eCommerce: Online Shopping Events

Amazon Second Prime Day 2023: What to Expect

Amazon is set to launch this year's second Prime Day (dubbed as "Prime Big Deal Days") soon, a 48-hour sale offering deep discounts exclusive to Prime members. The event targets holiday shoppers with deals on many products, along with limited-time Lightning Deals.

Article by Cihan Uzunoglu | October 05, 2023

Mark your calendars: Amazon is gearing up for its second Prime Day extravaganza of the year, known as Prime Big Deal Days, from 10 to 11 October. Exclusive to Prime members and spanning 48 hours, the event promises deep discounts across a myriad of categories and is extending its reach to shoppers in 19 countries this time around.

As retailers increasingly look to utilize the holiday shopping season, Amazon is no exception. Prime Big Deal Days aims to spotlight giftable items, such as handheld tech and beauty sets, offering consumers a head start on holiday purchases. Amazon's limited-time Lightning Deals shouldn’t also be overlooked – those fleeting opportunities to snag a bargain that require quick action. On that note, let’s start off with a brief look at how the last Prime Day event went.

This Year's First Prime Day Showed Amazon's Resilience

Despite the current global economic challenges, Amazon’s First Prime Day this year demonstrated resilience in the realm of digital commerce. This endurance was manifest in rising consumer expenditure and a preference for volume over higher-priced items.

As we previously covered, the event moved a staggering 375 million items, offering consumers savings of approximately US$2.5 billion. According to an analysis by Adobe, sales in the U.S. alone climbed to US$12.7 billion, marking a 6.1% nominal uptick from 2022. Extrapolating from these numbers, global sales could potentially reach around US$20.5 billion.

