eCommerce: Top Companies

Top 5 Online Retail Companies: Amazon Leads in Value and Revenue

Explore top eCommerce brands: Get key insights on the 5 largest online retailers' market cap, GMV, and revenue — essential data for analysts.

Article by Cihan Uzunoglu | May 13, 2024Download

Coming soon

Share

Top 5 Online Retail Companies: Key Insights

Amazon: The Seattle-native tech giant leads the online retail industry with the highest market value and sales, expanding into various areas like hardware and AI, but saw a small drop in direct eCommerce revenue in 2022 despite overall growth.

PDD: The top Chinese eCommerce company by market cap is highly valued in Asia and shows rapid growth, ranking high in revenue and GMV among global eCommerce firms, with its high Price-Earnings ratio reflecting expectations similar to a fast-growing tech startup.

Alibaba: The second-largest Chinese eCommerce company, has shown strong growth and high profitability, with a market value and earnings strategy that differ from its competitor JD.com, leading to a higher valuation and EPS.

MercadoLibre: The largest eCommerce company in the Americas outside the U.S., shows rapid growth and diversification, with a high valuation and EPS, outperforming industry giants in profitability metrics.

JD.com: The leading Chinese eCommerce company shows steady growth in revenue and sales, but its market value has dropped notably, partly due to economic pressures and strong competition from other companies like Alibaba and Pinduoduo.

Understand the world of online shopping: Here's an analysis with all the important numbers, like sales, company worth, and earnings for the five largest internet retail companies – perfect for anyone doing market research. We already explored key eCommerce trends among the top 250 publicly traded eCommerce firms, focusing on regional revenue distribution and industry performance. The Americas led in global revenue, while the online retail sector saw the most significant growth.

By online retail companies, we refer to the eCommerce companies that operate a marketplace or an online store as their main business with a generalist approach, generating over 50% of their revenues through their eCommerce business. While this article will focus on top 5 online retail companies from our top 220 eCommerce companies list, there are many more company types included in the list, such as apparel, auto & truck dealerships, grocery stores, home improvement retail, internet content & information, luxury goods, pharmaceutical retailers, software and specialty retail.

