eCommerce: Market Development

Top Product Categories in Saudi Arabia: Find the Best Selling Products With High Demand

Fashion, electronics, or furniture: What are the best-selling product categories with highest demand in Saudi Arabian eCommerce? Learn which products are on top in 2024.

July 12, 2024Download

Coming soon

Share

Trending Products in Saudi Arabia: Key Insights

Best Products to Sell Online in Saudi Arabia: Electronics is the leading product category in Saudi Arabian eCommerce, followed closely by Hobby & Leisure. Fashion ranks third.

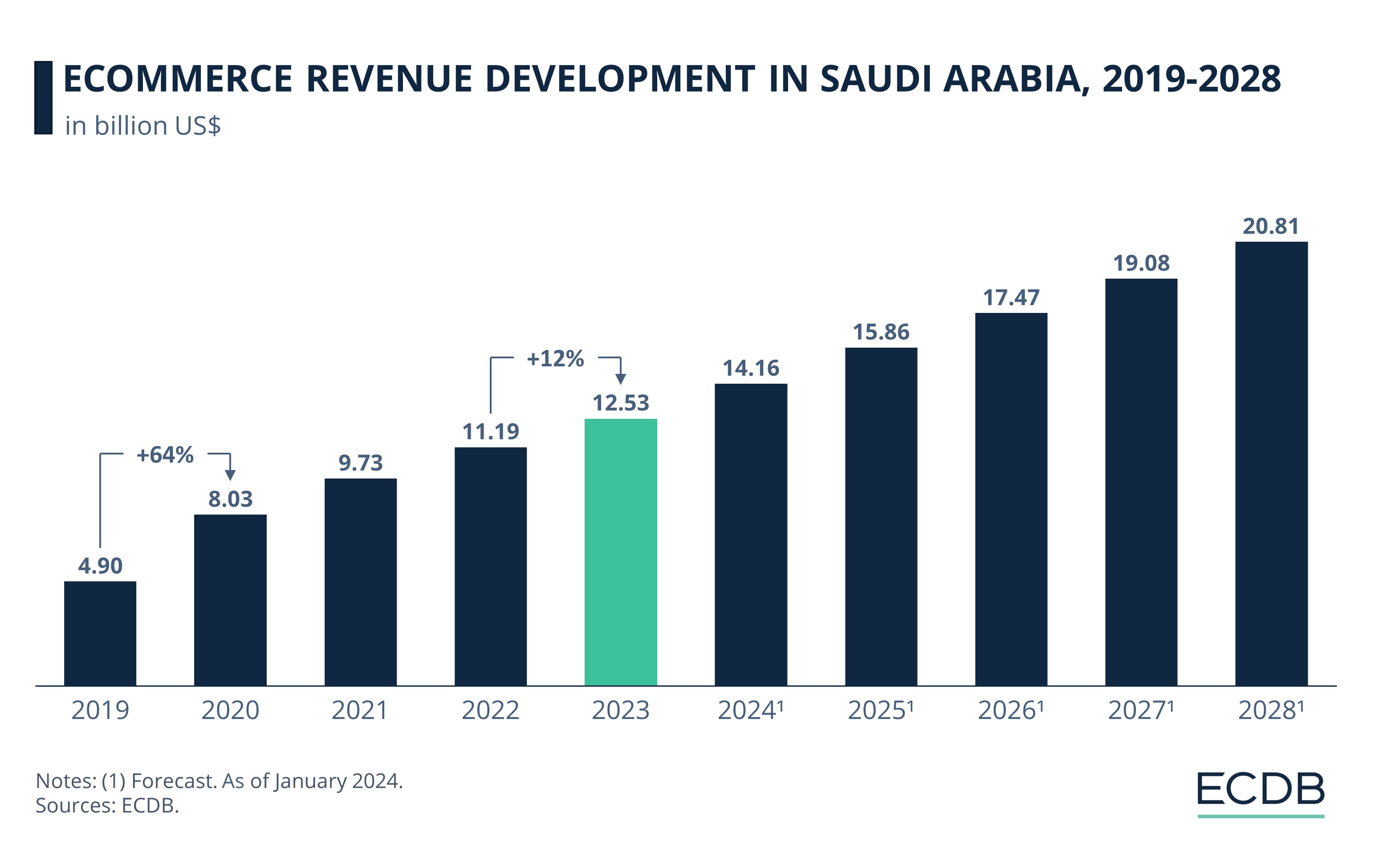

eCommerce Revenue Growth: Saudi Arabia’s eCommerce market generated revenues of US$12.5 billion in 2023. The online market forecast to grow at a CAGR (2024-2028) of 10.1% to reach US$21 billion by 2028.