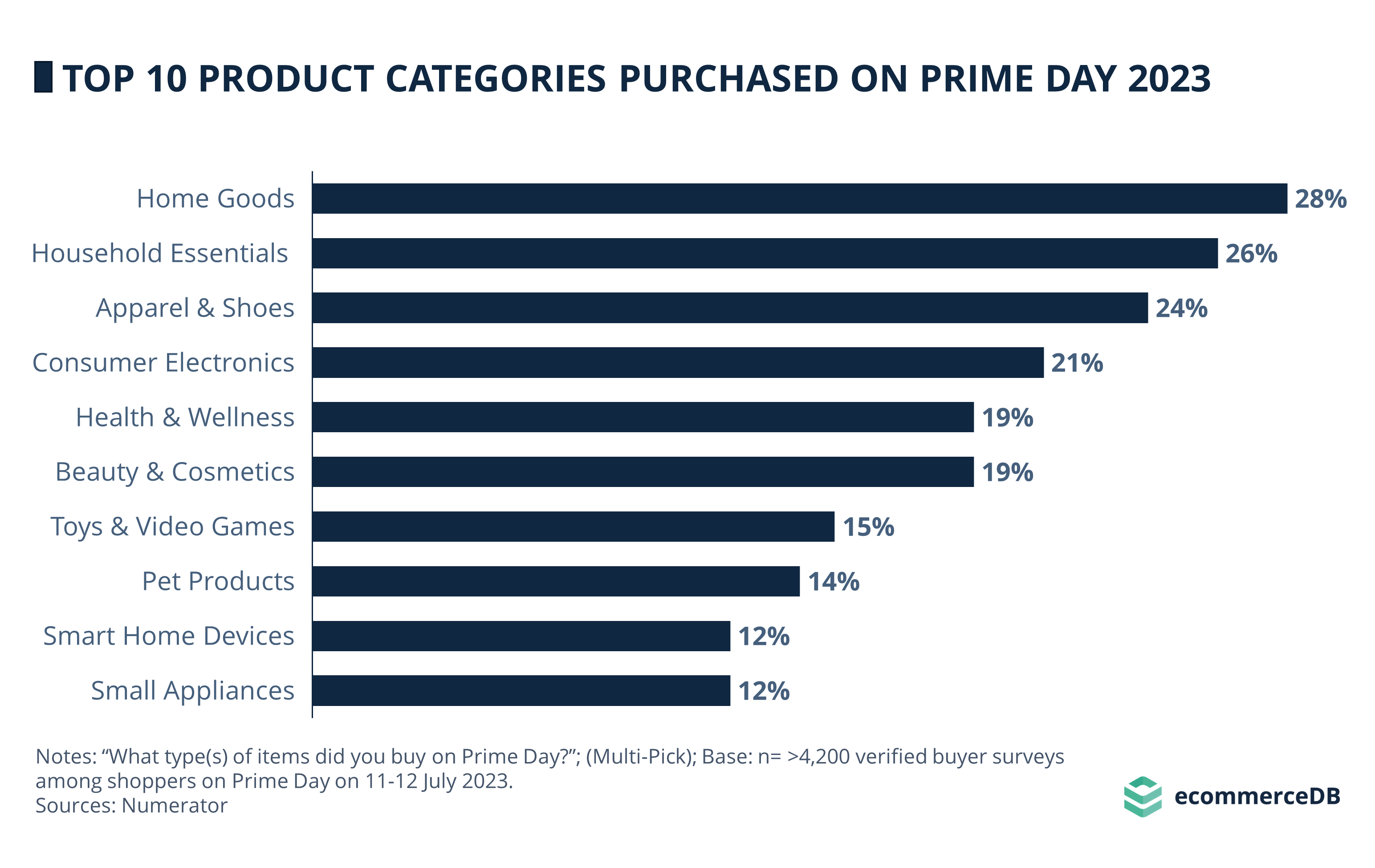

Payment preferences also evolved in comparison to last year’s Prime Day event. Options such as Buy Now, Pay Later accounted for 6.5% of transactions, amassing approximately US$927 million in revenue. Popular categories among buyers encompassed cleaning products, household essentials, and fashion.

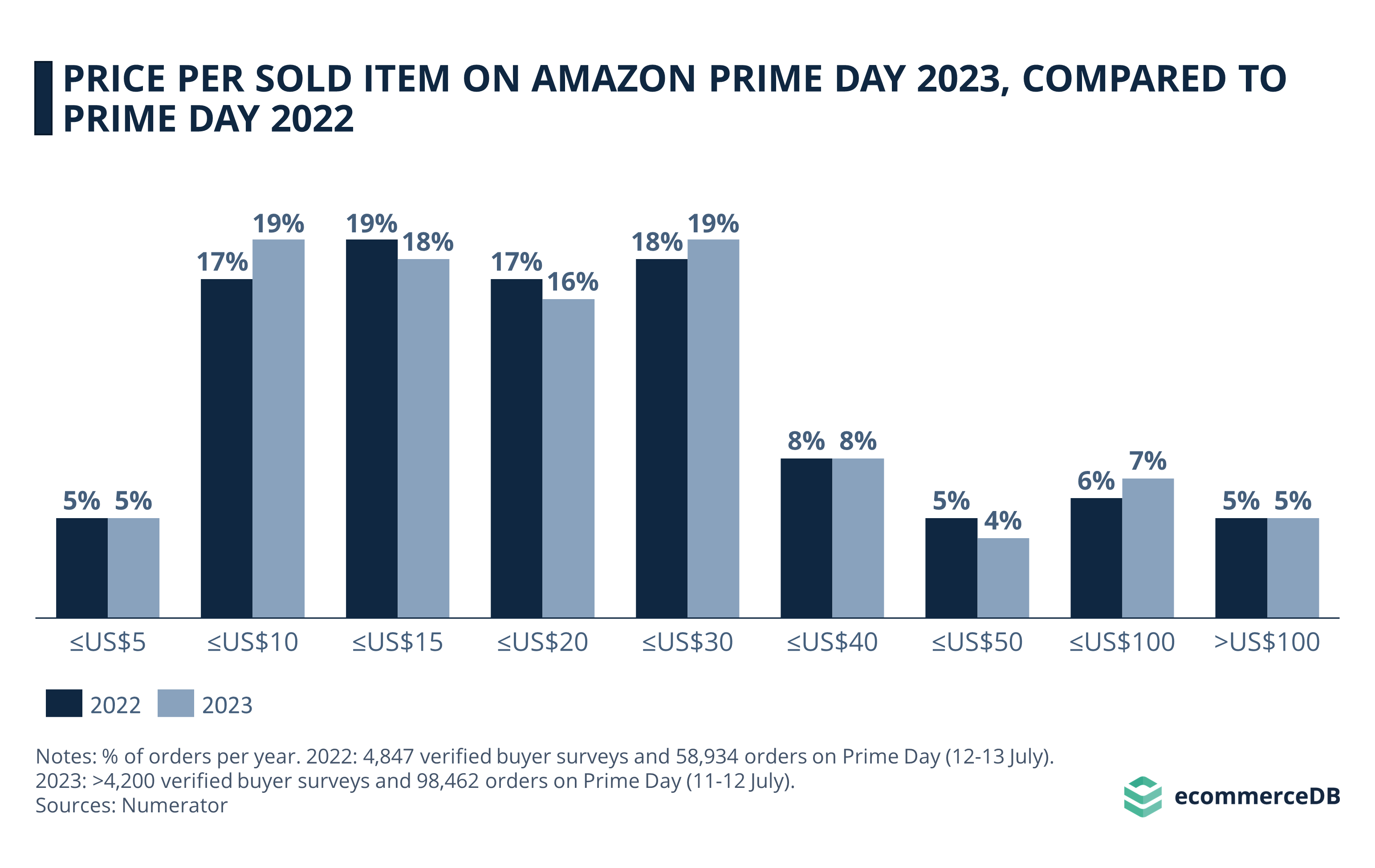

As far as consumer spending habits go, surveys verified by Numerator revealed shifts in order sizes and overall household spending compared to Prime Day 2022. The mean order size rose to US$54.05, a modest increase of roughly US$2 compared to the prior year. Likewise, household spending ascended to US$155.67, around US$11 more than the previous year's figures. Interestingly, consumers opted for a greater number of items rather than more costly ones, as evidenced by the lower mean price per item, which settled at US$32.35.

