How Household Income and Size Affect Shopping Behavior During Inflation in Germany

May 26, 2023

Rising inflation has led to higher prices across Europe, due to post-pandemic aftershocks in supply chains and the war in Ukraine, which has exacerbated supply disruptions. The post-pandemic recovery in consumer demand is creating a bottleneck effect as increased demand for goods and services meets supply constraints and rising costs.

The reasons for why inflation has risen so much – to levels last seen in the 1970s – are varied and as elusive as possible solutions to the predicament in which Europe finds itself. To gauge consumer behavior during rising prices, we analyze inflation-induced shopping behavior in relation to the demographic dimensions of net household income and household size.

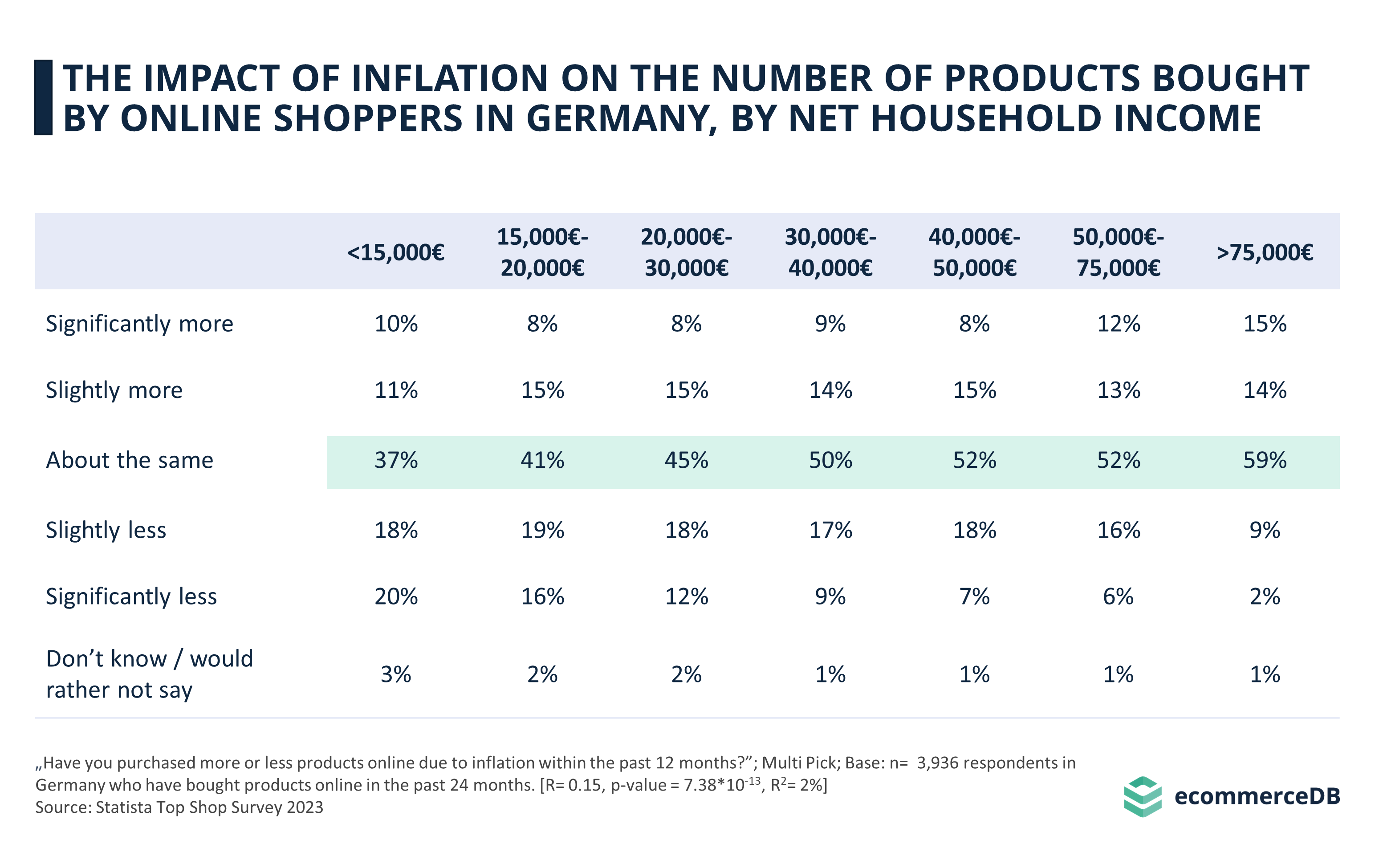

The Higher a Household's Net Income, the More Likely Shoppers Are to Buy the Same Number of Products or More

A survey conducted by Statista in 2023 asked online shoppers in Germany whether they had changed the number of products they bought online in the last year due to inflation. The most common answer was that respondents buy roughly the same number of products. As expected, a higher net household income has a positive impact on shopping behavior; less income leads to fewer products purchased, and more income allows for a greater number of products purchased.

Linear regression analysis confirms this positive correlation between net household income and purchase propensity. The correlation coefficient has a moderately positive effect on shopping behavior, and the p-value supports the statistical significance of this variable. However, a relatively low R² of 2% indicates that only 2% of the variance in the dependent variable can be explained by net household income, suggesting that other variables additionally affect the number of products online shoppers in Germany buy due to inflation.

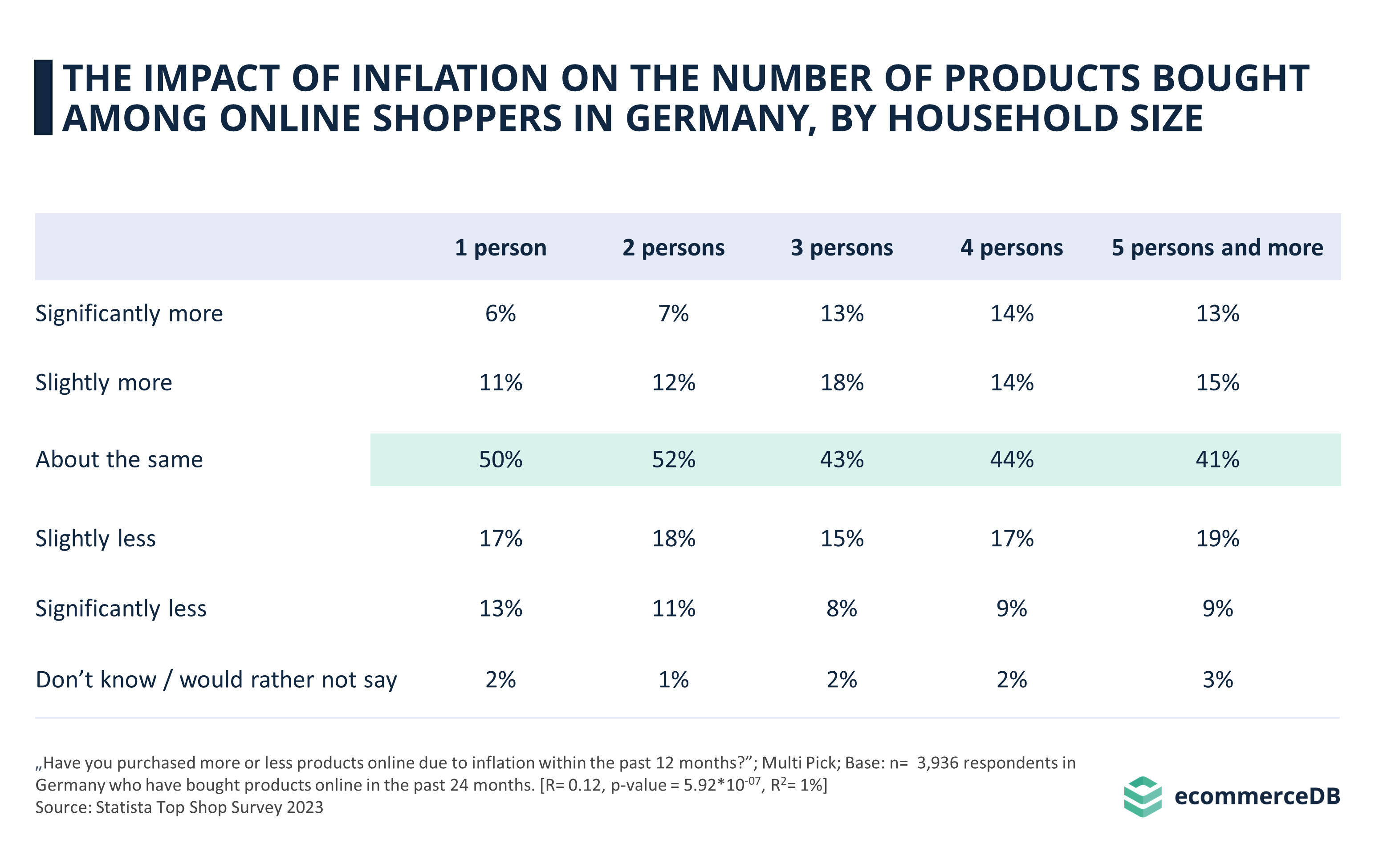

The Larger a Household, the More Likely Shoppers Are to Buy More Products Online

Looking at the household size of respondents, the results show that household size is negatively correlated with changing one’s online shopping behavior.

More precisely, about half of online shoppers from 1-person (50%) and 2-person households (52%) have not changed their behavior. This tendency decreases as household size increases, with 41% of households of 5 or more people having bought about the same number of products online during inflation.

Overall, there is a slightly positive correlation between household size and the propensity to buy more products online during inflation.

30% of 1-person-households have bought slightly less (17%) or significantly less (13%) due to inflation, compared to 17% of those who have bought more. Online shoppers living in 2-person households were also more likely to buy fewer products (29%) than to buy more (19%). Conversely, members of 3-person households were more likely to have bought more products (31%) than less (23%) online. The same applies to users living in households with 4 members, where 28% bought more compared to 26% who bought less. For larger households, there is an even balance, with 28% of shoppers having bought less and 28% having bought more.

While the linear regression analysis produces statistically weak, but significant results, the explanatory power is very low, with an R² of 1%.

Net Household Income and Household Size Are Both Positively Correlated With Purchasing More Products

As most online shoppers in Germany did not substantially change the number of products they bought online in the past year, the two variables of net household income and household size had opposing effects on changes in their behavior.