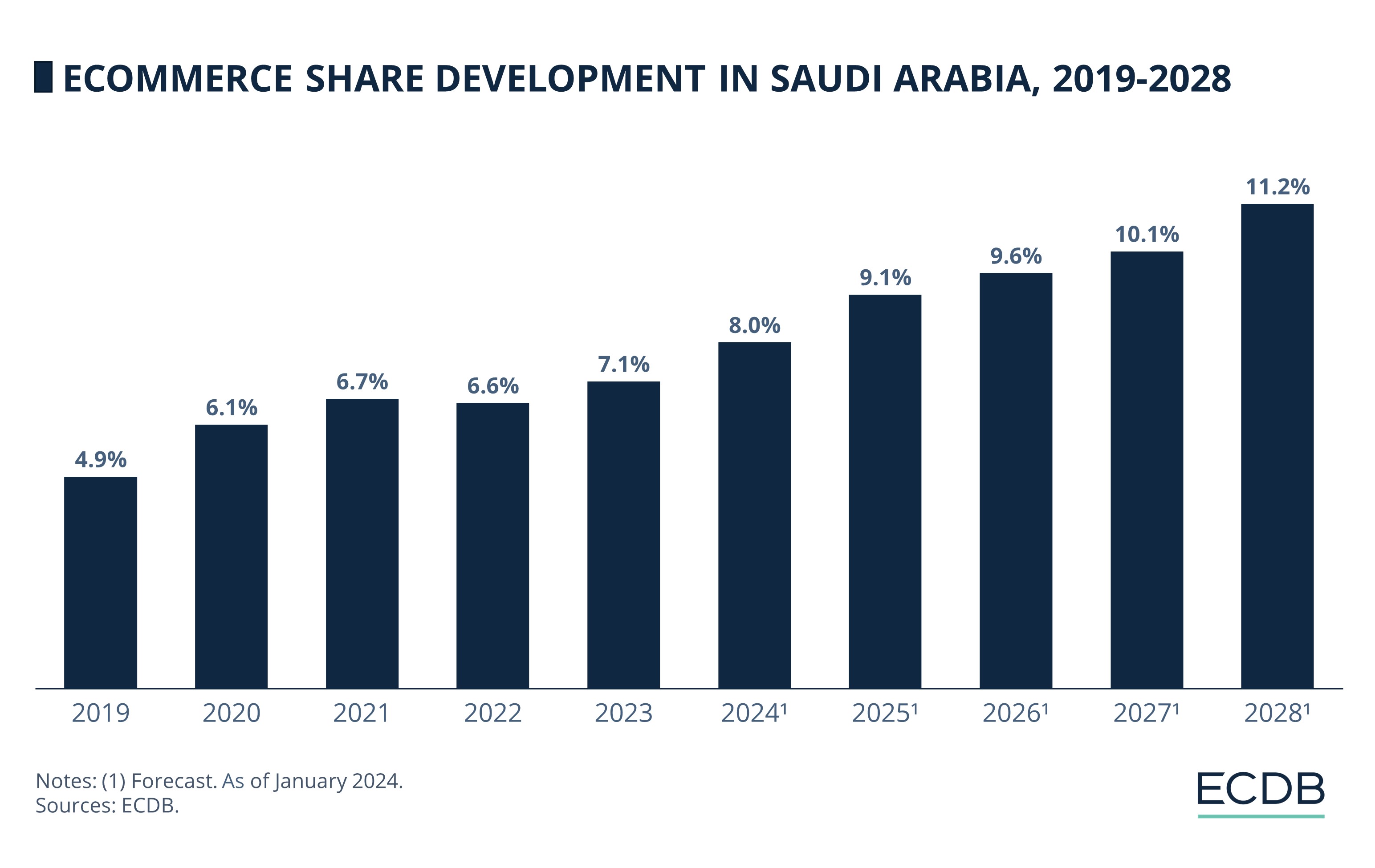

Online Share Development: Online sales accounted for 7% of Saudi Arabia’s total retail market in 2023. The eCommerce sales share is expected to surpass 11% by 2028.

Saudi Arabia is the 29th largest eCommerce market in the world. Revenues in the online market are still modest, but set to increase over the coming years.

What product categories are trending in Saudi Arabian eCommerce? ECDB identifies products that are in high demand in Saudi Arabia, revenue development and online market shares.

Top Online Product Categories 2023: Electronics Leads, Hobby & Leisure Second

ECDB data shows that currently, Electronics is the best-selling online product category in Saudi Arabia: it accounted for nearly a quarter (23.3%) of total eCommerce sales in 2023.

1. Electronics

Electronics is the leading product category in Saudi Arabia's online market, accounting for nearly a quarter (23.3%) of total eCommerce sales in 2023.

High Smartphone Penetration: Saudi Arabia has one of the highest smartphone penetration rates in the world. The use of smartphones drives the demand for electronics, including accessories and related gadgets.

Saudi Arabia Loves Tech: The population is tech-savvy, with a strong preference for the latest technology and gadgets.

Government Initiatives: The Saudi government’s Vision 2030 includes investments in digital infrastructure and eCommerce. Online payment systems and logistics networks have made it easier for consumers to purchase electronics online.

Consumer Trust and Reliability: Major online platforms like Amazon and Noon have established a presence in Saudi Arabia.

2. Hobby & Leisure

Hobby & Leisure ranks second in Saudi Arabia’s eCommerce market, making up 22.7% of the country’s online revenue. This category includes products related to sports, outdoor activities, toys, and games.

Increased Health and Fitness Awareness: There is a growing awareness of health and fitness among the population, leading to higher demand for sports equipment and outdoor activity gear.