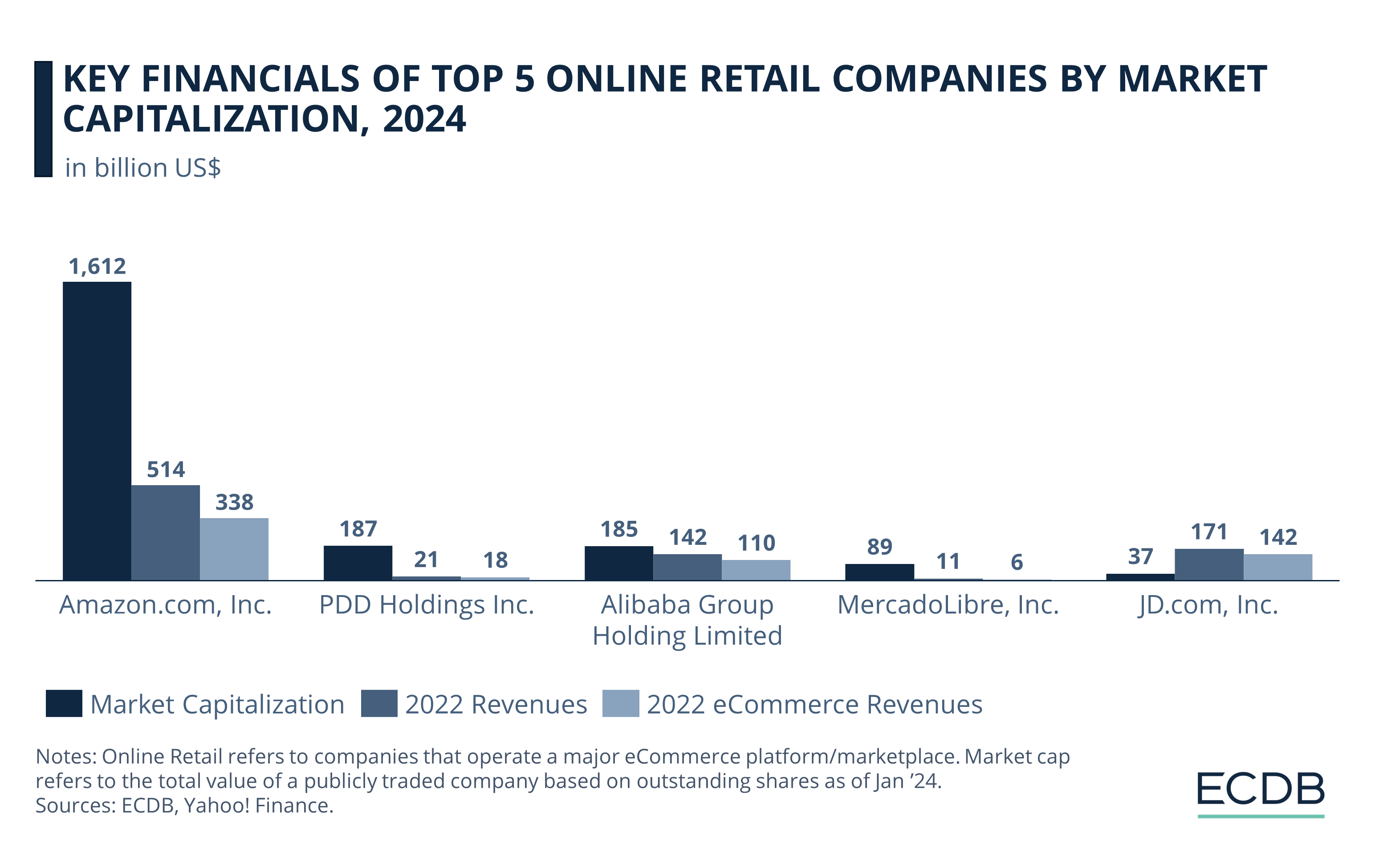

Our ranking of internet retail companies is based on market cap, which is the value of a company based on outstanding shares. Drawing on the data collected, this article will have a detailed look into the top 5 online retail companies among all publicly traded eCommerce companies.

1. Amazon

As one might expect, the Seattle-native tech giant Amazon dominates the competition with the highest market cap at US$1.61 trillion, as well as the highest overall revenue with US$514 billion and the highest eCommerce revenue of US$338 billion among online retail companies in our scope.

Despite a big focus on physical commerce through efforts like Amazon Go and Amazon Fresh, the company is valued at heights that is usually only seen with high-margin tech companies both in absolute and relative terms. As of 2022, eCommerce net sales of the company make up 43% of its overall revenue.

One of the factors contributing to Amazon's high market value is its broad business model – in fact, the broadest among the top online retailers in our analysis. The company offers hardware, physical stores, and cloud services, as well as increasing investments in AI.

