eCommerce Marketplaces in Germany 2024

Temu in Germany: Is It a Threat to Amazon, Zalando & Otto?

Temu in Germany: The entry of low-cost marketplaces with Asian origin lead to shifts in Germany's eCommerce market. At the same time, market leader Amazon is facing backlash from sellers over rising platform fees. How likely is it that Temu and Shein will surpass Amazon? Can domestic retailers Otto and Zalando hope to keep up?

Article by Nadine Koutsou-Wehling | July 02, 2024Download

Coming soon

Share

Temu in Germany 2024: Key Insights

Disruptive Launch: Temu's inception in 2022 was followed by a global surge in GMV (gross merchandise volume). Germany is one of temu.com's top markets, making up 7.6% of GMV in 2023.

Seller Dissatisfaction With Amazon Benefits Emerging Players: Germany's eCommerce market leader, Amazon, is using its leading position to demand an ever increasing share of seller revenues for its marketing and logistics services. While Amazon is currently ahead of all other players in the game, Asian competitors are actively contacting Amazon's disgruntled sellers and customers.

Zalando, Otto and Media Markt Most at Risk: Amazon's dominance in German eCommerce makes it hard to reach, but the lower ranks can be easily surpassed by emerging low-cost competitors from Asia. This is especially true if the latter start to create a workable infrastructure that could improve their services and enhance customer conveniences such as returns and fast delivery

.

The German eCommerce market is the 6th biggest worldwide, projected to reach US$120 billion in revenue by 2024. Some key drivers are eCommerce marketplaces, which allow sellers - large and small - to showcase their products to a wide audience.