Recreational Interests: The interest in hobbies and leisure activities, such as gaming, DIY projects, and creative arts, is on the rise. This is reflected in the robust sales of toys, games, and hobby supplies online.

Pandemic Influence: The COVID-19 pandemic has accelerated the adoption of new hobbies and leisure activities as people spent more time at home. This trend has continued post-pandemic, with many consumers still engaging in these activities and purchasing related products online.

Availability and Convenience: The wide variety of hobby and leisure products available online, combined with the convenience of home delivery, has made it easier for consumers to access and purchase these items.

3. Fashion

Fashion ranks third in Saudi Arabia's online market, accounting for 18.5% of total eCommerce sales.

Youthful Demographic: A significant portion of Saudi Arabia's population is interested in the latest fashion trends. Young people are highly active on social media platforms, where they are influenced by global fashion trends and online shopping habits.

Cultural Influences: Saudi consumers have a strong affinity for branded and high-quality clothing.

Convenience and Variety: Online shopping offers convenience and a wide variety of choices that physical stores might not provide. Consumers can browse through extensive catalogs, compare prices, and benefit from exclusive online discounts and promotions.

In 2023, Grocery was the bottom-ranked category, accounting for only 6.8% of total online sales. Its performance aligns with McKinsey’s findings, which discovered that grocery is one of the least digitally disrupted industries in Saudi Arabia. In other words, Saudi consumers still prefer the in-person experience for grocery shopping, with the turn to digital channels relatively low compared to other industries.

However, ECDB data indicates a future shift. By 2028, the share of Grocery is projected to increase by nearly four percentage points to make up 10.8% of Saudi Arabian eCommerce sales, which would place it ahead of Care Products and DIY.

Saudi Arabia’s eCommerce Market to Hit US$21 Billion by 2028

Increasing adoption of internet-based services and awareness of online shopping are some of the leading factors driving the expansion of eCommerce in Saudi Arabia.

In 2023, revenues from eCommerce stood at US$12.5 billion, recording year-on-year growth of 12%.

Per ECDB data, the largest leap in Saudi Arabia’s eCommerce sales occurred in 2020, when revenues increased by 64% compared to the previous year. This development aligns with the global trend of eCommerce acceleration seen during the pandemic.

By 2021, yearly growth evened out to 21% before settling at 15% in 2022. In the following years, the market expansion is expected to take place at a comparable rate.

The growth analysis shows that Saudi Arabia’s eCommerce market is expanding at a slow but steady pace. A similar pattern is observed for the country’s eCommerce share in total retail sales.

eCommerce Share: 7% of Saudi Arabia’s Retail Sales Generated Online in 2023

Like Saudi Arabia’s eCommerce revenue, the share of online sales to total retail sales in the country has also been climbing in the past years.

In 2023, online sales made up 7% of the total retail sales generated in Saudi Arabia. This growth in online sales share came after a decline seen in 2022.

The eCommerce share in Saudi Arabia also saw the biggest jump in 2020, when it made up 6.1% the total retail sales from just 4.9% in 2019.

Growth occurred in 2021 as well, before a decline was observed in 2022. But this downturn was small and reversed in the following year, suggesting that the shift to online shopping was more durable than just a pandemic-induced surge.

Projections anticipate the share of eCommerce sales in Saudi Arabia to increase steadily in the upcoming years.

Government Policy for Digital Transformation

The pandemic boosted eCommerce activity in Saudi Arabia, as it did worldwide. High rates of internet penetration helped drive the country’s eCommerce penetration rate. In addition, the growth of the online market – in terms of both revenue and sales share – is also shaped by the government’s long-term strategy to promote eCommerce.

Saudi Arabia’s Vision 2030 document singled out eCommerce as a key focus area in as far back as 2016. Plans to invest in the digital economy included improving online payment services, expanding the logistics network beyond major cities, and fostering the growth of SMEs (small and medium-sized enterprises) to make local eCommerce stores competitive with cross-border platforms.

In 2019, the government also introduced regulations under its eCommerce Law to curb fraud and cybercrime by online businesses, thus enhancing consumer trust in online shopping.

A recent report reflects the impact of this consolidated strategy. Per its findings, Saudi consumers, who familiarized themselves with eCommerce during the pandemic, have now embraced it. Today, they also demonstrate a preference for buying local: 74% of respondents said they expect to increase their purchases from homegrown eCommerce platforms over cross-border marketplaces or stores from the U.S., China, other Gulf countries, or Europe.

Moreover, findings by McKinsey also underscore rising digital adoption among Saudi consumers, who are mobile-first, purchase from online marketplaces, and plan to increase their use of digital channels to engage with various industries, including apparel and other retail product categories.

Saudi Arabia eCommerce: Closing Remarks

ECDB data on Saudi Arabia’s eCommerce market indicates that the country is set for sustained growth. Market growth – in terms of eCommerce revenue, online share, and top product categories – comes from rising digital adoption among consumers in various industries.

State policy towards strengthening the regulatory environment for eCommerce and supporting domestic platforms will shape the market dynamics going forward, with international players likely to face more challenge from local brands.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics