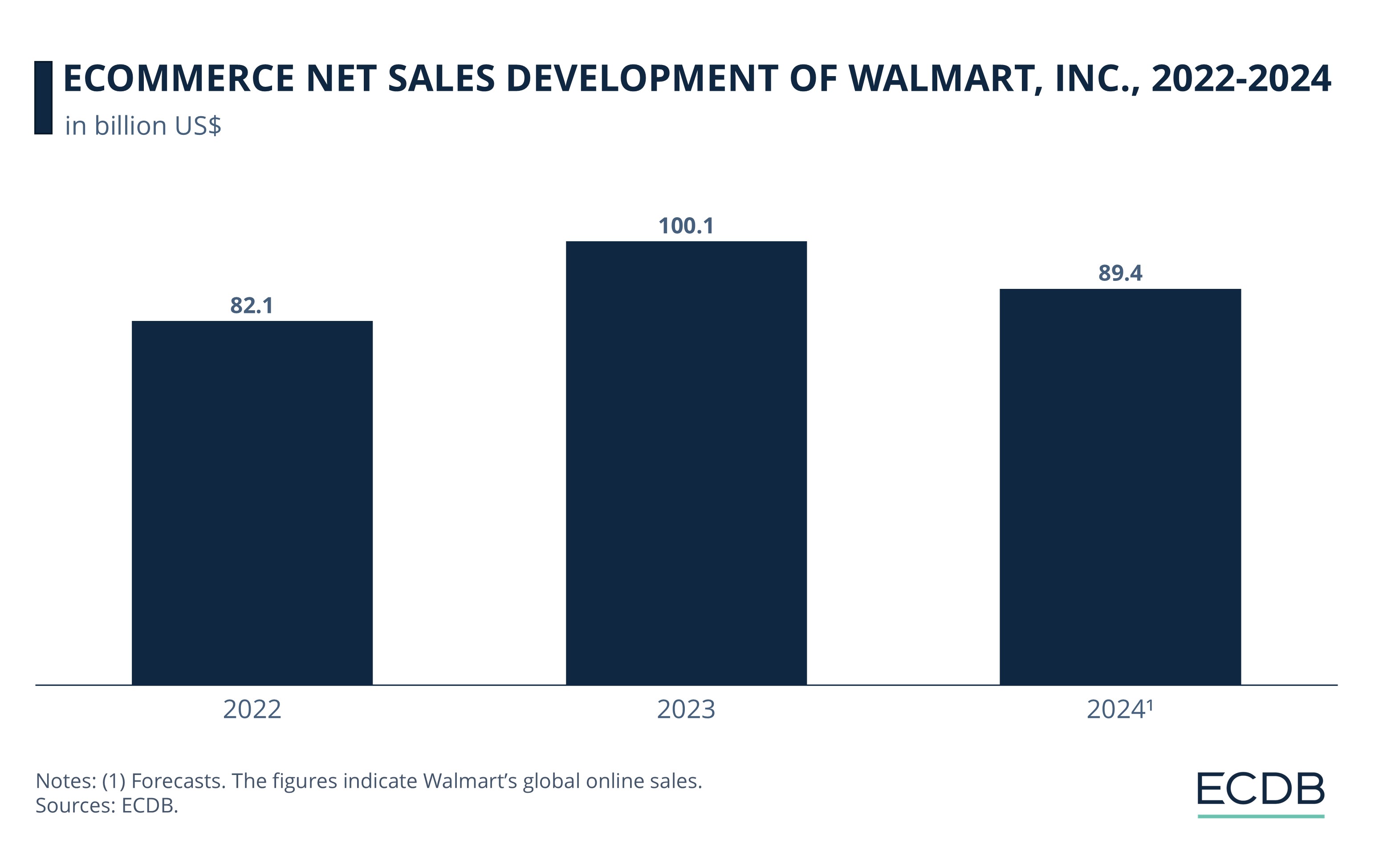

Walmart, Inc. is the second largest eCommerce company in the U.S. Its global online revenues crossed US$100 billion in 2023.

Walmart, Inc’s eCommerce sales recorded a higher growth than Amazon, Inc’s between 2019-2020. With a yearly increase of 63%, its eCommerce sales hit US$65 billion in 2020.

Since then, its eCommerce growth rates remained robust at 12%-13%. In 2023, Walmart’s yearly growth was a remarkable 22%, with revenues reaching US$100.1 billion.

A market decline is predicted for 2024. Walmart, Inc’s eCommerce sales are expected to shrink by 11% to US$89.4 billion this year.