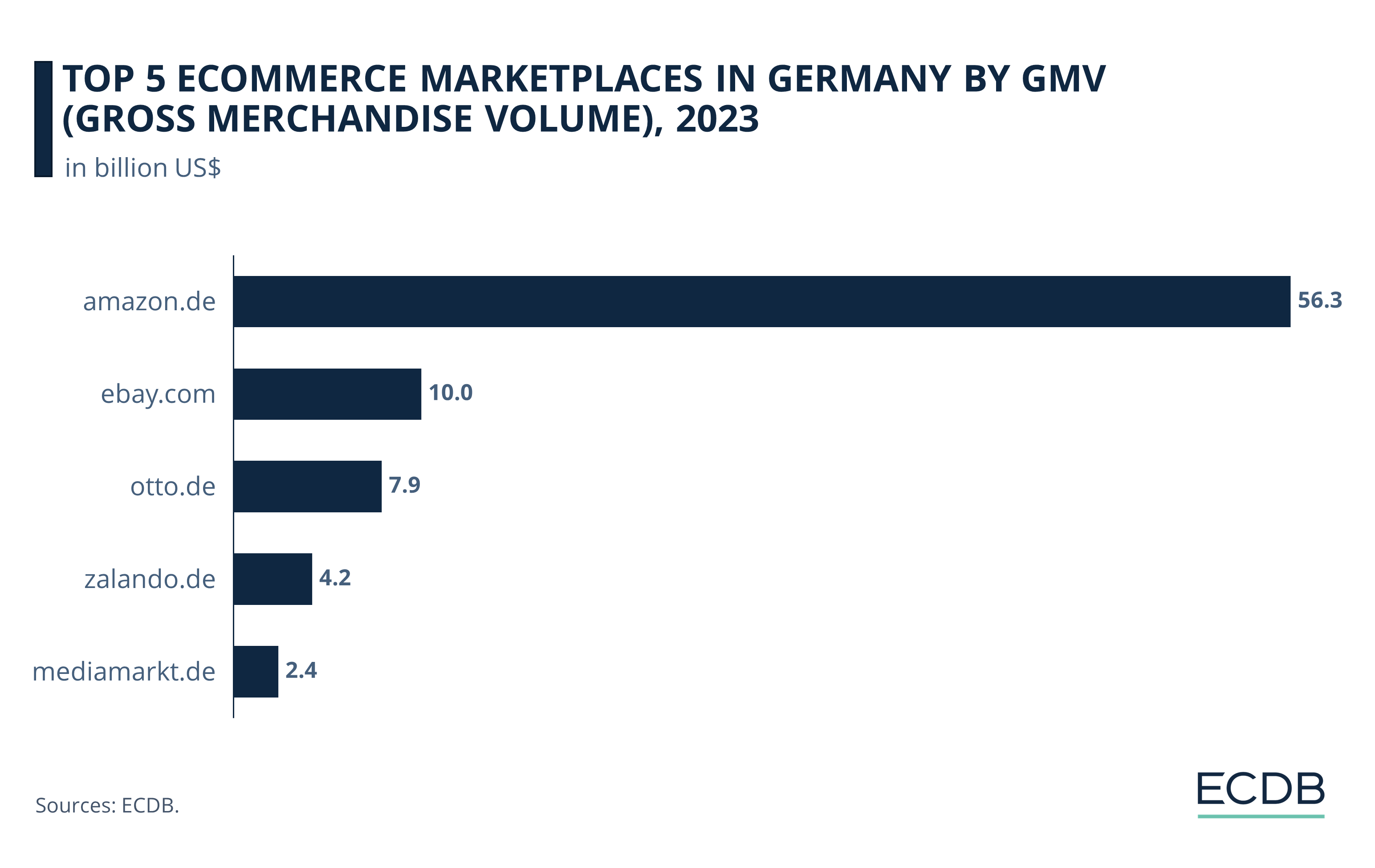

While U.S. online retailers Amazon and eBay occupy the top spots in the ranking of German eCommerce marketplaces, homegrown platforms like Zalando and Otto are also well established.

