Prime Day Sales in 2022: Did Inflation Impact Amazon?

Article by Nadine Koutsou-Wehling | July 06, 2023

Download

Coming soon

Share

This year on July 11 and 12, Amazon will once again offer discounts on select brands and products, as it has done every year since 2015. Last year, we reported on third-party estimates that Prime Day 2022 generated $12.1 billion, an 8% increase from the previous year. While the Prime Days in 2019 and 2020 saw the largest increases, with 71.4% and 44.4% growth, respectively, those rates slowed in the following two years, though still positive.

One factor that has played a role in the post-pandemic environment is rising inflation, which lowered living standards around the world as rising prices reduced real wages and, consequently, the income available to consumers to spend on consumer goods. In this context, this article examines shopper demographics, year-over-year spending, and the impact of inflation on Prime Day 2022.

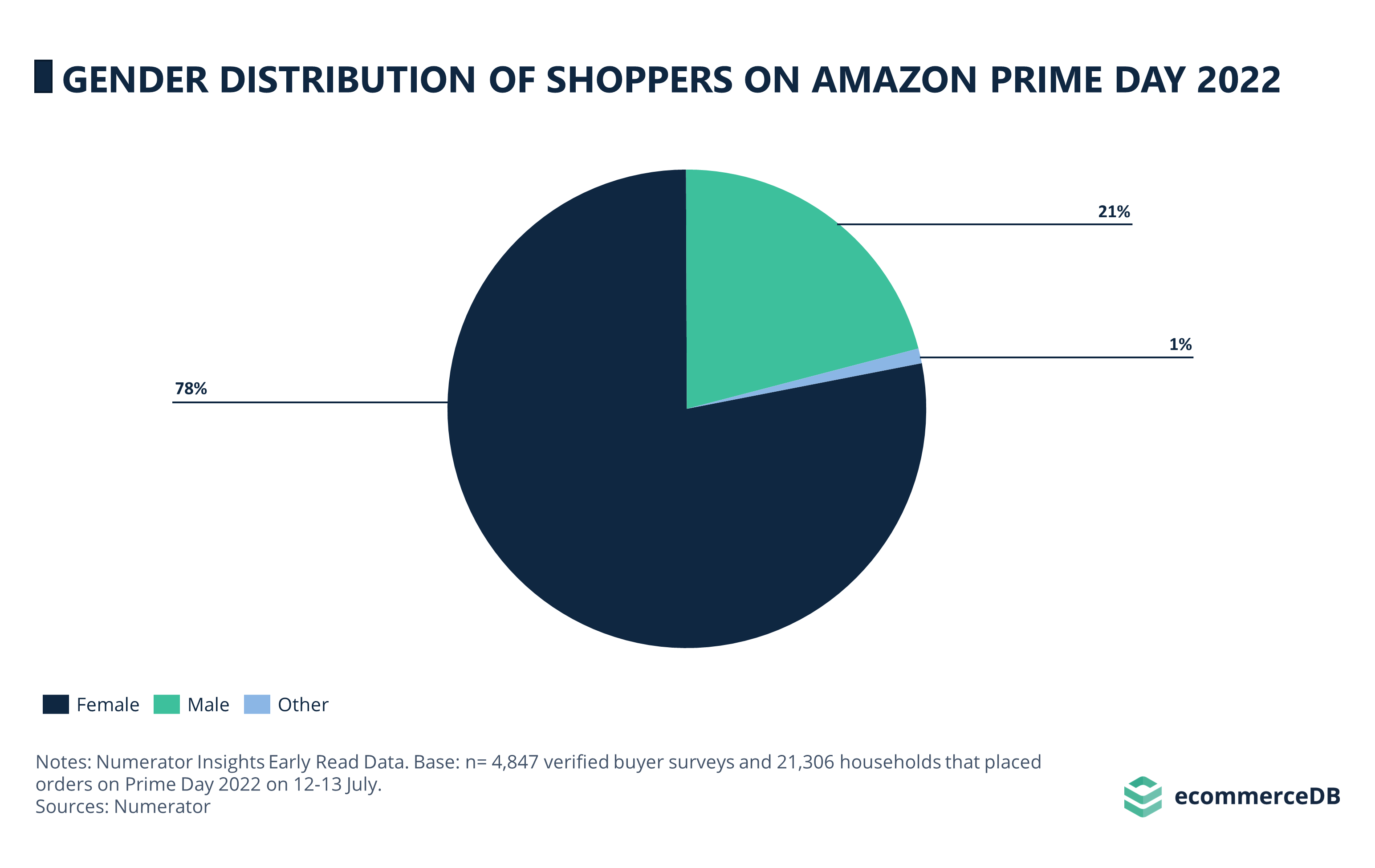

Prime Day: The Typical Shoppers Are Female Consumers Living in High-Income Households