While we take stock of Amazon's recent Prime Day successes and evolving customer behavior, the company's broader financial health adds another layer to the narrative. As Amazon’s financial gears turn, it's clear that the company isn’t just surviving; it's thriving in multiple domains. These strong financial underpinnings could potentially fuel more aggressive marketing and deeper discounts in future sales events.

Promising Second Quarter Results

As we approach the Second Prime Day shopping event, Amazon's Q2 2023 financials should shed some light on how the company is currently positioned.

According to numbers published by Amazon in August, net sales witnessed an 11% uptick, reaching US$134.4 billion. This consistent growth extended across various segments – North American sales rose 11%, international sales climbed 10%, and AWS (Amazon Web Services), Amazon's cloud computing division, increased by 12%. Yet, the financial figures reveal more than top-line growth.

Operating income surged to US$7.7 billion, a significant leap from US$3.3 billion in the same quarter last year. Notably, North America achieved profitability with an operating income of US$3.2 billion, while the international segment reduced its losses. AWS, though stable, showed a slight dip in operating income – an aspect worth monitoring given the intensifying competition in cloud services.

The highlight of the quarter was the transformative shift in cash flows. Operating cash flow soared 74% to US$61.8 billion, transforming from an outflow to a robust inflow. This liquidity positions Amazon well for impactful strategic investments and, potentially, more aggressive Prime Day promotions to entice customers further.

The upcoming Second Prime Day offers yet another opportunity for Amazon to flex its digital muscles, not just in the U.S. but across the globe.

What to Expect from the Second Prime Day 2023

In the lead-up to this year's Second Prime Day, it's worth taking a closer look at recurring trends and strategies that Amazon deploys to make these events successful. The retailer has been known to utilize its platform's capabilities fully, from enticing deals to Amazon Live features, amplifying consumer engagement.

One recurring theme is Amazon's focus on "Lightning Deals," time-sensitive offers that sellers submit via Amazon's Seller Central. These offers serve as a sales catalyst, particularly when the retail giant seeks to energize consumer activity in specific shopping quarters.

An interesting and underscored aspect in this context is inflation's influence on consumer behavior. While exact numbers from last year shouldn't be dwelt upon, the trend is that household essentials often come to the fore. Consumers, wary of rising prices, tend to prioritize essential items, which aligns with broader economic indicators.

Moreover, Prime Day serves as a launchpad for small businesses. Amazon has been keen to highlight its role as a facilitator for SMEs (Small and medium-sized enterprises). Initiatives like "Support Small Businesses to Win Big" not only endear customers but also generate substantial revenue for these smaller sellers.

The retail giant’s live commerce effort Amazon Live is another feature that has been gaining traction lately. Brands utilize this service to attract followers on the platform, countering criticism that Amazon's model lacks options for building customer loyalty. With tools like Amazon Live, Amazon Posts, and Amazon Brand Stores, the company offers various avenues for SMEs to connect with a broader audience.

Amazon Second Prime Day 2023: Key Takeaways

Amazon's Second Prime Day is not just about splashy discounts; it's a complex ecosystem that aims to engage consumers, uplift small businesses, and adapt to changing economic variables like inflation. Here are the most important takeaways from our analysis:

Despite economic headwinds, Amazon's First Prime Day this year showed growth in both U.S. and potential global sales, with consumer spending habits revealing a tilt toward buying more items rather than pricier ones, and newer payment methods like “Buy Now, Pay Later” gaining traction.

Amazon's Q2 2023 financials revealed an 11% increase in net sales to US$134.4 billion and a substantial surge in operating income, positioning the company well for strategic investments and potentially more aggressive promotions for the upcoming Second Prime Day event.

In anticipation of the upcoming Second Prime Day, Amazon employs a multi-faceted approach that includes time-sensitive "Lightning Deals," a focus on household essentials amid inflation concerns, and initiatives to boost small businesses, along with features like Amazon Live to enhance consumer engagement and brand loyalty.

Sources: Amazon, ecommerceDB (as well as the secondary sources in the referenced articles)

Related insights

Article

Top 5 Online Retail Companies: Amazon Leads in Value and Revenue

Top 5 Online Retail Companies: Amazon Leads in Value and Revenue

Article

DIY & Home Improvement Market Germany: Top Stores, User Preferences & Amazon

DIY & Home Improvement Market Germany: Top Stores, User Preferences & Amazon

Article

Top Online Marketplaces in Europe: Amazon with Huge Market Share

Top Online Marketplaces in Europe: Amazon with Huge Market Share

Article

Top 3 Online Marketplaces in Germany: Amazon Ranks First

Top 3 Online Marketplaces in Germany: Amazon Ranks First

Article

Amazon GMV: Which Domains Grew the Fastest?

Amazon GMV: Which Domains Grew the Fastest?

Back to main topics