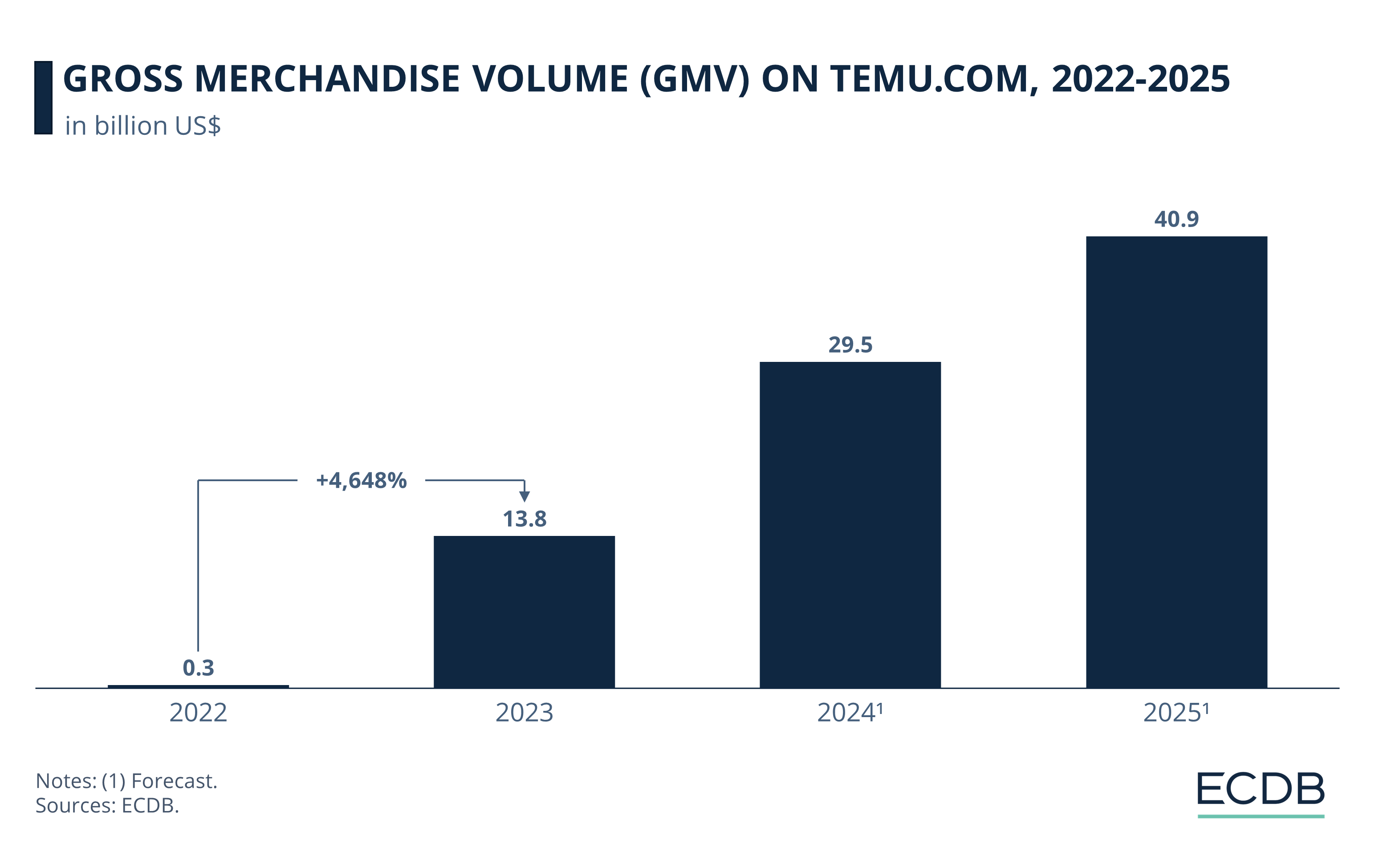

However, Chinese eCommerce giant PDD Holdings recently joined Germany’s top 10 with its marketplace Temu, which is enjoying great success with an annual global GMV growth of over 4,500% in 2023. At the same time, Amazon is facing backlash from sellers and competing retailers: This is good news for its competitors, who find it easier to lure disgruntled sellers and consumers away from the market leader.

With its low-cost strategy, Temu could surpass the other top retailers in the market at dizzying speed. Let’s assess the likelihood of that happening.

Temu: “Shop Like a Billionaire”

Temu was launched in 2022 by the eCommerce conglomerate PDD Holdings, which also operates China’s fourth largest marketplace Pinduoduo. Knowing about this affiliation is important, because PDD’s established position and expertise benefit Temu’s business.

Temu’s most distinctive feature is its low price strategy, coupled with additional benefits such as free shipping and returns. Together with its extensive marketing on social media platforms and during major events such as at this year’s Super Bowl, Temu is becoming increasingly well known among global consumers.

Check out Temu’s GMV development, which measures marketplace activity, as seen on Temu.com’s ECDB Marketplace Page:

Germany was not exempt from this surge. Quite the contrary: Germany is Temu.com’s fifth-largest market in terms of GMV, with around US$0.74 billion worth of products sold in 2023.