A demographical analysis of Prime Day 2022 verified buyer surveys shows that primarily female shoppers participated in last year’s shopping event. At an overwhelming 78%, this share significantly outperforms other gender categories. Therefore, men (21%) and other categories (1%) make up only a minor proportion of buyers on Prime Day.

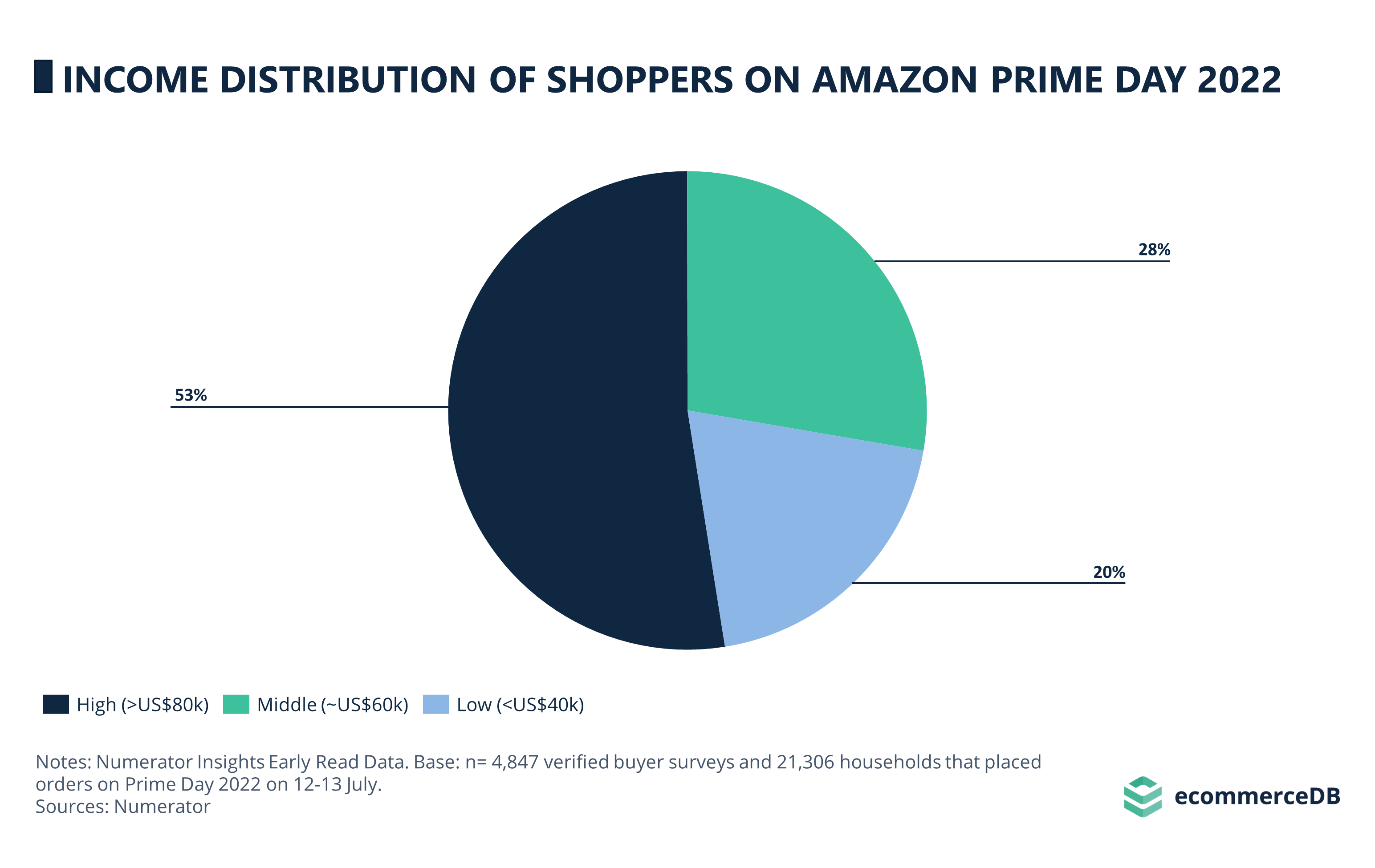

In addition, an examination of annual household income showed that more than half of shoppers (53%) belong to high income households, earning over US$80,000 a year. Consumers living in low-income households with less than US$40,000 are represented less, at 20%, and shoppers in households with incomes between these two figures make up 28%.