With increasing household income, shoppers are less likely to change their behavior, but those who do tend to buy more products. This is consistent with expectations, since rising prices are more likely to affect lower-income households more negatively than those who aren’t struggling to make ends meet.

Conversely, the larger the household size, the greater the change in purchasing behavior. More specifically, 1- and 2-person households tend to buy the same number of products or fewer, while larger households tend to make more changes in their shopping behavior and buy more products.

Both variables, although statistically significant, have low R² values of 2% to 1%, which means that the explanatory power is low and further variables should be examined to get a more complete picture of consumer behavior during inflation.

Sources

Related insights

Article

Walmart, Amazon & Shein: Which Store Ranks First in U.S. Online Fashion?

Walmart, Amazon & Shein: Which Store Ranks First in U.S. Online Fashion?

Article

Online Car Selling & Buying: Revenues, Forecast, Top Marketplaces & Trends

Online Car Selling & Buying: Revenues, Forecast, Top Marketplaces & Trends

Article

Fashion ReCommerce in the UK: Top Categories, Generational Attitudes, Leading Shops

Fashion ReCommerce in the UK: Top Categories, Generational Attitudes, Leading Shops

Article

Zalando, Otto & About You: Revenue, Market Growth, Business Strategies

Zalando, Otto & About You: Revenue, Market Growth, Business Strategies

Article

Online Shopping vs. In-Store Shopping in Europe: eCommerce Recovers After Post-Pandemic Dip

Online Shopping vs. In-Store Shopping in Europe: eCommerce Recovers After Post-Pandemic Dip

Back to main topics