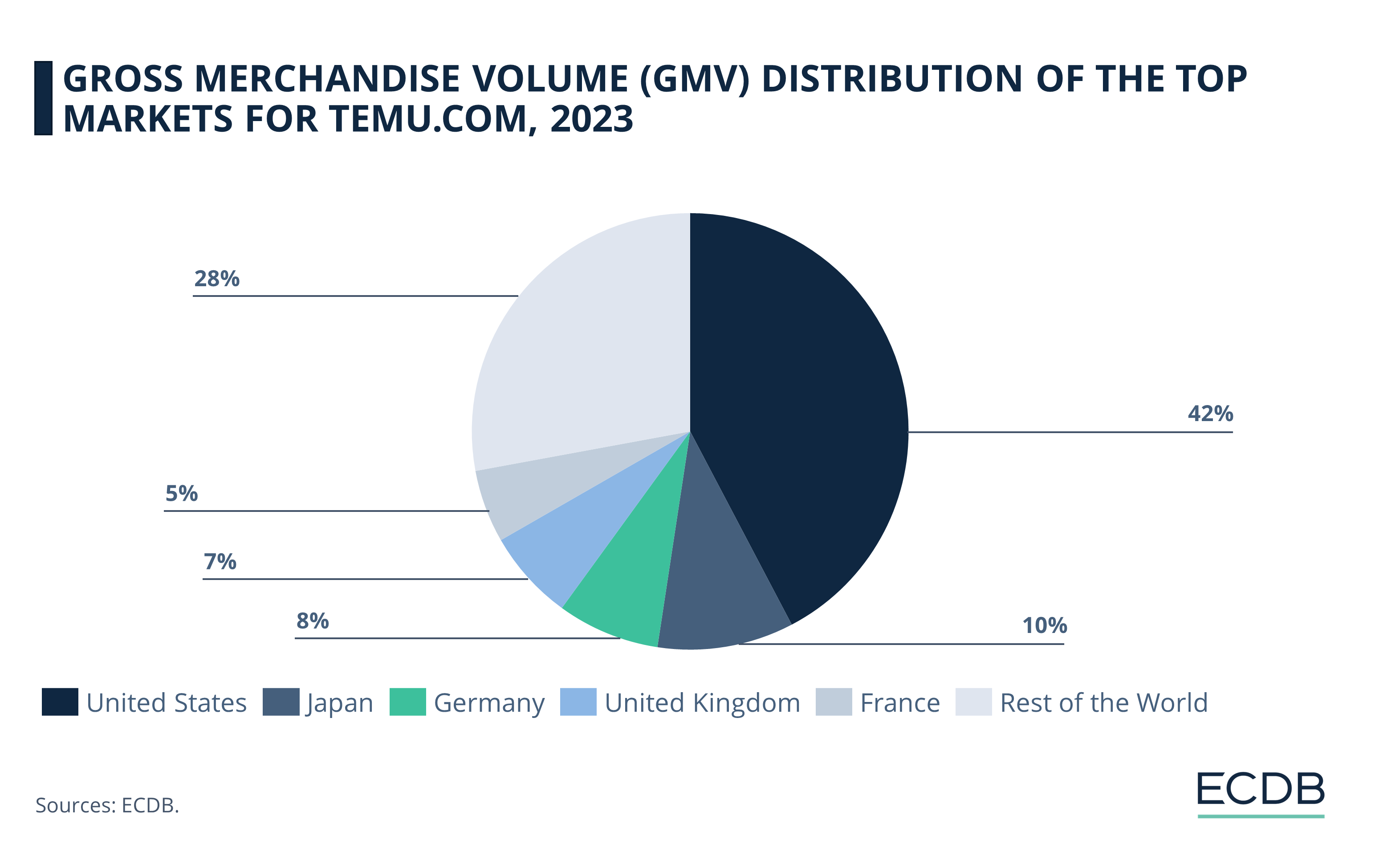

While the United States is clearly Temu’s most important market, with 43.3% of GMV on Temu.com generated by U.S. consumers, Japan is a distant second with 10.3% of GMV in 2023.

Germany is currently the fifth most lucrative market for Temu.com, accounting for 5.4% of its global GMV. The remaining top 5 markets are two other large European economies: the United Kingdom (6.8%) and France (5.6%). However, Temu.com’s wide reach and high diversification are apparent in the presence of many smaller markets, which together account for over 28% of GMV.

What Makes Temu Stand Out?

Temu incorporates features like gamification and social referrals to create a sense of accomplishment when consumers use the app, with which they are incentivized to participate and earn discounts.

