eCommerce: Market Insights

Home Improvement & DIY Germany: Top Stores, User Trends & Amazon

Online stores specializing in do-it-yourself (DIY) and home improvement grew during the pandemic, but they can't hope to reach Amazon's dominance. Here is why.

Article by Nadine Koutsou-Wehling | May 13, 2024Download

Coming soon

Share

DIY & Home Improvement in Germany: Key Insights

A Concentrated Market: The respective online stores of Bauhaus, Hornbach, and Obi generated similar net sales of around US$400 million in 2023. Other retailers with a focus on DIY & home improvement are not as relevant.

Amazon Takes the Lead Once Again: Amazon.de poses a challenge to DIY-focused retailers. Amazon's outstanding revenues in this product area are supported by consumer preferences for immediacy and a large selection.

Maintaining Pandemic Growth: Recent sales decreases for DIY online stores are in response to sudden spikes during the pandemic. In the case of obi.de, ECDB shows a typical net sales development over the last few years.

Three retailers are ahead of all others in the German DIY market: Bauhaus, Hornbach and Obi. Their respective online platforms are also the top sellers in the German DIY online market, but Amazon still takes the lead.

Learn about the net sales of the top DIY stores in 2023, how online shoppers prefer to buy their DIY & home improvement products, and an example in case: obi.de.

DIY Online Net Sales Remain Steady in 2023

The top 3 online stores on this list, bauhaus.info, hornbach.de, and obi.de, lead the way in terms of eCommerce net sales, while the remaining stores lag significantly behind. Within a range of about US$110 million, the top three stores are all centered around annual eCommerce net sales of US$430 million.

Bauhaus.info ranks first, with 2023 eCommerce net sales of US$490 million. Hornbach.de follows with US$487.7 million, and obi.de lags at US$380.4 million.

The other specialist online stores in the top 5 fall further behind. Casando.de scored eCommerce net sales of US$135.6 million in 2023 and globus-baumarkt.de US$100.7 million.

Since this ranking is limited to online stores that specialize in DIY and home improvement, the list changes if it includes all online retailers that sell DIY products. Here Amazon outperforms all the others.

Amazon.de Sells Most DIY Online in Germany

Online net sales for DIY products differ somewhat from the previous ranking because online stores such as bauhaus.info, hornbach.de and obi.de also sell categories outside of DIY.

These include electronics, furniture, or hobby & leisure products. As a result, the figures below deviate from the total net sales of the stores shown above:

The most notable trend in this regard, however, is Amazon’s dominance in the DIY category. With 2023 eCommerce net sales of US$1.3 billion, amazon.de towers over the others.

The second-highest grossing online platform for DIY products in Germany is another generalist retailer: otto.de. But Otto’s DIY net sales are only slightly higher than those of the specialist retailers.

Why is Amazon so successful in a category where established specialists can’t hope to keep up?

Reasons for Amazon’s Dominance in the German DIY Market

DIY and home improvement retailer Hornbach reported back in 2018 that Amazon poses a challenge: amazon.de is the first choice for users looking to buy DIY products online.

Amazon offers an enormous range of products to its customers. The retail giant had a working infrastructure and online user base long before the pandemic accelerated the need for online retail solutions in 2020. By investing in start-ups working on smart home tools, Amazon has long made its strategy of offering innovative technology at competitive prices known.

According to the incumbents, despite a growing online offering, consumers largely prefer to shop in their brick-and-mortar stores.

There are several reasons for this:

Immediate acquisition of products in the store

Physical and tactile inspection of products

Personal advice and guidance from in-store staff

Spontaneous nature of DIY purchases: depending on weather, breakage of tools, inspiration, and other reasons.

For many of these reasons, Amazon provides the answer: immediate, same-day or next-day delivery, extensive product recommendations and rating systems, AI or social media consultation.