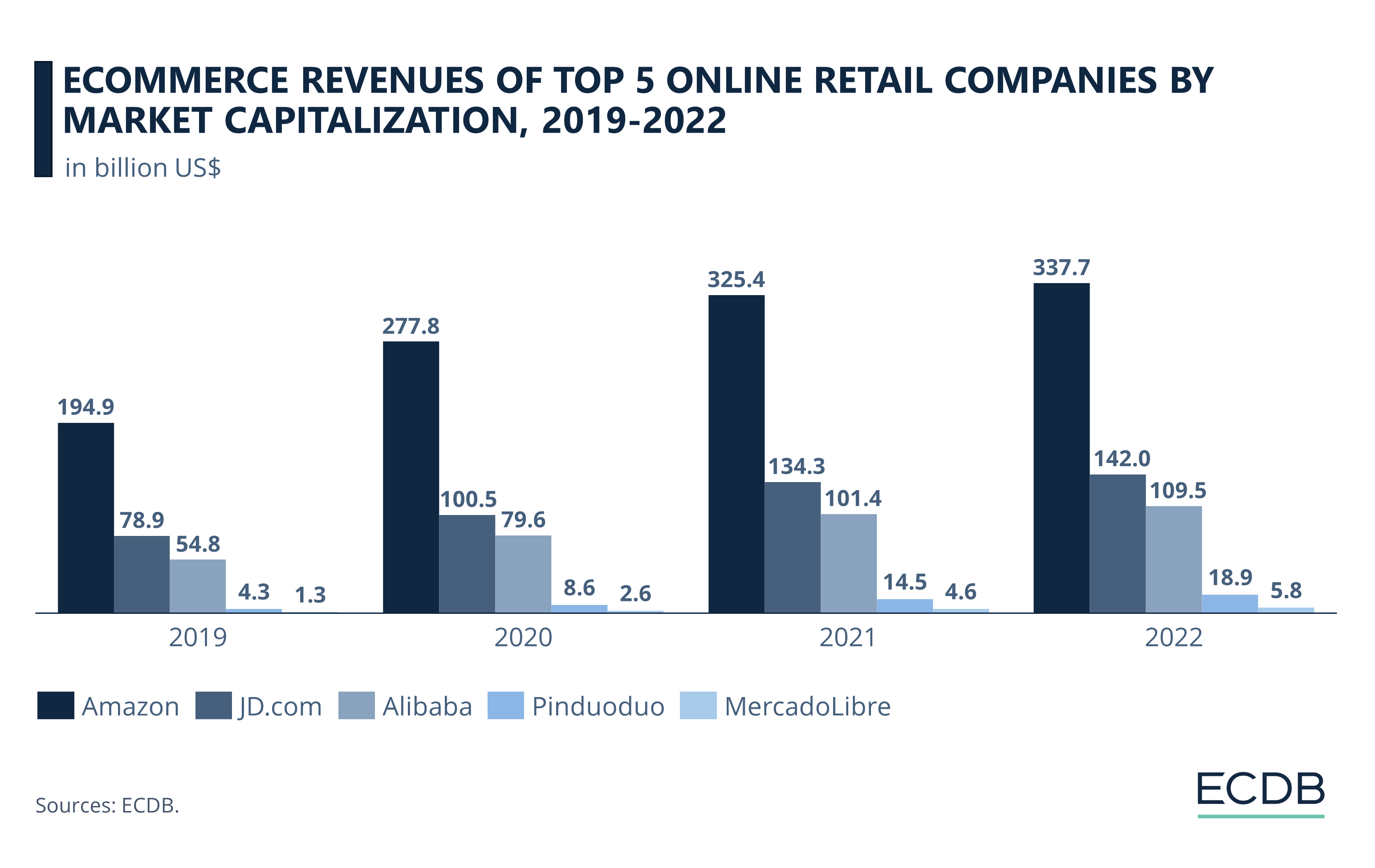

Over the last years, Amazon has seen continuous revenue growth. With the onset of the pandemic, its growth accelerated (CAGR of 22% between 2019 and 2022) and then slowed after the pandemic (9% YoY growth between 2021 and 2022).

While the company's eCommerce net sales dipped by 0.9% in 2022, its eCommerce GMV grew by 5.9%. This suggests that although the total value of goods sold through Amazon's platform increased, the firm's direct revenue from eCommerce activities declined modestly. Several factors could account for this divergence, including a higher volume of consumers purchasing from third-party sellers on Amazon, increased discount offerings, or elevated return rates.

2. PDD

At number 2, PDD is the largest Chinese eCommerce company by market cap. In all of Asia, the company is the eighth-most valuable only behind heavyweights such as Samsung, TSMC and Reliance Industries.

Since its foundation in 2015, the company has seen a fast and continuous revenue growth. PDD's CAGR since 2018 stands at 80%, while CAGR for GMV in the same time period is at 66%.

Among the top 220 eCommerce companies, PDD ranks 5th in overall revenue. In terms of GMV, the company takes the 4th spot with US$541.2 billion in 2022, showing the significance of marketplace business in China.

Price-earnings-ratio (P/E) refers to the ratio between the company's earnings and the company's price and is used to analyse a company's value, as well as the expectations for future earnings. A high P/E ratio means high valuation and higher expectations for growth.

PDD trades at more than 6 times its revenue, scoring a P/E of almost 32. This essentially means that the company is growing as quickly as a tech start-up, and its value is also assessed like a tech start-up.

3. Alibaba

For the first time in years, Alibaba is only the second highest-valued Chinese eCommerce company with a market cap of US$185 billion (as of January 2024). It also has the sixth-highest market value among all public Chinese companies, behind Tencent, Kweichow Moutai, ICBC, PDD and China Mobile.

With a continuous growth in the past decade, the Chinese retail giant scored an overall revenue of US$142.2 billion in 2022, with eCommerce net sales of US$44.4 billion and eCommerce GMV of US$1.3 trillion in the same year.

Alibaba has seen noticeable growth driven through direct net sales, with a CAGR of 65% since 2018. In the same time period, the company also achieved an increase from 10.6% to 31.2% in eCommerce share of business.

In comparison to JD.com, Alibaba has pursued a distinct growth strategy, which is reflected in the market capitalization and valuation of both companies. Alibaba initially carved out a robust presence as a marketplace and has more recently expanded its first-party eCommerce business. JD.com, conversely, built a strong foundation with its own net sales through a store-based model and is now focusing on enhancing its marketplace operations.