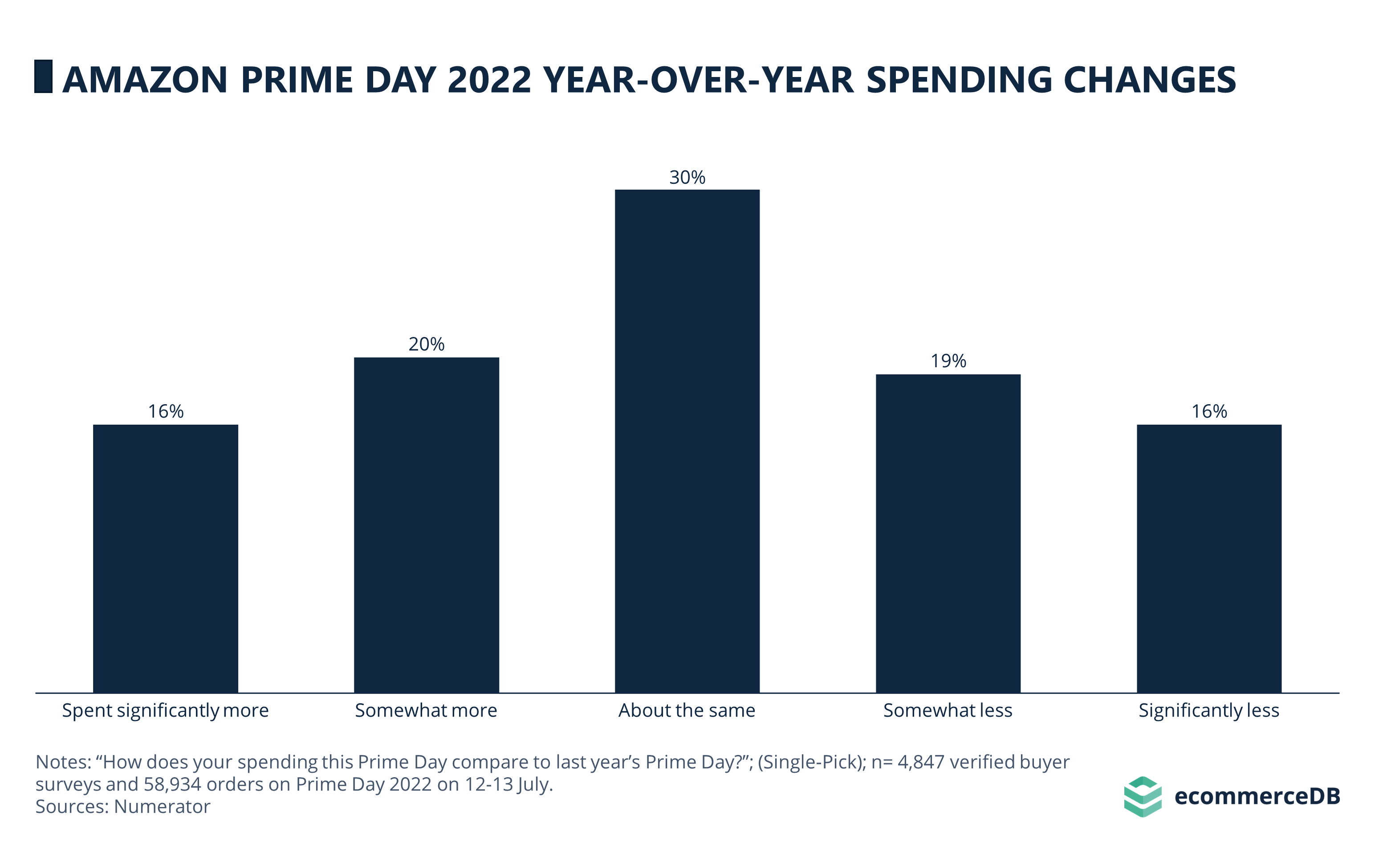

Prime Day 2022: Consumers Spent the Same or More Since Prime Day 2021

When Numerator asked verified Prime buyers how much they spent on Prime Day 2022 compared to the previous year’s shopping event, the most common response was that consumers spent the same amount in 2022 compared to 2021, with 30% of them saying so. Overall, one percentage point more shoppers said they spent more (36%) than those who said they spent less (35%). A closer look reveals that an equal share of respondents spent significantly more or less this year, at 16%, while there is a slight difference between those who spent somewhat more (20%) and somewhat less (19%).

Since shopping events like Prime Day are designed to offer consumers products at lower than usual prices, they should be particularly attractive to strained finances in an inflationary environment. With that in mind, let’s look at how inflation affected shopping behavior during Prime Day 2022.