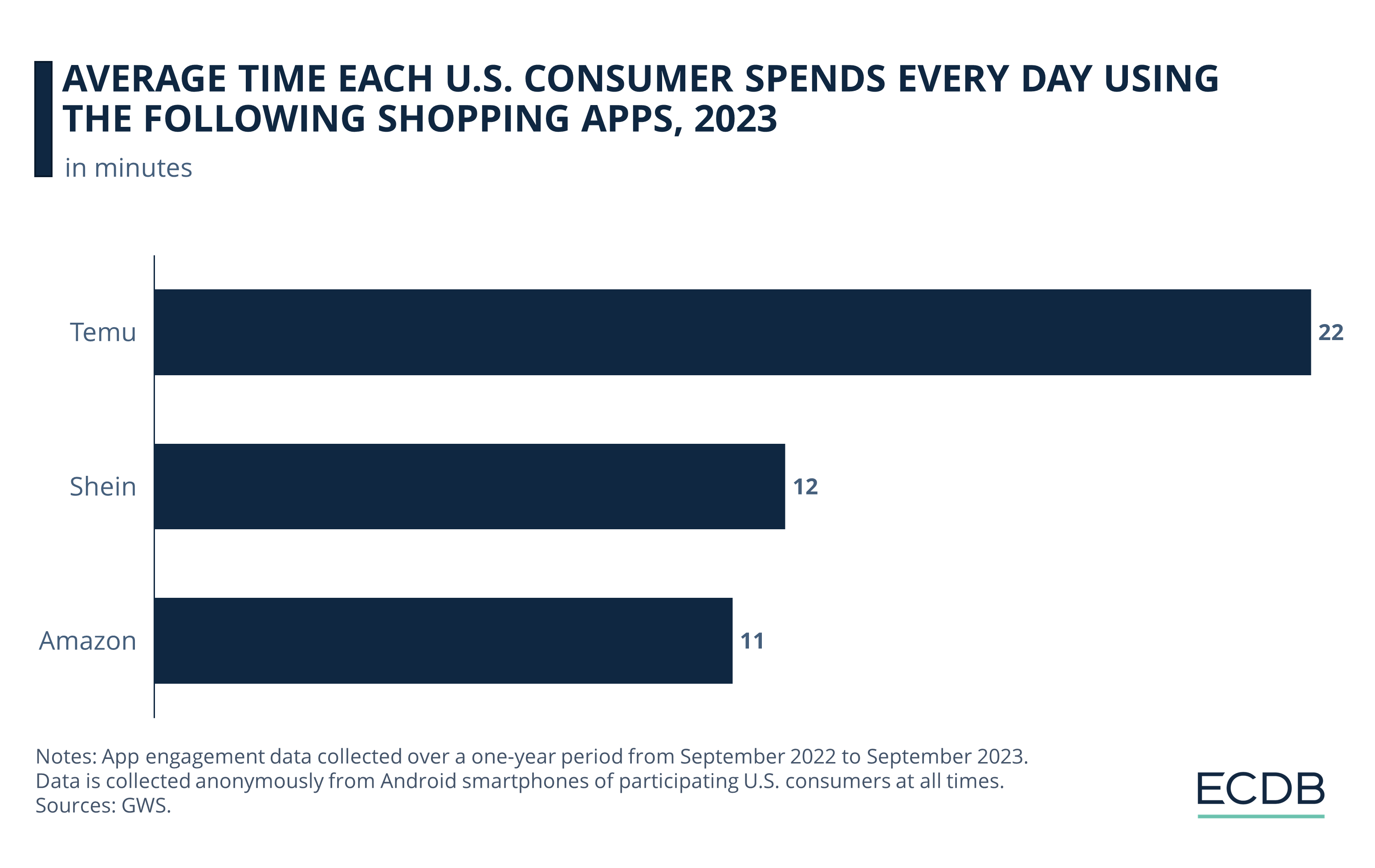

As a result, Temu has already outperformed Amazon and Shein in the average time consumers spend on their respective apps.

While Temu’s engagement strategy drives platform growth, market leader Amazon is facing frustration from sellers offering their products on its marketplace.