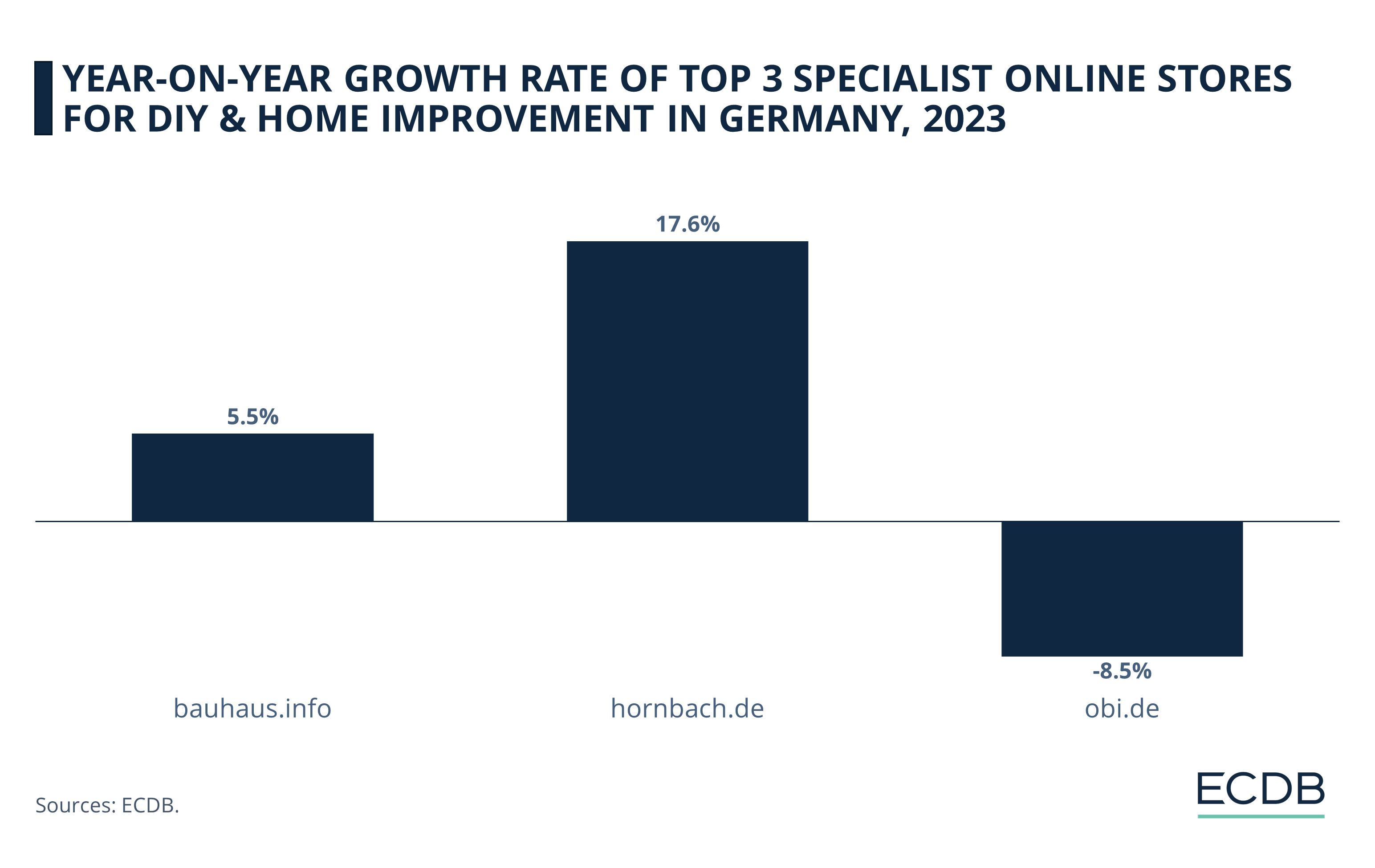

Top Online DIY Stores in Germany: Maintaining the Status Quo in 2023

2023 saw higher growth than in the previous year, with both bauhaus.info and hornbach.de having positive rates. Only obi.de appears to continue struggling:

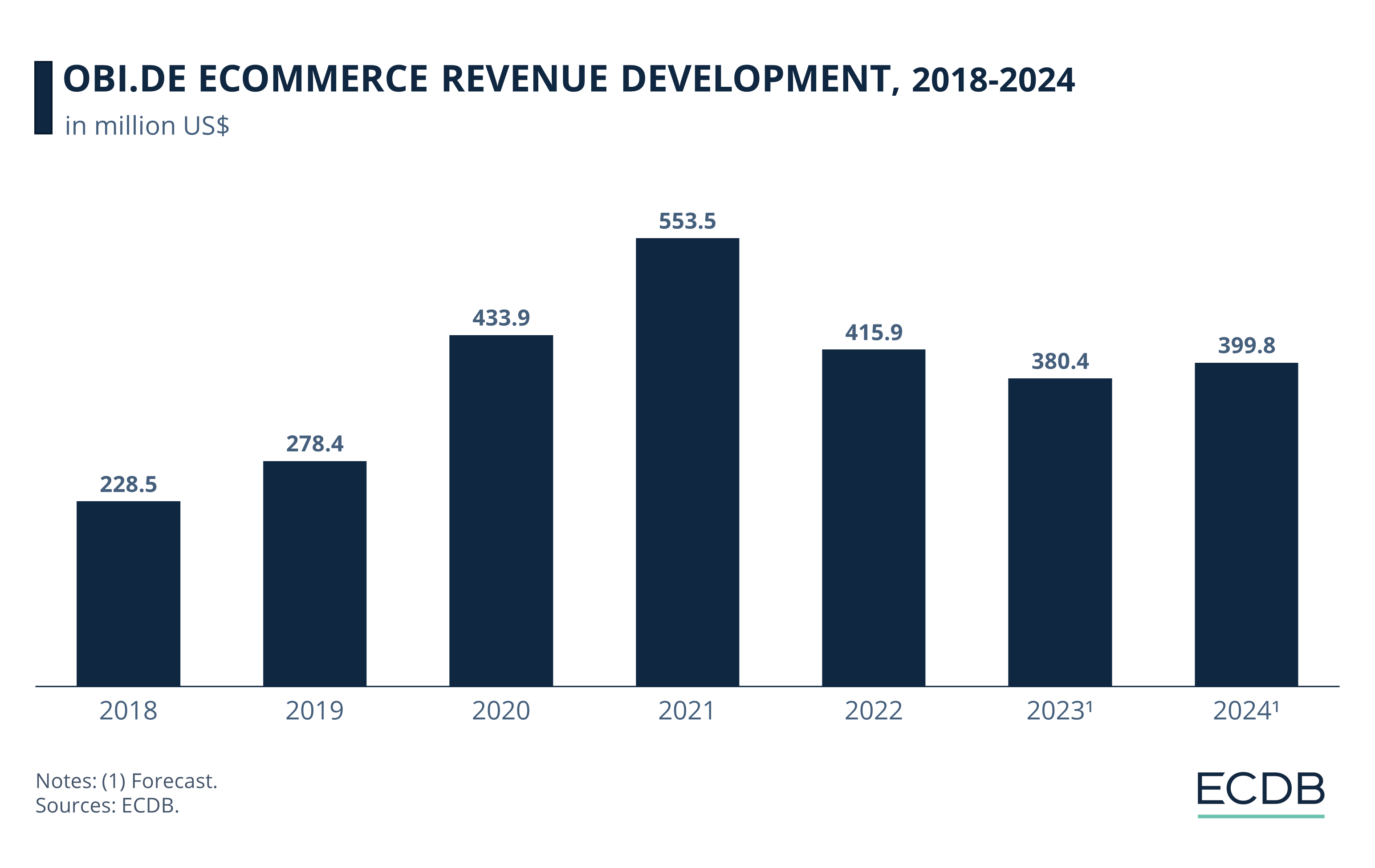

To put these losses into perspective, consider how obi.de's online net revenues have developed:

Obi Revenue 2024: Online Revenues Around US$400 Million

Obi.de saw consistent annual increases in online revenue in the years through 2021. While 2018 and 2019 saw moderate growth, with annual revenues of US$228.5 million and US$278.4 million, respectively, the pandemic brought a first surge in online revenues.

Pandemic Triggered Online Net Sales Surge

Growing at a rate of 55.9% of the previous figure, online net sales jumped to US$433.9 million in 2020. Of course, this development can be attributed to store closures and consumers’ caution to avoid public spaces during this period.

In the following year, 2021, online net sales increased again by 27.6% compared to the previous year. As a result, obi.de generated revenues of US$553.5 million in 2021. This sudden growth also explains the sharp decline in the following years.

Post-Pandemic Normalization, Albeit at Higher Levels Than Before 2020

Obi's eCommerce business saw the largest decrease in 2022, at 24.9%, and revenues declined further into 2023. This distinguishes Obi from its direct competitors who grew.

By 2024, forecasts expect obi.de to remain at the current level. Despite the losses of the last two years, obi.de’s online net sales are still well above what it generated online before 2020.

DIY in Germany: Wrap-Up

How can Obi, Bauhaus and Hornbach improve online sales? Connecting product discovery with a convenient strategy, which includes hybrid, can help ensure customers use the platform habitually.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Back to main topics