Walmart, Inc. first shifted its focus from brick-and-mortar to online retail in the pandemic years. Since then, the online share in its total retail sales has increased – from 7.5% in 2019 to 15.4% in 2023. In particular, its online grocery service is a growth engine. Walmart leverages its vast network of stores across the U.S. to provide speedier deliveries, offering tough competition to Amazon in this segment.

Discover Our Data: Our frequently updated rankings provide essential insights to help your business thrive. Wondering which stores and companies are excelling in eCommerce? Interested in the top-performing categories? Find the answers in our rankings for companies, stores, and marketplaces. Stay competitive with ECDB.

3. eBay, Inc.

eBay, Inc. is the third biggest eCommerce company in the United States in terms of revenue.

It generated 42.2% of its total eCommerce revenues in the U.S, amounting to US$31 billion. Among its other markets are the UK (16.9%), Germany (13.7%), and Australia (6.5%).

The company’s online sales have been declining in recent years. Its marketplace GMV dropped in both 2022 and 2023, with predictions of a further dip in 2024. A noticeable trend on eBay is the growing presence of China-based sellers. From 21% in 2018, Chinese sellers are anticipated to contribute up to 26% to its total GMV by 2024.

4. eBay Commerce, Inc.

eBay Commerce, Inc. is next, with eCommerce revenues of US$30 billion generated in the United States in 2023. It is part of eBay and is a money transmitter in the U.S. According to the parent company, eBay Commerce is its payment handling arm.

It is a nationally focused eCommerce company, with the U.S. accounting for over 87% of all its revenues last year. Other markets contribute much smaller shares – Canada (1.5%), the UK (1%), and Japan (0.8%).

eBay eCommerce has hobby & leisure as its largest product category, making up for 26% of its total revenues in 2023. It is followed by fashion (20.1%) and electronics (17.7%).

5. Apple, Inc.

Apple, Inc. is the fifth largest eCommerce company in the U.S., where it generated US$28.3 billion in 2023. Its eCommerce net sales were US$47.2 billion.

The largest portion of Apple’s online sales come from the U.S. – precisely, 54.8%. Other consumer markets like Japan (6.4%), China (6.3%) and the UK (4.9%) also contribute.