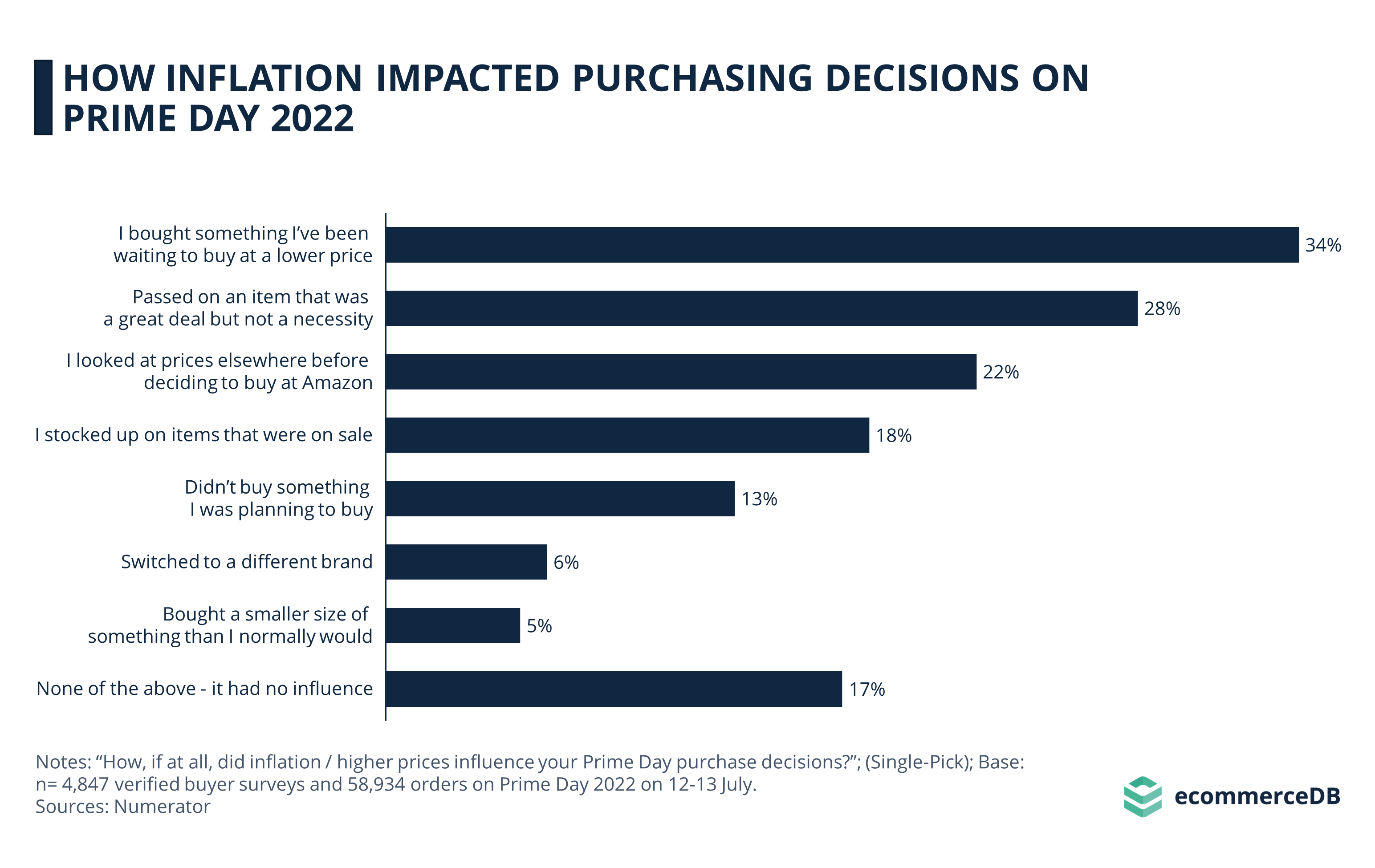

Users Tend to Wait for Prime Day to Get a Deal on High-Priced Items

When asked about the impact of inflation and rising prices on consumer behavior on Prime Day in July 2022, the most common response was that shoppers took advantage of the opportunity to buy something they had been waiting to buy at a lower price than usual (34%).

Frugality became more important as prices soared, as demonstrated by 28% of respondents who said they passed on an item that was a great deal but not a necessity. In our article on the role of non-Amazon purchases on Prime Day, we talked about the halo effect that Amazon’s shopping event had on other platforms. Apparently, the inflation also incentivized users to comparison shop, as 22% of them stated that they checked prices elsewhere before deciding to buy on Amazon.

In recent years, we have seen the global phenomenon of consumers mass buying and stockpiling in times of crisis. Similarly, 18% of respondents to the Numerator survey said they took advantage of Prime Day discounts to stock up on items that were on sale. Another behavior consumers exhibited was not buying something they intended to buy, at 13%. In addition, 6% of respondents switched to a different brand than they had previously purchased, and 5% reduced the size of their purchase.

Notably, 17% of consumers did not change their behavior in any of the above ways or said that inflation and rising prices had no impact on their shopping behavior.

Since most Prime Day shoppers belong to high-income households earning more than US$80,000 per year, inflation and rising prices may not have affected them as much as shoppers who were already struggling financially. Our insight into the impact of inflation on shoppers in Germany showed that the propensity to maintain or increase the products one purchases grows with rising income.

Inflation's Impact on Prime Day: Resilient Consumer Spend