Amazon: Falling Merchant Profits Meet Platform Dependency

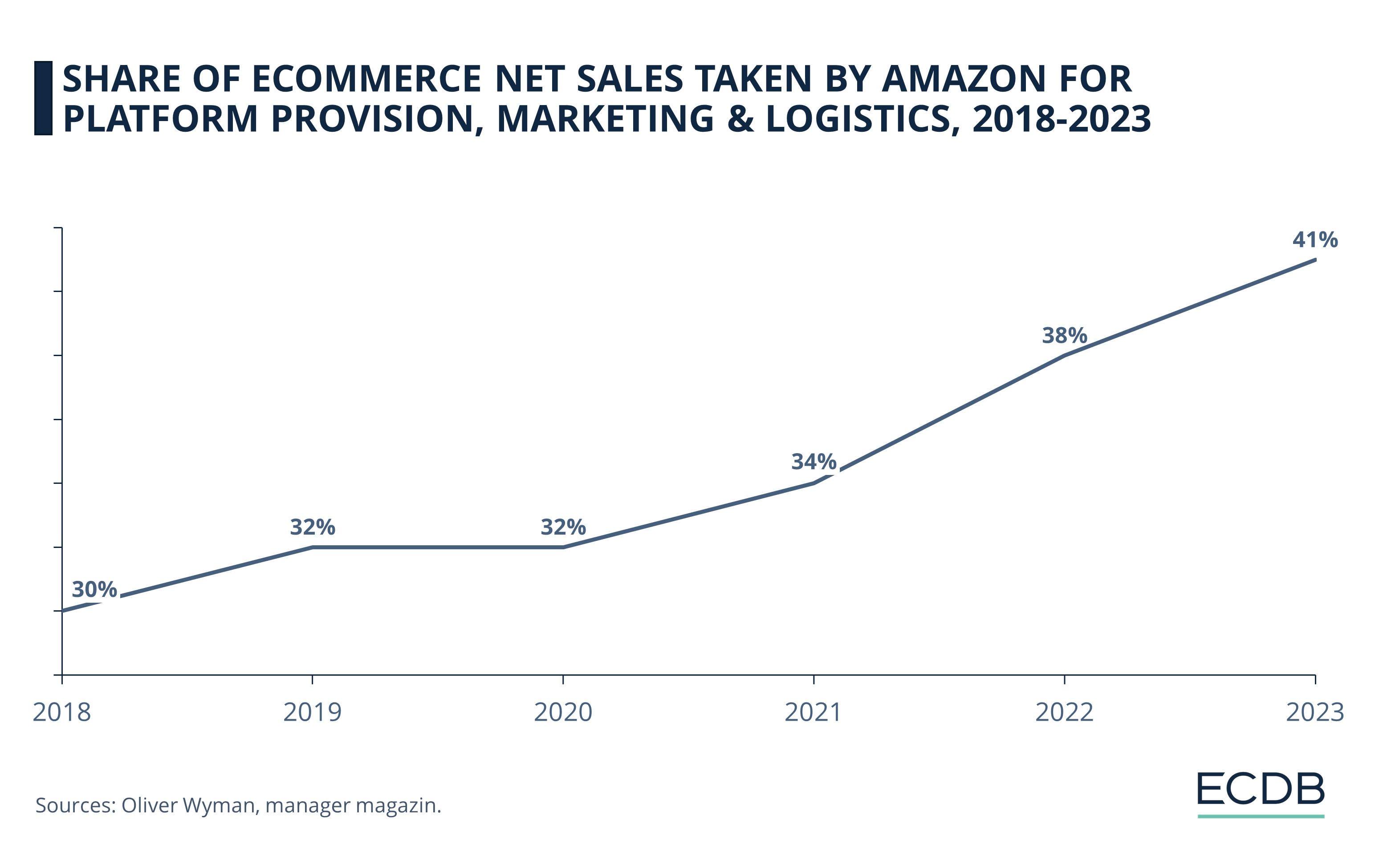

Amazon has recently come under fire for increasing merchant service fees on its platform. An investigation by German consulting firm Oliver Wyman found that since 2018, Amazon has been steadily increasing the fees it charges for providing the platform and related services.

As the chart shows, by 2023, Amazon incurred 41% of net sales for platform services, increasingly eating into sellers’ profits.

Note that these are maximum values, since Amazon charges a fee for providing the platform in any case, while marketing and logistics services are more or less voluntary. However, recent reports indicate that sellers are under pressure to spend an increasing share of their revenue on Amazon’s marketing services, because otherwise products will not be visible at a high enough rank for consumers to notice the items.

This also happens when consumers are searching for a specific brand: If that brand hasn’t paid for Amazon marketing, its products will appear on a later page, reducing the likelihood that consumers will see them behind the number of sponsored pages.

While some brands have already stopped selling their products on Amazon, smaller sellers and those without other significant distribution channels really have no choice but to sell on Amazon.

A Collective Outcry Against Amazon’s Seller Fees & Shein’s Adverse Recruitment Strategy

Then there are Amazon's discount events called Prime Days (which occur 1-2 times a year). Prime Days are extremely beneficial for consumers to shop on the platform, but sellers’ margins decrease even more during these events, resulting in profit losses.

Amazon is the leader in most European eCommerce markets, including Germany. This is due to its extensive network and capital, which allows it to offer consumer conveniences like next-day delivery and competitive prices. But the competitiveness of this approach is being challenged by growing seller dissatisfaction.

Chinese ultra-fast fashion eCommerce platform Shein understands this fact. According to Marketplace Pulse, Shein is actively recruiting Amazon’s largest sellers with more favorable offers (such as free advertising and a commission-free trial period).