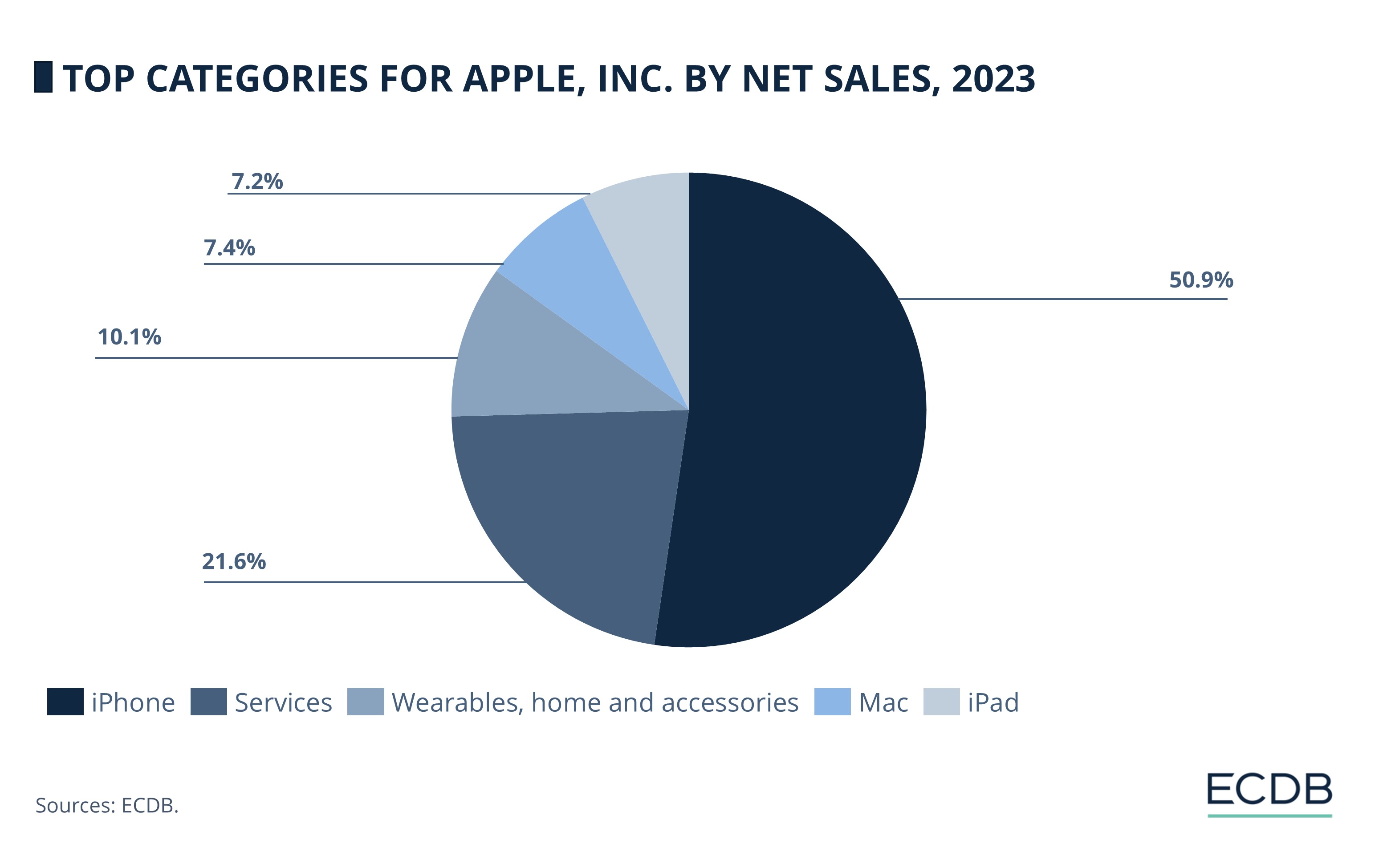

Apple Inc. operates exclusively in the product category electronics. Our data shows the performance of its sub-segments:

iPhone makes up for the lion’s share of Apple revenues. It accounted for nearly 51% of its net sales in 2023.

Apple’s Service’s segment is next, but its contribution was less than half that of iPhone, at 21.6%.

Wearables, home and accessories are next, with 10.1%. It is followed by Mac and iPad, both of which make comparable contributions at just over 7%.

Apple relies on its products for most of its revenue generation. They have a strong reputation and have ensured Apple’s position as the world’s most valuable brand in both 2022 and 2023. Its services are a growing segment, however. They include advertising, cloud services, and payment services like Apple Pay, among others.

The United States eCommerce Market: Revenue Growth

The United States is a growing eCommerce market, with a new milestone on the horizon: its 2024 revenues are projected to reach US$1.1trillion—equivalent to the current GDP of Saudi Arabia. By 2028, this figure will hit US$1.42 trillion.

As with its top eCommerce companies, the online retail market in the U.S. also saw the biggest expansion in revenues between 2019 and 2020. The pandemic gave an unprecedented boost to eCommerce sales in the country, helping revenues jump by over 50% in a one-year period. The growth rates normalized once the pandemic push subsided. Even so, it is notable that eCommerce revenues have continued growing in the country, with no decline recorded so far.

The compound annual growth rate (2024-2028) for the U.S. eCommerce market is also robust, at 7.4%. Although slightly behind China’s projected growth rate for the same period (8.1%), it is ahead of others like the UK (6%) and South Korea (6.4%).

Top eCommerce Companies in the United States: Closing Thoughts

The U.S. eCommerce market is populated by diverse companies. Its top companies in fact are global leaders. Most of them saw rapid expansion during the pandemic period and many of them have been able to sustain their growth momentum despite the tough economic climate and resumption of in-store shopping.

At present, Amazon and Walmart are the undisputed leaders in the U.S. eCommerce industry, thanks to their strong online ecosystem and logistical networks. The performance of other companies and their ranking may vary going forward.

Trends like reCommerce and social commerce are likely to shape the market, favoring one player over another. The looming TikTok ban and the proposed degradation of the country’s de minimis trade law are also expected to have an impact on the market dynamics.

Sources: ECDB; World Population Review.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Factors That Impact U.S. Holiday Shopping in 2024: Election, Deals, Weather, Number of Days

Factors That Impact U.S. Holiday Shopping in 2024: Election, Deals, Weather, Number of Days

Deep Dive

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Deep Dive

Walmart Introduces Prescription Deliveries, Outpacing Drugstores CVS and Walgreens

Walmart Introduces Prescription Deliveries, Outpacing Drugstores CVS and Walgreens

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Consumer Confidence Index (CCI) in the United States: eCommerce Analysis

Consumer Confidence Index (CCI) in the United States: eCommerce Analysis

Back to main topics