Earnings-per-share (EPS) serves as a pivotal metric in our analysis, offering a snapshot of a company's profitability. Calculated by dividing net income by the number of outstanding shares, EPS is a direct reflection of a company's earnings capacity. A higher EPS generally indicates better financial health and robust earnings, making it an attractive feature for investors.

Despite these differences, Alibaba's net sales growth has outstripped JD.com's marketplace expansion. This divergence in growth rates serves as a contributing factor in the different market valuations of the two companies, further emphasized by Alibaba's significantly higher EPS (4.7 versus 1.97), indicating greater profitability and hence a higher valuation.

4. MercadoLibre

The fourth largest online retail company on our list, MercadoLibre, is the largest non-U.S. eCommerce company in the Americas with a higher valuation than the likes of Tesco, eBay or JD.com.

With fast-growing revenues at a CAGR (2019-2022) of 66%, eCommerce net sales of the company more than tripled between 2020 and 2021, reaching from US$283 million to US$920 million. In addition to this, MercadoLibre’s GMV has increased by a nearly 35% CAGR between 2019 and 2022.

Founded in 1999, MercadoLibre has diversified its business across Latin America and leads in consumer-to-consumer app downloads as of 2022. The company has expanded to become akin to Amazon and Asian super apps in scope. It is the most-visited online store in Latin America and has a growing financial services platform similar to Alibaba and Ant Group. Fintech services contributed to nearly 45% of its revenue in Q2 2023, highlighting its evolution beyond just an online marketplace.

The factors touched upon in the previous paragraph set the foundation for MercadoLibre’s high market valuation. The company’s P/E ratio stands at an impressive 90. For comparison, Amazon’s P/E stands at 82, while companies like Microsoft and Apple have respective ratios of 39 and 32.

Perhaps even more impressive, with the highest EPS value of 19.5 among the top online retail companies, MercadoLibre overshadows giants like Microsoft and Apple, which stand at 10.3 and 6.1, respectively.

5. JD.com

The last top online retail company we will be looking at is JD.com. The Bejing-born giant ranks 2nd among eCommerce companies in our list by overall revenues, while ranking 2nd by eCommerce net sales and 9th in terms of market cap. In contrast to other top online retail companies we've examined, all of which have a market cap higher than their overall revenue and in turn higher than their eCommerce net sales, JD.com diverges from this pattern.

Since 2018, the company has been experiencing growing revenues with a CAGR of 25.1%, as well as growing eCommerce net sales (22.5% CAGR) and GMV (22.5% CAGR). In terms of revenue, JD.com is the largest Chinese eCommerce company in our top 220 list.

Due to the pandemic, most online retail companies had their peak in 2021 and are valued significantly lower since then. JD.com isn’t an exception to this – in fact, it is the most prominent victim of this drop in eCommerce valuation.

In a setting where Chinese companies are particularly under pressure as concerns about weak economic outlook of the country and rising interest rates persist, JD.com is missing a strong revenue driver in the face of Alibaba, as referenced earlier. The company has reported sluggish numbers in its core business, while facing strong competition from growing companies such as Pinduoduo.

Top 5 Online Retail Companies: Top 220 Generates >70% of Total Revenues

The top 5 online retail companies in our list generated revenues of US$877 billion in 2022 – accounting for more than 70% of all revenues generated by the top 220.

It should also be noted that eCommerce revenues here refer to both eCommerce net sales from online stores, as well as revenues generated from marketplaces through provisions, in order to better capture the entire business volume of these online retail companies.

Top Online Retail Companies: Final Thoughts

While eCommerce is still at the center for all the companies we’ve analysed, all are also strongly diversified businesses:

Most are active in media and entertainment, such as Amazon, Alibaba, MercadoLibre and JD.com.

Many are also active in financial services, with examples of Amazon, Alibaba and MercadoLibre having taken important steps in the recent years.

Logistics is also popular in this context, as Amazon, MercadoLibre, Alibaba, JD.com and PDD have significant presence in this sector.

Cloud technology is also gaining popularity among these companies, already implemented by the likes of Amazon, Alibaba and JD.com.

All top 5 online retail companies we’ve analysed show growing revenues and GMV. With the exception of Amazon, all companies also experience increasing eCommerce net sales.

Despite lower revenues, companies showing strong growth, such as PDD and MercadoLibre, are rewarded with high market valuations. JD.com, on the other hand, is struggling with slowing growth in China and a lack of strong revenue drivers.

Sources: Amazon, Investor’s Business Daily, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Back to main topics