In German eCommerce, Temu and Shein are not yet a credible threat to Amazon, but they could be to the market’s homegrown platforms.

Germany’s Top 5 Online Marketplaces:

Temu and Shein Threatening to Lower Ranks

While Amazon struggles with sellers and emerging competitors from Asia, Germany’s leading online retailers face their own challenges.

Amazon stands on its own at the top of the list, having recorded US$56.3 billion GMV in 2023. Marketplace transactions are notably smaller on the other platforms, which is also why they stand a greater risk of Temu and Shein surpassing them in the coming years. Temu.com already stood 8th place in 2023, with a GMV of US$1.04 billion in the market.

Therefore, fashion and electronics retailers have a choice to make: Adopt the Asian low-cost strategy or stand out with Amazon-like conveniences, such as fast (same-day or next-day) delivery, easy returns and discounting events.

Otto, Zalando & Media Markt: Strategic Moves to Stand Their Ground

A clear choice for Otto and Zalando: Both platforms rolled out new concepts for logistics network expansion and software services they offer B2B. In this way, Germany’s largest domestic retailers work to establish an additional financial branch, as well as improve networking and algorithmic efficiencies using big data.

Still, the threat of Temu, Shein, or AliExpress managing to build a functioning supply chain in Europe is looming. This would enhance their service even further and in turn hurt the domestic retailers that do not have Amazon’s head start. As of now, established eCommerce players in Germany have their extensive logistics networks and customer service capabilities to thank for their continued success, but what happens when Temu and the likes are starting to compete in this facet of the supply chain as well?

For the fifth-largest marketplace in the German ranking, Ceconomy-owned mediamarkt.de, low-priced consumer electronics offered on Temu are equally alarming. However, a contributing factor to the longevity of Media Markt and Saturn is their physical store network and omnichannel capabilities on the one hand as well as consumer recognition and trust on the other.

Is Temu A Threat to Amazon, Zalando & Otto? Closing Thoughts

Amazon’s confidence causes the market leader to claim an increasing share of revenue from sellers, who in turn are frustrated by this dynamic. While it does not currently appear like Amazon is about to relinquish its dominant position, competing networks are already being launched by domestic retailers.

Based on recent developments, with Asian marketplaces entering the scene to capitalize on disgruntled sellers and consumers looking for a bargain, it is probable that more networks of domestic online retailers will emerge, and/or merge with existing platforms. Using technological capabilities like Shein and Temu, retailers can keep inventory and costs down while offering a wider range of products and responding more immediately to consumer preferences.

The present media outrage over the success of Shein’s and Temu’s low-cost approach suggests that there is likely to be collective action against them by interest groups in their respective economies. Presently, Temu is making losses per order, which is made possible by PDD Holdings’ outstanding position through Pinduoduo. But if PDD Holdings, Shein, or Alibaba were to build a functioning logistics network in Europe at their current low-price model, even Amazon's market dominance would be at risk.

Sources: CNBC: 1 2 – manager magazin: 1 2 3 – Marketplace Pulse

FAQ

Is Temu a German company?

No, Temu is not a German company. Temu is an online marketplace owned by PDD Holdings Inc., a Chinese company based in Shanghai. It operates globally, including in the United States and Europe, but it is not based in Germany.

Is Temu available in Germany?

Yes, Temu is available in Germany. The online marketplace expanded its services to several European countries, including Germany. Customers in Germany can shop on Temu’s localized website and app, which are available in German and offer tailored payment methods and customer service in both English and German.

What is Temu Store?

Temu is an online marketplace launched in 2022 by PDD Holdings, known for its low prices, free shipping, and returns. It offers a wide range of products, including fashion, electronics, and home goods. Temu uses gamification and social media marketing to engage users.

Why is Temu so cheap?

Temu offers low prices by sourcing directly from manufacturers, eliminating intermediaries, and benefiting from PDD Holdings' economies of scale and efficient logistics. This direct approach reduces costs, allowing Temu to pass savings on to consumers.

Is Temu the same as Shein?

No, Temu and Shein are not the same. Temu, owned by PDD Holdings, offers a wide range of products, including electronics and home goods, while Shein focuses on fast fashion and accessories. Both are known for their low prices but operate independently with different primary product focuses.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Back to main topics