Despite a global inflationary environment, Amazon Prime Day 2022 exhibited moderate yet sustained growth, a trend that has continued since Prime Day’s inception in 2015. This article explored consumer responses in a post-pandemic online market characterized by rising prices and declining real incomes, lowering living standards in the process.

Slight Majority of Consumers Spent More

Results from the Numerator survey showed that 30% of respondents did not change their spending relative to the previous year’s Prime Day. On top of that, a slight majority of consumers (36%) said they spent more, compared to 35% who reported spending less. These responses are further broken down into 16% of respondents each who spent either significantly more or significantly less and 20% who spent somewhat more, followed by 19% who spent somewhat less than last year.

Looking for Deals to Avoid Rising Costs Is Most Common

Other behaviors that consumers reported were waiting for Prime Day to make larger purchases at discounted prices or adopting a more frugal attitude. A smaller share of consumers also showed resourcefulness by comparison shopping or stockpiling sale items. Nevertheless, 17% of users reported no change in behavior, suggesting that inflation had a limited impact on a substantial portion of Prime Day shoppers.

Sources: Numerator

Related insights

Article

Amazon's Top Competitors in the UK: GMV, Product Categories & Annual Growth

Amazon's Top Competitors in the UK: GMV, Product Categories & Annual Growth

Article

Temu Continues to Grow in 2024: Outselling Shein, Wish & Alibaba

Temu Continues to Grow in 2024: Outselling Shein, Wish & Alibaba

Article

Amazon: Which Domains Grew the Fastest?

Amazon: Which Domains Grew the Fastest?

Article

Most Valuable Global eCommerce Companies 2024

Most Valuable Global eCommerce Companies 2024

Article

Online Consumer Electronics Market in the United States: Top Players & Market Development

Online Consumer Electronics Market in the United States: Top Players & Market Development

Back to main topics